Content

Styrenics Market - Trends, Analysis and Forecast till 2034

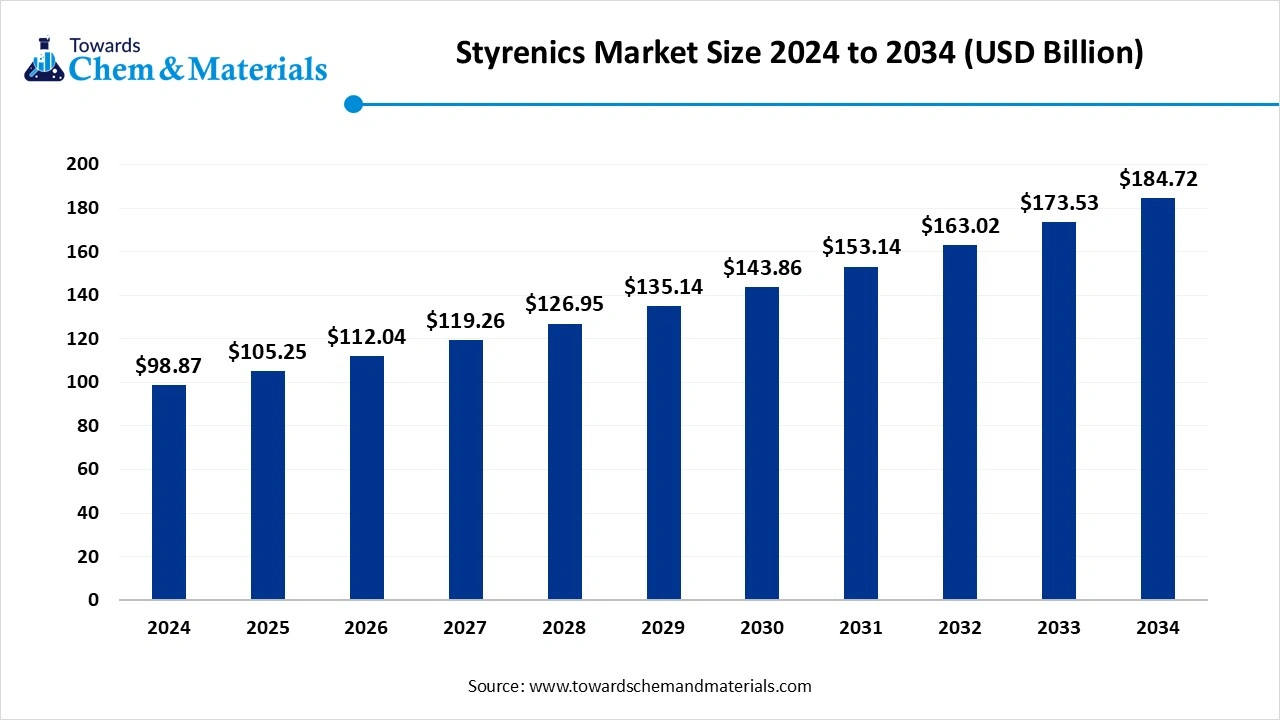

The global styrenics market size was reached at USD 98.87 billion in 2024 and is expected to hit around USD 184.72 billion by 2034, exhibiting a compound annual growth rate (CAGR) of 6.45% during the forecast period 2025 to 2034. The enlargement of the packaging industry has accelerated the industry's potential in recent years.

Key Takeaways

- By region, Asia Pacific dominated the market in 2024, owing to the heavy manufacturing infrastructure.

- By region, the Middle East and Africa are expected to grow at a notable rate in the future, akin to a sudden increase in industrial demand and expansion of the petrochemical capacities

- By product type, the polystyrene segment led the styrenics market in 2024, akin to its wide applications in sectors like insulation, packaging, and consumer products.

- By product type, the ABS segment is expected to grow at the fastest rate in the market during the forecast period, due to its combination of strength, toughness, and flexibility-making it suitable for many industries

- By application type, the packaging segment emerged as the top-performing segment in 2024 due to the affordability, lightweight, and durability of the PS and EPS materials.

- By application type, the automotive segment is expected to lead the market in the coming years, as carmakers are using more lightweight plastic parts to reduce vehicle weight and improve fuel efficiency.

- By end use, the packaging and FMCG segment led the market in 2024, as these sectors require lightweight, low-cost, and easy-to-process plastics.

- By end use, the medical segment is likely to experience notable growth during the expected period, akin to rising demand for safe, durable, and hygienic materials in healthcare.

Market Overview

From Molding to Medicine: How Styrenics are Shaping Industry

The styrenics market comprises a family of thermoplastic polymers derived from styrene monomer, used across a wide range of applications including packaging, automotive, construction, electronics, medical devices, and consumer goods. The market includes key products such as polystyrene (PS), expanded polystyrene (EPS), acrylonitrile butadiene styrene (ABS), styrene-butadiene rubber (SBR), styrene-acrylonitrile (SAN), and styrene block copolymers (SBC). These materials are valued for their moldability, impact resistance, insulation properties, and cost-effectiveness.

Which Factor Is Driving the Global Styrenics Market?

The enlarged expansion of the packaging industry is spearheading the industry's growth in the current period. Having the unique characteristics such as affordability, lightweight, and easy to shape has provided immense attention to the styrenics materials like polystyrene and expanded polystyrene. Moreover, these properties are also making it ideal for food packaging and electronics. Also, the need for protective and hygienic packaging has contributed to the industry's potential in recent years.

Market Trends

- The sudden shift towards eco-friendly styrenics is driving the market growth in the current period. As the major companies have been putting heavy investment into innovative sustainable materials in recent years.

- The increased use of styrenics in healthcare and medical products is leading to industry’s potential in the current period. The styrenics, such as ABS and SAN, are increasingly being used in these sectors.

Market Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 105.25 Billion |

| Market Size by 2034 | USD 184.72 Billion |

| Growth rate from 2024 to 2025 | CAGR 6.45% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Product Type, By Application, By End-User Industry, By Region |

| Key Companies Profiled | INEOS Group AG, BASF SE, SABIC, Chevron Phillips Chemical Company LLC, Repsol, LG Chem, Trinseo, TotalEnergies Styrenics |

Market Opportunity

Electric Mobility Fuels Demand for High-Performance Styrenics

The increasing demand for electric vehicles and electronics is expected to create significant opportunities for manufacturers in the coming years. Having properties like lightweight, heat resistance, and strength make the styrenics the ideal material in the development of modern electronics and electric vehicles. Also, the manufacturers can establish a partnership or collaboration with vehicle manufacturers, which can provide long-term profit margins and trust initiatives to the manufacturers during the projected period.

Market Challenge

Styrenics Industry Faces Turning Point Amid Plastic Reduction Mandates

The increased pressure from the government to reduce plastic waste is anticipated to hamper the industry's growth in the coming years. Moreover, several governments across the world are trying to reduce plastic dependency by using alternatives, which is limiting the sales of the styrenics. However, the manufacturers can take advantage of this sustainability shift by integrating the eco-friendly materials in the production of the styrenics, and they can also invest in the research and development activities for sustainable alternatives, which are affordable in the coming years.

Regional Insights

Asia Pacific dominated the market in 2024, akin to the heavy manufacturing infrastructure. Moreover, sectors such as the construction, packaging, and automotive are seen under the heavy usage of the styrenics, which has majorly led the industrial growth in the region over the past few years. Moreover, the regional countries such as China, India, and Japan have the presence of the major manufacturers of the styrenics, which creates a favorable environment for the market in the region, as per the recent observation.

Is China’s Styrenics Powerhouse Status Unshakable in the Current Period?

China maintained its dominance in the styrenics market, owing to the country's domestic consumption and the self-production environment in the current period. Moreover, the sectors in China, such as construction and packaging, have increasingly provided a sophisticated consumer base to the industry in recent years.

Middle East and Africa

The Middle East and Africa are expected to capture a major share of the market, owing to a sudden increase in industrial demand and expansion of the petrochemical capacities. Moreover, the regional countries are trying to reduce their dependency on oil and shifting focus towards different manufacturing capacities, which is expected to lead to the demand for styrenics, which is considered a crucial element in different manufacturing infrastructure such as the construction, packaging, and even consumer goods as per the future industry expectations.

Are Government-Backed Projects Fueling Styrenics Expansion in the Region?

Saudi Arabia and South Africa are expected to rise as dominant countries in the region in the coming years, owing to the countries’ heavy investments and the enlargement of sectors such as construction and automotive, as per recent observations. Moreover, the GCC countries such as Saudi Arabia and others are seen in heavy infrastructure development with the better government support, which can create huge demand for the styrenics in the coming years. while south Africa is trying to boost local manufacturing infrastructure which can create the huge opportunities for the styrenics manufacturers in the coming years.

Segmental Insights

Product Type Insights

How the Polystyrene Segment Dominated the Styrenics Market in 2024?

The polystyrene segment held the largest share of the market in 2024, due to its wide applications in sectors like insulation, packaging, and consumer products. Moreover, having unique characteristics such as affordability, lightweight, and easy molding, the polystyrene segment gained immense popularity in recent years. Also, the increased need for thermal insulation and fragile packaging protection has heavily provided the sophisticated consumer base to the polystyrene segment in the past few years.

The acrylonitrile butadiene styrene (ABS) segment is expected to grow at a notable rate during the predicted timeframe due to its combination of strength, toughness, and flexibility-making it suitable for many industries. ABS is used widely in automotive parts, electronics, home appliances, and even 3D printing. It is lightweight, impact-resistant, and easy to mold, which makes it ideal for complex designs and durable products. As electric vehicles and consumer electronics continue to grow, the demand for ABS will rise. Additionally, its use in medical devices and toys is expanding due to its safety and chemical resistance. These advantages make ABS a top choice for future product innovation.

Application Type Insights

Why Do Packaging Segments Dominated the Styrenics Market by Application Type?

The packaging segment held the largest share of the global styrenics market in 2024, owing to the affordability, lightweight, and durability of the PS and EPS materials. Furthermore, these materials are considered essential in the making of food containers, protective packaging, and trays, which has led to their demand in recent years. Also, the sudden surge in e-commerce, retail consumption, and food delivery has contributed to the packaging growth in the past few years.

The automotive segment is expected to grow at a notable rate, as carmakers are using more lightweight plastic parts to reduce vehicle weight and improve fuel efficiency. Styrenics like ABS and SAN are perfect for making dashboards, trims, and bumpers because they are strong, durable, and easy to mold. With the rise of electric vehicles (EVs), manufacturers want materials that are safe, heat-resistant, and cost-effective. Styrenics also help lower production costs compared to metal parts. As more countries push for EV adoption and lightweight cars, the demand for styrenics plastics in the automotive sector will continue to grow quickly.

End User Type Insights

Why Did Packaging and FMCG Segment Dominate the Styrenics Market in 2024?

The packaging and FMCG segment dominated the market with the largest share in 2024. These sectors require lightweight, low-cost, and easy-to-process plastics. Styrenics like polystyrene are widely used for food containers, hygiene products, household items, and electronics packaging. FMCG companies need reliable materials that protect products, attract consumers, and reduce shipping costs. Styrenics meet these needs while offering flexibility in design and production. With rising urbanization and consumer spending globally, the need for convenient, protective, and affordable packaging continues to rise-making packaging and FMCG the largest end-user segment for styrenics products worldwide.

The medical segment is expected to grow at a notable rate due to rising demand for safe, durable, and hygienic materials in healthcare. Styrenics like ABS and styrene-acrylonitrile (SAN) are widely used in medical devices, diagnostic tools, and lab equipment. They are resistant to chemicals, easy to sterilize, and don't break easily, making them ideal for hospitals and clinics. As global healthcare spending increases and more advanced medical technologies emerge, the need for reliable plastic components will grow. The shift toward disposable and single-use medical products will also boost the demand for styrenics materials in the medical field.

Recent Developments

- In November 2024, INEOS introduced its latest product line of styrenics. The newly introduced styrenics are called the Lustran® 532. Also, it is the ABS grade styrenics as per the report published by the company.(Source: www.ineos-styrolution.com)

- In January 2025, Ineos unveiled the latest polystyrene. The newly launched polystyrene is mainly developed for the food contact application as per the company's claim.(Source: www.sustainableplastics.com)

Top Companies list

- INEOS Group AG

- BASF SE

- SABIC

- Chevron Phillips Chemical Company LLC

- Repsol

- LG Chem

- Trinseo

- TotalEnergies Styrenics

Segment Covered

By Product Type

- Polystyrene (PS)

- General-Purpose Polystyrene (GPPS)

- High-Impact Polystyrene (HIPS)

- Expanded Polystyrene (EPS)

- White EPS

- Grey/Graphite EPS (Improved Insulation)

- Acrylonitrile Butadiene Styrene (ABS)

- Flame-Retardant ABS

- Transparent ABS

- High Heat-Resistance ABS

- Styrene-Acrylonitrile (SAN)

- Medical-Grade SAN

- Food-Contact Grade SAN

- Styrene-Butadiene Rubber (SBR)

- Emulsion SBR (E-SBR)

- Solution SBR (S-SBR)

- Styrene Block Copolymers (SBC)

- Styrene-Ethylene-Butylene-Styrene (SEBS)

- Styrene-Isoprene-Styrene (SIS)

- Styrene-Butadiene-Styrene (SBS)

By Application

- Packaging

- Food Containers & Trays

- Disposable Cutlery & Cups

- Blister Packs

- Automotive

- Dashboards & Interior Panels

- Bumpers & Grilles

- Lighting & Trim Parts

- Building & Construction

- Insulation (EPS/XPS Boards)

- HVAC Panels

- Pipes & Fittings

- Electrical & Electronics

- Casings (TVs, Monitors, Printers)

- Switches & Sockets

- Small Appliances

- Casings (TVs, Monitors, Printers)

- Consumer Goods

- Toys & Recreational Equipment

- Luggage & Suitcases

- Furniture Components

- Healthcare & Medical

- Syringe Barrels

- Labware & Diagnostic Devices

- Transparent Casings

- Footwear & Sports Equipment (Primarily using SBC & SBR)

By End-User Industry

- Packaging & FMCG

- Automotive & Transportation

- Construction & Infrastructure

- Electronics & Electrical Appliances

- Medical & Healthcare

- Retail & Consumer Goods

- Footwear & Sporting Goods

By Region

- North America

- U.S.

- Mexico

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Asia Pacific

- China

- India

- Japan

- South Korea

- Central & South America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- UAE