Content

What is the U.S. Plastic Compounding Market Size?

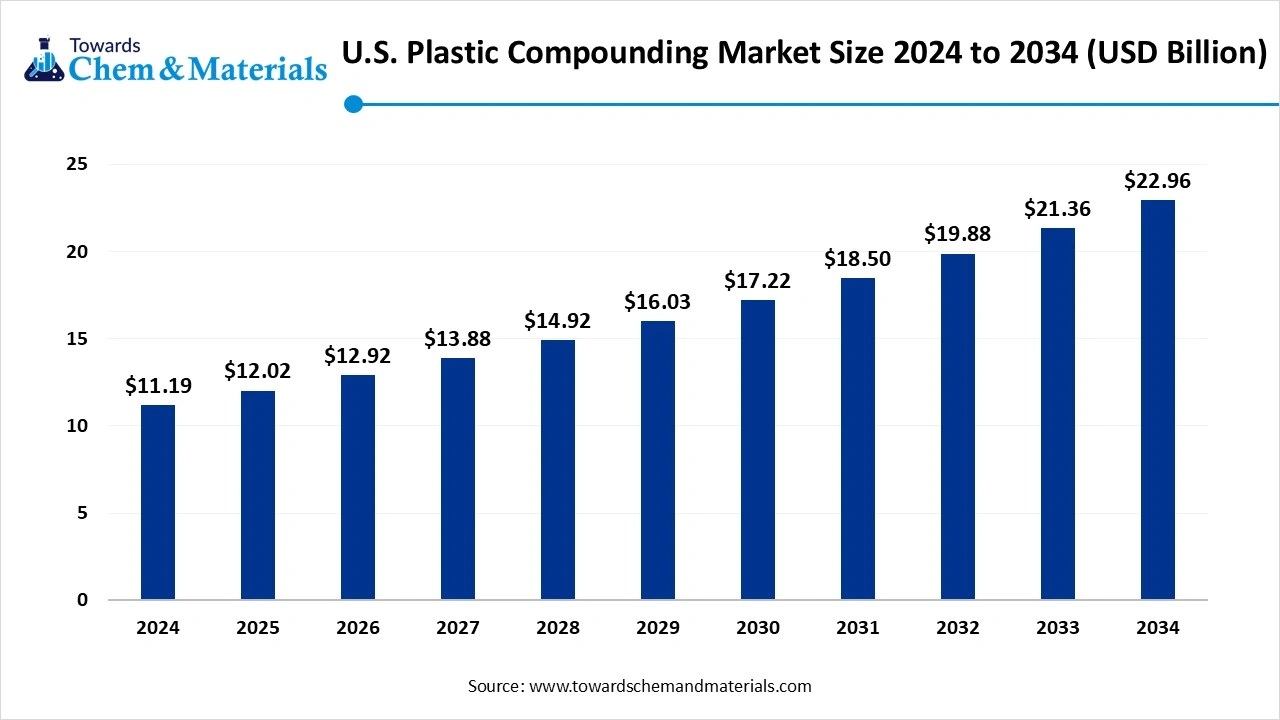

The U.S. plastic compounding market size was reached at USD 11.19 billion in 2024 and is expected to be worth around USD 22.96 billion by 2034, growing at a compound annual growth rate (CAGR) of 7.45% over the forecast period 2025 to 2034. The increased need for lightweight materials has accelerated industry potential in the region in recent years.

Key Takeaways

- By source type, the fossil-based segment led the U.S. plastic compounding market in 2024 with approximately 65-70% market share, due to factors such as the wide availability and traditional habits.

- By source type, the bio-based segment is expected to grow at the fastest rate in the market during the forecast period, akin to the sudden shift towards eco-friendly manufacturing and sustainability.

- By base polymer type, the polyethylene segment emerged as the top-performing segment in the market in 2024 with approximately 18-20% industry share, because it is one of the most widely used and cost-efficient polymers, offering flexibility, toughness, and chemical resistance.

- By base polymer type, PET is expected to lead the market in the coming years, due to its growing role in packaging, textiles, and electronics.

- By additives/fillers type, the mineral fillers segment led the market in 2024 with approximately 30-35% market share because fillers like calcium carbonate and glass fibers are inexpensive, widely available, and effective in improving the strength, stiffness, and dimensional stability of plastics.

- By additives/ fillers type, the flame retardant/specialty additives segment is expected to capture the biggest portion of the market in the coming years, due to rising safety and performance requirements.

- By application, the automotive segment led the market in 2024 with approximately 35-40% market share, because vehicles require large volumes of compounded plastics for interiors, exteriors, under-hood components, and lightweight structures.

- By application, the optical media segment is expected to grow at the fastest rate in the market during the forecast period, due to rising demand for plastics in electronics, data storage, and communication technologies.

Market Overview

From Polymers to Progress: Inside the United States Plastic Compounding Surge

The U.S. plastic compounding market has experienced sophisticated growth in recent years as the increased demand from sectors such as construction, packaging, and automotive. Furthermore, the country’s sudden shift towards advanced electronics, lightweight vehicles, and sustainable packaging has led the plastic compounding sector has gain major industry attention in the current period. Also, the industry is mainly focused on the polymers blending with materials such as fillers, reinforcement, and additives.

What Factor is driving the U.S. Plastic Compounding Market?

The increased expansion of the automotive industry's demand for lightweight and durable materials is spearheading the industry’s growth in recent years. Moreover, the regional shift towards fuel-efficient vehicles and advanced technology-based vehicles has immensely contributed to the market potential in recent years. Furthermore, by providing higher strength while being lightweight, the compounded plastic is expected to gain major industry share in the upcoming years, as per the recent United States survey.

Market Trends

- Greater awareness of sustainability in the manufacturing sector, as the country has demanded bio-based and recycled plastic in the past few years. Several companies in the United States have seen a heavy investment in bio-based polymers.

- The increased adoption of electric vehicles is driving the industry potential in recent years in the United States, where compounded plastic is considered a crucial material in the production.

Report Scope

| Report Attributes | Details |

| Market Size in 2026 | USD 12.92 Billion |

| Expected Size by 2034 | USD 22.96 Billion |

| Growth Rate from 2025 to 2034 | CAGR 7.45% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Source Basis, By Base Polymer Type, By Additives/Fillers/Modifiers, By Application Industry, |

| Key Companies Profiled |

LyondellBasell, BASF , Covestro , SABIC , Dow Chemical , Eastman Chemical , RTP Company , Celanese Corporation, Avient Corporation (formerly PolyOne) , Ensinger (U.S. operations), Americhem (via Infinity LTL Engineered, Compounds) , Samply Plastics (assumed compounding focus) , Aurora Plastics Company , Star Plastics Company , J-Tec Industries, Inc. , Ravago (U.S. compounding subsidiaries) , LANXESS (U.S. nylon compounding line) , Danimer Scientific (biopolymer compounding) , CCC Plastics , |

Market Opportunity

Opportunities in Aerospace and Defense Sectors

The increasing demand for high-performance compounds from industries like aerospace and defense is anticipated to create lucrative opportunities for manufacturers in the coming years. Also, the manufacturers can establish strategic collaboration with these industries and can make the customizable compounding, which provides long profit margins with a sophisticated and trustworthy consumer base during the forecast period.

Market Challenge

Fossil-Based Input Costs on a Turbulent Rise

The high volatility of the raw materials is likely to hinder the market growth in the current period. As Fossil-based raw materials like polyethylene and polypropylene are currently seen under the heavy price volatility due to factors such as geopolitical tensions and global trade wars. Furthermore, the country manufacturers are facing other challenges like regulatory standard implementation of the single-use plastic ban, and others, as per the recent regional observation.

Segmental Insights

Source Type Insights

How Did The Fossil-Based Segment Dominate The U.S. Plastic Compounding Market In 2024?

The fossil-based segment held the largest share of the market in 2024, due to factors such as wide availability and traditional habits. Furthermore, the cost-effectiveness and backed by a sophisticated supply chain, the fossil based segment has maintained its dominance in the United States industry in recent years. Also, the versatility of these polymers is driving their growth in the various industries such as automotive, packaging, and construction, as per recent observations.

The bio-based segment is expected to grow at a notable rate during the predicted timeframe, akin to the sudden shift towards eco-friendly manufacturing and sustainability. Also, the government pushes for sustainability by providing attractive benefits to manufacturers, such the attractive subsidies and tax reduction initiatives are likely to play a major role in the expansion of bio-based polymers in the United States in the upcoming days.

Base Polymer Type Insights

Why Does The Polyethylene Segment Dominate The U.S. Plastic Compounding Market By Base Polymer Type?

The polyethylene segment held the largest share of the market in 2024, because it is one of the most widely used and cost-efficient polymers, offering flexibility, toughness, and chemical resistance. It is heavily used in packaging, construction films, pipes, and automotive parts. Moreover, versatility has played a major role in the expansion of the segment in recent years.

The Polyethylene Terephthalate (PET) segment is expected to grow at a notable rate due to its growing role in packaging, textiles, and electronics. PET is recyclable, lightweight, and offers excellent clarity and strength, making it ideal for food packaging and optical applications. With the U.S. pushing recycling programs and PET's compatibility with circular economy initiatives, its role in compounding will expand strongly.

Additives/Fillers Type Insights

How Did The Mineral Fillers Segment Dominate The U.S. Plastic Compounding Market In 2024?

The mineral fillers segment dominated the market with the largest share in 2024 because fillers like calcium carbonate and glass fibers are inexpensive, widely available, and effective in improving the strength, stiffness, and dimensional stability of plastics. They are widely used in automotive and construction.

The flame retardants/specialty additives segment is expected to grow at a significant rate due to rising safety and performance requirements. These additives provide heat resistance, UV stability, antimicrobial protection, and improved fire safety, especially for automotive, electronics, aerospace, and healthcare sectors. With stricter U.S. safety standards, demand for advanced additives will grow faster than traditional fillers.

Application Insights

How is Plastic Transforming the Automotive Industry?

The automotive segment held the largest share of the market in 2024 because vehicles require large volumes of compounded plastics for interiors, exteriors, under-hood components, and lightweight structures. The drive for fuel efficiency and electric vehicles has made plastics essential in replacing metals. Moreover, the global government push for sustainability has contributed to the segment growth in the current period.

The optical media segment is expected to grow at a notable rate during the predicted timeframe due to rising demand for plastics in electronics, data storage, and communication technologies. Compounded plastics with clarity, toughness, and thermal stability are critical in lenses, optical fibers, and media devices. As digitalization and high-speed communication expand, the U.S. will see strong growth in optical-grade compounded plastics.

U.S. Plastic Compounding Market Value Chain Analysis

Distribution to Industrial Users : The plastic compounding is mainly distributed by the industrial sectors that can manage high-performance materials such as the thermoplastic elastomers, engineering resins, and others.

- Key Players: Dow, SABIC, and LyondellBasell

Chemical Synthesis and Processing : The plastic compounding chemical synthesis includes procedures like monomer introduction, polymer types, catalyst use, and others.

Regulatory Compliance and Safety Monitoring : Plastic compounding processes require rigorous regulatory compliance and safety monitoring to ensure worker safety and product quality.

Recent Developments

- In July 2025, The HydroGraph Clean Power Inc. established the compounding partner program recently. The main motive behind the launch of the program is to expand the graphene-enhanced thermoplastic, as per the report published by the company recently.(Source: www.compositesworld.com)

- In June 2025, Borealis is ready to introduce its latest recyclate-based polyolefins (rPO) compounding line in Belgium soon. Moreover, in these compounding, the company is expected to use recyclates as per the report published by the company recently.(Source: www.chemanalyst.com)

U.S. Plastic Compounding Market Top Companies

- LyondellBasell

- BASF

- Covestro

- SABIC

- Dow Chemical

- Eastman Chemical

- RTP Company

- Celanese Corporation

- Avient Corporation (formerly PolyOne)

- Ensinger (U.S. operations)

- Americhem (via Infinity LTL Engineered Compounds)

- Samply Plastics (assumed compounding focus)

- Aurora Plastics Company

- Star Plastics Company

- J-Tec Industries, Inc.

- Ravago (U.S. compounding subsidiaries)

- LANXESS (U.S. nylon compounding line)

- Danimer Scientific (biopolymer compounding)

- CCC Plastics

- Vi-Chem Corporation

Segment Covered

By Source Basis

- Fossil-based polymers

- Bio-based polymers

- Recycled polymers

By Base Polymer Type

- Polyethylene (PE)

- Polypropylene (PP)

- Polyvinyl chloride (PVC)

- Polystyrene (PS)

- Polyethylene terephthalate (PET)

- Polyamide (Nylon, PA)

- Polybutylene terephthalate (PBT)

- Polycarbonate (PC)

- Acrylonitrile butadiene styrene (ABS)

- Engineering high-performance: e.g., PEEK, PPS, PSU, PI

By Additives/Fillers/Modifiers

- Mineral fillers (e.g., talc, calcium carbonate)

- Reinforcements (e.g., glass fiber, carbon fiber)

- Flame retardants

- Stabilizers / Antioxidants / UV stabilizers

- Plasticizers

- Colorants / Masterbatches

By Application Industry

- Automotive

- Building & Construction

- Electrical & Electronics

- Packaging

- Consumer Goods

- Industrial Machinery

- Medical Devices

- Optical Media

- Aerospace & Defense