Content

What is the Current Very Low Sulphur Fuel Oil Market Size and Volume?

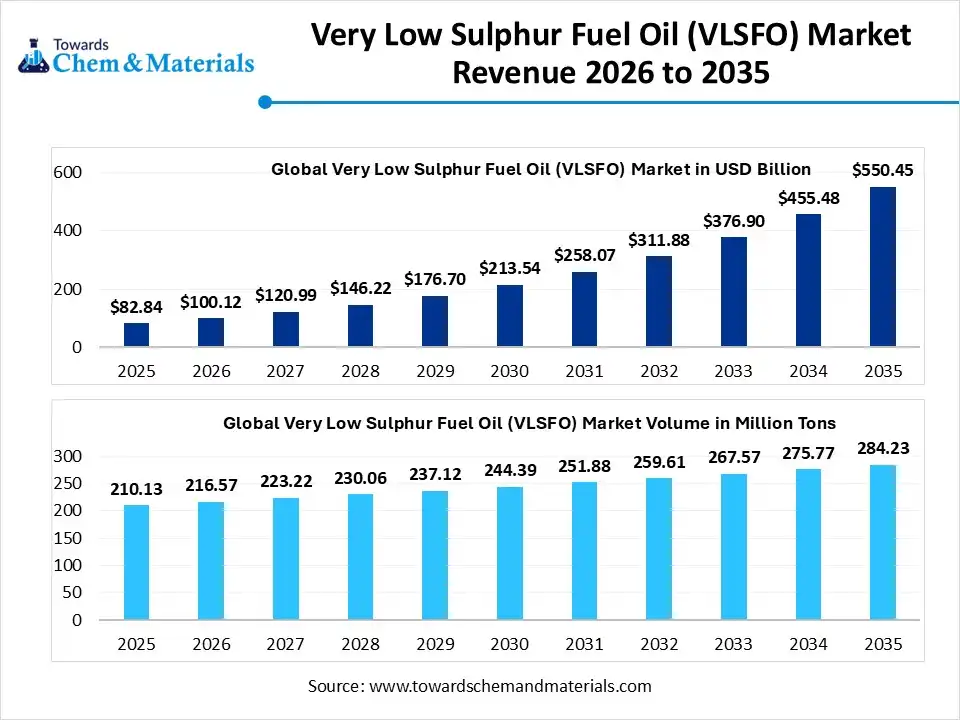

The global very low sulphur fuel oil market size was estimated at USD 82.84 billion in 2025 and is expected to increase from USD 100.12 billion in 2026 to USD 550.45 billion by 2035, growing at a CAGR of 20.85%. In terms of volume, the market is projected to grow from 216.57 million tons in 2026 to 284.23 million tons by 2035. exhibiting at a compound annual growth rate (CAGR) of 3.07% over the forecast period 2026 to 2035. The Asia Pacific dominated very low sulphur fuel oil market with the largest volume share of 44.23% in 2025. The growing demand for cleaner shipping fuels is the key factor driving market growth. Also, ongoing investment in blending and storage infrastructure, coupled with the surge in global trade, can fuel market growth further.

Report Highlights

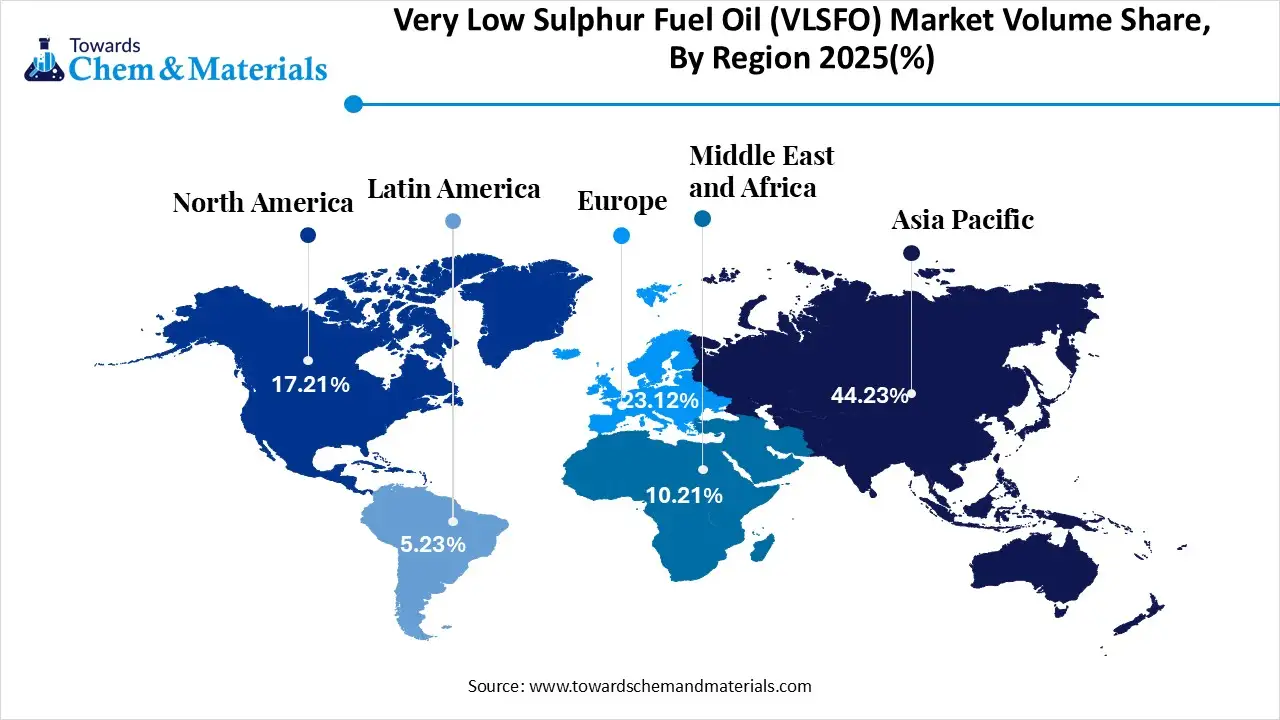

- Asia Pacific dominated the global very low sulphur fuel oil market with the largest volume share of 44.23% in 2025.

- The very low sulphur fuel oil market in Europe is expected to grow at a substantial CAGR of 2.44% from 2026 to 2035.

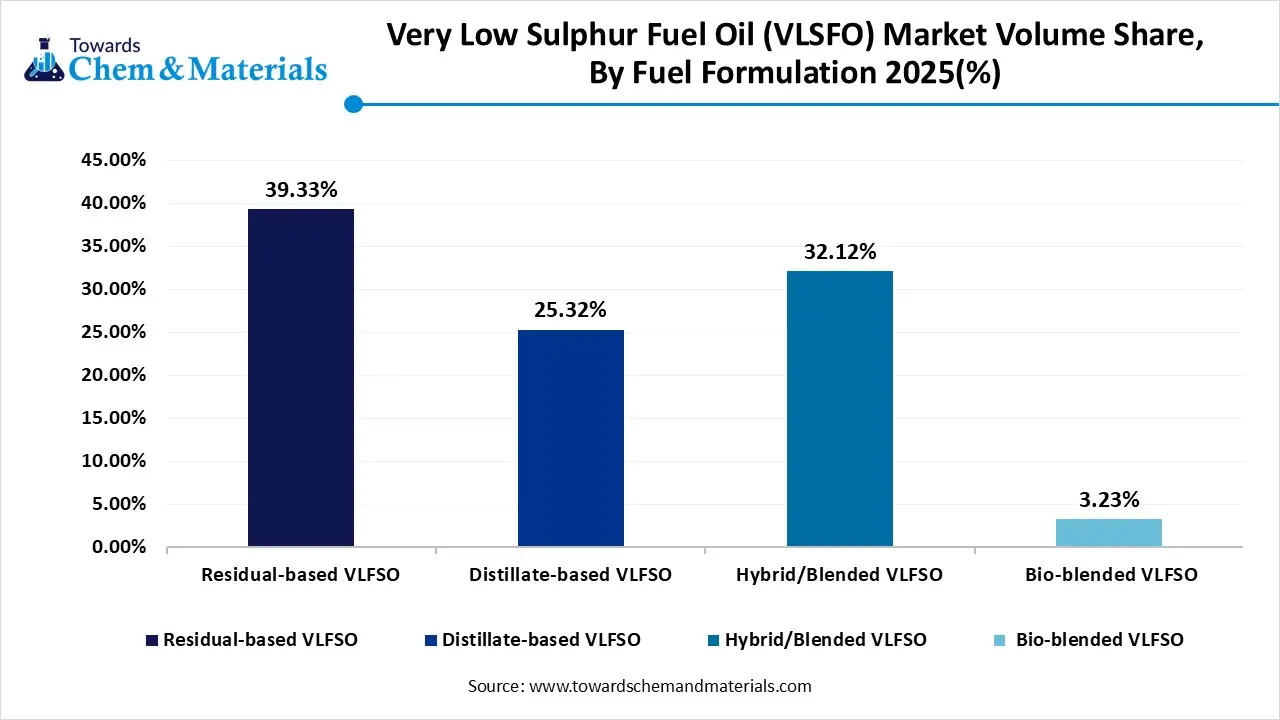

- By fuel formulation, the residual-based VLFSO segment dominated the market and accounted for the largest volume share of 39% in 2025.

- By fuel formulation, the the Bio-blended VLFSO segment is expected to grow at the fastest CAGR of 8.82% from 2026 to 2035

- By viscosity grade, the IFO 380 segment led the market with the largest revenue volume share of 72% in 2025.

- By vessel type, the container ships segment dominated the market and accounted for the largest volume share of 35% in 2025.

- By application, the marine propulsion segment led the market with the largest revenue volume share of 88% in 2025.

What is Very Low Sulphur Fuel Oil (VLSFO)?

Very Low Sulphur Fuel Oil (VLSFO) is a marine fuel formulated to contain a maximum sulphur content of 0.50% by mass. It was introduced primarily to comply with the International Maritime Organization's (IMO) 2020 regulations, which mandated a global reduction in sulphur emissions from 3.5% to 0.5%. The market involves refiners, blenders, traders, and ship operators meeting specifications and demand.

Very Low Sulphur Fuel Oil Market Trends

- The rapid advancements in refining technology are the latest trend in the market, shaping positive market growth by enabling the manufacturing of VLSFO while maintaining overall fuel performance and quality standards. These innovations have made VLSFO a convenient option for ship operators.

- The growing awareness regarding environmental concerns among most businesses and consumers is another major trend leading to market expansion. This transition towards environmental sustainability is likely to maintain the product demand in the near future.

- The ongoing R&D in refining technologies can lower the cost of manufacturing and enhance the environmental performance of VLSFO, offering more options for operators and shipowners to comply with environmental standards.

How Cutting Edge Technologies are Revolutionizing the Very Low Sulphur Fuel Oil Market?

The advanced technologies are transforming the market by boosting supply chain operations, boosting efficiency, and ensuring regulatory compliance by enabling a smooth fuel management through various methods. Furthermore, the advancements also help refineries propel manufacturing and shipping companies to enhance routing and procurement, to minimize the risks associated with hazardous operations.

Market Report Scope

| Report Attribute | Details |

| Market Size and Volume in 2026 | USD 100.12 Billion /216.57 million tons |

| Revenue Forecast in 2035 | USD 550.45 Billion / 284.23 million tons |

| Growth Rate | CAGR 20.85% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Units Considered | Value (Billion / Million), Volume (Tons) |

| Dominant Region | Asia Pacific |

| Segment Covered | By Fuel Formulation, By Fuel Formulation, By Vessel Type, By Application, By Region |

| Key companies profiled | Key players in the market include BP, Chevron, Exxon Mobil, Hindustan Petroleum, Indian Oil, Marathon Petroleum, Mediterranean Fuels, Phillips 66, Rosneft, Saudi Aramco, Shell, Sinopec, TotalEnergies, Viva Energy, and Vitol. |

Trade Analysis of Very Low Sulphur Fuel Oil Market :Import & Export Statistics

Exports

- In 2024, the United States exported $195M of Sulphur, being the 613th most exported product in the United States.

- In 2024, the main destinations of the United States' Sulphur exports were: Brazil ($87M), Mexico ($66.6M), Indonesia ($12.2M), New Caledonia ($6.9M), and Morocco ($6.49M).

Imports

- In 2025, the United States imported $107M of Sulphur, being the 848th most imported product in the United States.

- In 2025, the main origins of the United States' Sulphur imports were: Canada ($95.4M), India ($5.68M), Saudi Arabia ($4.81M), Italy ($552k), and China ($478k).

- On December 25, 2024, China's Ministry of Commerce (MOFCOM) announced the first 2025 export quota for low-sulfur marine fuel, setting it at 8 million tons, matching the prior year's initial release, with major allocations to Sinopec (3.82 million tons) and PetroChina (3.44 million tons), maintaining a stable supply for major state-owned refiners.

Very Low Sulphur Fuel Oil Market Value Chain Analysis

- Feedstock Procurement : It is the process to acquire the necessary raw materials required to produce fuels that meet the global sulfur cap regulation.

- Major Players: ExxonMobil, BP p.l.c.

- Chemical Synthesis and Processing: It refers to the essential refinery operations and chemical treatments necessary to produce marine fuel that complies with the International Maritime Organization's sulphur cap.

- Major Players: Shell International B.V, BP p.l.c.

- Packaging and Labelling: It refers to the collection of fuel samples into a specific container during the bunkering (refueling) process. This stage ensures the integrity of the fuel sample and prevents it from any alteration.

- Major Players: Petrobras, Vitol Bunkers.

- Regulatory Compliance and Safety Monitoring : It involves adhering to strict international standards and implementing robust quality control and handling procedures to ensure safe ship operations and environmental compliance.

- Major Players: Sinopec, Chevron Corporation

Very Low Sulphur Fuel Oil Market's Regulatory Landscape: Global Regulations

| Country/Region | Key Regulations |

| North America | The North American and U.S. Caribbean Sea ECAs (covering designated coastal areas off the United States and Canada) enforce a strict 0.10% sulphur limit. |

| Europe | The North Sea and Baltic Sea areas are designated ECAs with a 0.10% sulphur limit. The entire Mediterranean Sea is also expected to become a SOx-ECA with the same limit from May 1, 2025. |

| Asia Pacific | China has specific Inland Water ECAs (Yangtze and Xijiang Rivers) where a 0.10% sulphur limit has been in effect since January 1, 2020.South Korea also has designated ECAs with a 0.10% limit. |

Segmental Insights

Fuel Formulation Insights

How Much Share Did the Residual-Based VLFSO Reforming Segment Held in 2025?

The residual-based VLFSO segment dominated the market with 39% share in 2025. The dominance of the segment can be attributed to the growing focus on minimizing SOx and greenhouse gas (GHG) emissions, coupled with the stringent rules in ECAs.In addition, Refineries across the globe are increasingly investing in updating their facilities, utilising cutting-edge processes such as hydrodesulfurization.

The bio-blended VLSFO segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the growing demand for well-to-wake' decarbonization initiatives and robust availability of sustainable biomass feedstocks. Also, this fuel can be utilized in current marine engines with fewer modifications to the operational profile.

Very Low Sulphur Fuel Oil Market Volume and Share, By Fuel Formulation 2025-2035

| By Fuel Formulation | Market Volume Share (%), 2025 | Market Volume (Million Tons)2025 | Market Volume (Million Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| Residual-based VLFSO | 39.33% | 82.64 | 94.76 | 1.53% | 33.34% |

| Distillate-based VLFSO | 25.32% | 53.20 | 77.68 | 4.29% | 27.33% |

| Hybrid/Blended VLFSO | 32.12% | 67.49 | 97.26 | 4.14% | 34.22% |

| Bio-blended VLFSO | 3.23% | 6.79 | 14.52 | 8.82% | 5.11% |

Viscosity Grade Insights

Which Viscosity Grade Type Segment Dominated Very Low Sulphur Fuel Oil Market in 2025?

The IFO 380 segment held a nearly 72% market share in 2025. The dominance of the segment can be credited to the increasing infrastructure developments and rapid economic shifts. IFO 380 VLSFO provides a lower price and better energy density, which makes it the most cost-effective choice for transcontinental trade routes.

The IFO 180 segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by increasing global emphasis on minimizing air pollution and carbon emissions. Additionally, IFO 180 offers a good handling and emissions performance as compared to heavier grades such as IFO 380.

Vessel Type Insights

How Much Share Did the Container Ships Segment Held in 2025?

The container ships segment dominated the market with nearly 35% share in 2025. The dominance of the segment is owing to a surge in global trade requiring more container logistics, which makes VLSFO the compliant and efficient choice over scrubbers. Major operators have also announced heavy investments to revolutionize supply chains and expand vessel capacity.

The offshore support vessels (OSVs) segment is expected to grow at the fastest CAGR during the forecast period. The growth of the segment is due to ongoing technological innovations in fuel manufacturing and vessel operation. The integration of AI and smart sensors enables OSV operators to boost their fuel consumption, driving segment growth soon.

Application Insights

How Much Share Did the Marine Propulsion Segment Held in 2025?

The marine propulsion segment held approximately 88% market share in 2025. The dominance of the segment can be attributed to the stringent IMO emission rules and growing adoption of VLSFO by refineries to produce cleaner fuels. Furthermore, investments in refining technology enable the smooth manufacturing of VLSFO, enhancing supply availability.

The auxiliary power generation segment is expected to grow at the fastest CAGR over the study period. The growth of the segment can be credited to the growing operational efficiencies related to using compliant fuel types. VLSFO provides a more cost-effective solution for various operators compared to other alternatives like exhaust gas cleaning systems.

Regional Insights

How Did Asia Pacific Thrived in the Very Low Sulphur Fuel Oil Market in 2025?

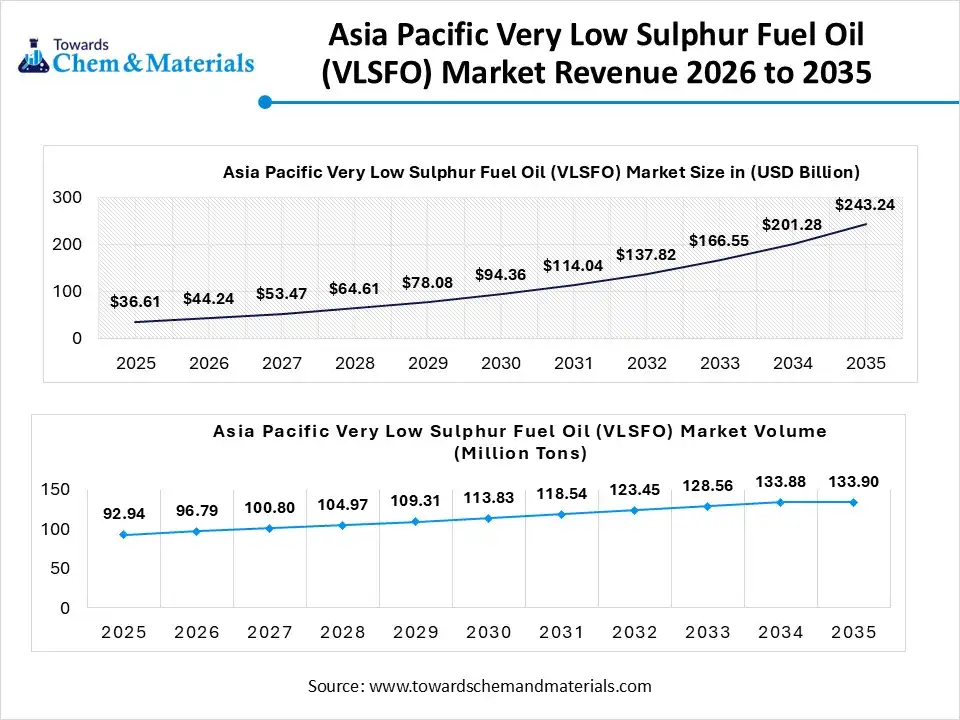

The Asia Pacific very low sulphur fuel oil market size is valued at USD 44.24 billion in 2026 and is expected to be worth around USD 243.24 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 20.87% over the forecast period from 2026 to 2035. The Asia Pacific very low sulphur fuel oil market volume is estimated at 96.79 million tons in 2026 and is projected to reach 133.90 million tons by 2035, growing at a CAGR of 4.14% from 2026 to 2035.

Asia Pacific dominated the market with 44.23% share in 2025. The dominance of the region can be attributed to the government's push towards using cleaner fuels, along with the rapid investment in port infrastructure to fulfil industry demand. In addition, the region's role as a global product hub and its extensive trade volumes boost consistent demand for bunkers.

China Very Low Sulphur Fuel Oil Market Trends

In the Asia Pacific, China dominated the market owing to stringent domestic emission regulations and ongoing investment in infrastructure development. Chinese refiners are consistently upgrading their facilities to create more VLSFO, growing supply reliability, and local availability of the product.

North America Very Low Sulphur Fuel Oil Market Trends

North America is expected to grow at a notable CAGR over the forecast period. The growth of the region can be linked to the surge in maritime trade and the cost-effectiveness of VLSFO over scrubbers. Moreover, enhanced refining processes allow for better manufacturing and blending of VLSFO, improving its quality.

U.S. Very Low Sulphur Fuel Oil Market Trends

In North America, the U.S. led the market due to increasing pressure for sustainable shipping and rising seaborne trade in coastal areas. VLSFO offers a cost-effective compliance solution as compared to the high maintenance and capital costs of scrubbers, contributing to the country's growth in the near future.

Very Low Sulphur Fuel Oil Market Volume and Share, By Region 2025-2035

| By Region | Market Volume Share (%), 2025 | Market Volume (Million Tons)2025 | Market Volume (Million Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| North America | 17.21% | 36.16 | 43.57 | 2.09% | 15.33% |

| Europe | 23.12% | 48.58 | 60.34 | 2.44% | 21.23% |

| Asia Pacific | 44.23% | 92.94 | 133.90 | 4.14% | 47.11% |

| South America | 5.23% | 10.99 | 14.55 | 3.17% | 5.12% |

| Middle East & Africa | 10.21% | 21.45 | 31.86 | 4.49% | 11.21% |

Europe Very Low Sulphur Fuel Oil Market Trends

Europe held a major market share in 2025. The growth of the region can be driven by the rapid shift towards sustainability initiatives and cleaner fuels, along with the robust existing maritime trade. Europe held a presence of leading bunker hubs such as Antwerp and Rotterdam, which have well-established infrastructure for supplying VLSFO.

Germany Very Low Sulphur Fuel Oil Market Trends

The growth of the market in the country can be fuelled by a surge in the use of biofuel blends with VLSFO and increasing maritime trade, which requires more fuel. German terminal operators and ports are heavily investing in new facilities for VLSFO manufacturing, storage, and blending.

South America Very Low Sulphur Fuel Oil Market Trends

South America held a major market share in 2025. The growth of the region can be boosted by growing world trade, propelling port demand, and increasing local production. National companies in the region are growing local VLSFO manufacturing to minimize import reliance, improving overall regional supply.

Middle East & Africa Very Low Sulphur Fuel Oil Market Trends

The Middle East & Africa are expected to grow at the fastest CAGR over the forecast period. The growth of the region can be credited to the expanding corporate sustainability goals and environmental awareness, which optimizes the adoption of sustainable options such as VLSFO and biofuels. The region is also witnessing a growth in its own economic policies, such as exports of minerals, oil, and gas, and manufactured goods.

Saudi Arabia Very Low Sulphur Fuel Oil Market Trends

Saudi Arabia held a significant market share in 2025. The growth of the country can be linked to the massive investment in port infrastructure and rapid investment in n ports and storage facilities. Also, Saudi Arabia's huge refining abilities enable it to produce VLSFO for both domestic demand and export.

Brazil Very Low Sulphur Fuel Oil Market Trends

The growth of the market in the country can be propelled by its surging refining capacity and ongoing adoption of cleaner fuels, which makes it an attractive and dynamic hub for marine bunkering. The country's increasing involvement in world trade raises shipping traffic, necessitating more VLSFO for refuelling.

Recent Developments

- In April 2025, Vitol launched an innovative FuelEU Maritime-compliant co-processed VLSFO. The new fuel is being manufactured under the ISCC-EU scheme certification and will be promoted in many locations by Vitol Bunkers. (Source: https://splash247.com)

Market Top Companies

- ExxonMobil Corporation: ExxonMobil Corporation is a major global supplier of Very Low Sulphur Fuel Oil (VLSFO) and a key player in the market, focusing on consistent fuel quality and developing lower-emission bio-blends to meet strict environmental regulations.

- Shell plc: Shell plc remains a cornerstone of the Very Low Sulphur Fuel Oil (VLSFO) market, leveraging a century of industry experience to navigate the rigorous standards set by the International Maritime Organization (IMO).

- BP p.l.c.

- TotalEnergies SE

- Chevron Corporation

- Saudi Aramco

- Sinopec (China Petroleum & Chemical Corporation)

- PetroChina Company Limited

- Reliance Industries Limited

- Valero Energy Corporation

- Neste Corporation

- SK Innovation Co., Ltd.

- S-Oil Corporation

- GS Caltex Corporation

- Petroliam Nasional Berhad (Petronas)

- Equinor ASA

- Repsol S.A.

- Eni S.p.A.

- Phillips 66

- Indian Oil Corporation Limited (IOCL)

Segments Covered in the Report

By Fuel Formulation

- Residual-based VLSFO

- Distillate-based VLSFO

- Hybrid/Blended VLSFO

- Bio-blended VLSFO (VLSFO-Biodiesel Blends)

By Viscosity Grade

- IFO 180 (Low Viscosity)

- IFO 380 (High Viscosity)

- IFO 500 (Extra High Viscosity)

- LSMGO (Low Sulphur Marine Gas Oil)

By Vessel Type

- Container Ships

- Bulk Carriers

- Oil and Chemical Tankers

- General Cargo Vessels

- Passenger and Cruise Ships

- Offshore Support Vessels (OSVs)

- Tugboats and Service Craft

By Application

- Marine Propulsion (Main Engines)

- Auxiliary Power Generation

- Industrial Heating and Boilers

- Stationary Power Plants

By Regional

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Australia

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa

- UAE