Content

Asia Pacific Oil & Gas Infrastructure Market Size & Share Report, 2034

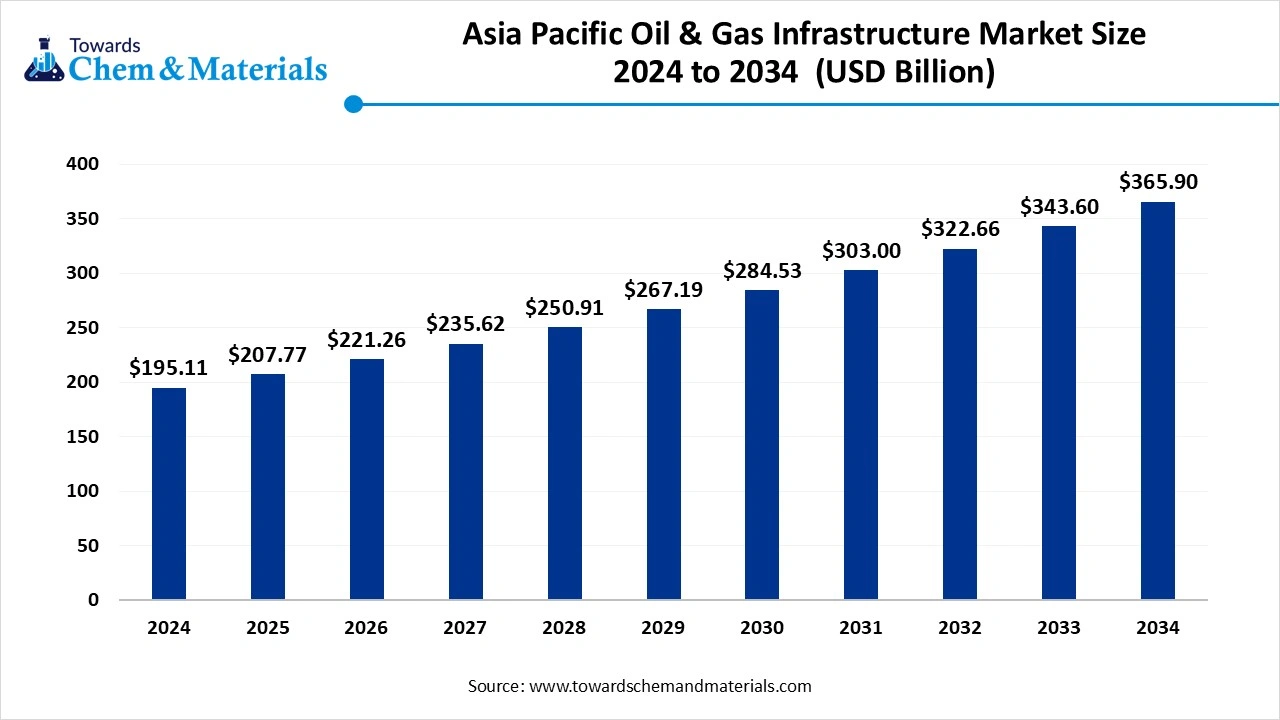

The Asia Pacific oil & gas infrastructure market size accounted for USD 207.77 billion in 2025 and is forecasted to hit around USD 365.90 billion by 2034, representing a CAGR of 6.49% from 2025 to 2034. Increasing energy demand in emerging economies is the key factor driving market growth. Also, growing investments in midstream infrastructure, coupled with the advancements in pipeline construction and monitoring, can fuel market growth further.

Key Takeaways

- By country, China dominated the market with a 40% share in 2024. The dominance of the country can be attributed to the increasing need for energy because of economic expansion and ongoing diversification of energy sources.

- By country, India is expected to grow at the fastest CAGR over the forecast period. The growth of the country can be credited to the rapid expansion of pipeline networks.

- By sector, the midstream segment held a 44% Asia Pacific oil & gas infrastructure market share in 2024. The dominance of the segment can be attributed to the growing energy demand and strategic investments in infrastructure development.

- By sector, the midstream segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the surge in demand for cleaner energy sources, along with the growth in LNG infrastructure.

- By infrastructure, the crude oil & gas pipelines (onshore & offshore) segment led the market by holding 36% market share in 2024. The dominance of the segment can be linked to the innovations in pipeline technology.

- By infrastructure, the LNG terminals segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by rising demand for cleaner energy sources, coupled with the need for energy security.

- By fuel type, the natural gas segment held a 42% market share in 2024. The dominance of the segment can be linked to the ongoing energy shift towards cleaner energy sources and a surge in global energy connectivity.

- By fuel type, the liquefied natural gas LNG segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by the expansion of regasification and liquefaction capacity.

- By material, the carbon steel segment dominated the market with 55% market share in 2024. The dominance of the segment is owed to the growing demand for cost-effective and strong materials in oil and gas extraction.

- By material, the thermoplastics (HDPE, PP for gas distribution) segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment is due to its corrosion resistance and cost-effective properties.

- By ownership, the national oil companies (NOCs) segment held a 50% market share in 2024. The dominance of the segment can be attributed to the growing investments in infrastructure and the crucial role of NOCs in securing energy supplies.

- By ownership, the private infrastructure developers (EPC, PPP models) segment is expected to grow at the fastest CAGR during the projected period. The growth of the segment can be credited to the growing demand for significant infrastructure investment.

- By application, the industrial consumption segment led the market by holding 38%market share in 2024. The dominance of the segment can be credited to the increase in industrial activity and strategic investments in LNG infrastructure.

- By application, the domestic power generation segment is expected to grow at the fastest CAGR during the study period. The growth of the segment is due to the rapid industrialization and growing investments in LNG infrastructure.

Technological Advancements are Expanding Market Growth

The Asia-Pacific Oil & Gas Infrastructure Market refers to the broad network of upstream, midstream, and downstream facilities supporting the exploration, production, processing, transportation, storage, and distribution of oil, natural gas, and LNG across the Asia-Pacific region. This includes key energy economies such as China, India, Australia, Japan, South Korea, Indonesia, and emerging players like Vietnam and the Philippines. With rising energy demand, a shift toward gas and LNG, and increasing investment in refinery and petrochemical capacities, the region's infrastructure is undergoing rapid modernization and expansion to enhance energy access, support industrialization, and transition toward cleaner fuels.

What Are the Key Trends Influencing the Asia-Pacific Oil & Gas Infrastructure Market?

- Surge in global energy consumption, especially for oil and natural gas, is the latest trend in the market. This rise in energy demand requires significant investments in infrastructure to optimise production, transportation, and refining, which will impact positive market growth soon.

- Increasing adoption of digital technologies such as big data analytics, IoT, and automation is enhancing operational efficiency and overall safety in oil and gas infrastructure. Also, environmental concerns and regulations are impelling the development of emission reduction technologies in the oil and gas industry.

- The oil and gas sector are rapidly investing in renewable energy ventures by exploring innovative ways to combine renewable energy sources into current infrastructure. In addition, the remote monitoring and control systems are increasingly being deployed to enhance the efficiency and safety of operations, particularly in remote areas.

Report Scope

| Report Attribute | Details |

| Market Size in 2025 | USD 207.77 Billion |

| Expected Size by 2034 | USD 365.90 Billion |

| Growth Rate from 2025 to 2034 | CAGR 6.49% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Sector, By Infrastructure Type, By Fuel Type, By Material Type, By Ownership / Operator, By Application, By Key Countries |

| Key Companies Profiled | China National Petroleum Corporation (CNPC), China National Offshore Oil Corporation (CNOOC), Oil and Natural Gas Corporation (ONGC), Indian Oil Corporation (IOC), Petronas (Malaysia), PT Pertamina (Indonesia), Woodside Energy (Australia), Santos Ltd. (Australia), SK Gas & SK Innovation (South Korea), Tokyo Gas & JERA (Japan), Chevron Corporation, ExxonMobil Asia Pacific, Shell Plc (Asia Operations), TotalEnergies (Asia Pacific) |

Market Opportunity

Shift to Natural Gas

The oil and gas industry are witnessing an ongoing shift towards natural gas, creating lucrative opportunities in the market. Natural gas acts as a bridge fuel in the energy transition due to its ability to minimize carbon emissions as compared to other fossil fuels. Furthermore, the growth of natural gas infrastructure, such as LNG terminals, pipelines, and city gas distribution networks, is necessary to fulfil the growing gas demand.

- In November 2024, PM Modi announced the launch of strategic initiatives worth ₹4,027 crore in the petroleum and natural gas sector, emphasizing cleaner fuel policies. The projects also include a ₹3,638 crore investment by Bharat Petroleum Corporation Ltd (BPCL) in Bihar.(Source: https://energy.economictimes.indiatimes.com)

Market Challenges

Aging Infrastructure

Many oil and gas facilities and pipelines are moving forward towards the end of their operational lifespan, necessitating costly upgrades, which is a major factor hampering market growth. Moreover, increasing awareness regarding the environmental impact of fossil fuels is propelling stringent regulations and public scrutiny, pushing companies to adopt more sustainable practices.

Country Insight

China dominated the Asia Pacific oil & gas infrastructure market with a 40% market share in 2024.

The dominance of the country can be attributed to the increasing need for energy because of economic expansion and ongoing diversification of energy sources. Additionally, China is rapidly developing its domestic oil and gas resources such as developing its domestic oil and gas resources to minimize dependence on imports, which is impacting positive market expansion.

India is expected to grow at the fastest CAGR over the forecast period. The growth of the country can be credited to the rapid expansion of pipeline networks and the advancements in LNG infrastructure across the country. Furthermore, the ongoing shift towards cleaner energy sources, particularly natural gas, is boosting the expansion of LNG infrastructure like regasification facilities and import terminals.

Who are the largest oil and gas companies by revenue in the Asia Pacific in 2023?

| Company Name | Revenue in USD billion |

| Sinopec | 478.5 |

| Reliance Industries | 124.0 |

| SOCAR | 70.0 |

| Nogaholding | 11.1 |

| Bangladesh Petroleum Corporation | 5.7 |

Segmental Insight

Sector Insight

Which Sector Type Segment Dominated the Asia Pacific Oil & Gas Infrastructure Market in 2024?

The midstream segment held a 44% market share in 2024. The dominance of the segment can be attributed to the growing energy demand and strategic investments in infrastructure development. The development of non-conventional resources such as tight oil and shale gas needs substantial midstream infrastructure for transportation and processing, driving segment growth shortly.

The midstream segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the surge in demand for cleaner energy sources, along with the growth in LNG infrastructure as a bridge fuel. Also, governments in the region are actively supporting the development of LNG infrastructure via policies, incentives, and investments.

Infrastructure Insight

Why Did the Crude Oil & Gas Pipelines Segment Dominated the Asia Pacific Oil & Gas Infrastructure Market in 2024?

The crude oil & gas pipelines (onshore & offshore) segment dominated the market by holding 36% market share in 2024. The dominance of the segment can be linked to the innovations in pipeline technology, rising energy demand, and ongoing investments in energy infrastructure. In addition, natural gas is seen as a cleaner fossil fuel, which leads to a surge in the expansion of gas pipeline infrastructure.

The LNG terminals segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by rising demand for cleaner energy sources, coupled with the need for energy security. LNG is considered a sustainable alternative to coal and oil, with lower emissions, which makes it a crucial fuel for power generation and industrial applications.

Fuel Type Insight

How Much Share Did the Natural Gas Segment Held in 2024?

The natural gas segment held a 42% market share in 2024. The dominance of the segment can be linked to the ongoing energy shift towards cleaner energy sources and a surge in global energy connectivity. Natural gas is often considered a bridge fuel in the shift to a lower-carbon economy, because it generates fewer emissions than coal when burned. This transition facilitates investments in natural gas infrastructure.

The liquefied natural gas LNG segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by the expansion of regasification and liquefaction capacity, along with the supportive government initiatives supporting natural gas as a transition fuel. Innovations in technologies for LNG production are also driving segment expansion.

Material Insight

Why the Carbon Steel Segment Held the Largest Asia Pacific Oil & Gas Infrastructure Market Share in 2024?

The carbon steel segment dominated the market with a 55% market share in 2024. The dominance of the segment is owed to the growing demand for cost-effective and strong materials in oil and gas extraction and the growth of both offshore and onshore drilling activities. Additionally, carbon steel is more cost-effective compared to other options such as stainless steel, which makes it a favoured choice for large-scale infrastructure projects.

The thermoplastics (HDPE, PP for gas distribution) segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment is due to its corrosion resistance and cost-effective properties, coupled with the rising investments in infrastructure projects. Moreover, these materials are known for their high flexibility, high tensile strength, and capability to withstand ground movement.

Ownership Insight

How Much Share Did the National Oil Companies (NOCs) Segment Held in 2024?

The national oil companies (NOCs) segment held a 50% Asia Pacific oil & gas infrastructure market share in 2024. The dominance of the segment can be attributed to the growing investments in infrastructure and the crucial role of NOCs in securing energy supplies. NOCs play an important role in the global energy landscape, especially in emerging nations, as they use their access to technology, capital, and domestic engagement to expand their operations.

The private infrastructure developers (EPC, PPP models) segment is expected to grow at the fastest CAGR during the projected period. The growth of the segment can be credited to the growing demand for significant infrastructure investment and ongoing government policies promoting PPP models, fuelling the segment's growth soon.

Application Insight

Which Application Segment Dominated the Asia Pacific Oil & Gas Infrastructure Market in 2024?

The industrial consumption segment led the market by holding 38%market share in 2024. The dominance of the segment can be credited to the increase in industrial activity, strategic investments in LNG infrastructure, and rapid growth in population. Moreover, the development of oil and gas pipelines is important for transporting resources to industrial and urban areas, fuelling segment growth soon.

The domestic power generation segment is expected to grow at the fastest CAGR during the study period. The growth of the segment is due to the rapid industrialization, growing investments in LNG infrastructure, along with the government policies supporting natural gas as a cleaner energy source. Many countries in the region are focusing on increasing domestic oil and gas production to lessen dependence on imports.

Recent Developments

- In April 2025, Indian Oil Corporation (IOC) unveiled a project, SPRINT, a crucial transformation initiative focusing on making the company future-ready amid an increasingly expanding global energy landscape.(Source: https://www.constructionworld.in)

- In March 2025, Morocco announced the launch of a $6 billion tender in the upcoming months to build and redesign its natural gas infrastructure. Tenders include LNG pipelines and terminals for the development of local gas resources.(Source: https://www.zawya.com)

Asia Pacific Oil & Gas Infrastructure Market Top Companies

- China National Petroleum Corporation (CNPC)

- China National Offshore Oil Corporation (CNOOC)

- Oil and Natural Gas Corporation (ONGC)

- Indian Oil Corporation (IOC)

- Petronas (Malaysia)

- PT Pertamina (Indonesia)

- Woodside Energy (Australia)

- Santos Ltd. (Australia)

- SK Gas & SK Innovation (South Korea)

- Tokyo Gas & JERA (Japan)

- Chevron Corporation

- ExxonMobil Asia Pacific

- Shell Plc (Asia Operations)

- TotalEnergies (Asia Pacific)

Segments Covered

By Sector

- Upstream (Offshore & Onshore Exploration, Drilling Platforms, FPSOs)

- Midstream (Pipelines, LNG Infrastructure, Storage)

- Downstream (Refineries, Petrochemicals, Fuel Retail Distribution)

By Infrastructure Type

- Crude Oil & Gas Pipelines (Onshore & Offshore)

- LNG Terminals (Import & Export)

- Compressor & Pumping Stations

- Underground and Above-Ground Storage

- Gas Processing & Fractionation Plants

- Refineries & Petrochemical Complexes

- Retail Fuel Distribution Networks

- Floating Storage & Regasification Units (FSRUs)

By Fuel Type

- Crude Oil

- Natural Gas

- Liquefied Natural Gas (LNG)

- Refined Petroleum Products

- Liquefied Petroleum Gas (LPG)

- Hydrogen (Emerging Infrastructure)

By Material Type

- Carbon Steel

- Stainless Steel

- Thermoplastics (HDPE, PP for gas distribution)

- Composite Materials

By Ownership / Operator

- National Oil Companies (NOCs) – e.g., CNPC, ONGC, Petronas

- International Oil Companies (IOCs) – e.g., Shell, ExxonMobil

- Independent Midstream Players

- Government & Public Infrastructure Authorities

- Private Infrastructure Developers (EPC, PPP models)

By Application

- Export (Australia, Malaysia, Brunei LNG Terminals)

- Import (India, China, Japan, South Korea LNG & Oil)

- Domestic Power Generation

- Industrial Consumption (Fertilizers, Petrochemicals)

- Commercial & Residential Use

- Transportation Fuels

By Key Countries

- China

- India

- Australia

- Japan

- South Korea

- Indonesia

- Malaysia

- Thailand

- Vietnam

- Philippines