Content

What is the Current Vinyl Acetate Monomer (VAM) Market Size and Volume?

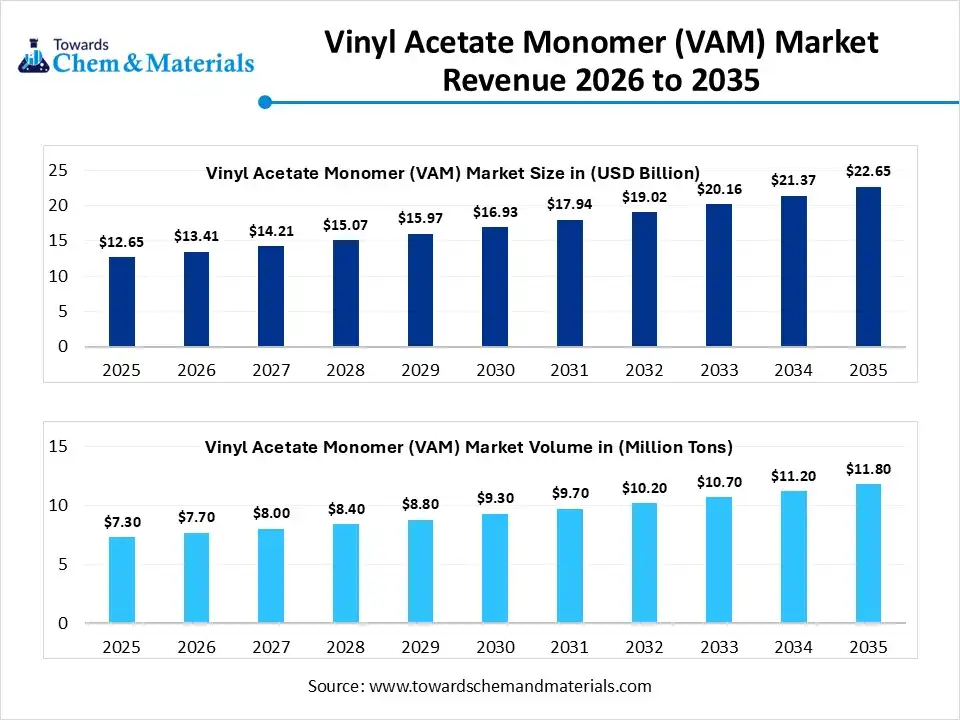

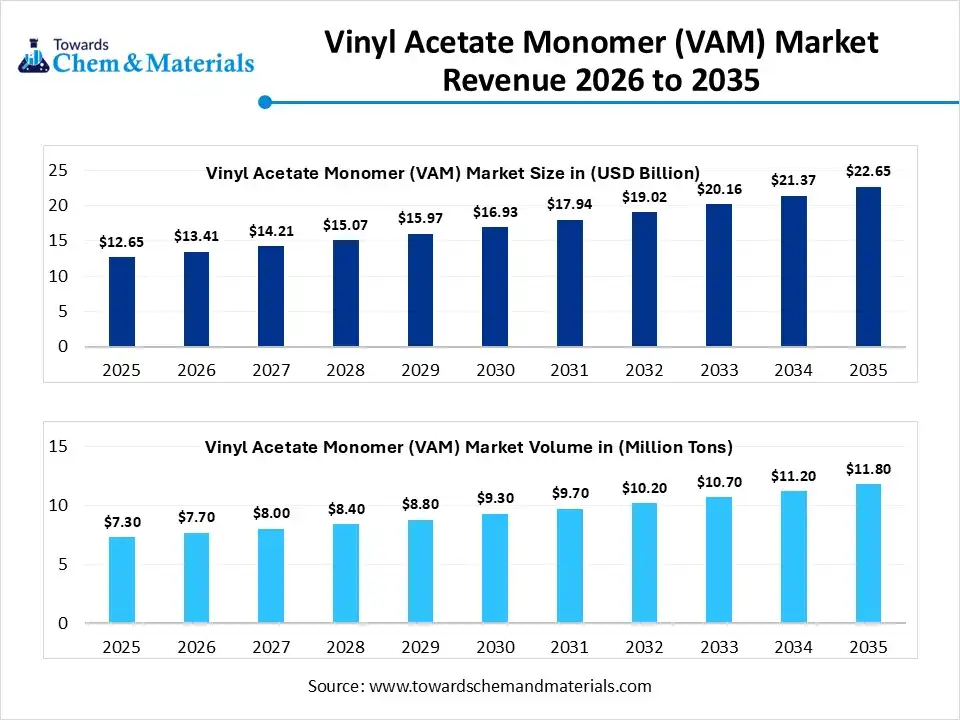

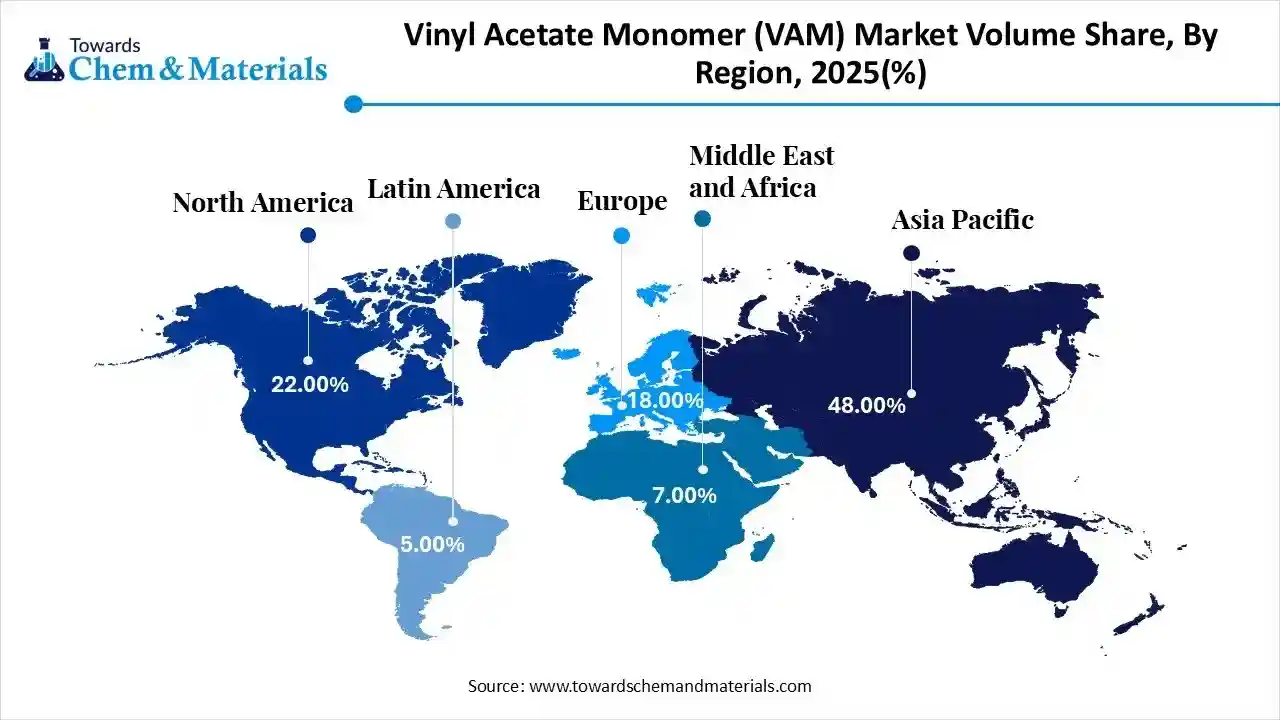

The global vinyl acetate monomer (VAM) market size was estimated at USD 12.65 billion in 2025 and is expected to increase from USD 13.41 billion in 2026 to USD 22.65 billion by 2035, growing at a CAGR of 6.0% from 2026 to 2035. In terms of volume, the market is projected to grow from 7.3 million tons in 2025 to 11.8 million tons by 2035. growing at a CAGR of 4.90% from 2026 to 2035. Asia Pacific dominated the vinyl acetate monomer (VAM) market with the largest volume share of 48% in 2025. The greater shift towards packaging has fueled the industry's growth in recent years.

Market Highlights

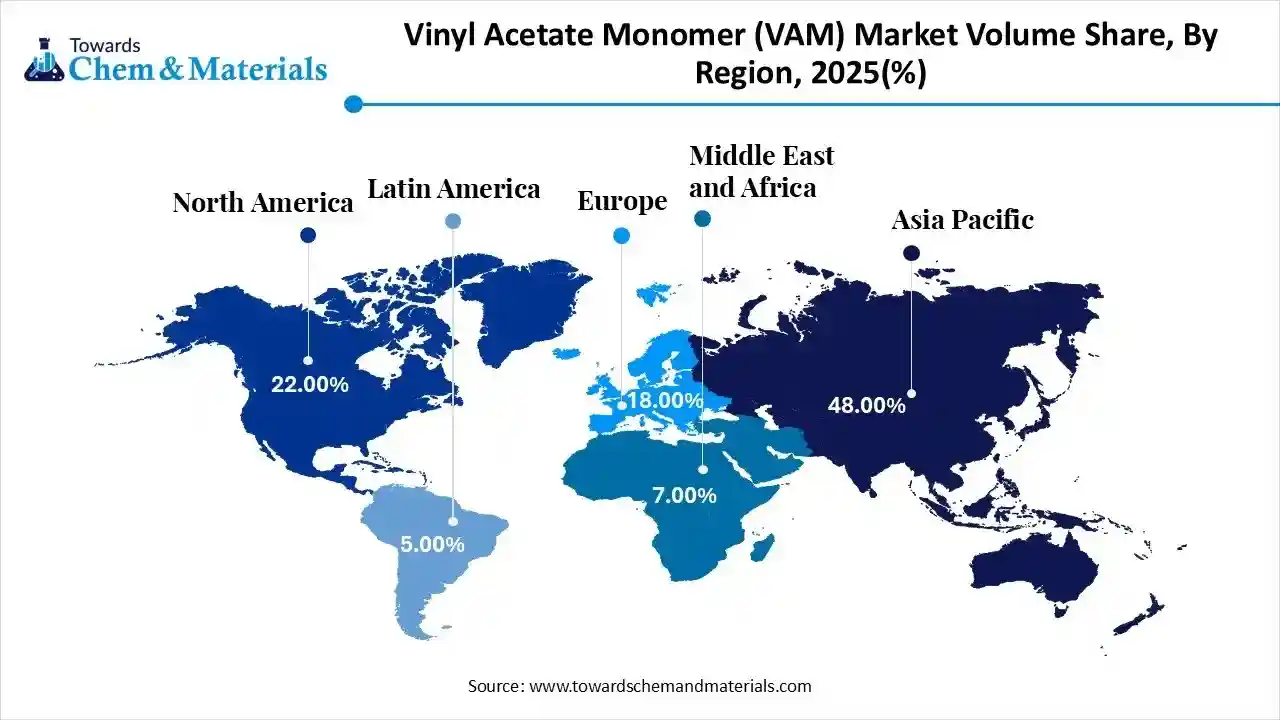

- The Asia Pacific dominated the global vinyl acetate monomer (VAM) market with the largest volume share of 48% in 2025.

- The vinyl acetate monomer (VAM) market in North America is expected to grow at a substantial CAGR of 6.53% from 2026 to 2035.

- The Europe vinyl acetate monomer (VAM) market segment accounted for the major volume share of 18.00% in 2025.

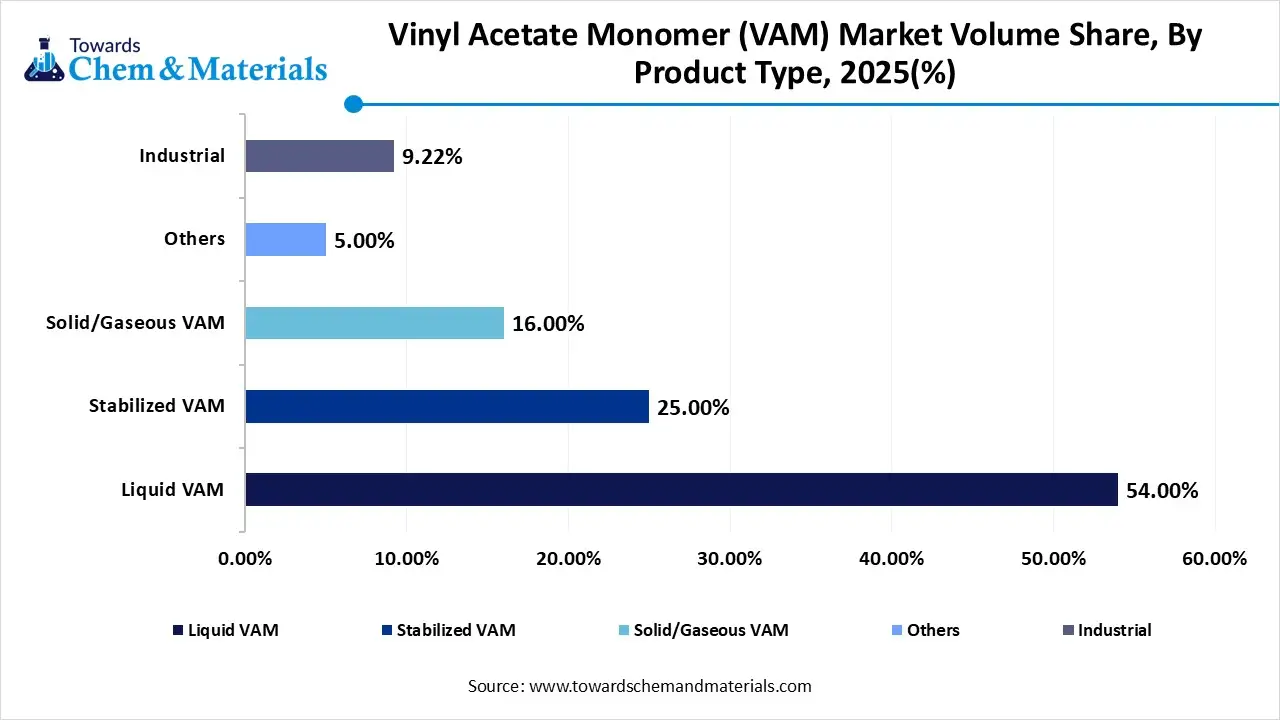

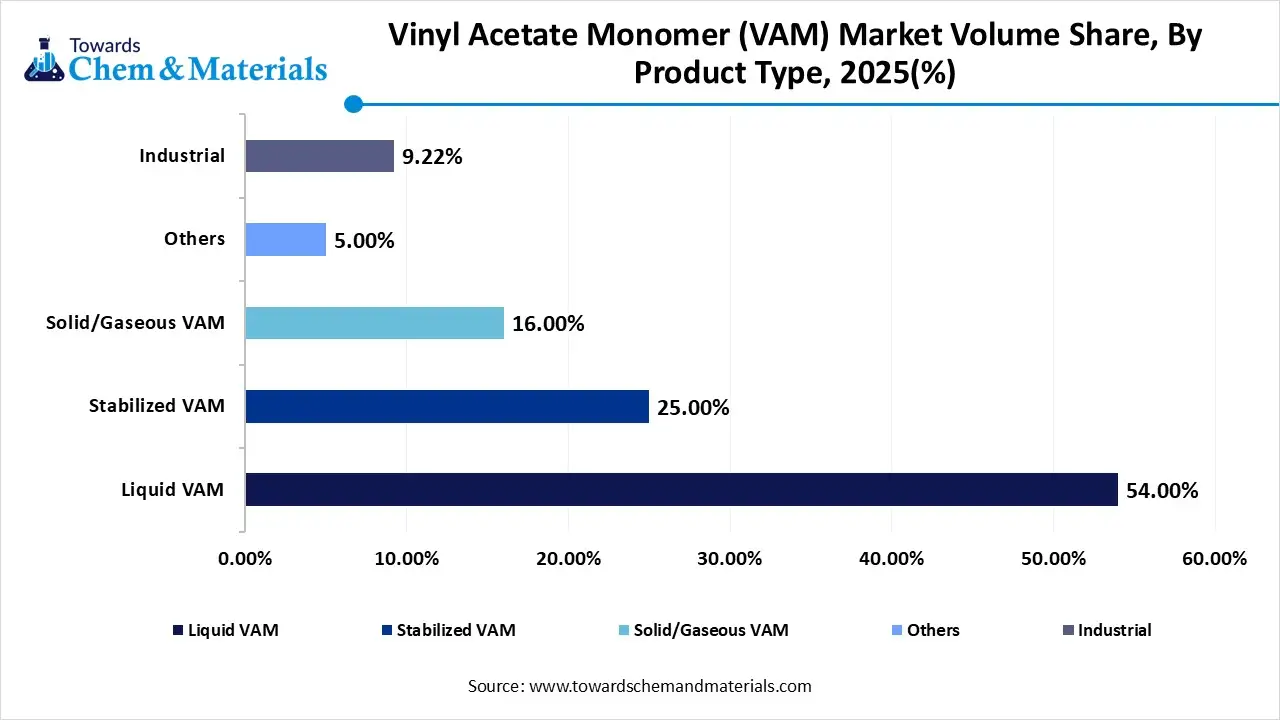

- By product type, the liquid VAM segment dominated the market and accounted for the largest volume share of 54% in 2025.

- By product type, the stabilized VAM segment is expected to grow at the fastest CAGR of 6.43% from 2026 to 2035 in terms of volume.

- By end-use insights, the packaging segment led the market with the largest revenue volume share of 38% in 2025.

Vinyl Acetate Monomer: Powering Modern Polymers

The colourless organic liquid, which plays a major role in the production of resins and polymers called the vinyl acetate monomer. Also, having the active reaction properties, the vinyl acetate monomer leads the emerging role in the formation of polymers. Also, the demand from sectors like construction materials, textiles, and paints is expected to elevate earnings potential for producers in the coming years.

Vinyl Acetate Monomer (VAM) Market Trends:

- The shift towards the specialized grades instead of large volume production for selling has contributed to the stronger cash flows for manufacturing enterprises in recent years. Moreover, the manufacturers are increasingly focusing on tailored solutions that provide better performance while meeting the environmental regulations in the current period.

- The emergence of the local production facility or plant establishment is likely to strengthen the bottom line for production firms in the coming years. Also, several developed regions have seen under the minimisation of reliance on the international supply chains or imports in the past few years.

- The increased focus on cost control and price sensitivity by consumers is expected to translate into favourable financial prospects for producers during the forecast period. Moreover, in the current era, several major brands have observed in offering stable price rates to protect their regular consumer base, as per the recent observation.

Report Scope

| Report Attribute | Details |

| Market Size and Volume in 2026 | USD 13.41 Billion / 7.7 Million Tons |

| Revenue Forecast in 2035 | USD 22.65 Billion / 11.8Million Tons |

| Growth Rate | CAGR 6% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Units Considered | Value (Billion / Million), Volume (Million Tons) |

| Dominant Region | Asia Pacific |

| Segment Covered | By Product Type, By End-User Industry, By Region. |

| Key companies profiled | Celanese Corporation, China Petrochemical Corporation (Sinopec), LyondellBasell Industries N.V., Dow Inc, Dairen Chemical Corporation (DCC), Wacker Chemie AG, Kuraray Co., Ltd., INEOS Group, Sipchem (Saudi International Petrochemical Co.), Chang Chun Group, Arkema S.A., Mitsubishi Chemical Group, Showa Denko K.K. (Resonac),Lotte Chemical Corporation, Jiangsu Sopo (Group) Co., Ltd. |

Consistency Meets Innovation in Production

The major manufacturers are focused on making production more controlled and efficient. Companies are using better monitoring systems to keep reactions stable and reduce waste. Machines and digital tools help track temperature, pressure, and quality in real time. This reduces mistakes and lowers energy use. Also, the goal is to produce the same quality product every time while following environmental rules.

Trade Analysis of the Vinyl Acetate Monomer (VAM) Market:

Import, Export, Consumption, and Production Statistics

- China has seen under the significant export of vinyl acetate in 2024, and the quantity of export is approximately around 66,278,700 KG as per the record.

- The United States reached $554 million in vinyl acetate exports in 2024, as per the published report.

Value Chain Analysis of the Vinyl Acetate Monomer (VAM) Market:

- Distribution to Industrial Users: By region,

- Key Players: Celanese Corporation and Dairen Chemical Corp

- Chemical Synthesis and Processing:Vinyl Acetate Monomer (VAM) is synthesized and processed primarily through the vapor-phase acetoxylation of ethylene, which accounts for approximately 75% of global production.

- Key Players: INEOS (formerly BP) and LyondellBasell

- Regulatory Compliance and Safety Monitoring:Regulatory compliance and safety monitoring for Vinyl Acetate Monomer (VAM) in 2026 are shaped by intensified scrutiny of its health impacts and stricter quality mandates in emerging markets.

- Safety Standards- California Proposition 65 (Carcinogen Listing) and India’s BIS Quality Control Order

Vinyl Acetate Monomer (VAM) Market Regulatory Landscape: Global Regulations

| Country / Region | Regulatory Body | Key Regulations | Focus Areas |

| United States | Environmental Protection Agency (EPA) | Toxic Substances Control Act (TSCA) Section 8(d) | Data Collection & Risk Assessment |

| European Union | European Chemicals Agency (ECHA) | REACH Regulation (EC No 1907/2006) | Harmonized Classification |

| China | Ministry of Ecology and Environment (MEE) | Ecological Environment Code | Pollution Control & Green Development |

Segmental Insights

Product Type Insights

How did the Liquid VAM Segment Dominate the Vinyl Acetate Monomer (VAM) Market in 2025?

The liquid VAM segment volume was valued at 3.9 million tons in 2025 and is projected to reach 6.1 million tons by 2035, expanding at a CAGR of 5.05% during the forecast period from 2025 to 2035. The liquid VAM segment dominated the market with 54% share in 2025, due to the offerings like consistency, ease of processing, and immediate scale. Moreover, having advantages like better pricing behavior, yield, and seasonal patterns, the manufacturers are increasingly preferring vegetable oil as the major feedstock in recent years.

The stabilized VAM segment volume was valued at 1.8 million tons in 2025 and is projected to reach 3.2 million tons by 2035, expanding at a CAGR of 6.43% during the forecast period from 2025 to 2035, owing to the greater safety, longer shelf life, and improved consistency. Moreover, by reducing the unwanted reactions specifically in longer shipping and high temperatures, the stabilized VAM is expected to lead the industry potential during the projected period. Also, the turn towards the materials that have a lower risk of degradation has also provided a greater advantage to the segment in the past few years.

Vinyl Acetate Monomer (VAM) Market Volume and Share, By Product Type, 2025-2035

| By Product Type | Market Volume Share (%), 2025 | Market Volume ( Million Tons)2025 | Market Volume (Million Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| Liquid VAM | 54.00% | 3.9 | 6.1 | 5.05% | 52.13% |

| Stabilized VAM | 25.00% | 1.8 | 3.2 | 6.43% | 27.14% |

| Solid/Gaseous VAM | 16.00% | 1.2 | 1.9 | 5.55% | 16.13% |

| Others | 5.00% | 0.4 | 0.5 | 4.48% | 4.60% |

End Use Insights

How did the Packaging Segment Dominate the Vinyl Acetate Monomer (VAM) Market in 2025?

The packaging segment dominated the market with 38% industry share in 2025, due to the VAM-based polymers providing strong adhesion, flexibility, and safety for food and consumer packaging. These materials help seal cartons, labels, films, and multilayer packaging structures efficiently. Also, packaging manufacturers value VAM because it supports high-speed production lines and consistent bonding performance.

The others (solar/automotive) segment is expected to grow akin to rising use of EVA and advanced polymer materials. In solar panels, VAM-based EVA films protect cells and improve energy and efficiency. Also, in automotive applications, these materials support lightweight design, noise reduction, and durability. Electric vehicle growth further increases demand for flexible, high-performance polymers.

Regional Insights

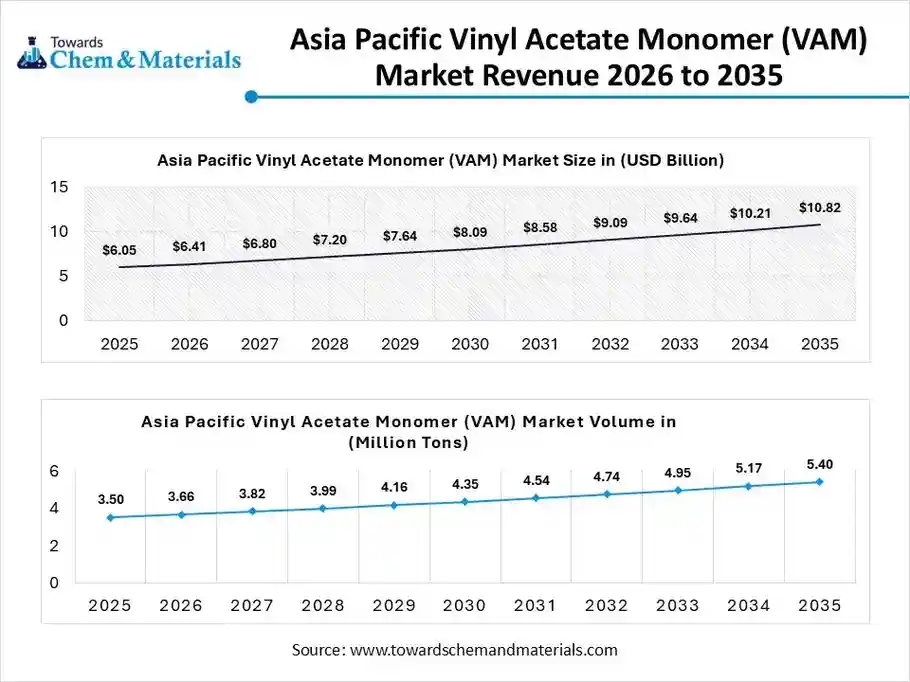

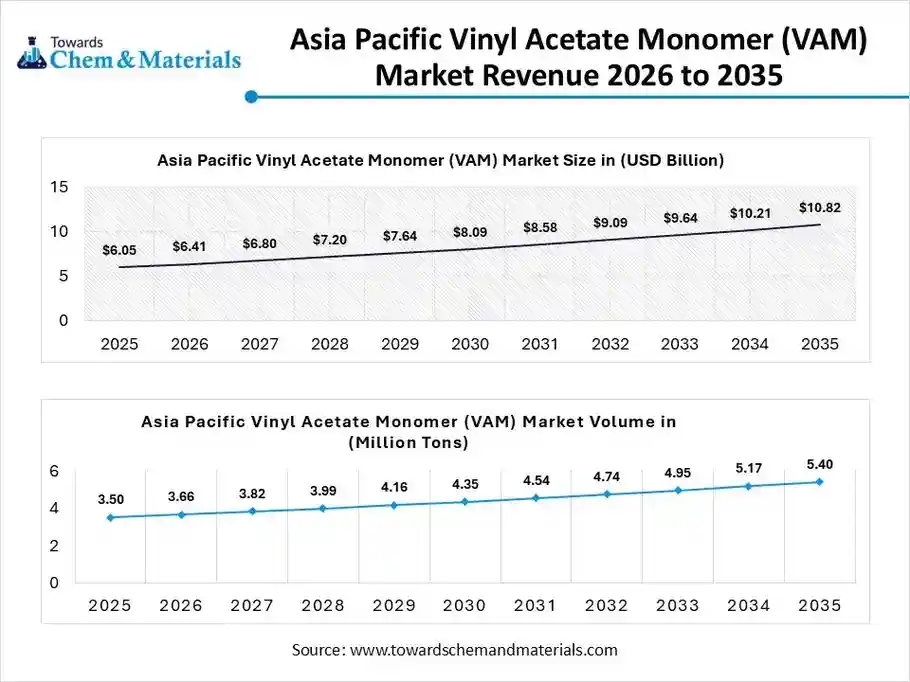

The Asia Pacific vinyl acetate monomer (VAM) market size was valued at USD 6.05 billion in 2025 and is expected to be worth around USD 10.82 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 5.99% over the forecast period from 2026 to 2035.

The Asia Pacific vinyl acetate monomer (VAM) volume was estimated at 3.5 million tons in 2025 and is projected to reach 5.4 million tons by 2035, growing at a CAGR of 4.82% from 2026 to 2035. Asia Pacific dominated the vinyl acetate monomer (VAM) market with 48% share in 2025, due to the presence of the heavy manufacturing infrastructure and stronger domestic demand. Also, by having stronger hold in sectors such as the construction, textiles, packaging, and consumer goods is actively creating lucrative opportunities for the VAM manufacturers in recent years. Moreover, factors like low labor cost and strong raw material availability have led to robust revenue growth across the industry in the past few years.

Policy Support Fuels Local VAM Growth in China

China maintained its dominance in the market, owing to the country being known as the major consumer or producer of the vinyl acetate monomer in the current period. Also, China has heavy chemical manufacturing clusters that have supported the greater production of the VAM in the country over the years. Furthermore, the government pushes for the minimization of imports, leading to the local VAM production in China nowadays.

North America Vinyl Acetate Monomer (VAM) Market Evaluation

The North America vinyl acetate monomer (VAM) volume was estimated at 1.6 million tons in 2025 and is projected to reach 2.8 million tons by 2035, growing at a CAGR of 6.53% from 2026 to 2035. North America is expected to capture a major share of the market with a rapid CAGR, owing to technology-driven demand rather than volume-based demand. The region focuses on high-performance applications, stable quality, and advanced materials. Moreover, the strong investment in clean energy, electric vehicles, and smart construction increases demand for VAM-based polymers. Producers in North America prioritize safety, consistency, and regulatory compliance, which suits future market needs.

Automation Demand Strengthens VAM Market in the United States

United States is expected to emerge as a prominent country for the market in the coming years due to strong innovation and application development. Also, demand comes from solar panels, automotive components, advanced packaging, and specialty adhesives. Moreover, the manufacturers in the United States prefer stabilized and high-quality VAM that supports automated production. The country also benefits from strong research capabilities, allowing faster adoption of new materials.

Europe Vinyl Acetate Monomer (VAM) Market Examination

The Europe vinyl acetate monomer (VAM) volume was estimated at 1.3 million tons in 2025 and is projected to reach 2.1 million tons by 2035, growing at a CAGR of 5.61% from 2026 to 2035. Europe is notably growing in the industry, owing to its focus on sustainability and regulation-driven innovation. The region promotes low-emission materials, recyclable packaging, and energy-efficient construction. These policies increase demand for advanced VAM-based polymers. European manufacturers also invest in process efficiency rather than scale, improving material performance.

Germany Drives High Grade VAM Demand

Germany is expected to gain a major industry share, akin to its strong industrial base and engineering focus. Demand comes from automotive manufacturing, industrial coatings, advanced packaging, and renewable energy applications. German companies prioritize precision, consistency, and compliance, which favors high-grade VAM products in the current period.

Vinyl Acetate Monomer (VAM) Market Volume and Share, By Region, 2025-2035

| By Region | Market Volume Share (%), 2025 | Market Volume ( Million Tons)2025 | Market Volume (Million Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| North America | 22.00% | 1.6 | 2.8 | 6.53% | 24.10% |

| Europe | 18.00% | 1.3 | 2.1 | 5.61% | 18.24% |

| Asia Pacific | 48.00% | 3.5 | 5.4 | 4.82% | 45.43% |

| Latin America | 5.00% | 0.4 | 0.6 | 5.76% | 5.13% |

| Middle East & Africa | 7.00% | 0.5 | 0.8 | 5.63% | 7.10% |

Recent Developments

- In November 2024, Kuraray acquires an ISCC PLUS certification, which plays a major in the creation of a certified supply chain starting with VAM. Also, the certification supports the international program of sustainable products, as per the company's claim.(Source: www.kuraray.com)

Top Vendors in the Vinyl Acetate Monomer (VAM) Market & Their Offerings:

- Celanese Corporation: As the world's largest producer of VAM, Celanese utilizes its proprietary VAntage® technology to lead the global market with the highest integrated production capacity across the Americas, Europe, and Asia.

- China Petrochemical Corporation (Sinopec): A state-owned energy giant and the primary VAM producer in Asia, Sinopec leverages a massive, integrated supply chain of coal-to-chemical and petrochemical feedstocks to dominate the Chinese market.

- LyondellBasell Industries N.V.: A global leader in refining and chemicals, LyondellBasell operates high-efficiency ethylene-based VAM facilities that primarily serve the global high-end adhesives and specialty polymer industries.

- Dow Inc.: A global materials science leader, Dow produces VAM as a critical internal building block to supply its high-performance segments in packaging, infrastructure, and consumer applications.

- Dairen Chemical Corporation (DCC)

- Wacker Chemie AG

- Kuraray Co., Ltd.

- INEOS Group

- Sipchem (Saudi International Petrochemical Co.)

- Chang Chun Group

- Arkema S.A.

- Mitsubishi Chemical Group

- Showa Denko K.K. (Resonac)

- Lotte Chemical Corporation

- Jiangsu Sopo (Group) Co., Ltd.

Segments Covered in the Report

By Product Type

- Liquid VAM

- Stabilized VAM

- Solid/Gaseous VAM

- Others

By End-User Industry

- Packaging

- Construction

- Adhesives & Sealants

- Textiles

- Paints & Coatings

- Others (Solar/Automotive)

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa