Content

What is the Plastic Compounding Market Sizea and Share?

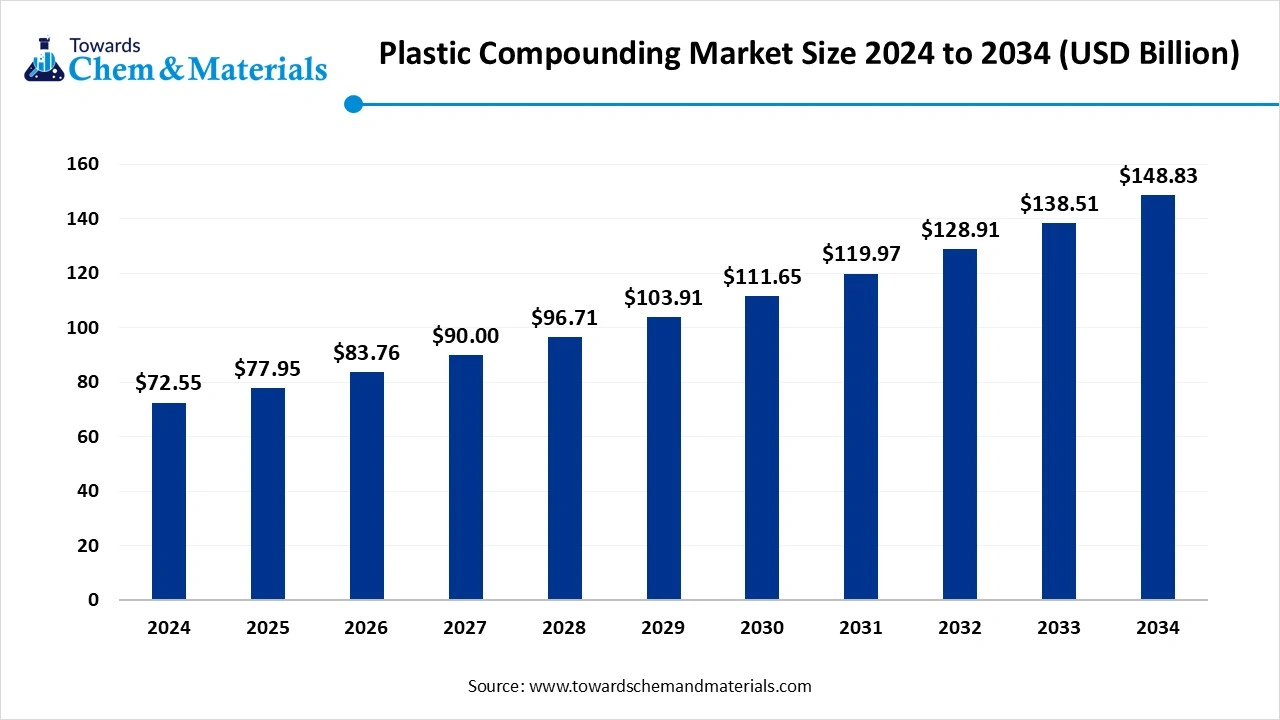

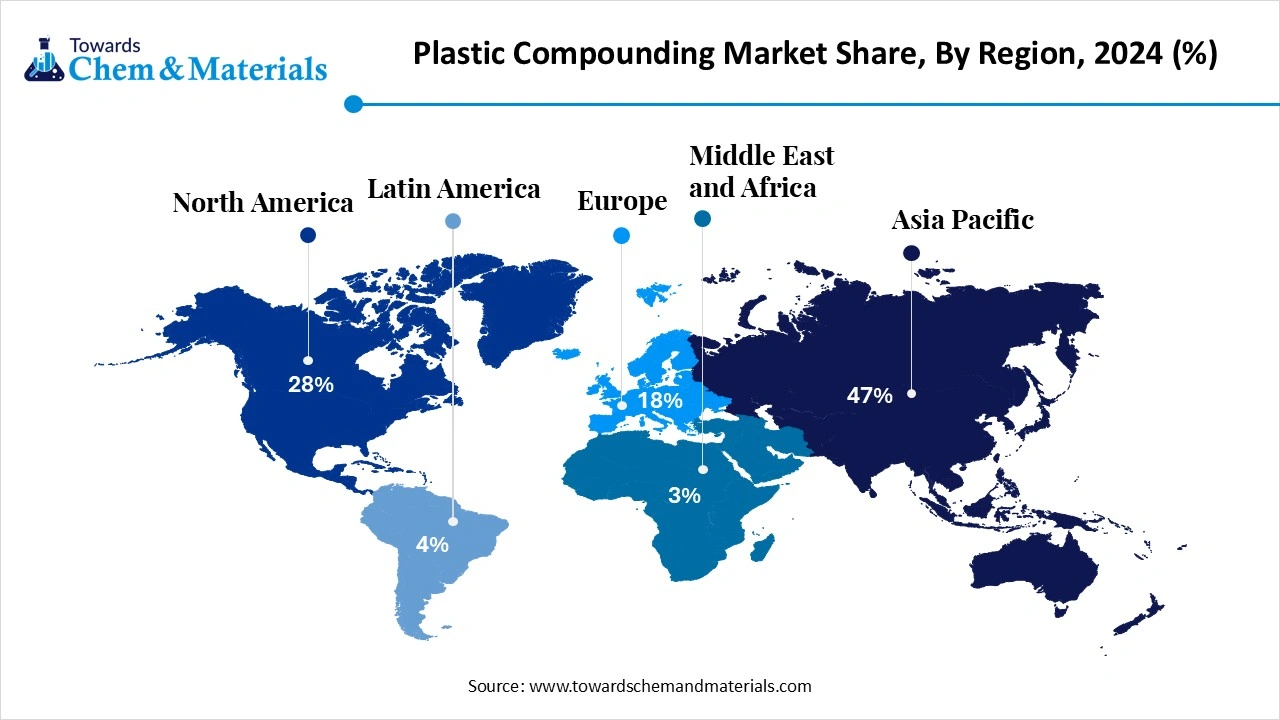

The global plastic compounding market size was valued at USD 72.55 billion in 2024 and is forecasted to surpass around USD 148.83 billion by 2034, growing at a compound annual growth rate (CAGR) of 7.45% over the forecast period from 2025 to 2034. Tthe Asia Pacific dominated the plastic compounding market with a market share of 47% in 2024. The growing urbanization and infrastructural development help the market to grow significantly in the industry.

Key Takeaway

- By region, Asia Pacific dominated the market 47% share in 2024. The growth market is due to rapid industrialization, urban development, and a robust manufacturing base.

- By region, Europe is anticipated to have significant growth in the market in the forecasted period. The growth is driven by its advanced manufacturing infrastructure and focus on sustainability

- By source, the fossil-based segment dominated the market in 2024. The demand for cost-effectiveness, wide availability, and established supply chains helps the growth.

- By source, the recycled segment is anticipated to grow significantly in the market during the forecasted period. Rising focus on sustainable alternatives to reduce environmental impact and meet regulatory requirements drives the growth.

- By product, the polypropylene segment dominated the plastic compounding market in 2024. The properties offered by the product, such as chemical resistance, low density, and high impact strength, drive the market growth.

- By product, the polyethylene segment is anticipated to grow in the forecasted period. The compound is valued for its properties like flexibility, toughness, and excellent chemical resistance, which increases the demand.

- By application, the automotive segment dominated the market in 2024. The growth is driven by the need for lightweight, durable, and cost-effective materials.

- By application, the packaging segment is anticipated to grow in the forecasted period. The growing demand for strength, flexibility, barrier protection, and lightweight characteristics of the product drives the market.

Rising Demand for Durable Materials: Plastic Compounding Market to expand

Plastic compounding is the process of combining base polymers with various additives, fillers, or reinforcements to produce tailored plastic materials with improved or specific properties. This is typically done by melting the polymer and blending it with the desired ingredients, such as stabilizers, colorants, flame retardants, or impact modifiers, using precise dosing through feeders or hoppers.

The compounding process often involves extrusion, where the molten mixture is forced through a die to form long strands. These strands are then cooled, either in a water bath or by spraying, as they travel along a conveyor. Finally, the cooled strands are chopped into uniform pellets using a granulator. These pellets are the final compound, ready to be used in manufacturing various plastic products with enhanced performance or functionality.

The plastic compounding market is driven by rising demand across key industries such as automotive, construction, electronics, and packaging. In the automotive sector, the push for lightweight, fuel-efficient vehicles has accelerated the adoption of high-performance plastic compounds. Urbanization and infrastructure development in emerging economies are also boosting the use of plastic compounds in construction. Additionally, the growing consumer electronics market requires durable and heat-resistant plastics for components.

Environmental concerns and regulations are further encouraging the development of sustainable and recyclable compounds. Technological advancements in polymer science are also enabling the creation of innovative materials with enhanced functionality and performance. These drives help the market to grow.

Market Trends

- The growing emphasis on the use of recycled products and materials, with growing concerns over environmental concerns and the use of sustainable materials, drives the growth of the market.

- The technological advancement in polymer science and the development of high-performance plastic compounds with enhanced properties drive the growth.

- Growth in automotive and electric vehicle applications, with increasing use, contributes to the overall performance of the vehicle.

- The growing demand for flexible, rigid, and sustainable packaging solutions fuels the growth of the market.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 77.95 Billion |

| Expected Size by 2034 | USD 148.83 Billion |

| Growth Rate from 2025 to 2034 | CAGR 7.45% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Source, By Product, By Application, By Region |

| Key Companies Profiled | BASF SE, SABIC, Dow, Inc., KRATON CORPORATION, LyondellBasell Industries Holdings B.V., DuPont de Nemours, Inc., RTP Company, S&E Specialty Polymers, LLC (Aurora Plastics), Asahi Kasei Corporation, Covestro AG, Washington Penn, Eurostar Engineering Plastics, KURARAY CO., LTD., Arkema, TEIJIN LIMITED, LANXESS, Solvay, SO.F.TER |

Market Opportunity

The Growing Demand for Sustainable and Biobased Compounds

One significant opportunity in the plastic compounding market is the growing demand for sustainable and bio-based compounds. As industries and consumers become more environmentally conscious, there is a rising preference for eco-friendly materials. This opens the door for compounders to innovate with biodegradable, recycled, or bio-based plastics that meet performance standards while reducing environmental impact.

Sectors like packaging, automotive, and consumer goods are increasingly seeking green alternatives, creating a strong market pull. Companies that invest in sustainable technologies and develop cost-effective, high-performance green compounds can gain a competitive edge and tap into new, regulation-driven market.

Market Challenge

The Growing Environmental Concerns and Regulatory Pressures

One major challenge in the plastic compounding market is managing environmental concerns and regulatory pressures. Governments worldwide are implementing strict regulations to reduce plastic waste and promote sustainability. This creates pressure on compounders to shift toward bio-based or recyclable materials, which often involve higher production costs and limited raw material availability.

Additionally, meeting evolving environmental standards requires continuous investment in R&D and upgrading manufacturing processes. Balancing cost-efficiency with eco-friendly innovation remains a complex issue, especially for small and medium-sized players. This challenge not only affects profitability but also influences market competitiveness and long-term growth strategies, which hinders the growth of the market.

Segmental Insights

Source Insights

The fossil-based segment dominated the plastic compounding market in 2024. Fossil-based plastic compounds represent the largest segment in the market, owing to their cost-effectiveness, wide availability, and established supply chains. These compounds, derived from petroleum-based polymers like polyethylene, polypropylene, PVC, polystyrene, and ABS, offer versatility and mechanical strength, making them suitable for a broad range of applications. Industries such as automotive, construction, electronics, and packaging rely heavily on fossil-based plastics for components, casings, insulation, and containers.

Despite increasing environmental concerns, demand for fossil-based compounds remains strong due to their performance consistency and ease of processing. However, regulatory pressure and sustainability goals are gradually pushing toward alternative materials.

The recycled segment expects significant growth in the plastic compounding market during the forecast period. Recycled plastic compounds are gaining momentum as industries seek sustainable alternatives to reduce environmental impact and meet regulatory requirements. These compounds are produced from post-consumer or post-industrial plastic waste, including polyethylene, polypropylene, Polyethylene Terephthalate (PET), and polystyrene.

They are increasingly used in packaging, automotive parts, construction materials, and consumer goods. Recycled compounds offer a lower carbon footprint and help reduce landfill waste, making them attractive for companies aiming to improve their sustainability profile. Technological advancements in sorting and processing have enhanced the quality and consistency of recycled materials, which drives the growth of the market.

Product Insights

The polypropylene segment dominated the market in 2024. Polypropylene compounds are widely used in the plastic compounding market due to their excellent balance of properties, including chemical resistance, low density, and high impact strength. They are commonly utilized in automotive components, household appliances, packaging materials, and consumer products. In the automotive industry, PP compounds contribute to lightweighting and fuel efficiency, especially in interior and under-the-hood parts.

Their adaptability allows for reinforcement with fillers like glass fiber to enhance mechanical performance. The recyclability and cost-effectiveness of polypropylene further support its strong market presence. Continuous innovation in formulations is expanding its applications across more technically demanding sectors.

The polyethylene segment expects significant growth in the plastic compounding market during the forecast period. Polyethylene compounds are a key segment in the market, valued for their flexibility, toughness, and excellent chemical resistance. Available in various forms such as LDPE, HDPE, and LLDPE, these compounds are widely used in packaging films, containers, pipes, cable insulation, and household goods.

Their lightweight nature and ease of processing make them ideal for both consumer and industrial applications. In infrastructure, HDPE compounds are preferred for piping systems due to their durability and corrosion resistance. With growing interest in recyclability and sustainability, polyethylene compounds, especially recycled grades, are being further developed to align with environmental goals and circular economy efforts, which drives the plastic compounding market growth.

Application Insights

The automotive segment dominated the plastic compounding market in 2024. The automotive industry is one of the largest consumers of plastic compounds, driven by the need for lightweight, durable, and cost-effective materials. Plastic compounds are used extensively in vehicle interiors, exteriors, under-the-hood components, and electrical systems.

Materials such as polypropylene, ABS, polyamide, and reinforced composites help reduce vehicle weight, improving fuel efficiency and lowering emissions. The shift toward electric vehicles is further boosting demand for advanced plastic compounds with high thermal stability and electrical insulation. In addition, aesthetics, design flexibility, and corrosion resistance make plastics a preferred choice in automotive manufacturing. Regulatory pressure for sustainability is also encouraging the use of recycled and bio-based compounds, which drives the market.

The packaging segment expects significant growth in the market during the forecast period. The packaging industry is a major driver of the plastic compounding market, utilizing materials like polyethylene, polypropylene, PET, and polystyrene for a wide range of applications. Compounded plastics offer the strength, flexibility, barrier protection, and lightweight characteristics required for both rigid and flexible packaging formats.

These materials are commonly used in food packaging, consumer goods, pharmaceuticals, and industrial products. The sector is increasingly focused on sustainability, leading to a surge in demand for recyclable, biodegradable, and lightweight plastic compounds. Innovations in multilayer films, antimicrobial additives, and clear barrier properties are enhancing functionality, while regulatory pressures are pushing the adoption of eco-friendly solutions. This helps the market to grow.

Regional Insights

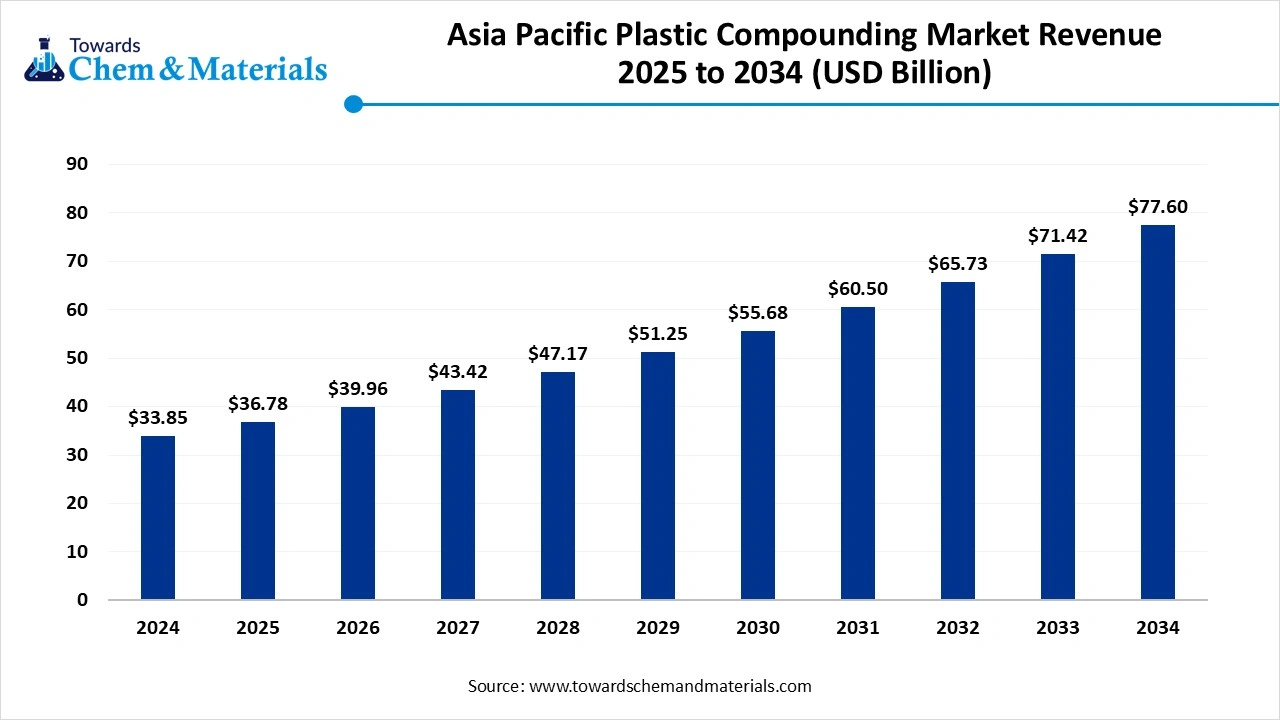

The Asia Pacific plastic compounding market size is reached at USD 36.78 billion in 2025 and is expected to be worth around USD 77.60 billion by 2034, growing at a compound annual growth rate (CAGR) of 8.65% over the forecast period 2025 to 2034.

The growth is seen due to rapid industrialization, urban development, and a robust manufacturing base. Countries like China, India, Japan, and South Korea are major contributors, driven by growing automotive, construction, and electronics industries.

The region benefits from low labor costs, a large consumer base, and supportive government policies promoting infrastructure and industrial growth. Additionally, rising environmental awareness is spurring demand for sustainable plastic compounds. Technological advancements and increased foreign investments are further strengthening the region’s position as a plastic compounding hub, with Asia Pacific expected to maintain the highest position in the market.

India is a leading market in plastic compounding due to the expansion of various industries.

India presents a promising landscape in the plastic compounding market due to its expanding automotive, construction, and packaging sectors. The government’s “Make in India” initiative is encouraging local manufacturing, which boosts demand for advanced plastic materials. Urbanization and infrastructure projects are creating substantial opportunities for compounded plastics in pipes, cables, and fittings.

- Furthermore, the electronics and consumer goods markets are growing rapidly, requiring high-performance compounds. Environmental regulations are also nudging the market toward bio-based and recyclable materials. India’s large skilled workforce, competitive production costs, and increasing R&D investments make it a key emerging market in the plastic compounding industry.

Europe's advanced manufacturing infrastructure and sustainability focus drive the growth of the market in the region.

Europe is anticipated to grow significantly in the plastic compounding market in the forecasted period. Europe remains a key region in the market, driven by its advanced manufacturing infrastructure and focus on sustainability. The region is known for strict environmental regulations, which are pushing industries to adopt recyclable and bio-based plastic compounds.

Major end-use sectors include automotive, construction, and electronics, all of which are evolving to meet EU climate goals. Innovation in lightweight and durable plastic materials is gaining traction, particularly for electric vehicles and green building projects. The region's strong emphasis on a circular economy is encouraging the development of advanced materials that reduce waste and enhance product life cycles, which increases the demand and helps in the growth of the market.

Germany's strong automotive and chemical sector drives the market growth.

Germany plays a central role in Europe’s plastic compounding industry because of its strong automotive, engineering, and chemical sectors. The demand for lightweight, high-performance materials is especially high in automotive manufacturing, which is increasingly shifting toward electric mobility. Germany's advanced R&D capabilities and skilled workforce make it a leader in developing innovative plastic compounds.

- Additionally, the country’s commitment to environmental standards supports the growth of sustainable plastic solutions. Industrial clusters in regions foster collaboration between manufacturers, research institutions, and policymakers, strengthening Germany’s position as a hub for high-quality and eco-friendly

Recent Developments

- CJ Biomaterials Launch: In November 2024, CJ Biomaterials, a division of South Korea’s CJ CheilJedang, expanded its PHACT-branded portfolio with the introduction of a new PHA compound, CB0400A, specifically designed for straw manufacturing. This innovative compound blends amorphous and semi-crystalline PHA grades, enhancing durability and reducing brittleness compared to current compostable polymers, offering a more resilient and sustainable alternative for straw applications.

- LyondellBasell Announcement: In July 2024, LyondellBasell, a global leader in the chemical industry, unveiled its new Schulamid ET100 product line, a groundbreaking polyamide-based compound. Specifically engineered for automotive interior structural applications like door window frames, the new product highlights LYB’s continued innovation and expertise in Engineered Polymers.

- EcoCortecLaunch: In June 2024, EcoCortec, a subsidiary of Cortec Corporation, announced the launch of its advanced compounding operations for VpCI polymers and bio-resins. Equipped with cutting-edge compounding lines at its polymer processing facility, the plant is now producing high-quality concentrated masterbatch. This new operation is set to enhance film quality and meet the premium standards expected by EcoCortec’s customers.

Top Companies List

- BASF SE

- SABIC

- Dow, Inc.

- KRATON CORPORATION

- LyondellBasell Industries Holdings B.V.

- DuPont de Nemours, Inc.

- RTP Company

- S&E Specialty Polymers, LLC (Aurora Plastics)

- Asahi Kasei Corporation

- Covestro AG

- Washington Penn

- Eurostar Engineering Plastics

- KURARAY CO., LTD.

- Arkema

- TEIJIN LIMITED

- LANXESS

- Solvay

- SO.F.TER

Segments Covered

By Source

- Fossil-based

- Bio-based

- Recycled

By Product

- Polyethylene (PE)

- Polypropylene (PP)

- Thermoplastic Vulcanizates (TPV)

- Thermoplastic Polyolefins (TPO)

- Polyvinyl Chloride (PVC)

- Polystyrene (PS)

- Polyethylene Terephthalate (PET)

- Polybutylene Terephthalate (PBT)

- Polyamide (PA)

- Polycarbonate (PC)

- Polyurethane (PU)

- Polymethyl Methacrylate (PMMA)

- Acrylonitrile Butadiene Styrene (ABS)

- Others

By Application

- Automotive

- Building & construction

- Electrical & electronics

- Packaging

- Consumer goods

- Industrial machinery

- Medical devices

- Optical media

- Aerospace & defense

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait