Content

U.S. Heat Treating Market Size and Share 2034

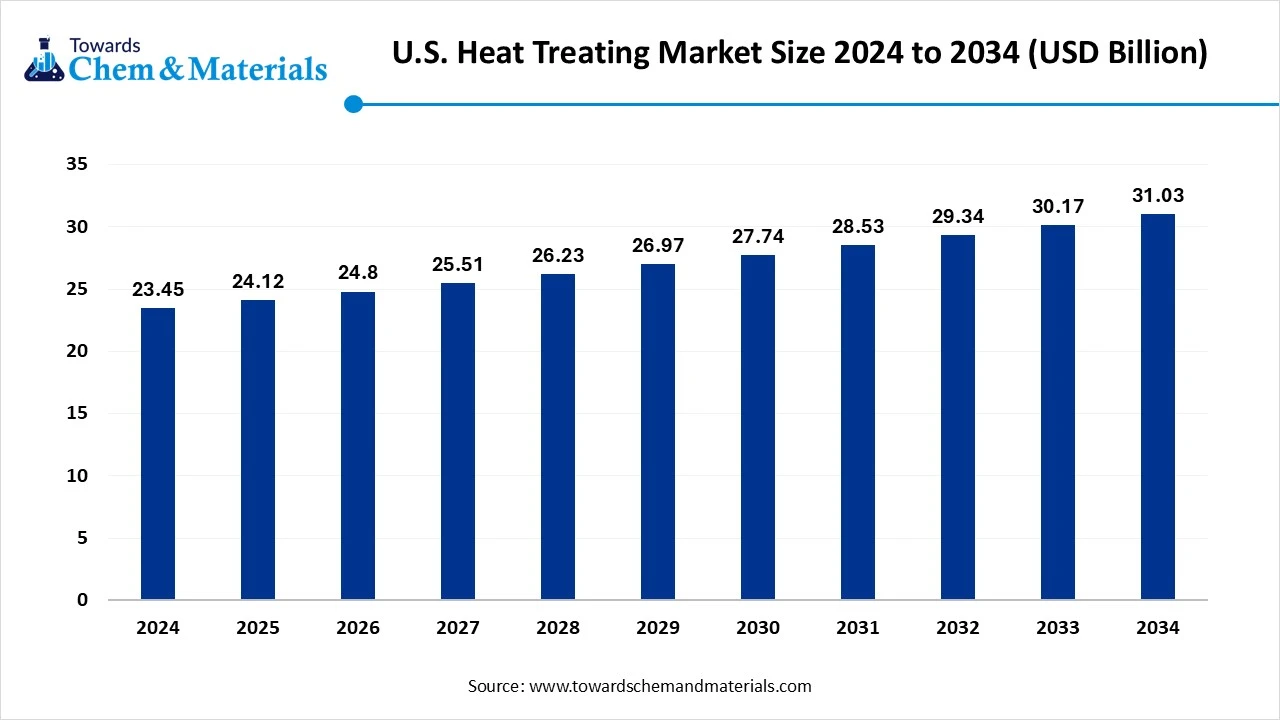

The U.S. heat treating market size was reached at USD 23.45 billion in 2024 and is expected to be worth around USD 31.03 billion by 2034, growing at a compound annual growth rate (CAGR) of 2.84% over the forecast period 2025 to 2034. The growth of the market is driven by the growing applications in various sectors like automotive, aerospace, and construction, which fuel the growth of the market.

Key Takeaways

- By process type, the hardening & tempering segment dominated the market in 2024. The hardening & tempering segment held approximately 35% share in the market in 2024. This process is widely used in automotive parts, cutting tools, and industrial machinery

- By process type, the vacuum heat treatment & nitriding segment is expected to grow significantly in the market during the forecast period. Vacuum heat treatment and nitriding processes are gaining traction due to their precision and superior surface hardening.

- By material type, the steel & alloys segment dominated the market in 2024. The steel & alloys segment held approximately 65% share in the market in 2024. Heat treatment improves tensile strength, ductility, and wear resistance of steel components

- By material type, the aluminum & titanium alloys (lightweight applications) segment is expected to grow in the forecast period. Their lightweight nature, combined with superior strength-to-weight ratios, makes them essential for fuel efficiency and performance optimization.

- By equipment type, the furnaces (gas & electric) segment dominated the market in 2024. The furnaces (gas & electric) segment held approximately 50% share in the market in 2024. They are used across steel, alloy, and aluminum treatment processes, making them central to the industry.

- By equipment type, the induction systems (precision & energy-efficient) segment is expected to grow in the forecast period. They are particularly suited for localized hardening of gears, shafts, and other automotive or aerospace components.

- By end use, the automotive & transportation segment dominated the market in 2024. The automotive & transportation segment held approximately 45% share in the market in 2024. With the rise of electric vehicles, lightweight alloy treatment is gaining prominence.

- By end use, the aerospace & defense segment is expected to grow in the forecast period. Stringent quality standards demand advanced processes such as vacuum heat treatment and nitriding to ensure reliability under extreme conditions.

- By service provider, the captive heat treating segment dominated the market in 2024. The captive heat treating segment held approximately 55% share in the market in 2024. Captive heat treating, where companies maintain in-house facilities, plays a vital role in the U.S. market.

- By service provider, the commercial heat treating (outsourcing trend) segment is expected to grow in the forecast period. Outsourcing provides flexibility, scalability, and access to specialized expertise.

Market Overview

Rising Demand For Durable Materials: U.S. Heat Treating Market To Expand

The U.S. heat treating market covers the provision of metal heat treatment services and technologies aimed at improving material properties such as hardness, strength, wear resistance, toughness, and fatigue life. Heat treating processes include annealing, tempering, carburizing, nitriding, hardening, stress relieving, and vacuum heat treatment.

The market serves industries such as automotive, aerospace & defense, heavy equipment, energy, construction, and general manufacturing. Growth is driven by rising demand for lightweight yet durable components, higher adoption of advanced alloys, stringent quality standards, and the modernization of manufacturing & defense sectors in the U.S.

What Are The Key Growth Drivers That Support The Growth Of the U.S. Heat Treating Market?

The growth of the market is driven by the growing demand from various sectors like automotive, construction, and aerospace, which fuels the growth of the market. The other key growth drivers that support the growth are the technological advancements, like integration of IoT, smart sensors, and advanced sensor control systems, material enhancements, and sustainability due to increasing adoption of energy efficiency and environmentally friendly heat treatment technologies in industry, further fueling the growth of the market. The other key drivers are the regulatory and economic drivers, like strict quality and environmental standards, and a strong industrial base fuel the growth and expansion of the market.

Market Trends

- Focus on efficiency and sustainability of industries for heat treatment solutions, and integration of green technology fuels the growth.

- The automation and digitalization through integration of IoT sensors and real-time monitoring for optimization is a growing trend.

- The growth in case hardening for enhancing surface hardness, which is used in various industries, also drives the growth.

- Increasing demand for steel from various industries due to its properties and widespread adoption also boosts the growth.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 24.12 Billion |

| Expected Size by 2034 | USD 31.03 Billion |

| Growth Rate from 2025 to 2034 | CAGR 2.84% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Process Type, By Material Type, By Equipment Type, By End-User Industry, By Service Provider, |

| Key Companies Profiled | Bluewater Thermal Solutions LLC, American Metal Treating, Inc., East-Lind Heat Treat, Inc., General Metal Heat Treating, Pacific Metallurgical, Inc., Advanced Heat Treat Corp., Bodycote, Nabertherm GsmbH, SECO/WARWICK, Solar Atmospheres, Unitherm Engineers Limited |

Market Opportunity

What Are The Key Growth opportunities that support the Growth Of The U.S. Heat Treating Market?

The key growth opportunity that supports the growth of the market is the technological advancements, like the development of smart low-cost systems with sensors and control units, which help in reducing errors and also provide valuable data for optimization, which increases the demand for the market.

The advanced heat treatment, due to growing demand for advanced techniques to achieve enhanced performance of the system, fuels the growth. Another key opportunity is the lightweight material enhancement, which helps in enhancing fuel efficiency and creates a significant opportunity for the growth of the market.

- The United States shipped out 6 Heat Tunnel shipments from September 2023 to August 2024 (TTM). These exports were handled by 4 United States exporters to 5 buyers, showing a growth rate of 20% over the previous 12 months.(Source: www.volza.com)

- Globally, China, Turkey, and Italy are the top three exporters of Heat Tunnel. China is the global leader in Heat Tunnel exports with 413 shipments, Turkey with 117 shipments, and Italy in 3rd place with 47 shipments.(Source: www.volza.com)

Market Challenge

What are the key challenges that hinder the growth of the U.S. Heat Treating Market?

The key challenges that hinder the growth of the market are the high initial investment costs for advanced heat treating equipment, such as automation systems and specialized furnaces limit the adoption by many manufacturers. Other key challenges are the environmental regulations and sustainability, supply chain disruption, raw material availability, technological adaptation, additive manufacturing integration, and skilled workforce shortage, which restrict the growth and expansion of the market.

Segmental Insights

Process Type Insights

Which Process Type Segment Dominated The U.S. Heat Treating Market In 2024?

The hardening & tempering segment dominated the U.S. heat treating market in 2024. Hardening and tempering processes dominate the market, offering enhanced strength, wear resistance, and durability to metals. This process is widely used in automotive parts, cutting tools, and industrial machinery components to improve mechanical performance. Its ability to balance hardness and toughness makes it indispensable across heavy industries. Continuous innovations in process control and automation further boost adoption, ensuring consistent output and compliance with stringent quality standards.

The vacuum heat treatment & nitriding segment expects significant growth in the market during the forecast period. Vacuum heat treatment and nitriding processes are gaining traction in the US due to their precision and superior surface hardening capabilities. Vacuum furnaces provide clean, controlled environments that minimize oxidation and contamination, critical for aerospace and medical components. Nitriding enhances fatigue resistance and corrosion protection, extending component life. These methods are favored for advanced applications requiring high-quality finishes and precision engineering, aligning with the country’s growing aerospace and defense manufacturing.

Material Type Insights

How Did Material Type Segment Dominated The U.S. Heat Treating Market In 2024

The steel & alloys segment dominated the market in 2024. Steel and alloy materials form the backbone of the US heat treating industry, driven by their extensive use in automotive, industrial, and construction sectors. Heat treatment improves tensile strength, ductility, and wear resistance of steel components, supporting applications from gears to structural frameworks. Advanced alloy steels benefit particularly from hardening, tempering, and nitriding, ensuring reliability under demanding operating conditions. Their versatility and widespread availability keep them the most dominant material category.

The aluminum & titanium alloys (lightweight applications) segment expects significant growth in the market during the forecast period. Aluminum and titanium alloys are witnessing growing adoption in US heat treating, especially in aerospace, automotive, and defense industries. Their lightweight nature, combined with superior strength-to-weight ratios, makes them essential for fuel efficiency and performance optimization. Specialized heat treatments improve fatigue resistance, corrosion protection, and dimensional stability. These materials are particularly important for engine parts, aircraft structures, and electric vehicle components, aligning with the industry shift toward sustainability and lightweight engineering.

Equipment Type Insights

Which Equipment Type Segment Dominated The U.S. Heat Treating Market In 2024

The furnaces (gas & electric) segment dominated the market in 2024. Furnaces remain the most widely used equipment type for heat treating in the US, available in both gas-fired and electric variants. Gas furnaces are preferred for large-scale, cost-effective operations, while electric furnaces provide precision control, energy efficiency, and environmental compliance. They are used across steel, alloy, and aluminum treatment processes, making them central to the industry. Continuous advancements in automation and digital monitoring enhance operational efficiency and product consistency.

The induction systems (precision & energy-efficient) segment expects significant growth in the U.S. heat treating market during the forecast period. Induction heat treating systems are expanding rapidly in the market due to their precision, speed, and energy efficiency. They are particularly suited for localized hardening of gears, shafts, and other automotive or aerospace components. The process allows for controlled heating with minimal distortion, reducing post-processing needs. Adoption is driven by industries seeking sustainability and cost efficiency, as induction systems offer reduced energy consumption and meet high-performance engineering demands.

End-User Industry

How Did End-User Industry Segment Dominate The U.S. Heat Treating Market In 2024

The automotive & transportation segment dominated the market in 2024. The automotive and transportation industry is the largest end-use segment for US heat treating, fueled by demand for durable and high-performance components. Gears, crankshafts, and engine parts undergo heat treatment to enhance wear resistance and fatigue strength. With the rise of electric vehicles, lightweight alloy treatment is gaining prominence. The sector’s focus on efficiency, safety, and longer component life ensures continued reliance on heat treating technologies for mass and specialized production.

The aerospace & defense segment expects significant growth in the U.S. heat treating market during the forecast period. Aerospace and defense industries are critical consumers of heat-treating services in the US, requiring precision-treated metals for aircraft structures, turbine blades, and defense equipment. Stringent quality standards demand advanced processes such as vacuum heat treatment and nitriding to ensure reliability under extreme conditions. Titanium and high-performance alloys are key materials here. The increasing emphasis on lightweight, fuel-efficient aircraft and advanced defense technologies sustains strong demand in this high-value segment.

Service Provider Insights

Which Service Provider Segment Dominated The U.S. Heat Treating Market In 2024

The captive heat-treating segment dominated the U.S. heat-treating market in 2024. Captive heat treating, where companies maintain in-house facilities, plays a vital role in the market. Large manufacturers, particularly in automotive and aerospace, prefer captive operations for greater control, consistent quality, and protection of proprietary processes. This approach reduces reliance on external vendors and shortens turnaround times. While capital-intensive, captive facilities are critical for companies with high production volumes and specialized material requirements, ensuring tighter integration with manufacturing processes.

The commercial heat treating (outsourcing trend) segment expects significant growth in the market during the forecast period. Commercial heat treating services are expanding across the US as industries increasingly outsource to reduce operational costs and avoid heavy capital investment. These service providers offer advanced capabilities such as vacuum furnaces and induction systems, catering to diverse sectors from automotive to aerospace. Outsourcing provides flexibility, scalability, and access to specialized expertise. The growing outsourcing trend supports small and medium enterprises, making commercial heat treating a key growth driver in the market.

U.S. Heat Treating Market Value Chain Analysis

- Chemical Synthesis and Processing: The heat treating is processed through annealing, hardening, tempering, normalizing, and stress relieving.

- Key players: ALD Thermal Treatment, Byron Products, Euclid Heat Treating, and Spectrum Thermal Processing

- Quality Testing and Certification : The heat treating requires AMS2750 (Aerospace Materials Specification), CQI-9 (Special Process: Heat Treat System Assessment), and IATF 16949.

- Distribution to Industrial Users: The heat treating is distributed to the automotive, aerospace, medical, energy, power generation, and construction industries.

- Key players: Bodycote, Paulo, Heat Treating Services Corporation of America, and Stahl Specialty Company.

Recent Developments

- In July 2025, Northern Heat Treat launched a new and innovative heat-treating technique. This launch focuses on the heat treatment of exploration drill rods used in diamond drilling.(Source: www.canadianmetalworking.com)

- In April 2025, Ipsen, headquartered in Cherry Valley, Illinois, USA. Announced the launch of service HUB, which is a single point of contact for the routine maintenance, technical support, and preventative service, delivering faster response times from the Field Service Team(Source: www.pim-international.com)

U.S. Heat Treating Market Top Companies

- Bluewater Thermal Solutions LLC

- American Metal Treating, Inc.

- East-Lind Heat Treat, Inc.

- General Metal Heat Treating,

- Pacific Metallurgical, Inc.

- Advanced Heat Treat Corp.

- Bodycote

- Nabertherm GsmbH

- SECO/WARWICK

- Solar Atmospheres

- Unitherm Engineers Limited

Segments Covered

By Process Type

- Hardening & Tempering

- Case Hardening (Carburizing, Carbonitriding)

- Annealing & Normalizing

- Stress Relieving

- Nitriding & Nitrocaburizing

- Vacuum Heat Treatment

- Induction & Flame Hardening

By Material Type

- Steel & Alloys

- Cast Iron

- Aluminum & Non-Ferrous Metals

- Titanium & Specialty Alloys

By Equipment Type

- Furnaces (Gas, Electric, Vacuum)

- Induction Systems

- Ovens & Kilns

- Auxiliary Equipment (Controls, Atmosphere Systems)

By End-User Industry

- Automotive & Transportation

- Aerospace & Defense

- Energy & Power Generation

- Construction & Heavy Machinery

- General Manufacturing & Tooling

- Medical & Healthcare

By Service Provider

- Captive Heat Treating (In-house by OEMs)

- Commercial Heat Treating (Independent Service Providers)