Content

U.S. Metamaterials Market Size, Share, Trends and Forecasts 2034

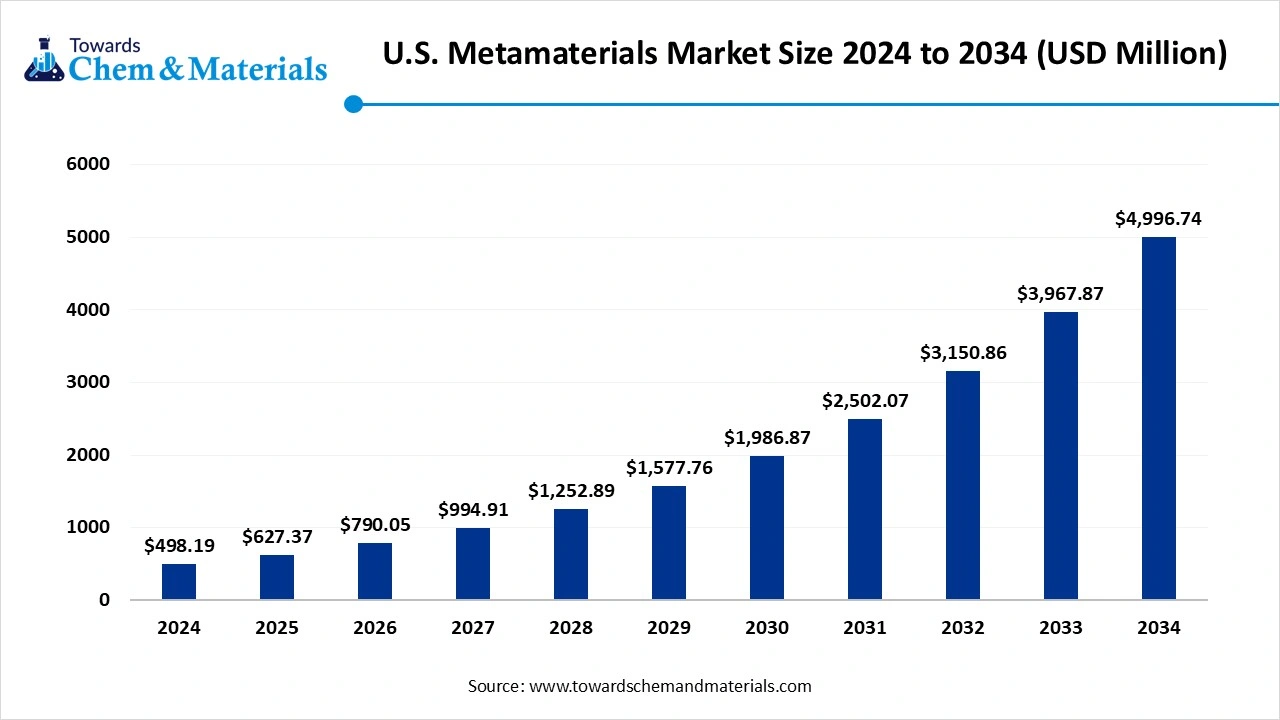

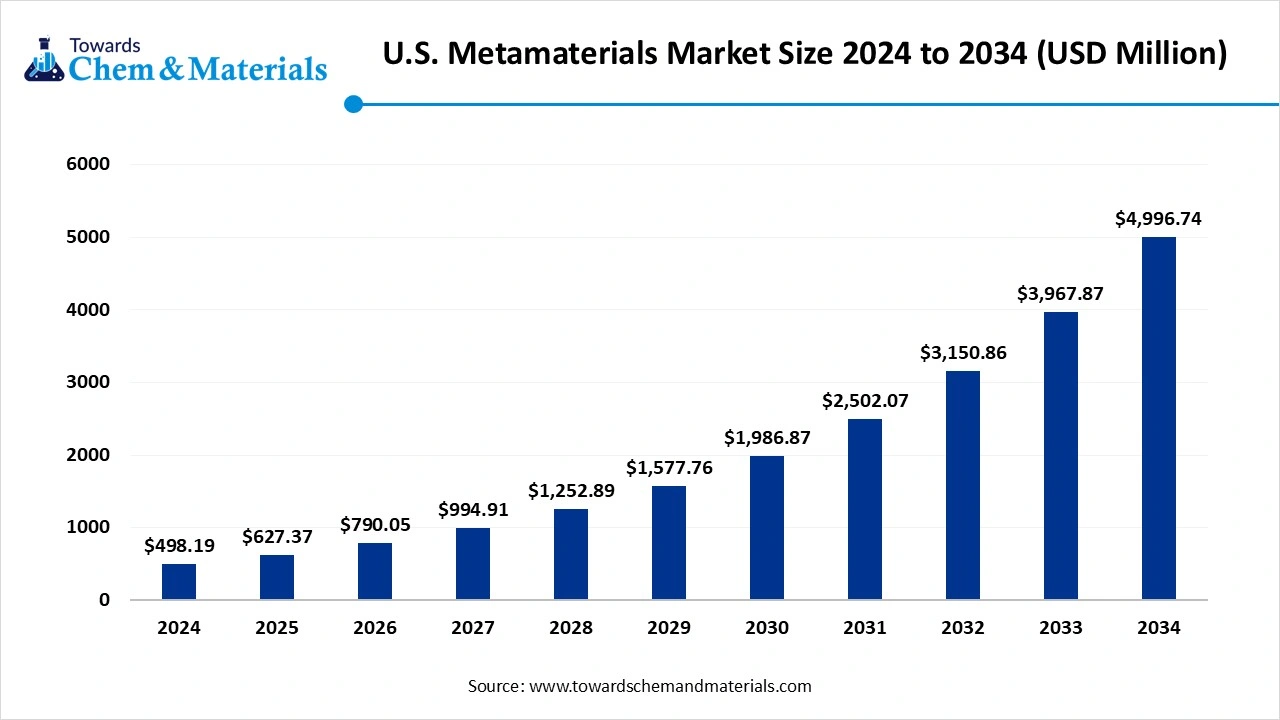

The U.S. metamaterials market size was valued at USD 498.19 million in 2024 and is expected to hit around USD 4,996.74 million by 2034, growing at a compound annual growth rate (CAGR) of 25.93% over the forecast period from 2025 to 2034. The growth of the market is driven by the growing demand for materials in the market and in various sectors, especially telecommunications, aerospace, and healthcare, which drives the growth of the market.

Key Takeaways

- By type of metamaterials, the electromagnetic metamaterials segment dominated the market with a share of 60% in 2024.

- By type of metamaterials, the mechanical metamaterials segment is expected to grow significantly in the market during the forecast period.

- By product form, the thin film segment dominated the market with a share of 55% in 2024.

- By product form, the bulk materials segment is expected to grow in the forecast period.

- By application, the telecommunications & networking segment dominated the market with a share of 35% in 2024.

- By application, the healthcare & medical devices segment is expected to grow in the forecast period.

Market Overview

What Is The Significance Of The U.S. Metamaterials Market?

The U.S. metamaterials market is crucial because it has the potential to transform various high-tech sectors such as defense, aerospace, and telecommunications. It offers advanced features like stealth capabilities, high-performance antennas, and improved medical imaging. Fueled by investments from both government and private sectors, technological progress, and increasing demand for alternatives to traditional materials, this market is a major catalyst for future innovation and economic development in the United States.

U.S. Metamaterials Market Outlook

- Industry Growth Overview: Between 2025 and 2034, the U.S. metamaterials market is projected to grow rapidly, driven by increasing adoption in aerospace, defense, telecommunications, and healthcare applications. Growth is supported by the expanding 5G infrastructure, advanced radar and antenna systems, and electromagnetic interference (EMI) shielding technologies.

Sustainability Trends: Sustainability in metamaterials is emerging through energy-efficient applications and resource optimization. Metamaterial-based antennas and sensors enable lighter, smaller, and lower-power devices, contributing to energy savings across communication and defense systems. - Global Expansion & Innovation: Leading U.S. players and research institutions are partnering to advance large-scale manufacturing and commercialization. Collaborations with aerospace and telecom companies are enhancing product deployment for satellite communications, stealth technologies, and photonics.

Key Technological Shifts In The U.S. Metamaterials Market :

Key technological shifts in the market are accelerating innovation by improving design and manufacturing, creating more scalable and customizable products. These advancements are enabling a wider range of applications, especially in telecommunications, aerospace, and healthcare. The integration of ArtificiaI Intelligence and ML in the streamlining of design and prototyping phases of metamaterials and AI integration also helps in optimization, and AI-driven techniques help rapidly explore a vast number of potential configurations.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 627.37 Million |

| Expected Size by 2034 | USD 4,996.74 Million |

| Growth Rate from 2025 to 2034 | CAGR 25.93% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Types of Metamaterials, By Product Form, By Application (Technology Use Cases), |

| Key Companies Profiled | NKT Photonics A/S , Plasmonics Inc. TeraView Ltd. , Metamagnetics Inc. , Fractal Antenna Systems Inc. , Alight Technologies ApS , Evolv Technology , Metashield LLC , Metamaterial Inc. , NanoSonic Inc. , Radi-Cool Inc. , Metaboards Ltd. , Metamaterial Technologies USA Inc. , QuesTek Innovations LLC , Lumotive Inc. |

Trade Analysis Of U.S. Metamaterials Market: Imports & Export Statistics

- North America, particularly the US, is a leader in the metamaterials market. This is due to a robust innovation ecosystem with strong government funding and a well-developed technological infrastructure.

- Prominent US-based companies in the market include Kymeta Corporation, Pivotal Commware, Echodyne Corp, and Metalenz, Inc.

- In 2023, the U.S. was reported to have exported $1.5 billion worth of metamaterial products, with Europe and Asia-Pacific being major importers.

- Most of the Phase Changing Material exports from the United States go to Colombia, the United Kingdom, and India.

- The United States shipped out 14 shipments of Phase Changing Material from Aug 2023 to Jul 2024. These exports were handled by 9 United States exporters to 2 Buyers, showing a growth rate of 133% over the previous twelve months.

U.S. Metamaterials Market Value Chain Analysis

- Chemical Synthesis and Processing: Metamaterials are synthesized using specialized microfabrication techniques, while processes like calendaring and chemical recycling are typically used for commodity materials such as plastics.

- Key players : Kymeta Corporation, Pivotal Commware, Fractal Antenna Systems, Inc., and Metalenz, Inc.

- Quality Testing and Certification: The metamaterials require AS9100 / EN 9100, ASTM Aerospace Material Standards, and FCC Certification.

- Key players: ASTM International, FDA, and UL Solutions

- Distribution to Industrial Users: The metamaterials are distributed to telecommunications, aerospace and defense, medical devices, automotive, construction, and consumer electronics industries.

- Key players: Echodyne Corp., Metalenz, Inc., Lumotive, and Uhnder.

Metamaterials Regulatory Landscape: Global Regulations

| Country / Region | Regulatory Body | Key Regulations | Focus Areas | Notable Notes |

| United States | Federal Communications Commission (FCC), U.S. Department of Defense (DoD), Food and Drug Administration (FDA), Federal Aviation Administration (FAA), ASTM / IEEE Standards Committees | - FCC Part 15 & 18 (electromagnetic emission and radiofrequency device compliance) - DoD MIL-STD-810 & MIL-STD-461 (environmental and electromagnetic compatibility standards for defense systems) - FDA 21 CFR Part 890 & 812 (for metamaterial-based medical or imaging devices) - FAA Part 23/25 Material Certification (for aerospace applications) - IEEE/ASTM Nanotechnology Standards (e.g., IEEE P2863) (characterization and testing of metamaterials) |

- Electromagnetic compatibility - Safety and performance in defense and medical applications - Material reliability and environmental testing - Emission compliance for wireless/optical devices |

The regulatory framework depends heavily on the end-use sector (defense, telecom, optics, medical). Most metamaterials fall under existing material or device standards rather than standalone regulation. Increasing focus on supply chain traceability and dual-use export controls (ITAR/EAR) for defense-related materials. |

Segmental Insights

Type of Metamaterials

Which Type Of Metamaterials Segment Dominated The U.S. Metamaterials Market In 2024?

The electromagnetic metamaterials segment dominated the market with a share of 60% in 2024. Electromagnetic metamaterials dominate the U.S. market, driven by advancements in radar absorption, antennas, and satellite communication. These materials alter electromagnetic wave propagation, enabling high-performance optical and radio-frequency applications. The rapid adoption in defense, aerospace, and telecommunications for stealth and beamforming technologies, combined with growing R&D funding, is expected to further accelerate market penetration and commercialization across major U.S. industries.

The mechanical metamaterials segment expects significant growth in the U.S. metamaterials market during the forecast period. Mechanical metamaterials are gaining significance in the U.S. due to their extraordinary structural properties, such as lightweight strength, negative Poisson’s ratio, and adaptive flexibility. They are being integrated into aerospace, automotive, and medical applications for impact resistance and performance optimization. Their tunable mechanical response makes them ideal for energy absorption, vibration control, and next-generation structural materials, supporting innovation in high-performance manufacturing sectors.

Product Form Insights

How Did The Thin Film Segment Dominate The U.S. Metamaterials Market In 2024?

The thin film segment dominated the market with a share of 55% in 2024. Thin-film metamaterials are extensively used in optics, flexible electronics, and advanced sensors across the U.S. market. These films provide precise control over light and electromagnetic responses, making them critical for photonic circuits, optical filters, and energy-efficient display technologies. Supported by nanofabrication advancements and high industrial demand, thin-film metamaterials are helping create lighter, more compact, and multifunctional components in electronics and renewable energy systems.

The bulk materials segment expects significant growth in the market during the forecast period. Bulk metamaterials in the U.S. are increasingly applied in acoustic dampening, vibration reduction, and structural applications. Their scalable manufacturing potential and robust performance make them suitable for infrastructure, transportation, and energy systems. They offer mechanical stability under stress and enhance energy harvesting capabilities, contributing to sustainable industrial design and improved material efficiency in construction, automotive, and power generation applications.

Application Insights

Which Application Segment Dominated The U.S. Metamaterials Market In 2024?

The telecommunications & networking segment dominated the market with a share of 35% in 2024. Metamaterials are revolutionizing the U.S. telecommunication sector by enhancing antenna efficiency, reducing signal loss, and improving 5G and upcoming 6G networks. Their ability to manipulate electromagnetic waves enables ultra-fast communication, compact device design, and increased data capacity. U.S. investments in next-generation networking, including defense communication and satellite connectivity, are expected to sustain strong growth in this application segment.

The healthcare & medical devices segment expects significant growth in the U.S. metamaterials market during the forecast period. In the U.S., metamaterials are transforming healthcare by enabling breakthroughs in diagnostic imaging, biosensing, and medical device performance. They enhance MRI imaging precision, develop miniaturized biosensors, and support wearable technologies for real-time monitoring. Collaborations between research institutes and medtech companies are promoting innovation in non-invasive diagnostic tools, therapeutic devices, and next-generation implant materials, strengthening the nation’s medical technology ecosystem.

Recent Developments

- In September 2025, Researchers at Rice University developed a soft magnetic metamaterial capable of remote control via an external magnet. This material can retain its shape without continuous power and is being explored for potentially revolutionizing implantable and ingestible medical devices.(Source: www.yahoo.com)

- In October 2025, Multiwave Technologies AG, a medical imaging company, successfully raised CHF 3.6 million in funding to support the development and regulatory approval of its portable MRI device, MGNTQ™. The funding will also facilitate the company's expansion into the United States with a new assembly plant in Lowell, Massachusetts, ahead of a planned 2026 commercial launch.(Source: ggba.swiss)

Top Players In The U.S. Metamaterials Market & Their Offerings:

- Echodyne Corporation: Specializes in metamaterial-based radar systems, offering compact and high-performance radar solutions for defense, autonomous vehicles, and security applications through its proprietary Metamaterial Electronically Scanning Array technology.

- Kymeta Corporation: Focused on advanced satellite communication systems, Kymeta develops metamaterial-based flat-panel antennas that enable high-speed, reliable connectivity for mobile, maritime, and defense markets.

- Metamaterial Technologies Inc.: Develops and manufactures advanced metamaterial products for aerospace, defense, and consumer electronics, including smart surfaces, holographic filters, and transparent conductive films.

- Multiwave Technologies AG: Provides metamaterial solutions for medical imaging, wireless communication, and electromagnetic applications, leveraging its expertise in computational design and advanced materials engineering.

- Nanohmics Inc.: Engages in the design and development of metamaterial-based optical and electromagnetic devices, offering innovative solutions for defense, aerospace, and sensing applications.

Other Top Players Are

- NKT Photonics A/S

- Plasmonics Inc.

- TeraView Ltd.

- Metamagnetics Inc.

- Fractal Antenna Systems Inc.

- Alight Technologies ApS

- Evolv Technology

- Metashield LLC

- Metamaterial Inc.

- NanoSonic Inc.

- Radi-Cool Inc.

- Metaboards Ltd.

- Metamaterial Technologies USA Inc.

- QuesTek Innovations LLC

- Lumotive Inc.

Segments Covered:

By Types of Metamaterials

- Electromagnetic Metamaterials

- Terahertz Metamaterials

- Photonic Metamaterials

- Tunable Metamaterials

- Frequency Selective Surfaces (FSS)

- Acoustic Metamaterials

- Noise Control

- Vibration Damping

- Mechanical Metamaterials

- Auxetic Materials

- Origami-inspired Structures

- Optical Metamaterials

- Negative Index Materials

- Plasmonic Metamaterials

- Thermal Metamaterials

- Thermal Cloaking

- Thermal Insulation

- Quantum & Other Metamaterials

- Quantum Metamaterials

- Elastic Metamaterials

By Product Form

- Thin Film

- 2D Materials

- Meta-surfaces

- Bulk Materials

- 3D Structures

- Composite Materials

By Application (Technology Use Cases)

- Telecommunications & Networking

- 5G/6G Networks

- Beam Steering

- Reconfigurable Intelligent Surfaces (RIS)

- Radar & Sensing

- Military Radar Systems

- Satellite Communications

- Stealth Technology

- Healthcare & Medical Devices

- Medical Imaging

- Biosensors

- Therapeutic Devices

- Energy & Environmental

- Solar Panels

- Thermal Management

- Energy Harvesting

- Consumer & Industrial Electronics

- Smartphones

- Wearables

- Acoustic & Vibration Control

- Others

- Robotics

- Agriculture