Content

What is the Current U.S. Biofuels Market Size and Share?

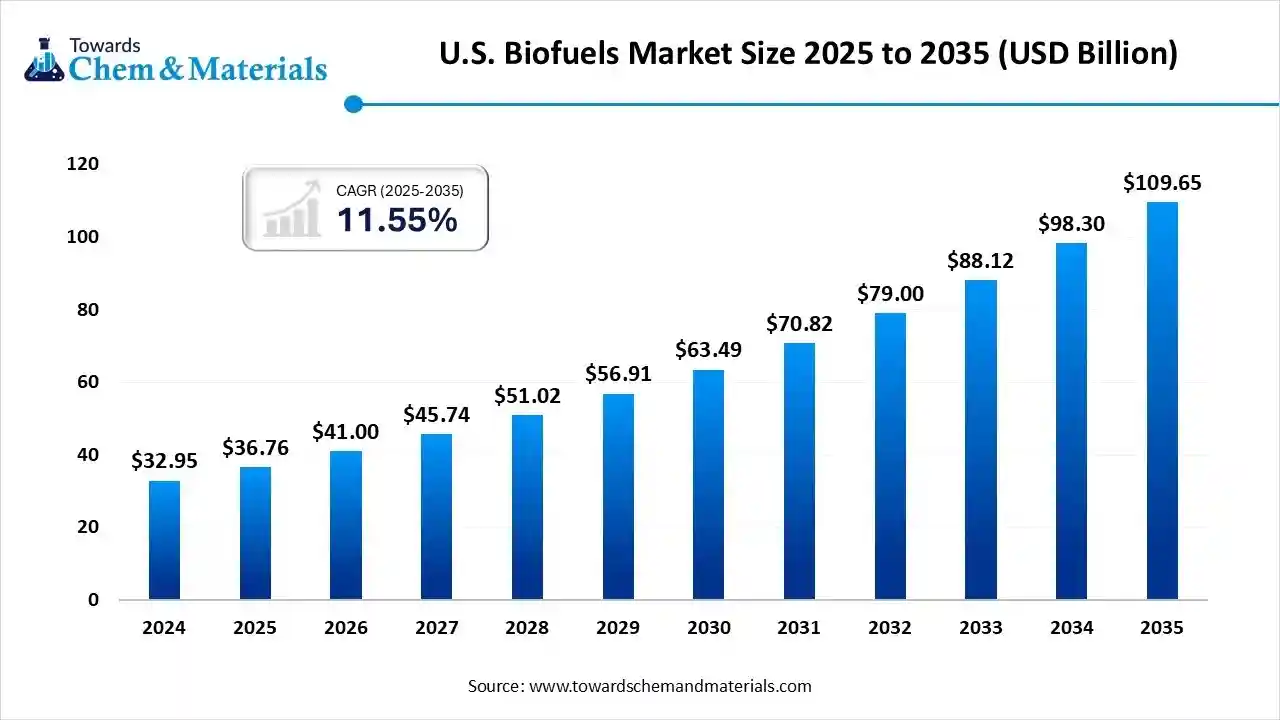

The U.S. biofuels market size is calculated at USD 36.76 billion in 2025 and is predicted to increase from USD 41.00 billion in 2026 and is projected to reach around USD 109.65 billion by 2035, The market is expanding at a CAGR of 11.55% between 2025 and 2035. The market is driven by favourable government policies, a push for decarbonization, and innovation in the production of second and third-generation biofuels.

Key Takeaway

- By type, the bioethanol segment accounted for 44.6% of the market in 2024.

- By type, the biodiesel segment is expected to grow at a 6.5% CAGR during the forecast period.

- By feedstock, the corn & sugarcane segment dominated the market, accounting for 47.2% in 2024.

- By feedstock, the algae segment is expected to grow at a 6.4% CAGR during the forecast period.

- By application, the transportation segment dominated the U.S. biofuels market, accounting for 54.3% in 2024.

- By application, the power generation segment is expected to grow at a 6.5% CAGR during the forecast period.

- By end-use industry, the automotive segment accounted for 56.8% of the U.S. biofuels market in 2024.

- By end-use industry, the aviation segment is expected to grow at a CAGR of 6.6% during the forecast period.

Market Overview

What is the significance of the U.S. Biofuels Market?

The U.S. biofuels market focuses on renewable fuels derived from agricultural feedstocks, waste materials, and algae to reduce dependence on fossil fuels and lower greenhouse gas emissions. Supported by federal mandates such as the Renewable Fuel Standard (RFS) and tax incentives, the market is expanding rapidly. Growing adoption of bioethanol and biodies

Current Trends in U.S. Biofuels Market :

- Industry Growth Overview: According to the United States Department of Agriculture’s Economic Research Service, U.S. ethanol production reached about 15.4 billion gallons in 2022, and combined biodiesel/renewable diesel production was approximately 3.1 billion gallons. With strong federal and state mandates and incentives, the market is positioned for further growth despite feedstock and land-use pressures.

- Sustainability Trends: Research published in Annual Reviews highlights that while biofuels form a significant part of the U.S. fuel supply, corn-based (first-generation) biofuels raise concerns around land-use change, food crop competition, and lifecycle emissions. Advanced biofuels from waste, residues, or non-food feedstocks are gaining attention as a more sustainable path forward, supported by both policy and technology developments.

- Country Expansion: U.S. biofuel exports were valued at USD 5.13 billion for biofuels in recent trade data, with 606,484 metric tons reported. As nations adopt low-carbon fuel standards, U.S. producers may increase shipments of renewable diesel and ethanol to global markets, enhancing export potential.

- Major Investors: Federal incentives under the Inflation Reduction Act (IRA) and other tax credit programmes boost investment in clean fuel production and feedstock innovation. A recent academic study finds these incentives weigh heavily in project economics. Major energy companies, agricultural firms, and renewable fuel producers are expanding capacity and technology partnerships to capitalise on these programmes and market growth.

- Startup Ecosystem: Emerging companies are developing modular biorefineries, waste-to-biofuel technologies, and next-generation feedstock processing systems. Academic work shows ethanol blends derived from waste feedstocks can achieve much lower carbon intensity (approx. 58.34 gCO₂e/MJ) than conventional gasoline (~92 gCO₂e/MJ) under favourable conditions. These startups are increasingly collaborating with established producers, leveraging policy support and aiming to scale up in a competitive, policy-driven environment.

Report Scope

| Report Attributes | Details |

| Market Size in 2026 | USD 41.00 Billion |

| Expected Size by 2034 | USD 109.65 Billion |

| Growth Rate from 2025 to 2034 | CAGR 11.55% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Type, By Feedstock, By End-Use Industry |

| Key Companies Profiled | Green Plains Inc, NextEra Energy Resources, LLC , Gevo Inc. , Pacific Ethanol, Inc. (now Alto Ingredients, Inc.) , World Energy, LLC , Other Top Players In U.S. Biofuels Market, POET LLC , Archer Daniels Midland Company (ADM, Green Plains Inc., Renewable Energy Group Inc. (Chevron Renewable Energy Group) , Valero Energy Corporation , Neste U.S. Inc. , Cargill, Incorporated , Chevron Corporation , BP America Inc. , Shell USA, Inc. , Pacific Ethanol Inc |

Key Technological Shifts In The U.S. Biofuels Market :

Major technological changes in the U.S. biofuels industry include the transition from first-generation to Advanced biofuels, a surge in renewable diesel and sustainable aviation fuel (SAF), enhanced conversion techniques for lignocellulosic biomass, and the adoption of artificial intelligence (AI) and hybrid systems to boost efficiency and cut costs. These developments are motivated by policy initiatives and the demand for sustainable, low-carbon energy options.

Trade Analysis Of U.S. Biofuels Market: Import & Export Statistics

- According to Volza's United States Export data, the United States exported 188 shipments of Fuel Dispensing from May 2024 to Apr 2025 (TTM). These exports were made by 65 United States exporters to 59 Buyers.

- Most of the Fuel Dispensing exports from the United States go to India, Mexico, and Costa Rica.

Globally, the top three exporters of Fuel Dispensing are China, India, and Italy. China leads the world in Fuel Dispensing exports with 6,630 shipments, followed by India with 5,783 shipments, and Italy taking the third spot with 1,168 shipments.(Source: www.volza.com) - According to Volza's United States Export data, the United States exported 69 shipments of Industrial Fuel from Jun 2023 to May 2024 (TTM). These exports were made by 19 United States exporters to 9 Buyers, marking a growth rate of 1% compared to the preceding twelve months

- Most of the Industrial Fuel exports from the United States go to Chile, Peru, and India.

Globally, the top three exporters of Industrial Fuel are Russia, the United Arab Emirates, and India. Russia leads the world in Industrial Fuel exports with 922 shipments, followed by the United Arab Emirates with 630 shipments, and India in third place with 262 shipments.(Source: www.volza.com)

U.S. Biofuels Market – Value Chain Analysis

- Chemical Synthesis and Processing :Biofuels in the United States are produced from feedstocks such as corn, soybeans, used cooking oil, and industrial waste oils using fermentation, transesterification, and hydroprocessing technologies. These processes yield key fuel types such as ethanol, biodiesel, and renewable diesel that meet national blending and low-carbon fuel requirements. Efficiency improvements in conversion systems are increasingly driven by investments in advanced enzymes and catalytic upgrading.

- Key players: Archer Daniels Midland Company (ADM), POET LLC, Valero Energy Corporation, Renewable Energy Group Inc., and Chevron Corporation.

- Quality Testing and Certification :Fuel quality is verified through testing of parameters such as energy content, viscosity, cold-flow performance, and controlled emissions. Standards such as ASTM D6751 for biodiesel and ASTM D4806 for ethanol ensure consistent compliance with EPA Renewable Fuel Standard (RFS) regulations and maintain compatibility with existing engines. Certification agencies play a key role in verifying carbon intensity scores for low-carbon fuel programs.

- Key players: ASTM International, UL Solutions, SGS, Intertek.

- Distribution to Industrial Users :Biofuels are moved through national logistics networks involving fuel terminals, storage hubs, rail systems, pipelines, and blending facilities before reaching transport fleets, aviation suppliers, and power generation companies. Refineries integrate biofuels into gasoline and diesel streams to meet federal and state blending mandates, especially in regions with Low Carbon Fuel Standards. Expansion of renewable diesel distribution is also shifting supply patterns in the western and southern United States.

- Key players: Valero Energy Corporation, Chevron Corporation, Marathon Petroleum Corporation, POET LLC.

Biofuels Regulatory Landscape: Global Regulations

| Country / Region | Regulatory Body | Key Regulations / Programs | Focus Areas | Notable Notes |

| United States | Environmental Protection Agency (EPA) | - Renewable Fuel Standard (RFS, Energy Policy Act 2005; EISA 2007) - Clean Air Act (CAA) - Greenhouse Gas Reporting Program (GHGRP) |

- Renewable volume obligations (RVOs) - RIN credit generation & trading - Lifecycle GHG reduction thresholds - Fuel registration & emission certification |

The RFS mandates blending of renewable fuels (ethanol, biodiesel, renewable diesel, SAF) into the fuel supply. Annual RVOs determine demand and credit prices. EISA 2007 introduced advanced and cellulosic categories. |

| U.S. Department of Energy (DOE) | - Bioenergy Technologies Office (BETO) - Clean Fuels & Vehicle Technology Programs |

- R&D funding for advanced biofuels & feedstocks - Infrastructure and technology commercialisation - Decarbonization of transport and industry |

DOE supports pilot & demonstration projects for algae-based, lignocellulosic, and waste-derived fuels through BETO and loan programs. | |

| U.S. Department of Agriculture (USDA) | - Rural Energy for America Program (REAP) - BioPreferred Program - Biorefinery, Renewable Chemical & Biobased Product Assistance Program |

- Feedstock cultivation support (corn, soy, cellulosic) - Grants and loan guarantees for biorefineries - Certification and labelling of biobased content |

USDA incentivises feedstock production and biorefinery expansion in rural areas. BioPreferred labelling promotes market adoption of certified biobased fuels and materials. | |

| Internal Revenue Service (IRS) U.S. Department of the Treasury |

- Inflation Reduction Act (IRA 2022) Tax Credits - Blender’s Credit (Biodiesel / Renewable Diesel) - Clean Fuel Production Credit (§45Z) |

- Tax incentives and production credits - GHG-based credit valuation - Support for domestic low-carbon fuels |

IRA introduced new credits (45V for clean hydrogen, 45Z for clean fuels) that tie incentives directly to GHG intensity, benefiting renewable diesel, SAF, and ethanol producers. | |

| Federal Aviation Administration (FAA) | - SAF Grand Challenge (2021) - Aviation Sustainability Centre (ASCENT) |

- Certification and blending of sustainable aviation fuel (SAF) - Supply-chain development and testing |

FAA coordinates with DOE/EPA to certify SAF pathways under ASTM D7566; goal: 3 billion gal SAF by 2030. | |

| California Air Resources Board (CARB) (state level) | - Low Carbon Fuel Standard (LCFS, 2009) | - Lifecycle GHG reduction through carbon intensity (CI) targets - Credit trading mechanism |

The LCFS complements the federal RFS by rewarding fuels with lower CI scores. Adopted in other states (Oregon, Washington) via Clean Fuels Programs. |

Segmental Insights

Type Insights

Why How Did The Bioethanol Segment Dominate The U.S. Biofuels Market In 2024?

The bioethanol segment dominated the U.S. biofuels market, accounting for 44.6% of the market in 2024. Bioethanol is the dominant biofuel type in the US market, primarily produced from corn and sugarcane feedstocks. It serves as a major gasoline additive, enhancing octane levels and reducing carbon emissions. The segment benefits from strong policy support under the Renewable Fuel Standard (RFS) and increasing demand for cleaner fuels across automotive applications. Ongoing advancements in cellulosic ethanol technology are further expanding its market potential.

The biodiesel segment is expected to grow at a CAGR of 6.5% in the U.S. biofuels market during the forecast period. Biodiesel, derived from vegetable oils and animal fats, is witnessing growing adoption as a substitute for conventional diesel in transportation and industrial applications. The US biodiesel market is driven by federal blending mandates, low-carbon fuel standards (LCFS), and tax incentives that promote renewable fuel use. Its compatibility with existing diesel engines and favourable emission profile contribute to its expanding share across logistics and agricultural sectors.

The biogas segment has seen notable growth in the U.S. biofuels market. Biogas production, primarily through anaerobic digestion of organic waste, is gaining prominence in the US as part of circular economy initiatives. The segment plays a key role in power generation and transportation, supported by rising investments in renewable natural gas (RNG) facilities. The use of landfill gas and agricultural waste enhances sustainability while creating additional revenue streams for waste management companies.

Feedstock Insights

Which feedstock Segment Dominates the U.S. Biofuels Market In 2024?

The corn & sugarcane segment dominated the U.S. biofuels market, accounting for 47.2% in 2024. Corn and sugarcane remain the most established feedstocks for biofuel production in the US, particularly for bioethanol. The country’s vast corn cultivation base supports large-scale ethanol production with high energy yields. Technological upgrades in fermentation efficiency and enzyme use are reducing production costs, while government subsidies and crop diversification programs sustain steady raw material availability.

The algae segment is expected to grow at a CAGR of 6.4% in the U.S. biofuels market during the forecast period. Algae-based biofuel production represents a next-generation pathway, offering high oil yields and carbon capture benefits. Although still at an early commercial stage, advancements in strain engineering and photobioreactor systems are enhancing scalability. The US Department of Energy’s support for algae R&D is fostering innovation, positioning it as a promising feedstock for sustainable aviation and marine fuels.

The waste oil & fats segment has seen notable growth in the U.S. biofuels market. Waste oils and animal fats are increasingly used for biodiesel and renewable diesel production in the US due to their cost-effectiveness and low carbon intensity. The segment supports circular economy principles by converting waste into valuable fuel. Policy frameworks such as the Renewable Fuel Standard (RFS2) and LCFS credits have accelerated investments in waste-derived biofuel facilities.

Application Insights

Why Did the Transportation Segment Dominate The U.S. Biofuels Market In 2024?

The transportation segment dominated the U.S. biofuels market, accounting for 54.3% in 2024. Transportation remains the largest application segment for biofuels in the US, supported by national blending mandates and growing consumer awareness of green mobility. Ethanol and biodiesel blends are widely used in light-duty and heavy-duty vehicles. The expansion of E10, E15, and B20 fuel grades across retail fueling stations continues to strengthen this segment.

The power generation segment is expected to grow at a CAGR of 6.5% in the U.S. biofuels market during the forecast period. Biofuels are increasingly utilised in distributed and backup power generation systems, especially in rural or off-grid areas. Their renewable nature and consistent energy output make them suitable for reducing dependence on fossil-based electricity. Co-firing of biofuels with natural gas is also gaining attention for lowering carbon footprints in industrial power plants.

The aviation segment has seen notable growth in the U.S. biofuels market. The aviation sector represents a rapidly emerging application area for biofuels, with sustainable aviation fuel (SAF) gaining regulatory and commercial momentum in the US. Major airlines and defence agencies are adopting SAF blends to meet net-zero emission goals. Increased investments from energy companies and partnerships with aircraft manufacturers are driving large-scale expansion of production capacity.

End Use Industry Insight

Which End Use Industry Segment Dominates the U.S. Biofuels Market In 2024?

The automotive segment dominated the U.S. biofuels market, accounting for 56.8% in 2024. The automotive industry is the primary consumer of biofuels, using ethanol and biodiesel blends to meet emission-reduction standards. Automakers are collaborating with fuel suppliers to develop engines optimised for higher blend ratios. The continued rise of hybrid and flex-fuel vehicles is supporting steady demand across passenger and commercial vehicle segments.

The aviation segment is expected to grow at a CAGR of 6.6% in the U.S. biofuels sector during the forecast period. Aviation is a high-growth end-use industry, as airlines transition to sustainable aviation fuels (SAF) to offset carbon emissions. Federal initiatives, such as the SAF Grand Challenge, are accelerating research and commercialisation. This shift aligns with global decarbonization targets, creating long-term opportunities for biofuel producers and refinery conversion projects.

The marine segment has seen notable growth in the U.S. biofuels market. The marine industry is increasingly adopting biofuels to comply with IMO 2020 emission standards. Biodiesel and renewable marine fuels are being tested and used across shipping fleets and naval operations. The focus on reducing sulfur emissions and improving lifecycle sustainability supports the long-term adoption of biofuels in maritime transport.

Recent Developments

- In April 2025, Green Plains Inc. selected Eco-Energy LLC as its exclusive ethanol marketing partner. Eco-Energy will handle all ethanol marketing and logistics for Green Plains' biorefineries, aiming to optimise value and improve supply chain efficiency for low-carbon ethanol.(Source: www.businesswire.com)

- In January 2025, U.S. scientists have engineered Camelina sativa to serve as a "hyperaccumulator" of nickel through a process called phytomining. This method uses genetically modified plants to extract valuable metals from soil while simultaneously providing a biofuel source and improving soil quality.(Source: interestingengineering.com)

Top Players in the U.S. Biofuels Market & Their Offerings:

- Green Plains Inc. – Green Plains is one of the largest ethanol producers in the U.S., with a strategic shift toward producing high-value bio-based products through advanced fermentation and carbon reduction technologies. The company also manufactures renewable corn oil, high-protein feed ingredients, and low-carbon fuel solutions that support decarbonized transportation markets.

- NextEra Energy Resources, LLC – NextEra is expanding beyond wind and solar into renewable fuels, including renewable natural gas and advanced biofuels. The company develops large-scale clean fuel projects that support fleet decarbonization, low-carbon transportation, and long-term U.S. energy transition goals.

- Gevo Inc. – Gevo specializes in producing sustainable aviation fuel, isobutanol-derived fuels, and renewable gasoline using advanced fermentation and alcohol-to-jet conversion technologies. The company focuses on low-carbon intensity fuels and integrates renewable electricity and carbon capture to reduce production emissions.

- Pacific Ethanol, Inc. (now Alto Ingredients, Inc.) – Alto Ingredients produces low-carbon ethanol, specialty alcohols, and high-quality animal feed co-products across its U.S. biorefineries. The company is diversifying into renewable fuels and specialty biochemicals, expanding its footprint in value-added bio-based markets.

- World Energy, LLC – World Energy is a major U.S. producer of biodiesel and sustainable aviation fuel, operating one of the largest commercial SAF facilities in California. The company supplies renewable jet fuel and low-carbon diesel to airlines, logistics providers, and transportation fleets seeking to meet clean-fuel commitments.

Other Top Players In U.S. Biofuels Market

- POET LLC – A leading ethanol producer that operates a large network of biorefineries and offers co-products such as distillers' grains and corn oil for feed and renewable fuel markets.

- Archer Daniels Midland Company (ADM) – ADM is a major producer of ethanol and biodiesel while also developing advanced biofuel technologies and carbon capture systems to reduce lifecycle emissions.

- Green Plains Inc. – A key ethanol and renewable feed producer with ongoing investments in high-protein feed, renewable corn oil, and low-carbon technologies.

- Renewable Energy Group Inc. (Chevron Renewable Energy Group) – A leading biodiesel and renewable diesel producer with a nationwide footprint of biorefineries supplying low-carbon fuels to transportation and industrial markets.

- Valero Energy Corporation – A major producer of renewable diesel through its joint venture with Darling Ingredients, Diamond Green Diesel, supplying low-carbon fuel into domestic and export markets.

- Neste U.S. Inc. – The U.S. arm of Neste, a global leader in renewable diesel and sustainable aviation fuel, supplying large volumes of low-carbon fuels to transportation, aviation, and municipal fleets.

- Cargill, Incorporated – A producer of biodiesel and renewable fuel feedstocks, including vegetable oils and waste-based inputs, supporting both domestic production and global biofuel supply chains.

- Chevron Corporation – Expanding aggressively into renewable diesel, SAF, and renewable natural gas, integrating biofuel assets through acquisitions and joint ventures such as REG.

- BP America Inc. – Develops renewable diesel and sustainable aviation fuel projects and invests in biogas and waste-to-fuel technologies to support its low-carbon strategy.

- Shell USA, Inc. – Invests in renewable diesel, SAF, and waste-to-fuel technologies while developing hydrogen-ready and biofuel-integrated mobility solutions across the U.S.

- Pacific Ethanol Inc. – Continues to be a relevant name in ethanol production under its Alto Ingredients structure, producing low-carbon ethanol and specialty alcohol products.

Segments Covered:

By Type:

- Bioethanol

- Biodiesel

- Biogas

- Bio-butanol

- By Feedstock:

- Corn & Sugarcane

- Algae

- Waste Oil & Fats

- Cellulosic Material

By Application:

- Transportation

- Power Generation

- Aviation

- Industrial Heating

By End-Use Industry:

- Automotive

- Aviation

- Marine

- Industrial