Content

What is the Lignin-based Biopolymers Market Size 2025 And Growth Rate?

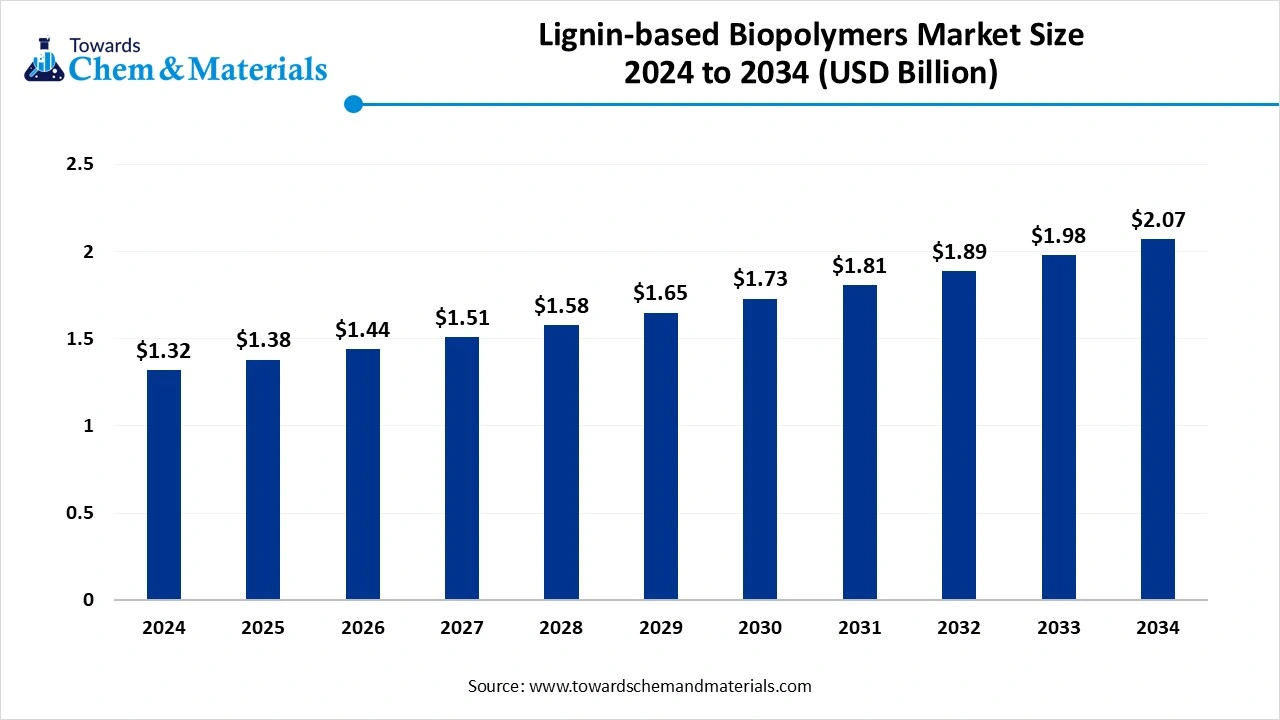

The global lignin-based biopolymers market size accounted for USD 1.32 billion in 2024 and is predicted to increase from USD 1.38 billion in 2025 to approximately USD 2.07 billion by 2034, expanding at a CAGR of 8.11% from 2025 to 2034. Increasing demand for sustainable packaging solutions is the key factor driving market growth. Also, the innovations in fractionation technologies coupled with the scalable and cost-effective availability of lignin from the paper and pulp industry can fuel market growth further.

Key Takeaways

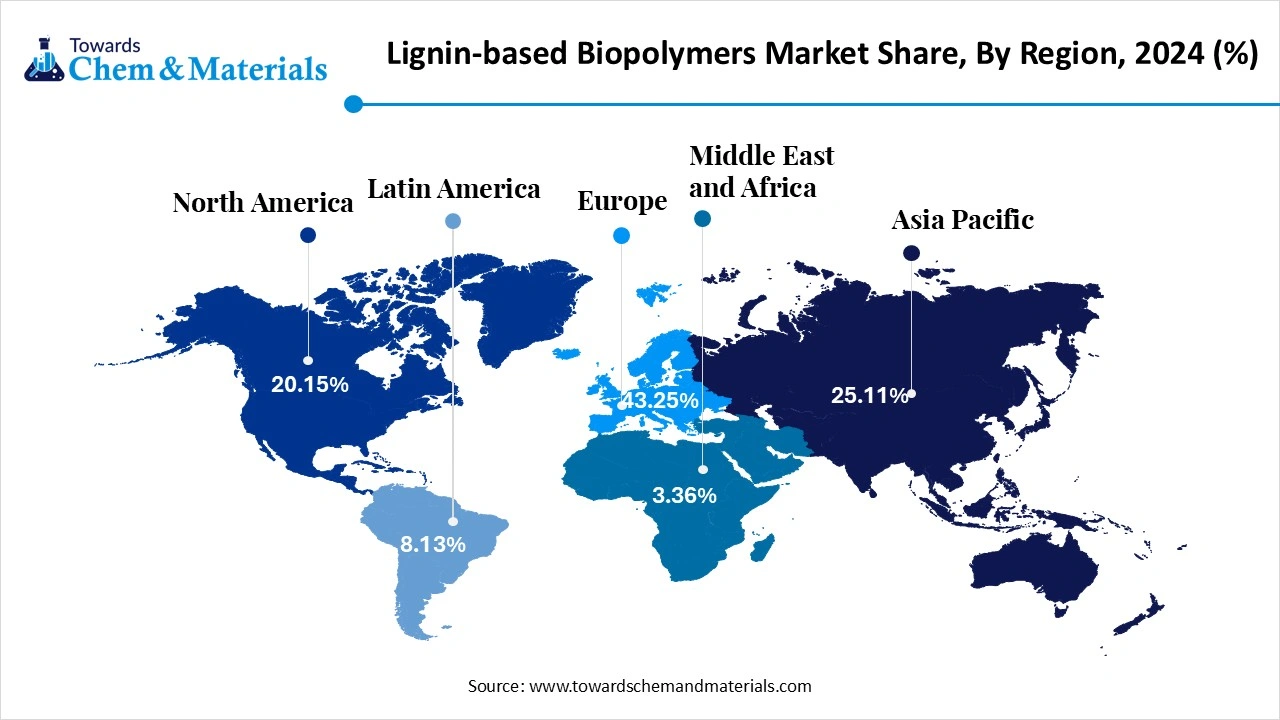

- Europe lignin-based biopolymers market dominated the global market and accounted for the largest revenue share of 43.25% in 2024.

- The Asia Pacific lignin-based biopolymers market is expected to expand at a rapid CAGR of 5.39% from 2025 to 2034

- Lignosulfonates dominated the lignin-based biopolymers market across the product type segmentation in terms of revenue, accounting for a revenue share of 83.10% in 2024.

- Kraft lignin is emerging as a strategic raw material for the production of high-value bio-based chemicals and engineered polymers and is anticipated to grow at the fastest CAGR of 5.87% over the forecast period.

- Automotive dominated the lignin-based biopolymers market across the end use segmentation in terms of revenue, accounting for a revenue share of 40.23% in 2024.

- The construction segment is projected to witness a substantial CAGR of 4.39% through the forecast period.

Growing Demand for Sustainable Packaging Solutions Expanding Market Growth

The market possesses biodegradable polymers extracted from lignin, a plant-originated byproduct, utilized as an eco-friendly option to petroleum-based plastics. Lignin is one of the most abundant polymers on Earth. Hence it is a readily renewable and available resource. Lignin has a complicated chemical structure with different functionalities that can be used and modified for numerous applications. The material's UV resistance, rigidity, and compatibility with thermoplastic and thermoset systems make it convenient for use in, coatings, adhesives, automotive parts, and composite panels. Global efforts to minimize carbon emissions to support sustainable practices are expected to propel market growth shortly.

What are the Key Trends Influencing the Lignin-based Biopolymers Market?

- The market is driven because of a shift in consumer preference for plastic products that are sustainable, which is also the latest market trend. Traditional plastics, which are generally made of oil, take a long time to degrade or separate and require a significant amount of time in landfills. However biodegradable polymers degrade more quickly than traditional plastics due to the actions of microbes.

- The demand for aligning is growing on a global scale because of the raised awareness regarding the extensive range of applications it offers. The increasing availability of raw materials and smooth manufacturing is strengthening the expansion of the market across the world.

- Lignin found its substantial use in concrete additives like dust suppressants, binders, and others. They are utilized as binders for building insulation and enhance the performance of asphalt binders. Lignin-based polymers are economical and safer than salt and petroleum-based products generally applied to road surfaces. This is the major factor leading to market growth.

How is the Government Supporting the Lignin-based Biopolymers Market?

Governments across the globe are promoting he market through various measures, such as funding for research and development, regulatory incentives and optimising the utilisation of regulatory incentives. Governments are providing grants, tax breaks and other financial incentives to impel companies to invest in lignin-based biopolymer manufacturing and research.

National and international initiatives such as the EU Green Deal and other bioeconomy strategies are propelling the adoption of lignin-based materials as a part of low-carbon economy models. Governments in various countries are banning single-use plastics, generating lucrative opportunities for bioplastics like lignin-based biopolymers, to fulfil the market demand for polymers.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 1.38 Billion |

| Market Size by 2034 | USD 2.07 Billion |

| Growth Rate from 2025 to 2034 | CAGR 8.11% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| High Impact Region | Asia Pacific |

| Segment Covered | By Product, By End Use, By Region |

| Key Companies Profiled | Borregaard, Stora Enso, UPM Biochemicals, MetGen, Ingevity, Lignolix, West Fraser |

Market Opportunity

Surge in Construction Projects

There is a significant expansion in construction projects across the globe is presenting lucrative opportunities in the lignin-based biopolymers market. Lignin-based polymers can be utilized in construction materials, providing sustainable options to conventional concrete and cement, potentially minimizing carbon emissions globally. Furthermore, lignin-based biopolymers are utilized as soil amendments, enhancing soil fertility and structure, while also providing an eco-friendly alternative to traditional materials.

- In October 2024, Earthodic raised $6m for bio-based coatings in seed funding to boost its development of recyclable coatings for paper packaging. Earthodic also has plans to expand its business into the U.S.(Source: packagingnews)

Market Challenge

Complex Structural Heterogeneity

The complicated heterogeneity of lignin is the major factor hindering market growth. This heterogeneity emerges from changes in lignin's molecular composition, which is impacted by the plant source softwood, hardwood, and grasses. Moreover, this complex structural heterogeneity of lignin can create challenges in processing and production. It can also make it challenging to control and predict the properties of the final product.

Regional Insight

Europe dominated the lignin-based biopolymers market in 2024. The dominance of the region can be attributed to the growing usage of biopolymers and bioplastics in industries such as consumer products, packaging, and transportation. Consumers' shift towards biodegradable and bio-based items has been increasing because of growing environmental concerns along with the implementation of stringent regulations. In addition, funding through national bioeconomy strategies is strengthening lignin R&D in the region.

- In September 2024, Engineering firm Royal HaskoningDHV announced to deployment of the UK's first-ever Kaumera pilot plant to derive biopolymers from sewage sludge, in Blackburn. If successful, this project can change the economics of wastewater treatment.(Source: envirotecmagazine)

Lignin-based Biopolymers Market in Germany

In Europe, Germany led the market owing to the country's advanced paper and pulp industry that offers a stable lignin supply. Also, ongoing collaborations between companies and universities are fuelling innovation in lignin-based materials. German manufacturers are adopting eco-friendly development practices, impacting positive market growth in the country further.

Asia Pacific is expected to grow at the fastest CAGR over the forecast period. The growth of the region can be credited to the rapidly increasing population coupled with the increasing consumer demand for sustainable plastic goods. Additionally, the growth of various end-use industries in emerging economies such as China and India has been boosted by increasing consumer purchasing power.

Lignin-based Biopolymers Market in China

In Asia Pacific, China dominated the market due to the growing demand for sustainable packaging solutions, especially in the e-commerce sector. Major market players in the region are actively engaging in acquisitions, mergers, and collaborations to grow their lignin processing capabilities. The Chinese government is imposing stricter environmental regulations to promote sustainable practices, further fuelling the market growth.

Who are the Top Polyethylene Exporters in the World in 2023?

| Country | Exports in Billion USD |

| USA | USD 4.90 billion |

| Saudi Arabia | USD 3.95 billion |

| United Arab Emirates | USD 2.36 billion |

| South Korea | USD 1.95 billion |

| Belgium | USD 1.65 billion |

(Source: tradeimex)

Segmental Insights

Product Type Insights

Which Product Type Segment Dominate the Lignin-Based Biopolymers Market in 2024?

Lignosulfonates segment dominated the market in 2024. The dominance of the segment can be attributed to the growing demand for eco-friendly fossil-based plastics along with the demand for low-carbon materials. Lignosulfonates are especially used in sectors requiring dispersing agents, binders, and crystal growth modifiers. Moreover, their compatibility with sustainability goals has positioned them as convenient additives in low-carbon building materials.

Kraft's lignin segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the growing need for renewable and sustainable materials. Also, it is a byproduct of the pulping industry and, a cost-effective and readily available source of lignin for different applications. Kraft lignin can be utilized in an extensive range of applications such as coatings, foams, and elastomers.

- In June 2025, Södra starts the construction of its latest kraft lignin plant. The facility is a crucial step in Södra's strategy to make more from its business by incorporating new bio-based products. This plant will further boost the green transition and will propel the growth of the market.(Source: pulpapernews)

End-Use Insights

Why Automotive Segment Dominated the Lignin-Based Biopolymers Market in 2024?

The automotive segment dominated the market in 2024. The dominance of the segment can be linked to the increasing demand for lightweight materials to minimize vehicle emissions and weight. Lignin's capability to improve mechanical performance while minimizing reliance on petroleum-based resins is increasingly being explored through partnerships between bio-material innovators and automotive manufacturers.

The construction segment is expected to grow at a significant CAGR over the projected period. The growth of the segment can be driven by the growing adoption of insulation foams, lignin-based adhesives, and concrete plasticizers due to their cost-effectiveness and lower environmental impact. Furthermore, lignin-based biopolymers can be utilized to improve and modify the performance of concrete, cement, and other building materials, enhancing their overall durability, strength, and other properties.

Recent Developments

- In June 2024, Swedish greentech company Lignin Industries AB introduced bio-based plastic obtained from forest residues. This bio-based material is developed from lignin, which is found in trees. The company has developed Renol, a bio-based material.(Source: packagingeurope)

- In October 2024, Praj Industries Limited launched the country's first demonstration facility for biopolymers at Jejury near Pune, India, which marks a substantial step in domestic bioplastic production. The new facility spans up to 3 acres and has a manufacturing capacity of 100 tonnes per annum.(Source: thehindubusinessline)

Top Companies List

- Borregaard

- Stora Enso

- UPM Biochemicals

- MetGen

- Ingevity

- Lignolix

- West Fraser

Segments Covered

By Product Type

- Lignosulfonates

- Kraft Lignin

- Organosolv Lignin

- Hydrolyzed Lignin

- Others Product

By End-Use

- Construction

- Agriculture

- Packaging

- Automotive

- Other Applications

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait