Content

What is the Current Drilling Waste Management Market Size and Share?

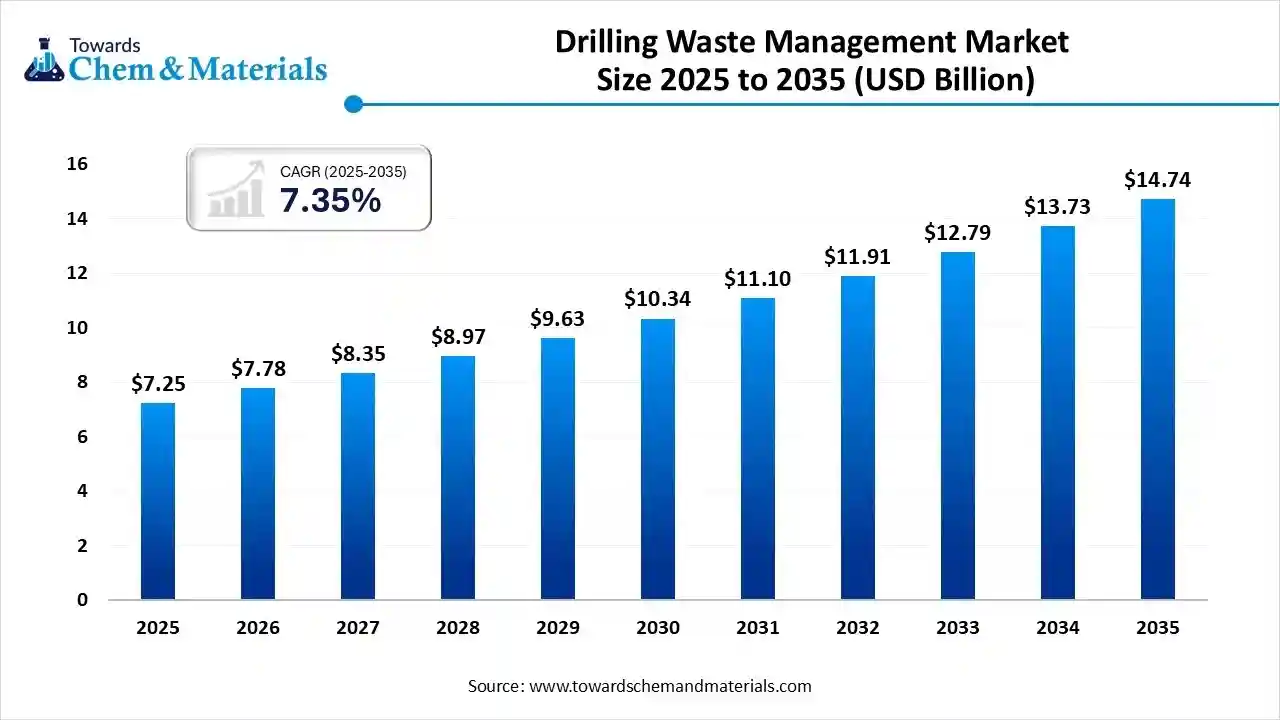

The global drilling waste management market size was estimated at USD 7.25 billion in 2025 and is predicted to increase from USD 7.78 billion in 2026 and is projected to reach around USD 14.74 billion by 2035, The market is expanding at a CAGR of 7.35% between 2026 and 2035. North America dominated the drilling waste management market with a market share of 40% the global market in 2025. The rise in drilling activities and focus on minimizing land pollution drives the market growth.

Key Takeaways

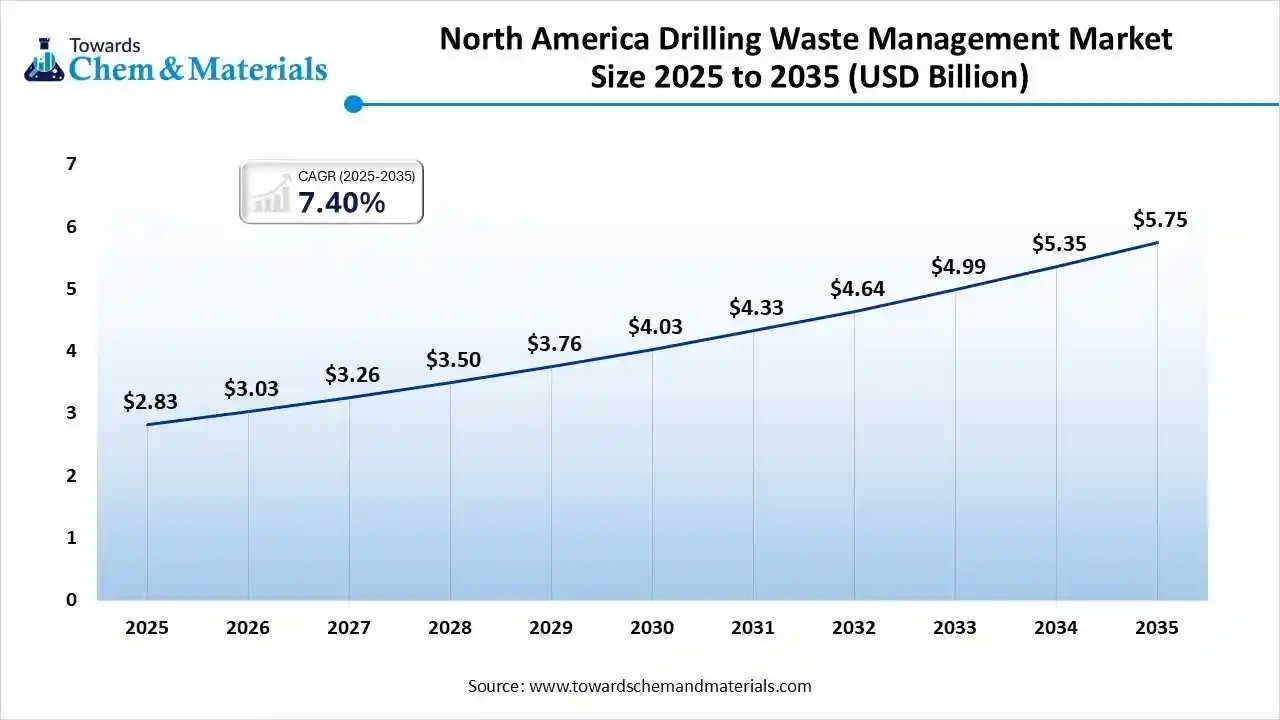

- By region, North America led the industrial cleaning chemicals market with the largest revenue share of over 40% in 2025.

- By service type, the solids control segment led the market with the largest revenue share of 45% in 2025.

- By waste type, the drill cuttings segment led the market with the largest revenue share of 60% in 2025.

- By technology, the mechanical treatment segment accounted for the largest revenue share of 55% in 2025.

- By application location, the onshore segment dominated with the largest revenue share of 70% in 2025.

- By end-user, the oil & gas operators segment dominated the market and accounted for the largest revenue share of 85% in 2025.

What is Drilling Waste Management?

The drilling waste management market growth is driven by stringent pollution regulations, a surge in deepwater exploration, a shift towards eco-friendly practices, the expansion of offshore drilling activities, the development of integrated services, rising energy demand, and a strong focus on the circular economy. The advancements in treatments like bioremediation, cutting re-injection, thermal desorption, and advanced filtration support drilling waste management and lower the environmental footprint.

Drilling waste management is the process of reducing, disposing of, treating, and reusing waste generated during oil & gas drilling. The various drilling wastes are drill cuttings, drilling fluids, produced water, and drilling muds. The common technologies used for drilling waste management are solids-liquid separation, CRI, solids control, bioremediation, and thermal desalination.

Drilling waste management offers benefits like environmental protection, resource efficiency, wildlife protection, improved performance, disposal cost minimization, and resource conservation.

Drilling Waste Management Market Trends

- Stringent Regulation: The stricter government regulations, like RCRA, EIA, EPA, and others, for efficient disposal of drill cuttings and fluids, increase the development of drilling waste management solutions.

- Expansion of E&P: The expanding drilling operations in shale gas, deepwater, and ultra-deepwater increase the adoption of drill waste management for managing high amounts of waste.

- Surging Energy Demand: The increasing energy demand in offshore and onshore drilling activities and high exploration of oil & gas generates a vast amount of wastes like contaminated water waste, mud, fluids, & cuttings that require drilling waste management.

Report Scope

| Report Attribute | Details |

| Market Size Value in 2026 | USD 7.78 Billion |

| Revenue Forecast in 2035 | USD 14.74 Billion |

| Growth Rate | CAGR 7.35% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Dominant Region | North America |

| Fastest Growing Region | Middle East & Africa |

| Segments covered | By Service Type, By Waste Type, By Technology, By Application Location, By End-User, By Region |

| Key companies profiled | National Oilwell Varco, Inc. (NOV), Baker Hughes Company, Halliburton Company, Schlumberger Limited (SLB), TWMA, Secure Energy Services, Inc., Derrick Equipment Company, Augean PLC, Scomi Group Bhd, Imdex Limited, GN Solids Control, Tervita Corporation, Newalta Corporation, Clean Harbors, Inc., Veolia Environnement S.A., Suez S.A., Ridgeline Canada, Inc., Specialty Drilling Fluids Ltd., Nuverra Environmental Solutions, Inc. |

Key Technological Shifts in the Drilling Waste Management Market:

The drilling waste management market is undergoing key technological shifts driven by the demand for performance efficiency, resource recovery, sustainability, and regulatory compliance. The technological innovations, like data analytics, advanced solids control systems, IoT integration, automation, blockchain, and robotics, enable sustainable operations and boost efficiency. The major shift is the adoption of artificial intelligence (AI) minimizes waste and optimizes logistics.

AI optimizes operational parameters like drilling speed, mud weight, and flow rates. AI accurately separates different types of waste material and easily determines waste collection routes. AI lowers contamination rates and lowers GHG emissions. AI makes informed decisions on waste management and monitors drilling waste in real-time. Overall, AI plays an important role in drilling waste management by offering valuable insights and enhancing economic performance.

Trade Analysis of Drilling Waste Management Market: Import & Export Statistics

- The United States exported 3,695 shipments of drilling fluid.

- Vietnam exported 4,715 shipments of oil drilling equipment.

- China exported 471 shipments of shale shakers.

- Germany exported 98,709 shipments of centrifuges.

Drilling Waste Management Market Value Chain Analysis

- Chemical Synthesis and Processing: The steps, like neutralization, coagulation, flocculation, chemical demulsification, precipitation, oxidation, reduction, stabilization, and adsorption, are performed during chemical synthesis and processing of drilling waste management.

- Key Players:- Baker Hughes Company, Veolia Environment S.A., SUEZ S.A., Halliburton Company, Schlumberger

- Quality Testing and Certifications: Quality testing ensures testing of hydrocarbon content, physical flow, trace metals, toxicity, contaminants, chloride concentration, and pH levels. The relevant certifications involve ZWL Verification, ISO 14001, and ISO 9001.

- Key Players:- Bureau Veritas, HQTS, SGS SA, TUV Rheinland

- Regulatory Compliance and Safety Monitoring: The regulatory compliance involves documentation, site restoration, waste classification, & disposal standards, and safety monitoring looks for engineering controls, auditing, real-time monitoring, emergency response planning, personnel protection, & incident investigation.

- Key Players:- NOV, Halliburton Company, Weatherford International plc, SLB

Drilling Waste Management Solutions Across Countries

| Country | Regulations | Primary Waste | Waste Management Technology |

| United States |

|

|

|

| Arabia |

|

|

|

| China |

|

|

|

| United Kingdom |

|

|

|

Segmental Insights

Service Type Insights

Why the Solids Control Segment Dominates the Drilling Waste Management Market?

The solids control segment dominated the drilling waste management market with a 45% share in 2025. The strong focus on smoother drilling and the need to lower pump wear increases demand for solids control. The stringent rules to reduce waste and the presence of technologies like hydraulic fracturing & horizontal drilling increase the use of solids control. The high volume of mud & cuttings and focus on recovering drilling fluids requires solids control, driving the overall market growth.

The treatment & disposal segment expects the fastest growth in the market during the forecast period. The surge in oil & gas exploration and increasing awareness about water & land pollution increases demand for treatment & disposal. The high volume of drilling wastes and corporate social responsibility increase the use of treatment & disposal.

Waste Type Insights

How did the Drill Cuttings Segment hold the Largest Share in the Drilling Waste Management Market?

The drill cuttings segment held the largest revenue share of 60% in the drilling waste management market in 2025. The presence of geothermal projects, reach wells, and shale plays increases the production of drill cuttings. The growing oil & gas exploration and increasing energy demand generate drill cuttings. The increasing petroleum exploration and stringent environmental regulations on drilling waste drive the overall growth of the market.

The produced water and other E&P segment is experiencing the fastest growth in the market during the forecast period. The rise in deepwater & shale drilling activities and stricter rules in waste management solutions increases the production of produced water. The increasing scarcity of freshwater resources and treatments like biological, physical, & chemical increase the management of produced water and E&P.

Technology Insights

Why is the Mechanical Treatment Dominating the Drilling Waste Management Market?

The mechanical treatment segment dominated the drilling waste management market with a 55% share in 2025. The growing use of centrifuges, shakers, and hydrocyclones helps market expansion. The cost-effectiveness and high operational efficiency of mechanical treatment help market growth. The high volume of waste and stringent regulations on waste disposal increase demand for mechanical treatment. The availability of mobile units and modular units of mechanical treatment drives the market growth.

The thermal treatment segment is the fastest-growing in the market during the forecast period. The high amount of waste due to deepwater exploration & shale drilling increases demand for thermal treatment. The strong focus on shrinking waste volume and recovering resources like treated solids & hydrocarbons requires thermal treatment. The increasing need to lower environmental impact and handle complex wastes requires thermal treatment. The energy efficiency and operational feasibility of thermal treatment support the overall market growth.

Application Location Insights

How did the Onshore Segment hold the Largest Share in the Drilling Waste Management Market?

The onshore segment held the largest revenue share of 70% in the drilling waste management market in 2025. The vast reserves of shale in the U.S. and the focus on an easy method for waste collection increase the adoption of onshore locations. The lower cost methods and simpler logistics of onshore sites help the expansion of the market. The presence of various management techniques like injection, biological, land application, & thermal, and simple deployment of diverse technologies drives the market growth.

The offshore segment is experiencing the fastest growth in the market during the forecast period. The stringent regulation for marine infrastructure protection and increasing ultra-deepwater exploration increases demand for offshore locations. The adoption of technologies like recycling, mobile treatment units, and automated systems in offshore sites helps market expansion. The surge in offshore activities in the South China Sea, the Gulf of Mexico, and the North Sea supports the overall market growth.

End-User Insights

Which End-User Segment Dominated the Drilling Waste Management Market?

The oil & gas operators segment dominated the drilling waste management market with an 85% share in 2025. The vast presence of drilling fluids & drill cuttings and stringent ESG compliance develops efficient drill waste management solutions. The oil & gas operators generate a high amount of contaminated chemicals, solids & liquids, and a rise in global exploration helps market expansion. The increasing oil & gas operators' investment in containment systems, advanced solids, and thermal units drives the overall market growth.

The environmental service providers segment is the fastest-growing in the market during the forecast period. The stricter environmental regulations for drilling waste disposal and the expansion of geothermal and shale drilling increase demand for environmental service providers. The high preference for minimizing the environmental footprint and innovations like closed-loop system supports the overall market growth.

Regional Insights

The North America drilling waste management market size was valued at USD 2.83 billion in 2025 and is expected to reach USD 5.75 billion by 2035, growing at a CAGR of xx% from 2026 to 2035. North America dominated the market with a 40% share in 2025. The extensive onshore drilling activities and stringent rules for sustainable disposal methods increase the adoption of drilling waste management. The innovations, like waste recycling, zero-discharge systems, and mobile treatment units, help market expansion. The strong focus on hazardous waste handling and the presence of horizontal drilling & hydraulic fracturing require drilling waste management. Strong service providers like Schlumberger and Halliburton drive the market growth.

Frontline Operations: U.S. at the Centre of Drilling Waste Management

The United States is a major contributor to the market. The high drilling activity, especially in Texas, and the stringent environmental regulations increase demand for drilling waste management to manage wastes like produced water, drilling muds, and cuttings. The extensive service providers' presence and high preference for resource recovery increase demand for drilling waste management. The increasing use of solids control, closed-loop systems, and automated monitoring supports the overall growth of the market.

- The United States exported 111 shipments of shale shakers.

Middle East & Africa Drilling Waste Management Market Trends

The Middle East & Africa are experiencing the fastest growth in the market during the forecast period. The presence of untapped oil & gas reserves and better waste management initiatives like the UAE’s Zero Waste 2030 & Saudi Arabia’s Vision 2030 increases the adoption of drilling waste management. The stringent regulations to curb pollution and focus on lowering the environmental footprint increase demand for drilling waste management. The continuous investment in energy infrastructure and the shift towards sustainable operations drive the market growth.

Sustainability Era: Saudi Arabia's Role in Drilling Waste Management

Saudi Arabia is a key contributor to the market. The surge in offshore and onshore drilling activities and stricter rules like zero-discharge policies increases demand for drilling waste management. The growing concerns like water pollution & soil pollution, and the expansion of the oil sector require drilling waste management. The increasing investment in advanced containment and growing demand for services like solids disposal, control, and treatment drive the overall market growth.

Asia Pacific Drilling Waste Management Market Trends

Asia Pacific is growing notably in the market. The growing drilling operations in the Bay of Bengal and the South China Sea, and high demand for natural gas, increase the adoption of drilling waste management. The expansion of ultra-deepwater drilling activities, especially in countries like Malaysia, India, China, and the rapid growth in CBM, requires drilling waste management. The stricter environmental waste management regulations and advancements like hydrocyclones, solids control, & centrifuges support the overall growth of the market.

Drilling Waste Management Transformation in China

China is growing at a substantial rate in the market. The presence of offshore & shale reserves and stringent environmental control on waste disposal increases demand for drilling waste management. The investment in technologies like AI-powered monitoring, thermal desorption, and slurry injection helps market expansion. The presence of extensive salt mining operations and hazardous waste complexity requires drilling waste management, supporting the overall growth of the market.

- China exported 136,819 shipments of centrifuges.

Europe Drilling Waste Management Market Trends

Europe is growing significantly in the market. The stricter mandates for lowering pollution and surging North Sea drilling in the UK and Norway increase demand for drilling waste management. The industrial shift towards source reduction and increasing investment in waste management solutions increases the development of advanced drilling waste management. The growing use of advanced technologies like bioremediation, solids control, thermal treatment, and solidification drives the overall market growth.

Smart Solutions: UK’s Impact on Drilling Waste Management

The United Kingdom is growing in the market. The stricter environmental regulations for drilling and a focus on protecting the marine ecosystem increase demand for drilling waste management. The increasing awareness about sustainable practices and the rise in North Sea drilling activities require drilling waste management. The increasing investment in on-site thermal treatment and focus on lowering waste volume support the overall market growth.

South America Drilling Waste Management Market Trends

South America is growing in the market. The surging offshore and onshore drilling, especially in Argentina, Brazil, and Colombia, and stricter regulations for direct dumping, increase the adoption of drilling waste management. The growing use of CRI & TDUs and a strong focus on sustainability drive the market growth.

Green Growth: Brazil’s Innovations in Drilling Waste Management

Brazil is significantly growing in the market. The growing offshore drilling activity and presence of ultra-deepwater & harsh deepwater environments increase the adoption of drilling waste management. The increasing types of waste, like produced water, drill cuttings, and drilling fluids, require drilling waste management. The significant presence of natural & oil gas reserves and increasing investment in waste management infrastructure support the overall market growth.

Recent Developments

- In February 2025, TWMA broke ground on a drilling waste management facility in Habshan, Abu Dhabi. The facility streamlines operations like management, transportation, and treatment of drill cuttings. The facility consists of RotoMill technology, and the drill cuttings processing capacity is 300 tonnes. The facility lowers CO2 emissions and supports sustainable drilling waste management.(Source:twma.com)

- In December 2024, SLB launched Stream high-speed intelligent telemetry, Stream for drilling complex wells. The Stream integrates artificial intelligence and increases drilling confidence. The Stream enables optimal drilling decisions and is deployed in 14 countries.(Source: www.slb.com )

Top Companies List

- Schlumberger Limited (SLB): The leading technological company specialized in reservoir drilling, processing, characterization, and production for oil & gas, and offers technologies like centrifuges & cuttings dryers to lower waste volume.

- Halliburton Company: The company offers solutions for formation evaluation, completion, cementing, drilling, well construction, artificial lift, and production optimization to lower operational costs and reduce the volume of waste.

- Baker Hughes Company: The company offers equipment, products, and services to lower environmental impact & minimize waste volume, and provides Cuttings Re-injection services to process solid drilling waste.

- National Oilwell Varco, Inc. (NOV): The company offers physical and mechanical waste treatment technologies like Hot Oil TDUs, CRI Systems, and integrated solutions to support the energy industry.

Companies in the Drilling Waste Management Market

- National Oilwell Varco, Inc. (NOV)

- Baker Hughes Company

- Halliburton Company

- Schlumberger Limited (SLB)

- TWMA

- Secure Energy Services, Inc.

- Derrick Equipment Company

- Augean PLC

- Scomi Group Bhd

- Imdex Limited

- GN Solids Control

- Tervita Corporation

- Newalta Corporation

- Clean Harbors, Inc.

- Veolia Environnement S.A.

- Suez S.A.

- Ridgeline Canada, Inc.

- Specialty Drilling Fluids Ltd.

- Nuverra Environmental Solutions, Inc.

Segments Covered

By Service Type

- Solids Control (On-Rig Separation)

- Shale Shakers

- Desanders and Desilters

- Centrifuges

- Mud Cleaners

- Treatment & Disposal

- Thermal Desorption Units (TDU)

- Cuttings Reinjection (CRI) / Slurry Injection

- Bioremediation / Landfarming

- Stabilization / Solidification

- Chemical Treatment

- Landfills (Final Disposal)

- Containment & Handling

- Cuttings Transfer and Conveyance Systems (Vacuum, Screw)

- Storage Tanks and Bins

- Fluid Transport and Logistics

- Recycling & Recovery

- Base Fluid Recovery (Oil/Synthetic)

- Water and Completion Fluid Recycling

By Waste Type

- Drill Cuttings

- Oil-Based Cuttings (OBC)

- Synthetic-Based Cuttings (SBC)

- Water-Based Cuttings (WBC)

- Used Drilling Fluids (Muds)

- Oil-Based Muds (OBM)

- Synthetic-Based Muds (SBM)

- Water-Based Muds (WBM)

- Produced Water and Other E&P Waste

- Completion and Workover Fluids

- Waste Lubricants

By Technology

- Mechanical Treatment (Physical Separation)

- High-G Dryers and Centrifuges

- Filtration Systems

- Thermal Treatment

- Thermal Desorption Units (TDU)

- Incineration (Less Common/Regulated)

- Chemical/Physical Treatment

- Stabilization/Solidification Agents

- Flocculation and Coagulation

- Biological Treatment

By Application Location

- Onshore

- Conventional Wells

- Unconventional Wells (Shale, Tight Oil)

- Offshore

By End-User

- Oil and Gas Operators

- Mining Companies

- Environmental Service Providers (Contractors)

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa