Content

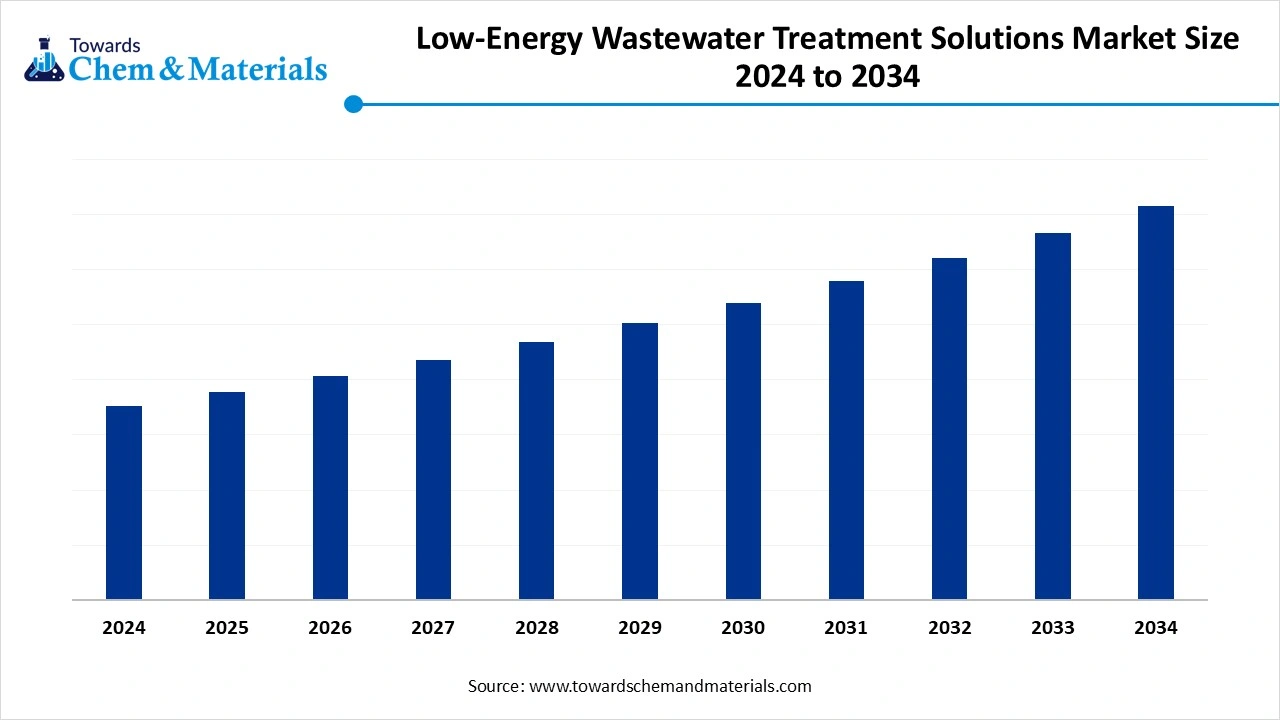

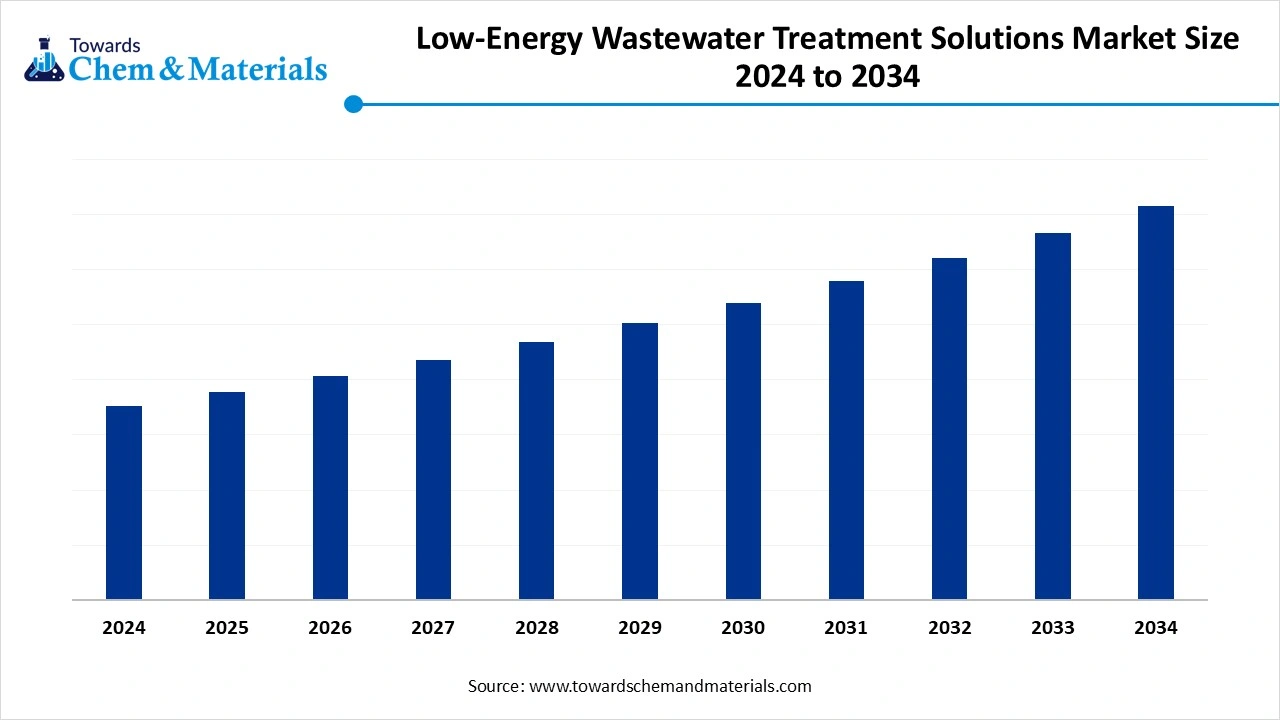

Low-Energy Wastewater Treatment Solutions Market Size and Growth 2025 to 2034

Low-Energy Wastewater Treatment Solutions Market is rapidly evolving with innovative deployment models and diverse end-user adoption. Government utilities remain the largest consumers, but residential societies and real estate developers are emerging as the fastest-growing segments, driven by on-site wastewater solutions for housing and commercial projects. the ongoing implementation of the sustainability standards and infrastructure development needs has accelerated the industry's potential in recent years.

Key Takeaways

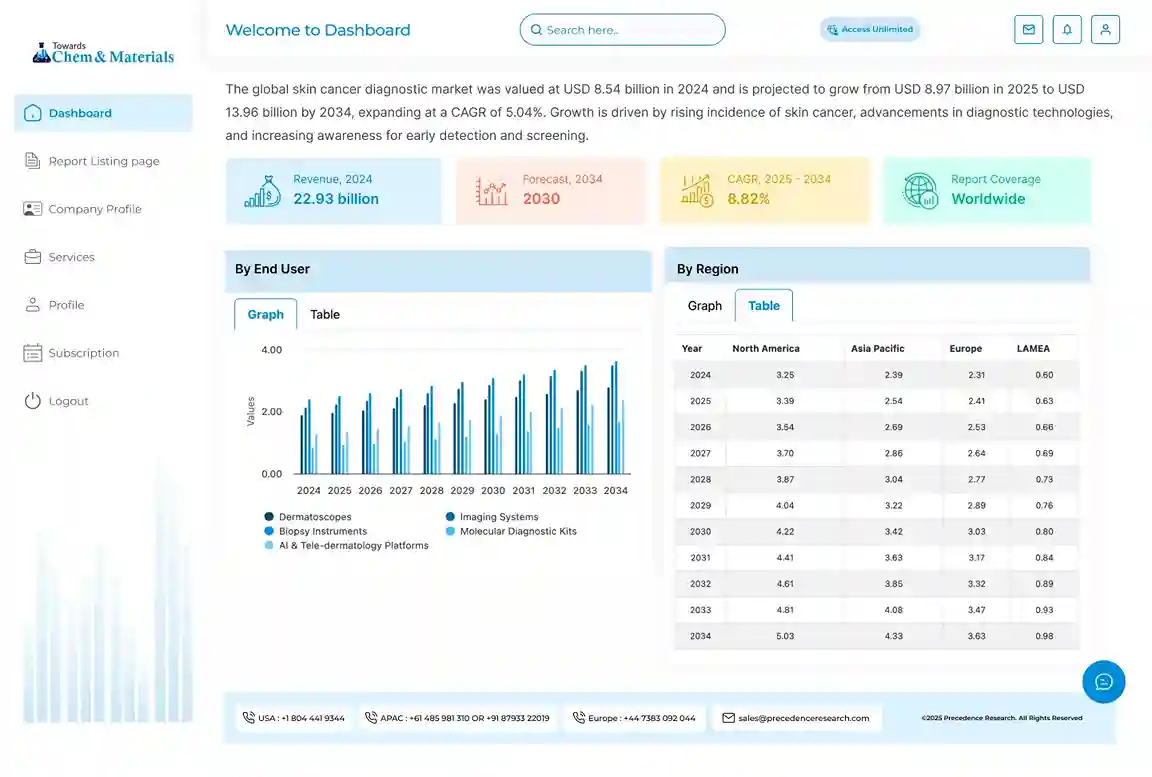

- By region, North America dominated the low-energy wastewater treatment solutions market in 2024, owing to strong governmental support for eco-friendly and sustainable initiatives and greater wastewater management systems.

- By region, Asia Pacific is expected to grow at a notable rate in the future, owing to increased water pollution concerns and significant infrastructure development in the coming years.

- By region, Europe is expected to grow at a significant pace, akin to the increased governmental focus on the climate targets.

- By technology type, the membrane bioreactors segment emerged as the top-performing segment in 2024 due to its significant abilities, such as the high-quality water supply and low energy consumption.

- By technology type, the anaerobic treatment systems segment is likely to experience notable growth during the expected period, akin to their high strength in the purification the industrial water while consuming low-rate energy

- By energy source, the digitally optimized aeration segment led the market in 2024, as it allows precise control over oxygen delivery, which reduces energy use in biological treatment.

- By energy source, the energy recovery systems segment is expected to grow significantly over the forecast period because they convert waste energy from treatment processes into usable energy.

- By end user type, the government utilities segment accounted for the highest of the low-energy wastewater treatment solutions market in 2024, akin to their responsibility for public water management.

- By end user type, the residential societies / real estate developers segment is projected to experience the quickest growth in the market over the forecast years, owing to rising demand for on-site wastewater treatment in new housing and commercial projects.

- By treatment capacity, the >500 m3/day segment captured the biggest portion of the market in 2024, owing to the inclusion of large municipal plants and industrial users who require high-capacity treatment.

- By treatment capacity, 5-500 m3/day are anticipated to expand at the highest rate in the coming years, as the rising demand from small towns, housing societies, schools, hospitals, and small industries.

- By deployment model, the fixed installations segment led the low-energy wastewater treatment solutions market in 2024 because most traditional treatment plants are stationery, built with concrete tanks and permanent systems

- By deployment model, the containerized or portable units segment is expected to grow at the fastest rate in the market during the forecast period. They are ideal for temporary setups, remote locations, or emergency needs

- By distribution channel, the direct sales segment emerged as the top consumer of the market in 2024, as manufacturers often deal directly with utilities, industries, or real estate developers.

- By distribution channel, the maintenance & operations-as-a-service is likely to witness the most rapid growth in the market in the years ahead, owing to rising demand for hassle-free and long-term solutions.

Market Overview

From Rural Demands to Global Impact: The Growth of Low-Energy Wastewater Systems

The low-energy wastewater treatment solutions market refers to the industry segment focused on technologies, systems, and services that treat municipal, industrial, or decentralized wastewater using minimal energy input compared to conventional systems, while maintaining or improving treatment performance. Moreover, the ongoing shift towards green mandates has provided a significant advantage for industry in recent years. The increased awareness of wastewater concern in rural areas is severely contributing to industry growth, as per the recent market observation.

Which Factor Is Driving the Growth of the Low-Energy Wastewater Treatment Solutions Market ?

The increased focus on sustainability initiatives across the globe is driving industry growth in the current period. As several regional governments are increasingly updating their infrastructure while replacing the traditional systems that consume excess power supplies in recent years. Also, these governments are actively offering advantages such as tax reduction and subsidies to residential developers and individuals who are installing these low-energy systems, which can contribute to market growth nowadays. Some of the individuals establish sophisticated businesses with an idea of the reuse of wastewater in recent years.

Market Opportunity

Portable Treatment Systems Open Profitable Doors in Undeveloped Regions

The development of compact and portable systems for the rural areas is projected to create lucrative opportunities for the manufacturers in the coming years. By having features like easy installation and low maintenance, the manufacturers can create huge profit margins during the forecast period. Also, manufacturers can tap into the underdeveloped regional market where the consumer is actively seeking cost-effective and low-maintenance machinery, which can provide them with a sophisticated consumer base in the coming years, as per the future industry expectations.

Market Trends

- The increasing need for decentralized water systems is spearheading industry growth in the current period. Several regions are actively installing decentralized wastewater management systems to minimize the need for long pipelines and lower energy use.

- The integration of the latest technology in the wastewater management systems is driving the industry further. Several systems are seen in integrated with smart sensors and software for high-quality performance and better control.

- The ongoing establishment of the real estate sector is severely contributing to the industry's growth in recent years, as several infrastructure developers have been actively looking for compact wastewater treatment units in the past few years.

Market Challenge

Capital Barriers Slow Adoption Despite Long-Term Savings

The initial cost of this system is expected to hinder the industry's growth in the coming years. Moreover, these advanced machines can save money in the long run, but the smaller and mid-sized manufacturers cannot afford these types of advanced systems. Furthermore, some of the developing regions cannot afford these types of expensive systems owing to their low financial budgets, which can create growth barriers for the industry in the coming years.

Regional Insights

North America dominated the market in 2024, akin to having strong governmental support for eco-friendly and sustainable initiatives and greater wastewater management systems. Moreover, the technological advances played a major role in the development of the advanced wastewater management systems in the region in recent years. as the region is seen under the heavy need for decentralized water treatments in the region day which is contributing to the industry growth in the current period as per the recent regional observation.

Is the United States Leading the Green Wastewater Revolution Through R&D?

The United States maintained its dominance in the low-energy wastewater treatment solutions market, owing to major investments in research and development programs for green infrastructures. Moreover, the country has observed the large-scale project deployments of energy-efficient treatments in the current period. Moreover, the government in the United States has pushed green initiatives by providing attractive benefits for developers, like tax reductions and attractive subsidies in the rental years.

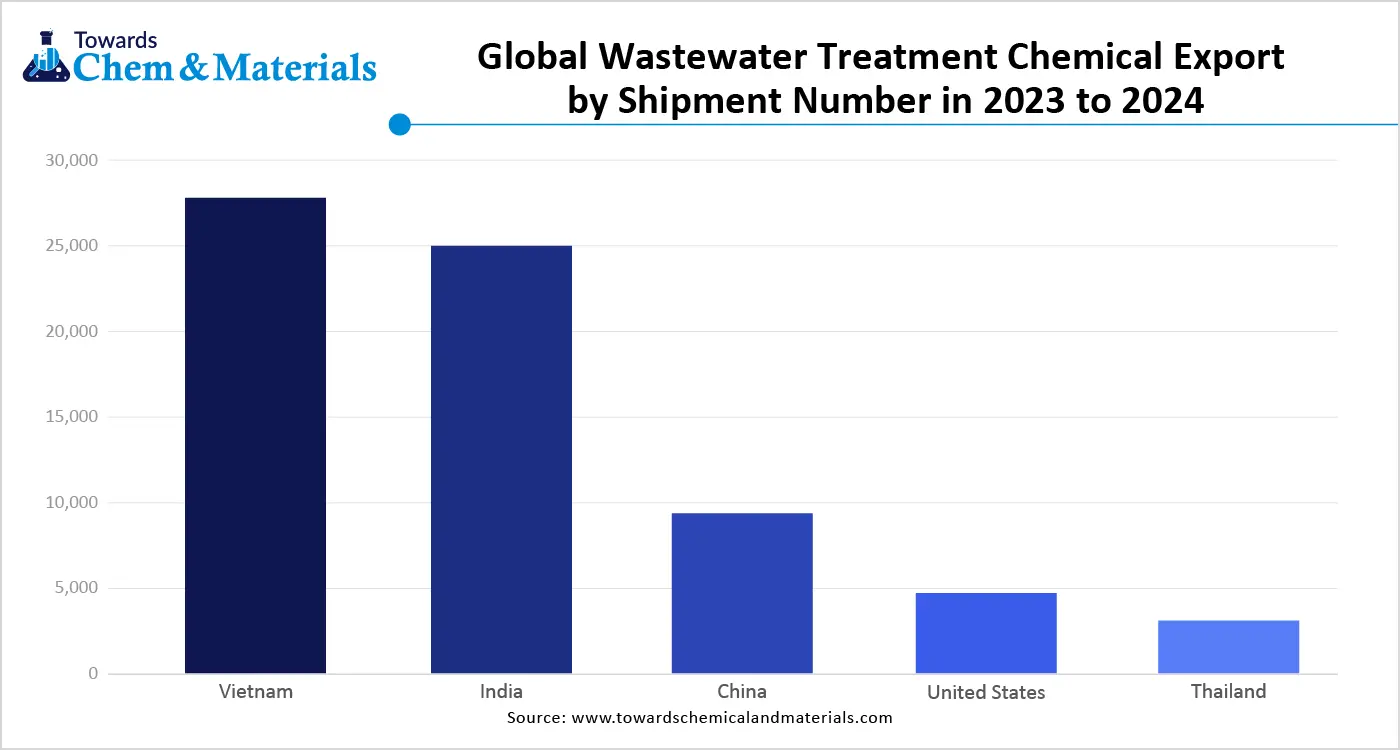

Asia Pacific is expected to capture a major share of the market during the forecast period, owing to increased water pollution concerns and significant infrastructure development in the coming years. the regional countries such as India, China, and South Korea is actively seen in putting investments in the energy efficient solution for the ongoing water treatment concerns which is likely to provide wide consumer baser to the manufacturer during the forecast period. Furthermore, some countries are facing severe water shortages with sewage blocking problems, which need decentralized wastewater treatment systems, which are expected to gain major industry share in the coming years.

How Are Smart Cities Powering China’s Eco-Wastewater Boom?

China is expected to rise as a dominant country in the Asia Pacific region in the coming years, owing to the presence of the latest technologies and urban development in recent years. China is considered a developed nation globally due to its infrastructure development, which includes better waste management systems. Also, the government of China is sophisticatedly managing and investing in innovations for the smart city development, which is expected to drive the growth of the industry in the coming years.

The European market is anticipated to grow at a noble rate in the coming years, akin to increased governmental focus on the climate targets. Many rational countries, such as Germany, the United Kingdom, and others, are trying to maintain carbon neutrality, which is actively pushing the growth of low-energy solutions in these nations. Moreover, the region is increasingly installing smart water systems, which include sensors and automation, and is likely to contribute to the future growth of the water solution market during the projected period.

Segmental Insights

Technology Type Insights

How the Membrane Bioreactors Segment Dominated the Low-Energy Wastewater Treatment Solutions Market in 2024?

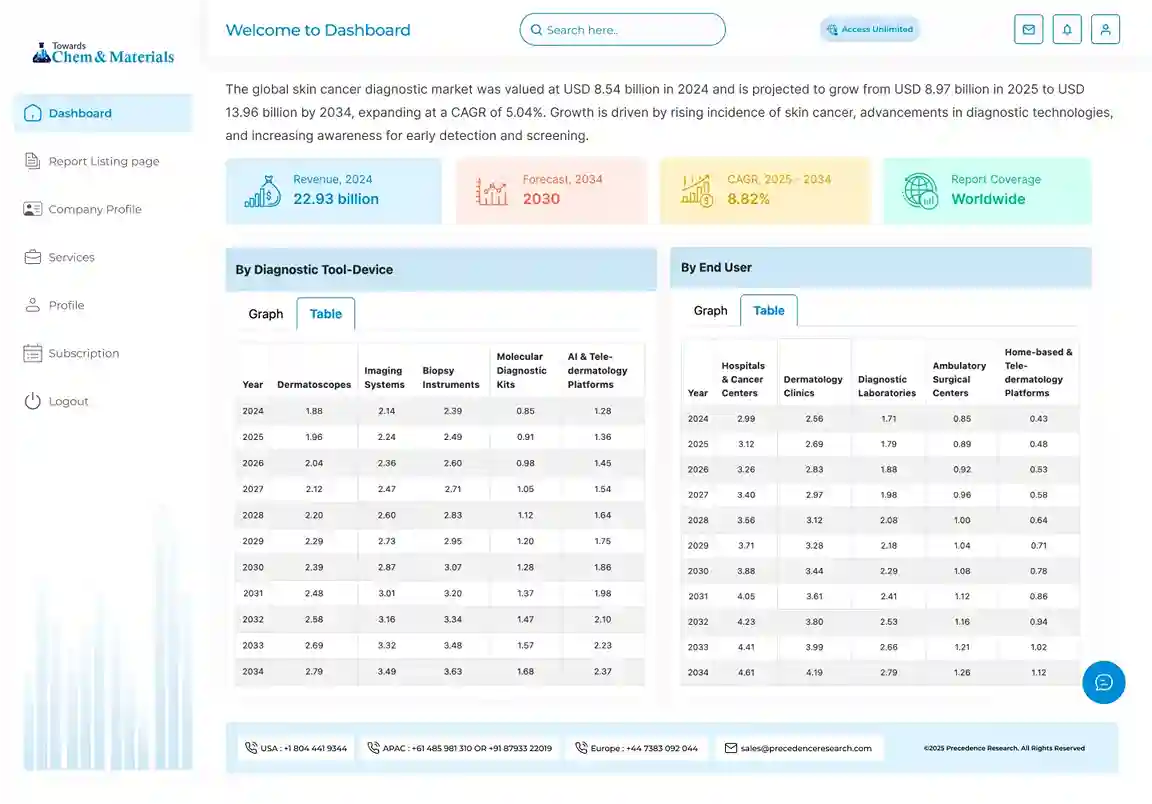

The membrane bioreactors segment held the largest share of the market in 2024, due to its significant abilities, such as the high-quality water supply and low energy consumption. Moreover, by combining filtration and biological treatment, the membrane bioreactors increasingly reduce dependence on the additional units, which has provided them with industry attention in recent years. Also, the systems need a compact design. Bioreactors have increasingly preferred membrane bioreactors in the past few years, owing to their ideal size.

The anaerobic treatment systems segment is seen to grow at a notable rate during the predicted timeframe, owing to their high strength in the purification of industrial water while consuming low-rate energy. Moreover, these systems have more advantages, like the fact that they produce biogas while purification, which can be reused after the process. Furthermore, the need for sufficiency and green energy models is anticipated to contribute to the segment growth further, as per the recent industry observations.

Energy Source Insights

Why Digitally Optimized Aeriation Segment Dominated the Low-Energy Wastewater Treatment Solutions Market by Application Type?

The digitally optimized aeriation segment held the largest share of the low-energy wastewater treatment solutions market in 2024, akin to it allowing precise control over oxygen delivery, which reduces energy use in biological treatment. These systems use smart sensors and AI to monitor and adjust aeration levels based on wastewater load. Since aeration is one of the most energy-intensive parts of wastewater treatment, optimizing it helps significantly reduce electricity costs. These systems are gaining popularity in municipal treatment plants and large industries where energy savings and process efficiency are critical. Their data-driven approach also enables predictive maintenance and better operational planning.

The energy recovery systems segment is expected to grow at a notable rate because they convert waste energy from treatment processes into usable energy. These include systems like biogas capture, heat exchangers, and turbine generators. As industries aim to lower energy bills and carbon footprints, these solutions provide both cost savings and sustainability benefits. Governments are also offering incentives for renewable energy integration, making energy recovery more attractive. These systems are ideal for large treatment plants and energy-intensive industrial sites that want to improve overall efficiency and meet environmental regulations.

End User Insights

Why Did the Government Utilities Segment Dominate the Low-Energy Wastewater Treatment Solutions Market in 2024?

The government utilities segment dominated the market with the largest share in 2024, owing to their responsibility for public water management. Municipal wastewater treatment plants are upgrading their systems to meet stricter regulations on energy use and discharge quality. Government bodies often have access to public funding or international loans for sustainable projects, enabling the adoption of energy-efficient systems. Large-scale government-driven projects, especially in cities, are also driving volume-based demand. Public utilities also act as role models by setting standards for energy efficiency and low environmental impact, encouraging the private sector to follow suit.

The residential societies and real estate developers segment is expected to grow at the fastest rate in the market during the forecast period, akin to rising demand for on-site wastewater treatment in new housing and commercial projects. Urbanization, water scarcity, and pressure to reuse water are driving the trend of building-level or community-level treatment units. Developers are also integrating these systems as value-added features to attract eco-conscious buyers. Compact, low-maintenance, and energy-efficient systems are ideal for these setups. Government regulations on green buildings and decentralized wastewater treatment will also support adoption among builders and housing communities.

Treatment Capacity Insights

Why is the >500m³/day Segment Preferred by High-Capacity Seekers?

The >500m³/day segment held the largest share of the market in 2024, due to it includes large municipal plants and industrial users who require high-capacity treatment. These systems are often installed in cities, industrial parks, and commercial hubs where wastewater volumes are very high. Large-scale systems can justify investment in energy-efficient technologies because the savings are significant over time. Moreover, bigger plants have the resources to implement smart automation and energy recovery, further boosting their preference for low-energy systems. The demand for retrofitting existing plants with better capacity and lower energy consumption also supports this segment.

The 5-500m²/day segment is observed to grow at the fastest rate during the forecast period, owing to rising demand from small towns, housing societies, schools, hospitals, and small industries. These end users require compact, cost-effective, and efficient solutions. Manufacturers are increasingly targeting this segment with modular and plug-and-play systems that are easy to operate and maintain. Also, many new real estate developments are including small-capacity treatment plants to ensure water reuse and meet sustainability norms. The trend toward decentralization in water treatment also aligns with the needs of this growing segment.

Deployment Model Insights

Why is the Fixed Installations Segment Will Preferred for the Installations?

The fixed installations segment led the low-energy wastewater treatment solutions market in 2024, due to the fact that most traditional treatment plants are stationery, built with concrete tanks and permanent systems. These are common in cities, industrial zones, and institutional setups. They are often large and designed for long-term use. These systems are preferred when space, access to skilled labor, and funding are available. They also support sophisticated automation, making them efficient and reliable over time. Governments and public bodies often choose fixed systems for large population clusters due to their proven track record and ability to handle large loads consistently.

The containerized or portable units segment is expected to grow at the fastest rate in the market during the forecast period. They are ideal for temporary setups, remote locations, or emergency needs. These systems are plug-and-play, easy to transport, and quick to install. They are becoming very popular in developing areas, construction sites, disaster zones, and industries with shifting production sites. Their modular nature allows easy scaling based on changing capacity needs. As real estate and rural development continue to expand, demand for portable, low-energy wastewater treatment units will rise. These units also align well with decentralized water management strategies.

Distribution Channel Insights

How the Direct Sales (OEM to end user) Segment Dominated the Low-Energy Wastewater Treatment Solutions Market in 2024?

The direct sales (OEM to end user) segment held the largest share of the market in 2024. As manufacturers often deal directly with utilities, industries, or real estate developers. This helps in offering customized solutions and better after-sales service. OEMs can build strong relationships, understand exact requirements, and offer bundled services like installation and training. Large buyers prefer direct contact to ensure quality and avoid distributor margins. The model also helps with faster feedback and product improvements. In B2B sales like wastewater treatment, direct engagement is often more efficient and profitable for both sides.

The maintenance and operations as a service segment is seen to grow at a notable rate during the predicted timeframe, owing to rising demand for hassle-free and long-term solutions. Instead of buying and managing their systems, many users prefer to outsource the operation and maintenance to experts. This model helps reduce upfront capital costs and ensures consistent performance. Service providers handle everything from monitoring to repairs, often using remote diagnostics and AI. As industry shifts toward performance-based contracts and sustainable water use, this model will grow, especially in hotels, housing societies, and industrial clients with limited technical staff.

Recent Developments

- In April 2024, Thermax introduced the latest facility for water treatment solutions in Pune, India. Moreover, this space includes the latest and advanced production techniques with automation, as per the report published by the company.(Source: infra.economictimes.indiatimes.com)

- In April 2025, Tedagua unveiled its latest treatment system for the reuse of treated wastewater. This system is based on the reverse osmosis technology, as per the company's claim.(Source: smartwatermagazine.com)

Top Companies list

- Veolia Water Technologies

- SUEZ

- Xylem Inc

- Kubota Corporation

- Aquatech International

- Thermax Limited

- GE Water (now part of SUEZ)

- Paques Environmental Technologies

- Pentair X-Flow

- Toray Membrane

- Fluence Corporation

- Cambrian Innovation

- Voltea

- Saltworks Technologies

- Genesis Water Technologies

Segment Covered

By Technology Type

- Anaerobic Treatment Systems (Fastest growth over the forecast period)

- Membrane Bioreactors (Dominant in 2024) – 28.6%

- Electrochemical Treatment

- Advanced Oxidation Processes

- Construction Wetlands & Nature-based Systems

- Decentralized Modular Units

- Others (Microbial Fuel Cells)

By Energy Source

- Passive-Gravity Based Systems

- Solar-Assisted Treatment

- Energy-Recovery Systems

- Digitally Optimized Aeration

By End-user

- Government Utilities / Municipalities

- Industrial Firms

- Residential Societies / Real Estate Developers

- Agriculture & Aquaculture Farms

- Others (Tourism & Hospitality Sector, etc.)

By Treatment Capacity

- <50 m3/day

- 5-500 m3/day

- >500 m3/day

By Deployment Model

- Containerized/Portable Units

- Fixed Installations

- Build-Own-Operate Systems

By Distribution Channel

- Direct Sales (OEM to End-user)

- System Integrators & Engineering, Procurement, and Construction (EPC) Firms

- Distributors / Dealers / Channel Partners

- Online Platforms & E-marketplaces

- Maintenance & Operations-as-a-Service (OaaS)

- Public-Private Partnerships (PPPs)

By Region

- North America

- U.S.

- Mexico

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Asia Pacific

- China

- India

- Japan

- South Korea

- Central & South America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- UAE