Content

Specialty Fabric Processing Market Size and Forecast 2025 to 2034

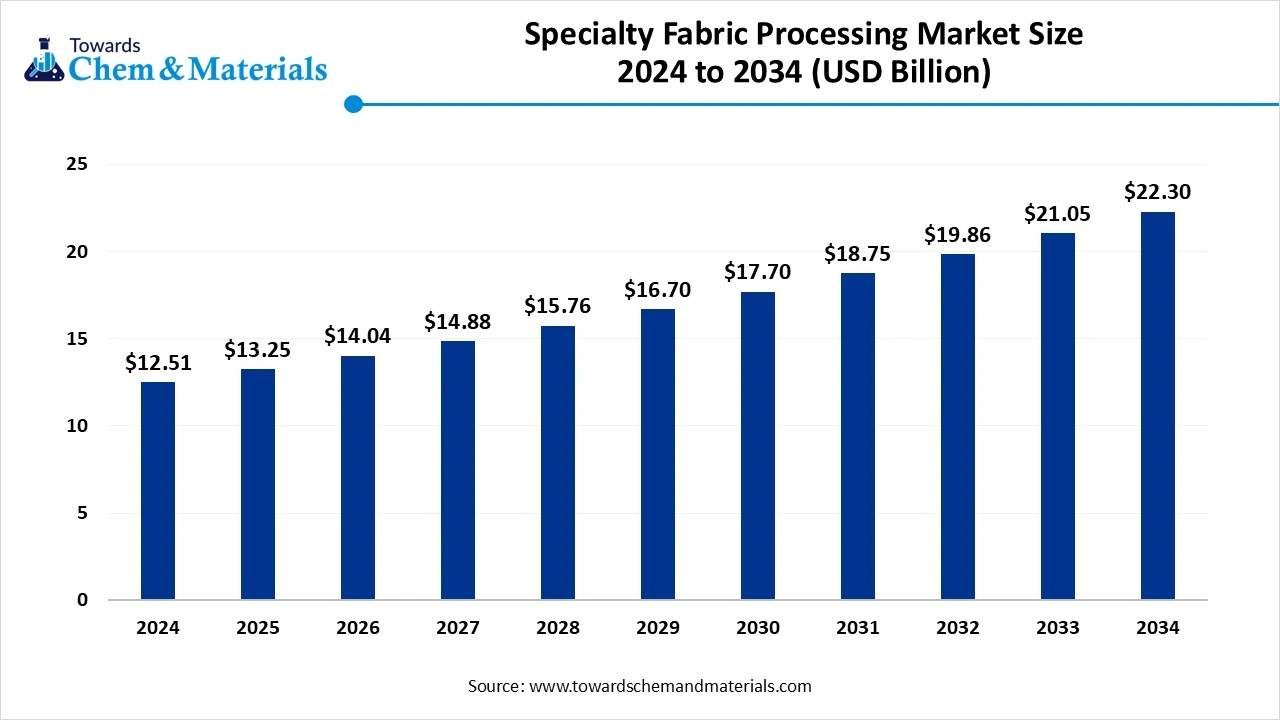

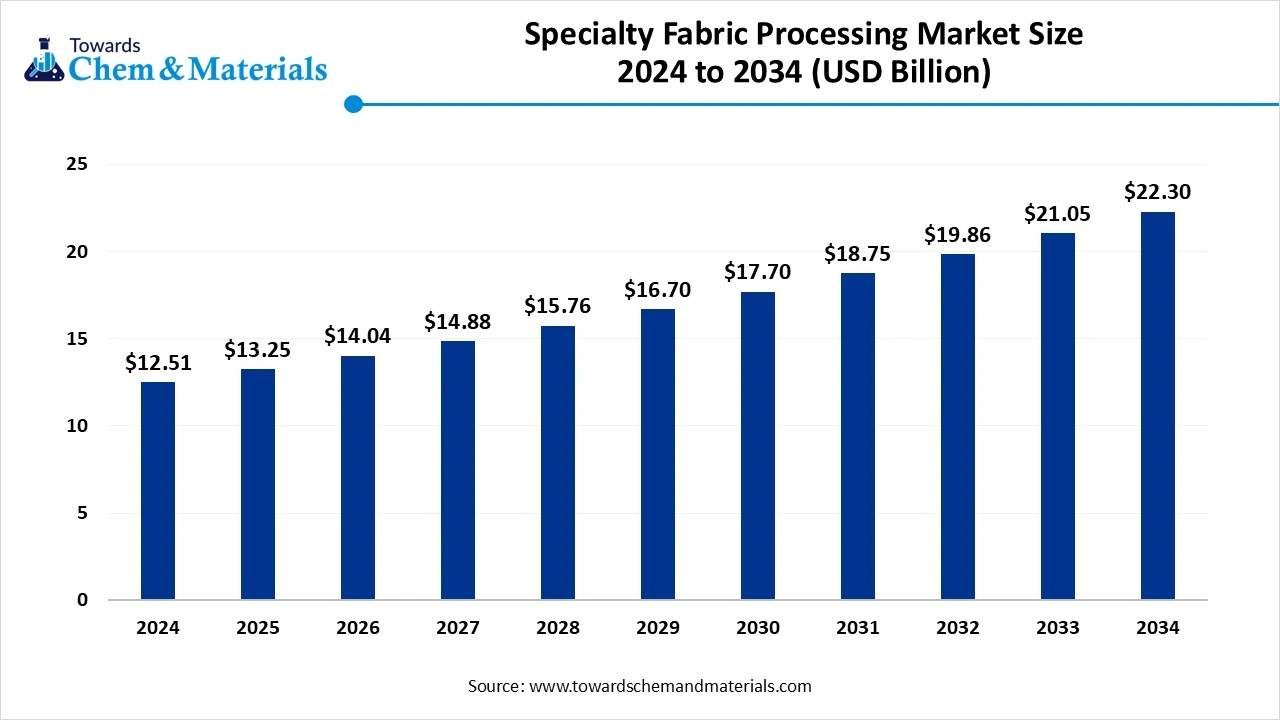

The global specialty fabric processing market size was reached at USD 12.51 billion in 2024 and is expected to be worth around USD 22.3 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.95% over the forecast period 2025 to 2034. The growing demand across sectors like automotive, construction, & healthcare, and increasing focus on sustainability drive the market growth.

Key Takeaways

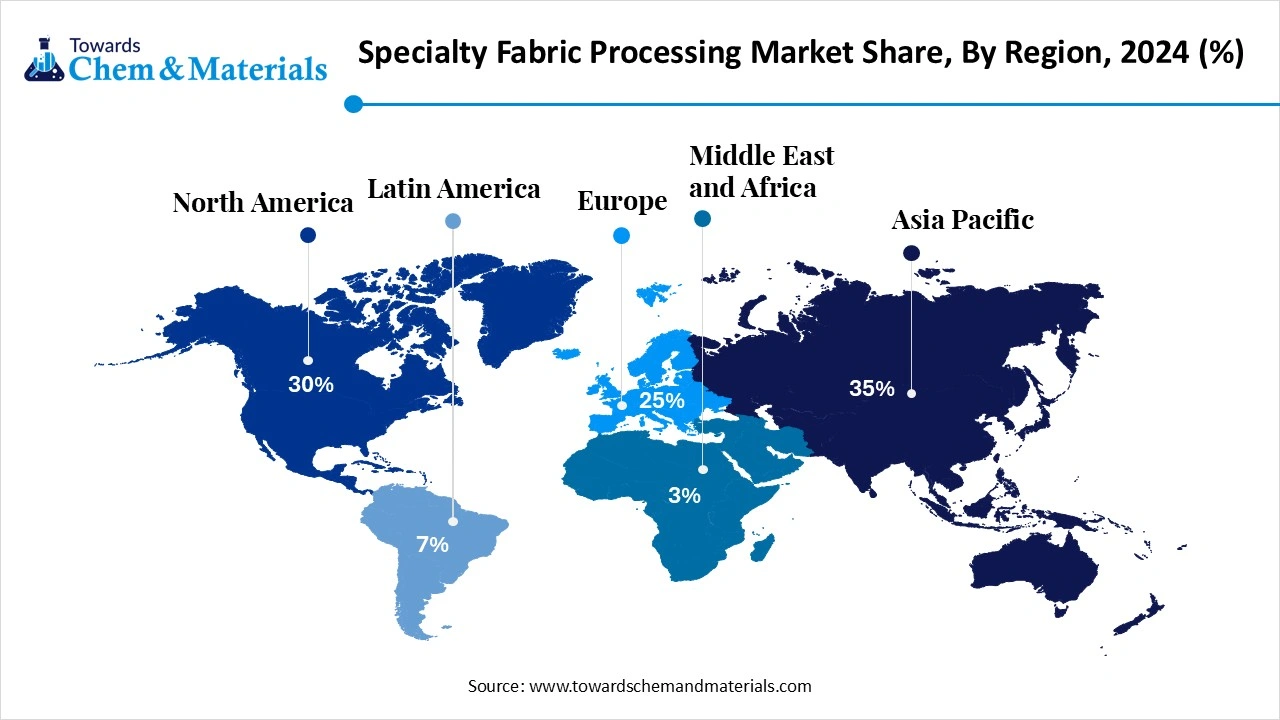

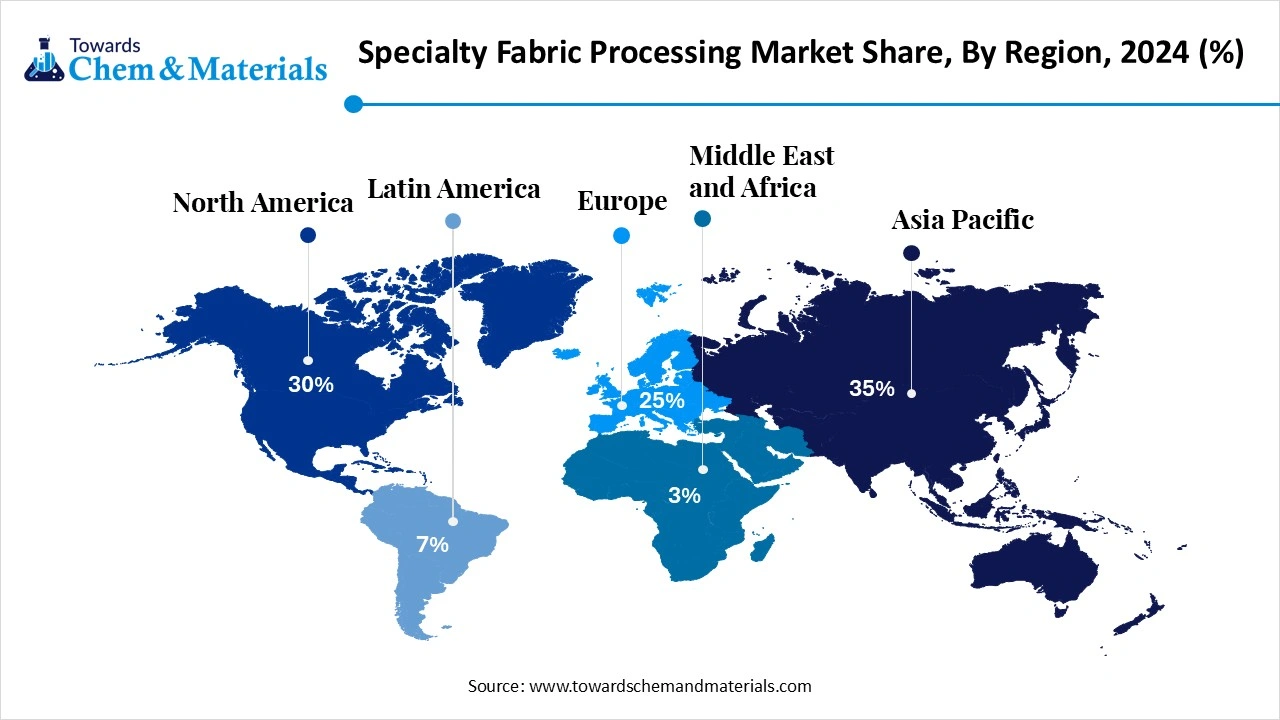

- By region, Asia Pacific held a largest 47% share in the specialty fabric processing market in 2024 due to the strong presence of abundant raw materials.

- By region, North America is growing at the fastest CAGR in the market during the forecast period due to the growing home textile industry.

- By processing type, the coating segment held a dominating share of 37% in the market in 2024 due to the increasing demand for apparel.

- By processing type, the plasma & bio-based finishing segment is expected to grow at the fastest CAGR in the market during the forecast period due to the strong focus on sustainability.

- By fabric type, the woven specialty fabrics segment dominated with holding 44% share in the market in 2024 due to its adaptability with a wide range of materials.

- By fabric type, the composite & multi-layered fabrics segment is expected to grow at the fastest CAGR in the market during the forecast period due to the growing production of automotive parts.

- By functional property, the flame retardant & water repellent segment held the largest share of 40% in the market in 2024 due to the stringent fire safety regulations.

- By functional property, the antimicrobial & UV-resistant segment is expected to grow at the fastest CAGR in the market during the forecast period due to the increasing focus on infection prevention.

- By end user industry, the protective clothing & industrial PPE segment dominated with holding 39% share in the specialty fabric processing market in 2024 due to the growing industrial activities.

- By end user industry, the healthcare & sportswear segment is expected to grow at the fastest CAGR in the market during the forecast period due to the growing sports activities.

- By distribution channel, the direct supply to the OEMs segment held largest share of 61% in the market in 2024 due to the increasing demand for unique products.

- By distribution channel, the online industrial platforms segment is expected to grow at the fastest CAGR in the market during the forecast period due to the growing focus on customization.

Specialty Fabric Processing: Art Behind Fabric and Textile Finishing

Specialty fabric processing is a technique of fabric finishing to enhance fabric qualities like functionality and appearance. The process aims to improve specialized functionality, performance, and aesthetics. The technique includes various chemical and physical treatments like UV protection, flame retardancy, anti-microbial finishing, water repellency, and many others. The technique improves characteristics of fabrics like softness, wrinkle resistance, color fastness, durability, and stain resistance. Specialty fabrics are widely used in applications like medical textiles, industrial applications, sportswear, outdoor apparel, and many more.

The growing demand for geotextiles in construction activities like reinforcement, drainage, and erosion control increases demand for specialty fabrics. The increasing development of automotive parts like interior components, seats, and carpets increases demand for specialty fabrics. Factors like growing demand for high-performance fabrics, increasing development of smart textiles, and growing industrialization contribute to the growth of the specialty fabric processing market.

- Turkey exported $156M of woven fabrics in 2023.(Source: oec.world)

- Turkey exported $1.96B of knitted fabrics in 2023.(Source: oec.world)

- Vietnam exported 39,904 shipments of textile fabric.(Source: www.volza.com)

