Content

U.S. Glass Product Manufacturing Market Size and Growth 2025 to 2034

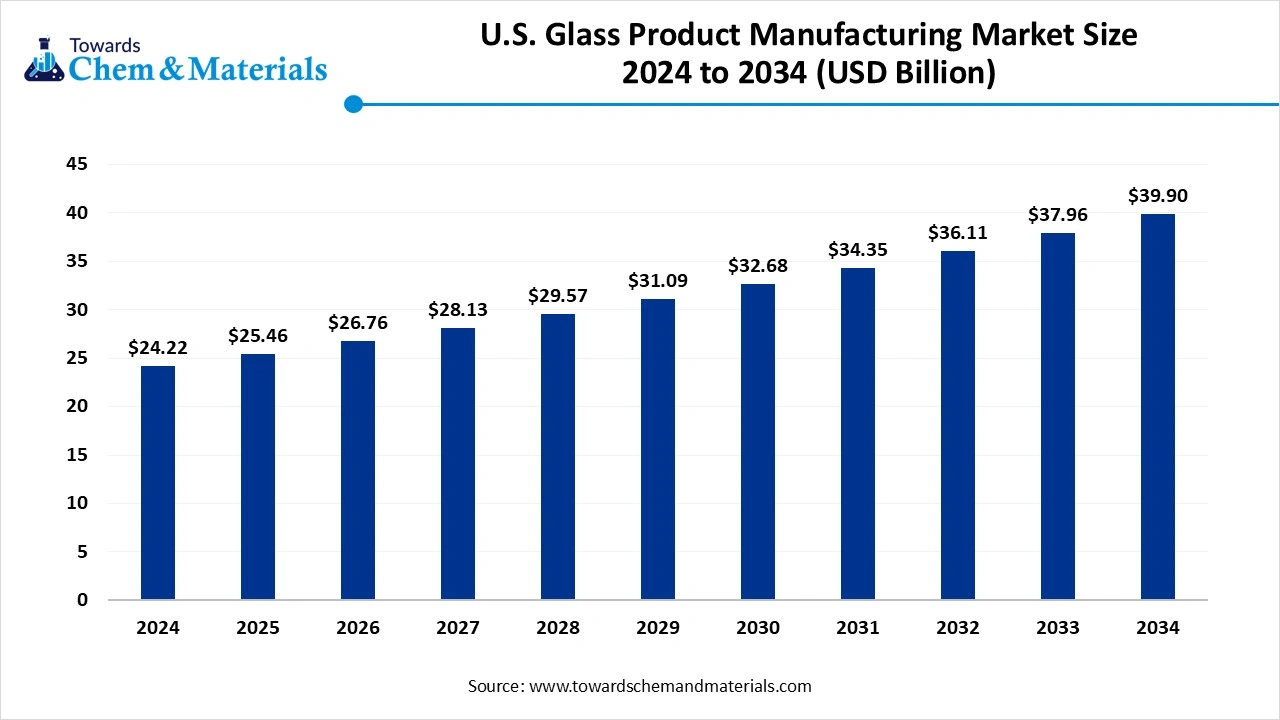

The U.S. glass product manufacturing-market size was valued at USD 24.22 billion in 2024, grew to USD 25.46 billion in 2025, and is expected to hit around USD 39.90 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.12% over the forecast period from 2025 to 2034. The demand for glass products from various industries due to their benefits and properties, rapid urbanization, and infrastructure development drives the growth of the market.

Key Takeaways

- By product type, the flat/float glass segment dominated the market in 2024. The flat/float glass segment held approximately 35% share in the market in 2024. Its affordability, uniform thickness, and adaptability make it critical for large-scale construction and infrastructure projects.

- By product type, the coated & functional glass segment is expected to grow significantly in the market during the forecast period. The rise in energy-efficient buildings and sustainable design trends drives the growth of the market.

- By end-use industry, the construction & building segment dominated the market in 2024. The construction & building segment held approximately 40% share in the market in 2024. Steady residential housing, commercial towers, and urban infrastructure influence the growth of the market.

- By end-use industry, the energy segment is expected to grow in the forecast period. The durability and highly transparent nature influence the growth.

- By material composition, the soda-lime glass segment dominated the market in 2024. The soda-lime glass segment held approximately 65% share in the market in 2024. Used extensively in construction, packaging, and automotive industries.

- By material composition, the aluminosilicate/strengthened glass segment is expected to grow in the forecast period. It is widely used in smartphones, tablets, automotive displays, and specialty architectural installations.

- By processing stage, the secondary processing segment dominated the market in 2024. The secondary processing segment held approximately 50% share in the market in 2024. Secondary processing enhances the usability and value of glass through cutting, laminating, tempering, and polishing.

- By processing stage, the fabricated assemblies (IGUs, curtainwall) segment is expected to grow in the forecast period. Insulated glass units (IGUs) offer superior energy efficiency, while curtainwall systems enhance building facades.

- By manufacturing scale, the mass-production segment dominated the market in 2024. The mass-production segment held approximately 70% share in the market in 2024. supplying industries such as construction, automotive, and packaging with standardized, cost-effective products.

- By manufacturing scale, the specialty / small-batch production segment is expected to grow in the forecast period. Application in various sectors drives the growth.

Market Overview

Rising Demand For Durable Materials: U.S. Glass Product Manufacturing Market To Expand

Glass product manufacturing begins by mixing raw materials like silica sand, soda ash, and limestone into a batch, which is then melted in a furnace at high temperatures (around 1500°C). The molten glass is then formed into a specific shape using methods such as blowing or floating, followed by processes like annealing for strength and cooling. Finally, the products undergo quality inspection and packaging, with defective items often recycled back into the process.

What Are The Key Growth Drivers That Support The Growth Of the U.S. Glass Product Manufacturing Market?

The growth of the US glass product manufacturing market is driven by the demand from various sectors, especially automotive, construction, and packaging, due to the benefits and properties offered.

The growing population and rapid urbanization increase the demand for residential and commercial construction, which increases the demand for glass for windows, interior, and exterior applications, driving the growth of the market.

The growing packaging industry and demand for sustainable packaging, premium products, and craft beverage increases the demand for the market. The technological advancements and innovation in materials like smart glass and energy-efficient glass for the support and adoption of sustainable building practices and renewable energy solutions drive the growth of the market.

Market Trends

- Smart Glass and Solar Glass: The demand for advanced products like smart glass for energy efficiency and glass front sheets for solar panels is on the rise.

- Focus on Sustainability: Manufacturers are investing in advanced production techniques to reduce waste, improve recyclability, and develop eco-friendly material production, says Precision Business Insights.

- Technological Advancements: Companies are innovating to improve efficiency, scalability, and supply chain management.

- Growth in Fiber Glass: Fiber glass is identified as a lucrative segment with the fastest growth in the market

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 25.46 Billion |

| Expected Size by 2034 | USD 39.90 Billion |

| Growth Rate from 2025 to 2034 | CAGR 5.12% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Product Type, By End-Use Industry, By Material Composition, By Processing Stage, By Manufacturing Scale |

| Key Companies Profiled | Owens-Illinois (O-I Glass), Corning Incorporated , Guardian Industries (Guardian Glass), AGC Inc. (Asahi Glass) – U.S. operations , Saint-Gobain North America (Saint-Gobain Glass Solutions) , Vitro Architectural Glass (Vitro S.A.B. de C.V.) , Ardagh Group – Glass Packaging North America , SCHOTT North America , NSG Group / Pilkington North America, Cardinal Glass Industries , Libbey Inc. , Anchor Hocking Company , Anchor Glass Container Corp. , Oldcastle BuildingEnvelope (CRH) , Gallo Glass Company , PPG Industries (legacy glass, specialty/tech glass in U.S.) , Fuyao Glass America, Saverglass Inc. (U.S. glass packaging arm) , McGrory Glass , J.E. Berkowitz (JE Berkowitz Glass, part of Trulite) |

Market Opportunity

The Growing Demand From Various Sectors

Opportunities in the U.S. glass manufacturing market lie in leveraging the increasing demand from key sectors like construction, automotive, and packaging. Specific opportunities include developing sustainable glass products through recycled materials and energy-efficient processes, innovating with smart glass and energy-efficient glazing for residential and commercial use, and integrating digital technologies for optimized production and supply chain resilience. Furthermore, embracing circular economy principles by investing in closed-loop recycling systems for glass cullet presents a new value-creation avenue.

Market Challenge

High Cost And Supply Chain Disruption

The key challenges that hinder the growth of the market are the high energy costs and environmental concerns, like energy-intensive processes and strict regulations, which demand more expensive technologies, which add up to the high operational costs and carbon emissions, hindering the growth of the market.

The other key challenges are capital and investment challenges, like high initial costs, technology adoption, raw material price fluctuations, and supply chain vulnerabilities, which restrict the growth and expansion of the market.

Segmental Insights

Product Type Insights

Which Product Type Segment Dominated The U.S. Glass Product Manufacturing Market In 2024?

The flat/float glass segment dominated the market in 2024. Flat/float glass is the backbone of the US glass manufacturing market, widely used in windows, facades, and automotive glazing. Its affordability, uniform thickness, and adaptability make it critical for large-scale construction and infrastructure projects. The segment continues to benefit from steady housing demand, commercial developments, and ongoing innovation in clarity, durability, and thickness, ensuring its relevance in both traditional and modern applications.

The coated & functional glass segment expects significant growth in the U.S. glass product manufacturing market during the forecast period. Coated and functional glass is gaining strong momentum due to the rise in energy-efficient buildings and sustainable design trends. Products such as low-emissivity (Low-E) glass, solar control coatings, and self-cleaning surfaces are increasingly specified in modern construction projects.

This segment is also finding applications in renewable energy and advanced electronics, where specialized coatings improve performance. Growing emphasis on reducing energy consumption supports the expansion of this segment in the US.

End-Use Industry Insights

How Did The Construction And Building Segment Dominate The U.S. Glass Product Manufacturing Market In 2024?

The construction & building segment dominated the market in 2024. Construction and building remain the largest end uses for glass products in the US, driven by steady residential housing, commercial towers, and urban infrastructure. Glass is now seen as both a structural and aesthetic material, offering insulation, noise reduction, and design appeal. With sustainable construction gaining traction, demand for energy-efficient glazing, curtain walls, and insulated glass units is steadily expanding across the sector.

The energy segment expects significant growth in the market during the forecast period. Energy is emerging as a high-growth end-use segment, particularly due to the expansion of renewable energy infrastructure. Photovoltaic panels, solar thermal systems, and wind turbines rely on highly transparent, durable, and functional glass. US investment in solar farms and decentralized clean energy solutions is creating opportunities for advanced glass types, ensuring long-term growth for this application area.

Material Composition Insights

Which Material Composition Segment Dominated The U.S. Glass Product Manufacturing Market In 2024?

The soda-lime glass segment dominated the market in 2024. Soda lime glass dominates US glass production due to its cost-effectiveness, versatility, and ease of forming. Used extensively in construction, packaging, and automotive industries, it represents the standard choice for large-scale applications. Its recyclability also adds to its value, aligning with sustainability initiatives. Innovation in improving its durability and optical performance has further reinforced its widespread adoption.

The aluminosilicate/strengthened glass segment expects significant growth in the U.S. glass product manufacturing market during the forecast period.

Aluminosilicate/strengthened glass caters to specialized markets where durability, heat resistance, and impact strength are critical. In the US, it is widely used in smartphones, tablets, automotive displays, and specialty architectural installations. The segment benefits from the growing electronics industry and rising consumer demand for premium, durable devices. Its use in aerospace and defense also adds to its long-term potential.

Processing Stage Insights

How Did The Secondary Processing Segment Dominate The U.S. Glass Product Manufacturing Market In 2024?

The secondary processing segment dominated the market in 2024. Secondary processing enhances the usability and value of glass through cutting, laminating, tempering, and polishing. This stage is critical for transforming raw float glass into safe, durable, and visually appealing products for construction, automotive, and industrial use. The demand for customized designs and functional improvements continues to drive growth in this segment, making secondary processing a major value driver in the US glass industry.

The fabricated assemblies (IGUs, curtainwall) segment expects significant growth in the U.S. glass product manufacturing market during the forecast period. Fabricated assemblies (IGUs, curtainwall) are increasingly integral to modern architecture, providing insulation, safety, and aesthetic appeal. Insulated glass units (IGUs) offer superior energy efficiency, while curtainwall systems enhance building facades. With growing emphasis on green buildings and LEED-certified projects, the adoption of fabricated assemblies has accelerated. These high-value products are shaping the future of urban construction in the U.S. market.

Manufacturing Scale Insights

Which Manufacturing Scale Segment Dominated The U.S. Glass Product Manufacturing Market In 2024?

The mass-production segment dominated the market in 2024. Mass production dominates US glass output, supplying industries such as construction, automotive, and packaging with standardized, cost-effective products.

Automated float lines and advanced manufacturing processes enable consistent quality and high volumes, making mass production essential for meeting nationwide demand. Its scale efficiency ensures affordability and widespread availability.

The specialty/small-batch production segment expects significant growth in the U.S. glass product manufacturing market during the forecast period. Specialty/small batch production serves niche markets that demand precision, customization, and advanced performance features.

This includes bespoke architectural glass, aerospace applications, and specialty electronics. While smaller in scale, this segment adds high value, catering to unique requirements such as ultra-thin, curved, or high-strength glass. Innovation and design flexibility are the hallmarks of this segment in the US.

U.S. Glass Product Manufacturing Market Value Chain Analysis

- Chemical Synthesis and Processing: The glass product manufacturing is processed through extraction, melting, refining, forming, and molding.

- Key players: AGC Inc., Guardian Industries, Gentex Corporation, Pella Corp., and Viracon

- Quality Testing and Certification: The glass product manufacturing requires BIS Certification and CE Marking.

- Distribution to Industrial Users: The glass product manufacturing is distributed to the packaging, automotive, electronics, consumer goods, and construction industries.

- Key players: Guardian Industries, Pella Corp., and Viracon.

Recent Developments

- In August 2025, AGY, a U.S. based company and manufacturer of specialty glass fiber products, announced the launch of L-HDI. The product provides consumers with high performance, mechanical integrity, and thermal reliability.(Source: www.businesswire.com)

- In December 2024, Owens Corning, a global leader in residential and commercial building products, announced the launch of a new glass nonwoven production line in Fort Smith, aiming to provide high-performance nonwoven technology.(Source: www.fibre2fashion.com)

U.S. Glass Product Manufacturing Market Top Companies

- Owens-Illinois (O-I Glass)

- Corning Incorporated

- Guardian Industries (Guardian Glass)

- AGC Inc. (Asahi Glass) – U.S. operations

- Saint-Gobain North America (Saint-Gobain Glass Solutions)

- Vitro Architectural Glass (Vitro S.A.B. de C.V.)

- Ardagh Group – Glass Packaging North America

- SCHOTT North America

- NSG Group / Pilkington North America

- Cardinal Glass Industries

- Libbey Inc.

- Anchor Hocking Company

- Anchor Glass Container Corp.

- Oldcastle BuildingEnvelope (CRH)

- Gallo Glass Company

- PPG Industries (legacy glass, specialty/tech glass in U.S.)

- Fuyao Glass America

- Saverglass Inc. (U.S. glass packaging arm)

- McGrory Glass

- J.E. Berkowitz (JE Berkowitz Glass, part of Trulite)

Segments Covered

By Product Type

- Flat / Float Glass

- Clear float sheet

- Low-E / coated glass

- Patterned/textured glass

- Mirror-backed glass

- Insulating & Laminated Glass

- Insulating glass units (IGUs)

- Laminated glass (PVB/ionoplast)

- Tempered & Strengthened Glass

- Fully tempered glass

- Heat-strengthened glass

- Glass Containers & Packaging

- Beverage bottles

- Food jars & containers

- Pharmaceutical vials & ampoules

- Cosmetic & specialty bottles

- Household & Consumer Glassware

- Tableware & drinkware

- Bakeware & cookware

- Lighting glassware (lamps, globes)

- Technical & Specialty Glass

- Optical glass (lenses, prisms)

- Display & cover glass (TVs, smartphones, touchscreens)

- Borosilicate labware & apparatus

- High-purity & semiconductor glass

- Fiberglass & Glass Fibers

- Insulation (batts, loose-fill)

- Reinforcement fibers for composites

- Specialty textile fibers

- Coated & Functional Glass

- Solar PV glass (low-iron, AR coated)

- Transparent conductive glass

- Smart glass / electrochromic glass

By End-Use Industry

- Construction & Building

- Automotive & Transportation

- Packaging (Food, Beverage, Pharma, Cosmetics)

- Consumer Goods (Tableware, Cookware, Lighting)

- Electronics & Appliances

- Energy (Solar & renewable applications)

- Industrial & Scientific (Labware, process glass)

- Healthcare & Pharmaceutical (Medical containers, devices)

By Material Composition

- Soda-lime glass

- Borosilicate glass

- Aluminosilicate / strengthened glass

- Lead crystal & decorative glass

- Low-iron glass

By Processing Stage

- Primary Production (melting, float, molding, drawing)

- Secondary Processing (cutting, tempering, laminating, coating)

- Fabricated Assemblies (IGUs, curtainwall, system integration)

By Manufacturing Scale

- Mass-production (float lines, container furnaces)

- Specialty / small-batch production (custom & technical glass)