Content

U.S. Specialty Oleochemicals Market Size and Forecast 2025 to 2034

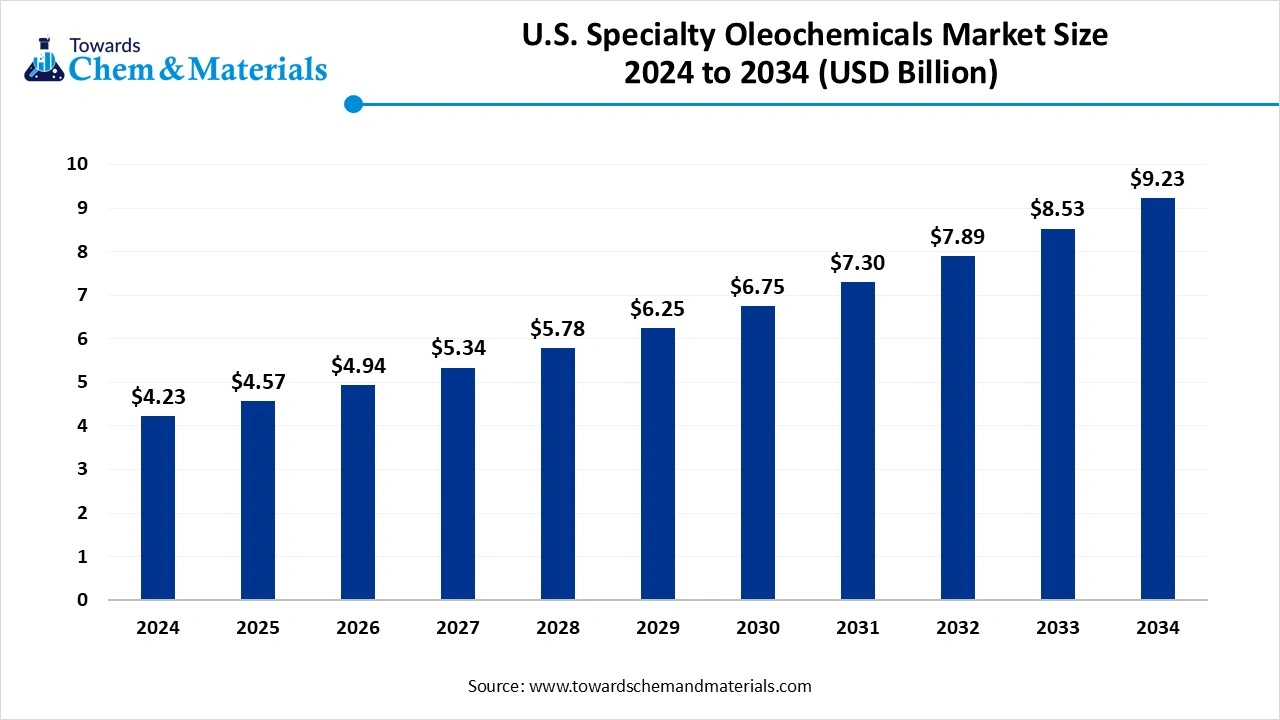

The U.S. specialty oleochemicals market size accounted for USD 4.23 billion in 2024 and is predicted to increase from USD 4.57 billion in 2025 to approximately USD 9.23 billion by 2034, expanding at a CAGR of 8.11% from 2025 to 2034. The growth of the market is driven by the rising demand by the industries and consumers for biodegradable materials and green chemicals, amid rising environmental concerns drives the growth of the market due to growing awareness among the consumers and manufacturers.

Key Takeaway

- By product, the specialty esters segment dominated the market in 2024. Its promising property of high temperature stability has caught the attention of many industries and fuels the growth.

- By product, the fatty acid methyl ester segment is expected to grow significantly in the market during the forecast period. The growing demand for its application in cosmetics and the care industry drives the growth.

- By application, the industrial segment dominated the market in 2024. The growing demand for biodegradable products drives the growth of the market.

- By application, the personal care and cosmetics segment is expected to grow in the forecast period. Its properties, like moisturizing and conditioning, drive the growth with increasing demand.

Market Overview

Title- Rising Demand for Durable Materials: U.S. Specialty Oleochemicals Market to Expand

Specialty oleochemicals are chemicals made from renewable plant-based sources that replace petroleum-based products. They're used in many areas, including lubricants, cosmetics, biodegradable polymers, and biosurfactants. These chemicals come from plant oils and animal fats, providing a renewable alternative to petroleum-based materials. They're designed to replace petroleum-based products in various applications, promoting sustainable practices by using renewable resources and reducing our reliance on fossil fuels.

They meet the growing demand for natural and eco-friendly products, helping develop new and innovative products across different industries. For example, fatty acids and derivatives are used in food, personal care, and pharmaceutical industries. Glycerine and derivatives are used in detergents, cosmetics, soaps, and personal care products. Esters and surfactants are used in various industrial and personal care products.

What Are the Key Market Drivers Responsible for The Growth of The U.S. Specialty Oleochemicals Market?

The key drivers responsible for the growth of the U.S. Specialty Oleochemicals Market are the growing consumer demand for sustainable and eco-friendly alternatives to synthetic chemicals, amid growing environmental stress and tension drives the growth of the market. The governmental initiatives and policies shifting towards sustainability due to growing awareness about the environment, promoting green chemistry, drive the demand for the market.

Increasing focus on biodegradability and the use of renewable materials with a wide range of applications in various sectors like cosmetics, pharmaceuticals, plastics, automobile, and food and beverages, and also in cleaning agents, boosts the growth of the market, and with a variety of functionalities further fuels the growth of the market. Technological innovation in the processing of bio-based materials and products in cosmetic and personal care, due to its benefits, boosts the growth and expansion of the market.

- According to Volza's United States Export data, the US shipped out 192 specialty chemical shipments. These exports were handled by 43 US exporters to 39 buyers. (Source: volza)

- Globally, the United States, Malaysia, and Singapore are the top three exporters of Materials Composite. The United States is the global leader in specialty chemicals exports with 992 shipments, followed closely by Malaysia with 423 shipments, and Singapore in third place with 351 shipments.(Source: volza)

Market Trends

- The growing consumer demand for green chemicals and biodegradable materials amid rising environmental concerns increases the demand for specialty chemicals as they are less harmful to the environment, which drives the growth of the market.

- The growing demand for biobased materials from various industries, because of their benefits in personal care and cosmetics, food processing, pharmaceutical, and other industries, drives the growth of the market.

- Technological advancement in manufacturing processes and in product design helps in improved product efficiency, and product properties are a growing trend that drives the growth of the market.

- Government regulations and initiatives for the use of renewable and biodegradable resources to preserve natural resources increase the demand for specialty chemicals, which drives the growth of the market.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 4.57 Billion |

| Expected Size by 2034 | USD 9.23 Billion |

| Growth Rate from 2025 to 2034 | CAGR 8.11% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Product, By Application |

| Key Companies Profiled | Vantage Specialty Chemicals, Emery Oleochemicals, Evonik Industries AG, Wilmar International Ltd, Kao Chemicals, PT. Eco green Oleochemicals, Cargill, Incorporated., Oleon NV, IOI Oleochemical, Twin Rivers Technologies, Inc. |

Market Opportunity

What Is the Key Market Opportunity Responsible for The U.S. Specialty Oleochemicals Market Growth?

Rising environmental benefits offering and technological advancement are the two key opportunities responsible for the growth of the U.S. specialty oleochemicals market. The specialty chemicals are renewable and eco-friendly alternatives to the traditional synthetic chemicals, which are low-toxic and cause less environmental effect, while having many applications in various industries, like chemicals, cosmetics, and pharmaceuticals, which drives the market growth. Ground-breaking research and development in the advancement of processes and methods of formulations to offer products with efficiency, and also helps in cost effectiveness with advanced applications, boosts the growth of the market. These factors help explore the chances of expansion of the market and create opportunities for growth.

Market Challenge

High Production Cost Is a Challenge That Hinders the Growth of The U.S. Specialty Oleochemicals Market.

High production cost due to an expensive manufacturing process and high-quality equipment use results in high cost of the final product, affecting the profitability which hinders the growth of the market as manufacturers faces challenges for the availability of raw materials, which results in limited scalability of the product, which contributes to the higher production cost. Supply chain issue also causes a challenge in the overall growth of the market, affecting the profitability of the U.S. specialty oleochemicals market.

Segmental Insights

By Product

Which Product Segment Dominated the U.S. Specialty Oleochemicals Market In 2024?

The specialty esters segment dominated the U.S. specialty oleochemicals market in 2024. Specialty esters have seen growth in the market due to their wide range of applications in various industries, due to their properties and characteristics. Their promising properties, like their stability at high temperatures, low volatility, and compatibility with other materials, make them a preferred choice by manufacturers. They are widely used due to their wide application in various industries as plasticizers, lubricants, emollients, solvents, and as coalescing agents, boosting the growth of the market. Specialty esters are also used by the industries because of the benefits they offer, like it helps as enhancing and improving the performance of the product and formulation, their versatility in various industries, and a replacement for traditional phthalates further helps in the growth of the market.

The fatty acid methyl ester segment expects significant growth in the U.S. specialty oleochemicals market during the forecast period. The growth of the market is driven by its wide range of applications in industries like biodiesel production, which aligns with sustainability and environmental benefits, as a lubricant to enhance performance, and properties like biodegradability and lower toxicity, in coating formulations, which help enhance durability and flexibility to changing climate conditions. They are also used in the cosmetics industry due to their moisturizing and conditioning properties in lotions, creams, and soaps, which further boosts the growth of the market. Its key application in the food industry for the products plays a major and crucial role as an emulsifier, stabilizer, and also as a flavor carrier, fueling the growth of the market. These factors and applications drive the growth of the market and help in expansion.

By Application

How Did the Industrial Segment Dominate the U.S. Specialty Oleochemicals Market In 2024?

The industrial segment dominated the U.S. specialty oleochemicals market in 2024. The growth of the market is driven by its properties, which are less toxic and eco-friendly which causing less harm to the environment as compared to the traditional synthetic chemicals, which aligns with the sustainable environment initiatives. Its application in various industries like food processing, pharmaceutical, nutraceutical, and cosmetology drives the growth.

Its properties and technological innovation in the processing of the material further boost the growth. They are extensively used in industries as they are a renewable source and also provide durability, flexibility, and adhesion, which are very useful in industries. Oleochemicals are used in industries as a cleaning agent in industrial cleaning, fueling the growth and expansion of the market.

The personal care and cosmetics segment expects significant growth in the U.S. specialty oleochemicals market during the forecast period. Personal care and cosmetics products use specialty chemicals due to rising demand from consumers for chemical-free products, which are safe and stable to use with fewer environmental problems, and align with sustainability policies. They are widely used due to their conditioning and moisturizing properties and their viscosity to enhance the spreadability of the product, which attracts the consumers and increases the demand for the product. They are also used widely to ensure environmental compliance with environmental regulations, likely to cause fewer allergic reactions and are biodegradable, and are favoured by various manufacturers as they are derived from natural sources like fats and oils, driving the growth and boosting the expansion of the market.

Recent Developments

- In February 2025, LLB Specialties, a major player in distributing specialty chemicals and ingredients across North America, announced a new partnership with Kerry Group, a globally renowned provider of taste and nutrition solutions for the pharmaceutical industry and, food and beverage industry. The collaboration aims to enhance the availability and quality of pharmaceutical lactose ingredients for use in life sciences applications. LBB Specialties will be Kerry's distribution partner in the United States and Canada for its new line of emollients, emulsifiers, and fermentation-derived actives specifically designed for skin care, personal care, and cosmetics.(Source: prnewswire)

- Later this year, in February 2025, TCL Specialties LLC, USA, a subsidiary of Thirumalai Chemicals Ltd, India, will break ground on a new petrochemical and food ingredients plant in New Martinsville, WV. The $200 million Phase I investment will bring a state-of-the-art, modular facility online, equipped with IoT technology and designed to produce Maleic Anhydride and specialty chemicals. The plant is set to start operations in Q4 2025, with full capacity expected by H1 2026, as it taps into local resources to serve North and Latin American markets.(Source: fibre2fashion)

Top Companies List

- Vantage Specialty Chemicals

- Emery Oleochemicals

- Evonik Industries AG

- Wilmar International Ltd

- Kao Chemicals

- PT. Eco green Oleochemicals

- Cargill, Incorporated.

- Oleon NV

- IOI Oleochemical

- Twin Rivers Technologies, Inc.

Segments Covered:

By Product

- Specialty Esters

- Fatty acid Methyl Ester

- Glycerol Esters

- Alkoxylates

- Fatty Amines

- Others

By Application

- Personal Care & Cosmetics

- Consumer Goods

- Food Processing

- Textiles

- Paints & Inks

- Industrial

- Healthcare & Pharmaceuticals

- Polymer & Plastic Additives

- Others