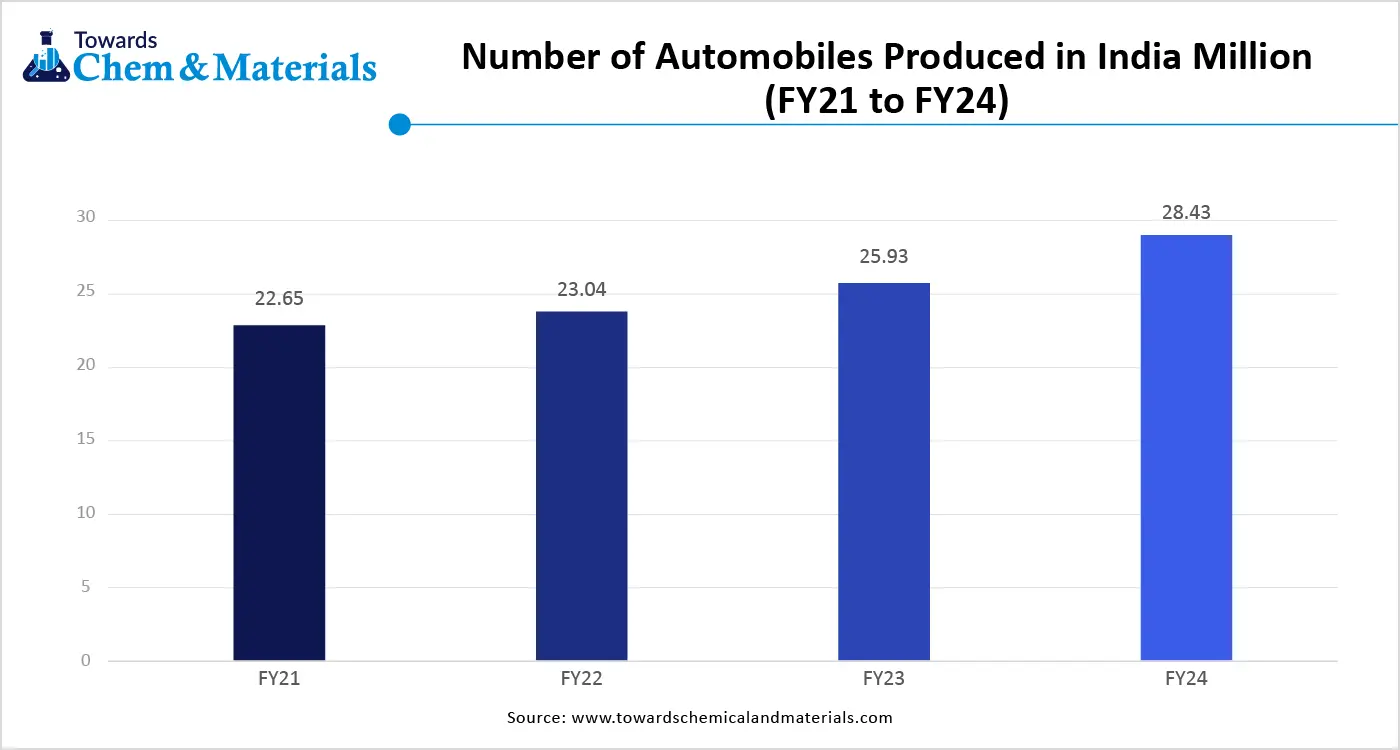

The Growing Automotive Industry Propels Market Growth

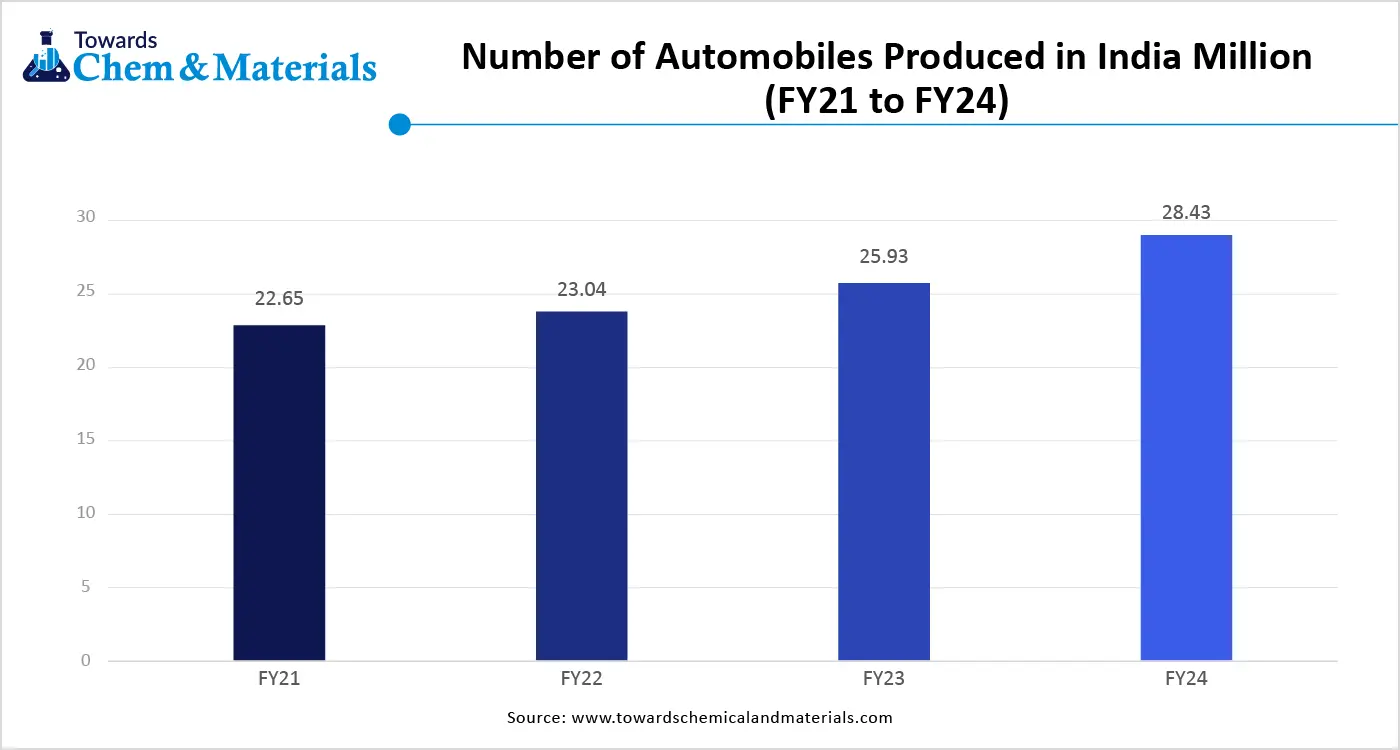

The growing automotive industry in various regions increases demand for specialty fabric processing in various applications. The increasing consumer demand for aesthetics, comfort, and durability increases the adoption of specialty fabrics. The strong focus on minimizing emissions and enhancing fuel efficiency in electric & traditional vehicles increases demand for specialty fabrics.

The rise in electric vehicles increases demand for thermal management and battery placements that require specialty automotive fabrics.

The increasing demand for sustainable & comfortable seating fabrics in luxury to mid-range vehicles increases demand for specialty fabric processing. The growing production of various vehicles, like electric vehicles, passenger cars, and commercial vehicles, increases demand for various types of specialty fabrics. The need for advanced safety features like seatbelts & airbags in vehicles increases demand for specialty fabric processing. The growing automotive industry is a key driver for the specialty fabric processing market.

Market Trends

- Growing Demand for Sportswear: The growing demand for various sportswear, like athletic shoes, activewear, and others, increases demand for specialty fabrics for enhancing stretching, wicking moisture away, enhancing breathability, and drying quickly.

- Development of Smart Textiles: The growing development of smart textiles, like the integration of sensors and electronics, enhances features like data collection & temperature control. The smart textiles development enhances applications in various sectors.

- Growing Healthcare Sector: The growing healthcare sector increases demand for specialty fabrics for manufacturing medical textiles like surgical dressing & wound dressing.

Report Scope

| Report Attribute | Details |

| Market Size in 2025 | USD 13.25 Billion |

| Expected Size by 2034 | USD 22.3 Billion |

| Growth Rate from 2025 to 2034 | CAGR 5.95% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Processing Type, By Fabric Type, By Functional Property, By End-Use Industry, By Distribution Channel, By Region |

| Key Companies Profiled | Milliken & Company, Trelleborg AB, Saint-Gobain Performance Plastics, TenCate Protective Fabrics, Low & Bonar PLC, Albany International Corp., Freudenberg Performance Materials, Arvind Ltd., Techtex Industrial Nonwovens, Sioen Industries NV, Heytex Bramsche GmbH, Erez Thermoplastic Products, Apex Mills, Schoeller Textil AG, Baltex Technical Textiles |

Market Opportunity

Growing Construction Activity Unlocks Opportunity for Market Growth

The rapid urbanization and increasing construction activities in developing nations increase demand for specialty fabric processing for various construction applications. The growing development of infrastructure projects like buildings, roads, and bridges increases demand for high-performance materials like specialty fabric. The increasing construction applications like roofing materials, tensile structures, geotextiles, and insulation increase the adoption of specialty fabrics. The increasing demand for wind and shade protection for construction increases the adoption of specialty fabrics.

The increasing need for protective clothing for construction workers increases demand for specialty fabrics. The increasing focus on creating weather-resistant structures in foundations, roofs, and walls increases demand for specialty fabrics. The focus on creating unique architectural designs fuels demand for specialty fabrics. The growing construction activity creates an opportunity for the specialty fabric processing market.

Market Challenge

High Production Cost Limits Expansion of Specialty Fabric Processing Market

Despite several benefits of the specialty fabric processing in various sectors, the high production cost restricts the market growth. Factors like specific finishing needs, specialized machinery, and complex manufacturing processes are responsible for high production costs. The need for advanced machinery for complex knitting and weaving increases the costs.

The requirement of advanced finishing techniques like unique dyeing processes, water-repellency, and fire resistance increases the production costs. The expensive raw materials like specialized synthetic yarns, silk, and linen directly affect the market. The need for complex fiber blends requires high cost. The complex finishing and design require a high cost. The need for multiple processing steps, like finishing, dyeing, and printing, increases the production cost. The high production cost hampers the growth of the market.

Regional Insights

Asia Pacific Specialty Fabric Processing Market Trends

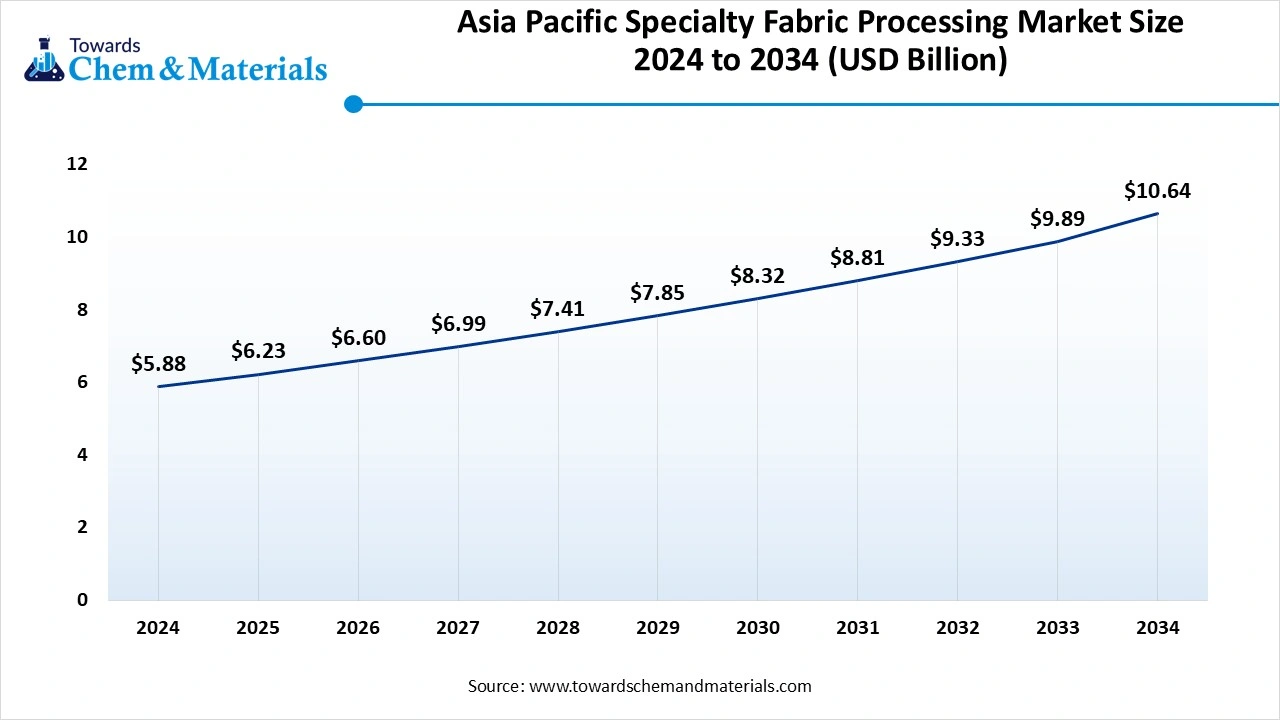

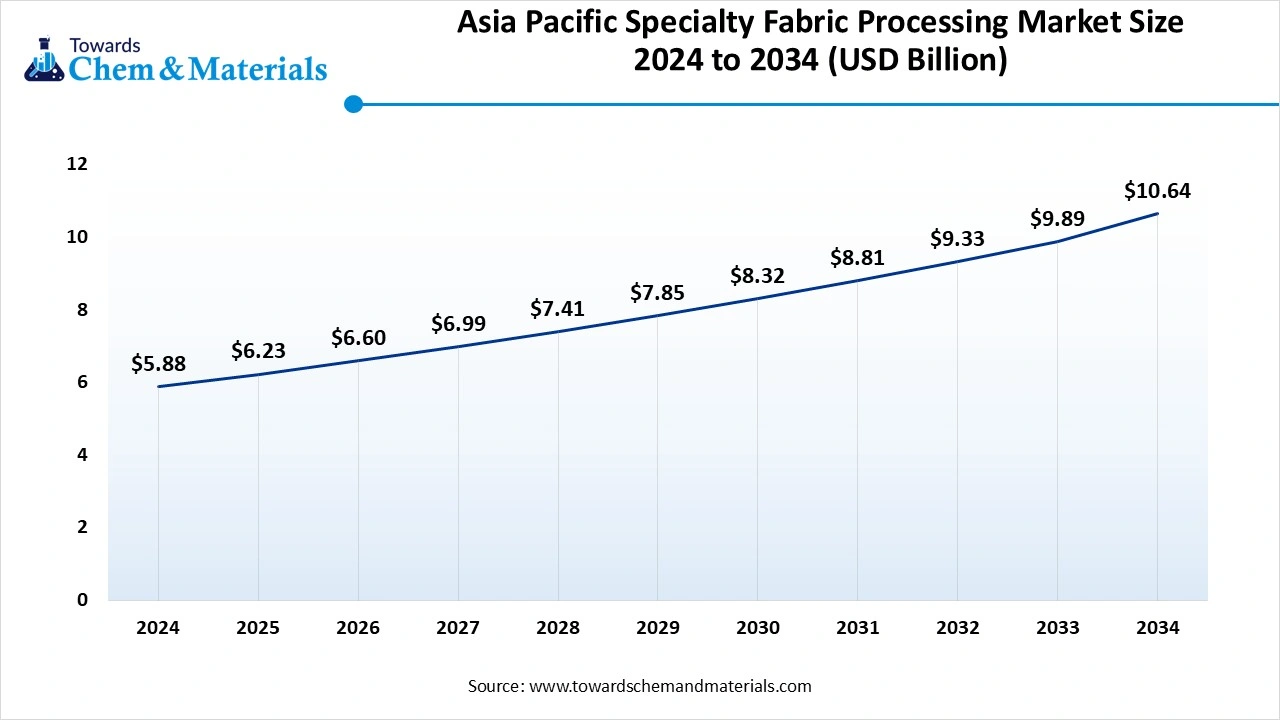

The Asia Pacific specialty fabric processing market size was estimated at USD 5.88 billion in 2024 and is anticipated to reach USD 10.64 billion by 2034, growing at a CAGR of 6.11% from 2025 to 2034.Asia Pacific dominated the market in 2024.

The well-established textile production in countries like India, Vietnam, China, and Bangladesh helps the market growth. The low labor cost for textile processing & production and the presence of abundant raw materials like cotton, silk, and other materials increase the specialty fabric processing. The increasing government investment in the textile sector and ongoing technological advancements like automation & digital printing increase the demand for specialty fabric processing. The growing demand across key sectors like agriculture, automotive, sports, and construction drives the market growth.

China Specialty Fabric Processing Market Trends

China is a major contributor to the specialty fabric processing market. The well-established textile industry and strong network of supply chains increase demand for specialty fabric processing. The strong government support for the textile industry through various policies and the increase in the production of textiles help the market growth. The strong focus on technological advancements, like advanced technologies, automation, & smart manufacturing, and high export of textiles supports the market growth.

- China exported $1.13B of woven fabrics in 2023. (Source: oec.world)

- China exported $18.5B of knitted fabrics in 2023.(Source: oec.world)

- China exported 127,956 shipments of textile fabric.(Source: www.volza.com)

North America Specialty Fabric Processing Market Trends

North America is experiencing the fastest growth in the market during the forecast period. The increasing demand for high-performance textiles in various sectors like protective clothing, automotive, and construction increases the adoption of specialty fabric processing. The growing medical applications increase demand for specialty fabric processing for personal care products and disposable protective care. The growth in home textiles and the growing athleisure & performance apparel sector increases demand for specialty fabric processing, supporting the overall growth of the market.

United States Specialty Fabric Processing Market Trends

The United States is a key contributor to the market. The increasing demand for high-tech fibers in industrial applications, medical textiles, and protective clothing increases the demand for specialty fabric processing. The focus on digitalization in manufacturing and design in the textile industry increases demand for specialty fabric processing. The strong preference for eco-conscious textiles & customizable textiles, and the growing expansion of e-commerce support the market growth.

- The United States exported $48.1M of woven fabrics in 2024.(Source: oec.world)

Segmental Insights

Processing Type Insights

Why did the Coating Segment Dominate the Specialty Fabric Processing Market?

The coating segment dominated the market in 2024. The increasing demand for transforming ordinary fabrics into specialized materials increases the adoption of coatings. The increasing demand for apparel like sportswear, jackets, and protective clothing increases the adoption of coatings. They enhance properties like breathability, abrasion resistance, waterproofing, and chemical resistance. The increasing demand for customization and increasing consumer demand for unique textiles increases the demand for coating. The increasing demand for coatings in industries like healthcare, automotive, and construction drives the market growth.

The plasma & bio-based finishing segment is the fastest-growing in the market during the forecast period. The focus on surface modifications of fabrics increases demand for plasma finishing to enhance properties like adhesion, antimicrobial activity, hydrophilicity, and anti-pilling. The increasing focus on sustainability and reducing environmental impact increases the adoption of bio-based finishing. The stricter environmental regulations and increasing consumer demand for functional textiles increase the adoption of plasma & bio-based finishing, supporting the overall growth of the market.

Fabric Type Insights

How Woven Specialty Fabrics Segment Held the Largest Share in the Specialty Fabric Processing Market?

The woven specialty fabrics segment held the largest revenue share in the market in 2024. The growing demand for advanced and traditional textiles in various industries increases the demand for woven specialty fabrics. The increasing demand across applications where tear & wear resistance is crucial increases demand for woven specialty fabrics. Woven fabrics can be developed with various yarn weave patterns, types, and densities. They are cost-effective and adaptable to various kinds of materials. The growing demand across industries like construction, aerospace, and defense drives market growth.

The composite & multi-layered fabrics segment is experiencing the fastest growth in the market during the forecast period. The increasing production of lightweight aircraft and vehicle components increases demand for composite & multi-layered fabrics. The increasing demand for wind turbine blades increases the adoption of composite & multi-layered fabrics. This kind of fabric provides better flexibility and strength. The focus on enhancing the performance of sports apparel & equipment and the growing development of various automotive parts like interior components, body panels, & others increases the adoption of composite & multi-layered fabrics, supporting the overall market growth.

Functional Property Insights

Why did Flame Retardant & Water Repellent Segment Dominate the Specialty Fabric Processing Market?

The flame retardant & water repellent segment dominated the market in 2024. The stricter fire safety regulations across various industries like residential, industrial, and commercial increase the adoption of flame retardant specialty fibers. The increasing demand for protective coatings in industries like oil & gas, construction, and manufacturing increases the adoption of flame retardant & water repellent specialty fibers. The growing applications like building upholstery, insulation, and curtains in construction increase demand for flame retardant specialty fibers. The growing demand across sectors like transportation and military drives the market growth.

The antimicrobial & UV-resistant segment is the fastest-growing in the specialty fabric processing market during the forecast period. The growing expansion of the healthcare sector and increasing focus on enhancing hygiene increase demand for antimicrobial specialty fabric. The growing demand for everyday clothing and sportswear increases the adoption of antimicrobial specialty fabrics. The increasing demand for automotive upholstery, outdoor apparel, and swimwear fuels demand for UV-resistant specialty fabrics. The focus on infection prevention and increasing demand for protecting skin from harmful UV rays increases adoption of antimicrobial & UV-resistant specialty fabrics, supporting the overall market growth.

End-Use Industry Insights

Which End-User Industry Held the Largest Share in the Specialty Fabric Processing Market?

The protective clothing & industrial PPE segment held the largest revenue share in the market in 2024. The stricter safety regulations in workplaces and specific safety standards increase the adoption of protective clothing & industrial PPE. The growing manufacturing activities increase the adoption of protective clothing & industrial PPE to prevent risks from chemicals, machinery, and others. The growing construction and oil & gas industry increases demand for protective clothing & industrial PPE. The growth in various industrial activities like oil & gas, manufacturing, and construction drives the market growth.

The healthcare & sportswear segment is experiencing the fastest growth in the market during the forecast period. The growing awareness about hygiene in healthcare facilities and the aging population increases demand for healthcare textiles. The focus on health monitoring with smart textiles and the increasing demand for advanced materials like controlled drug release, biocompatible implants, and wound dressing help the market growth. The strong focus on fitness and various sports activities increases the adoption of athletic wear & sportswear, supporting the overall market growth.

Distribution Channel Insights

How Direct Supply to OEMs Segment Dominated the Specialty Fabric Processing Market?

The direct supply to OEMs segment dominated the specialty fabric processing market in 2024. The increasing demand for unique products and specialized fabrics increases the adoption of direct supply to OEMs. The focus on fast fashion trends and growth in direct-to-consumer brands helps the market growth. The focus of brands is to prioritize core strengths, like outsourcing, design, and manufacturing increases adoption of direct supply to OEMs, driving the overall growth of the market.

The online industrial platforms segment is the fastest-growing in the market during the forecast period. The increasing accessibility of various designs and a range of fabrics before manufacturing increases demand for online industrial platforms. The growing customization trends in sectors like home décor, sportswear, and others increase the adoption of online industrial platforms. The growth in technical textiles & smart textiles and advancements in online industrial platforms support the market growth.

Recent Developments

- In November 2024, Hunza G launched sun-protective swimwear. The collection range includes a Rashguard top, a sleeveless swimsuit, and a Rashguard swimsuit. The collection is made up of UPF50+, breathable fabric, and blocks approximately 90% sunrays.(Source: hypebae.com)

- In August 2024, BASF collaborated with Syngenta, PCPB, and ICPPE and launched protective clothing for farmers in Kenya. The new clothing is certified by ISO and can be used by farmers while applying crop protection solutions. The protective clothing is affordable and promotes safe agricultural practices.(Source: www.fibre2fashion.com)

- In August 2024, Apex Mills launched new fabrics, OutStretch for super long-lasting stretch. The fabric quality is long-lasting and provides exceptional durability. The fabric is made up of elastomer yarns and offers properties like moisture wicking, recyclability, shape retention, & comfort. The collection includes various finishes, like anti-odor protection/antimicrobial, water repellency, fire resistance, and abrasion resistance. (Source: www.textileworld.com)

Specialty Fabric Processing Market Top Companies

- Milliken & Company

- Trelleborg AB

- Saint-Gobain Performance Plastics

- TenCate Protective Fabrics

- Low & Bonar PLC

- Albany International Corp.

- Freudenberg Performance Materials

- Arvind Ltd.

- Techtex Industrial Nonwovens

- Sioen Industries NV

- Heytex Bramsche GmbH

- Erez Thermoplastic Products

- Apex Mills

- Schoeller Textil AG

- Baltex Technical Textiles

Segments Covered

By Processing Type

- Coating (PU, PVC, Silicone, PTFE)

- Lamination

- Dyeing & Printing (Digital, Sublimation, Reactive)

- Heat-Setting & Calendaring

- Chemical Finishing (Anti-microbial, Flame Retardant, Water/Oil Repellent)

- Plasma & UV Finishing

- Bio-Based/Enzyme Finishing

By Fabric Type

- Woven Specialty Fabrics

- Non-Woven Specialty Fabrics

- Knitted Specialty Fabrics

- Composite/Multi-layered Technical Fabrics

By Functional Property

- Flame Retardant

- Water & Oil Repellent

- Anti-Microbial & Anti-Fungal

- UV Resistant

- Anti-Static

- Thermal & Acoustic Insulation

- Conductive/E-Textile Enabled

- Abrasion & Chemical Resistance

By End-Use Industry

- Protective Clothing (Military, Firefighting, Industrial PPE)

- Healthcare & Hygiene

- Automotive Interiors

- Sportswear & Outdoor Gear

- Industrial Filtration & Conveyor Belts

- Construction & Geotextiles

- Home Furnishing & Upholstery

- Aerospace & Defense

By Distribution Channel

- Direct Supply to OEMs

- Textile Distributors & Agents

- Online Industrial Platforms

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- South Africa

- UAE

- Saudi Arabia

- Kuwait