Content

Boiler Water Treatment Chemicals Market Size and Growth 2025 to 2034

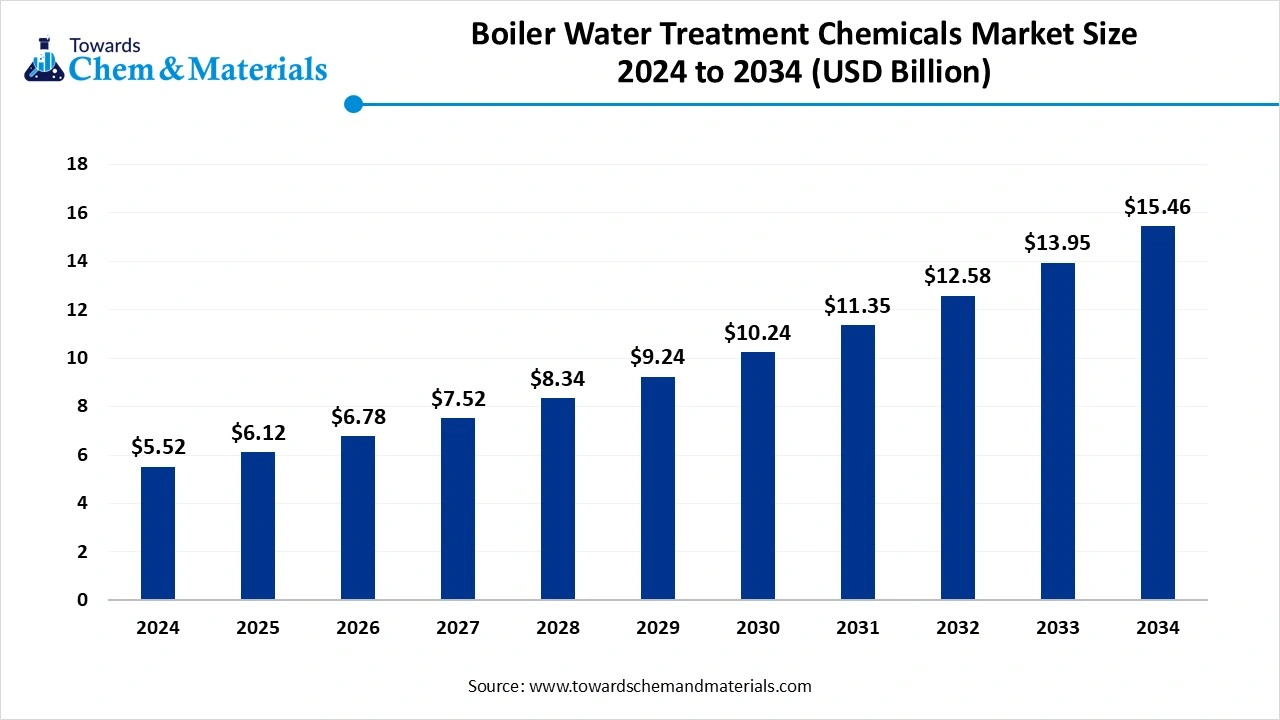

The global boiler water treatment chemicals market size was reached at USD 5.52 billion in 2024 and is expected to be worth around USD 15.46 billion by 2034, growing at a compound annual growth rate (CAGR) of 10.85% over the forecast period 2025 to 2034. The growing expansion of power generation, rising demand across the food & beverage industry, and rapid industrialization drive the market growth.

Key Takeaways

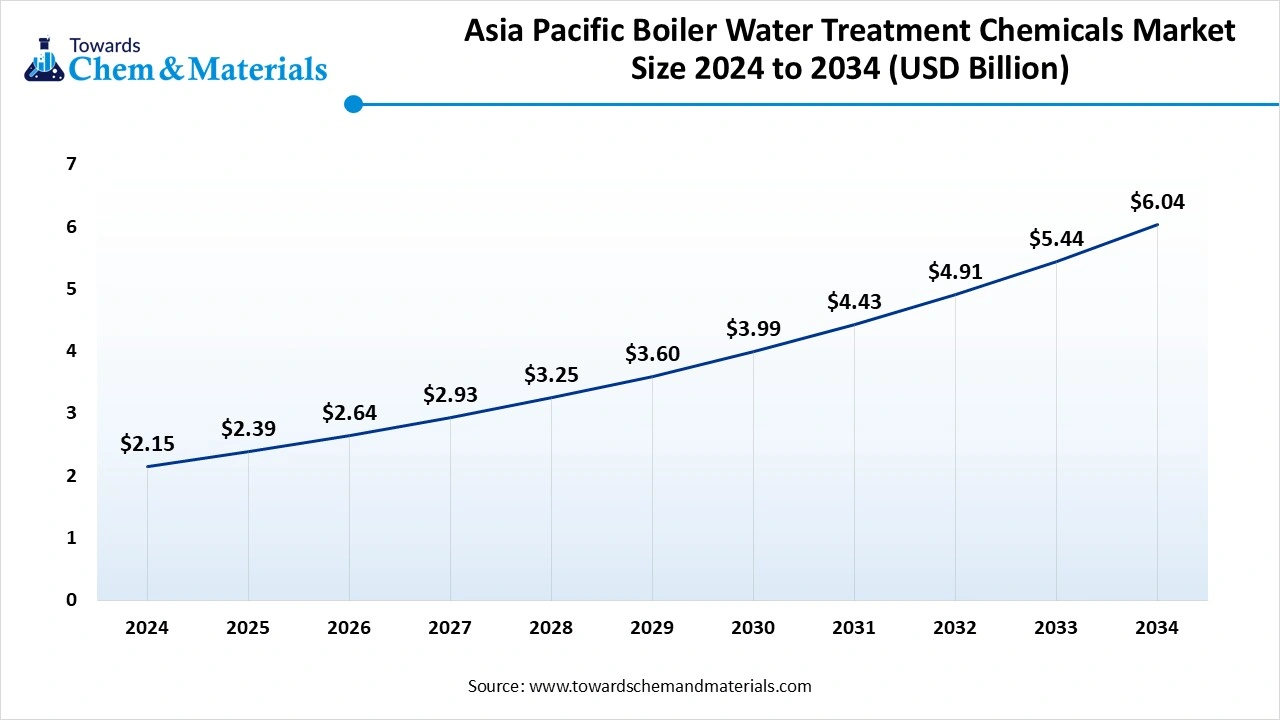

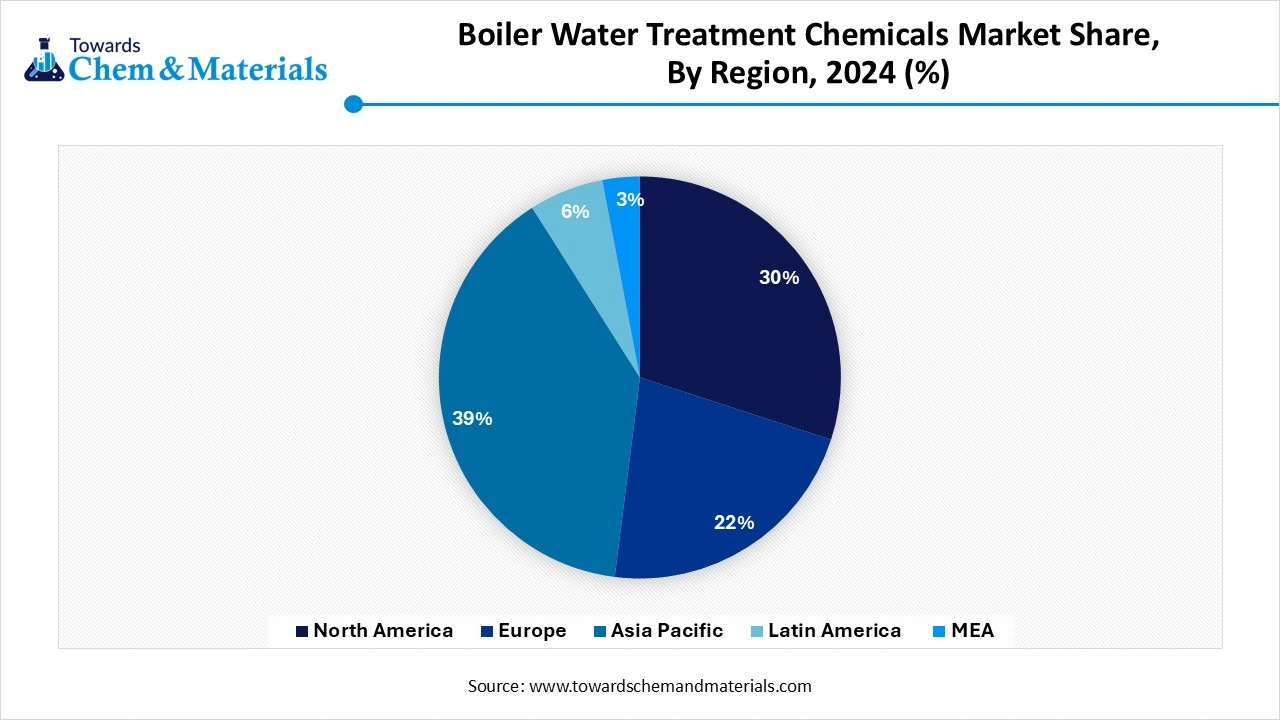

- The Asia Pacific boiler water treatment chemicals market size was estimated at USD 2.15 billion in 2024 and is expected to reach USD 6.04 billion by 2034, growing at a CAGR of 10.88% from 2025 to 2034.

- By region, Middle East & Africa is growing at the fastest CAGR in the market during the forecast period due to the strong presence of limited freshwater resources.

- By product type, the oxygen scavengers segment held a 24% share in the market in 2024 due to the focus on preventing the corrosion of boilers.

- By product type, the scale inhibitors segment is expected to grow at the fastest CAGR in the market during the forecast period due to the stringent regulations on water quality.

- By boiler type, the water-tube boiler segment held a 37% share in the market in 2024 due to the high electricity demand.

- By boiler type, the electric boiler segment is expected to grow at the fastest CAGR in the market during the forecast period due to the growing demand for high-quality feed water.

- By treatment type, the internal treatment segment held a 48% share in the boiler water treatment chemicals market in 2024 due to the growing demand for maintaining the integrity of internal boiler components.

- By treatment type, the condensate treatment segment is expected to grow at the fastest CAGR in the market during the forecast period due to the increasing adoption of neutralizing oxygen scavengers.

- By end-use industry, the power generation segment held a 29% share in the market in 2024 due to growing demand for electricity production.

- By end-use industry, the food & beverage segment is expected to grow at the fastest CAGR in the market during the forecast period due to the increased consumption of packaged foods.

- By form, the liquid segment held a 65% share in the market in 2024 due to the ease of application.

- By form, the solid segment is expected to grow at the fastest CAGR in the market during the forecast period due to the lower CO2 emissions.

- By distribution channel, the direct sales segment held a 60% share in the market in 2024, due to the growing demand for a tailored solution.

- By distribution channel, the online platforms segment is expected to grow at the fastest CAGR in the market during the forecast period due to the growing digital transformation.

Boiler Water Treatment Chemicals Role in Feedwater and Boilers Safety

The boiler water treatment chemicals are chemicals used to prevent foaming, scale buildup, and corrosion in boilers. The chemicals used in boiler water treatment are scale inhibitors, corrosion inhibitors, oxygen scavengers, and alkalinity builders. Oxygen scavengers include diethylhydroxylamine, hydrazine, and sodium sulfite. Scale inhibitors include polymers and phosphates.

Alkalinity builders include potassium hydroxide and sodium hydroxide. The corrosion inhibitors include diethylaminoethanol, morpholine, and cyclohexylamine. Boiler water treatment chemicals increase the equipment's lifespan and ensure reliable operation. The growth in industrial activity and stringent environmental regulations increases demand for boiler water treatment chemicals. The focus on preventing scaling and corrosion in boilers fuels demand for boiler water treatment chemicals. Factors like growing power demand and growing demand across food & beverage, chemical manufacturing, oil & gas, and the pharmaceutical industry contribute to the boiler water treatment chemicals market.

- The United States exported 1,190shipments of boiler water treatment.(Source: www.volza.com)

- India exported 945 shipments of boiler water treatment.(Source: www.volza.com)

- The United States exported 1,479 shipments of scale inhibitor.(Source: www.volza.com)

- The United States exported 11,191 shipments of corrosion inhibitor.(Source: www.volza.com)

- India exported 383 shipments of diethylhydroxylamine.(Source: www.volza.com )

Growing Oil & Gas Industry Drives Market Growth

The growing oil & gas industry in various regions increases demand for boiler water treatment chemicals for various applications. The growing oil & gas refining & extraction processes fuel demand for boiler water treatment chemicals for different operations like refining, hydraulic fracturing, and drilling. The focus on enhancing oil recovery processes and the need for innovative water treatment solutions in the oil & gas industry increases the adoption of boiler water treatment chemicals. Processes like cleaning, power generation, and heating in the oil & gas sector fuel the adoption of boiler water treatment chemicals. The rapid growth in the shale gas and oil production and exploration helps the market growth. The growing oil & gas industry is a key driver for the growth of the boiler water treatment chemicals market.

Market Trends

- Growing Industrial Growth: The rapid industrial growth in various regions increases demand for boiler water treatment chemicals for steam generation. Processes like chemical manufacturing, textile production, power generation, and food processing require boiler water treatment chemicals.

- Technological Advancements: The ongoing technological advancements and innovations like real-time monitoring, remote monitoring, advanced treatment, smart chemical dosing system, and improved formulations help the market growth.

- Growing Water Quality Concerns: The increasing demand for clean water and growing water quality concerns increase demand for effective boiler water treatment chemicals for removing water impurities and maintaining water quality.

Report Scope

| Report Attribute | Details |

| Market Size in 2025 | USD 6.12 Billion |

| Expected Size by 2034 | USD 15.46 Billion |

| Growth Rate from 2025 to 2034 | CAGR 10.85% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Product Type, By Boiler Type, By Treatment Type, By End-Use Industry, By Form, By Distribution Channel, By Region |

| Key Companies Profiled | Ecolab Inc., SUEZ Water Technologies & Solutions (Veolia), Solvay S.A., Kemira Oyj, BASF SE, DuPont de Nemours, Inc., Kurita Water Industries Ltd., Accepta Ltd., Dow Chemical Company, Chemtreat, Inc. (A Danaher Company), Veolia Water Technologies, Lonza Group AG, Buckman Laboratories International Inc., Arkema Group, Akzo Nobel N.V., GE Water & Process Technologies, Feralco Group, Avista Technologies, Inc., Chemtex Speciality Limited, Thermax Limited |

