Content

What is the Current Lithium Titanium Oxide Market Size and Volume?

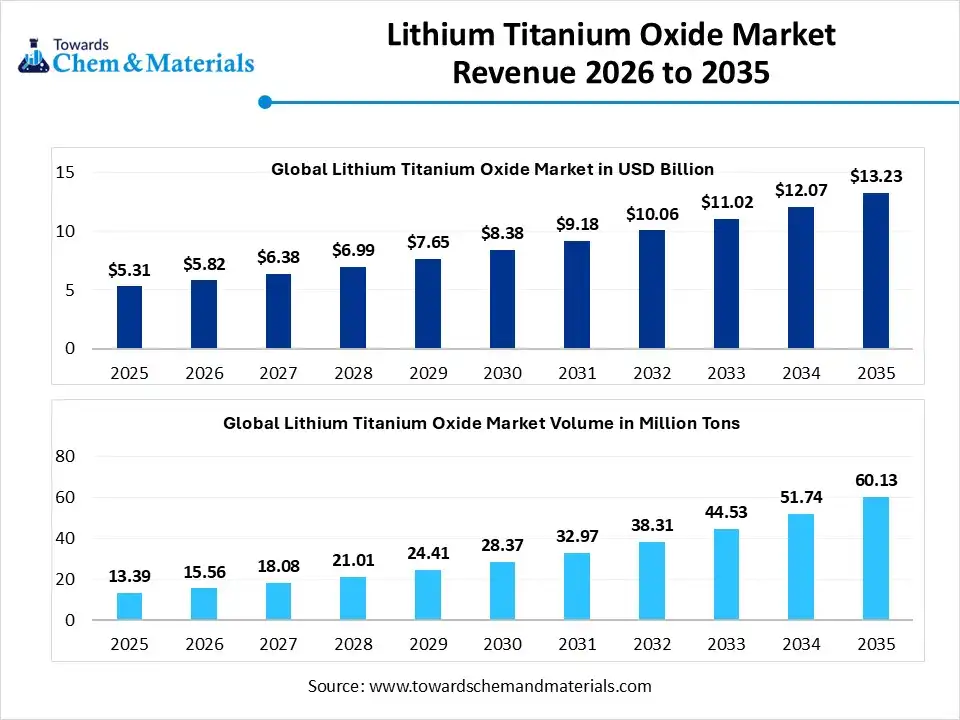

The global lithium titanium oxide market size was estimated at USD 5.31 billion in 2025 and is expected to increase from USD 5.82 billion in 2026 to USD 13.23 billion by 2035, growing at a CAGR of 9.55%. In terms of volume, the market is projected to grow from 15.56 million tons in 2026 to 60.13 million tons by 2035. exhibiting at a compound annual growth rate (CAGR) of 16.21% over the forecast period 2026 to 2035. The Asia Pacific dominated Lithium Titanium Oxide market with the largest volume share of 78.23% in 2025.

The Strong demand for electric vehicles (EVs), especially hybrids, the need for stable energy storage systems, and supportive government policies are driving the growth of the market. The Lithium Titanium Oxide (LTO) chemically is a spinel-structured ceramic material primarily utilized as an advanced anode in lithium-ion batteries. Known as a "zero-strain" material, it undergoes negligible volume change during lithiation and delithiation, granting it exceptional cycle life (often exceeding 20,000 cycles) and high thermal stability.

Report Highlights

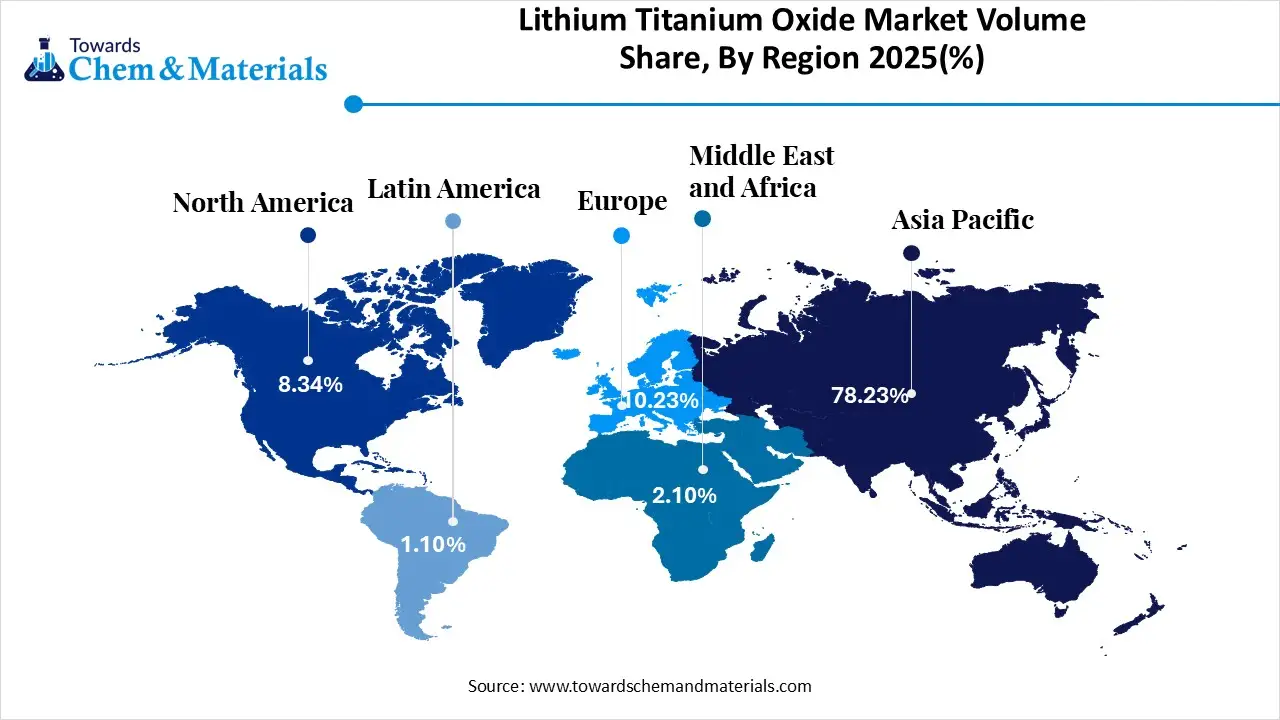

- Asia Pacific dominated the global lithium titanium oxide market with the largest volume share of 78.23% in 2025.

- The lithium titanium oxide market in Europe is expected to grow at a substantial CAGR of 22.67% from 2026 to 2035.

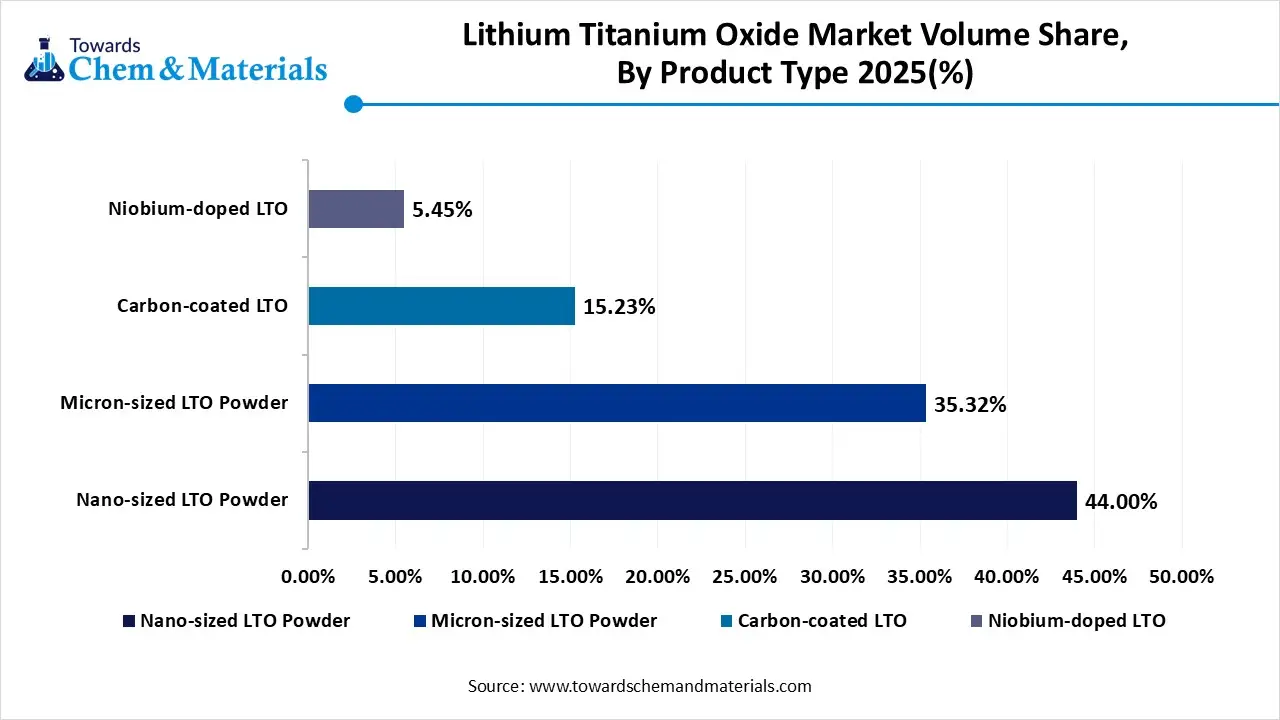

- By product type, the nano-sized LTO powder segment dominated the market and accounted for the largest volume share of 44% in 2025.

- By product type, the micron-sized LTO powder segment is expected to grow at the fastest CAGR of 16.93% from 2026 to 2035 in terms of volume.

- By material grade, the battery grade segment led the market with the largest revenue volume share of 87% in 2025.

- By cell format, the cylindrical cells segment dominated the market and accounted for the largest volume share of 38% in 2025.

- By voltage capacity, the high voltage (> 48V) segment led the market with the largest revenue volume share of 59% in 2025.

- By application, the electric vehicles (automotive) segment dominated the market and accounted for the largest volume share of 54% in 2025.

What is the Significance of the Lithium Titanium Oxide Market?

The lithium titanium oxide market is significant for enabling safer, faster-charging, and longer-lasting energy storage, crucial for electric vehicles, grid stabilization, and industrial uses, driven by electrification, renewable energy integration, and demand for reliable power in mission-critical applications. Its key value lies in LTO's superior safety, extreme fast-charge capability, and extended cycle life over traditional batteries, making it ideal for heavy-duty transport, backup power, and medical devices where reliability trumps energy density.

Lithium Titanium Oxide Market Growth Trends:

- Industrial Automation: Rising adoption of Automated Guided Vehicles (AGVs) and Autonomous Mobile Robots (AMRs) needs efficient, durable batteries.

- EVs & HEVs: LTO's quick charging and safety make it ideal for electric transport, especially in the Asia Pacific with supportive government policies.

- Long Cycle Life: Over 20,000 cycles, reducing replacement costs for large-scale applications.

- Rapid Charging: Significantly faster charging than conventional Li-ion batteries.

- Extreme Temperature Performance: Excellent reliability in wide temperature ranges, suitable for aerospace and demanding industrial uses.

- Government Initiatives: Favorable policies in APAC (China, India, Japan, Korea) boost EV adoption and LTO demand

Report Scope

| Report Attribute | Details |

| Market Size and Volume in 2026 | USD 5.82 Billion / 15.56 Million Tons |

| Revenue Forecast in 2035 | USD 13.23 Billion / 60.13 Million Tons |

| Growth Rate | CAGR 9.55% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Units Considered | Value (Billion / Million), Volume (Million Tons) |

| Dominant Region | Asia Pacific |

| Segment Covered | By Product Type, By Material Grade, By Battery Cell Format, By Voltage Capacity, By Application, By Regional |

| Key companies profiled | BTR New Material Group, Microvast Holdings, NEI Corporation, Ossila, SAT Nano Technology Material , Stanford Advanced Materials, Tokyo Chemical Industry India , Xiamen AOT Electronics Technology, Xiamen TOB New Energy Technology, Xiamen Tmax Battery Equipments-Global Forecast 2026 To 2035 |

Key Technological Shifts In The Lithium Titanium Oxide Market:

The lithium titanium oxide (LTO) market is experiencing several significant technological developments aimed at strengthening its main advantages, safety, fast charging capabilities, and durability, while trying to overcome its key drawbacks of lower energy density and higher cost. A core component of LTO technology involves lithium titanate nanoparticles, which offer a large surface area for quick ion transfer. Ongoing research is aimed at optimizing these nanostructures to boost their performance and catalytic efficiency.

Trade Analysis of the Lithium Titanium Oxide Market: Import & Export Data

- According to global export statistics, the world shipped 13 consignments of Lithium Titanium from May 2024 to April 2025 (TTM). These shipments were made by 2 exporters to 2 buyers.

- Most Lithium Titanium exports from the world are destined for India, the United States, and Colombia.

- Globally, the leading exporters of Lithium Titanium are China, the United States, and the Netherlands. China is the top exporter with 46 shipments, followed by the United States with 8 shipments and the Netherlands with 5 shipments.

Lithium Titanium Oxide Market - Value Chain Analysis

- Material Synthesis and Processing : Lithium titanium oxide is produced through processes such as solid-state reaction or sol–gel synthesis, precursor mixing, high-temperature calcination, particle size control, surface modification, and powder refinement for use as an anode material in advanced lithium-ion batteries.

- Key players: Toshiba Corporation, Ishihara Sangyo Kaisha Ltd., Yinlong Energy, NEI Corporation.

- Quality Testing and Certification : The lithium titanium oxide materials require certifications for electrochemical performance, material purity, thermal stability, and battery safety compliance. Key certifications include ISO quality standards, IEC battery material testing, UN 38.3 transport safety compliance, and RoHS environmental conformity.

- Key players: ISO (International Organization for Standardization), IEC (International Electrotechnical Commission), UL Solutions, TÜV SÜD.

- Distribution to Industrial Users: Lithium titanium oxide is supplied to lithium-ion battery manufacturers serving electric vehicles, fast-charging energy storage systems, public transportation batteries, industrial power solutions, and grid-scale energy storage applications.

- Key players: Toshiba Corporation, Yinlong Energy, Altairnano.

Lithium Titanium Oxide Regulatory Landscape: Global Regulations

Segmental Insights

Product Type Insights

Which Product Type Segment Dominated The Lithium Titanium Oxide Market In 2025?

The nano-sized LTO powder segment dominated the market, accounting for a 44% share in 2025. Nano-sized lithium titanium oxide powder is gaining strong traction due to its superior electrochemical performance, high surface area, and faster lithium-ion diffusion characteristics. These properties enable ultra-fast charging, enhanced cycle life, and improved power density. However, higher production costs and complex manufacturing processes slightly limit large-scale adoption.

The micron-sized LTO powder segment is projected to grow at fastest CAGR between 2026 and 2035 in the market. Micron-sized LTO powder is widely used in cost-sensitive and industrial battery applications where stability, safety, and long operational life are prioritized over ultra-fast charging. Micron-sized LTO powders are commonly used in stationary energy storage systems, industrial equipment, and backup power solutions requiring consistent and long-term performance.

Lithium Titanium Oxide Market Volume and Share, By Product Type 2025-2035

| By Product Type | Market Volume Share (%), 2025 | Market Volume (Million Tons)2025 | Market Volume (Million Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| Nano-sized LTO Powder | 44.00% | 5.89 | 22.49 | 16.05% | 37.40% |

| Micron-sized LTO Powder | 35.32% | 4.73 | 19.32 | 16.93% | 32.13% |

| Carbon-coated LTO | 15.23% | 2.04 | 13.43 | 23.30% | 22.34% |

| Niobium-doped LTO | 5.45% | 0.73 | 4.89 | 23.53% | 8.13% |

Material Grade Insights

How Did the Battery Grade Segment Dominated The Lithium Titanium Oxide Market In 2025?

The battery grade segment dominated the market, accounting for an 87% share in 2025. Battery-grade lithium titanium oxide is manufactured with stringent purity, particle size distribution, and performance consistency standards to meet lithium-ion battery requirements. This grade is extensively used in electric vehicles, grid-scale energy storage, and fast-charging battery systems. Rising investments in EV infrastructure and renewable energy integration continue to drive strong demand for battery-grade LTO materials globally.

The industrial-grade segment is projected to grow at fastest CAGR between 2026 and 2035 in the market. Industrial-grade LTO materials are primarily used in non-automotive and specialized industrial applications where ultra-high electrochemical performance is not mandatory. Industrial-grade LTO offers cost advantages and adequate performance for lower-intensity applications, supporting its adoption in developing markets and price-sensitive industrial segments.

Cell Format Insights

Which Cell Format Segment Dominated The Lithium Titanium Oxide Market In 2025?

The cylindrical cells segment dominated the lithium titanium oxide market, accounting for a 38% share in 2025. Cylindrical LTO battery cells are widely adopted due to their mechanical stability, efficient thermal management, and standardized manufacturing processes. Their robust structure allows for improved safety and long operational life, making cylindrical LTO cells ideal for high-power and high-cycle applications requiring reliability under demanding operating conditions.

The pouch cells segment is projected to grow at fastest CAGR between 2026 and 2035 in the market. Pouch-type LTO cells offer advantages such as lightweight design, flexible form factors, and higher volumetric energy efficiency. Although pouch cells require advanced thermal management systems, their design flexibility and space-saving benefits make them attractive for next-generation EV platforms and advanced energy storage applications.

Voltage Capacity Insights

How Did The High Voltage (>48V) Segment Dominated The Lithium Titanium Oxide Market In 2025?

The high voltage (> 48V) segment dominated the market, accounting for a 59% share in 2025. High-voltage LTO battery systems above 48V are primarily used in electric vehicles, grid-scale energy storage, and heavy-duty industrial applications. These systems support fast charging, high power output, and long cycle life. Growing demand for high-performance, safe, and durable batteries continues to drive adoption in high-voltage segments.

The low voltage (<12) segment is projected to grow at fastest CAGR between 2026 and 2035 in the lithium titanium oxide market. Low-voltage LTO batteries below 12V are typically used in auxiliary power systems, backup energy storage, and specialized electronics. These batteries offer excellent safety, long lifespan, and stable performance. While demand is comparatively lower than for high-voltage systems, this segment remains important for niche and support applications.

Application Insights

Which Application Segment Dominated The Lithium Titanium Oxide Market In 2025?

The electric vehicles (automotive) segment dominated the market, accounting for a 54% share in 2025. The automotive segment represents one of the most significant growth drivers for the LTO market, driven by the need for fast-charging, long-life, and safe battery solutions. LTO batteries are increasingly used in electric buses, delivery vehicles, and commercial fleets due to their ability to withstand frequent charging cycles and extreme operating conditions. Government support for electrification further accelerates adoption in this segment.

The energy storage systems (ESS) segment is projected to grow at fastest CAGR between 2026 and 2035 in the lithium titanium oxide market. LTO batteries are widely adopted in energy storage systems due to their long cycle life, thermal stability, and ability to perform efficiently under high charge-discharge rates. The growing focus on renewable energy integration and smart grid development continues to support strong demand for LTO-based energy storage solutions.

Regional Insights

How Did Asia Pacific Dominates The Lithium Titanium Oxide Market In 2025?

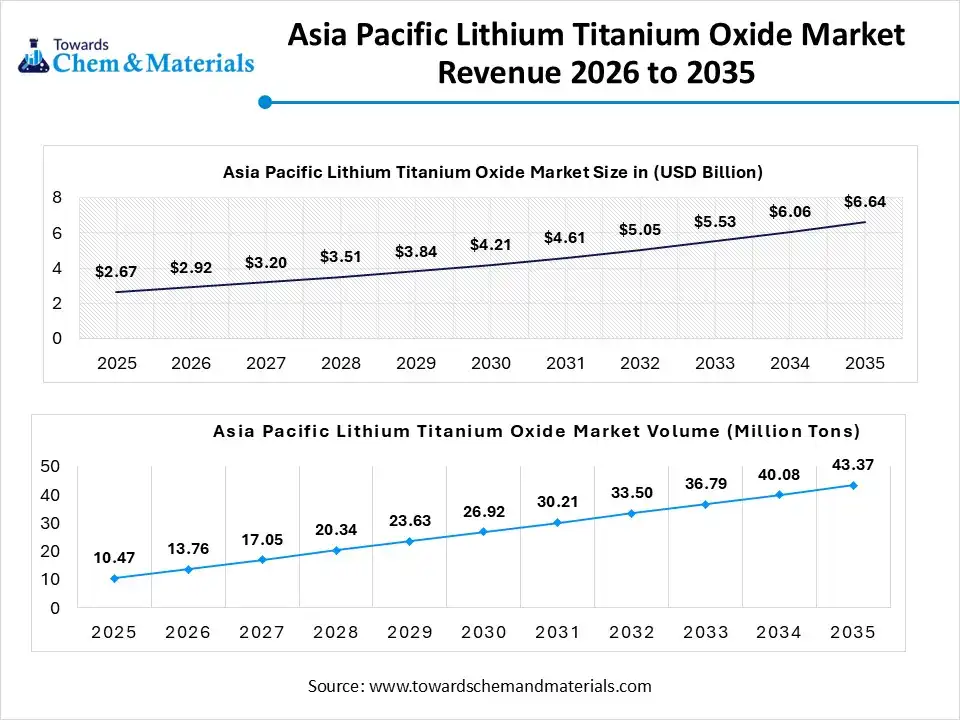

The Asia Pacific lithium titanium oxide market size is valued at USD 2.92 billion in 2026 and is expected to be worth around USD 6.64 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 9.57% over the forecast period from 2026 to 2035. The Asia Pacific lithium titanium oxide market volume is estimated at 13.76 million tons in 2026 and is projected to reach 43.37 million tons by 2035, growing at a CAGR of 17.10% from 2026 to 2035.

Asia Pacific dominates the lithium titanium oxide market in 2025 with a share of 78%. The growth of the market is attributed due to strong battery manufacturing ecosystems, rapid electric vehicle adoption, and large-scale energy storage deployments. Countries in the region benefit from vertically integrated supply chains, government support for clean mobility, and extensive R&D investments in advanced lithium-ion chemistries emphasizing safety and fast charging.

China: Lithium Titanate Oxide Market Growth Trends

China leads regional demand for lithium titanate oxide owing to its large EV fleet, public transportation electrification, and grid-scale energy storage projects. Strong domestic battery manufacturers, state-backed clean energy policies, and continuous investments in fast-charging battery technologies drive the adoption of LTO materials in buses, industrial vehicles, and power backup systems.

Europe's Growth In The Lithium Titanate Oxide Market Is Driven By Stringent Regulations

Europe is expected to experience fastest growth in the lithium titanium oxide market in the forecast period. Europe’s lithium titanate oxide market is driven by stringent emission regulations, electrification of public transport, and increasing renewable energy penetration. The region prioritizes sustainable battery technologies with enhanced safety and durability, positioning LTO as a niche but strategic solution for specific automotive and stationary energy storage applications.

Germany: Lithium Titanate Oxide Market Growth Trends

Germany’s demand for lithium titanate oxide is supported by its advanced automotive industry and strong focus on battery innovation. Applications in electric buses, industrial automation, and renewable energy storage benefit from LTO’s fast charging and long cycle life, complemented by government-backed research programs and pilot battery manufacturing initiatives.

Lithium Titanium Oxide Market Volume and Share, By Region 2025-2035

| By Region | Market Volume Share (%), 2025 | Market Volume (Million Tons)2025 | Market Volume (Million Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| North America | 8.34% | 1.12 | 6.10 | 20.76% | 10.14% |

| Europe | 10.23% | 1.37 | 8.62 | 22.67% | 14.33% |

| Asia Pacific | 78.23% | 10.47 | 43.37 | 17.10% | 72.13% |

| South America | 1.10% | 0.15 | 0.72 | 19.31% | 1.20% |

| Middle East & Africa | 2.10% | 0.28 | 1.32 | 18.77% | 2.20% |

North America Lithium Titanate Oxide Market Growth Is Driven By Growing Support And Investments

North America shows steady growth in the lithium titanate oxide market, supported by rising investments in grid resilience, renewable energy storage, and electrified public transportation. The region emphasizes battery safety, long cycle life, and rapid charging, making LTO attractive for defense, aerospace, and critical infrastructure applications.

U.S.: Lithium Titanate Oxide Market Growth Trends

The U.S. market benefits from federal funding for advanced battery research, electric transit systems, and energy storage integration. Growing adoption of fast-charging batteries for military vehicles, data centers, and grid stabilization supports demand for lithium titanate oxide, while domestic battery innovation and pilot-scale manufacturing strengthen long-term market prospects.

South America's Growth In The Market Is Driven By Renewable Energy Integration

South America represents an emerging market for lithium titanate oxide, driven by the gradual electrification of public transport and renewable energy integration. While adoption remains limited compared to other regions, increasing focus on grid stability and sustainable mobility creates opportunities for specialized battery chemistries such as LTO.

Brazil: Lithium Titanate Oxide Market Growth Trends

Brazil’s market growth is supported by investments in electric buses, renewable power generation, and energy storage solutions. Lithium titanate oxide finds application in projects requiring high safety and durability, particularly in urban transportation and backup power systems, aided by government initiatives promoting clean energy and smart infrastructure development.

Middle East And Africa Modernization In The Region Drives The Growth Of The Market.

The Middle East & Africa market is at a nascent stage, with growth driven by renewable energy projects, grid modernization, and critical infrastructure development. Demand for robust and temperature-resistant battery technologies supports the gradual adoption of lithium titanate oxide in energy storage and industrial applications.

GCC Countries: Lithium Titanate Oxide Market Growth Trends

GCC countries show growing interest in lithium titanate oxide for energy storage, supporting solar and smart grid projects. Extreme climate conditions increase demand for safe, long-life batteries, positioning LTO as a suitable option for backup power, transportation infrastructure, and renewable integration under national energy diversification strategies.

Recent Developments

- In May 2025, Australian battery manufacturer Zenaji launched a global licensing model for its Lithium Titanate (LTO) battery technology. This initiative aims to accelerate the international production of its long-life storage solutions and allows international partners to manufacture and rebrand Zenaji's Aeon and Eternity energy storage systems locally. (Source: https://www.ess-news.com/)

- In July 2025, Singapore's first fully electric tug, the PXO-ACE-1, was launched by the Coastal Sustainability Alliance (CSA) at the PaxOcean shipyard. The vessel is equipped with a 3 MWh Lithium-Titanium-Oxide (LTO) battery system and is anticipated to start operating in local waters by the first quarter of 2026. (Source: https://www.offshore-energy.biz)

- In June 2024, Toshiba Corporation, Sojitz Corporation, and CBMM introduced the world's prototype electric bus utilizing next-generation Niobium Titanium Oxide (NTO) battery technology. (Source: https://www.global.toshiba)

Top players in the Lithium Titanium Oxide Market & Their Offerings:

- Toshiba Corporation (Japan): Toshiba is a pioneer in lithium titanate (LTO) battery technology and materials. Its LTO materials are used in high-power, fast-charging energy storage systems, electric vehicles, and industrial applications thanks to excellent cycle life, safety, and wide operating temperature ranges.

- Altairnano (USA): Altairnano specializes in LTO battery materials and cells with high power density and long cycle life. Its products are tailored for grid energy storage, aerospace, defense, and fast charging applications, with a focus on robust performance and repeatability.

- Leclanché SA (Switzerland): Leclanché develops LTO battery modules and systems designed for microgrid storage, heavy-duty transport, and industrial backup. The company focuses on integrating LTO materials into scalable energy storage solutions for commercial use.

- Shenzhen Kaicong Electric Co., Ltd. (China): Shenzhen Kaicong produces LTO battery components and material precursors serving domestic and export markets. The company emphasizes scalable synthesis and supply chain reliability for LTO production.

- Microvast, Inc. (USA): Microvast integrates LTO materials into battery packs and energy storage modules for heavy-duty vehicles, buses, and industrial applications. The company’s focus is on fast charge, high power, and durability in demanding use cases.

- Yinlong Energy Co., Ltd. (Gree)

- BTR New Material Group Co., Ltd.

- Ishihara Sangyo Kaisha, Ltd.

- Microvast Holdings, Inc.

- Tianjin B&M Science and Technology Co., Ltd.

- Chengdu Xingneng New Material Co., Ltd.

- NEI Corporation

- Xiamen TOB New Energy Technology Co., Ltd.

- Titan Kogyo, Ltd.

- AME Energy

- Shenzhen Kejing Star Technology Company

- Targray

- American Elements

- SAT Nano Technology Material Co., Ltd.

- Anhui Tiankang (Group) Shares Co., Ltd.

- Mitsubishi Chemical Group Corporation

Segments Covered:

By Product Type

- Nano-sized LTO Powder

- Micron-sized LTO Powder

- Carbon-coated LTO

- Niobium-doped LTO

By Material Grade

- Battery Grade

- Industrial Grade

- Research/Lab Grade

By Battery Cell Format

- Cylindrical Cells

- Prismatic Cells

- Pouch Cells

By Voltage Capacity

- Low Voltage (<12V)

- Medium Voltage (12V–48V)

- High Voltage (>48V)

By Application

- Electric Vehicles (EVs)

- Hybrid Electric Vehicles (HEVs)

- Plug-in Hybrid Electric Vehicles (PHEVs)

- Electric Buses and Coaches

- Electric Trucks and Delivery Vans

- Energy Storage Systems (ESS)

- Grid Frequency Regulation

- Peak Shaving and Load Leveling

- Renewable Energy Integration (Solar/Wind)

- Industrial UPS Systems

- Industrial and Heavy Duty

- Automated Guided Vehicles (AGVs)

- Autonomous Mobile Robots (AMRs)

- Electric Forklifts and Cranes

- Railway and Light Rail Systems

- Marine and Offshore

- Electric Ferries and Ships

- Submarines and AUVs

- Aerospace and Defense

- Unmanned Aerial Vehicles (UAVs)

- Satellite Power Systems

- Military Tactical Equipment

- Consumer Electronics

- Wearable Devices

- Fast-charging Styluses (e.g., S-Pen)

- Power Tools

- Medical Devices

- Mobile Diagnostic Equipment

- Implantable Devices

By Regional

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Australia

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa

- UAE