Content

Water Treatment Polymers Market Size and Growth 2025 to 2034

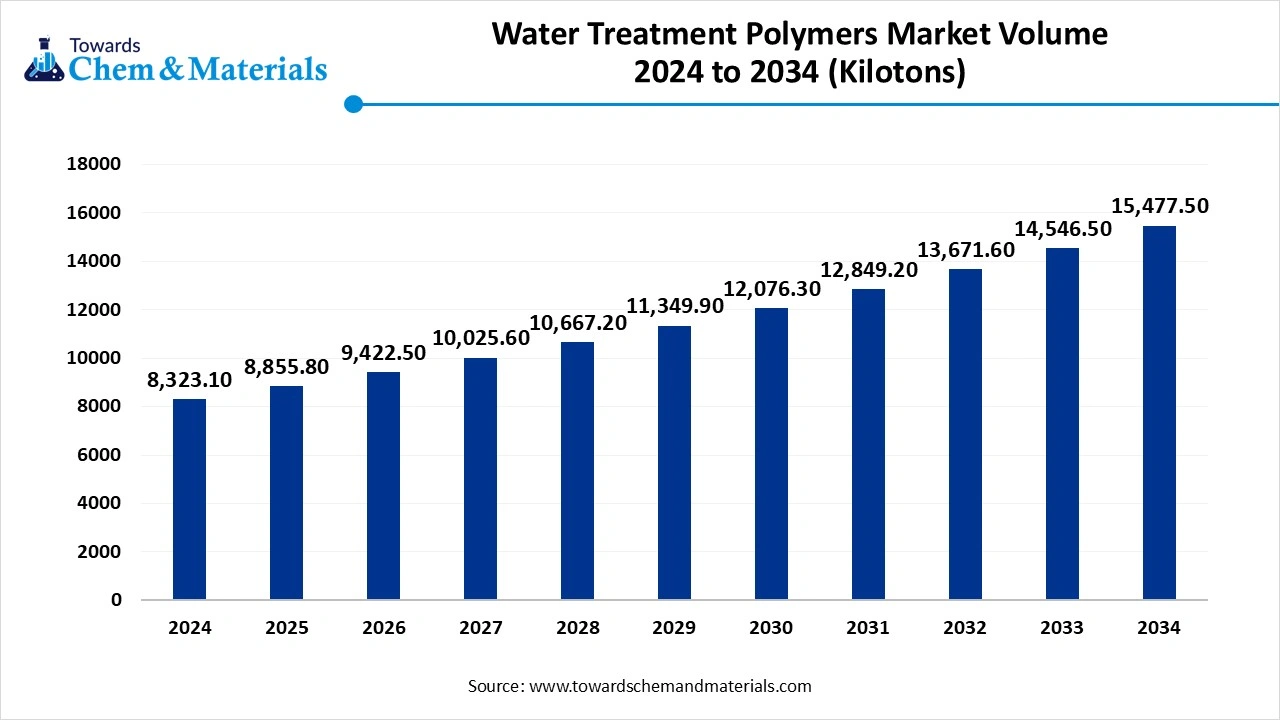

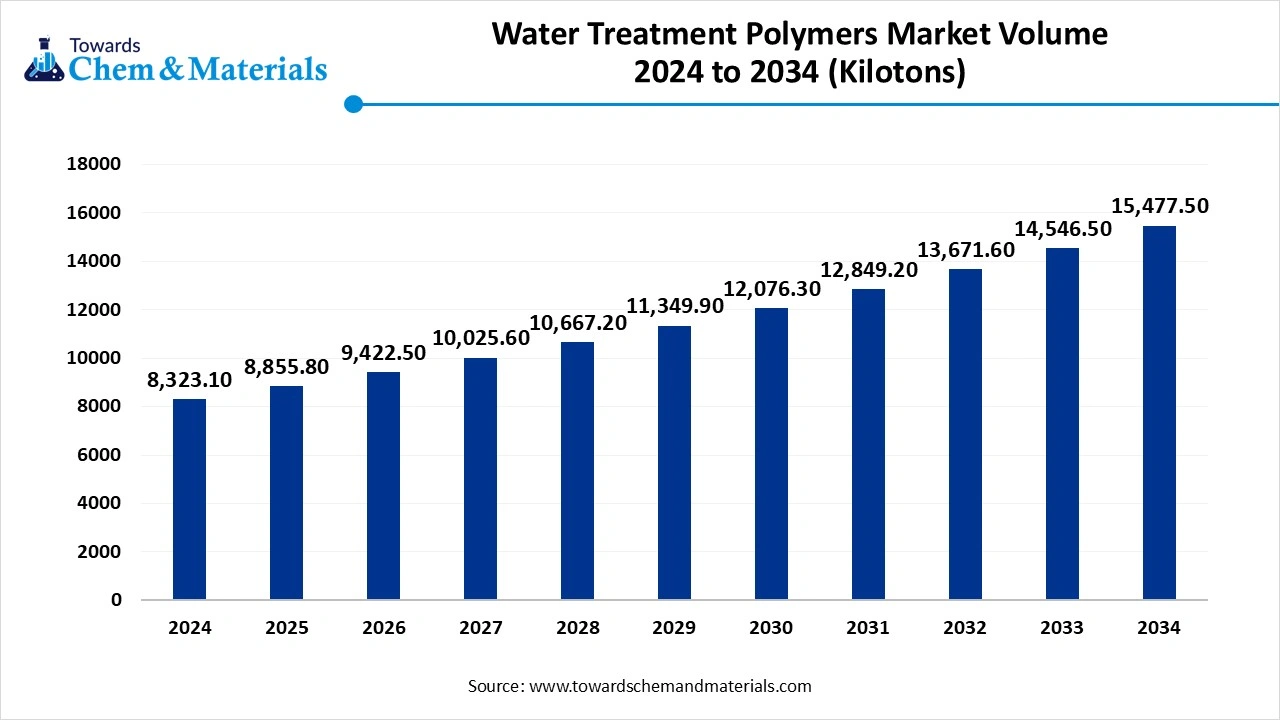

The global water treatment polymers market volume was valued at 8,323.10 kilotons in 2024 and is estimated to reach around 15,477.50 kilotons by 2034, exhibiting a compound annual growth rate (CAGR) of 6.40% during the forecast period 2025 to 2034. Shift towards urbanization, an increase in industrialization, and a shift towards sustainable and eco-friendly alternatives drive the growth of the market.

Key Takeaway

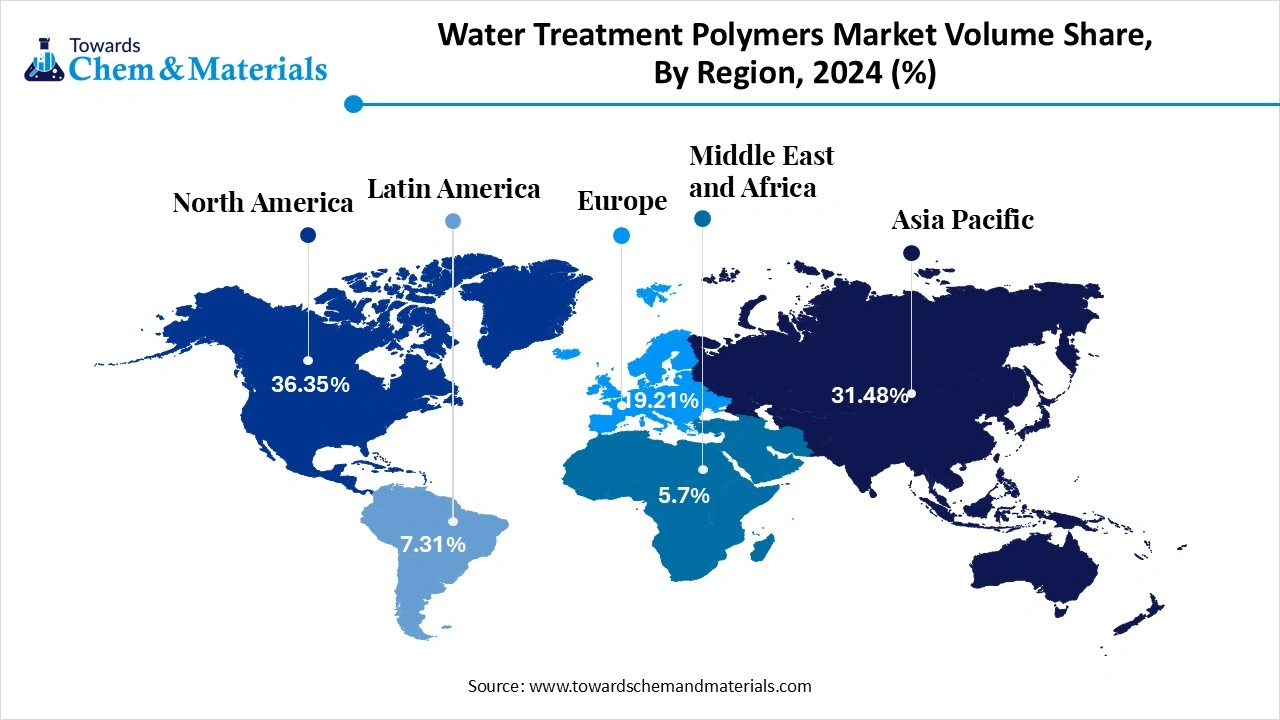

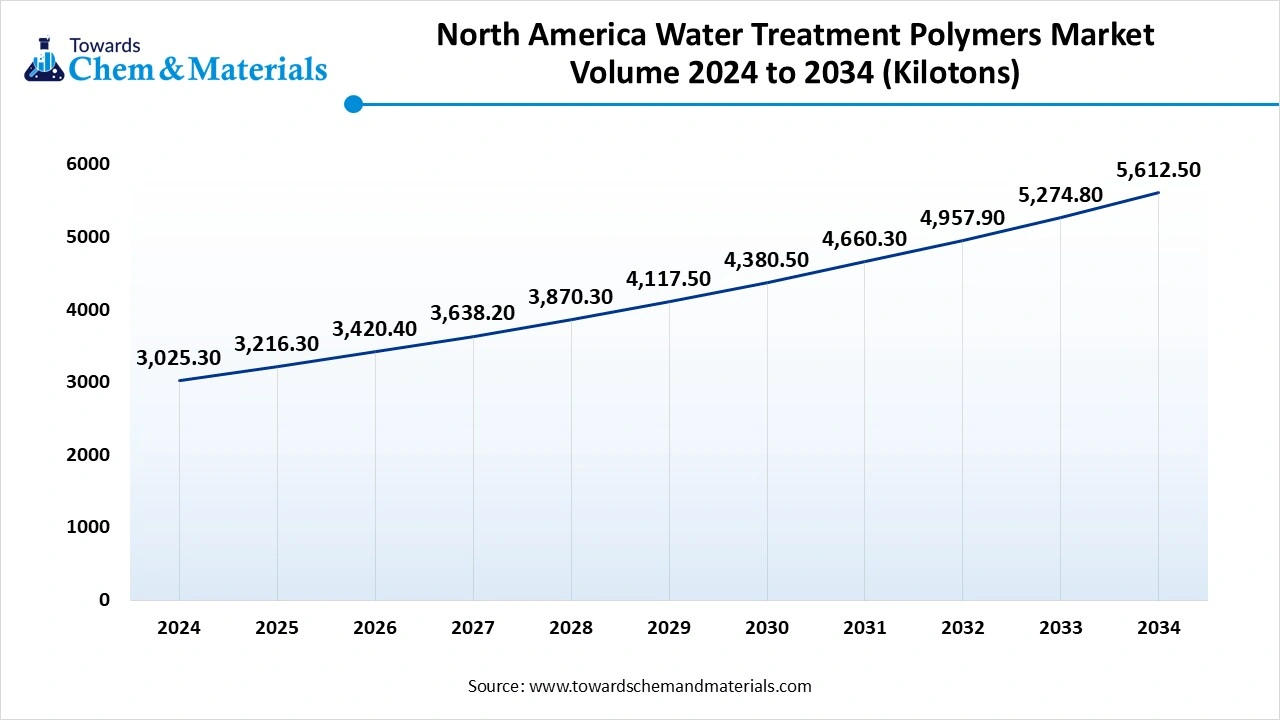

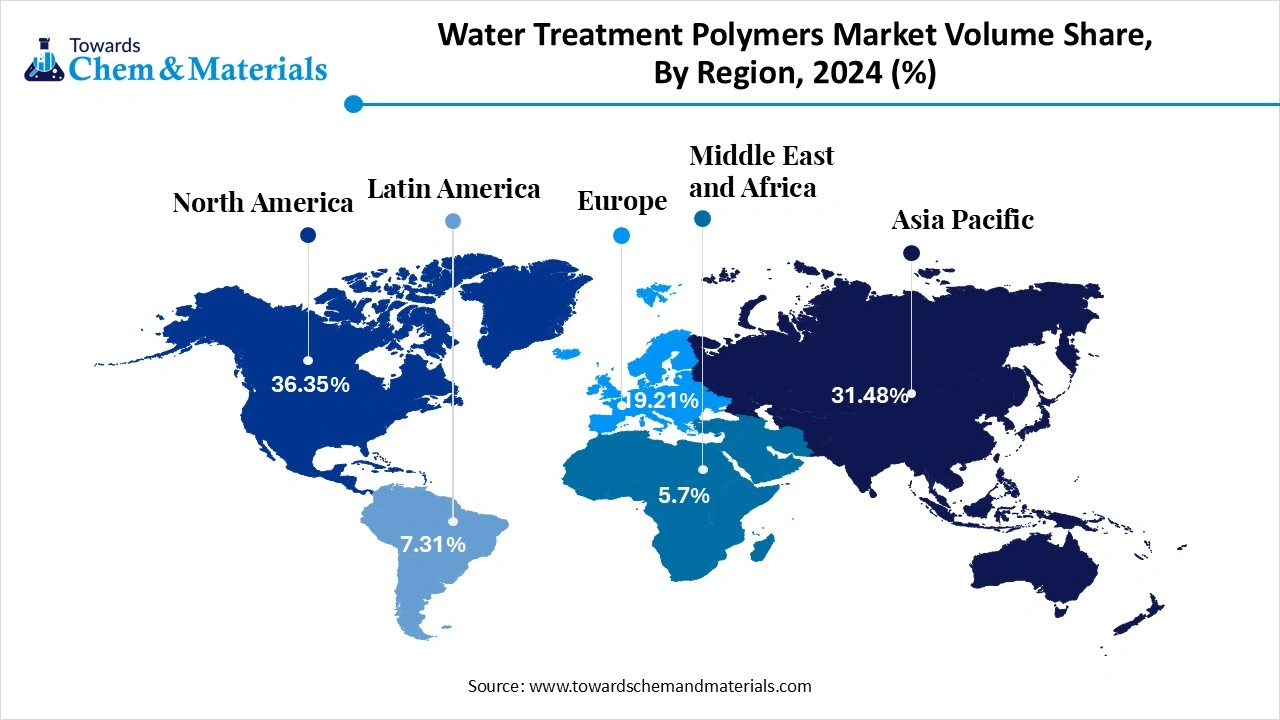

- The North America water treatment polymers market dominated the global market and accounted for the largest volume Share of 36.35% in 2024.

- The Asia Pacific water treatment polymers market is expected to grow the fastest at 6.73% CAGR from 2025 to 2034.

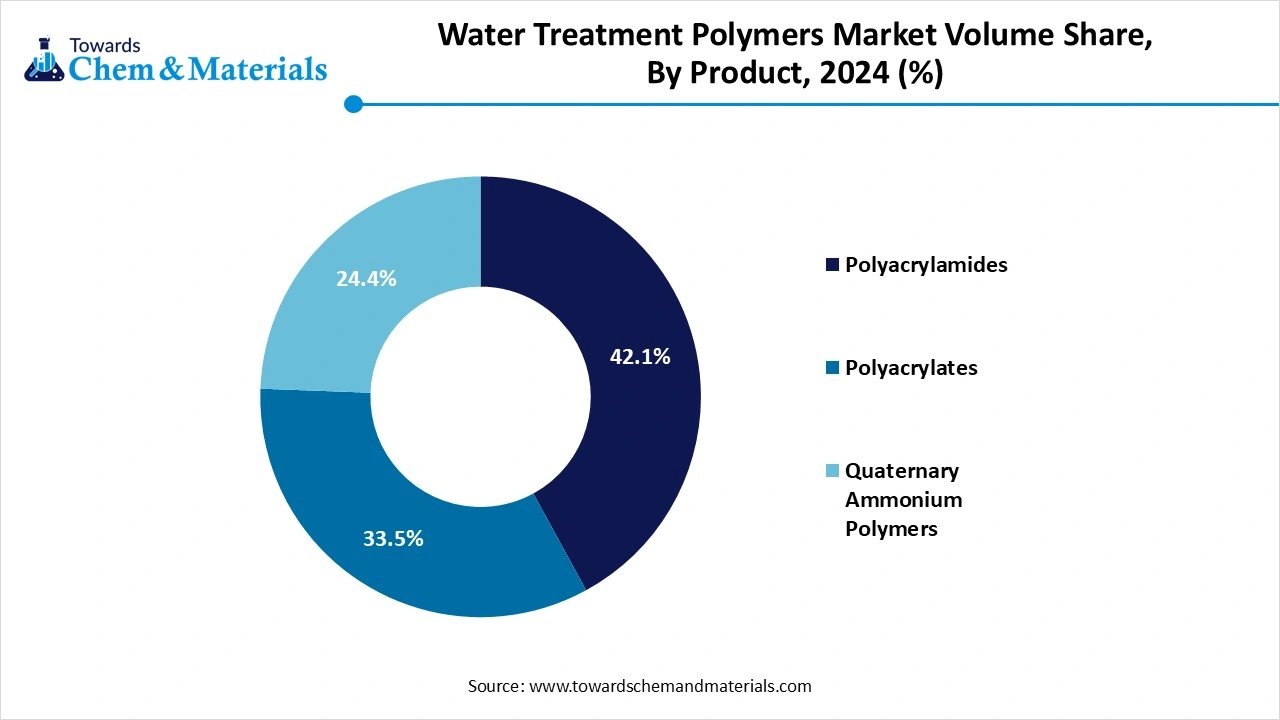

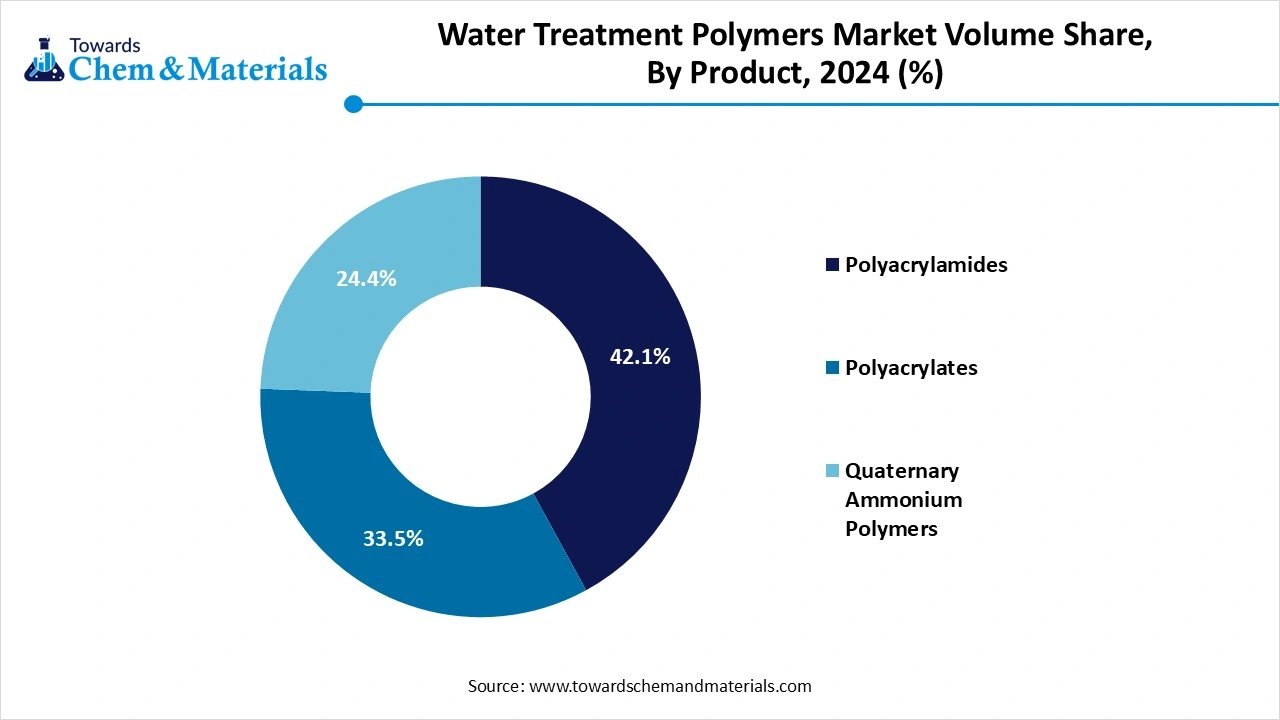

- By product type, the polyacrylamides segment dominated the market with the largest volume Share of 42.1% in 2024

- By product type, the Polyacrylates segment in the water treatment polymers market is expected to grow significantly at a CAGR of 6.67% over the forecast period.

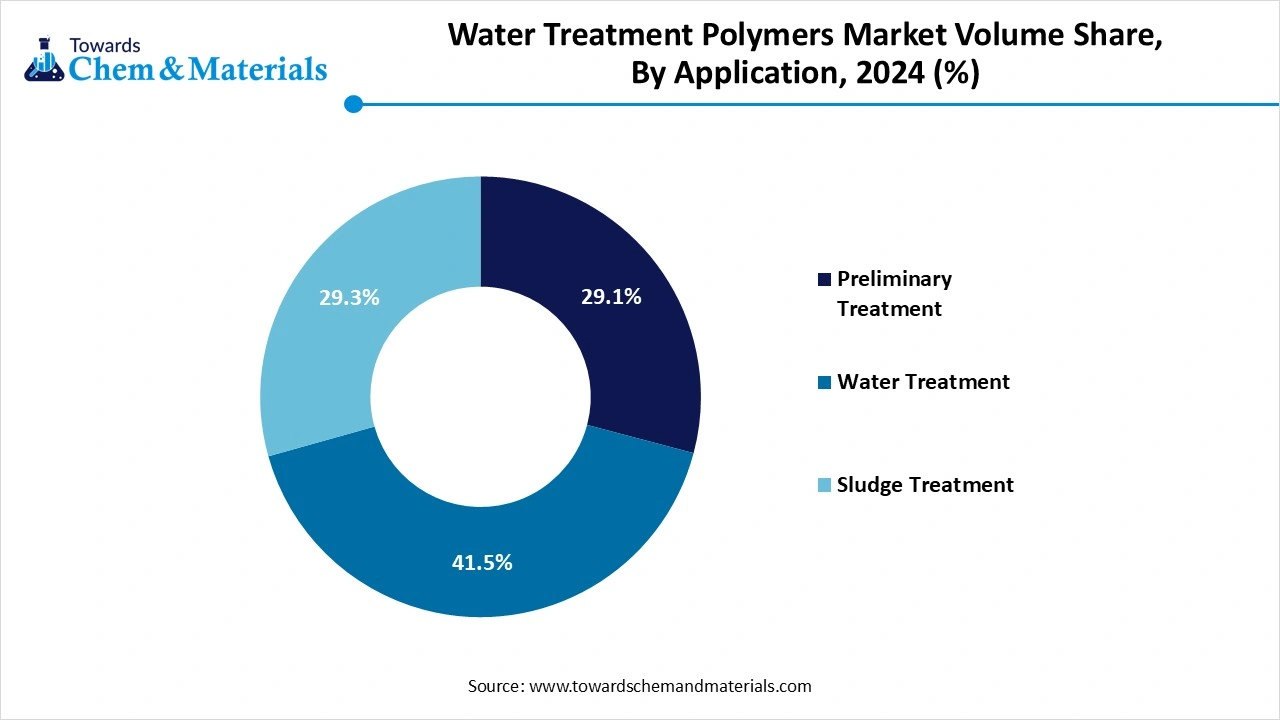

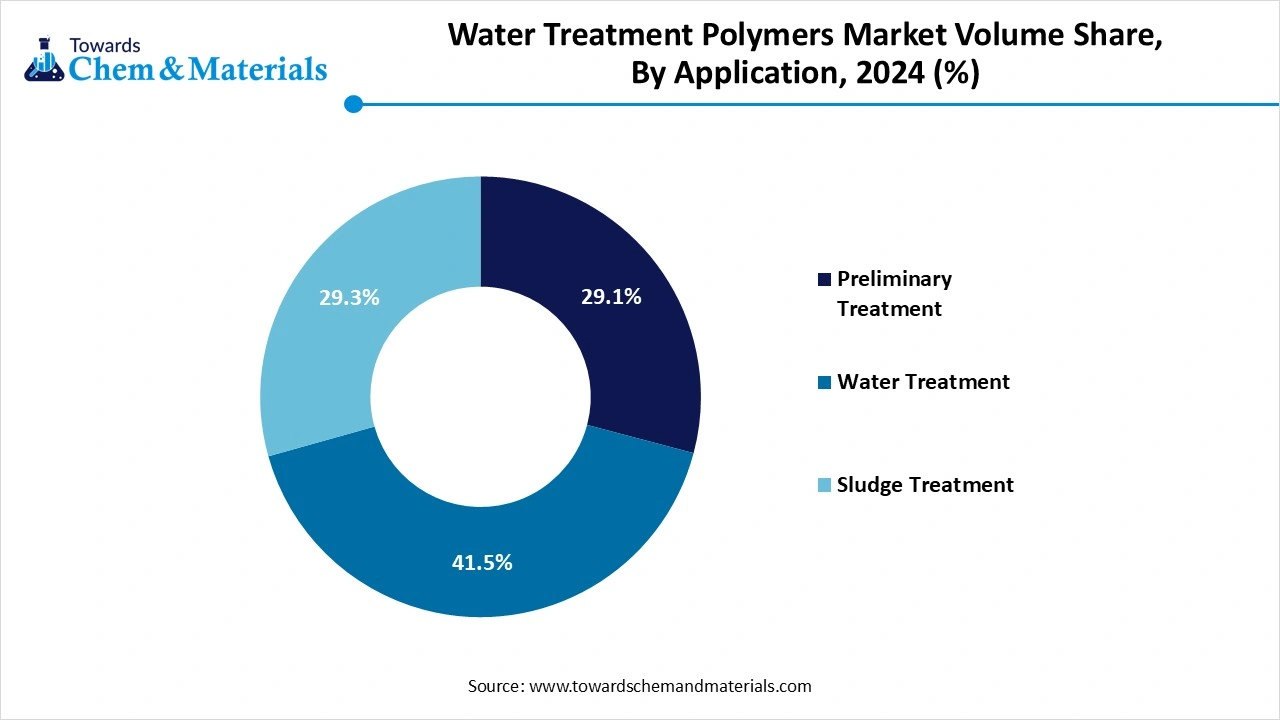

- By application, the water treatment segment dominated the market with the largest volume Share of 41.5% in 2024

- By application, the Preliminary Treatment segment is expected to grow significantly at a CAGR of 6.32% over the forecast period.

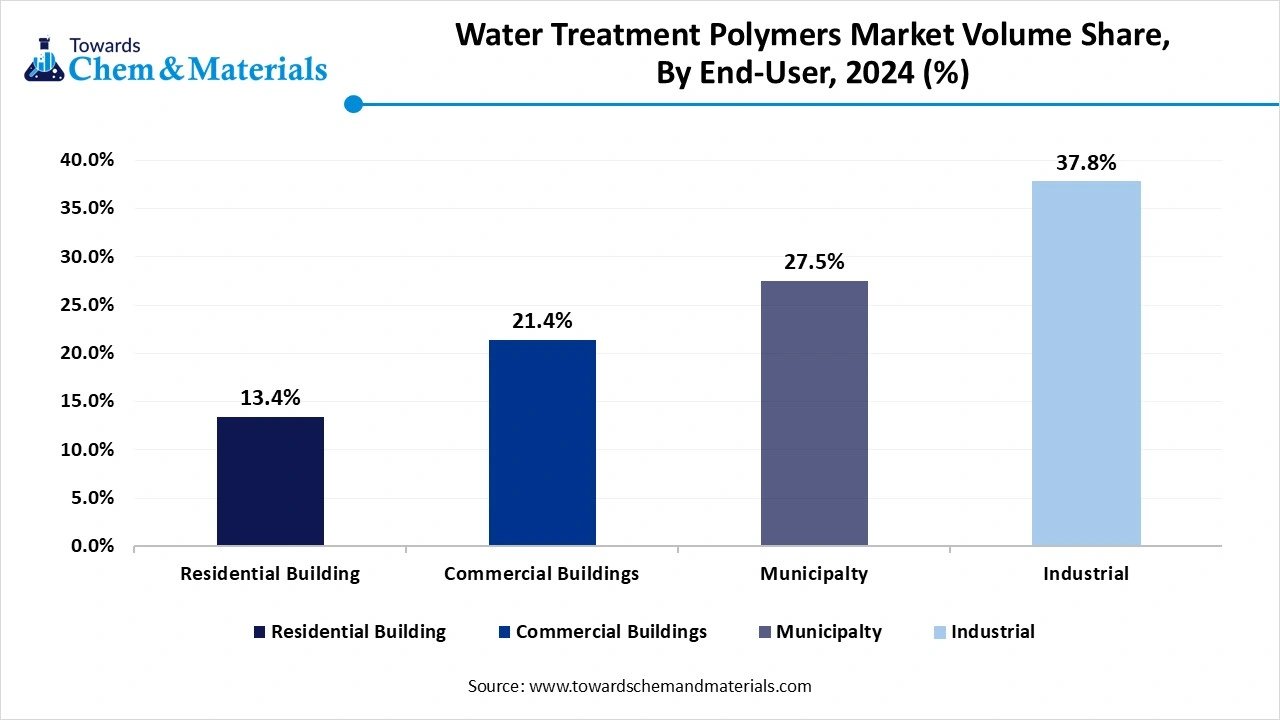

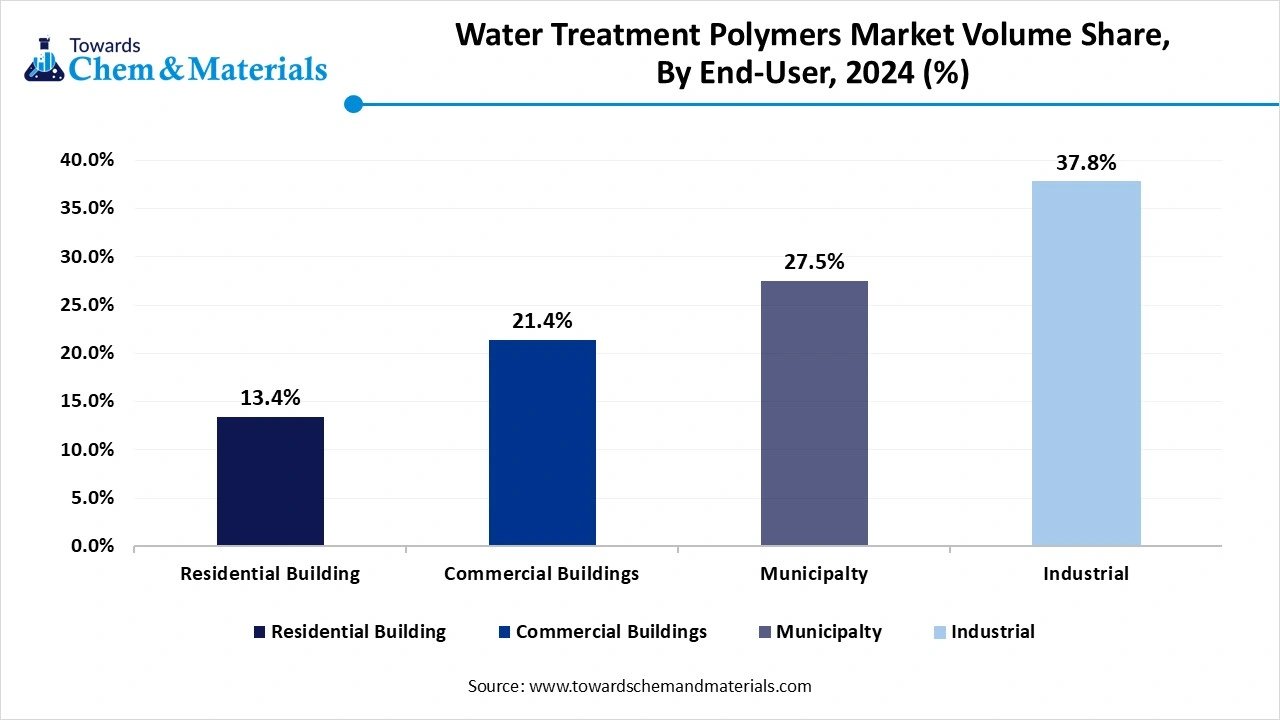

- By End-User, the industrial segment dominated the market with the largest volume Share of 37.8% in 2024

- By End-User, the municipalty segment is expected to grow significantly at a CAGR of 6.51% over the forecast period.

Rising Demand for Clean Water: Water Treatment Polymers Market to Expand

Water treatment polymers are chemical compounds used to enhance the efficiency of water purification processes by aiding in removing suspended solids, contaminants, and dissolved substances. These polymers, which include coagulants and flocculants, work by destabilizing particles and aggregating them into larger clumps that can be more easily filtered or settled out. Commonly used in municipal, industrial, and wastewater treatment systems, they help improve water clarity, reduce sludge volume, and meet environmental discharge standards. Their application is essential in power generation, oil and gas, food processing, and chemical manufacturing.

The drivers responsible for the growth of the market include growing industrialization and urbanization, which increase the demand for clean water and effective wastewater management across sectors like power, oil & gas, pharmaceuticals, and food processing. Stricter environmental regulations and government policies mandating the treatment of industrial effluents before discharge are also pushing the adoption of water treatment polymers. Additionally, rising global concerns over water scarcity and the need for water reuse and recycling are fueling market growth. Technological advancements in polymer formulations that improve efficiency and reduce environmental impact further support the market's expansion.

- There are a total of 37,195 Water Treatment Suppliers in the World, exporting to 40,759 buyers globally.

Water Treatment Polymers Market Trends

- Demand for eco-friendly and biodegradable polymers increases the demand and driving the growth of the market.

- Integration of smart technologies and incorporation of AI, the internet of things enhances the efficiency of the water treatment process.

- Stringent environmental regulation and imposing stricter standards by regulatory bodies compel industries to adopt advanced polymer-based treatment solutions.

- Investment in research and development, and focus on advanced polymer advancement, drives the growth.

Market Report Scope

| Report Attributes | Details |

| Market Volume in 2025 | 8,855.80 Kilotons |

| Expected Volume by 2034 | 15,477.50 Kilotons |

| Growth Rate from 2025 to 2034 | CAGR 6.40% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Dominant Region | North America |

| Segment Covered | By Product , By Application, By Region |

| Key Companies Profiled | Ashland, Arkema, BASF SE, CP Kelco US Inc., DuPont, Gantrade Corporation, Kemira, Kuraray Co. Ltd, Merck KGaA, Mitsubishi Chemical Corporation, Nouryon, Polysciences Inc., SNF Group, Sumitomo Seika Chemicals Company |

Market Opportunity

Rapid Urbanization And Growing Demand From Emerging Economies Create Growth Opportunities

One major opportunity in the water treatment polymers market lies in the growing demand from emerging economies. Rapid urbanization, expanding industrial sectors, and increasing awareness of waterborne diseases are driving the need for effective water and wastewater treatment solutions in these regions.

Governments are investing heavily in water infrastructure and sanitation projects, often backed by international funding and public-private partnerships. This creates a significant opportunity for polymer manufacturers to introduce cost-effective, efficient, and eco-friendly solutions tailored to local needs, thereby expanding their market footprint and addressing critical water challenges.

Water Treatment Polymers Market Challenge

Growing Environmental And Health Concerns Hinder The Growth Of The Market

One significant challenge in the water treatment polymers market is the environmental and health concerns associated with synthetic polymers, particularly those derived from petrochemicals. Many conventional polymers, such as polyacrylamides, can leave behind residual monomers like acrylamide, which are toxic and potentially carcinogenic.

The disposal of sludge containing these polymers can also lead to long-term environmental contamination. As regulatory scrutiny increases and demand for sustainable solutions grows, manufacturers face pressure to develop safer, biodegradable alternatives without compromising performance or significantly increasing costs, posing both a technological and economic hurdle.

Regional Insights

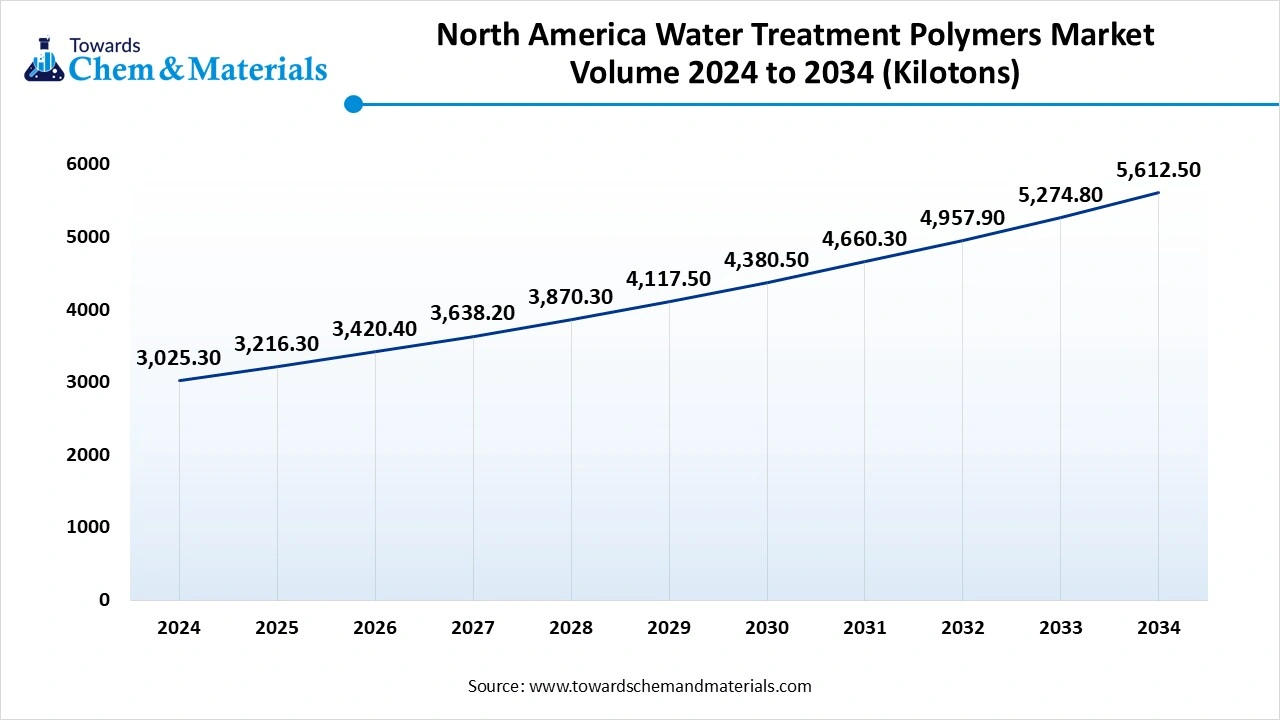

North America Dominated The Market Due to Its Well-Established Industrial Base, Which Helped The Market to Grow. North America dominated the water treatment polymers market in 2024. The North America water treatment polymers market Volume was valued at 3,025.3 Kilotons in 2024 and is expected to be worth around 5,612.5 Kilotons by 2034, growing at a compound annual growth rate (CAGR) of 6.33% over the forecast period 2025 to 2034. The growth is due to its well-established industrial base, advanced water treatment infrastructure, and strict environmental regulations. The region’s focus on sustainability and regulatory compliance drives continual innovation in polymer-based treatment solutions. Demand is further fueled by the increasing need for wastewater reuse and recycling, particularly in water-intensive industries such as oil & gas, chemicals, and manufacturing. Investment in smart water technologies and the modernization of aging infrastructure also supports the growing use of advanced polymers in municipal and industrial water treatment systems.

The Stringent Regulation in the Country Drives The Growth of the Market In the United States, the water treatment polymers market is primarily driven by stringent regulations enforced by agencies such as the Environmental Protection Agency (EPA), which mandate the treatment of industrial and municipal wastewater before discharge. The country has a mature water treatment industry, with ongoing upgrades to outdated systems and strong investment in research and development for more effective and eco-friendly polymer solutions. The rising occurrence of droughts and freshwater scarcity in certain states has also heightened interest in water reuse and efficient treatment technologies, further boosting the demand for performance-enhancing polymers.

Water Treatment Polymers Market Volume Share, By Region, 2024- 2034 (%)

| By Region | Market Volume Shares (%)2024 | Market Volume (Kilotons)(2024) | Market Volume Shares (%)2034 | Volume (Kilotons)(2034) | CAGR |

| North America | 36.35% | 3025.3 | 36.11% | 5588.6 | 6.33% |

| Europe | 19.21% | 1599.0 | 19.48% | 3015.2 | 6.55% |

| Asia Pacific | 31.48% | 2620.1 | 32.48% | 5027.1 | 6.73% |

| Latin America | 7.31% | 608.4 | 6.91% | 1069.5 | 5.80% |

| Middle East & Africa | 5.7% | 470.3 | 5.0% | 777.1 | 5.14% |

Asia Pacific is Anticipated to Grow Due to Rapid Urbanization and Industrialization in the Region, Asia Pacific anticipated to grow in the water treatment polymers market in the forecast period. The growth is driven by rapid industrialization, urbanization, and escalating environmental concerns. Expanding industries such as power generation, semiconductors, pharmaceuticals, and food and beverage processing have intensified the demand for effective water treatment solutions.

Governments across the region are implementing stringent environmental regulations and investing in wastewater treatment infrastructure to mitigate pollution and ensure sustainable water management. Additionally, the adoption of advanced technologies, including membrane filtration and smart water treatment systems, is enhancing the efficiency and effectiveness of water purification processes. These factors collectively contribute to the significant growth and development of the market in Asia Pacific.

The Growth In China For The Market Is Driven By Its Industrial Base and Strict Environmental Policies, China is a key player in the Asia Pacific water treatment polymers market; the growth is driven by its extensive industrial base and proactive environmental policies. The Chinese government has prioritized water pollution control, leading to substantial investments in wastewater treatment infrastructure, particularly in rural areas. Initiatives under the country's five-year plans have allocated significant funding towards enhancing wastewater treatment capabilities, thereby increasing the demand for water treatment polymers such as polyacrylamide. Moreover, China's focus on sustainable development and environmental protection continues to stimulate advancements in water treatment technologies, reinforcing its leading position in the regional market.

Segmental Insights

Product Type Insights

The polyacrylamides segment dominated the water treatment polymers market in 2024. Polyacrylamide is one of the most widely used polymers in water treatment, primarily due to its excellent flocculation and coagulation properties. It is commonly applied in both anionic and cationic forms to aggregate suspended particles in wastewater, making them easier to remove.

Industries such as municipal water treatment, oil and gas, paper manufacturing, and mining extensively rely on polyacrylamide to enhance sedimentation and improve sludge dewatering efficiency. Its versatility, effectiveness at low dosages, and adaptability to various water chemistries make it a preferred choice. Ongoing advancements in polymer chemistry are also leading to the development of more environmentally friendly and high-performance polyacrylamide variants, further strengthening its market presence.

The polyacrylates segment expects significant growth in the water treatment polymers market during the forecast period. Polyacrylate polymers are widely used in water treatment applications due to their ability to act as effective dispersants and flocculants. These polymers are particularly valuable in controlling scale formation, dispersing solids, and enhancing the efficiency of water purification processes.

Water Treatment Polymers Market Volume Share, By Product, 2024 -2034 (%)

| By Product | Market Volume Shares (%)2024 | Market Volume (Kilotons)(2024) | Market Volume Shares (%)2034 | Market Volume (Kilotons)(2034) | CAGR |

| Polyacrylamides | 42.1% | 3499.9 | 41.8% | 6472.9 | 6.34% |

| Polyacrylates | 33.5% | 2791.2 | 34.4% | 5321.9 | 6.67% |

| Quaternary Ammonium Polymers | 24.4% | 2032.0 | 23.8% | 3682.7 | 6.13% |

Polyacrylate is commonly utilized in industries such as water treatment, textiles, paper, and detergents, where it helps prevent fouling and scaling in pipes and machinery. Its water-soluble nature and ability to adjust to various water conditions make it suitable for both municipal and industrial wastewater treatment. The growing demand for more efficient and cost-effective treatment solutions is driving the increased use of polyacrylate, especially in regions facing water scarcity and contamination issues.

Application Insights

The preliminary treatment segment dominated the water treatment polymers market in 2024. Preliminary treatment refers to the initial stage in the water or wastewater treatment process, focusing on the removal of large debris, solids, and other materials that could damage equipment or hinder the efficiency of subsequent treatment stages. This phase typically includes processes such as screening, grit removal, and primary sedimentation.

The primary goal is to reduce the load on more advanced treatment systems, ensuring that finer filters and biological treatment processes can operate more effectively. In water treatment plants, preliminary treatment often involves the use of chemicals like coagulants and flocculants, such as polyacrylamide, to help remove larger particles and settle out solid waste. This stage is crucial for improving the efficiency of overall water treatment and ensuring the longevity and performance of treatment infrastructure.

The water treatment segment expects significant growth in the water treatment polymers market during the forecast period. Water treatment is a crucial process aimed at making water safe for human consumption, industrial use, and environmental discharge. It encompasses a series of physical, chemical, and biological processes designed to remove contaminants, pathogens, and undesirable chemicals from raw water sources.

Water Treatment Polymers Market Volume Share, By Application, 2024- 2034 (%)

| By Application | Market Volume Shares (%)2024 | Market Volume (Kilotons)(2024) | Market Volume Shares (%)2034 | Volume (Kilotons)(2034) | CAGR |

| Preliminary Treatment | 29.1% | 2422.9 | 28.9% | 4470.1 | 6.32% |

| Water Treatment | 41.5% | 3457.4 | 42.9% | 6646.0 | 6.75% |

| Sludge Treatment | 29.3% | 2442.7 | 28.2% | 4361.4 | 5.97% |

The treatment process typically involves several stages, including coagulation and flocculation, sedimentation, filtration, and disinfection. In many cases, polymers like polyacrylamide, polyacrylate, and other coagulants and flocculants are used to enhance the removal of suspended solids and organic matter.

Advanced water treatment also includes technologies such as reverse osmosis, ultraviolet disinfection, and activated carbon filtration, which help in removing dissolved solids and improving the quality of water. As water scarcity and quality issues become more pressing globally, efficient water treatment is essential to ensure public health, environmental sustainability, and the reuse of water resources.

End Use Insights

The industrial segment dominated the water treatment polymers market in 2024. Industrial water treatment is a specialized segment focused on addressing the unique water needs of various industries, including manufacturing, oil & gas, power generation, food and beverage, textiles, and pharmaceuticals. Water used in industrial processes often requires treatment to remove contaminants, control scaling and fouling, and ensure the safe discharge of effluents.

The use of water treatment polymers such as polyacrylamide, polyacrylate, and others is widespread in industrial applications to improve the efficiency of processes like cooling, boiler water treatment, and wastewater treatment. These polymers help in the flocculation and coagulation of suspended solids, control scale formation, and enhance the dewatering of sludge. Given the increasing regulatory pressure on industrial effluent management and the need for water reuse, industries are investing in advanced water treatment technologies and efficient polymers to reduce costs, comply with environmental standards, and improve operational efficiency.

The municipality segment expects significant growth in the water treatment polymers market during the forecast period. Municipal water treatment involves the treatment of water used by public systems to ensure it is safe for drinking, bathing, and other domestic purposes. This segment focuses on providing clean, potable water to communities and treating wastewater for safe disposal or reuse. The processes include coagulation, flocculation, sedimentation, filtration, and disinfection, often supported by polymers like polyacrylamide and polyacrylate to improve the removal of suspended solids and organic contaminants.

Water Treatment Polymers Market Volume Share, By End-User, 2024 - 2034(%)

| By End-User | Market Volume Shares (%)2024 | Market Volume (Kilotons)(2024) | Market Volume Shares (%)2034 | Market Volume (Kilotons)(2034) | CAGR |

| Residential Building | 13.4% | 1111.8 | 14.2% | 2200.6 | 7.06% |

| Commercial Buildings | 21.4% | 1777.4 | 21.2% | 3282.0 | 6.32% |

| Municipalty | 27.5% | 2288.6 | 27.8% | 4300.7 | 6.51% |

| Industrial | 37.8% | 3145.3 | 36.8% | 5694.2 | 6.11% |

Municipal water treatment also plays a critical role in reducing the spread of waterborne diseases and meeting regulatory standards for water quality. As urban populations grow and water demand increases, municipalities are adopting more advanced treatment technologies and polymer solutions to address challenges such as aging infrastructure, water scarcity, and contamination control, ensuring sustainable and efficient water management for communities.

Water Treatment Polymers Recent Developments

Prayag Polymers

- Launch: In April 2025, Prayag Polymers introduced a complete range of PVC-O (Oriented Polyvinyl Chloride) pipes. It is specially made for the irrigation, high-pressure water distribution, and other applications.

ZymoChem

- Launch: In July 2024, ZymoChem announces the introduction of BAYSE, the first 100% biodegradable and biobased super absorbent polymer (SAP).

Top Companies List

- Ashland

- Arkema

- BASF SE

- CP Kelco US Inc.

- DuPont

- Gantrade Corporation

- Kemira

- Kuraray Co. Ltd

- Merck KGaA

- Mitsubishi Chemical Corporation

- Nouryon

- Polysciences Inc.

- SNF Group

- Sumitomo Seika Chemicals Company

Segments Covered in the Report

By Product Type

- Polyacrylamides

- Polyacrylates

- Quaternary Ammonium Polymers

By Application

- Preliminary Treatment

- Water Treatment

- Sludge Treatment

By End Use

- Residential Buildings

- Commercial Buildings

- Municipality

- Industrial

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait