Content

What is the Current Biofertilizer Market Size and Share?

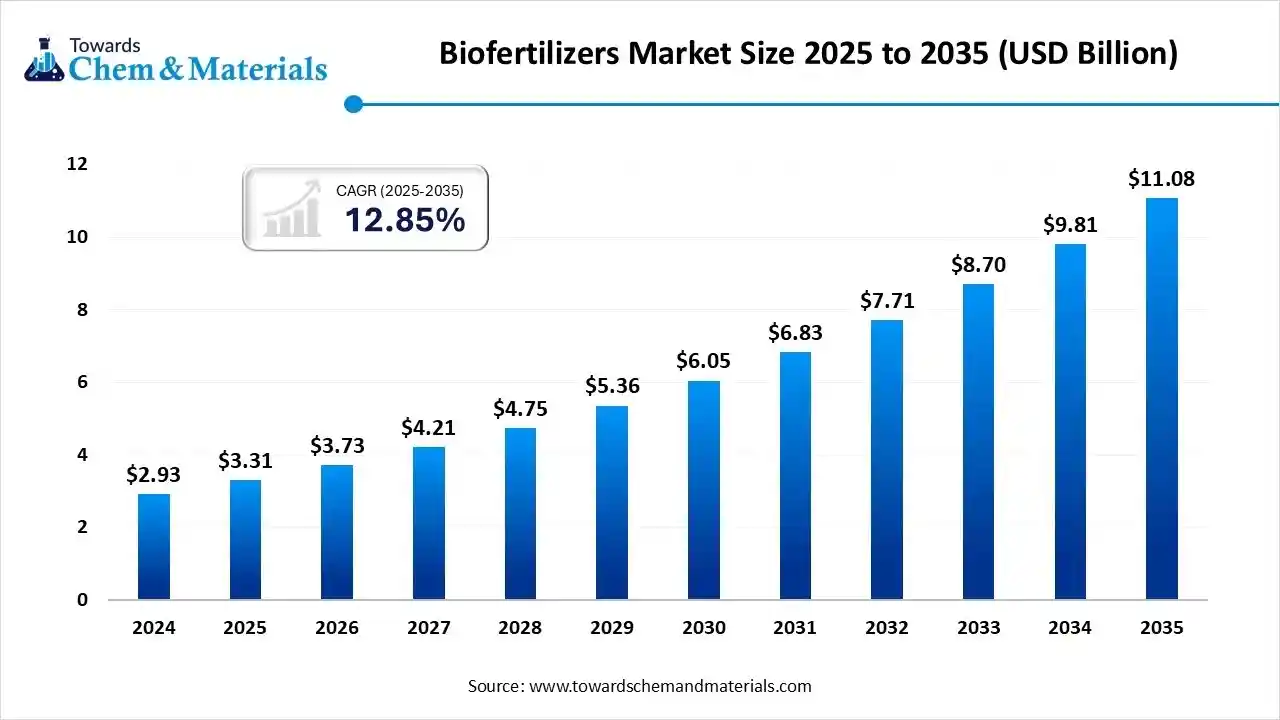

The global biofertilizer market size is calculated at USD 3.31 billion in 2025 and is predicted to increase from USD 3.73 billion in 2026 and is projected to reach around USD 11.08 billion by 2035, The market is expanding at a CAGR of 12.85% between 2025 and 2035. Asia Pacific dominated the biofertilizer market with a market share of 46.70% the global market in 2024. The global shift towards sustainable, environmentally friendly agricultural practices has accelerated the market in recent years.

Key Takeaways

- By region, Asia Pacific dominated the biofertilizer market with approximately 46.7% industry share in 2024.

- By region, Europe is likely to capture an 11.3% CAGR in the upcoming years.

- By type, the nitrogen-fixing biofertilizers segment dominated the market with approximately 41.5% in 2024.

- By type, the mycorrhizal biofertilizers segment is expected to grow at a 11.2% rate in the market during the forecast period.

- By microorganism type, the bacterial biofertilizers segment dominated the market with approximately 62.8% industry share in 2024.

- By microorganism type, the cyanobacterial/algal biofertilizers segment is expected to grow at a 10.7% rate in the biofertilizer market during the forecast period.

- By formulation, the solid biofertilizers segment dominated the market with approximately 56.2% industry share in 2024.

- By formulation, the liquid biofertilizers segment is expected to grow at a CAGR of 12.4% in the market during the forecast period.

- By mode of application, the seed treatment segment dominated the market with approximately 47.6% industry share in 2024.

- By mode of application, the foliar spray segment is expected to grow at the fastest rate in the biofertilizer market during the forecast period.

- By crop type, the cereals and grains segment dominated the market with approximately 43.2% in 2024.

- By crop type, the fruit and vegetable segment is expected to grow at a rate of 10.6% in the market during the forecasted period.

- By end use, the agriculture segment dominated the market with approximately 61.5% industry share in 2024.

- By end use, the organic farming segment is expected to grow at the fastest rate in the market during the forecast period.

Beyond Chemicals: The Global Move Toward Biological Fertility

- The global bio fertilizers market comprises living microbial inoculants that promote plant growth by enhancing nutrient availability through biological nitrogen fixation, phosphate solubilization, potassium mobilization, and production of growth-promoting substances.

- These include bacterial, fungal, and algal formulations applied to seeds, soil, or plants to increase productivity, soil health, and agricultural sustainability.

- Biofertilizers are gaining prominence as eco-friendly alternatives to synthetic fertilizers, driven by global initiatives promoting regenerative and organic farming, soil restoration, and reduced chemical dependency.

- The market growth is fueled by government subsidies for bio-based inputs, expansion of organic-certified farmlands, and technological advancements in microbial strain development, carrier materials, and formulation stability. Asia-Pacific leads production and consumption, while Europe and North America focus on regulatory-backed sustainable agriculture and high-value organic crops.

Biofertilizer Market Outlook:

- Industry Growth Overview: Between 2025 and 2034, the increased demand for cheaper and cleaner ways to feed crops is being embraced as a transformative trend in the market. Moreover, the establishment of mobile microfactories near farms, which helps maintain affordability, has gained prominence in innovation-led discussions over the past few years.

- Sustainability Trends: Modern farming has shifted towards the use of recycled nutrients, and buyers are willing to pay a premium for higher scores in recent years. Also, several food brands are asking suppliers to use short biofertilizers, which can then use the statement on the labelling. The establishment of the local agriculture waste hubs is being hailed as a disruptive force in the sector nowadays.

- Global Expansion: The biofertilizer manufacturer has been shipping kits in bulk, not just bulk bags, in the current period. Also, regions like Asia Pacific and North America are actively investing in the development of microbial fertilizers over the past few years, as per the observation. The global farming conferences and campaigns have contributed to the industry's growth in recent years.

- Innovation in the Field : Technological advances have transformed the industry's potential in recent years, as several farmers are observed using smart spreaders and drones. Moreover, the soil sensors are regarded as a major technological advancement in the sector. Also, technologically advanced initiatives, such as microbiome passports, have been widely discussed in technology forums and whitepapers over the past few years.

Report Scope

| Report Attributes | Details |

| Market Size in 2026 | USD 3.73 Billion |

| Expected Size by 2035 | USD 11.08 Billion |

| Growth Rate from 2025 to 2035 | CAGR 12.85% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2026 - 2035 |

| Leading Region | Asia Pacific |

| Fastest Growing Region | Europe |

| Segment Covered | By Type, By Microorganism Type, By Formulation, By Mode of Application, By Crop Type, By End-Use, By Region |

| Key Companies Profiled | Novozymes, UPL Limited, IPL Biologicals Limited, Koppert Biological Systems,Bayer AG, Syngenta AG, Rizobacter Argentina S.A., Gujarat State Fertilizers & Chemicals Ltd (GSFC), National Fertilizers Limited (NFL), Indian Farmers Fertiliser Cooperative Limited (IFFCO), Bioceres S.A.,Biolchim S.p.A., Valagro SpA, Symborg, Mapleton Agri Biotech Pty Limited, Kiwa Bio-Tech Products Group Corporation, Atlántica Agrícola, Verdesian Life Sciences |

Trade Analysis of the Biofertilizer Market:

- Import, Export, Consumption, and Production Statistics Germany has exported $2.38 billion worth of fertilizers in 2024, as per the latest report.(Source: tradingeconomics.com)

- The biofertilizer companies in China are producing biofertilizers in huge amounts, and the amount is estimated as 35 million tons, as per the latest regional study.(Source: pmc.ncbi.nlm.nih.gov)

Value Chain Analysis of the Biofertilizer Market:

- Distribution to Industrial Users :The distribution of biofertilizers to industrial users (large-scale farms and plantations) is typically handled through a combination of direct sales, specialized distributors, and agricultural cooperatives.

- Key Players: Novozymes A/S, UPL Limited, and Lallemand Inc.

- Chemical Synthesis and Processing :Biofertilizers primarily rely on biological processing, which involves the mass production and formulation of living microorganisms.

- Key Players: Rizobacter Argentina S.A., Gujarat State Fertilizers & Chemicals Ltd., and Symborg

- Regulatory Compliance and Safety Monitoring : Regulatory compliance and safety monitoring of the biofertilizer market are handled by specific government agencies in each country, aimed at ensuring product efficacy.

- Key Agencies: Ministry of Agriculture, India, European Commission (EC), Europe, and Environmental Protection Agency (EPA), United States.

Biofertilizers Market Regulatory Landscape: Global Regulations

| Country / Region | Regulatory Body | Key Regulations | Focus Areas | Notable Notes |

| China | Ministry of Agriculture and Rural Affairs (MARA) | Measures on the Management of Fertilizer Registration (Decree 8) | Ensuring product efficacy through stricter efficiency experiments | It is the government authority responsible for the registration, oversight, and quality control of fertilizers and agricultural inputs, including biofertilizers. |

| India | Central Pollution Control Board (CPCB) | Fertilizer (Control) Order (FCO), 1985 | Fertilizer (Control) Order (FCO), 1985 | An apex organization that sets national standards for environmental compliance in manufacturing. |

| United States | Environmental Protection Agency (EPA) | Federal Insecticide, Fungicide, and Rodenticide Act (FIFRA) | Clarifying the regulatory pathway for biostimulants and biofertilizers | Regulates products with pesticidal claims under the Federal Insecticide, Fungicide, and Rodenticide Act (FIFRA). |

| Europe | European Chemicals Agency (ECHA) | Fertilizing Products Regulation (FPR) (EU) 2019/1009 | Reducing reliance on synthetic fertilizers | This agency manages the technical and administrative aspects of the REACH regulation and supports the implementation of the Fertilising Products Regulation (FPR). |

Segmental Insights:

Type Insights

How did the Nitrogen-Fixing Biofertilizers Segment Dominate the Biofertilizer Market in 2024?

- The nitrogen-fixing biofertilizers segment dominated the market, accounting for approximately 41.5% of industry share in 2024, as these fertilizers help plants obtain nitrogen naturally. Moreover, by turning atmospheric nitrogen into the form of nitrogen that the tree needs, called the best food for the plant, nitrogen-fixing fertilizers have gained significant industry attention in recent years.

- On the other hand, the mycorrhizal biofertilizers segment is expected to grow at a 11.2% rate owing to its benefits, such as helping roots reach more water and nutrients. Moreover, by forming the web on the roots, which can bring nutrients, phosphorus, and water into plants, the segment is expected to create lucrative opportunities during the forecast period. Also, the farmers are using these fertilizers for the long-term soil benefits in the current period.

- The sulfur-oxidizing biofertilizers segment is also notably growing, akin to several soil formats lack sulfur. Also, by improving the protein and oil content in crops, sulfur has emerged as the ideal fertilizer in the current period. Moreover, farmers growing oilseeds and cereals have been in high demand for sulfur-oxidizing biofertilizers in recent years.

Microorganism Insights

Why Does the Bacterial Biofertilizers Segment Dominate the Biofertilizer Market by Microorganism?

- The bacterial biofertilizers segment dominated the market, accounting for approximately 62.8% of industry share in 2024, as bacteria are easy to grow, store, and apply. Types like Rhizobium, Azotobacter, and Pseudomonas work well across many crops and climates. Farmers can coat seeds, mix with fertilizer, or spray fields with bacterial products without big changes to routine.

- The cyanobacterial/algal biofertilizer segment is expected to grow rapidly at a 10.7% CAGR because it can be mass-produced with low inputs and provides both nutrients and organic matter.

- Algae add nitrogen, phosphorus, and useful organic compounds to soil and help with soil moisture.

- The actinomycetes-based formulations segment is also growing rapidly because these microbes are sensitive and difficult to mass-produce. They require specialized fermentation and careful handling, which adds cost. Farmers also find their effects slower and less consistent than simpler bacteria or fungi products.

Formulation Insights

How Did the Solid Biofertilizers Segment Dominate the Biofertilizer Market in 2024?

- The solid biofertilizers segment dominated the market with approximately 56.2% industry share in 2024, as they are easy to store, transport, and spread using existing farm machines. Solid biofertilisers often last longer on the shelf and mix well with dry fertilizers. Farmers like solid products because they are less messy than liquids and less prone to spoilage if handled correctly.

- On the other hand, the liquid biofertilizers segment is expected to grow rapidly at a 12.4% because they are quick to apply, mix well with foliar sprays, and are compatible with precision irrigation systems. Liquids show fast action, can be used through drip lines, and are easy to blend with adjuvants. As greenhouse and high-value crop farming expand, growers want liquids for precise dosing and faster plant response.

- The encapsulated/carrier-free formulations segment is also notably growing, driven by increased exploration activities and refinery modernization. Water treatment chemicals are essential in controlling corrosion, scaling, and fouling in drilling, production, and processing systems. As environmental standards tighten, companies invest more in effective treatment solutions to minimize water discharge and equipment damage, driving continuous demand for industrial water treatment products in this segment.

Mode of Application Insights

How Did the Seed Treatment Segment Dominate the Biofertilizer Market in 2024?

- The seed treatment segment dominated the market with approximately 47.6% industry share in 2024, as it provides microbes a close start with the plant. Treating seed is simple, uses little product, and protects seedlings during the most vulnerable stage. It fits well with mechanized planting and is trusted by many growers.

- On the other hand, the foliar spray segment is expected to grow rapidly at a 11.8% CAGR because it delivers nutrients and microbes directly to plant leaves for rapid action. For high-value fruits, vegetables, and greenhouse crops, growers want quick fixes to correct deficiencies or boost growth during key stages.

- The soil treatment segment is also notably growing because farmers want long-term soil health, not just quick fixes. Adding microbes and organic matter to soil improves soil structure, water-holding capacity, and nutrient cycling over seasons. As regenerative and conservation farming spread, soil inoculants and amendments are used more to rebuild degraded land.

Crop Type Insights

Why Does the Cereals and Grains Segment Dominate the Biofertilizer Market by Crop Type?

- The cereals and grains segment dominated the market, accounting for approximately 43.2% of industry share in 2024, as they cover most farmland and require large nutrient inputs year after year. Farmers apply biofertilisers to boost early growth and grain filling, where returns are obvious. Large acreage yields large product volumes, so suppliers focus on cereal crops.

- The fruits and vegetables segment is expected to grow at a 10.6% CAGR as consumers demand precise nutrition and higher product quality. Growers pay more for solutions that improve taste, shelf life, and appearance.

- Biofertilisers are ideal for controlling micronutrients and boosting plant health without leaving residues.

The pulses and oil seeds segment is also notably growing, they help fix soil and meet demand for plant protein and vegetable oil. Farmers add biofertilisers to improve nodulation and increase protein or oil content. Pulses also lower the need for synthetic nitrogen in rotations, a big climate benefit.

End Use Insights

How Did the Agriculture Segment Dominate the Biofertilizer Market in 2024?

- The agriculture segment dominated the market, accounting for approximately 61.5% of industry share in 2024, as farms are the primary source of nutrient demand. Crop growers buy the most product in big volumes for fields, greenhouses, and orchards. Farmers look for cost-effective ways to boost yield and reduce fertilizer bills.

- On the other hand, the organic farming segment is expected to grow at an expected rate of 12.8% as consumers seek food with fewer chemicals and better soil health. Organic rules favor biofertilisers and recycled inputs, making these products essential for certified farms. As organic acreage grows and supply chains pay premiums for organic produce, more farmers switch systems.

- The greenhouse and controlled environment farming segment is also notably growing, because it gives higher yields and year-round crops. These systems need precise nutrition and benefit from biofertilisers that work well with hydroponics and fertigation.

Regional Analysis:

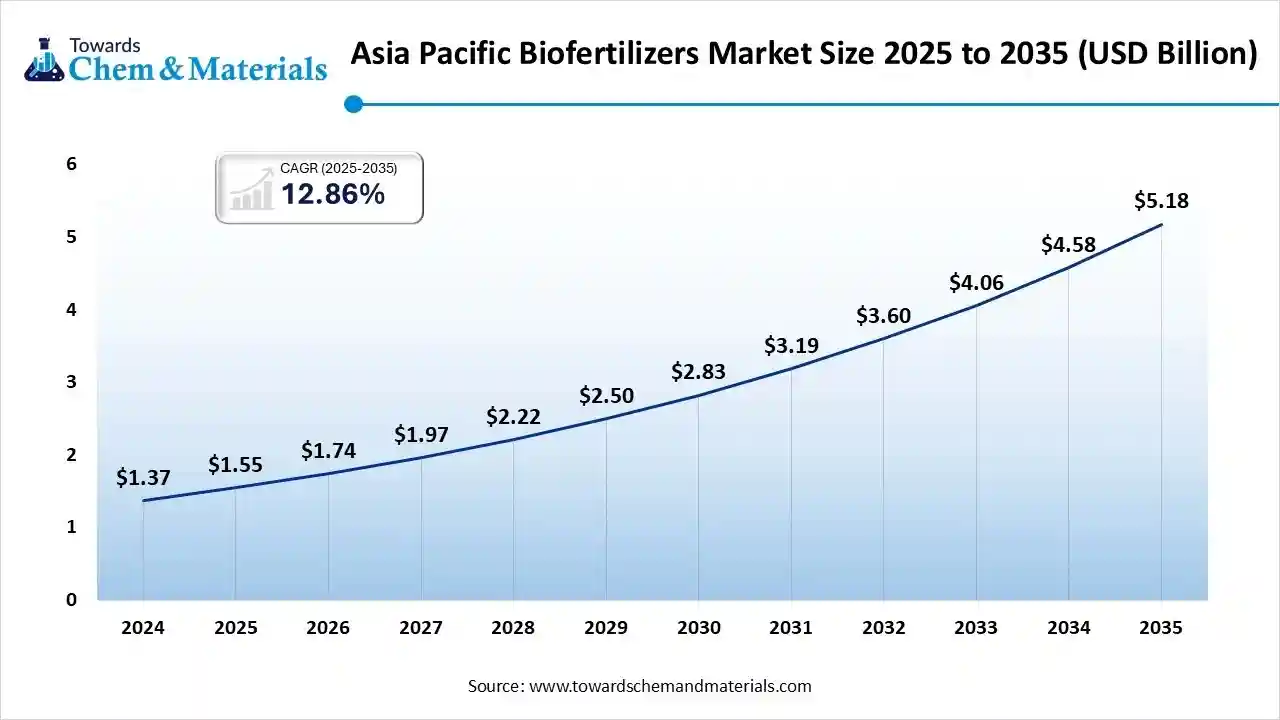

The Asia Pacific biofertilizer market size was valued at USD 1.55 billion in 2025 and is expected to surpass around USD 5.18 billion by 2035, expanding at a compound annual growth rate (CAGR) of 12.86% over the forecast period from 2025 to 2035. Asia Pacific dominated the biofertilizer market with a 46.7% industry share, owing to the expansion of farmland and modern farming practices in recent years.

Moreover, the regional countries such as China, India, and Japan have their own modern and traditional fertilizers and farming methods. Furthermore, the region has seen heavy production of microbial products, which has stabilized prices at a low level while easing supply. The region is also expected to grow at a high CAGR of 11.3% during the forecasted period.

China Strengthens Its Grip on the Biofertilizers Market

China maintained its dominance in the biofertilizer market due to the stronger government push

for agriculture and advanced chemical innovations. Moreover, the manufacturers in China have seen a heavy investment in the production of the local microbial strains and pilot projects as per the latest regional survey.

Europe Biofertilizer Market Analysis

Europe is expected to capture a major share of the biofertilizer market, driven by a push to reduce chemical runoff while supporting organic and recycled fertilizer production. Moreover, regional manufacturers are actively shifting towards modern farming practices, where biofertilizers are likely to play a major role in the industry's expansion during the projected period.

Germany’s Smart Farms Embrace Biofertilizers For a Sustainable Future

Germany is expected to emerge as a prominent player in the biofertilizer market in the coming years, owing to advanced research centers and technology-based farming practices. Also, several farms in Germany have seen widespread adoption of bio products and precision tools in recent years, according to regional observations.

North America Biofertilizer Market Trends

North America is a notably growing region due to the greater acceptance of the new bio-product for raw and specialty crops in recent years. Furthermore, countries in the region, such as Canada and the United States, are seeing significant startup activity, with advanced microbial blends gaining major industry attention in recent years.

Soil Health Takes Centre Stage As the United States Adopts Biofertilizers at Scale

The United States is expected to gain significant market share due to its large farmland, modern technology, and strict environmental regulations. U.S. farmers are focusing on soil-friendly products to reduce pollution and greenhouse gas emissions. Biofertilisers made from microbes, compost, and algae are being used widely in corn, wheat, and fruit farming.

Biofertilizers Market Share, By Region, 2024 (%)

| Regional | Revenue Share |

| North America | 22.11% |

| Europe | 18.44% |

| Asia Pacific | 46.70% |

| Latin America | 8.15% |

| Middle East and Africa | 6.61% |

Latin America Biofertilizer Market Analysis

Latin America is expected to capture a major share of the biofertilizer market because many farmers still rely on cheap chemical fertilisers. Awareness about biofertilisers is lower, especially among small farmers, and supply chains are less developed. Some countries lack proper certification or quality control for biofertiliser products, thereby reducing farmers' confidence.

Brazil’s Biodiversity Fuels a New Era of Sustainable Farming

Brazil is expected to emerge as a prominent player in the biofertilizer market in the coming years, given its vast farmland and rich biodiversity, but progress is uneven. Large agribusinesses are testing microbial fertilisers for soybeans, sugarcane, and corn, but smaller farms often stick to chemical options. Brazil's biofertiliser startups are growing, but they face challenges with regulations and product shelf life.

Recent Developments

- In September 2025, ICL created a strategic collaboration with BioPrime. The collaboration aims to launch an advanced biofertilizer solution in India, as per the published report.(Source: igrownews.com)

Top Vendors in the Biofertilizer Market & Their Offerings:

- Novozymes – Novozymes, headquartered in Denmark, is a global biotechnology leader specializing in microbial and enzyme-based agricultural solutions. Its biofertilizer portfolio includes nitrogen-fixing and phosphate-solubilizing microorganisms that enhance nutrient uptake, soil health, and crop yield sustainability. The company’s products, such as TagTeam and JumpStart, are widely adopted in sustainable farming and precision agriculture.

- UPL Limited – UPL Limited, based in India, is one of the largest global providers of sustainable agricultural inputs. Its biofertilizer range includes microbial and biostimulant formulations designed to improve soil fertility and nutrient efficiency. UPL’s integrated approach combines traditional fertilizers with biologicals to promote regenerative agriculture and reduce chemical dependency.

- IPL Biologicals Limited – IPL Biologicals Limited develops high-quality microbial solutions, including nitrogen fixers, phosphate solubilizers, and potassium mobilizers. The company’s products focus on improving nutrient availability and soil microbiome balance, contributing to better crop productivity and long-term soil fertility management.

- Koppert Biological Systems – Koppert Biological Systems, headquartered in the Netherlands, provides comprehensive biological solutions for sustainable agriculture. Its biofertilizer products leverage beneficial microbes and natural soil enhancers to support root development, nutrient cycling, and plant resilience. The company’s offerings integrate biological pest control with soil and plant health optimization.

- Bayer AG – Bayer integrates biologicals into its crop science division, offering microbial-based biofertilizers and biostimulants that enhance nutrient efficiency and plant vitality. The company’s focus on research-driven innovation supports sustainable agriculture and reduced environmental impact through advanced microbial technologies.

- Syngenta AG – Syngenta develops biofertilizers and microbial inoculants as part of its biological crop solutions. The company’s portfolio aims to improve soil structure, nutrient absorption, and plant resilience, aligning with its sustainability strategy for regenerative agriculture.

- Rizobacter Argentina S.A. – Rizobacter is a global biofertilizer leader specializing in inoculants and seed treatments based on Rhizobium and Azospirillum species. The company focuses on biological nitrogen fixation, seed coating technologies, and microbial innovations for legume and cereal crops.

- Gujarat State Fertilizers & Chemicals Ltd (GSFC) – GSFC manufactures biofertilizers including Rhizobium, Azotobacter, and Phosphate Solubilizing Bacteria (PSB) formulations. The company integrates biofertilizers into sustainable farming programs that aim to restore soil fertility and reduce chemical fertilizer use.

- National Fertilizers Limited (NFL) – NFL produces a range of microbial-based biofertilizers designed to enhance soil productivity and nutrient cycling. Its portfolio supports government-backed initiatives promoting organic and sustainable agriculture across India.

- Indian Farmers Fertiliser Cooperative Limited (IFFCO) – IFFCO is a major producer of organic and biofertilizers, offering microbial consortia that improve nutrient uptake and promote soil regeneration. The cooperative’s Nano Biofertilizer initiatives reflect its focus on technological advancement and sustainable agriculture practices.

- Bioceres S.A. – Bioceres, based in Argentina, develops agricultural biotechnology products including biofertilizers that enhance plant growth and nutrient absorption. Its microbial formulations support environmentally responsible farming and complement its broader portfolio in bio-agriculture.

- Biolchim S.p.A. – Biolchim, an Italian company, produces biostimulants and microbial fertilizers that improve soil fertility and plant vigor. Its biofertilizers are formulated to promote root growth and enhance nutrient uptake efficiency under diverse environmental conditions.

- Valagro SpA – Valagro, also based in Italy, specializes in biostimulants and biofertilizers that leverage natural and microbial ingredients to improve plant nutrition. The company’s products enhance productivity and resilience, supporting the transition toward sustainable crop management.

- Symborg – Symborg focuses on microbial biofertilizers that boost nitrogen fixation and phosphorus mobilization. The company’s flagship product MycoUp leverages mycorrhizal fungi to improve root health and nutrient efficiency in crops.

- Mapleton Agri Biotech Pty Limited – Mapleton Agri Biotech, based in Australia, develops biofertilizers and microbial inoculants for sustainable agriculture. The company’s formulations promote nutrient availability, soil biodiversity, and water-use efficiency.

- Kiwa Bio-Tech Products Group Corporation – Kiwa Bio-Tech, based in China, manufactures biofertilizers and organic soil conditioners derived from beneficial microorganisms. Its products enhance nutrient cycling, soil structure, and environmental sustainability in intensive agricultural systems.

- Atlántica Agrícola – Atlántica Agrícola, based in Spain, provides biofertilizers, biostimulants, and organic nutrient formulations. Its microbial products support crop productivity, soil regeneration, and stress tolerance under diverse agroclimatic conditions.

- Verdesian Life Sciences – Verdesian Life Sciences develops nutrient-use efficiency technologies and microbial biofertilizers that optimize plant nutrition. The company’s products integrate biological nitrogen fixation and phosphorus enhancement solutions to support precision agriculture and sustainable farming.

Segments Covered in the Report

By Type

- Nitrogen-Fixing Biofertilizers

- Rhizobium

- Azospirillum

- Azotobacter

- Phosphate-Solubilizing Biofertilizers (PSB)

- Bacillus spp.

- Pseudomonas spp.

- Potassium-Mobilizing Biofertilizers (KMB)

- Frateuria aurantia

- Bacillus mucilaginosus

- Mycorrhizal Biofertilizers

- Vesicular Arbuscular Mycorrhiza (VAM)

- Ectomycorrhiza

- Sulfur-Oxidizing Biofertilizers

- Thiobacillus spp.

- Complex / Mixed Biofertilizers

- Multi-strain and consortium-based inoculants

By Microorganism Type

- Bacterial Biofertilizers

- Rhizobium, Azospirillum, Bacillus

- Fungal Biofertilizers

- Mycorrhiza, Trichoderma

- Cyanobacterial / Algal Biofertilizers

- Anabaena, Nostoc, Oscillatoria

- Actinomycetes-Based Formulations

By Formulation

- Solid Biofertilizers

- Peat-Based

- Lignite-Based

- Vermiculite-Based

- Liquid Biofertilizers

- Aqueous Microbial Suspensions

- Oil-Based Concentrates

- Encapsulated / Carrier-Free Formulations

- Polymer and Gel Carriers

- Microencapsulated Beads

By Mode of Application

- Seed Treatment

- Seed Coating

- Seed Dressing

- Soil Treatment

- Broadcasting

- Furrow / Pit Application

- Foliar Spray

- Nutrient Absorption Enhancement

By Crop Type

- Cereals & Grains

- Wheat

- Maize / Corn

- Rice

- Fruits & Vegetables

- Tomato, Potato, Citrus, Apple

- Pulses & Oilseeds

- Soybean

- Groundnut

- Lentil

- Fiber Crops

- Cotton, Jute

- Plantation & Cash Crops

- Tea, Coffee, Sugarcane

By End-Use

- Agriculture

- Row Crops & Horticulture

- Organic Farming

- Certified Organic Cultivation

- Greenhouse & Controlled Environment Farming

- Protected Crop Systems

- Turf & Landscaping

- Sports Grounds, Gardens

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa