Content

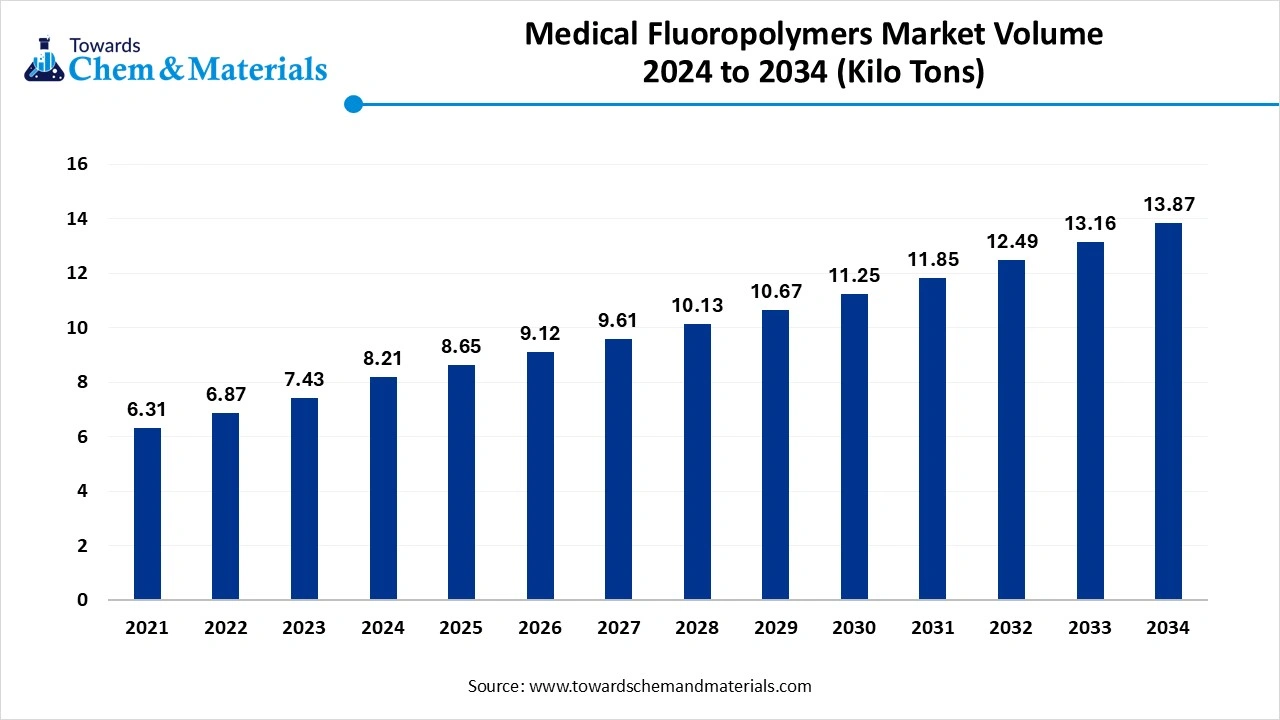

Medical Fluoropolymers Market Volume to Hit 13.87 Kilotons by 2034.

The global medical fluoropolymers market volume was reached at 8.21 kilo tons in 2024 and is expected to be worth around 13.87 kilo tons by 2034, growing at a compound annual growth rate (CAGR) of 5.39% over the forecast period 2025 to 2034. The enlarged expansion of the global healthcare infrastructure has accelerated industry potential in the current period.

Key Takeaways

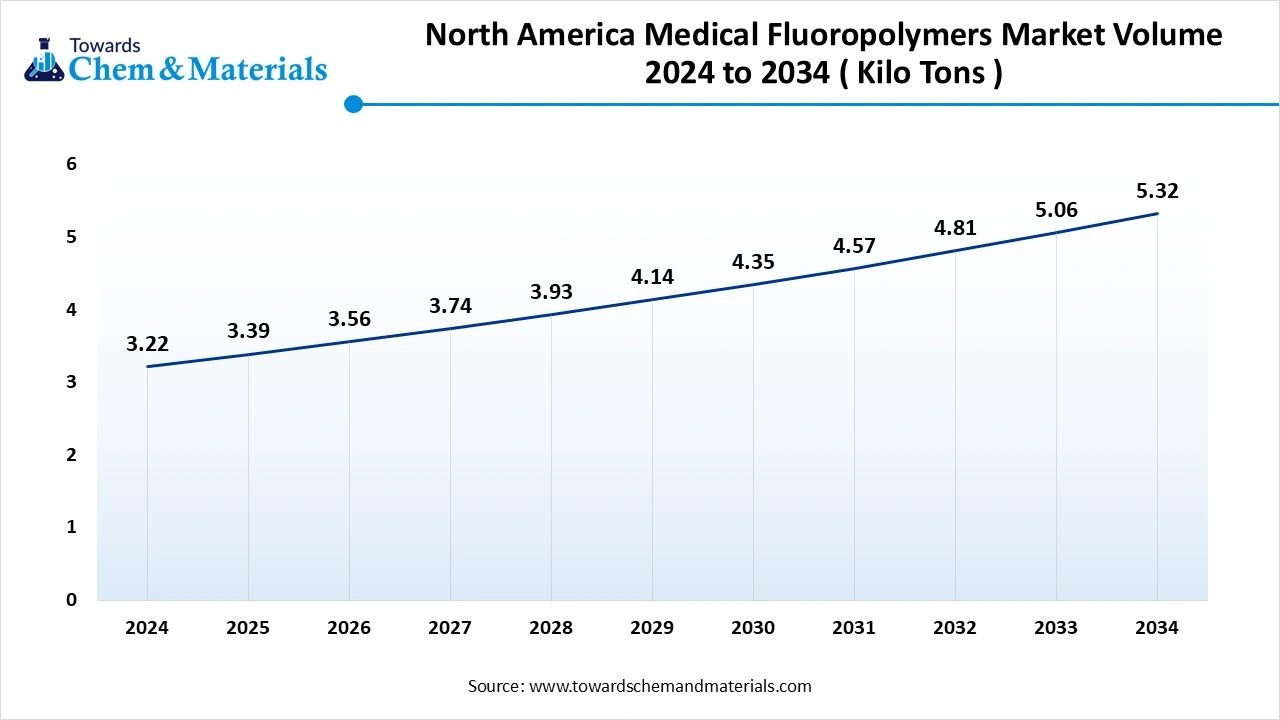

- The North America medical fluoropolymers market Volume is estimated at 3.39 Kilo Tons in 2025 and is expected to reach 5.32 Kilo Tons by 2034, growing at a CAGR of 5.14% from 2025 to 2034.

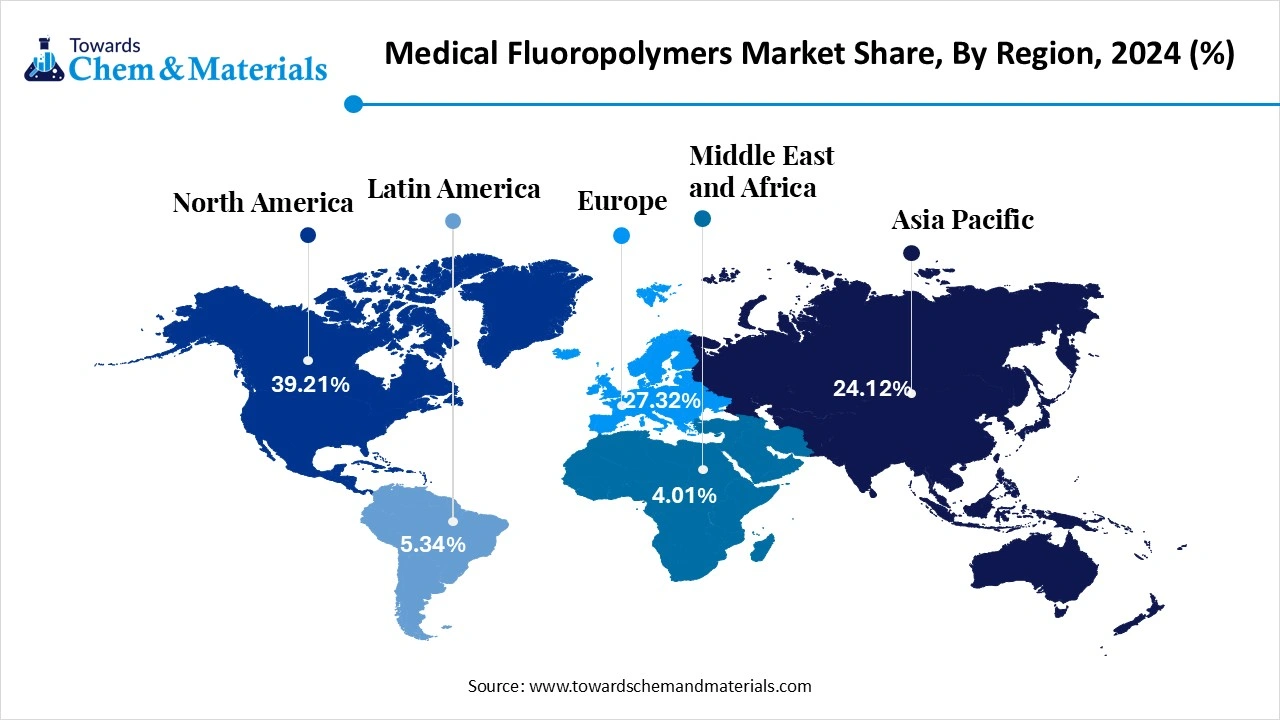

- The North America medical fluoropolymers market held the largest volume share of 39.21% of the global market in 2024.

- The Asia Pacific medical fluoropolymers market is expected to register the fastest CAGR of 9.04% over the forecast period by 2025-2034.

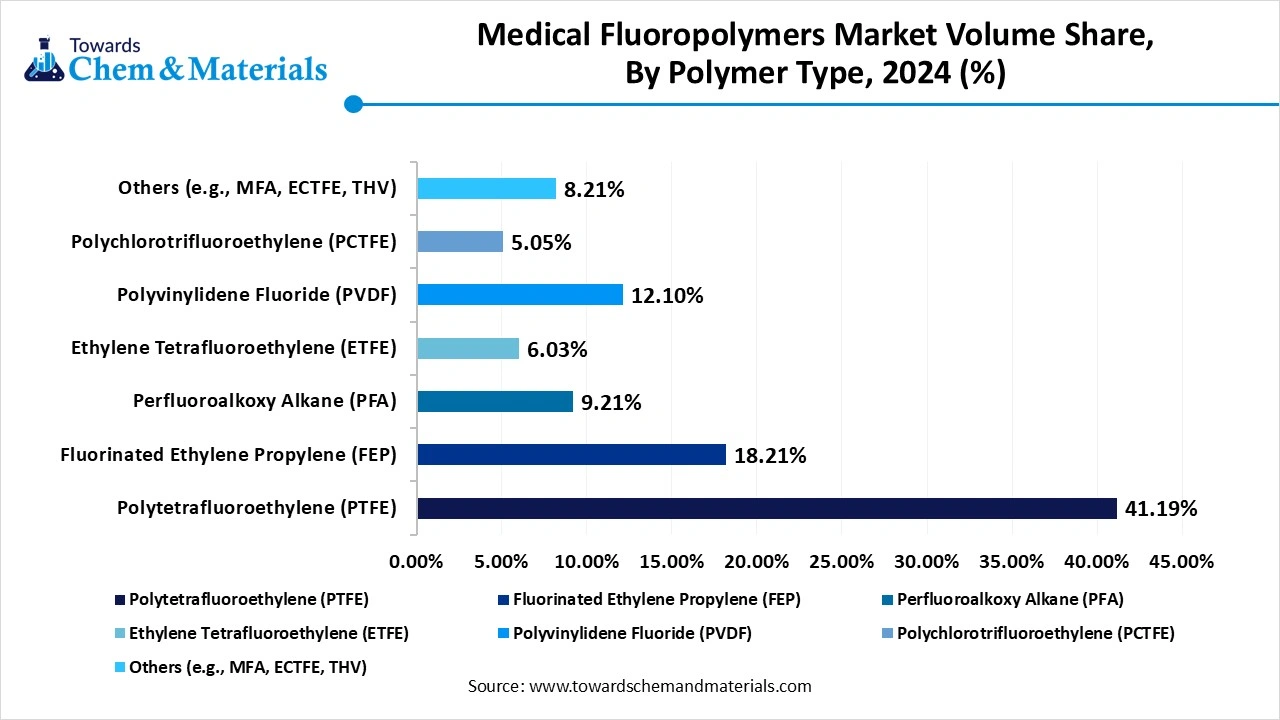

- By Polymer Type, the polytetrafluoroethylene (PTFE) segment dominated the market with the largest volume share of 39.91% in 2024.

- By Polymer Type, the ethylene tetrafluoroethylene (ETFE) segment is projected to grow at the fastest CAGR of 10.02% over the forecast period by 2025-2034.

- By application, the catheters and guide wires segment emerged as the top-performing segment in 2024, due to their increased usage in diagnostic and surgical procedures.

- By application, the implantable devices segment is expected to lead the market in the coming years, due to a sudden increased need for internal solutions for chronic conditions in recent years.

- By form, the tubes and pipes segment led the market in 2024, because it is considered an essential component in a wide range of medical devices.

- By form, the film segment is expected to capture the biggest portion of the market in the coming years, due to its growing use in implant coatings, wound dressings, diagnostic membranes, and drug delivery systems.

- By processing technology, the extrusion segment led the market in 2024, as it is the most common and cost-effective way to manufacture long, uniform tubing and wires using fluoropolymers

- By processing technology, the injection moulding segment is expected to grow at the fastest rate in the market during the forecast period, ue to their ability to produce complex, detailed components like connectors, valves, and implant parts with minimal waste.

- By end user, the medical device manufacturers segment led the medical fluoropolymers market in 2024 because they are the primary users of fluoropolymers in making catheters, surgical tools, implants, and tubing.

- By end user, the pharmaceutical companies segment is expected to capture the biggest portion of the market in the coming years as they increase their use of fluoropolymers in drug delivery systems, storage containers, and packaging.

Market Overview

Medical Fluoropolymers: Enabling Innovation in Devices and Drug Delivery

The medical fluoropolymers market refers to the industry focused on the production and application of fluorinated polymers used in medical devices, pharmaceutical packaging, drug delivery systems, and related healthcare applications. These polymers are valued for their biocompatibility, chemical resistance, thermal stability, and low-friction properties.

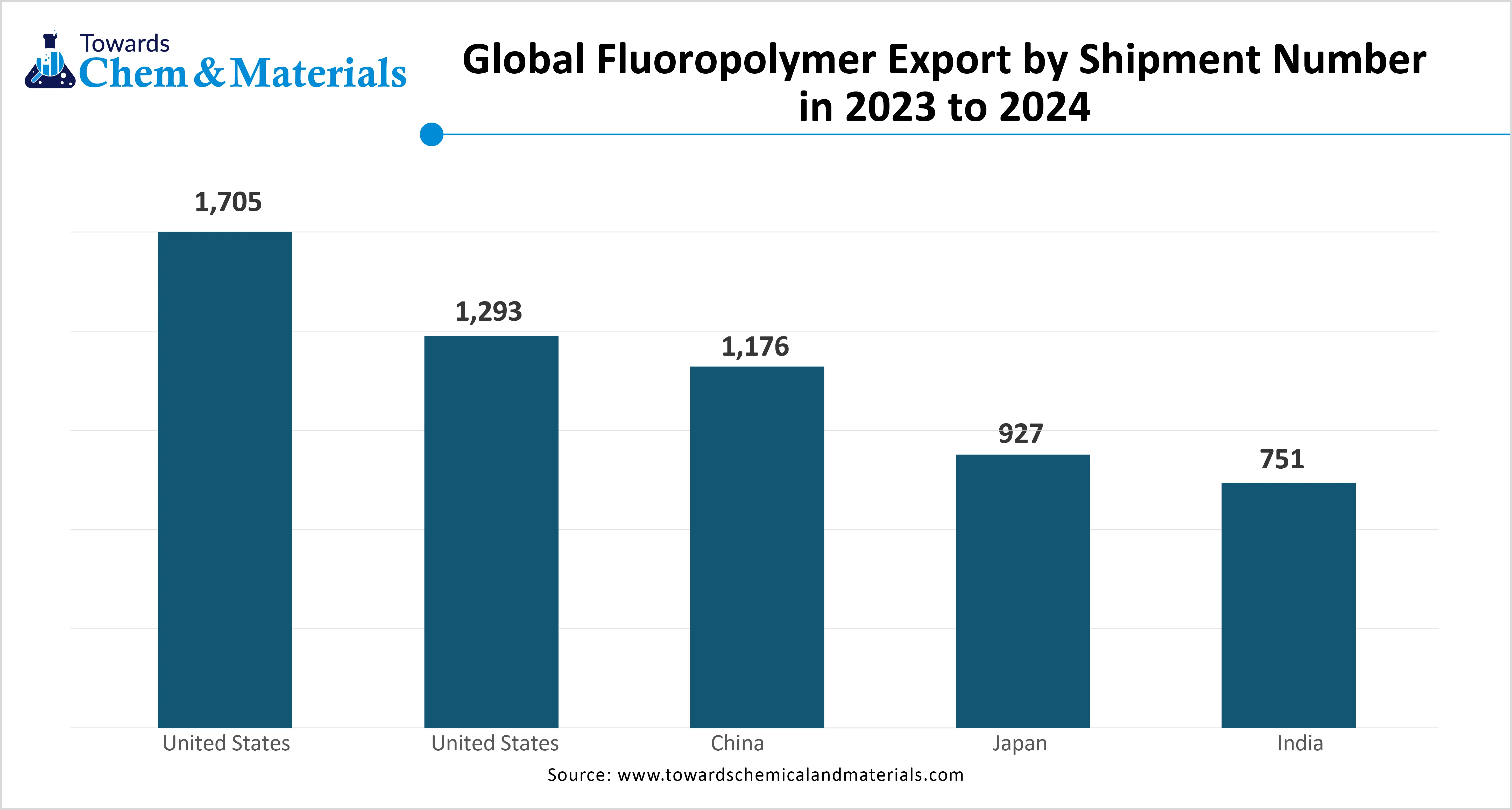

The United States maintained its dominance in fluoropolymer exports. Additionally, United Kingdom ranks second in these exports. Other countries also have higher shipment numbers during these years, according to the infographic.

Which Factor Is Driving the Medical Fluoropolymers Market?

The increased need for high-performance and biocompatible materials in the production of medical devices is spearheading the industry growth in the current period. Having non-reactivity properties and body fluid resistance, the medical fluoropolymers have been increasingly used by medical device manufacturers in recent years. Moreover, the shift towards minimal invasive surgeries is providing the sophisticated consumer base to the industry as the medical fluoropolymers materials are seen to reduce the risk of infection, as per the recent survey.

- The sudden increased demand for wearable medical devices has driven industry growth in recent years. In the production of these devices, lightweight and biocompatible materials have been used in recent years

- The sudden shift towards disposable medical devices has contributed to the industry's growth in the past few years. Several professionals have been using these medical fluoropolymers in integrated single-use devices in recent years.

Report Scope

| Report Attribute | Details |

| Market Volume in 2025 | 8.65 Kilo Tons |

| Expected Volume by 2034 | 13.87 Kilo Tons |

| Growth Rate from 2025 to 2034 | CAGR 5.39% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | North America |

| Segment Covered | By Polymer Type, By Application, By Form, By Processing Technology, By End-User, By Region |

| Key Companies Profiled | Daikin Industries, Ltd., 3M (Dyneon), Chemours Company, Solvay S.A., Arkema Group , Honeywell International Inc., AGC Inc. (Asahi Glass) , Saint-Gobain Performance Plastics , Dongyue Group , Kureha Corporation , Zeus Industrial Products , Fluorocarbon Company Ltd , Mitsui Chemicals, Inc., Quadrant Engineering Plastics , Greene Tweed , Heraeus Holding , SABIC (Specialty Materials) , W.L. Gore & Associates , Polyflon Technology Ltd , Mersen Group |

Market Opportunity

Healthcare Infrastructure Investment Fuels Demand in Developing Economies

The manufacturing plant establishment in the developing region is expected to create lucrative opportunities for manufacturers in the coming years. Moreover, the manufacturers can sell their products in the developing region as these regions are seen as being under heavy investment in healthcare infrastructure nowadays. Also, by offering affordable solutions, manufacturers can gain substantial industry share in these regions as per the future industry expectations.

Market Challenge

Expensive Production Processes Create Barriers for New and Mid-Sized Players

The high cost of the raw fluoropolymer is projected to hinder industry growth during the forecast period, as the production of the high-purity grade for medical use can be expensive sometimes, which can create growth barriers for new entrants and mid-sized businesses in the upcoming years.

Segmental Insights

Polymer Type Insights

How did the PTFE Segment Dominate the Medical Fluoropolymers Market in 2024?

The PTFE segment held the largest share of the market in 2024, due to its unique properties such as biocompatibility, non-stickiness, and chemical resistance. Not reacting with the body tissues or fluids, the PTFE has gained immense industry attention in recent years. Moreover, their easy sterilization and stability make them ideal for critical medical applications, which has also provided a wide consumer base to the segment in the past few years.

The ETFE segment is expected to grow at a notable rate during the predicted timeframe. Health professionals have actively seen ETFE in advanced medical applications owing to its flexibility, excellent strength, and clarity over the previous years. As the need for supportive material for thinner wall construction, which is a priority for minimally invasive tools, the ETFE can gain a major industry share during the projected period, as per the latest observation.

Global Medical Fluoropolymers Market Volume Share, By Polymer Type, 2024-2034 (%)

| By Polymer Type | Market Volume Share, 2024 (%) | Market Volume Kilo Tons - 2024 | Market Volume Share, 2034(%) | Market Volume Kilo Tons- 2034 | CAGR(2024- 2034 %) |

| Polytetrafluoroethylene (PTFE) | 41.19% | 3.38 | 35.32% | 4.90 | 4.20% |

| Fluorinated Ethylene Propylene (FEP) | 18.21% | 1.50 | 19.21% | 2.66 | 6.63% |

| Perfluoroalkoxy Alkane (PFA) | 9.21% | 0.76 | 11.23% | 1.56 | 8.36% |

| Ethylene Tetrafluoroethylene (ETFE) | 6.03% | 0.50 | 8.43% | 1.17 | 10.02% |

| Polyvinylidene Fluoride (PVDF) | 12.10% | 0.99 | 13.21% | 1.83 | 7.04% |

| Polychlorotrifluoroethylene (PCTFE) | 5.05% | 0.41 | 5.04% | 0.70 | 5.98% |

| Others (e.g., MFA, ECTFE, THV) | 8.21% | 0.67 | 7.56% | 1.05 | 5.03% |

| Total | 100% | 8.21 | 100% | 13.87 | 5.38% |

Application Insights

Why does the Catheters and Guide Wires Segment Dominate the Medical Fluoropolymers Market by Application?

The catheters and guide wires segment held the largest share of the medical fluoropolymers market in 2024, due to their increased usage in diagnostic and surgical procedures. By providing chemical resistance, biocompatibility, and flexibility to the catheters and guide wires, the fluoropolymers have been increasingly used in the production of these catheters and guide wires in recent years.

The implantable devices segment is expected to grow at a notable rate due to a sudden increased need for internal solutions for chronic conditions in recent years. Manufacturers of orthopedic materials, pacemaker industries, and vascular grafts are increasingly shifting towards fluoropolymers, akin to their durability and chemical stability in recent years.

Form Insights

Why Did the Tubes and Pipes Segment Dominate the Medical Fluoropolymers Market in 2024?

The tubes and pipes segment dominated the market with the largest share in 2024, because it is considered an essential component in a wide range of medical devices. Moreover, by offering a smooth internal surface with corrosion resistance, the fluoropolymer-based tubes have gained immense market share in recent years. Furthermore, these fluoropolymer tubes are actively seen being used in the catheter infusing systems in recent years.

The film segments are expected to grow at a notable rate due to their growing use in implant coatings, wound dressings, diagnostic membranes, and drug delivery systems. Fluoropolymer films are thin, flexible, and biocompatible, offering a new way to develop lightweight and high-performance medical products. With the rise in wearable and patch-based medical technologies, the demand for fluoropolymer films is increasing. These films can be engineered to allow breathability, selective permeability, or drug diffusion, depending on the medical need.

Processing Technology Insights

Why Did the Extrusion Segment Dominate the Medical Fluoropolymers Market in 2024?

The extrusion segment held the largest share of the medical fluoropolymers market in 2024, as it is the most common and cost-effective way to manufacture long, uniform tubing and wires using fluoropolymers. This method ensures consistent quality and allows manufacturers to produce high volumes of medical tubes, catheters, and sheaths with precise thickness and flexibility. Extrusion is widely adopted due to its scalability, speed, and compatibility with PTFE and FEP. Medical device manufacturers favor this method for its ability to meet tight tolerance requirements and FDA standards.

The injection molding segments are expected to grow at a notable rate due to their ability to produce complex, detailed components like connectors, valves, and implant parts with minimal waste. As medical devices become more compact and customized, injection molding offers flexibility in shape, size, and material blends. This method is ideal for fluoropolymers like ETFE and PFA that need precise molding for intricate designs.

End User Insights

Why Did the Medical Device Manufacturers Segment Dominate the Medical Fluoropolymers Market in 2024?

The medical device manufacturers segment held the largest share of the medical fluoropolymers market in 2024, because they are the primary users of fluoropolymers in making catheters, surgical tools, implants, and tubing. These companies prioritize high-performance materials that meet strict medical safety standards, and fluoropolymers are ideal due to their stability, non-reactivity, and longevity. Manufacturers rely on these materials to create FDA-approved, high-precision devices used globally.

The pharmaceutical companies’ segments are expected to grow at a rapid rate as they increase their use of fluoropolymers in drug delivery systems, storage containers, and packaging. These materials offer chemical resistance, non-stick properties, and sterility, which are critical for preserving drug quality. As drug formulations become more complex and sensitive pharmaceutical firms seek high-quality containers and delivery devices made from fluoropolymers.

Regional Insights

The North America medical fluoropolymers market Volume was estimated at 3.22 Kilo Tons in 2024 and is anticipated to reach 5.32 Kilo Tons by 2034, growing at a CAGR of 5.14% from 2025 to 2034.

North America dominated the market in 2024, akin to increased healthcare spending and advanced healthcare infrastructure in the current period. Regional countries such as the United States and Canada have been actively seen in the heavy adoption of advanced materials for applications such as tubing, catheters, and surgical instruments in recent years. Also, the region is observed as putting an enlarged investment in research and development activities for innovative medical technologies.

Is the United States Leading the Way in Medical Fluoropolymers Through Local Innovation?

The United States maintained its dominance in the medical fluoropolymers market, owing to its strong local production capacity of medical devices. The presence of the leading medical companies has been actively driving the growth of the industry in recent years. Also, the manufacturers are actively using fluoropolymers, such as PTFE and ETFE, in the country nowadays.

Asia Pacific is expected to capture a major share of the market during the forecast period, owing to enlarged healthcare expenditure in recent years. By providing cost-effective medical treatments and a shift toward self-sufficiency is severely contributing to, the industry has grown in recent years. Also, the regional countries such as India, China, and Japan have been increasingly investing in advanced hospital infrastructure and local manufacturing in the past few years, which is leading the industry's potential nowadays.

Will China’s Push for High-quality Medical Devices Redefine Global Standards?

China is expected to rise as a dominant country in the region in the coming years, owing to the stronger push towards self-reliance in medical technologies. The country’s manufacturers have been heavily using advanced technologies to develop innovative and cost-effective devices, where the government is actively supporting them while providing some advantages to the manufacturers, such as tax reduction and subsidies, in recent years. Furthermore, the increasing need for quality standards of products like surgical tubes, catheters, and implants is expected to contribute to the industry's potential in the coming years.

Medical Fluoropolymers Market Volume Share, By Region, 2024-2034 (%)

| By Region | Volume Share, 2024 (%) | Market Volume Kilo Tons - 2024 | Volume Share, 2034 (%) | Market Volume Kilo Tons - 2034 | CAGR (2025 - 2034) |

| North America | 39.21% | 3.22 | 36.43% | 5.32 | 5.14% |

| Europe | 27.32% | 2.24 | 24.32% | 3.37 | 4.64% |

| Asia Pacific | 24.12% | 1.98 | 31.12% | 4.32 | 9.04% |

| Latin America | 5.34% | 0.44 | 4.03% | 0.56 | 2.74% |

| Middle East & Africa | 4.01% | 0.33 | 4.10% | 0.57 | 6.26% |

| Total | 100% | 8.21 | 100% | 13.87 | 5.38% |

Recent Developments

- In August 2024, Pexco started providing expert solutions of fluoropolymers in several industries. Moreover, Pexco can provide solutions in sectors such as aerospace, energy, medical, and even semiconductor, as per the report published by the company(Source: performanceplastics.com)

- In July 2024, Junkosha introduced its latest product line of the PFA tubing solution. Also, the newly launched PFA tubing solution is a high-barrier solution, and it was showcased at SEMICON West 2024, as per the report published by the company.(Source: www.junkosha.com)

Top Companies List

- Daikin Industries, Ltd.

- 3M (Dyneon)

- Chemours Company

- Solvay S.A.

- Arkema Group

- Honeywell International Inc.

- AGC Inc. (Asahi Glass)

- Saint-Gobain Performance Plastics

- Dongyue Group

- Kureha Corporation

- Zeus Industrial Products

- Fluorocarbon Company Ltd

- Mitsui Chemicals, Inc.

- Quadrant Engineering Plastics

- Greene Tweed

- Heraeus Holding

- SABIC (Specialty Materials)

- W.L. Gore & Associates

- Polyflon Technology Ltd

- Mersen Group

Segment Covered

By Polymer Type

- Polytetrafluoroethylene (PTFE)

- Fluorinated Ethylene Propylene (FEP)

- Perfluoroalkoxy Alkane (PFA)

- Ethylene Tetrafluoroethylene (ETFE)

- Polyvinylidene Fluoride (PVDF)

- Polychlorotrifluoroethylene (PCTFE)

- Others (e.g., MFA, ECTFE, THV)

By Application

- Catheters & Guidewires

- Drug Delivery Systems

- Surgical Instruments

- Implantable Devices

- Tubing & Piping Systems

- Pharmaceutical Packaging

- Diagnostic Equipment

- Medical Textiles & Films

By Form

- Films

- Sheets

- Granules

- Dispersions

- Powder

- Tubes & Pipes

- Rods & Bars

By Processing Technology

- Extrusion

- Injection Molding

- Compression Molding

- Blow Molding

- Thermoforming

- Rotational Molding

By End-User

- Hospitals

- Ambulatory Surgical Centers

- Diagnostic Labs

- Pharmaceutical Companies

- Medical Device Manufacturers

- Contract Research Organizations (CROs)

By Region

- North America

- U.S.

- Mexico

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Asia Pacific

- China

- India

- Japan

- South Korea

- Central & South America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- UAE