Content

U.S. Enzymes Market Size and Growth 2025 to 2034

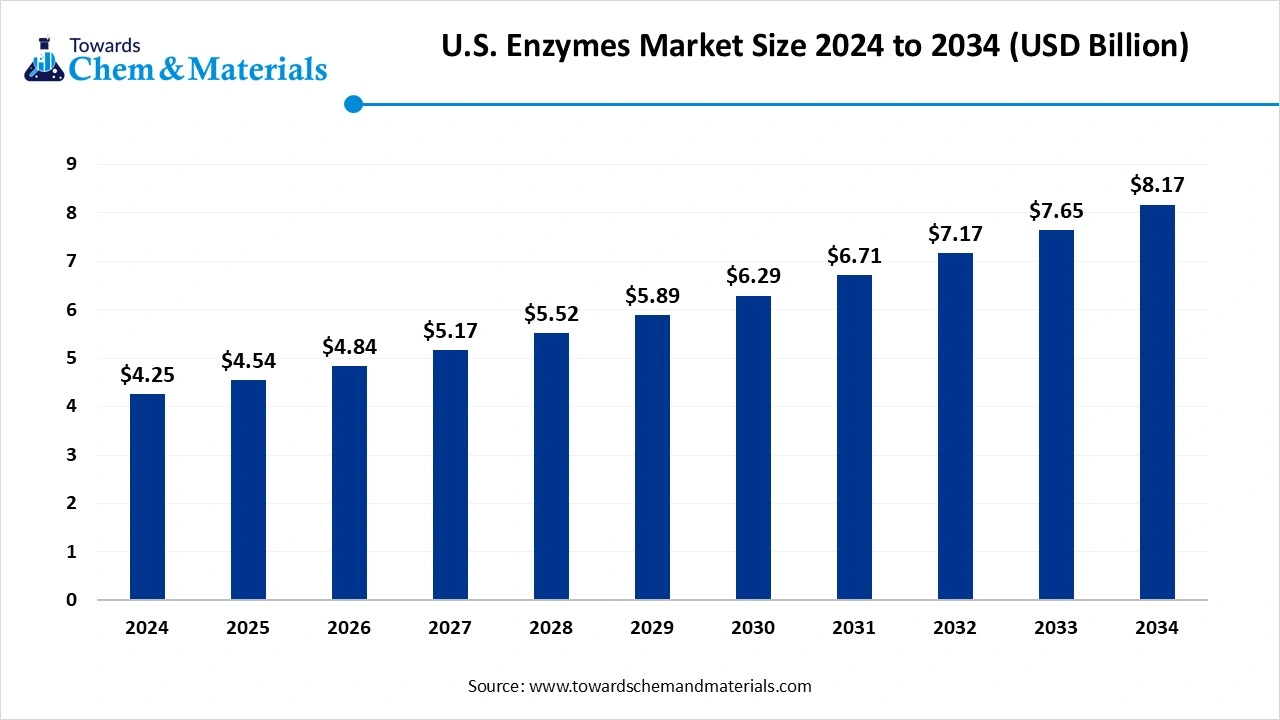

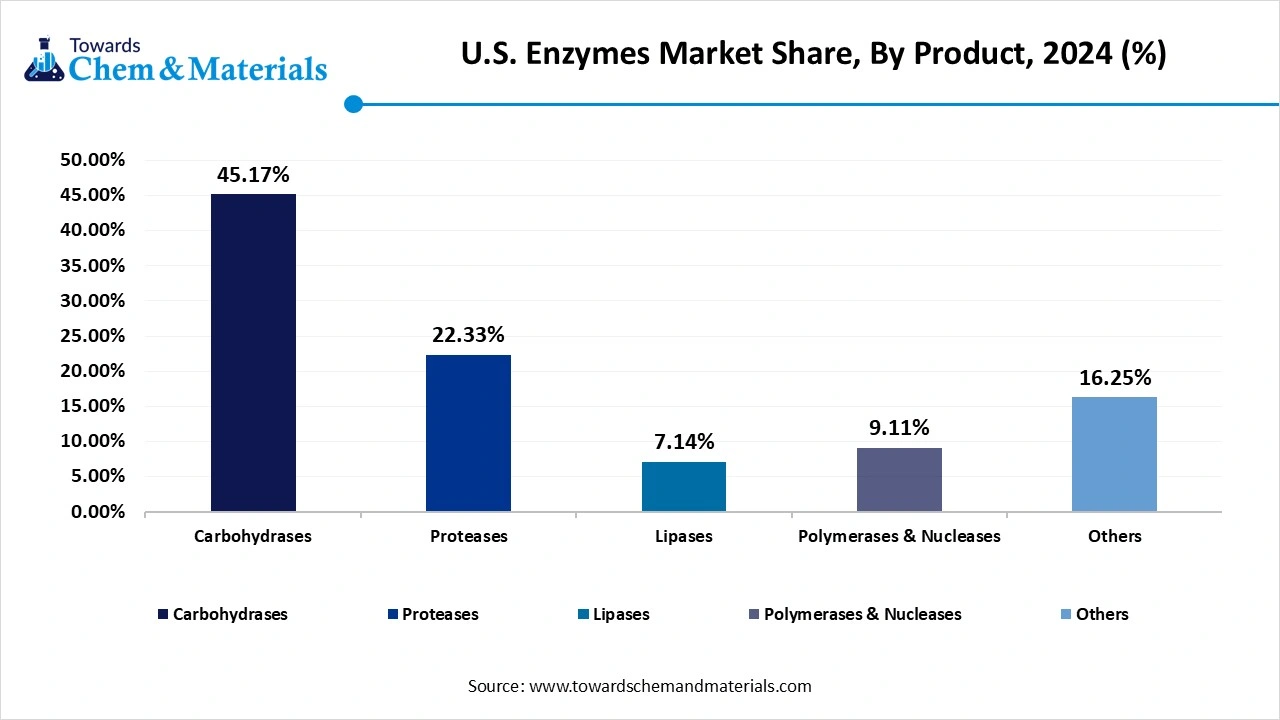

The U.S. enzymes market size was valued at USD 4.25 billion in 2024. The market is projected to grow from USD 4.54 billion in 2025 to USD 8.17 billion by 2034, exhibiting a CAGR of 6.75% during the forecast period. The growing demand for industrial and specialty enzymes from different sectors is the key factor driving the market growth. Also, increasing environmental concerns across the globe coupled with the surge in health consciousness among consumers can fuel market growth further.

Key Takeaways

- By type, Industrial enzymes dominated the U.S. enzymes market in 2024. The dominance of the segment can be attributed to the increasing use of enzymes across various sectors.

- By type, the specialty enzymes segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the increasing demand for specialty enzymes in the pharmaceutical industry.

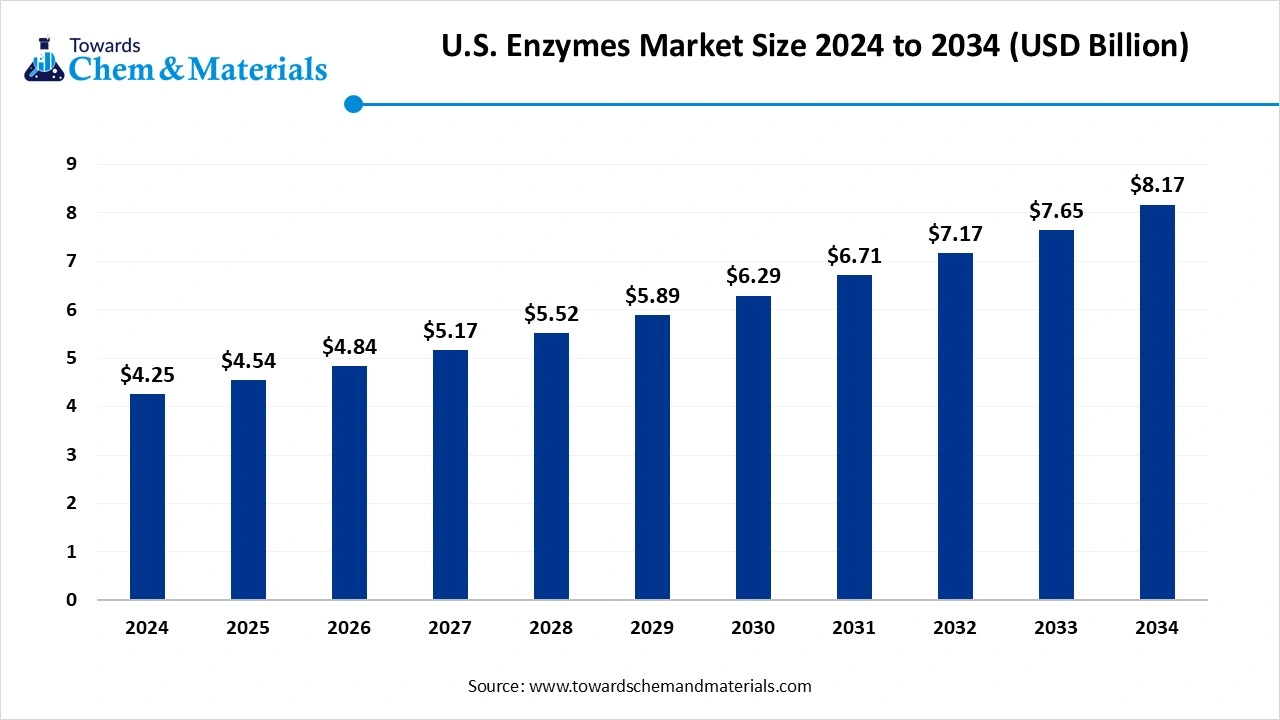

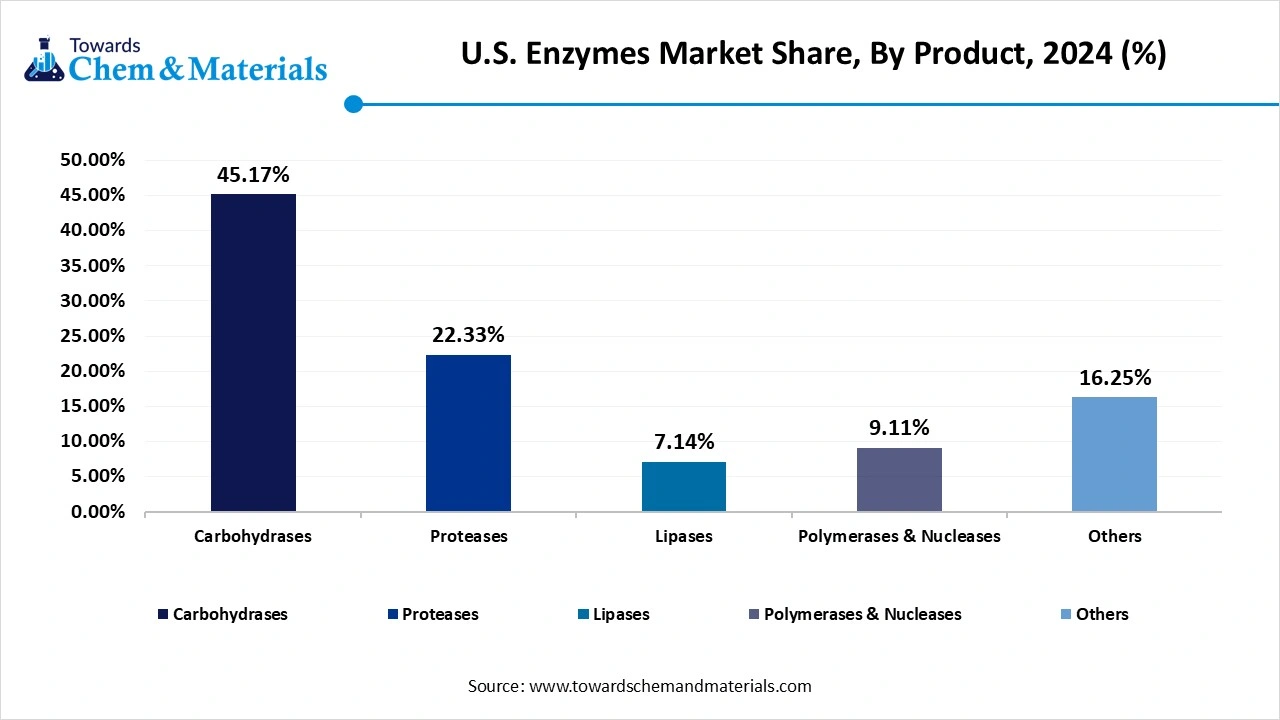

- By product, the carbohydrase segment held the largest market share in 2024. The dominance of the segment can be linked to their wide use in the food and beverage industry.

- By product, the proteases segment is expected to grow at the fastest CAGR during the projected period. The growth of the segment can be driven by the diverse applications of proteases in numerous industries.

- By source, the microorganism segment held the largest U.S. enzymes market share in 2024. The dominance of the segment is owing to the growing demand for fungi-based enzymes in different applications.

- By source, the animal source segment is expected to grow at the fastest CAGR during the projected period. The growth of the segment is due to the increasing need for enzymes, especially for treating pancreatic conditions.

Surge in Demand for Speciality Enzymes Expanding Market Growth

The market includes the demand and supply of enzymes utilized in different commercial and industrial applications within the US. These enzymes basically are proteins that act as catalysts and are used to fasten and facilitate chemical reactions across many sectors. These enzymes are obtained from organisms like fungi, bacteria, and plants and are used to improve the efficiency of various processes. They are generally available in proteases, lipases, amylases ligninases, and cellulases each distinguished based on their use. Factors such as innovations in biotechnology, the growing need for eco-friendly processes, and the demand for enzyme-based solutions are propelling overall market growth.

What Are the Key Trends Influencing the U.S. Enzymes Market?

- The ongoing expansion of the biofuel sector presents a substantial growth opportunity for the market. The world is increasingly shifting towards eco-friendly energy alternatives; hence biofuels have been introduced as a convenient alternative to traditional fossil fuels, providing a more sustainable energy source.

- The increasing use of enzyme made products in therapies for conditions like cardiovascular diseases, cancer, and lysosomal disorders is the latest market trend driving market growth. Also, pharmaceutical manufacturers are also becoming more aware of the addition of biocatalysts into the production process.

- The addition of innovative technology in the production process is the major factor boosting market growth during the forecast period. The growing use of enzymes for industrial processes has increased clinical research and studies for biocatalysis with enhanced or novel properties. Various companies are emphasizing technological innovations for the development of new products.

How is the Government Supporting the U.S. Enzymes Market?

The U.S. government is supporting the market through various initiatives such as facilitating sustainable practices, investing in research and development, and supporting the adoption of enzyme-based solutions in a wide array of industries including agriculture, biofuels, and pharmaceuticals. These efforts promote sustainability, improve the economy, and solve environmental challenges.

Government agencies such as the U.S. Department of Agriculture (USDA) and the National Institutes of Health (NIH) have invested extensively in biotechnology research, such as enzyme-related advancements. Moreover, the U.S. Environmental Protection Agency (EPA) facilitated the use of enzymes in eco-friendly farming methods and environmental remediation.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 4.54 Billion |

| Expected Size by 2034 | USD 8.17 Billion |

| Growth Rate from 2025 to 2034 | CAGR 6.75% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Type, By Product, By Source, By Region |

| Key Companies Profiled | Novozymes, DuPont, AB Enzyme, BASF SE, DSM (Koninklijke DSM N.V.), Amano Enzymes Inc., Kerry Group, Engrain LLC, Amano Enzyme, AG Scientific |

Market Opportunity

Increasing Use in Textiles and Detergents

Textiles and detergents use enzymes for bio-washing and paper and pulp sector use enzymes for wastewater and pulp bleaching treatments. They are further used for scouring, bleaching, desizing, and denim washing enhancing fabric quality and minimizing overall environmental impact. Furthermore, enzymes offer milder treatment conditions which lead to enhanced fabric softness, appearance, and durability.

- In June 2024, NEXGEL, Inc. and STADA collaborated to launch a top European DAO enzyme supplement with Histasolv, in North America. Histasolv's advanced packaging and formulation distinguished it from other competitors in the market.(Source: globenewswire)

Market Challenge

Stringent Safety Considerations

Strict safety and regulatory requirements pose a substantial hurdle to the growth of the market. Enzyme-based products are utilized across various industrial processes and must fulfil rigorous regulatory standards by undergoing wide safety assessments. Moreover, concerns related to toxicity, allergenicity, and future environmental impacts of the use of enzymes require complete risk evaluations along with the proper implementation of effective measures.

Country Insight

The growth of the US enzyme market is attributed to the surge in disposable income coupled with the shifting consumer's lifestyle preferences. The market growth is further impacted by factors such as quality, safety, regulatory frameworks, and consumer perception. In addition, increasing demand for sustainable technologies and the growth of the biofuel industry are influencing positive market growth shortly.

Which are the Top Export Companies & Enzyme Suppliers in the United States in 2024?

| Company | Export Shipment of Enzyme |

| NEW ENGLAND BIOLABS | 21,911 |

| LIFE TECHNOLOGIES CORPORATION | 7,928 |

| ABBOTT LABORATORIES INTL LLC DIAGNOSTIC | 5,518 |

| ABT LABS INTL LLC ALIC | 4,717 |

| DANISCO US INC | 2,488 |

Segmental Insight

Type Insights

Which Type Segment Dominated the U.S. Enzymes Market in 2024?

The industrial enzymes segment led the market in 2024. The dominance of the segment can be attributed to the increasing use of enzymes across various sectors such as cleaning products, food & beverages, animal feed, and biofuel. Industrial enzymes, which boost chemical reactions play a significant role in optimizing different industrial processes and the manufacturing of a variety of products. Industrial enzymes can be manufactured in large quantities and are cost-effective than conventional chemical processes.

The specialty enzymes segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the increasing demand for specialty enzymes in the pharmaceutical, biopharmaceutical, and biotechnology industries especially in drug development. Additionally, Specialty enzymes such as proteinase K are crucial for RNA and DNA extraction in genomic research facilitating innovations in individualised medicine and diagnostics.

- In October 2024, Novo Nordisk Pharmatech introduced a new enzyme for drug production. Trypsin products such as Trypsinnex are utilized in bioproduction processes like virus activation, cell dissociation, and insulin production.(Source: medwatch)

By Product Type

Why Carbohydrase Segment Dominate the U.S. Enzymes Market in 2024?

The carbohydrase segment held the largest market share in 2024. The dominance of the segment can be linked to its wide use in the food and beverage industry, particularly in dairy products processing. The carbohydrase segment is further distinguished into cellulases, amylases, and others. Moreover, carbohydrase is utilized across different animal types, such as ruminants, poultry, and swine, which makes them an important component of feed formulations.

The protease segment is expected to grow at the significant CAGR over the forecast period. The growth of the segment can be driven by the diverse applications of proteases in numerous industries such as pharmaceuticals, biotechnology, food processing, and detergents. Also, proteases enhance protein digestibility, raise nutritional value in food products, and improve flavour profiles. They are also necessary in meat tenderizing.

Source Insights

How Did Microorganisms Segment Held the Largest U.S. Enzymes Market Share in 2024?

The microorganisms source segment dominated the market in 2024. The dominance of the segment is owing to the growing demand for fungi-based enzymes in different applications. Microbial enzyme production has also earned substantial traction because of its cost-effectiveness, low energy requirements, and eco-friendly nature which makes it ideal for different industrial processes. These are highly suitable for vegetarians, driving segment growth further.

The animal source segment is expected to grow at the fastest CAGR during the projected period. The growth of the segment is due to the increasing need for enzymes, especially for treating pancreatic conditions such as exocrine pancreatic insufficiency. Furthermore, animal feed enzymes also support animal growth and productivity by improving nutrient absorption and digestion. The animal-based product has greater demand from the pharmaceutical sector.

Recent Developments

- In July 2024, Novonesis, a major supplier of enzymes for the detergent sector has launched luminous, a biological substitute to petroleum-based technologies for keeping the brightness and whiteness of fabrics. This advancement addresses the increasing demand for sustainable solutions in the laundry industry.(Source: worldbiomarketinsights)

- In March 2024, Aralez Bio, a San Francisco-based company designed a platform that creates 100 times more compound variation using mechanisms that are also 50 times greener than traditional methods. Aralez Bio's biocatalytic platform is created on three solid foundations.(Source: chemanager-online)

Top Companies List

- Novozymes

- DuPont

- AB Enzyme

- BASF SE

- DSM (Koninklijke DSM N.V.)

- Amano Enzymes Inc.

- Kerry Group

- Engrain LLC

- Amano Enzyme

- AG Scientific

Segments Covered

By Type

- Industrial Enzymes

- Food & Beverages

- Meat Processing

- Dairy Products

- Beverages

- Bakery & Confectionery

- Other Food Products

- Detergents

- Animal Feed

- Biofuels

- Textiles

- Pulp & Paper

- Nutraceutical

- Personal Care & Cosmetics

- Wastewater

- Others

- Specialty Enzymes

- Pharmaceutical

- Research & Biotechnology

- Diagnostics

- Biocatalyst

By Product

- Carbohydrases

- Proteases

- Lipases

- Polymerases & Nucleases

- Others

By Source

- Plants

- Animals

- Microorganisms