Market Opportunity

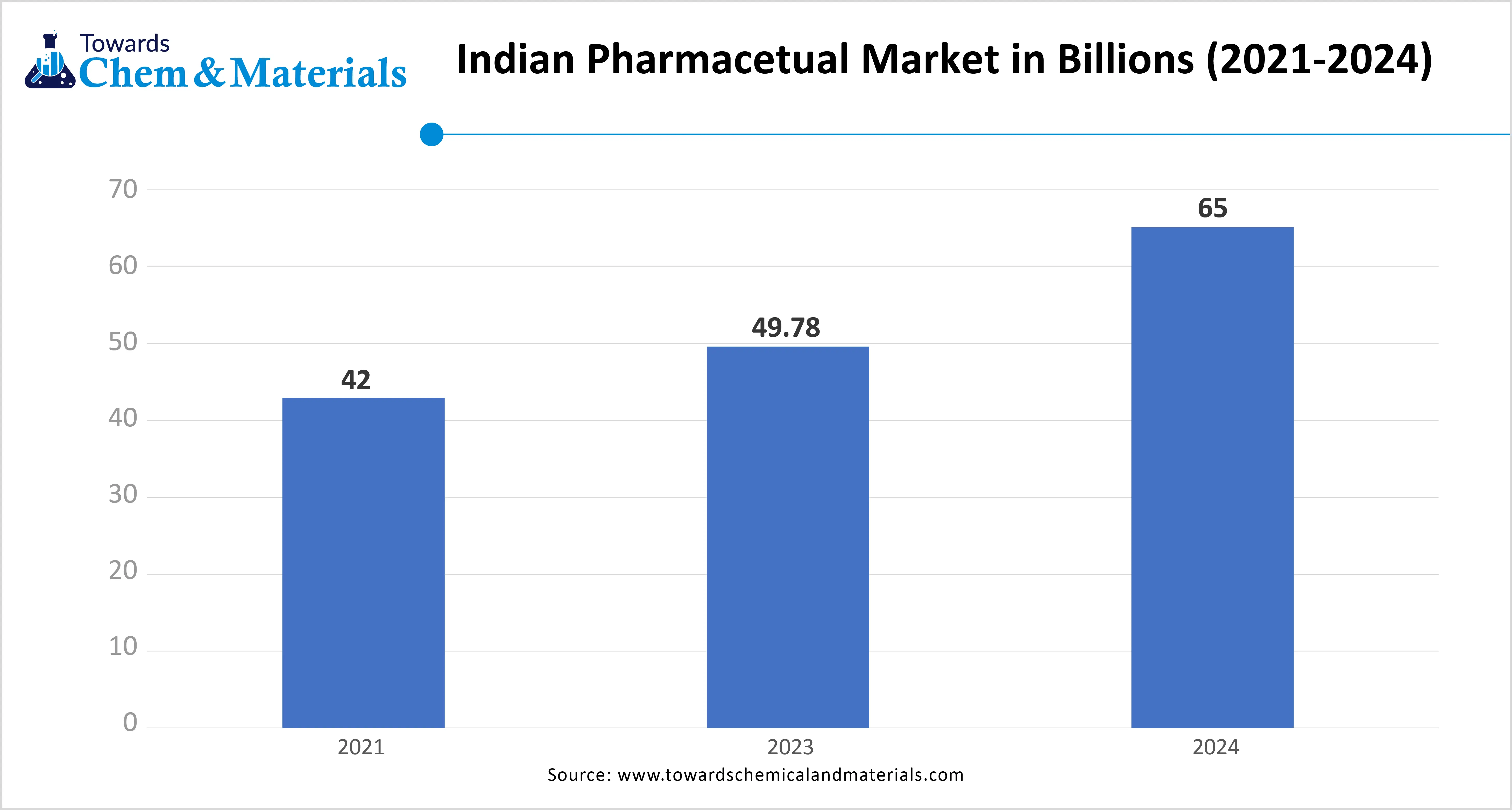

Growing Expansion of Pharmaceutical Industry

The growing expansion of the pharmaceutical industry increases demand for boiler water treatment chemicals for various purposes. The requirement of pure water in pharmaceutical applications like sterilization, drug formulation, and cleaning increases demand for boiler water treatment chemicals. The stricter regulations by the EMA and the FDA in the pharmaceutical industry fuel demand for boiler water treatment chemicals for lowering microbial contamination in pharmaceutical products.

The different pharmaceutical processes and needs for specialized treatments in the pharmaceutical industry increase demand for boiler water treatment chemicals. The growing advancements in the formulations of drugs help the market growth. The increasing demand for sterilization and sanitization in the pharmaceutical industry requires boiler water treatment chemicals. The growing expansion of the pharmaceutical industry creates an opportunity for the growth of the boiler water treatment chemicals market.

Market Challenge

High Initial Investment Shuts Down Expansion of Market

Despite several benefits of boiler water treatment chemicals, the high initial investment restricts the market growth. Factors like complex treatment systems, high cost of specialized chemicals, and precise dosing equipment are responsible for the high initial investment. The specialized chemicals like corrosion inhibitors, oxygen scavengers, and scale inhibitors cost is high.

The accurate dosing of equipment increases the cost. The need for dosing equipment like sensors, feed pumps, and controllers increases the cost. The maintenance and installation of equipment require a higher cost. The complex treatment systems, like reverse osmosis plants and ion exchange systems, increase the initial investment. The high initial investment hampers the growth of the boiler water treatment chemicals market.

Regional Insights

How Asia Pacific Dominated the Boiler Water Treatment Chemicals Market?

The Asia Pacific boiler water treatment chemicals market size was estimated at USD 2.15 billion in 2024 and is anticipated to reach USD 6.04 billion by 2034, growing at a CAGR of 10.88% from 2025 to 2034. Asia Pacific dominated the boiler water treatment chemicals market in 2024. The rapid urbanization and growing industrialization in the region increase demand for boiler water treatment chemicals. The growing expansion of the power generation sector helps the market growth.

The growing investment in water treatment and the government's strong support for water conservation fuel demand for boiler water treatment chemicals. The increasing manufacturing activities in industries like metal processing, food processing, and pharmaceuticals increase the adoption of boiler water treatment chemicals. The expansion of end-user industries like textile and chemical processing drives the overall growth of the market.

China Boiler Water Treatment Chemicals Market Trends

China is a major contributor to the market. The growth in industrial activities like chemical processing, manufacturing, and power generation increases demand for boiler water treatment chemicals. The increasing power generation demand through sources like hydropower, coal, and nuclear helps the market growth. The stringent environmental regulations for industries and growing investment in advanced water treatment technologies increase the adoption of boiler water treatment chemicals. The growing focus on the adoption of renewable energy supports the market growth.

- China exported 729 shipments of boiler water treatment.(Source: www.volza.com)

- China exported 1,457 shipments of scale inhibitor.(Source: www.volza.com )

Which Region is the Fastest Growing in the Boiler Water Treatment Chemicals Market?

The Middle East & Africa are experiencing the fastest growth in the market during the forecast period. The presence of limited freshwater resources and a rising population increases demand for boiler water treatment chemicals. The growing oil & gas industry in the region helps the market growth. The stringent regulations for water pollution fuel demand for boiler water treatment chemicals. The expansion of manufacturing in industries like textiles, food & beverages, and chemicals fuels demand for boiler water treatment chemicals. The growing pharmaceuticals and petrochemicals industry helps the market growth. The presence of key players like Akzo Nobel, Ecolab, BASF, and DowDuPont drives the overall growth of the market.

Boiler Water Treatment Chemicals Trends in the United Arab Emirates

The United Arab Emirates is growing in the boiler water treatment chemicals market. The limited presence of fresh water resources increases the adoption of boiler water treatment chemicals. The strong industrial base in manufacturing, oil & gas, and petrochemicals helps the market growth. The strong focus on conserving fresh water resources and water recycling increases the adoption of boiler water treatment chemicals. The stringent government regulations for water treatment and advancements in water treatment technologies support the overall growth of the market.

Segmental Insights

Product Type Insights

Why did Oxygen Scavengers Segment Dominate the Boiler Water Treatment Chemicals Market?

The oxygen scavengers segment dominated the boiler water treatment chemicals market in 2024. The increasing demand for various oxygen scavengers like hydrazine, sulfites, and bisulfites helps the market growth. Oxygen scavengers prevent corrosion and maintain optimal boiler performance. They minimize downtime and require lower maintenance costs. The growing demand for diethylhydroxylamine and sodium sulfite helps the market growth. The growing demand across applications like oil & gas, power generation, food packaging, and pharmaceuticals supports the overall growth of the market.

The scale inhibitors segment is the fastest growing in the market during the forecast period. The increasing demand for scale inhibitors like polymers and phosphates helps the market growth. Scale inhibitors lower heat transfer efficiency and prevent scale deposit formation on boilers. The strong focus on water treatment and stricter regulation for water quality increases the adoption of scale inhibitors. They extend the lifespan of boilers and minimize requirements for premature replacements. The growing demand across sectors like oil & gas, food & beverage, power generation, and manufacturing supports the market growth.

Boiler Type Insights

How Water-Tube Boiler Segment Held the Largest Share in the Boiler Water Treatment Chemicals Market?

The water-tube boiler segment held the largest revenue share of the boiler water treatment chemicals market in 2024. The growing demand for high-purity steam in the power generation industry increases demand for water-tube boilers. The expansion of power generation and the growing need for electricity help the market growth. The increasing demand for handling higher steam volumes and pressures fuels demand for water tube boilers. These boilers easily adapt to fluctuating steam demand and minimize fuel and water usage. The growing demand across the chemical sectors drives the market growth.

The electric boiler segment expects the fastest growth in the market during the forecast period. The rapid urbanization and growing consumption of energy increase demand for electric boilers. The increasing demand for preventing problems like corrosion and scaling increases the adoption of electric boilers. The strong focus on higher-quality feedwater and preventing boiler damage increases the adoption of electric boilers. These boilers are easy to install and need less maintenance. The increasing demand across heating applications like industrial processes, space heating, and water heating supports the market growth.

Treatment Type Insights

How Internal Treatment Segment Dominates the Boiler Water Treatment Chemicals Market?

The internal treatment segment dominated the boiler water treatment chemicals market in 2024. The increasing focus on treating issues like corrosion and scale formation increases demand for internal treatment. The demand for handling residual problems and the need for safety against contaminants increases the adoption of internal treatments. The increasing demand for combating components like silica, hardness, and oxygen helps the market growth. Internal treatment is a cost-effective and optimizes heat transfer efficiency. They maintain the integrity of internal boiler components and avoid unexpected downtime. The growing demand for maintaining boiler efficiency drives the market growth.

The condensate treatment segment is the fastest growing in the market during the forecast period. The growing demand for neutralizing oxygen scavengers and amines to prevent corrosion increases demand for condensate treatments. The rapid industrialization and growing demand for power generation increase the adoption of condensate treatment. The stricter regulations for wastewater discharge increase demand for condensate treatment. The growing advancements in condensate treatment chemical formulations and focus on maintaining efficient heat transfer support the market growth.

End-Use Industry Insights

Which End-User Industry Held the Largest Share in the Boiler Water Treatment Chemicals Market?

The power generation segment held the largest revenue share of the boiler water treatment chemicals market in 2024. The rapid urbanization and growing demand for power generation help the market growth. The increasing demand for water in power plants like nuclear energy, thermal energy, coal, and oil increases the demand for boiler water treatment chemicals. The higher demand to produce power worldwide increases the adoption of boiler water treatment chemicals. The rapid growth in electricity generation drives the overall growth of the market.

The food & beverage segment expects the fastest CAGR in the market during the forecast period. The growing expansion of the food processing industry increases demand for boiler water treatment chemicals for reliable steam generation. The focus on preventing contamination of food and stringent food safety regulations helps the market growth. The company's strong focus on optimizing the production processes of food and beverages increases demand for boiler water treatment chemicals. The processes like sterilization, processing, cooking, and cleaning in the food & beverage industry require boiler water treatment chemicals. The growing consumption of packaged and processed foods supports the overall growth of the market.

Form Insights

Why did Liquid Segment Dominate the Boiler Water Treatment Chemicals Market?

The liquid segment dominated the boiler water treatment chemicals market in 2024. The growing demand for easy-to-inject, handle, and measure chemicals in boiler systems increases the adoption of liquid for. The focus on lowering handling hazards fuels the adoption of liquid forms, helping the market growth. Liquid form easily dissolves in water and is cost-effective. They readily integrate with other chemicals and are effective in controlling corrosion. The growing demand across large power plants and small industrial units drives the market growth.

The solid segment is the fastest growing in the market during the forecast period. The focus on minimizing the risk of leaks and spills increases demand for solid form. The focus on reducing carbon dioxide emissions and meeting environmental standards increases the adoption of solid form. The need for lowering storage space and simplified transportation increases demand for solid form. These forms require a lower disposal cost and need fewer frequent refills. The stringent environmental regulation and focus on sustainability supports the market growth.

Distribution Channel Insights

How Direct Sales Segment Held the Largest Share of the Boiler Water Treatment Market?

The direct sales segment held the largest revenue share of the boiler water treatment chemicals market in 2024. The growing demand for customized solutions and the need for conducting on-site assessments increases the demand for direct sales. The focus on building stronger relationships between customers and manufacturers increases adoption of direct sales, helping the overall growth of the market. The control over distribution channels and pricing strategies increases demand for direct sales. The focus on enhancing after-sales service, like ongoing support, troubleshooting, and maintenance, drives the overall growth of the market.

The online platforms segment expected to experience the fastest growth in the market during the forecast period. The growing demand for convenience to purchase, research, and compare various boilers increases the demand for online platforms. The availability of application guides, detailed product information, and technical specifications helps market growth. The easy availability of a wide range of boiler water treatment chemicals increases sales on online platforms. The growing digital transformation and 24/7 availability support the overall growth of the market.

Recent Developments

- In September 2024, Babcock Wanson launched the LV-Pack low-voltage industrial electric boiler. The boiler offers maximum efficiency with zero NOx and CO2 emissions. The boiler provides real-time monitoring and is fitted with a Navinergy monitoring system.(Source: www.pandct.com )

- In February 2025, AtmosZero launched the electric boiler 2.0. The new boiler replaces fossil-fired industrial boilers and offers low-cost decarbonized steam. The per-year facility will manufacture 100 boilers, and the boiler offers 2X efficiency.(Source: www.craftbrewingbusiness.com)

- In May 2025, Fujifilm launched the e-boiler 7MW system in Tilburg. The system focuses on supplying green steam, and the site operates on 100% renewable electricity. The project includes optimization of the smart system, heat pumps, and residual heat recovery.(Source: pharmaceuticalmanufacturer.media)

Top Companies List

- Ecolab Inc.

- SUEZ Water Technologies & Solutions (Veolia)

- Solvay S.A.

- Kemira Oyj

- BASF SE

- DuPont de Nemours, Inc.

- Kurita Water Industries Ltd.

- Accepta Ltd.

- Dow Chemical Company

- Chemtreat, Inc. (A Danaher Company)

- Veolia Water Technologies

- Lonza Group AG

- Buckman Laboratories International Inc.

- Arkema Group

- Akzo Nobel N.V.

- GE Water & Process Technologies

- Feralco Group

- Avista Technologies, Inc.

- Chemtex Speciality Limited

- Thermax Limited

Segments Covered

By Product Type

- Oxygen Scavengers

- Corrosion Inhibitors

- Scale Inhibitors/Antiscalants

- Sludge Conditioners/Dispersants

- Alkalinity Builders

- Foaming Agents/Anti-foaming Agents

- pH Boosters

- Biocides

- Chelating Agents

By Boiler Type

- Fire-tube Boiler

- Water-tube Boiler

- Electric Boiler

- Waste Heat Boiler

By Treatment Type

- Internal Treatment

- External/Pre-treatment

- Condensate Treatment

By End-Use Industry

- Power Generation

- Oil & Gas

- Chemical & Petrochemical

- Food & Beverage

- Pulp & Paper

- Textile

- Metals & Mining

- Pharmaceuticals

- Heating, Ventilation, and Air Conditioning (HVAC)

- Others (Hospitals, Institutions, etc.)

By Form

- Liquid

- Solid

- Powder

- Granules

- Gas

By Distribution Channel

- Direct Sales

- Distributors & Dealers

- Online Platforms

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- South Africa

- UAE

- Saudi Arabia

- Kuwait