Content

Oxo Alcohol Market Size | Companies Revenue

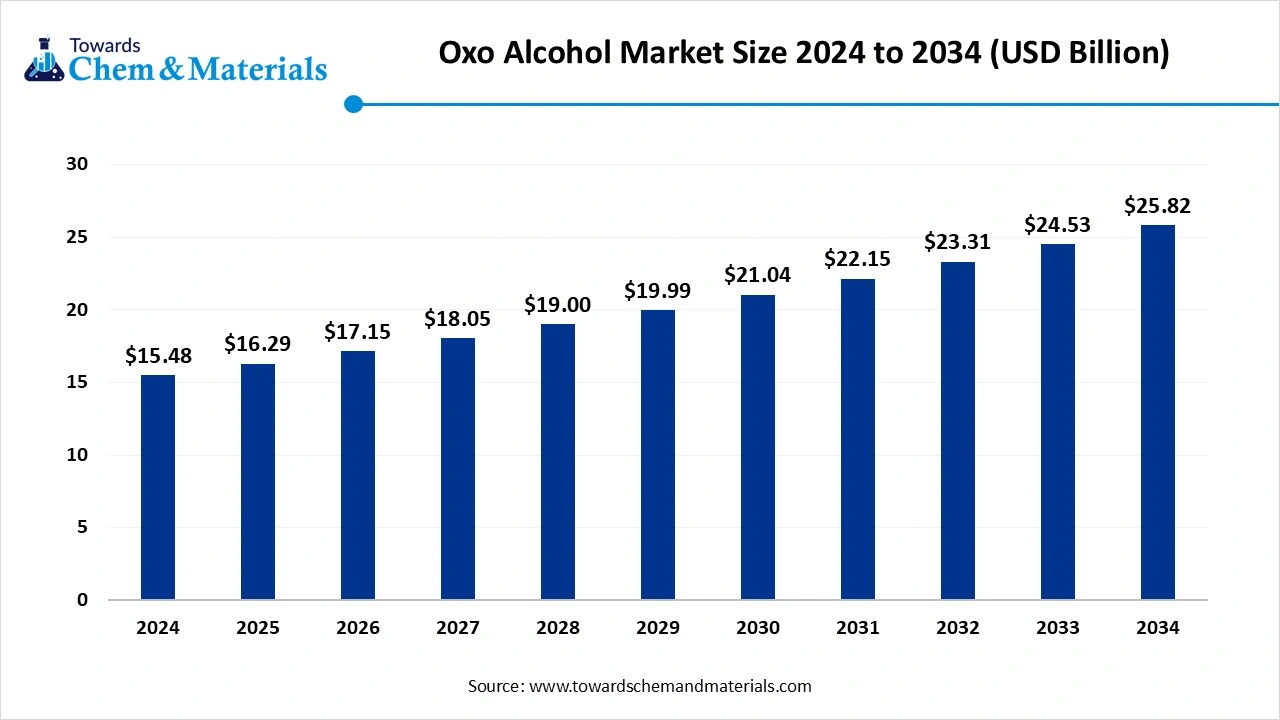

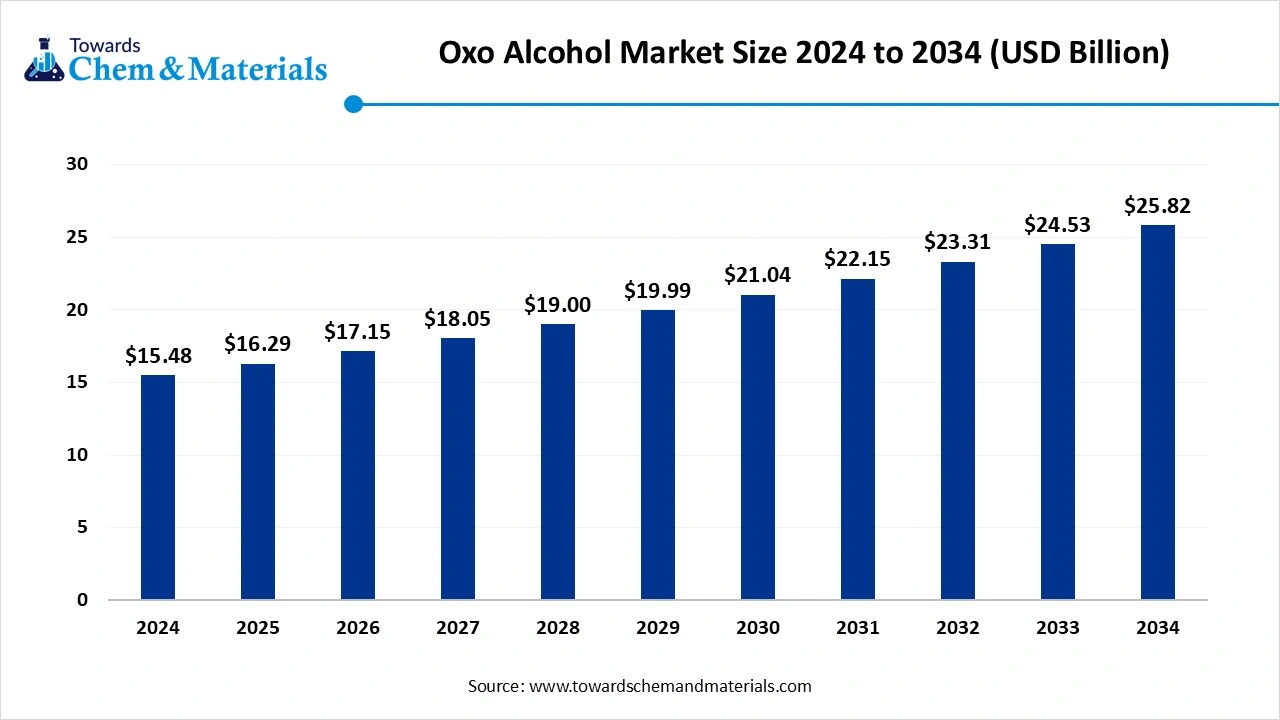

The global oxo alcohol market size was reached at USD 15.48 billion in 2024 and is expected to be worth around USD 25.82 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.25% over the forecast period 2025 to 2034. The increased need for plasticizers and coatings has accelerated industry potential in recent years.

Key Takeaways

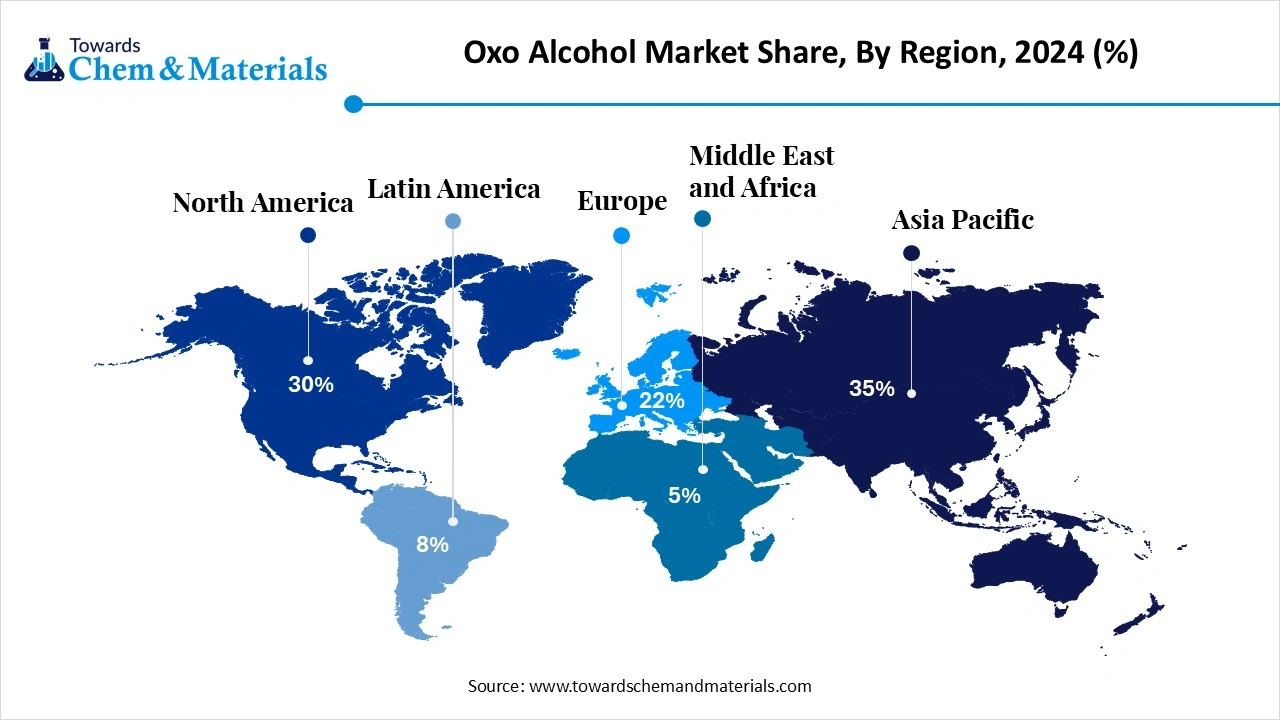

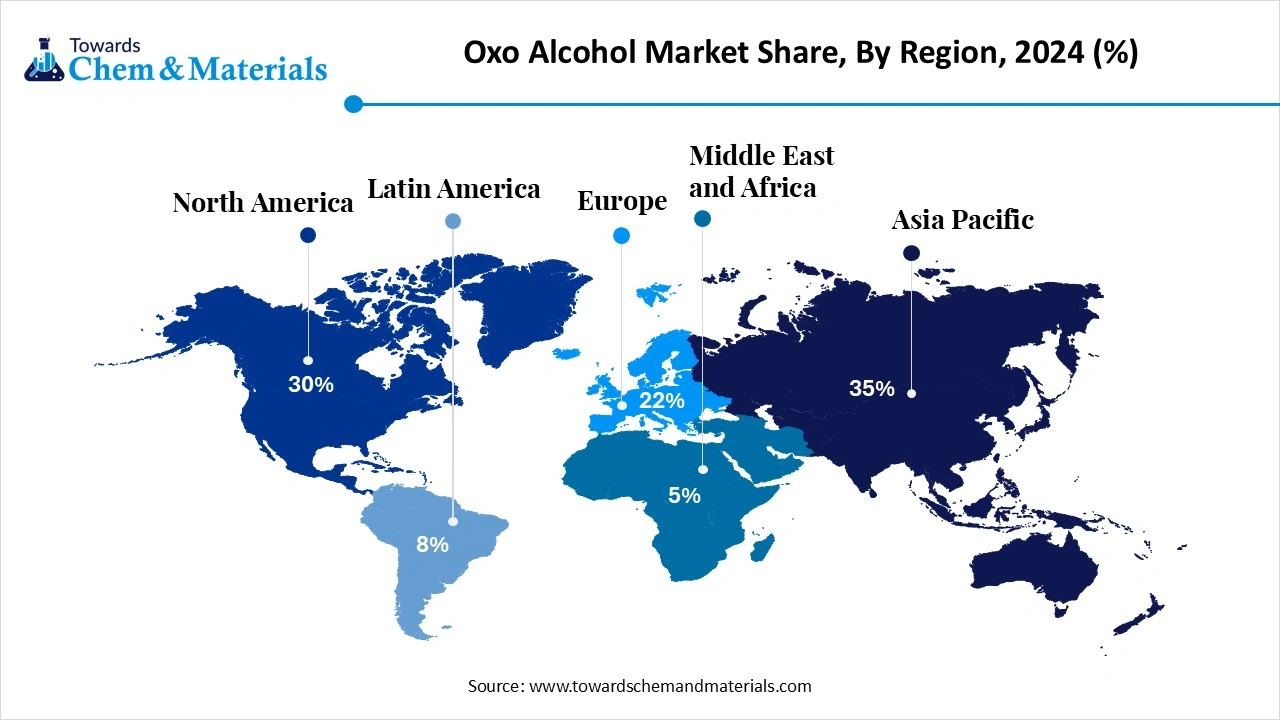

- By region, Asia Pacific dominated the oxo alcohol market in 2024 with 46% of the industry share, akin to the enlarged industrial and construction sectors, which are experiencing rapid growth in the current period.

- By region, Middle East & Africa is expected to grow at a fastest rate in the future, owing to factors such as rapid industrialization and massive energy investment in recent years.

- By product type, the 2-ethylhexanol segment led the market in 2024 with 45% of market share, due to increased demand from sectors such as the automotive, construction, cables, and wires in recent years.

- By product type, the isobutanol segment is expected to grow at the fastest rate in the market during the forecast period, akin to the increasing need for high-performance paints and coatings, where isobutanol plays a crucial role in this application.

- By end use, the chemical and petrochemicals segment emerged as the top-performing segment in the market in 2024 with 41% of market share, due to increased production of resins, plasticizers, and solvents in the current period.

- By end use, the paint and coatings are expected to growth as the fastest rate in the market in the coming years, due to booming construction, infrastructure, and automotive sectors worldwide.

- By distribution channel, the direct sales segment led the market in 2024 with 60% market share. As Direct sales are preferred by major oxo alcohol producers to maintain control over pricing, supply, and relationships with large industrial clients.

- By distribution channel, the online B2B platforms segment is expected to capture the biggest portion of the market in the coming years. These platforms allow buyers and sellers to connect efficiently, compare prices, and place orders in real-time.

Market Overview

The Backbone of Modern Manufacturing: Exploring the Oxo Alcohols

The oxo alcohol market encompasses alcohols synthesized through the oxo (hydroformylation) process, where alkenes react with synthesis gas (CO + H₂) to form aldehydes, which are then hydrogenated into alcohols. Common types include n-butanol, isobutanol, and 2-ethylhexanol (2-EH). These alcohols serve as critical intermediates in the manufacture of plasticizers, acrylates, lubricants, solvents, coatings, and adhesives. Growth is driven by the expanding construction, automotive, paints & coatings, and packaging industries, alongside rising demand for PVC plasticizers and acrylic esters.

What Factor is Driving the Oxo Alcohol Market?

The increased global need for plasticizers is spearheading industry growth in the current period. As several plastic manufacturers are increasingly seen under the heavy demand for plasticizers to make their plastic smooth and flexible, the plasticizers have gained immense industry attention in recent years. Furthermore, industries like automotive and construction can maintain the plasticizers' dominance in the upcoming years, as per the future industry expectations.

Market Trends

- The sudden shift in the green material adoption is driving industry growth in the current period. Several manufacturers are putting heavy investment in R&D activities to produce plastics where the oxo alcohol is involved.

- The increased need for industrial and decorative coatings is contributing to industry growth in recent years, which has immensely boosted global oxo alcohol consumption.

Report Scope

| Report Attribute | Details |

| Market Size in 2025 | USD 15.48 Billion |

| Expected Size by 2034 | USD 16.29 Billion |

| Growth Rate from 2025 to 2034 | CAGR 5.25% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Product Type, By End-Use Industry, By Distribution Channel,By Region |

| Key Companies Profiled | BASF SE, Dow Inc. , ExxonMobil Chemical , Grupa Azoty S.A. , Sinopec Corp. , Eastman Chemical Company , LG Chem Ltd. , Mitsubishi Chemical Corporation , Evonik Industries AG , OQ Chemicals (formerly Oxea GmbH) , ZAK S.A. , Andhra Petrochemicals Ltd. , SABIC , Formosa Plastics Group , Petronas Chemicals Group Berhad |

Market Opportunity

Production Shift to Emerging Economies Unlocks New Market Avenues

The establishment of the production plants in the developing regions is expected to create lucrative opportunities for the manufacturers in the upcoming years. Moreover, these emerging regions are actively seen under the heavy expansion of sectors like packaging, construction materials, and infrastructure, which is likely to create a greater sales environment for the manufacturer in the coming years. Also, the manufacturers can establish strategic collaboration with local facilities, where they can boost their production while reducing the product cost and meeting the local demand quickly.

Market Challenge

Price Instability in Petrochemicals Casts a Shadow on Future Growth

The continuous price fluctuation of raw materials is expected to hamper industry growth during the forecast period, as the Oxo chemical is tightly linked with the petrochemicals, which are regularly seen under heavy price fluctuations. These price fluctuations can create growth barriers for the new entrants and mid-sized businesses, which have limited budgets.

Oxo Alcohol Market Size & Share Report, 2034

The Asia Pacific oxo alcohol market size was estimated at USD 7.12 billion in 2024 and is anticipated to reach USD 12.11 billion by 2034, growing at a CAGR of 5.45% from 2025 to 2034.

Asia Pacific dominated the oxo alcohol market in 2024, akin to the enlarged industrial and construction sectors, which are experiencing rapid growth in the current period. Furthermore, the regional countries such as India, China, and Japan are considered the world's largest producers of pastes, coatings, and plasticizers, with the major consumption. Moreover, having advantages such as the low labor cost and affordable raw materials has played a major role in the expansion of the regional market in recent years.

Global Oxo Alcohol Market Revenue, By Regional, 2024-2034 (USD Billion)

| By Regional | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 |

| North America | 3.12 | 3.27 | 3.55 | 3.63 | 3.84 | 4.11 | 4.37 | 4.53 | 4.65 | 4.69 | 5.04 |

| Europe | 3.83 | 4.15 | 4.29 | 4.66 | 4.72 | 4.86 | 5.12 | 5.50 | 5.85 | 6.19 | 6.37 |

| Asia-Pacific | 6.20 | 6.47 | 6.87 | 7.38 | 7.62 | 7.99 | 8.39 | 8.93 | 9.22 | 9.74 | 10.43 |

| Latin America | 1.22 | 1.33 | 1.30 | 1.31 | 1.58 | 1.68 | 1.67 | 1.73 | 1.86 | 2.04 | 2.02 |

| Middle East & Africa | 1.10 | 1.07 | 1.13 | 1.07 | 1.23 | 1.37 | 1.50 | 1.46 | 1.72 | 1.87 | 1.98 |

Can China Maintain Its Reign in the Global Oxo Alcohol Market?

China maintained its dominance in the market, owing to the presence of one of the largest chemical manufacturing industries in recent years. Moreover, the country is known as one of the leading exporters of oxo alcohols such as the 2 2-ethylhexanol and others in recent years. Moreover, with the greater push for domestic production and the enlarged consumption, the industry is expected to grow at a significant pace in the upcoming years, as per future expectations.

Middle East & Africa Oxo Alcohol Market Trends

The Middle East & Africa are expected to capture a major share of the market during the forecast period, owing to factors such as rapid industrialization and massive energy investment in recent years. Moreover, the region is certainly seen as looking for investment in the downstream chemical industries to boost domestic Oxo chemical production, where the abundant oil reserves can rise as one of the great advantages in the upcoming years.

Is a New Power Shift Brewing Between Saudi Arabia and South Africa?

Saudi Arabia and South Africa are expected to rise as dominant countries in the region in the coming years, owing to enlarged investment in the petrochemical sectors and a construction boom in both countries. Moreover, Saudi Arabia is trying to boost production capacities of the value-added chemicals like Oxo chemicals and others, where South Africa is seen under the heavy demand for adhesives and coatings in the current period, as per the recent industry survey.

Segmental Insights

Product Type Insights

How Did The 2-Ethylhexanol Segment Dominate The Oxo Alcohol Market In 2024?

The 2-ethylhexanol segment held the largest share of the market in 2024, due to increased demand from sectors such as the automotive, construction, cables, and wires in recent years. Moreover, having excellent solvency and easier compatibility with other materials is contributing immediately to the segment growth in the current period. Furthermore, as the construction actively increases globally, the 2-ethyhexanol is expected to rise as a crucial element in the industry as per the future industry expectations.

Global Oxo Alcohol Market Revenue, By Product Type, 2024-2034 (USD Billion)

| By Product Type | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 |

| n-Butanol | 5.28 | 5.57 | 6.00 | 6.54 | 6.73 | 6.95 | 7.37 | 7.86 | 8.14 | 8.26 | 9.16 |

| Isobutanol | 2.43 | 2.48 | 2.52 | 2.47 | 2.76 | 3.00 | 3.19 | 3.48 | 3.58 | 3.88 | 4.05 |

| 2-Ethylhexanol (2-EH) | 6.12 | 6.64 | 6.79 | 7.32 | 7.57 | 7.97 | 8.57 | 8.77 | 9.26 | 9.69 | 10.25 |

| Others | 1.65 | 1.60 | 1.83 | 1.71 | 1.94 | 2.07 | 1.92 | 2.04 | 2.33 | 2.70 | 2.36 |

The isobutanol segment is expected to grow at a notable rate during the predicted timeframe, akin to the increasing need for high-performance paints and coatings, where isobutanol plays a crucial role in these applications. Furthermore, the sudden shift towards green material initiatives is anticipated to provide immense attention to isobutanol, which is commonly considered a cleaner alternative.

End Use Insights

Why Does The Chemical And Petrochemicals Segment Dominate The Oxo Alcohol Market in 2024?

The chemical and petrochemical segment held the largest share of the market in 2024, due to increased production of the resins, plasticizers, and solvents in the current period. Moreover, the demand for performance materials is contributing to the growth of the segment in recent years, as Oxo chemicals are considered a crucial element in production.

Global Oxo Alcohol Market Revenue, By End-Use , 2024-2034 (USD Billion)

| By End-Use | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 |

| Chemicals & Petrochemicals | 3.85 | 4.18 | 4.27 | 4.61 | 4.76 | 4.96 | 5.17 | 5.58 | 5.68 | 6.00 | 6.75 |

| Building & Construction | 3.08 | 3.39 | 3.41 | 3.54 | 3.75 | 4.09 | 4.21 | 4.36 | 4.64 | 4.81 | 5.06 |

| Automotive | 2.38 | 2.40 | 2.67 | 2.62 | 2.89 | 3.00 | 3.09 | 3.30 | 3.43 | 3.63 | 3.80 |

| Paints & Coatings | 2.32 | 2.31 | 2.43 | 2.81 | 2.80 | 3.01 | 3.25 | 3.35 | 3.43 | 3.79 | 3.70 |

| Plastics & Polymers | 1.56 | 1.61 | 1.74 | 1.77 | 1.94 | 1.99 | 2.00 | 2.26 | 2.47 | 2.60 | 2.63 |

| Textiles | 1.20 | 1.19 | 1.29 | 1.43 | 1.37 | 1.51 | 1.79 | 1.73 | 1.90 | 2.04 | 2.05 |

| Pharmaceuticals & Personal Care | 1.10 | 1.20 | 1.33 | 1.27 | 1.49 | 1.43 | 1.52 | 1.57 | 1.76 | 1.66 | 1.82 |

The paint & coatings segment is expected to grow at a notable rate during the forecast period, due to booming construction, infrastructure, and automotive sectors worldwide. Oxo alcohols serve as solvents and coalescing agents in various formulations, improving paint application and finish. As demand for eco-friendly and high-performance coatings increases, the role of oxo alcohols will grow. The rise of decorative and industrial coatings, especially in the Asia Pacific and the Middle East, will drive consumption.

Distribution Channel Insights

Why Does The Direct Sales Segment Dominate The Oxo Alcohol Market in 2024?

The direct sales segment dominated the market with the largest share in 2024. As Direct sales are preferred by major oxo alcohol producers to maintain control over pricing, supply, and relationships with large industrial clients. It allows for tailored contracts, bulk deals, and consistent product quality assurance. This channel is especially favored by chemical and petrochemical companies that require large volumes of specific alcohol.

The online B2B Platforms segment is expected to grow at a significant rate during the forecast period. These platforms allow buyers and sellers to connect efficiently, compare prices, and place orders in real-time. As digitalization increases, companies are streamlining procurement through online portals. B2B marketplaces offer transparency, broader reach, and lower transaction costs, especially for small and mid-sized firms.

Recent Developments

- In June 2024, Technip Energies and Mitsubishi Chemical introduced the latest OXO alcohol technology. Moreover, the newly launched technology is called the OXO M-Process.(Source: www.ten.com)

- In October 2024, Perstorp announced that it to expand its portfolio of oxo alcohols in Asia. Moreover, the company is planning to expand the C8-C10 oxo alcohols as per the report published by the company recently.(Source: www.fuelsandlubes.com )

Oxo Alcohol Market Top Companies

- BASF SE

- Dow Inc.

- ExxonMobil Chemical

- Grupa Azoty S.A.

- Sinopec Corp.

- Eastman Chemical Company

- LG Chem Ltd.

- Mitsubishi Chemical Corporation

- Evonik Industries AG

- OQ Chemicals (formerly Oxea GmbH)

- ZAK S.A.

- Andhra Petrochemicals Ltd.

- SABIC

- Formosa Plastics Group

- Petronas Chemicals Group Berhad

Segment Covered

By Product Type

- n-Butanol

- Isobutanol

- 2-Ethylhexanol (2-EH)

- Others (e.g., Pentanol, Heptanol)

By End-Use Industry

- Chemicals & Petrochemicals

- Building & Construction

- Automotive

- Paints & Coatings

- Plastics & Polymers

- Textiles

- Pharmaceuticals & Personal Care

By Distribution Channel

- Direct Sales (Industrial Bulk Contracts)

- Distributors & Chemical Traders

- Online B2B Platforms

By Region

- North America

- U.S.

- Mexico

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Asia Pacific

- China

- India

- Japan

- South Korea

- Central & South America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- UAE