Content

U.S. Oil & Gas Market Size & Share Report, 2034

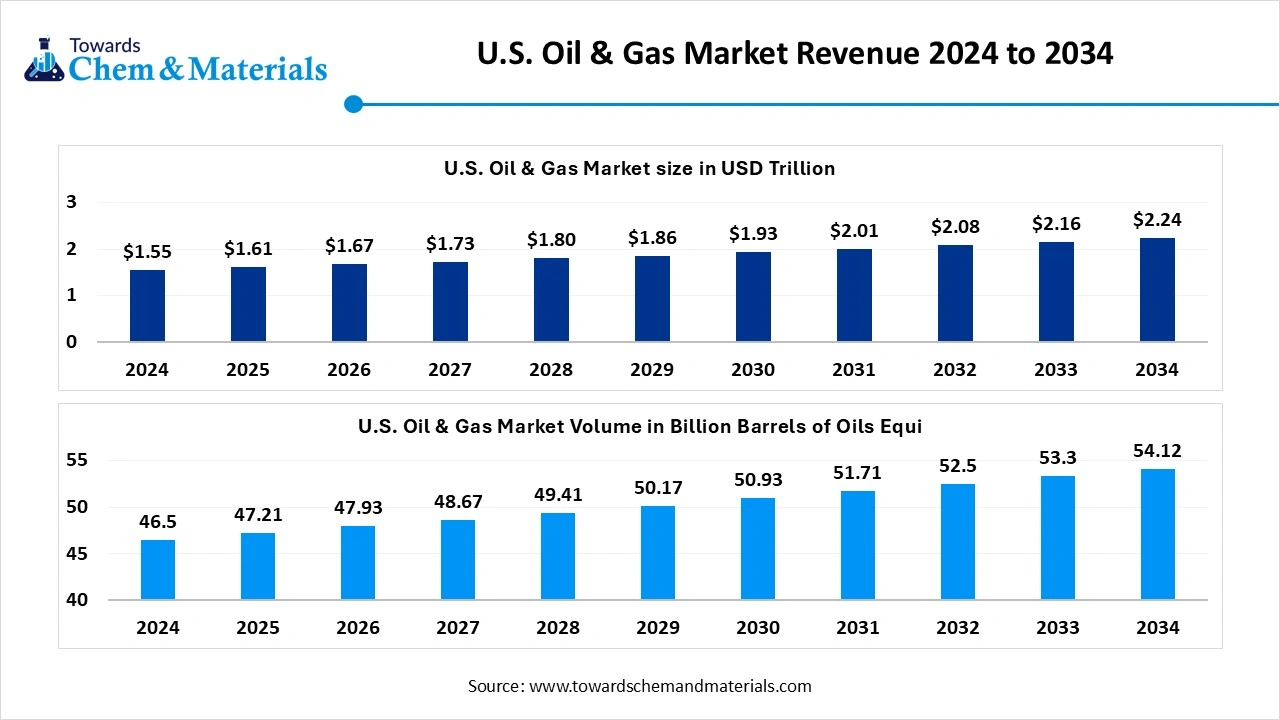

The U.S. oil & gas market size is calculated at USD 1.55 trillion in 2024, grew to USD 1.61 trillion in 2025, and is projected to reach around USD 2.24 trillion by 2034. The market is expanding at a CAGR of 3.75% between 2025 and 2034. The growing demand for energy, rapid growth in the transportation sector, and strong presence of natural gas infrastructure drive the market growth.

Key Takeaways

- South held a 51% share in the U.S. oil & gas market in 2024 due to the strong presence of large reserves of oil & gas.

- Northeast is growing at the fastest CAGR in the market during the forecast period due to the growing energy demand.

- By sector, the upstream segment held a 50% share in the market in 2024 due to the increasing investment in the energy sector.

- By sector, the midstream segment is expected to grow at the fastest CAGR in the market during the forecast period due to the growing integration of digital technologies with midstream operations.

- By resource type, the natural gas segment held a 54% share in the market in 2024 due to the well-established pipeline network.

- By resource type, the liquified natural gas segment is expected to grow at the fastest CAGR in the market during the forecast period due to the growing expansion of LNG infrastructure.

- By extraction technique, the unconventional segment held a 65% share in the market in 2024 due to the increasing export of LNG.

- By extraction technique, the offshore segment is expected to grow at the fastest CAGR in the market during the forecast period due to the supportive government policies.

- By end-use, the transportation segment held a 42% share in the U.S. oil & gas market in 2024 due to the growing modes of transportation.

- By end-use, the petrochemical feedstock segment is expected to grow at the fastest CAGR in the market during the forecast period due to the strong presence of the advanced infrastructure for transportation & production of natural gas.

- By deployment, the Permian Basin segment held a 44% share in the market in 2024 due to the well-established transportation infrastructure.

- By deployment, the Marcellus Shale segment is expected to grow at the fastest CAGR in the market during the forecast period due to the improvements in the productivity of the drilling rig.

- By technology, the hydraulic fracturing segment held a 41% share in the market in 2024 due to the shorter production cycle.

- By technology, the AI & predictive maintenance segment is expected to grow at the fastest CAGR in the market during the forecast period due to the increasing demand for identifying equipment failures.

- By distribution, the integrated oil companies segment held a 47% share in the market in 2024 due to the growing investment in research & development.

- By distribution, the independent producers segment is expected to grow at the fastest CAGR in the market during the forecast period due to the quick adoption of new technologies.

U.S. Oil & Gas Power Behind Energy Independence and Transition

The U.S. oil & gas market is the process of production, refining, exploration, distribution, and transportation of natural gas & crude oil. It encompasses the full hydrocarbon value chain—upstream (exploration and production), midstream (transportation and storage), and downstream (refining and distribution). With a strong focus on energy independence, technological innovation, and shale resource development, the U.S. has become a top global producer and exporter of both oil and natural gas.

The oil & gas industry is a significant contributor to the economy of the United States through energy supply, job creation, and tax revenue. The growing commercial & residential demand for energy increases the adoption of oil & gas. Factors like supportive government policies, focus on energy independence, growth in the transportation sector, growing industrial sector, and increasing demand for power generation contribute to the market growth.

- The United States exported $118B of crude petroleum oils in 2024. (Source: oec.world )

- The United States exported $62.2B of petroleum gas in 2024. (Source: oec.world )

- The United States exported $8.89B of refined petroleum in May 2025.(Source: oec.world)

Growing Petrochemical Industry Drives U.S. Oil & Gas Market Growth

The growing petrochemical industry in the United States increases demand for oil & gas. The increasing demand for feedstocks for the production of petrochemicals increases demand for liquified natural gas and natural gas. The growing investment in the petrochemical plants and the increasing expansion of existing petrochemical facilities fuel demand for oil & gas. The increasing production of petrochemicals like propylene and ethylene fuels the demand for oil & gas.

The increasing demand for petrochemicals in various applications like packaging, energy storage systems, plastics, and automotive parts fuels demand for oil & gas. The increasing Gulf Coast region investment in the petrochemical facilities increases access to shale gas. The growing demand for petrochemicals across sectors like automotive, electronics, packaging, and construction increases demand for oil & gas. The growing petrochemical industry is a driver for the market.

Market Trends

- Rise in LNG Exports: The growing demand for cleaner energy sources increases the adoption of LNG. The growing expansion of export capacity of liquified natural gas helps the market growth. For instance, the United States exported $41.8B of liquified natural gas in 2023.(Source : oec.world)

- Growing Demand for Energy: The growing energy demand in the United States due to factors like growing transportation, increasing industrial activity, and growth in data centers increases consumption of oil & gas.

- Technological Advancements: The ongoing technological advancements like sustainability-focused innovations, digital transformations, and automation increase the safety and efficiency of oil & gas applications.

Report Scope

| Report Attribute | Details |

| Market Volume in 2025 | 47.21 Billion Barrels of Oils Equi. |

| Expected Volume by 2034 | 54.12 Billion Barrels of Oils Equi. |

| Growth Rate from 2025 to 2034 | CAGR 1.53% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Sector, By Resource Type, By Extraction Technique, By End Use, By Deployment Type,By Technology, By Distribution Channel, By Region |

| Key Companies Profiled | ExxonMobil Corporation, Chevron Corporation, ConocoPhillips, Occidental Petroleum (Oxy), EOG Resources, Inc., Pioneer Natural Resources, Devon Energy Corporation, Marathon Petroleum Corporation, Phillips 66, Valero Energy Corporation, Kinder Morgan, Inc., Williams Companies, Inc., Hess Corporation, Chesapeake Energy Corporation, Antero Resources Corporation, Diamondback Energy, Inc., Halliburton Company, Schlumberger Ltd. (U.S. Operations), Baker Hughes Company, Tellurian Inc. (LNG Developer/Exporter) |

Market Opportunity

Industrial Growth Surges Demand for Oil & Gas in U.S.

The industrial growth in the United States increases demand for oil & gas for various applications. The growth in industrial processes increases demand for feedstock, power generation, and heating, which requires oil & gas. The increasing development of infrastructure, factories, and machinery for industrial purposes increases demand for oil & gas for the production of energy. The growing industrial growth increases the demand for transportation, which requires oil & gas-derived fuels like jet fuel, gasoline, and diesel.

The rapid urbanization increases industrial growth, which fuels demand for cooling, transportation, heating, and electricity. The growing industrial processes like manufacturing, refining, and petrochemical production increase demand for oil & gas, like various refined products, natural gas, and liquified petroleum gas. The industrial growth creates an opportunity for the U.S. oil & gas market growth.

Market Challenge

High Production Cost Limits Expansion of U.S. Oil & Gas Market

Despite several benefits of the oil & gas industry in the United States, the high production cost restricts the market growth. Factors like complex extraction processes, increased water management costs, geopolitical instability, and the need for advanced drilling technologies are responsible for the high production costs. The advanced drilling technologies, like hydraulic fracturing, increase the production cost. The complexity of fracking technology requires high costs. The fracking process generated a large amount of wastewater, and the disposal of this wastewater is expensive. The advanced technologies like multi-stage fracking and horizontal drilling require a high initial cost. The cost of accessing environmentally sensitive and remote areas is high. The high production cost restricts the market growth.

Segmental Insights

Sector Insights

Why did Upstream Segment Dominate the U.S. Oil & Gas Market?

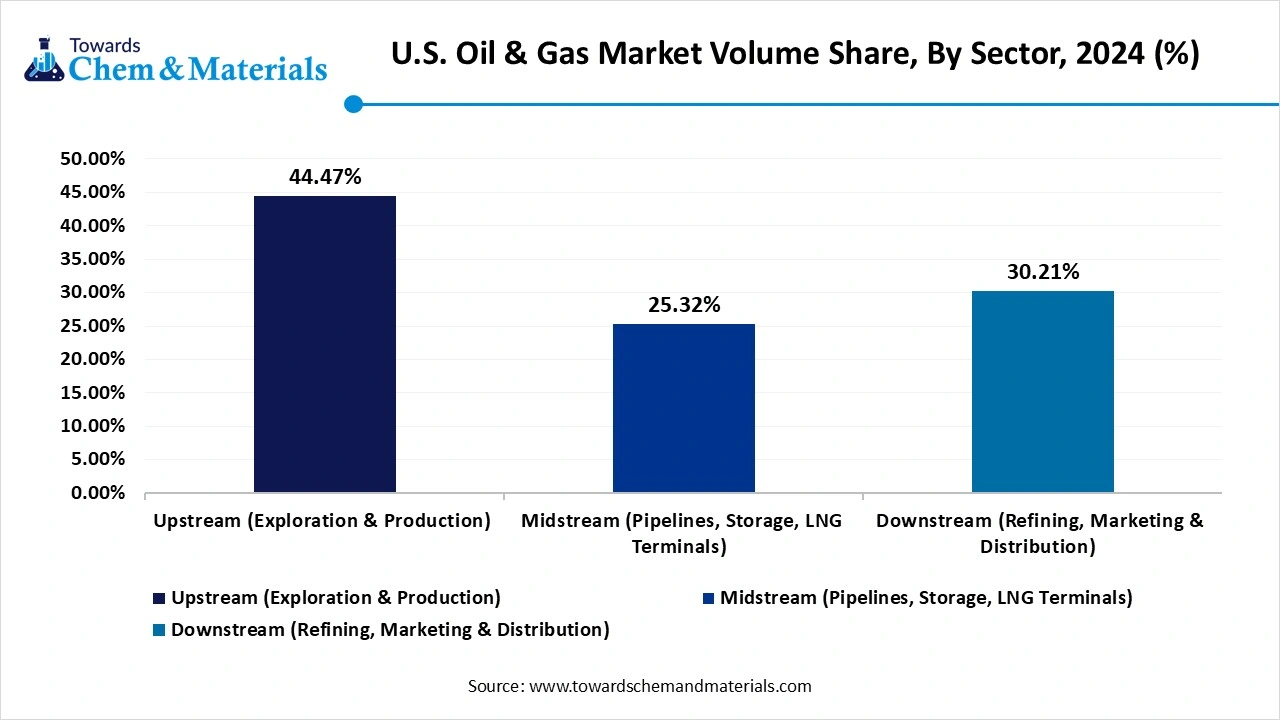

The upstream segment dominated the U.S. oil & gas market in 2024. The presence of advanced extraction technologies like horizontal drilling and hydraulic fracturing increases the extraction of oil & gas. The strong presence of shale formations in areas like Eagle Ford, Permian Basin, and Bakken helps the market growth. The growing investment in the energy sector and the exploitation of shale gas reserves increase the upstream activities. The well-established infrastructure for transportation, exploration, and drilling drives the market growth.

The midstream segment is the fastest-growing in the market during the forecast period. The growing demand for distribution, transportation, and storage of oil & gas increases demand for the midstream sector. The increasing development of pipelines and infrastructure for the transportation of oil & gas, and technological advancements, help the market growth. The increasing production of oil & gas and the expansion of existing pipeline networks increase demand for midstream infrastructure. The growing digitalization, like machine learning, AI, and other technologies in midstream, improves maintenance of pipelines, enhances predictive insights, and optimizes distribution of resources. The increasing midstream activity in areas like Oklahoma & Texas, and focus on sustainable practices, supports the market growth.

U.S. Oil & Gas Market Volume Share, By Sector, 2024-2034 (%)

| By Sector | Volume Share, 2024 (%) | Market Volume - 2024( Billion Barrels of Oils Equi.) | Volume Share, 2034 (%) | Market Volume - 2034( Billion Barrels of Oils Equi.) | CAGR (2025 - 2034) |

| Upstream (Exploration & Production) | 44.47% | 20.68 | 39.56% | 21.41 | 0.39% |

| Midstream (Pipelines, Storage, LNG Terminals) | 25.32% | 11.77 | 28.32% | 15.33 | 2.97% |

| Downstream (Refining, Marketing & Distribution) | 30.21% | 14.05 | 32.12% | 17.38 | 2.40% |

| Total | 100% | 46.50 | 100% | 54.12 | 1.53% |

Resource Type Insights

How Natural Gas Segment Held the Largest Share in the U.S. Oil & Gas Market?

The natural gas segment held the largest revenue share in the U.S. oil & gas market in 2024. The presence of large reserves of natural gas, especially in shale formations, helps the market growth. The ongoing technological advancements, like horizontal drilling and hydraulic fracturing, increase the extraction of natural gas. The growing power generation and strong industrial base increase demand for natural gas. The well-developed network of pipelines and increasing extraction of natural gas from shale formations drive the market growth.

The liquified natural gas (LNG) segment is the fastest-growing in the market during the forecast period. The growing expansion of LNG export infrastructure, like facilities and terminals, helps the market growth. The shift towards cleaner energy and a focus on reducing carbon footprint increases the adoption of LNG. The growing power generation and industrial expansion increase demand for LNG. The increasing investment in LNG infrastructure, liquefication plants, and export terminals supports the overall growth of the market.

Extraction Technique Insights

Why did Unconventional Segment Dominate the U.S. Oil & Gas Market?

The unconventional segment dominated the U.S. oil & gas market in 2024. The strong presence of shale oil & gas in areas like Bakken, Permian Basin, and Eagle Ford increases the adoption of unconventional extraction for the production of oil & gas. The growing technological advancements like hydraulic fracturing & horizontal drilling increase the adoption of unconventional extraction. The presence of tight gas & tight oil resources fuels demand for unconventional extraction. The growing export of LNG & crude oil and supportive government policies drive the market growth.

The offshore segment is the fastest-growing in the market during the forecast period. The increasing demand for oil & natural gas increases the demand for offshore extraction. The increasing production of oil & gas from ultra-deepwater & deepwater reserves increases the adoption of offshore extraction. The growing demand for energy increases the demand for drilling activities, which include offshore exploration. The supportive government policies for offshore drilling and advancements in reservoir management support the market growth.

End Use Insights

Which End User Industry Held the Largest Share in the U.S. Oil & Gas Market?

The transportation segment held the largest revenue share in the U.S. oil & gas market in 2024. The growing modes of transportation like commercial trucks, ships, personal vehicles, airplanes, and cars increase demand for oil-based fuels, helping the market growth. The increasing production of petroleum products like jet fuel, gasoline, and diesel increases demand for crude oil. The increasing development of transportation infrastructure, like ports, roads, and railways, increases demand for oil & gas. The focus on a sustainable transportation system and growing air travel drives the market growth.

The petrochemical feedstock segment is the fastest-growing in the market during the forecast period. The growing extraction of shale gas increases the production of petrochemical feedstock like ethylene. The growing US Gulf Coast investment in the expansion of petrochemical facilities fuels the production of petrochemical feedstock. The growing demand for petrochemical feedstocks in the automotive & packaging industries helps the market growth. The well-established infrastructure for transportation & production of natural gas and technological advancements in refining processes support the market growth.

Deployment Type Insights

Which Deployment Type Dominates the U.S. Oil & Gas Market?

The onshore segment dominated the market in 2024. The less expensive infrastructure and easier access to maintenance, exploration, & drilling increase demand for onshore operations. The presence of shale in Eagle Ford, Permian, and Bakken increases demand for onshore deployment. The growing investment in transportation, pipelines, and processing facilities drives the market growth.

How Permian Basin Segment Held the Largest Share in the U.S. Oil & Gas Market?

The Permian Basin held the largest revenue share as a sub-segment. The presence of natural gas and prolific oil in the Permian Basin helps the market growth. The technological advancements like hydraulic fracturing and horizontal drilling increase the extraction of oil & gas from shale. The focus on energy independence and a well-established network of transportation infrastructure, pipelines, and processing facilities drives the market growth.

The Marcellus Shale is the fastest-growing sub-segment. The presence of abundant reserves of natural gas in the Marcellus Shale helps the market growth. The refinement & development of technologies like hydraulic fracturing and horizontal drilling increase the potential of the Marcellus shale. The growing demand for energy security and improvements in drilling rig productivity support the market growth.

Technology Insights

Why the Hydraulic Fracturing Segment Held the Largest Share in the U.S. Oil & Gas Market?

The hydraulic fracturing segment held the largest revenue share in the U.S. oil & gas market in 2024. The abundant shale resources of tight oil & shale gas increase demand for hydraulic fracturing technology. The presence of unconventional oil & gas resources increases the adoption of hydraulic fracturing. The supportive regulatory environment for hydraulic fracturing and well-established infrastructure for processing, production, & transportation of oil & gas help the market growth. The shorter production cycle and increasing export of natural gas drive the market growth.

The AI & predictive maintenance segment is the fastest-growing in the market during the forecast period. The focus on scheduling equipment maintenance and identifying failures of equipment increases the adoption of AI & predictive maintenance. The increasing demand for identifying hazards like equipment malfunctions & leaks fuels the adoption of AI & predictive maintenance. The focus on optimizing energy consumption and reducing carbon footprint increases adoption of AI, supporting the overall growth of the market.

Distribution Channel Insights

How Integrated Oil Segment Dominates the U.S. Oil & Gas Market?

The integrated oil companies segment dominated the U.S. oil & gas market in 2024. The growing development of new technologies, like refining processes and drilling technologies, in integrated oil companies, helps the market growth. The increasing demand for controlling various stages, like production, marketing, exploration, and refining, fuels the demand for integrated oil companies. The need to control the supply chain and growing investment in large-scale projects like deep-seal drilling help the market growth. The growing integrated oil companies' investment in R&D and presence of integrated companies like Chevron & ExxonMobil drive the market growth.

The independent producers segment is the fastest-growing in the market during the forecast period. The growing demand for liquified natural gas and the expansion of LNG export facilities increases demand for independent producers. The increasing focus on production & exploration of oil & gas fuels demand for independent producers. The faster adoption of new technologies like AI, EOR techniques, and digitalization in independent producers helps market growth. The quick adoption of changing conditions and increasing demand for oil & gas supports the market growth.

Insights Country

How South Region Dominated the U.S. Oil & Gas Market?

The South U.S. dominated the U.S. oil & gas market in 2024. The well-established reserves of oil & natural gas in New Mexico & Texas help the market growth. The presence of refineries, a network of pipelines, and storage facilities increases the production of oil & gas. The extensive export terminals for liquified natural gas and access to international & domestic markets increase the export of oil & gas. The focus on the development of techniques like horizontal drilling & hydraulic fracturing and offshore oil & gas reserves in the Gulf of Mexico drives the overall growth of the market.

Why Northeast U.S. experiencing the Fastest Growth in the U.S. Oil & Gas Market?

The Northeast U.S. is experiencing the fastest growth in the market during the forecast period. The abundant reserves of shale gas in the Marcellus and Utica Shale help the market growth. The extensive presence of advanced extraction techniques like horizontal drilling and hydraulic fracturing increases the production of oil & gas. The strong network of pipelines for the transportation of natural gas helps the market growth. The large energy-consuming areas and well-developed industrial hubs fuel energy demand, supporting the overall growth of the market.

Recent Developments

- In April 2025, Aon launched coverage for plugging abandoned oil & gas wells in the U.S. The product offers protection in carbon credits for investors and buyers. (Source: www.businessinsurance.com)

- In July 2025, BLM launched a historic oil lease sale in the eastern U.S. The eastern lease creates opportunities like access to newer geological assessments, proximity to eastern refining capacity, and advanced horizontal completion & drilling techniques. The regions included in the eastern lease sales are Mid-Atlantic coastal areas, Appalachian Basin regions, and Southeastern states.(Source: oilprice.com)

U.S. Oil & Gas Market Top Companies

- ExxonMobil Corporation

- Chevron Corporation

- ConocoPhillips

- Occidental Petroleum (Oxy)

- EOG Resources, Inc.

- Pioneer Natural Resources

- Devon Energy Corporation

- Marathon Petroleum Corporation

- Phillips 66

- Valero Energy Corporation

- Kinder Morgan, Inc.

- Williams Companies, Inc.

- Hess Corporation

- Chesapeake Energy Corporation

- Antero Resources Corporation

- Diamondback Energy, Inc.

- Halliburton Company

- Schlumberger Ltd. (U.S. Operations)

- Baker Hughes Company

- Tellurian Inc. (LNG Developer/Exporter)

Segments Covered

By Sector

- Upstream (Exploration & Production)

- Midstream (Pipelines, Storage, LNG Terminals)

- Downstream (Refining, Marketing & Distribution)

By Resource Type

- Crude Oil (WTI, LLS, Bakken, etc.)

- Natural Gas (Shale Gas, Tight Gas)

- Liquefied Natural Gas (LNG)

- Refined Petroleum Products

By Extraction Technique

- Unconventional (Shale, Tight Oil, Hydraulic Fracturing)

- Conventional Onshore

- Offshore (Gulf of Mexico)

By End Use

- Transportation (Automotive, Aviation)

- Power Generation

- Industrial Use

- Residential & Commercial

- Petrochemical Feedstock

By Deployment Type

- Onshore (Permian, Bakken, Marcellus, Eagle Ford, etc.)

- Offshore (Gulf of Mexico, California Coast)

By Technology

- Hydraulic Fracturing & Horizontal Drilling

- Seismic Imaging

- Carbon Capture & Storage (CCS)

- AI & Predictive Maintenance

- Remote Monitoring & SCADA

- Digital Twin & IoT Applications

By Distribution Channel

- Integrated Oil Companies

- Independent Producers

- Oilfield Services Companies

- Pipeline Operators

- LNG Exporters

By Region

- Northeast

- Midwest

- South

- West

- Gulf Coast