Content

Polymer Denture Material Market Size, Share | Industry Report, 2034

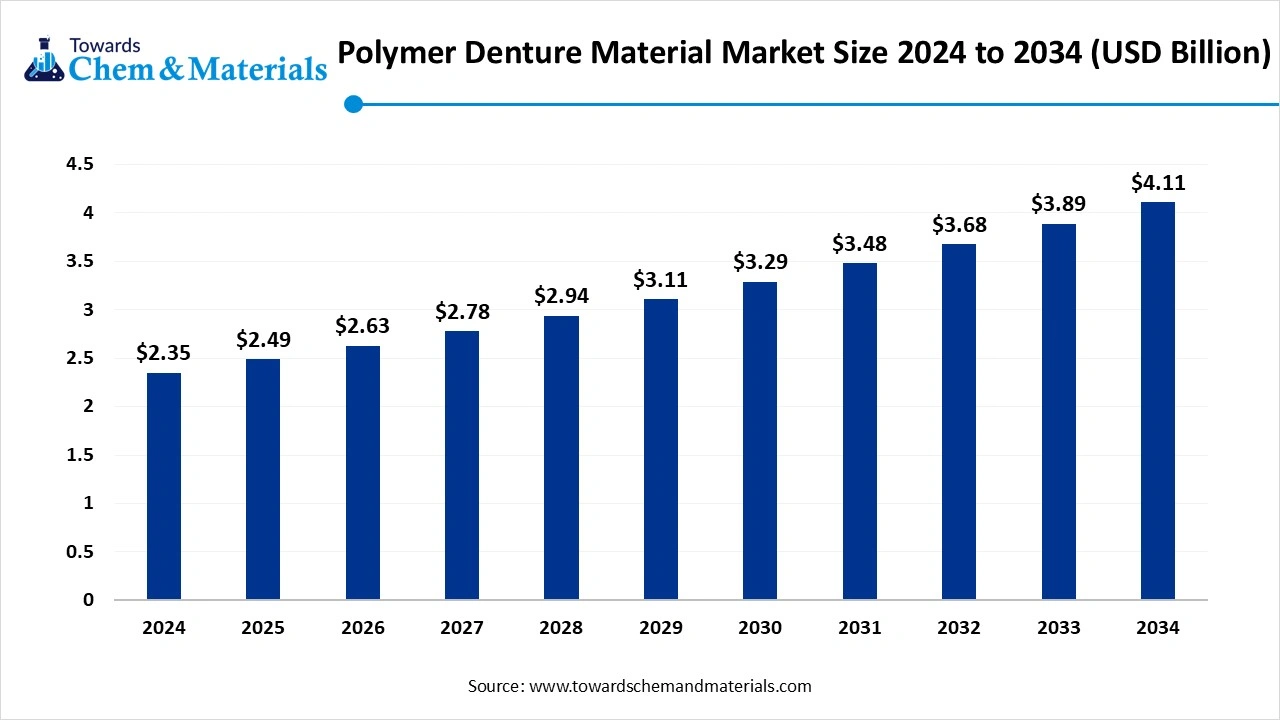

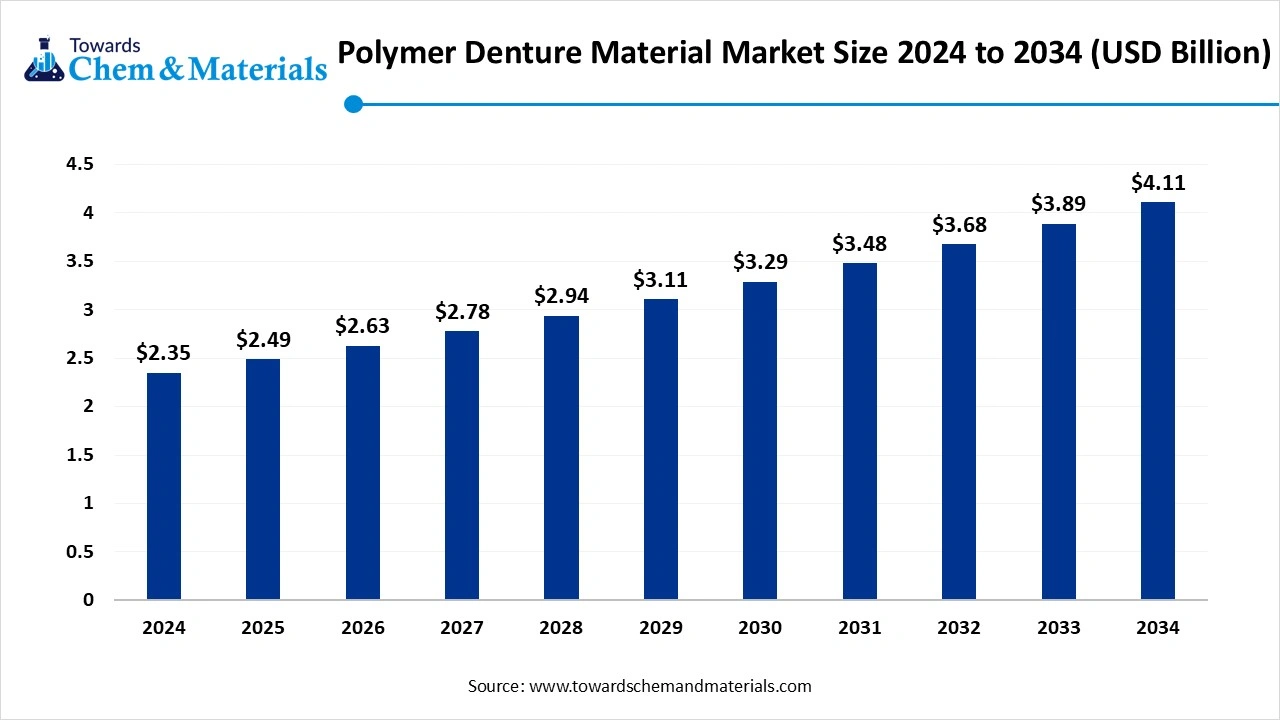

The global polymer denture material market size accounted for USD 2.49 billion in 2025 and is forecasted to hit around USD 4.11 billion by 2034, representing a CAGR of 5.75% from 2025 to 2034. The increasing aging population is the key factor driving market growth. Also, the growing incidence of tooth loss coupled with the enhanced access to dental care services, can fuel market growth further.

Key Takeaways

- By region, North America dominated the polymer denture material market with a 35% market share in 2024. The dominance of the region can be attributed to the increasing elderly population and growing demand for teeth care.

- By region, Asia Pacific is expected to grow at the fastest CAGR over the forecast period. The growth of the region can be credited to the enhanced healthcare infrastructure.

- By material type, the PMMA segment dominated the market with a 45% share in 2024. The dominance of the segment can be attributed to its aesthetic qualities and affordability.

- By material type, the 3D printable polymers (Photopolymer Resins) segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the innovations in material science, along with the rising adoption of digital dentistry.

- By denture type, the complete dentures segment held a 50% market share in 2024. The dominance of the segment can be linked to the growing demand for restorative dental solutions and the increasing incidence of tooth loss across the globe.

- By denture type, the overdentures segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by a surge in demand for individualized dental solutions, coupled with the developments in dental technologies.

- By processing technology, the heat cure segment dominated the market with 38% market share in 2024. The dominance of the segment is owed to the growing demand for cosmetic dentistry and sugar in the incidence of dental issues.

- By processing technology, the 3D printing segment is expected to grow at the fastest CAGR over the projected period. The growth of the segment is due to the escalating demand for customized and affordable dental solutions.

- By end-user, the dental laboratories segment held a 55% market share in 2024. The dominance of the segment can be credited to the ongoing adoption of technologies such as 3D printing.

- By end-user, the dental clinics segment is expected to grow at the fastest CAGR during the study period. The growth of the segment can be attributed to a rising awareness of oral health, with the importance of regular check-ups.

- By application, the removable prosthetics segment dominated the market with 60% market share in 2024. The dominance of the segment can be driven by ongoing innovations in materials and design.

- By application, the implant-supported dentures segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be linked to the rising popularity of these dentures.

- By distribution channel, the dental distributors segment held a 50% market share in 2024. The dominance of the segment can be due to the rising number of dental procedures, such as extractions.

- By distribution channel, the online channel segment is expected to grow at the fastest CAGR during the projected period. The growth of the segment is owed to the raised e-commerce adoption and growing demand for affordable and convenient dental solutions.

Advancements in Dental Technologies are Expanding Market Growth

The polymer denture material market refers to the industry involved in the production and sale of synthetic polymer-based materials used to fabricate full and partial dentures. These polymers offer high biocompatibility, aesthetic properties, and mechanical strength. Key types include polymethyl methacrylate (PMMA), polyamide (nylon), and high-impact acrylics, which are widely used by dental labs, clinics, and hospitals for both removable and fixed denture prosthetics. Patients are rapidly seeking dentures that provide superior comfort and natural-looking aesthetics, which is propelling the development and use of innovative polymer blends with enhanced stain resistance and thermal stability.

What Are the Key Trends Influencing the Polymer Denture Material Market?

The rising awareness and adoption of dental care services are the latest trends in the market, impacting positive market growth. With a surge in disposable incomes and enhanced healthcare infrastructure, particularly in developing economies, more individuals to adopting dental treatments with preventive care.

Dental acrylics are playing a key role in the market, providing a reliable and versatile option for both partial and complete dentures. These materials are preferred for their ease of manipulation and their capability to mimic the natural look of teeth and gums, leading to market expansion shortly.

Ongoing shift towards high-performance thermoplastic materials is another major trend boosting market growth. This factor is shifting the use of higher-performance thermoplastic materials like nylon, replacing traditional acrylic resin and polyamide to offer better strength, flexibility, and abrasion resistance.

Market Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 2.49 Billion |

| Market Size by 2034 | USD 4.11 Billion |

| Growth rate from 2024 to 2025 | CAGR 5.75% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | North America |

| Segment Covered | By Material Type, By Denture Type, By Processing Technology, By End User, By Application, By Distribution Channel, By Region |

| Key Companies Profiled | Dentsply Sirona, Ivoclar Vivadent, Kulzer GmbH (Mitsui Chemicals Group), GC Corporation, VOCO GmbH, Lang Dental Manufacturing, 3M ESPE, Acryl Dental, DenMat Holdings, LLC, YAMAHACHI Dental Mfg., Co., Candulor AG, Vertex-Dental B.V., Kuraray Noritake Dental, Prime Dental Products, Modern Dental Group, Trevalon Hi, ProTech Dental Studio, Fiber Force (Synca Marketing Inc.), Keystone Industries, Zhermack S.p.A. |

Market Opportunity

Development of Cutting-Edge Biocompatible Material

The creation of innovative bio-compatible material is the major factor creating lucrative opportunities in the market. This material has various benefits over the conventional denture base materials, like increased aesthetics and strength. Furthermore, utilisation of 3D Printing technology to make dentures is a clear market-expanding factor as dentures created through this technology are compatible with the patient and can also be fabricated according to the individual's needs.

- In February 2025, US-based 3D printer producer,3D Systems has launched its latest improvements in dental 3D printing at the Hyatt Regency Chicago. This launch involves the new NextDent 300 MultiJet 3D printer, created to simplify denture procedures.(Source: www.3dsystems.com)

Market Challenges

Fabrication Complexities

Digital denture fabrication techniques, such as 3D printing and milling, can create challenges in achieving the desired surface finish and precision. While additive manufacturing provides precision, individualization, hurdles remain in using certain materials, including PLA, in AM for dental applications. Moreover, innovative digital dentistry and polymerizes can be quite costly, potentially hindering the adoption by smaller dental practices.

Regional Insights

North America dominated the polymer denture material market with a 35% market share in 2024. The dominance of the region can be attributed to the increasing elderly population and growing demand for teeth care. Additionally, the market is witnessing an increasing shift towards more innovative polymer blends that provide stain resistance, superior translucency, and thermal stability. The growing adoption of CAD/CAM technologies in clinics and dental labs is optimizing production, minimizing turnaround times, and improving fit.

Polymer Denture Material Market in the U.S.

In North America, the U.S. led the market owing to the rising oral health awareness, innovations in denture technology, along the growing demand for functional and aesthetically pleasing dentures. The major market players in the US market are Dentsply Sirona, Makevale, Lang Dental, Patterson Companies, and Keystone Industries.

Asia Pacific is expected to grow at the fastest CAGR over the forecast period. The growth of the region can be credited to the enhanced healthcare infrastructure, rising healthcare expenditure, and increasing awareness of dental health in developing nations such as China and India. Moreover, favourable government policies and he strong presence of a significant number of laboratories and dental clinics are further propelling regional expansion.

Polymer Denture Material Market in China

In the Asia Pacific, China dominated the market by holding the largest market share due to ongoing government support, innovations in technology, and rising awareness regarding oral health is boosting its expansion in the country. Moreover, major cities such as Shanghai, Beijing, and Guangzhou are central to the demand for dentures and related materials.

Segmental Insight

Material Type Insight

Which Material Type Segment Dominated the Polymer Denture Material Market in 2024?

The PMMA segment dominated the market with a 45% share in 2024. The dominance of the segment can be attributed to its aesthetic qualities and affordability. PMMA is extensively utilised in dentures due to its resistance to wear and tear, biocompatibility, and ease of processing. It is used in different stages of denture fabrication, from custom trays to the final appliance. PMMA's popularity stems from its ability to offer both aesthetically pleasing and affordable denture solutions.

The 3D printable polymers (Photopolymer Resins) segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the innovations in material science, along with the rising adoption of digital dentistry. Also, developments in filler technologies, monomers, and self-healing capabilities are fuelling innovations in the segment.

Denture Type Insight

Why Complete Dentures Segment Dominated the Polymer Denture Material Market in 2024?

The complete dentures segment held a 50% market share in 2024. The dominance of the segment can be linked to the growing demand for restorative dental solutions and the increasing incidence of tooth loss across the globe. In addition, acrylic resins, especially PMMA, remain one of the most popular materials for denture bases because of their favourable properties such as durability, strength, and colour-matching capabilities.

The overdentures segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by a surge in demand for individualized dental solutions, coupled with the developments in dental technologies. These dentures are supported by natural teeth or implants, which gives retention and stability as compared to conventional dentures.

Processing Technology Insight

How Heat Cure Segment Held a Largest Polymer Denture Material Market Share in 2024?

The heat cure segment dominated the market with 38% market share in 2024. The dominance of the segment is owed to the growing demand for cosmetic dentistry, a surge in the incidence of dental issues, and innovations in denture processing techniques. Moreover, this material is preferred for its durability and strength, which makes it a convenient choice for partial and full dentures.

The 3D printing segment is expected to grow at the fastest CAGR over the projected period. The growth of the segment is due to the escalating demand for customized and affordable dental solutions, coupled with the innovations in additive manufacturing technologies 3D printing enable the production of dentures at a very low cost compared to conventional methods.

End User Insight

How Dental Laboratories Segment Dominated the Polymer Denture Material Market in 2024?

The dental laboratories segment held a 55% market share in 2024. The dominance of the segment can be credited to the ongoing adoption of technologies such as 3D printing, CAD/CAM, and intraoral scanners, which are transforming workflows of dental labs, enhancing precision, efficiency, and the quality of restorations. Additionally, ongoing advancements in dental materials like biocompatible polymers and high-strength ceramics are expanding the possibilities for dental restorations.

The dental clinics segment is expected to grow at the fastest CAGR during the study period. The growth of the segment can be attributed to the rising awareness of oral health, with the importance of regular check-ups, which fuels the demand for dentistry services such as fillings, cleanings, and preventative care. Also, the desire for aesthetic enhancements, propelled by celebrity and social media influence, is driving segment growth soon.

Application Insight

Which Application Segment Dominated the Polymer Denture Material Market in 2024?

The removable prosthetics segment dominated the market with 60% market share in 2024. The dominance of the segment can be driven by ongoing innovations in materials and design, along with the surge in public awareness campaigns and other initiatives, which are increasing awareness regarding the importance of oral health. Furthermore, removable prosthetics are more affordable than fixed restorations, which makes them a more convenient option for an extensive range of patients.

The implant-supported dentures segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be linked to the rising popularity of these dentures due to the benefits offered by them, such as enhanced chewing efficiency, improved stability, and a more natural feel as compared to conventional dentures.

Distribution Channel Insight

How Much Market Share Did Dental Distributors Segment Held in 2024?

The dental distributors segment held a 50% market share in 2024. The dominance of the segment can be due to the rising number of dental procedures, such as extractions, root canal treatments, and restorations, which is driving the demand for dental consumables. In addition, the expansion of DSOs and group practices in developing markets is also impacting the demand for cutting-edge dental equipment and consumables.

The online channel segment is expected to grow at the fastest CAGR during the projected period. The growth of the segment is owed to the raised e-commerce adoption, growing demand for affordable and convenient dental solutions, along with the innovations in online dental services. Consumers are increasingly turning towards online platforms for purchasing various goods like denture materials.

Recent Developments

- In February 2025, Pidilite Industries declared that the licence for Central Drugs Standard Control Organization (CDSCO) has been received by its dental solution brand called Pidilite Wizdent and Kuraray. Pidilite Industries is recognised for its wide array of dental consumables.(Source: www.freepressjournal.in)

- In July 2024, Stratasys introduced the DentaJet XL, an innovative high-speed 3D printer created to enhance dental lab productivity and minimize costs. This digital solution is engineered specifically for digital dental labs that should deliver high volumes of applications.(Source: www.tctmagazine.com )

Top Companies List

- Dentsply Sirona

- Ivoclar Vivadent

- Kulzer GmbH (Mitsui Chemicals Group)

- GC Corporation

- VOCO GmbH

- Lang Dental Manufacturing

- 3M ESPE

- Acryl Dental

- DenMat Holdings, LLC

- YAMAHACHI Dental Mfg., Co.

- Candulor AG

- Vertex-Dental B.V.

- Kuraray Noritake Dental

- Prime Dental Products

- Modern Dental Group

- Trevalon Hi

- ProTech Dental Studio

- Fiber Force (Synca Marketing Inc.)

- Keystone Industries

- Zhermack S.p.A.

Segments Covered

By Material Type

- PMMA (Polymethyl Methacrylate)

- Polyamide (Nylon-based)

- High-Impact Acrylics

- Flexible Denture Materials

- Composite Resins

- Thermoplastic Resins

- Urethane Dimethacrylate (UDMA)

- Others (Hybrid Polymers, etc.)

By Denture Type

- Complete Dentures

- Conventional Full Dentures

- Immediate Full Dentures

- Partial Dentures

- Cast Partial

- Flexible Partial

- Interim Partial

- Overdentures

By Processing Technology

- Heat-Cure

- Cold-Cure (Auto-Polymerizing)

- CAD/CAM Milling (Prefabricated Discs/Blocks)

- 3D Printing (Photopolymerizable Resins)

By End User

- Dental Laboratories

- Dental Clinics

- Hospitals

- Academic & Research Institutes

By Application

- Removable Prosthetics

- Fixed Prosthetics (Hybrid Dentures)

- Implant-Supported Dentures

- Trial/Temporary Dentures

- Repair and Relining

By Distribution Channel

- Direct Sales (OEMs to Labs/Clinics)

- Dental Distributors & Wholesalers

- Online Channels (B2B Portals, E-commerce Dental Platforms)

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait