Content

U.S. Ceramic Tiles Market Size, Share, Trends and Forecasts 2034

The U.S. ceramic tiles market size was reached at USD 4.85 Billion in 2024 and is expected to be worth around USD 9.64 billion by 2034, growing at a compound annual growth rate (CAGR) of 7.11% over the forecast period 2025 to 2034.The growing construction activities and increasing home renovation drive the market growth.

Key Takeaways

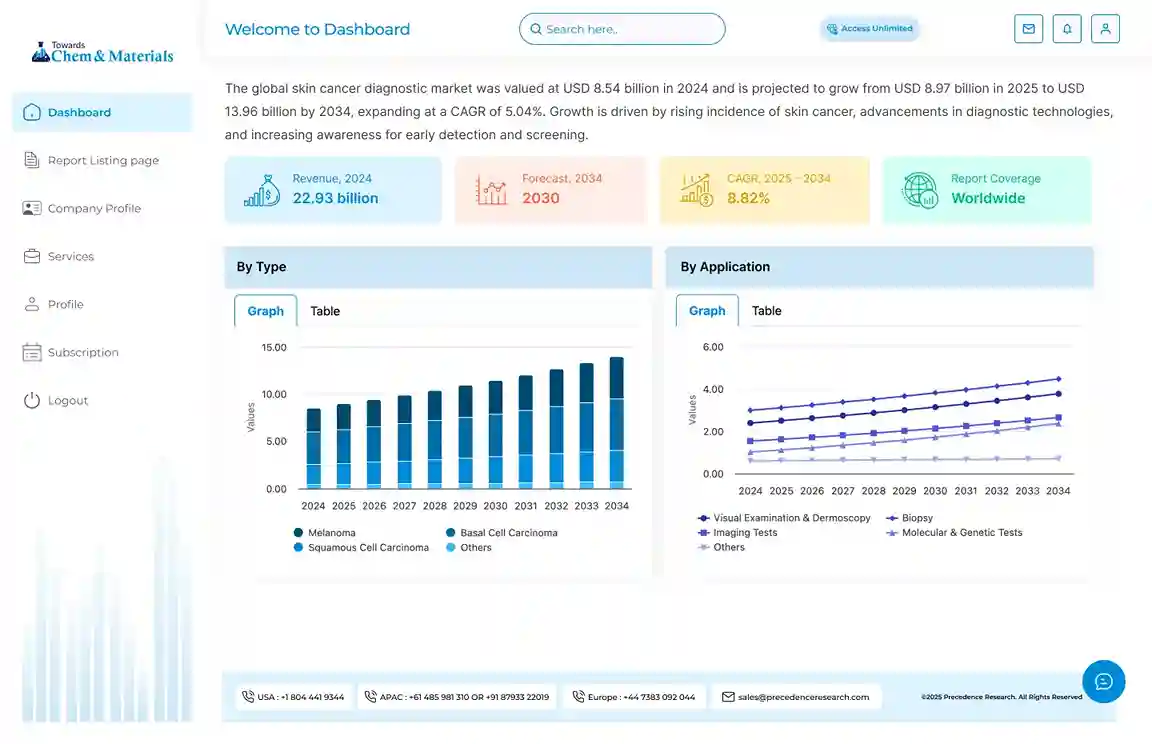

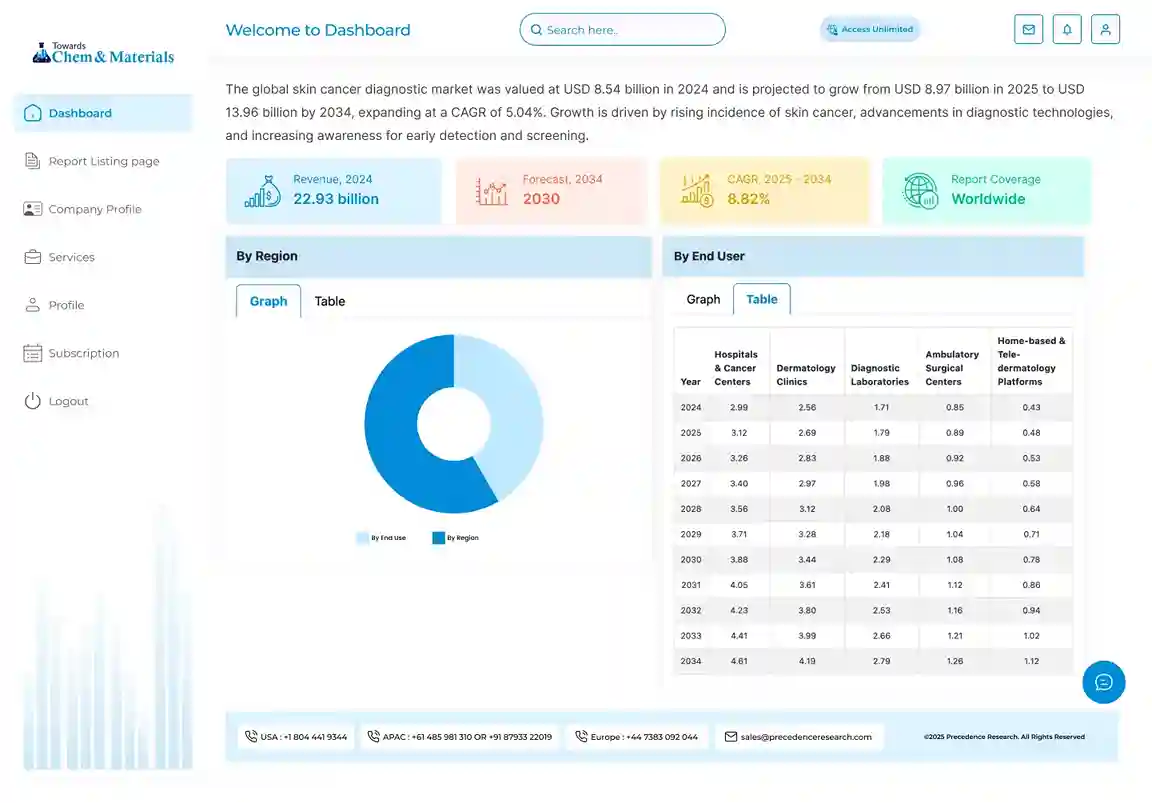

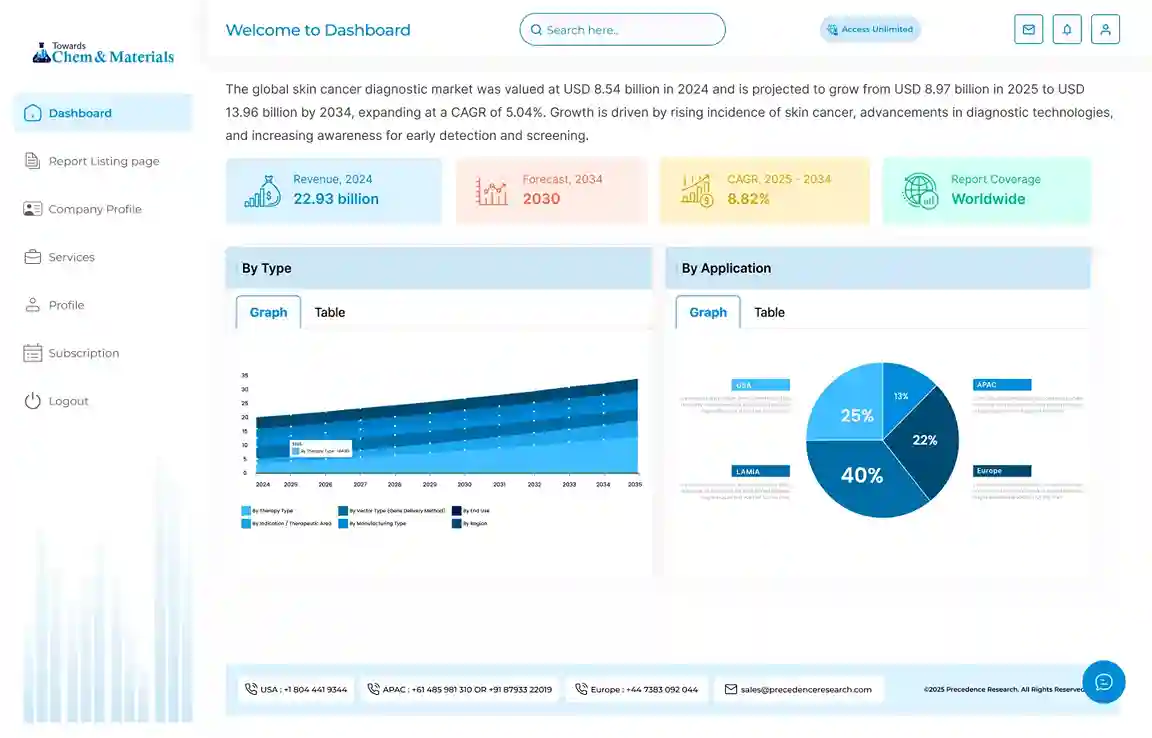

- By product type, the porcelain tiles segment held a 35% share in the market in 2024.

- By product type, the large format tiles segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By application, the flooring segment held a 50% share in the market in 2024.

- By application, the wall cladding segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By construction type, the new construction segment held a 60% share in the market in 2024.

- By construction type, the renovation & replacement segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By distribution, the home centers segment held a 40% share in the market in 2024.

- By distribution, the online retailers segment is expected to grow at the fastest CAGR in the market during the forecast period.

What are Ceramic Tiles?

The U.S. ceramic tiles market growth is driven by growing residential construction activities, increasing adoption of green building materials, rising development of commercial infrastructure projects, and a rise in home renovation.

Ceramic tiles are a blend of water, clay, and sand that are shaped & fired at high temperatures in a kiln to create a stylish & durable product. Ceramic tiles offer characteristics like low maintenance, water absorption, high durability, and various design styles. They are widely used in countertops, kitchen flooring, residential floors, interior walls, tabletops, and bathroom floors.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 5.19 Billion |

| Expected Size by 2034 | USD 9.64 Billion |

| Growth Rate from 2025 to 2034 | CAGR 7.11% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Product Type, By Application, By Construction Type, By Distribution Channel |

| Key Companies Profiled | Arizona Tile, The Tile Shop, MSI Surfaces, Bedrosians Tile & Stone, Pavé Tile, Wood & Stone, Hakatai, Susan Jablon Mosaics, Clayhaus Ceramics, Roca Tile USA, Vitromex USA, Stonepeak Ceramics Inc., AKDO, Metropolitan Ceramics, Florim USA, Interceramic |

U.S. Ceramic Tiles Market Outlook:

- Industry Growth Overview: Between 2025 and 2034, the industry is expected to see accelerated growth in high-margin niches such as home renovation and residential construction projects. Growth is being reinforced by rapid urbanization and preference for durable & stylish interiors in States like Texas, New York, California, and Florida.

- Sustainability Trends: Sustainability is transforming the U.S. ceramic tiles outlook, with a strong focus on energy-efficient manufacturing, minimizing water consumption, and growing use of recycled content. For instance, Mohawk Industries uses recycled content for the development of tiles to lower its carbon footprint.

- Major Investors: Corporate companies and foreign investors are actively investing in ceramic tiles, driven by innovations in manufacturing processes and growth in the construction sector, and high demand for sustainable building materials. Mohawk Industries invested in Marazzi Group, American Olean, Daltile Corporation, and Vitromex for the production of ceramic tiles.

Key Technological Shifts in the U.S. Ceramic Tiles Market:

The U.S. ceramic tiles market is undergoing key technological shifts driven by the demand for visually appealing designs, enhanced quality control, and detect defects in tiles. One of the most significant transformations is the integration with Artificial Intelligence, which minimizes the consumption of energy and enables a sustainable manufacturing process.

AI streamlines the product development process and generates personalised tile designs. AI improves predictive quality, visual inspection, and real-time color management.

- For instance, Mohawk Industries uses AI to inform its new tile collections, improve product consistency, boost productivity in manufacturing operations, and detect production flaws.

Trade Analysis of the U.S. Ceramic Tiles Market: Import & Export Statistics

- The United States exported $791K of glazed ceramic tiles (>7cm) in 2023.(Source: oec.world)

- The United States exported $64.1M of unglazed ceramic tiles, flags (>7cm wide) in 2023.(Source: oec.world)

- The United States imported 478,697 shipments of ceramic tile.(Source: www.volza.com)

- The United States imported 89 shipments of decorative ceramic tile.(Source: www.volza.com)

U.S. Ceramic Tiles Market Value Chain Analysis

- Feedstock Procurement: The feedstock procurement involves the process of sourcing, buying, & supply management of feedstocks like feldspar, water, clay, & quartz.

- Chemical Synthesis & Processing: The chemical synthesis & processing involve steps like ceramic body preparation, firing, glazing, and decoration.

- Quality Testing & Certifications: The quality testing involves testing of water absorption, abrasion resistance, slip resistance, strength, chemical resistance, & dimensional accuracy, and certifications like PTCA & ASTM.

What are the Different Types of Ceramic Tiles?

| Types | Characteristics | Used For |

| Glazed Ceramic Tiles |

|

|

| Unglazed Ceramic Tiles |

|

|

| Porcelain Tiles |

|

|

| Mosaic Tiles |

|

|

Market Opportunity

Growing Construction Activities Surge Demand for Ceramic Tiles

The rapid urbanization and growth in construction activities in the United States increase demand for ceramic tiles. The rise in the development of commercial & residential construction requires ceramic tiles for applications like kitchen flooring, interior walls, and bathroom floors.

The growth in the development of infrastructure projects and real estate increases the adoption of ceramic tiles. The growing projects like schools, malls, airports, & hospitals, and trending modern designs, increase demand for ceramic tiles. The strong government support for infrastructure development and growing renovation of residential & commercial projects requires ceramic tiles. The growing construction activities create an opportunity for the growth of the U.S. ceramic tiles market.

Market Challenge

High Production Cost Creates Hurdles in Market Growth

Despite several applications of the ceramic tiles in the United States, the high production cost restricts the market growth. Factors like an energy-intensive manufacturing process, high-quality materials, fluctuations in raw material prices, and stringent environmental regulations are responsible for the high production cost.

The volatility in prices of feedstocks like quartz, clay, & feldspar and the complex manufacturing process increase the cost. The stricter environmental regulations and supply chain disruption issues require a high cost. The high production cost hampers the growth of the market.

Segmental Insights

Product Type Insights

Why the Porcelain Tiles Segment Dominates the U.S. Ceramic Tiles Market?

The porcelain tiles segment dominated the market with a 35% share in 2024. The growing development of residential and commercial construction activities increases demand for porcelain tiles. They offer exceptional strength and a low water absorption rate. Porcelain tiles require low maintenance and offer mold resistance. The growth in the development of commercial spaces like airports, restaurants, malls, & hotels increases demand for ceramic tiles, supporting the overall growth of the market.

The large format tiles segment is the fastest-growing in the market during the forecast period. The strong focus on an expansive look and the increasing need for a modern aesthetic increase demand for large format tiles. The growing development of commercial and residential spaces increases the adoption of large format tiles. The growth in home renovations and increasing demand for sustainable materials requires large format tiles, supporting the overall growth of the market.

Application Insights

Which Application Held the Largest Share in the U.S. Ceramic Tiles Market?

The flooring segment held the largest revenue share of 50% in the market in 2024. The strong focus on premium aesthetics and growth in residential construction activities requires flooring. The rise in the development of commercial projects and the focus on energy-efficient homes increases demand for flooring. The growth in commercial projects and the rise in residential renovations require flooring, driving the overall growth of the market.

The wall cladding segment is experiencing the fastest growth in the market during the forecast period. The growing development of kitchen and bathroom spaces increases demand for wall cladding. The booming home renovation projects and the development of multifamily housing projects require wall cladding. The shift towards DIY home improvements and a focus on energy-efficient construction increases the adoption of wall cladding, supporting the overall growth of the market.

Construction Type Insights

Why New Construction Segment Dominating the U.S. Ceramic Tiles Market?

The new construction segment dominated the market with a 60% share in 2024. The growing construction of new homes and high investment in the development of commercial projects increase demand for ceramic tiles. The growth in the development of retail spaces, new office buildings, and hotels requires ceramic tiles. The increasing infrastructure development and rise in the adoption of green buildings increase demand for ceramic tiles, driving the overall growth of the market.

The renovation & replacement segment is the fastest-growing in the market during the forecast period. The strong focus on home improvement and high spending on home renovation projects requires ceramic tiles. The focus on improving the aesthetic appeal of homes and increasing customization of homes increases demand for ceramic tiles. The growing home improvement sales and focus on interior refreshes require ceramic tiles, supporting the overall growth of the market.

Distribution Channel Insights

How Home Centers Segment Held the Largest Share in the U.S. Ceramic Tiles Market?

The home centers segment held the largest revenue share of 40% in the market in 2024. The simple purchasing process and the convenience of buying increase the adoption of home centers. The strong focus on DIY and the growing trend of renovation increase buying from home centers. The increasing need for an omnichannel shopping experience and the availability of various products drive the overall growth of the market.

The online retailers segment is experiencing the fastest growth in the market during the forecast period. The availability of a broader range of products and digital visualization tools increases purchasing from online retailers. The high level of convenience and price competitiveness increases the adoption of online retailers. The availability of sample box services and the increasing need for personalised products support the overall market growth.

Country Insights

South U.S. Ceramic Tiles Market Trends

The South region dominated the market with a 30% share in 2024. The presence of abundant raw materials and the growing single-family home construction increases the demand for ceramic tiles. The growth in residential construction activities and the rise in commercial construction projects increase the adoption of ceramic tiles. The growing home & commercial renovation activities and the rise in flooring options require ceramic tiles, driving the overall growth of the market.

West U.S. Ceramic Tiles Market Trends

The West region expects the fastest growth in the market during the forecast period. The growth in the development of residential construction projects and the booming home renovation activities increase demand for ceramic tiles. The rise in the development of single-family homes and a strong focus on design & quality increases demand for ceramic tiles. The growing development of commercial infrastructure projects like retail spaces, hotels, & offices requires ceramic tiles, supporting the overall growth of the market

Recent Developments

- In October 2023, Du-Co Ceramics introduced the latest metallized product range. The product range includes ceramic to metal assemblies, metalized steatite bushings, and hermetically sealed ceramic terminals. (Source: du-co.com )

- In September 2025, Tile of Spain launched its 13th annual U.S. Quick Ship Collection featuring more than 115 ceramic tiles. The collection is applicable for commercial & residential projects and offers current architectural trends & design.(Source: www.fcnews.net)

- In April 2024, Florim USA launched large-format tile. The tile is made up of gauged porcelain and consists of a size 32 inches by 96 inches. The tile is applicable for vanities, dining tables, end tables, benches, high-top bars, outdoor kitchens, shower surrounds, and countertops.(Source: www.fcnews.net)

Top Companies List

- Mohawk Industries: The global flooring manufacturer leader with a comprehensive product line including luxury vinyl tile, hardwood flooring, ceramic & porcelain tile, and laminate.

- Dal-Tile Corporation: The North America-based company manufactures products like large format slabs, porcelain, metal, ceramic, & glass tiles, and natural stone.

- Emser Tile: The Los Angeles-based company offers a commercial and residential product range, including ceramic tiles, luxury vinyl tile, natural stone, and others.

- Crossville Inc: The US-based company manufactures high-quality ceramic & porcelain tiles for commercial & residential projects.

- Florida Tile: The American distributor and manufacturing company that manufactures products like ceramic, glass, porcelain, natural stone, and metal tiles.

Other Top Companies

- Arizona Tile

- The Tile Shop

- MSI Surfaces

- Bedrosians Tile & Stone

- Pavé Tile, Wood & Stone

- Hakatai

- Susan Jablon Mosaics

- Clayhaus Ceramics

- Roca Tile USA

- Vitromex USA

- Stonepeak Ceramics Inc.

- AKDO

- Metropolitan Ceramics

- Florim USA

- Interceramic

Segments Covered

By Product Type

- Porcelain Tiles

- Glazed Ceramic Tiles

- Unglazed Ceramic Tiles

- Mosaic Tiles

- Decorative Tiles

- Wood-Look Tiles

- Stone-Look Tiles

- Glass Tiles

- Large Format Tiles

- Thin Tiles

- Anti-Slip Tiles

- Outdoor Tiles

By Application

- Flooring

- Wall Cladding

- Countertops

- Ceiling Tiles

- Roofing Tiles

By Construction Type

- New Construction

- Renovation & Replacement

By Distribution Channel

- Home Centers

- Specialty Stores

- Online Retailers

- Distributors

- Direct Sales