Content

U.S. Extruded Polystyrene Market Size and Growth 2025 to 2034

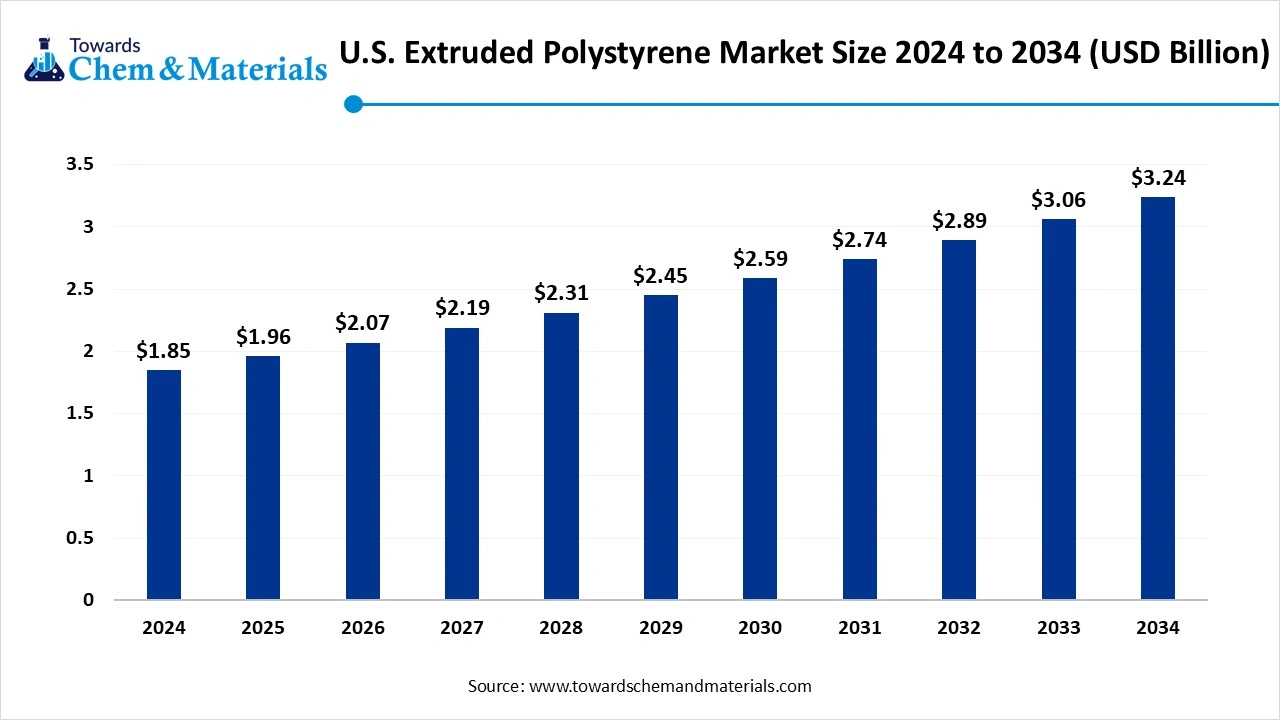

The U.S. extruded polystyrene market size was reached at USD 1.85 billion in 2024 and is expected to be worth around USD 3.24 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.75% over the forecast period 2025 to 2034. The rise in investments in cold chain logistics is the key factor driving market growth. Also, the rapid surge in residential and commercial construction, coupled with the innovations in manufacturing processes, can fuel market growth further.

Key Takeaways

- By region, the South region dominated the U.S. extruded polystyrene market by holding approximately 30% share in 2024. The dominance of the region can be attributed to the rapid urbanization and the ongoing infrastructure development.

- By region, the West region is expected to grow at the fastest CAGR over the forecast period. The growth of the region can be credited to the rise in urbanisation, which leads to higher infrastructure development.

- By application, the thermal insulation - walls segment dominated the market by holding approximately 35% share in 2024. The dominance of the segment can be attributed to the increasing focus on energy efficiency.

- By application, the packaging segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the ongoing expansion of the e-commerce sector and the need for more sophisticated cold chain logistics.

- By product type, the standard density segment held approximately 50% market share in 2024. The dominance of the segment can be linked to the surge in infrastructure and construction activities across the globe.

- By product type, the high-density segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by the increasing global need for more efficient energy building materials.

- By board thickness, the medium boards segment led the market by holding approximately 45% market share in 2024. The dominance of the segment is owed to the rapid urbanization and infrastructure development in the country.

- By board thickness, the thin boards segment is expected to grow at the fastest CAGR during the projected period. The growth of the segment is due to the surge in renovations and construction projects in the country.

- By faced, the unfaced XPS segment held approximately 40% market share in 2024. The dominance of the segment can be attributed to the rising need for energy-efficient construction.

- By faced, the foil-faced XPS segment is expected to grow at the fastest CAGR during the study period. The growth of the segment can be credited to the rising need for high-performance insulation in infrastructure and construction projects.

- By end use, the residential segment dominated the market by holding approximately 40% share in 2024. The dominance of the segment can be linked to the growing regulatory focus on energy-efficient and sustainable construction.

- By end use, the infrastructure segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by materials' crucial properties, such as moisture resistance and high compressive strength.

Technological Advancements are Expanding Market Growth

The market includes manufacturers, suppliers, and products associated with XPS, a strong, cell foam insulation material with exceptional moisture and thermal resistance properties, specifically utilized in commercial and residential construction for walls, foundations, and roofs, along with in specialized applications such as cold storage and roadways. Ongoing technological innovations and advancements are rapidly unlocking new applications for XPS.

What Are the Key Trends Influencing the U.S. Extruded Polystyrene Market?

- Growing use of the extruded polystyrene in residential and commercial construction across the globe for insulation and minimizing greenhouse gas emissions in the more developed countries is the latest trend in the market. Also, the development of green buildings can impact positive market growth further.

- Innovations in XPS manufacturing technology enhance the thermal performance, promoting its adoption in more demanding applications such as cold storage. Moreover, growing awareness regarding energy conservation globally is boosting demand for XPS as an insulation material in construction.

- Increasing demand for energy efficiency is another trend shaping positive market expansion. Stringent energy performance needs and the increasing awareness regarding sustainability are fuelling the demand for XPS in buildings, which leads to energy saving and enhanced thermal insulation.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 1.96 Billion |

| Expected Size by 2034 | USD 3.24 Billion |

| Growth Rate from 2025 to 2034 | CAGR 5.75% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Application, By Product Type, By Board Thickness, By Faced, By End-Use Industry, By Region (U.S.) |

| Key Companies Profiled | Owens Corning, Dow (The Dow Chemical Company), DuPont, Kingspan Group, Johns Manville, Atlas Roofing Corporation / Atlas Molded, Products, BASF Corporation, Carlisle Construction Materials (CCM), Saint-Gobain, Knauf Insulation, Insulfoam, DiversiFoam Products, ACH Foam Technologies, Foam-Control, Universal Foam Products, Premier Building Systems, RMAX, Carpenter Co., Amvic Building System, Thermal Foams Inc. |

Market Opportunity

Ongoing Development of Bio-based Expanded Polystyrene

Expanded polystyrene producers are increasingly investing in the R&D of biodegradable and bio-based expanded polystyrene solutions to stay compliant with sustainability mandates. Furthermore, advancements such as plant-based polystyrene with enhanced biodegradable foams can open advanced avenues of opportunities for major market players globally.

- In December 2024, Carlisle Companies announced the acquisition of Thermafoam, a producer of expanded polystyrene insulation materials in Texas. ThermaFoam serves the residential, commercial, and infrastructure construction sectors via PowerFoam and ThermaFoam brands.(Source: businesswire.com)

Market Challenges

High-Performance Substitutes

Materials such as mineral wool and polyisocyanurate provide superior properties in areas like fireproofing and thermal insulation, hindering market growth soon. Moreover, the installation costs of XPS are high due to its premium properties, which pose a barrier for some construction projects, creating challenges to XPS's market share.

Country Insight

U.S. Extruded Polystyrene Market Trends

The south region dominated the market by holding a 30% share in 2024. The dominance of the region can be attributed to the rapid urbanization and the ongoing infrastructure development, creating a need for XPS as an energy-efficient and durable building material. In addition, growing awareness regarding the green building standards, which favor XPS's exceptional thermal insulation properties, can fuel regional growth further.

The West region is expected to grow at the fastest CAGR over the forecast period. The growth of the region can be credited to the rise in urbanisation, which leads to higher infrastructure development. Furthermore, XPS is utilised in various major sectors beyond construction, such as automotive and the packaging sector. Its durable and lightweight nature makes it a more versatile material in the region.

Segmental Insight

Application Insight

Which Application Type Segment Dominated the U.S. Extruded Polystyrene Market in 2024?

The thermal insulation - walls segment dominated the market by holding a 35% share in 2024. The dominance of the segment can be attributed to the increasing focus on energy efficiency and the rapid expansion of the construction sector. Furthermore, the push for green building and eco-friendly construction practices encourages the use of sustainable and high-performance insulation materials like XPS.

The packaging segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the ongoing expansion of the e-commerce sector and the need for more sophisticated cold chain logistics. In packaging, the refrigerated transport packaging segment shows the fastest growth due to factors such as cost-effectiveness and its ability to customize packaging.

Product Type Insight

Why Standard Density Segment Dominated the U.S. Extruded Polystyrene Market in 2024?

The standard density segment held a 50% market share in 2024. The dominance of the segment can be linked to the surge in infrastructure and construction activities across the globe, along with the government support for sustainable buildings. Also, expanding commercial, residential, and public infrastructure projects, especially in developing states in the U.S., are impacting positive segment growth further.

The high-density segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by increasing global need for more efficient energy building materials, coupled with the rising demand for temperature-controlled logistics, particularly for cold chain storage and product advancements for improved fire resistance, leading to segment expansion shortly.

Board Thickness Insight

How Much Share Did the Medium Boards Segment Held in 2024?

The medium boards segment led the market by holding 45% market share in 2024. The dominance of the segment is owing to the rapid urbanization and infrastructure development in the country, along with the incentives for green buildings. Additionally, medium-density XPS boards minimize the energy consumption in renovation and construction projects, aligning with net-zero initiatives.

The thin boards segment is expected to grow at the fastest CAGR during the projected period. The growth of the segment is due to the surge in renovations and construction projects in the country and increasing awareness regarding supportive government incentives. Moreover, governments in the region are supporting energy-efficient buildings through regulations and incentives like tax credits.

Faced Insight

Which Faced Type Segment Dominated U.S. Extruded Polystyrene Market in 2024?

The unfaced XPS segment dominated with 40% market share in 2024. The dominance of the segment can be attributed to the rising need for energy-efficient construction, fuelled by strict building codes and a push for sustainable building practices. Furthermore, unfaced XPS finds wide use in several construction applications such as roofs, walls, and floors.

The foil-faced XPS segment is expected to grow at the fastest CAGR during the study period. The growth of the segment can be credited to the rising need for high-performance insulation in infrastructure and construction projects and the rise in urbanization in the country. Foil-faced XPS boards give exceptional moisture resistance, which is important for the long-term performance of insulation.

End-Use Industry Insight

Why Did the residential segment Held the Largest U.S. Extruded Polystyrene Market Share in 2024?

The residential segment dominated the market by holding a 40% share in 2024. The dominance of the segment can be linked to the growing regulatory focus on energy-efficient and sustainable construction, coupled with the demand for XPS in home renovations, especially for walls, foundations, and floors. Also, a substantial wave of home renovations in regions with colder climates will fuel the demand for XPS soon.

The infrastructure segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by materials' crucial properties, such as moisture resistance and high compressive strength, which are important for applications such as tunnels and building foundations. Moreover, XPS helps buildings meet stringent standards and codes.

U.S. Extruded Polystyrene Market-Value Chain Analysis

Feedstock Procurement

Feedstock procurement is the process of sourcing and obtaining essential raw materials necessary for producing XPS foam boards and other products.

Chemical Synthesis and Processing

The chemical synthesis and processing of polystyrene give the foundation for manufacturing the XPS foam boards utilized mainly for insulation purposes.

Packaging and Labelling

Extruded polystyrene (XPS) plays a crucial role in the market, especially in applications where unique properties give benefits over other materials.

Regulatory Compliance and Safety Monitoring

It encompasses the adherence to different state, federal, and local regulations concerning the production, handling, utilization, and disposal of XPS products, by ensuring their safety.

Recent Developments

- In November 2023, Huhtamaki introduced fiber-based egg cartons, created from 100% recycled materials, in the U.S. for the first time. The cartons will provide more branding space and be available in many colors later.(Source: www.huhtamaki.com)

U.S. Extruded Polystyrene Market Top Companies

- Owens Corning

- Dow (The Dow Chemical Company)

- DuPont

- Kingspan Group

- Johns Manville

- Atlas Roofing Corporation / Atlas Molded Products

- BASF Corporation

- Carlisle Construction Materials (CCM)

- Saint-Gobain

- Knauf Insulation

- Insulfoam

- DiversiFoam Products

- ACH Foam Technologies

- Foam-Control

- Universal Foam Products

- Premier Building Systems

- RMAX

- Carpenter Co.

- Amvic Building System

- Thermal Foams Inc.

Segments Covered

By Application

- Building & Construction

- Thermal Insulation – Walls

- Thermal Insulation – Roofs

- Thermal Insulation – Floors

- Structural Panels

- Foundation Systems

- Packaging

- Food Packaging (e.g., trays, containers)

- Refrigerated Transport (e.g., liners, coolers)

- Industrial Packaging (e.g., point-of-sale displays)

- Consumer Goods Packaging

- Other Industrial Uses

- Sports Equipment

- Crafts & Hobby Supplies

- Miscellaneous Industrial Components

By Product Type

- Standard Density XPS (e.g., ~1.25–1.5 lb/ft³)

- High Density XPS (e.g., ~1.8–2.0 lb/ft³)

- Ultra-High Density XPS (e.g., >2.0 lb/ft³)

By Board Thickness

- Thin Boards (< 1 inch)

- Medium Boards (1–2 inches)

- Thick Boards (> 2 inches)

By Faced

- Faced XPS

- Foil-Faced

- Coated-Faced (e.g., polymeric coatings)

- Paper-Faced

- Unfaced XPS

By End-Use Industry

- Residential (e.g., homes, housing)

- Commercial (e.g., offices, retail, industrial buildings)

- Infrastructure (e.g., bridges, tunnels, roadways)

- HVAC & Refrigeration (specialized applications)

- Others (e.g., agriculture, marine)

By Region (U.S.)

- Northeast

- Midwest

- South

- West