Content

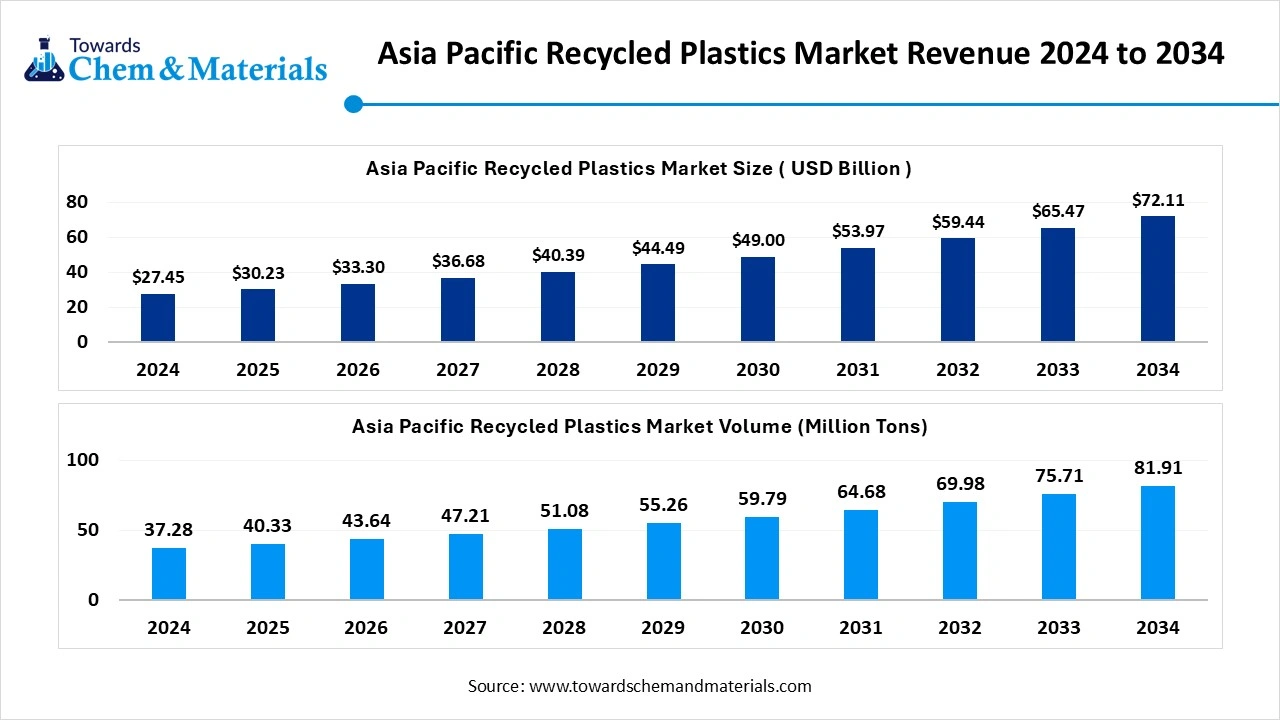

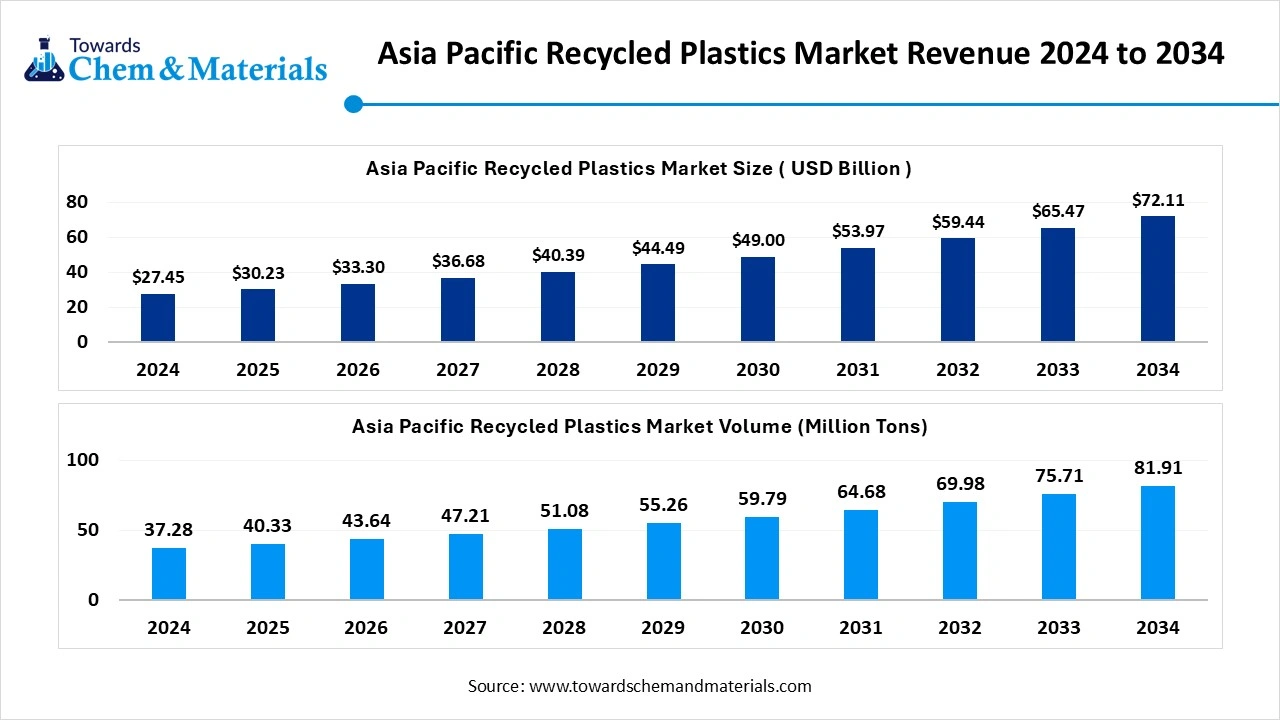

What is the Asia Pacific Recycled Plastics Market Volume and Size ?

The Asia Pacific recycled plastics market stands at 40.33 million tons in 2025 and is forecast to reach 81.91 million tons by 2034, expanding at a CAGR of 8.19% from 2025 to 2034.

The Asia Pacific recycled plastics market size was estimated at USD 30.23 billion in 2025 and is predicted to increase from USD 33.30 billion in 2026 to approximately USD 72.11 billion by 2034, expanding at a CAGR of 10.14% from 2025 to 2034. The market is driven by increasing government support for recycling, growing environmental concerns, rapid urbanisation, and a high demand for recycled materials in various sectors.

Key Takeaways

- By type, the polyethylene terephthalate segment dominated the market with a share of approximately 37% in 2024.

- By type, the polypropylene segment is expected to grow significantly in the market during the forecast period.

- By source, the bottles segment dominated the market with a share of approximately 44% in 2024.

- By source, the films and sheets segment is expected to grow in the forecast period.

- By the recycling process, the mechanical recycling segment dominated the market with a share of approximately 70% in 2024.

- By the recycling process, the chemical recycling segment is expected to grow in the forecast period.

- By application, the packaging segment dominated the market with a share of approximately 45% in 2024.

- By application, the automotive segment is expected to grow in the forecast period.

Market Overview

What Is The Significance Of The Asia Pacific Recycled Plastics Market?

Recycled plastics are polymer materials reprocessed from post-consumer or post-industrial plastic waste through mechanical or chemical recycling methods. These materials are reused in the manufacturing of packaging, automotive components, construction products, textiles, and consumer goods, helping to reduce environmental impact and resource dependency.

Asia Pacific Recycled Plastics Market Outlook:

- Industry Growth Overview: Between 2025 and 2034, the Asia Pacific recycled plastics market is projected to grow strongly, driven by rising plastic waste generation, government recycling mandates, and corporate sustainability commitments. China, India, Japan, and Southeast Asian countries are witnessing increasing adoption of recycled plastics in packaging, construction, and automotive applications.

- Sustainability Trends: Sustainability is the central growth driver, with companies focusing on mechanical and chemical recycling to improve material quality and traceability. There is a growing shift toward recycled PET (rPET), recycled polypropylene (rPP), and recycled polyethylene (rPE) in consumer goods and packaging.

- Regional Expansion & Investments: Major resin producers, recyclers, and packaging firms are expanding capacity across India, China, and Southeast Asia to strengthen domestic recycling ecosystems. Strategic alliances between global material companies and local recyclers are improving supply chain integration and product certification.

Report Scope

| Report Attributes | Details |

| Market Size in 2026 | USD 33.30 Billion |

| Expected Size by 2034 | USD 72.11 Billion |

| Growth Rate from 2025 to 2034 | CAGR 10.14% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Type, By Source, By the Recycling Process, By Application, By Region |

| Key Companies Profiled | Other Top Players Are, KW Plastics , Far Eastern New Century Corporation , Formosa Plastics Group , Teijin Limited , Zhejiang Luhai Holding Co., Ltd. , SK Chemicals Co., Ltd. , Cleanaway Waste Management Limited , Plastic Energy , SUEZ Recycling & Recovery Asia , PolyCycl Private Limited , GreenMantra Technologies Ltd. |

Key Technological Shifts In The Asia Pacific Recycled Plastics Market:

The main technological changes in the Asia Pacific recycled plastics market are driven by the need to boost sorting efficiency, improve the quality of recycled materials, and handle difficult-to-recycle plastics. Increasingly, AI-powered sorting systems and robotics are being used in material recovery facilities (MRFs) to identify and separate plastics more quickly, accurately, and consistently than manual methods.

This is essential for producing high-purity feedstock for subsequent processing. These advancements, supported by stricter government regulations such as EPR schemes and corporate sustainability targets, are critical for addressing waste contamination issues and fostering a robust circular economy in the APAC region.

Trade Analysis Of the Asia Pacific Recycled Plastics Market: Import & Export Statistics

- There are 4 shipments were made by 4 Indian exporters to 4 buyers. The primary destinations for these exports were the United States, Turkey, and Russia.

- Vietnam, the United States, and China are the top three global exporters of recycled plastic. Vietnam leads the world with 3,886 shipments. The United States is second with 3,158 shipments, followed by China with 2,601 shipments.(Source: www.volza.com)

- Plast-O-Fine Industries is India's leading importer of recycled plastic, holding a dominant 40% market share with eight recorded shipments.

- Following as the second largest importer is ALPLA INDIA PVT LTD, which accounts for 25% of the total market share, equating to five shipments.

- POLYZEN TRADING CO ranks third, making up 15% of the total import volume with three shipments.(Source: www.volza.com)

Asia Pacific Recycled Plastics Market -- Value Chain Analysis

- Chemical Synthesis and Processing : Recycled plastics in the Asia Pacific are produced through collection, sorting, washing, shredding, and reprocessing via

- Key players : Veolia Environnement S.A., SUEZ Recycling and Recovery, Indorama Ventures Public Co. Ltd., Alpla Group, LyondellBasell Industries

- Quality Testing and Certification : Recycled plastics undergo testing for purity, melt flow index, and mechanical strength under standards such as ISO 15270 and ISO 9001, ensuring compliance with environmental and safety norms.

- Key players: SGS, TÜV SÜD, Intertek, Bureau Veritas

- Distribution to Industrial Users : Recycled plastics are distributed to packaging, automotive, construction, and electronics sectors for manufacturing sustainable and cost-effective products.

- Key players: Indorama Ventures, Alpla Group, MBA Polymers Inc., Veolia Environnement S.A.

Asia Pacific Recycled Plastics Regulatory Landscape: Global Regulations

| Country / Region | Regulatory Body | Key Regulations / Frameworks | Focus Areas | Notable Notes |

| China | Ministry of Ecology and Environment (MEE), National Development and Reform Commission (NDRC), State Administration for Market Regulation (SAMR) | - Solid Waste Pollution Prevention and Control Law (amended 2020) - Circular Economy Promotion Law (amended 2021) - Catalogue for Waste Import Restrictions (“National Sword Policy”, 2018) - GB/T 40006-2021 – Recycling identification for plastics |

- Waste segregation and recycling systems - Recycled plastic quality standards - Ban on plastic waste imports - Promotion of biodegradable alternatives |

China’s ban on imported plastic waste reshaped global recycling flows. Domestic recyclers are incentivised under the Green Materials Development Plan (2021–2025). Focus on mechanical recycling capacity and traceability systems. |

| India | Ministry of Environment, Forest and Climate Change (MoEFCC), Central Pollution Control Board (CPCB), Bureau of Indian Standards (BIS) | - Plastic Waste Management (PWM) Rules, 2016 (amended 2022) - Extended Producer Responsibility (EPR) Guidelines, 2022 - Recycled Plastics Manufacture and Usage Rules (1999) - BIS IS 14534:1998 – Guidelines for recycling plastics |

- EPR compliance and traceability - Plastic waste segregation and labelling - Minimum recycled content mandates - Ban on single-use plastics |

India’s PWM Rules mandate traceable EPR obligations and annual recycling targets for producers and importers. By 2025, recycled content in packaging will be compulsory for major producers. |

| Japan | Ministry of the Environment (MOE), Ministry of Economy, Trade and Industry (METI) | - Plastic Resource Circulation Act (2022) - Container and Packaging Recycling Law (1995; revised 2020) - Green Procurement Law (2001) |

- Design for recyclability - Reuse and circular design requirements - Mandatory corporate waste reduction plans |

Japan’s Plastic Resource Circulation Act mandates corporate recycling plans, eco-design labelling, and reduced virgin plastic usage. Focus on closed-loop recycling and bioplastic development. |

| South Korea | Ministry of Environment (MoE), Korea Environment Corporation (KECO) | - Act on Resource Circulation of Electrical and Electronic Equipment and Vehicles (2018) - Recycling and Waste Management Act (amended 2020) - K-Eco Label Program |

- Producer recycling responsibility - Waste segregation and recycling - Eco-labelling and recycled material use |

South Korea enforces EPR schemes across packaging and plastics, with recycling quotas. The K-Eco Label certifies products with high recycled content and environmental compliance. |

| Thailand | Ministry of Natural Resources and Environment (MNRE), Pollution Control Department (PCD) | - Roadmap on Plastic Waste Management (2018–2030) - Circular Economy Framework under Thailand 4.0 |

- Single-use plastic phase-out - Recycled plastic quality standards - Material recovery and reuse |

Thailand’s roadmap bans non-recyclable plastics by 2025. Focus on PET and HDPE recycling infrastructure and circular economy partnerships with industry. |

Segmental Insights

Type Insight

Which Type Segment Dominated The Asia Pacific Recycled Plastics Market In 2024?

The polyethylene terephthalate segment dominated the market with a share of approximately 37% in 2024. PET is one of the most widely recycled plastics in the Asia Pacific region, primarily used in beverage bottles and food containers. The demand for recycled PET (rPET) is growing rapidly due to rising sustainability goals and packaging mandates. India and China are leading producers, with mechanical recycling dominating. The recycled PET market benefits from strong collection networks and corporate commitments to use rPET in consumer packaging.

The Polypropylene segment expects significant growth in the market during the forecast period. Recycled polypropylene is gaining importance due to its wide applications in automotive parts, packaging films, and household goods. Advances in sorting and washing technologies have improved the purity and mechanical properties of recycled PP. Chemical recycling is also emerging to handle contaminated waste streams. The demand from the packaging and construction sectors across the Asia Pacific continues to drive strong market growth for recycled PP.

Source Insight

How Did Bottles Segment Dominated The Asia Pacific Recycled Plastics Market In 2024?

The Bottles segment dominated the market with a share of approximately 44% in 2024. Post-consumer bottles represent the primary feedstock for recycled plastics, especially for PET and HDPE. Efficient collection systems in countries like China and Japan support large-scale recycling operations. Bottles are easily segregated, cleaned, and converted into flakes or pellets for reuse in packaging and textiles. Government programs promoting bottle-to-bottle recycling are significantly boosting material recovery and circular economy initiatives.

The Films & Sheets segment expects significant growth in the market during the forecast period. Recycling of films and sheets is expanding, supported by improved technologies for handling flexible packaging waste. Polyethene and polypropylene films are recycled into pellets used for non-food packaging, agricultural covers, and industrial products. In the Asia Pacific, demand for recycled film materials is rising from local converters seeking cost-efficient, sustainable raw materials. Chemical recycling methods further enhance the recovery of complex multilayer films.

Recycling Process Insight

Which Recycling Process Segment Dominated The Asia Pacific Recycled Plastics Market In 2024?

The mechanical recycling segment dominated the market with a share of approximately 70% in 2024. Mechanical recycling dominates the market due to its cost-effectiveness and established infrastructure. The process involves sorting, washing, shredding, and remoulding plastics into new products. India and Southeast Asian countries have robust mechanical recycling networks serving the packaging, textile, and construction sectors. However, maintaining consistent material quality remains a key challenge in scaling production for high-value applications.

The chemical recycling segment expects significant growth in the Asia Pacific recycled plastics market during the forecast period. Chemical recycling is gaining momentum as a complementary approach to mechanical recycling. It breaks down plastics into monomers or fuels, enabling the recovery of materials unsuitable for mechanical processing. Japan, South Korea, and China are investing heavily in advanced depolymerisation and pyrolysis facilities. This process supports circularity for multilayer packaging and contaminated plastics, offering higher-quality recycled polymers for industrial reuse.

Application Insight

How Did the Packaging Segment Dominated The Asia Pacific Recycled Plastics Market In 2024?

The packaging segment dominated the market with a share of approximately 45% in 2024. The packaging sector represents the largest application for recycled plastics in the Asia Pacific, driven by sustainability regulations and brand initiatives to incorporate recycled content. Recycled PET and PP are widely used in containers, bottles, and flexible packaging. Growing consumer awareness and retailer commitments to eco-friendly packaging continue to expand the market, especially in India, China, and Southeast Asia.

The automotive segment expects significant growth in the Asia Pacific recycled plastics market during the forecast period. Recycled plastics are increasingly adopted in the automotive industry to reduce vehicle weight and environmental impact. Polypropylene and polyethene-based recycled compounds are used in interior panels, bumpers, and underbody components. Automakers in Japan, China, and South Korea are integrating more recycled materials to meet sustainability goals. Rising electric vehicle production further enhances demand for lightweight recycled polymers.

Country Insights

Asia Pacific Recycled Plastics Market Trends In India

India’s recycled plastics market is rapidly growing due to an expanding recycling infrastructure, increasing plastic waste collection, and government initiatives promoting circular economy practices. The informal recycling sector plays a significant role, particularly in PET and PP recovery. Demand from packaging, textiles, and automotive industries is accelerating, supported by extended producer responsibility (EPR) mandates and industrial investments in chemical recycling.

Asia Pacific Recycled Plastics Market Trends In China

China remains the largest market for recycled plastics in the Asia Pacific region, driven by industrial demand and policy support for waste reduction. Following the import ban on plastic waste, domestic recycling capacity has expanded significantly. The country leads in chemical recycling innovation and rPET production for global packaging brands. Localised material recovery systems and sustainability policies continue to strengthen China’s recycling ecosystem.

Recent Developments

- In April 2025, Dow Chemicals launched a major initiative in partnership with SCG Chemicals (SCGC) to accelerate plastic waste recycling across the Asia-Pacific region. The program aims to transform 200,000 tonnes of plastic waste annually into circular products by 2030.(Source: www.bangkokpost.com)

- In January 2025, the United Nations Development Programme (UNDP) and The Coca-Cola Foundation (TCCF) launched a three-year, multi-country program with a $15 million grant from TCCF to expand plastic waste management and recycling initiatives in nine countries across the Asia Pacific. (Source: www.undp.org)

Top players in the Analytical Chemistry Market & Their Offerings:

- Indorama Ventures Public Company Limited: One of the world’s largest PET recyclers, producing food-grade recycled PET (rPET) flakes and pellets for packaging, textiles, and beverage industries through its ESG+ initiatives.

- Veolia Environment S.A.: Operates large-scale recycling facilities across Asia, specialising in PET and HDPE recycling for packaging, consumer goods, and industrial applications, contributing to circular plastic initiatives.

- Alpek S.A.B. de C.V.: Through its subsidiaries, Alpek operates PET and rPET production facilities in Asia, focusing on bottle-to-bottle recycling for the beverage and food packaging sectors.

- MBA Polymers, Inc.: Operates advanced recycling plants in China and India, producing recycled ABS, HIPS, and PC/ABS blends for electronics and automotive markets.

Other Top Players Are

- KW Plastics

- Far Eastern New Century Corporation

- Formosa Plastics Group

- Teijin Limited

- Zhejiang Luhai Holding Co., Ltd.

- SK Chemicals Co., Ltd.

- Cleanaway Waste Management Limited

- Plastic Energy

- SUEZ Recycling & Recovery Asia

- PolyCycl Private Limited

- GreenMantra Technologies Ltd.

Segments Covered:

By Type

- Polyethylene Terephthalate (PET)

- High-Density Polyethylene (HDPE)

- Polypropylene (PP)

- Low-Density Polyethylene (LDPE)

- Polystyrene (PS)

- Polyvinyl Chloride (PVC)

- Others (ABS, Nylon, etc.)

By Source

- Bottles

- Films & Sheets

- Foams

- Fibers

- Others (Containers, Trays, etc.)

By the Recycling Process

- Mechanical Recycling

- Chemical Recycling

By Application

- Packaging

- Building & Construction

- Automotive

- Textiles

- Electrical & Electronics

- Others (Furniture, Industrial Products)