Content

What is the U.S. Water and Wastewater Treatment Market Size ?

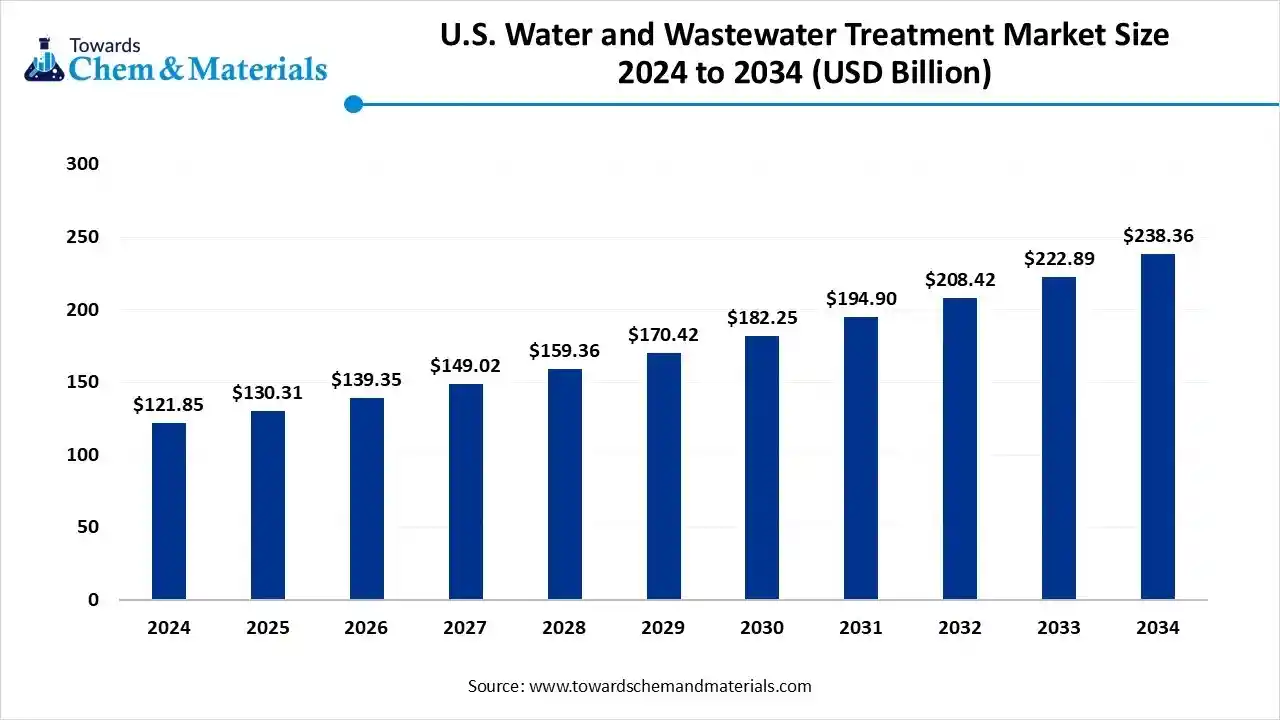

The U.S. water and wastewater treatment market size was accounted for USD 121.85 billion in 2024 and is predicted to increase from USD 130.31 billion in 2025 to approximately USD 238.36 billion by 2034, expanding at a CAGR of 6.94% from 2025 to 2034. Increasing awareness regarding water conservation and reuse is a key factor driving market growth. Also, advancements in areas such as membrane filtration and UV disinfection, coupled with the stringent federal and state regulations, can fuel market growth further.

Key Takeaways

- By type, the municipal water & wastewater treatment segment dominated the market with nearly 52% share in 2024.

- By type, the industrial water & wastewater treatment segment held approximately 38% market share and is expected to grow at the fastest CAGR over the forecast period.

- By treatment technology, the membrane filtration segment held the largest market share of nearly 27% in 2024.

- By treatment technology, the desalination & water reuse segment held approximately 8% market share and is expected to grow at the fastest CAGR over the forecast period.

- By component, the equipment segment dominated the market by holding approximately 45% share in 2024.

- By component, the software & digital solutions segment held approximately 10% market share and is expected to grow at the fastest CAGR over the forecast period.

- By application, the potable water treatment segment dominated the market with nearly 36% share in 2024.

- By application, the water reuse & recycling segment held nearly 15% market share and is expected to grow at the fastest CAGR during the projected period.

- By end user, the municipal utilities segment dominated the market by holding nearly 44% share in 2024.

- By end user, the industrial sectors segment held approximately 33% market share and is expected to grow at the fastest CAGR over the forecast period.

What is U.S. Water and Wastewater Treatment Market?

The U.S. Water and Wastewater Treatment Market involves the systems, technologies, chemicals, and services used to purify water and treat wastewater for municipal, industrial, and commercial use. It includes physical, chemical, and biological processes designed to remove contaminants, ensure water quality, and enable reuse or safe discharge.

The market is driven by aging infrastructure, regulatory mandates from the EPA, water scarcity concerns, industrial discharge standards, and the growing adoption of smart and decentralized treatment systems. Increasing investment in advanced technologies such as membrane filtration, UV disinfection, biological nutrient removal, and digital water monitoring is further shaping market growth.

U.S. Water and Wastewater Treatment Market Outlook

- Industry Growth Overview: Increasing concerns regarding water scarcity and the increasing cost of water are driving the need for more effective water use, recycling, and reuse technologies. Also, the growth of water-intensive sectors such as food processing, manufacturing, and pharmaceuticals increases the volume of industrial wastewater that requires treatment.

- Sustainability Trends: Key sustainability trends in the market include the use of digital technologies such as AI and IoT to enhance efficiency and an emphasis on energy efficiency through renewable sources. Growing emphasis on removing emerging contaminants like microplastics and PFAS can help to maintain the sustainability trend in the market soon.

- Major Investors: Major investors and players in the market include large multinational companies such as Veolia, Suez, and Xylem. The market also has specialized technology providers, including Evoqua, DuPont, and 3M, along with the emerging players having an increasing focus on services and advanced infrastructure.

Report Scope

| Report Attributes | Details |

| Market Size in 2026 | USD 139.35 Billion |

| Expected Size by 2034 | USD 238.36 Billion |

| Growth Rate from 2025 to 2034 | CAGR 6.94% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Type, By Treatment Technology, By Component, By Application, By End User |

| Key Companies Profiled | Ecolab's Nalco Water, Veolia North America, SUEZ North America (Veolia subsidiary) , Pentair plc , 3M Company , Aqua-Aerobic Systems, Inc. , Evoqua Water Technologies (part of Xylem) , Danaher Corporation (Hach, Trojan Technologies) , AECOM , Jacobs Solutions Inc. , Kurita America Inc. , DuPont Water Solutions , Siemens Water Technologies , ITT Inc. , Calgon Carbon Corporation , Hydranautics (Nitto Group Company) , Ovivo Inc. , Clean Water Services , Black & Veatch |

Key Technological Shift in the U.S. Water and Wastewater Treatment Market

Key technological shifts in the market include a greater emphasis on digital transformation, coupled with the rapid adoption of innovative treatment technologies such as Advanced Oxidation Processes (AOPs). Also, Artificial intelligence and digital twins' technology are increasingly being used to predict maintenance needs, optimize workflows, and enhance overall operational efficiency and safety.

Trade Analysis of U.S. Water and Wastewater Treatment Market: Import & Export Statistics:

- From May 2024 to April 2025, the U.S. exported 230 shipments of water treatment chemicals. This represents an 84% increase over the previous year and involved 59 U.S. exporters and 36 buyers.(Source: www.volza.com)

- Despite a strong domestic chemical production, the U.S. still imports a significant amount of chemicals, with an estimated 2024 value of $600 billion, making it one of the world's top importers.(Source: www.importglobals.com)

U.S. Water and Wastewater Treatment Market Value Chain Analysis

- Feedstock Procurement : It refers to the sourcing and acquisition of raw materials for conversion into valuable resources such as nutrients or energy.

- Chemical Synthesis and Processing : It includes the production and application of specialty chemical products used to disinfect, purify, and condition water.

- Packaging and Labelling : This stage involves the stringent regulations for chemicals utilized in treatment facilities. This also includes a specific set of rules for container types.

- Regulatory Compliance and Safety Monitoring : It involves the detailed framework of rules, permits, and oversight that protects public health, ensures water safety, and prevents environmental pollution.

Case Study: Xylem Inc. Sets New Standard with Technological Innovations

Xylem Inc.'s position in the market is defined by its strategic acquisition of Evoqua, its comprehensive product portfolio, and dependence on public sector funding. The company also reported robust financial results in 2024 and maintains a notable outlook for 2025.

- In 2023, the acquisition of Evoqua Water Technologies substantially grew Xylem's market share and product offerings in the market and its position as a key market player.

U.S. Water and Wastewater Treatment Market's Regulatory Landscape: Global Regulations

| Country/Region | Key Regulations/Investments |

| Arizona | The state established an Aquifer Protection Program (APP) in 1989. Since 2001, new and expanding wastewater treatment plants exceeding a certain size must use high-performing tertiary treatment. |

| Nevada | Nevada has five distinct categories for water reuse, which may be used for irrigation. All five require at least secondary treatment, but higher-quality categories have much stricter coliform limits. |

| Texas | The Texas Commission on Environmental Quality (TCEQ) regulates water reuse, defining different water quality criteria for Type I and Type II reclaimed wastewater. |

Segmental Insights

Type Insights

How Much Share Did the Municipal Water & Wastewater Treatment Segment Held in 2024?

- The municipal water and wastewater treatment segment dominated the market with nearly 52% share in 2024. The dominance of the segment can be attributed to the increasing demand to upgrade aging infrastructure and the rise in emphasis on energy efficiency.

- The industrial water & wastewater treatment segment held approximately 38% market share and is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the surge in industrial activity and a rising emphasis on water reuse and sustainability.

- The commercial & institutional treatment segment held nearly 10% market share in 2024. The growing concerns over water scarcity and the demand for higher water quality in various industries are the major growth drivers of the segment.

Treatment Technology Insights

Which Treatment Technology Segment Dominated the U.S. Water and Wastewater Treatment Market in 2024?

- The membrane filtration segment held the largest market share of nearly 27% in 2024. The dominance of the segment can be linked to the rapid infrastructure modernization and rising water scarcity, which leads to a greater demand for reuse and recycling.

- The desalination & water reuse segment held nearly 8% market share and is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by a surge in consumer and industrial awareness regarding environmental protection and the importance of water conservation.

- The biological treatment segment held a 22% market share in 2024. Stringent regulations on water quality and wastewater discharge push industries and municipalities to adopt more effective treatment technologies, including biological methods.

- The disinfection segment held a nearly 16% market share in 2024. The growing concerns over emerging contaminants, along with the need to upgrade existing water infrastructure, are major segment drivers.

Component Insights

Which Component Type Segment Dominated the U.S. Water and Wastewater Treatment Market in 2024?

The equipment segment dominated the market by holding approximately 45% share in 2024. The dominance of the segment is owed to the modernization of aging infrastructure, coupled with the growing emphasis on water reuse and conservation due to water scarcity.

The software & digital solutions segment held approximately 10% market share and is expected to grow at the fastest CAGR over the forecast period. The growth of the segment is due to rapid innovations in technology like IoT and AI, along with the surge in temperatures and population growth, in many regions in the U.S, which are undergoing water scarcity issues.

The services segment held nearly 17% market share in 2024. Many major companies are outsourcing their water and wastewater treatment services to specialized firms that can offer expert, customized solutions. Also, increasing concerns over water scarcity are supporting investments in more sustainable water management practices. the chemicals segment held approximately 28% market share in 2024. Increasing urban areas and populations grow the volume of both municipal and industrial wastewater. This puts pressure on municipalities to offer clean and safe drinking water.

Application Insights

How Much Share Did the Potable Water Treatment Segment Held in 2024?

- The potable water treatment segment dominated the market with nearly 36% share in 2024. The dominance of the segment can be attributed to the growing need for advanced treatment technologies such as reverse osmosis and membrane filtration. Also, federal and state governments are heavily investing in infrastructure sustainability and modernisation.

- The water reuse & recycling segment held nearly 15% market share and is expected to grow at the fastest CAGR during the projected period. The growth of the segment can be credited to the rapid implementation of regulations from agencies like the EPA and acts such as the Clean Water Act for recycling systems.

- The wastewater treatment segment held approximately 34% market share in 2024. Ongoing growth in industrial and urban areas is straining current treatment capacity, which pushes demand for more robust and efficient treatment systems in both the municipal and industrial sectors.

- The desalination segment held a nearly 7% market share in 2024. Desalination offers a reliable method to augment water supply, particularly in areas or regions witnessing drought. Depletion of freshwater sources requires new water supply solutions like desalination.

End User Insights

Which End User Segment Dominated the U.S. Water and Wastewater Treatment Market in 2024?

- The municipal utilities segment dominated the market by holding nearly 44% share in 2024. The dominance of the segment can be linked to the technological innovations that enhance treatment efficiency, along with the increasing need for clean and reclaimed water.

- The industrial sectors segment held approximately 33% market share and is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by growing clean water demand from specific industries such as food and beverage, coupled with the rapid adoption of advanced technologies for efficiency and compliance.

- The commercial & institutional segment held nearly 13% market share in 2024. The segment's growth is mainly fuelled by stringent environmental regulations, such as standards set by the U.S. Environmental Protection Agency (EPA).

- The agriculture & others segment held approximately 10% market share in 2024. This segment mainly focuses on treating water for livestock and irrigation, with other miscellaneous uses like recreational water and hydropower.

Regional Insights

Which U.S. Region Dominated the Market in 2024?

The South region dominated the market with approximately 33% share in 2024. The dominance of the region can be attributed to the surge in water-intensive sectors such as food processing, manufacturing, and pharmaceuticals, which necessitated more effective wastewater management systems. In addition, ongoing population growth in the South increases both industrial and domestic demand for clean water and boosts the need for wastewater management.

The West region holds approximately 26% market share and is expected to grow at the fastest CAGR over the forecast period. The growth of the region can be credited to the aging infrastructure, severe water scarcity, and population growth. The western U.S states such as California, Arizona, and Nevada often face water scarcity problems. This makes cutting-edge water treatment for reuse and recycling a necessity.

The Midwest region held approximately 22% market share and was expected to grow at a notable CAGR over the forecast period. The growth of the region can be driven by heavy investment in aging infrastructure, along with the stringent environmental regulations. Furthermore, the region's manufacturing industry is a major water user, with sectors such as chemical, automotive, and paper production requiring large volumes of water.

Recent Developments

- In September 2025, Veolia unveiled its cutting-edge Hubgrade Center in Scottsdale, Arizona, to revolutionize wastewater treatment services across the western United States. The facility combines human expertise with AI and real-time data to boost wastewater and water treatment for municipalities.(Source: www.indianchemicalnews.com)

- In January 2025, the University of Alberta unveiled an interdisciplinary research centre that aimed at maintaining wastewater and water services reliable, safe, and sustainable for generations to come.(Source: www.ualberta.ca)

Top U.S. Water and Wastewater Treatment Market Companies

Xylem Inc

Xylem Inc. is a global water technology provider specializing in solutions for the entire water cycle, including transport, treatment, and analysis. The company was spun off from ITT Corporation in 2011 and has since grown into a leading force in the water industry.

Corporate info

- Headquarters: Washington, D.C., United States.

- Employees: Approximately 23,000 worldwide.

- 2024 Revenue: $8.6 billion

History and background

Origin. On January 12, 2011, ITT announced plans to separate into three independent, publicly traded companies. The water and wastewater division was formally launched as Xylem Inc. on October 31, 2011, after its spin-off from ITT Corporation.

Mergers & Acquisitions

- In August 2016, Xylem acquired Sensus (smart meters, network technologies and analytics for the water industry) for about US$1.7 billion in cash. This was aimed at accelerating Xylem’s “systems intelligence” strategy (meters + networks + analytics) in water and adjacent markets.

- In January 2023 (completed May 2023), Xylem announced and then closed the acquisition of Evoqua Water Technologies Corp. (a leader in advanced water & wastewater treatment solutions) in an all stock transaction of around US$7.5 billion. The deal created the world’s largest pure play water technology company.

Partnerships & Collaborations

- Partnership with Isle Utilities (Jan 2022) to create the “Trial Reservoir” a funding mechanism to deploy early stage water tech pilots in utilities (especially tech to reduce carbon emissions in water systems).

- Expanded partnership with Imagine H2O (Oct 2021) – Xylem became a global partner to support water tech start ups, through its Xylem Innovation Labs, mentoring, accelerator programs.

Product Launches / Innovations

- The acquisition of Sensus gave Xylem advanced metering infrastructure (AMI) and analytics capabilities (FlexNet® network).

- The Idrica acquisition integrates real time analytics and network monitoring capabilities into Xylem’s digital water offering (“Xylem Vue”).

- The SEAS partnership pilots “air‐to‐water” systems for industrial / solar cleaning usage this points to product innovation in new water source technologies.

Key Technology Focus Areas

- Smart metering & network analytics (via Sensus acquisition)

- Digital water / IoT / data analytics solutions for utilities and networks (Idrica, Xylem Vue)

- Advanced water & wastewater treatment solutions and services (Evoqua acquisition)

- Emerging technologies for water scarcity & resilience (e.g., air to water, advanced filtration/disinfection)

- Sustainability technologies: reducing carbon footprint of water/wastewater systems, enabling circular water reuse.

- Service/solutions business model innovation (integrated lifecycle services, outcome based models).

R&D Organisation & Investment

- Xylem Innovation Labs and its accelerator/partnering initiatives further indicate a structured approach to innovation (collaborations with startups, pilots, scaling).

- The magnitude of recent acquisitions (Sensus, Evoqua, Idrica) also embed R&D/technology capabilities as part of inorganic investment.

SWOT Analysis

Strengths

- Global leadership in water technology solutions with broad geographic reach and strong brand.

- Diversified product + service portfolio across the water cycle.

- Strong inorganic growth track record (large acquisitions) that enhance capability and scale.

Weaknesses

- Heavy reliance on inorganic growth: integration risk, cost synergies risk, cultural/operational fit challenges.

- Exposure to cyclical industrial markets and infrastructure spending, which may be affected by macroeconomic / public sector budget constraints.

- Complexity of managing many product/service segments globally; potential dilution of focus.

Opportunities

- Growing global need for water infrastructure upgrades, aging assets, water scarcity, regulatory pressures driving investment.

- Digital transformation of water utilities offers large addressable market (smart metering, analytics, leak detection, asset management).

- Growth in emerging markets (India, Africa, Latin America) where water access, sanitation and infrastructure are under penetrated.

Threats

- Macroeconomic/inflation pressure increasing costs of materials, logistics, impacting margins.

- Regulatory/geopolitical risks: water infrastructure is often heavily regulated, subject to public procurement cycles, environmental rules, tariffs/currency exposure.

- Competitive pressure: other players moving into digital water and services; rapid tech shifts could disrupt incumbent equipment based model.

Recent News & Strategic Updates

- On Oct 28 2025, Xylem reported a strong Q3 2025: adjusted EPS of US$1.37 (up 23% y/y) and revenue of US$2.3 billion (+8% y/y). The company raised full year EPS guidance to US$5.03 5.08 from US$4.70 4.85.

- In Q2 2024 (reported July 30), Xylem raised its profit forecast for full year 2024, citing resilient demand for water & wastewater treatment products: new EPS guidance US$4.18–4.28 per share.

Other Companies in the Market

- Ecolab's Nalco Water: It is a dominant force in the U.S. water and wastewater treatment market, providing comprehensive solutions for industrial and institutional clients. They focus on helping businesses reduce water and energy consumption, improve operational efficiency, and meet sustainability goals.

- Veolia North America: It is a major player in the U.S. water and wastewater treatment market, operating as the largest private municipal water company and among the top hazardous waste management firms.

- SUEZ North America (Veolia subsidiary)

- Pentair plc

- 3M Company

- Aqua-Aerobic Systems, Inc.

- Evoqua Water Technologies (part of Xylem)

- Danaher Corporation (Hach, Trojan Technologies)

- AECOM

- Jacobs Solutions Inc.

- Kurita America Inc.

- DuPont Water Solutions

- Siemens Water Technologies

- ITT Inc.

- Calgon Carbon Corporation

- Hydranautics (Nitto Group Company)

- Ovivo Inc.

- Clean Water Services

- Black & Veatch

Segments Covered in the Report

By Type

- Municipal Water & Wastewater Treatment

- Industrial Water & Wastewater Treatment

- Commercial & Institutional Treatment

By Treatment Technology

- Membrane Filtration (RO, UF, NF, MF)

- Biological Treatment (Activated Sludge, MBR, SBR)

- Disinfection (UV, Ozone, Chlorination)

- Clarification & Filtration Systems

- Desalination & Water Reuse

- Chemical Treatment (Coagulation, Flocculation)

- Others (Adsorption, Ion Exchange, Advanced Oxidation)

By Component

- Equipment (Pumps, Valves, Membranes, Aerators, etc.)

- Chemicals (Coagulants, Flocculants, Biocides, pH Adjusters)

- Services (Operation, Maintenance, Consulting)

- Software & Digital Solutions (IoT, AI, SCADA, Smart Water Management)

By Application

- Potable Water Treatment

- Wastewater Treatment

- Water Reuse & Recycling

- Desalination

- Groundwater Remediation & Industrial Process Water

By End User

- Municipal Utilities

- Industrial Sectors

- Power Generation

- Food & Beverage

- Pharmaceuticals

- Chemicals & Petrochemicals

- Electronics & Semiconductors

- Commercial & Institutional

- Agriculture & Others