Content

What is the Current Europe Plastics Market Size and Volume?

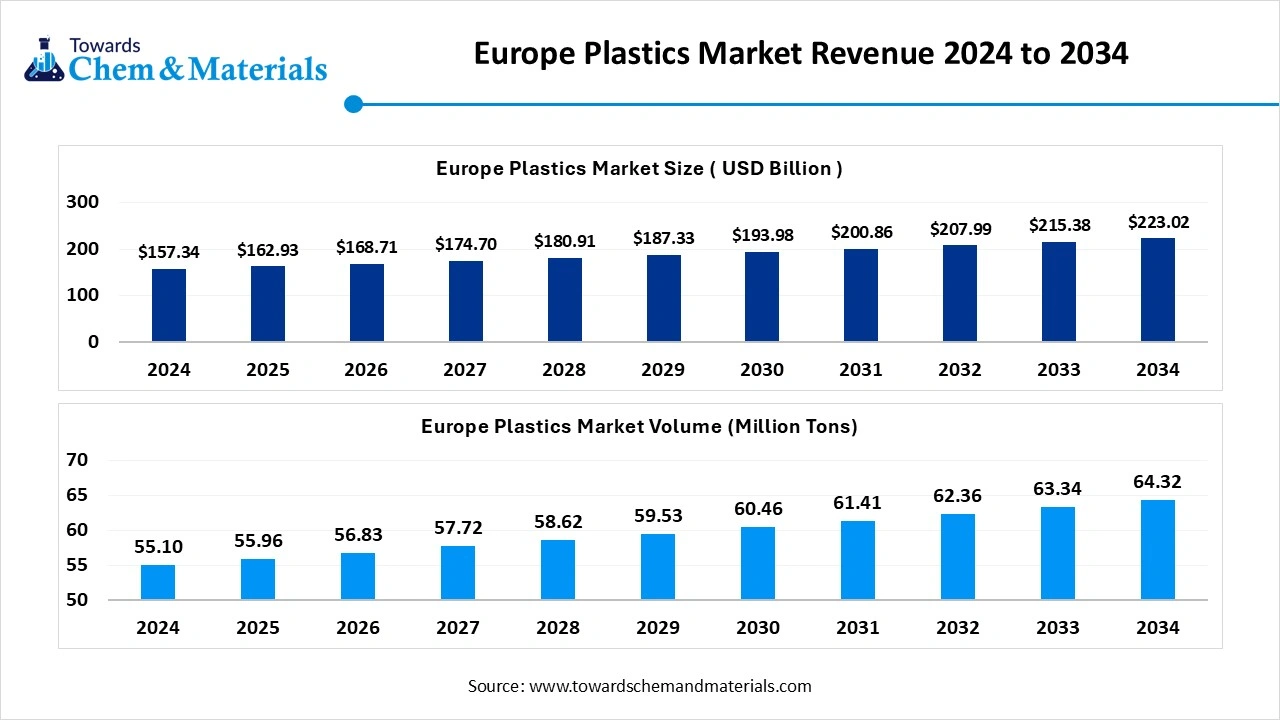

The Europe plastics market size is expected to reach a volume of approximately 55.96 million tons in 2025, with a forecasted increase to 64.32 million tons by 2034, growing at a CAGR of 1.56% from 2025 to 2034.

The Europe plastics market size is calculated at USD 162.93 billion in 2025 and is expected to surpass around USD 223.02 billion by 2034, growing at a compound annual growth rate (CAGR) of 3.55% over the forecast period 2025 to 2034. The Rising environmental awareness is the key factor driving market growth. Also, the increasing shift towards a circular economy, coupled with the ongoing government regulations promoting recycling, can fuel market growth further.

Key Takeaways

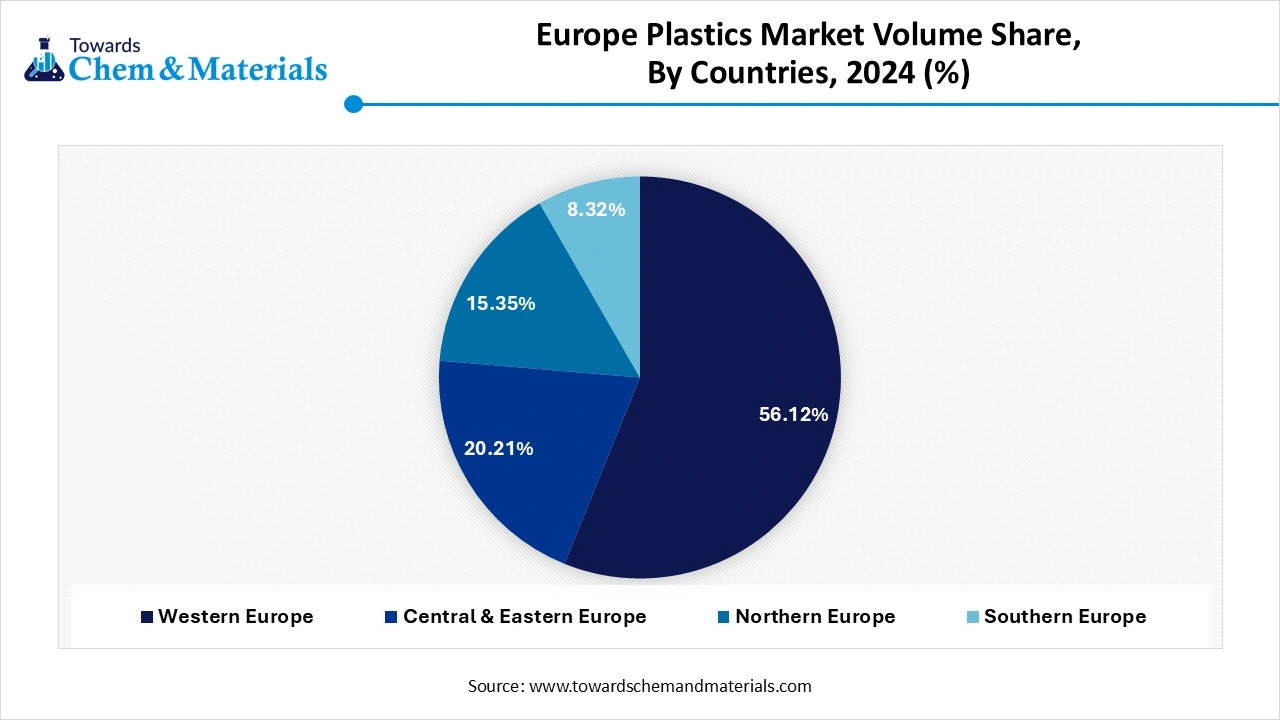

- By region, Western Europe dominated the Europe plastics market with a 45% market share in 2024. The dominance of the region can be attributed to the ongoing environmental regulations and increasing consumer awareness.

- By region, Eastern Europe is expected to grow at the fastest CAGR over the forecast period. The growth of the region can be credited to the growing demand for recycled PET in textiles, packaging, and the automotive industries.

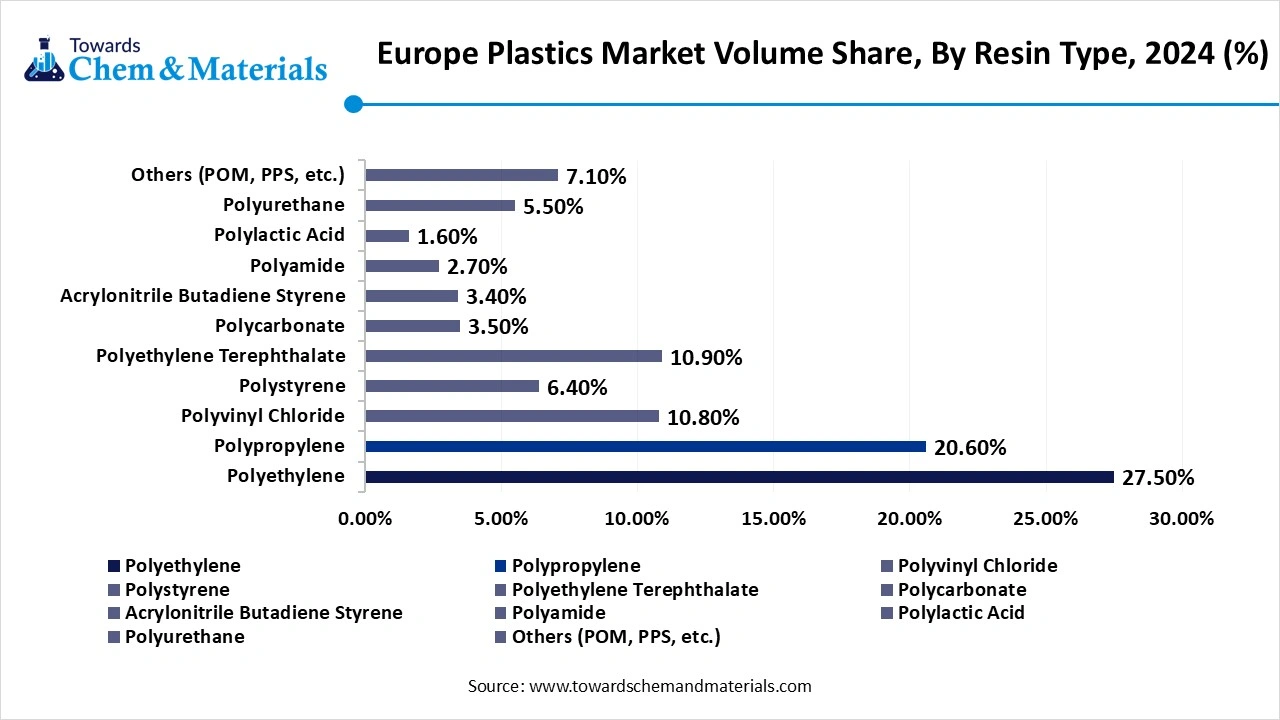

- By resin type, the polypropylene (PP) segment held a 22% market share in 2024. The dominance of the segment can be attributed to the rising product demand in the automotive, packaging, and construction industries.

- By resin type, the polylactic acid (PLA) segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the increasing consumer demand for sustainable products.

- By technology, the injection molding segment led the market with a 35% market share in 2024. The dominance of the segment can be linked to the ongoing advancements in molding technology.

- By technology, the 3D printing/additive manufacturing segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by the growing adoption of 3D printed plastics across various industries.

- By application, the packaging segment dominated the market by holding 40% market share in 2024. The dominance of the segment is owed to the surge in the e-commerce sector and the rising need for convenience packaging.

- By application, the healthcare & medical segment is expected to grow at the fastest CAGR over the projected period. The growth of the segment is due to a rapid surge in population growth and raised health awareness across the region.

- By material origin, the fossil-based plastics segment led the market with 88% market share in 2024. The dominance of the segment can be linked to the robust global demand for plastics and established infrastructure.

- By material origin, the bioplastics segment is expected to grow at the fastest CAGR over the study period. The growth of the segment can be credited to the ongoing advancements in bioplastics production.

- By functionality, the thermoplastics segment held an 80% market share in 2024. The dominance of the segment can be attributed to the increasing use of thermoplastics in automobiles.

- By functionality, the high-performance plastics segment is expected to grow at the fastest CAGR over the forecast period. The dominance of the segment is due to its lighter weight, cost-effectiveness, and superior properties.

Advancements in Plastics Technology are Expanding Market Growth

The European Plastics Market encompasses the production, processing, and distribution of synthetic and semi-synthetic polymers made primarily from petrochemicals and increasingly from bio-based sources. These plastics are molded into a wide variety of products and applications across industries such as packaging, automotive, construction, healthcare, electronics, agriculture, and consumer goods. The European market is shaped by stringent environmental regulations, a growing circular economy focus, and strong R&D for sustainable and advanced plastic materials. Advancements in areas such as recycling technologies and biodegradable plastics are impacting positive market growth soon.

What Are The Key Trends Influencing The Europe Plastics Market?

- Increasing awareness regarding energy saving is the latest trend in the market. This raises consciousness is propelling businesses towards the use of recycled plastics as an eco-friendly option, as a segment of much larger energy efficiency objectives. Hence, many market players in Europe are increasingly investing in chemical recycling by promoting technological advancements.

- The surge in government incentives and subsidies to companies is another trend shaping market growth positively. Governments across Europe have recognized the major role recycling plays while addressing plastic pollution and supporting sustainable lifestyles.

- New technologies are rapidly emerging in recycling, like chemical recycling and advanced sorting systems, to enhance the overall quality and efficiency of the product. Also, digitalization is improving production efficiency and allowing for more sophisticated use of resources, contributing to market expansion further.

Report Scope

| Report Attribute | Details |

| Market Volume in 2025 | 55.96 Million Tons |

| Expected Volume by 2034 | 64.32 Million Tons |

| Growth Rate from 2025 to 2034 | CAGR 1.56% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Resin Type, By Technology, By Application, By Material Origin, By Functionality, By Region |

| Key Companies Profiled | BASF SE (Germany), LyondellBasell Industries (Netherlands), INEOS Group (UK), Borealis AG (Austria), SABIC Europe (Netherlands), Covestro AG (Germany), Arkema S.A. (France), TotalEnergies Polymers (France), Repsol S.A. (Spain), Evonik Industries AG (Germany), LANXESS AG (Germany), Röchling Group (Germany), Ensinger GmbH (Germany), Solvay S.A. (Belgium), Celanese Europe BV (Germany), DSM Engineering Materials (Netherlands), ExxonMobil Chemical Europe, Versalis (Italy – subsidiary of Eni), MOL Group (Hungary), Plásticos Compuestos S.A. (Spain) |

Market Opportunity

Transition Toward Bioplastics Production

Many producers are increasingly investing in bio-based plastics, which are obtained from renewable sources such as sugarcane, corn, and algae. The environmental demand and regulatory pressure surrounding petroleum-based plastics have enabled this transition to minimize carbon footprints. Furthermore, the huge plastic demand from the packaging sector due to the rise in e-commerce and food delivery services is responsible for the rapid plastic demand in Europe.

- In March 2025, Agilyx ASA announced the launch of Plastyx in partnership with Carlos Monreal for the cutting-edge plastic recycling market. Plastyx is created to lessen the gap between production and supply by enhancing material processing capabilities. (Source : www.indianchemicalnews.com)

Market Challenge

Imports of Recycled Plastics

Growing imports of non-EU recycled plastics are the major factor hindering market expansion for the domestically produced recycled plastics, weakening the European plastic industry further. Moreover, the presence of harmful substances in some plastics can impact recycling efforts because these substances can pose health challenges and make the recycled material inconvenient for some applications.

Regional Insights

Western Europe dominated the regional market with a 45% market share in 2024. The dominance of the region can be attributed to the ongoing environmental regulations, increasing consumer awareness, and the extensive adoption of circular economy frameworks. The western European countries, such as France, Germany, and the Netherlands, are investing heavily in recycling technologies such as chemical recycling, which is impacting positive regional growth further.

Europe Plastics Market Volume Share, By Region, 2024-2034 (%)

| By Region | Volume Share, 2024 (%) | Market Volume Million Tons - 2024 | Volume Share, 2034 (%) | Market Volume Million Tons - 2034 | CAGR (2025 - 2034) |

| Western Europe | 56.12% | 30.92 | 51.23% | 32.95 | 0.71% |

| Central & Eastern Europe | 20.21% | 11.14 | 24.32% | 15.64 | 3.85% |

| Northern Europe | 15.35% | 8.46 | 16.35% | 10.52 | 2.45% |

| Southern Europe | 8.32% | 4.58 | 8.10% | 5.21 | 1.43% |

| Total | 100% | 55.10 | 100% | 64.32 | 1.56% |

Europe Plastics Market in Germany

In the Western Europe region, Germany led the market owing to the growing demand for lightweight materials in the construction and automotive sectors, coupled with the innovations in recycling technologies. In addition, German regions such as North Rhine-Westphalia and Bavaria are emerging as major production and innovation hubs for plastics, supported by ongoing industrial policies.

Eastern Europe is expected to grow at the fastest CAGR over the forecast period. The growth of the region can be credited to the growing demand for recycled PET in textiles, packaging, and automotive industries due to rising environmental consciousness among the people living in this region of Europe. Furthermore, eastern European countries such as the Czech Republic, Poland, and Hungary are becoming crucial centers for aerospace manufacturing, which drives the demand for aerospace plastics.

Which are the Top European Countries for Plastic Item Exports in 2024?

| Country | Exports in billions |

| Germany | 11.1 billion |

| Italy | 3.7 billion |

| France | 3.6 billion |

| Poland | 3.4 billion |

| Netherlands | 2.7 billion |

Segmental Insight

Resin Type Insight

Which Resin Type Segment Dominated the Europe Plastics Market in 2024?

The polypropylene (PP) segment held a 22% market share in 2024. The dominance of the segment can be attributed to the rising product demand in the automotive, packaging, and construction industries, along with its increasing application in the electrical & electronics sector. Also, the ongoing trend towards eco-friendly and sustainable products is also impacting the segment growth, with a growing emphasis on bio-based PP.

The polylactic acid (PLA) segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the increasing consumer demand for sustainable products, especially in packaging, and governmental initiatives focusing on minimizing plastic waste. PLA's composability and biodegradability make it a crucial choice for packaging.

Europe Plastics Market Volume Share, By Resin Type, 2024 (%)

| By Resin Type | Volume Share, 2024 (%) | Market Volume Million Tons - 2024 | Volume Share, 2034 (%) | Market Volume Million Tons - 2034 | CAGR (2025 - 2034) |

| Polyethylene | 27.50% | 15.15 | 24.90% | 16.02 | 0.62% |

| Polypropylene | 20.60% | 11.35 | 21.80% | 14.02 | 2.38% |

| Polyvinyl Chloride | 10.80% | 5.95 | 9.40% | 6.05 | 0.18% |

| Polystyrene | 6.40% | 3.53 | 4.60% | 2.96 | -1.93% |

| Polyethylene Terephthalate | 10.90% | 6.01 | 12.10% | 7.78 | 2.92% |

| Polycarbonate | 3.50% | 1.93 | 4.50% | 2.89 | 4.61% |

| Acrylonitrile Butadiene Styrene | 3.40% | 1.87 | 3.60% | 2.32 | 2.38% |

| Polyamide | 2.70% | 1.49 | 3.80% | 2.44 | 5.67% |

| Polylactic Acid | 1.60% | 0.88 | 3.50% | 2.25 | 10.98% |

| Polyurethane | 5.50% | 3.03 | 5.60% | 3.60 | 1.94% |

| Others (POM, PPS, etc.) | 7.10% | 3.91 | 6.20% | 3.99 | 0.21% |

| Total | 100% | 55.10 | 100% | 64.32 | 1.56% |

Technology Insight

Why Injection Molding Segment Dominated the Europe Plastics Market in 2024?

The injection molding segment dominated the market with 35% market share in 2024. The dominance of the segment can be linked to the ongoing advancements in molding technology, including micro-molding and multi-material molding, which are improving product abilities and expanding application areas. There is also a rising demand for injection molded plastics, which can be recycled and aligns with the European environmental regulations.

The 3D printing/additive manufacturing segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by growing adoption of 3D printed plastics across various industries such as aerospace, automotive, and healthcare, coupled with the innovations in materials and rising emphasis on sustainability.

Application Insight

How Did the Packaging Segment Held the Largest Europe Plastics Market Share in 2024?

The packaging segment dominated the market by holding 40% market share in 2024. The dominance of the segment is owed to the surge in the e-commerce sector and the rising need for convenience packaging. Plastic materials such as HDPE, PET, and LDPE are widely used in many industries as a convenient packaging material. Additionally, flexible packaging materials such as pouches and films are witnessing rapid growth because of their cost-effectiveness and versatility.

The healthcare & medical segment is expected to grow at the fastest CAGR over the projected period. The growth of the segment is due to a rapid surge in population growth and raised health awareness across the region. Plastics are necessary in producing items such as IV bags, syringes, implants, and diagnostic tools. The new innovations in medical-grade polymers are playing a key role in the segment's expansion.

Material Origin Insight

Which Material Origin Segment Dominated the Europe Plastics Market in 2024?

The fossil-based plastics segment dominated the market with 88% market share in 2024. The dominance of the segment can be linked to the robust global demand for plastics, established infrastructure, and huge dependence on fossil fuels as a primary feedstock within the plastic and petrochemical industry. Furthermore, many fossil-based plastics can be replaced with bioplastics in existing applications.

The bioplastics segment is expected to grow at the fastest CAGR over the study period. The growth of the segment can be credited to the ongoing advancements in bioplastics production, such as the development of enhanced processing techniques with new bio-based materials, which are improving the performance of bioplastics by minimizing the production costs.

Functionality Insight

Why Did the Thermoplastics Segment Dominated the Europe Plastics Market in 2024?

The thermoplastics segment held an 80% market share in 2024. The dominance of the segment can be attributed to the increasing use of thermoplastics in automobiles to minimize weight, enhance fuel efficiency, and improve design flexibility. Moreover, thermoplastic polyolefins (TPOs) are becoming popular in waterproofing, roofing, and other construction applications because of their weather resistance and durability, driving segment growth further.

The high-performance plastics segment is expected to grow at the fastest CAGR over the forecast period. The dominance of the segment is due to its lighter weight, cost-effectiveness, and superior properties such as mechanical strength, chemical stability, and high thermal resistance. Continuous advancements in applications such as packaging, construction, and consumer goods are creating new avenues for market growth.

Recent Developments

- In June 2025, Ineos Olefins & Polymers Europe introduced recycled plastic manufacturing in France. The French facility obtains an advanced pyrolysis oil to fulfil EU recycled content demands.(Source: www.plasticstoday.com)

- In December 2024, Symphony Environmental Ltd., a U.K.-based packaging technology company, launched a natural and biodegradable resin. The new product is designed with natural minerals to minimize the amount of fossil-derived polypropylene (PP) or polyethylene (PE) used.(Source : www.recyclingtoday.com)

Top Companies List

- BASF SE (Germany)

- LyondellBasell Industries (Netherlands)

- INEOS Group (UK)

- Borealis AG (Austria)

- SABIC Europe (Netherlands)

- Covestro AG (Germany)

- Arkema S.A. (France)

- TotalEnergies Polymers (France)

- Repsol S.A. (Spain)

- Evonik Industries AG (Germany)

- LANXESS AG (Germany)

- Röchling Group (Germany)

- Ensinger GmbH (Germany)

- Solvay S.A. (Belgium)

- Celanese Europe BV (Germany)

- DSM Engineering Materials (Netherlands)

- ExxonMobil Chemical Europe

- Versalis (Italy – subsidiary of Eni)

- MOL Group (Hungary)

- Plásticos Compuestos S.A. (Spain)

Segments Covered

By Resin Type (Volume, Kilotons; Revenue, USD Million, 2021 - 2034)

- Polyethylene (PE)

- HDPE

- LDPE

- LLDPE

- Polypropylene (PP)

- Polyvinyl Chloride (PVC)

- Polystyrene (PS)

- General Purpose PS

- High Impact PS

- Polyethylene Terephthalate (PET)

- Polycarbonate (PC)

- Acrylonitrile Butadiene Styrene (ABS)

- Polyamide (PA)

- Polylactic Acid (PLA)

- Polyurethane (PU)

- Others (POM, PPS, PBT, etc.)

By Technology (Volume, Kilotons; Revenue, USD Million, 2021 - 2034)

- Injection Molding

- Blow Molding

- Extrusion

- Thermoforming

- Compression Molding

- Rotational Molding

- 3D Printing/Additive Manufacturing

By Application (Volume, Kilotons; Revenue, USD Million, 2021 - 2034)

- Packaging

- Rigid Packaging

- Flexible Packaging

- Automotive & Transportation

- Interior Components

- Exterior Components

- Under-the-hood Applications

- Construction

- Pipes & Fittings

- Insulation

- Roofing & Cladding

- Electrical & Electronics

- Casing & Enclosures

- Connectors & Housings

- Healthcare & Medical

- Disposables

- Medical Devices

- Drug Delivery Systems

- Consumer Goods

- Household Goods

- Sports & Leisure Products

- Agriculture

- Mulch Films

- Greenhouse Films

- Irrigation Components

- Industrial Machinery

- Textiles (Technical textiles, fibers)

By Material Origin (Volume, Kilotons; Revenue, USD Million, 2021 - 2034)

- Fossil-based Plastics

- Bioplastics

- Bio-based (drop-in bio PET, bio PE)

- Biodegradable (PLA, PHA, PBS)

By Functionality (Volume, Kilotons; Revenue, USD Million, 2021 - 2034)

- Thermoplastics

- Thermosets

- Engineering Plastics

- High-performance Plastics

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait