Content

U.S. Cosmetic Chemicals Market Size and Share 2034

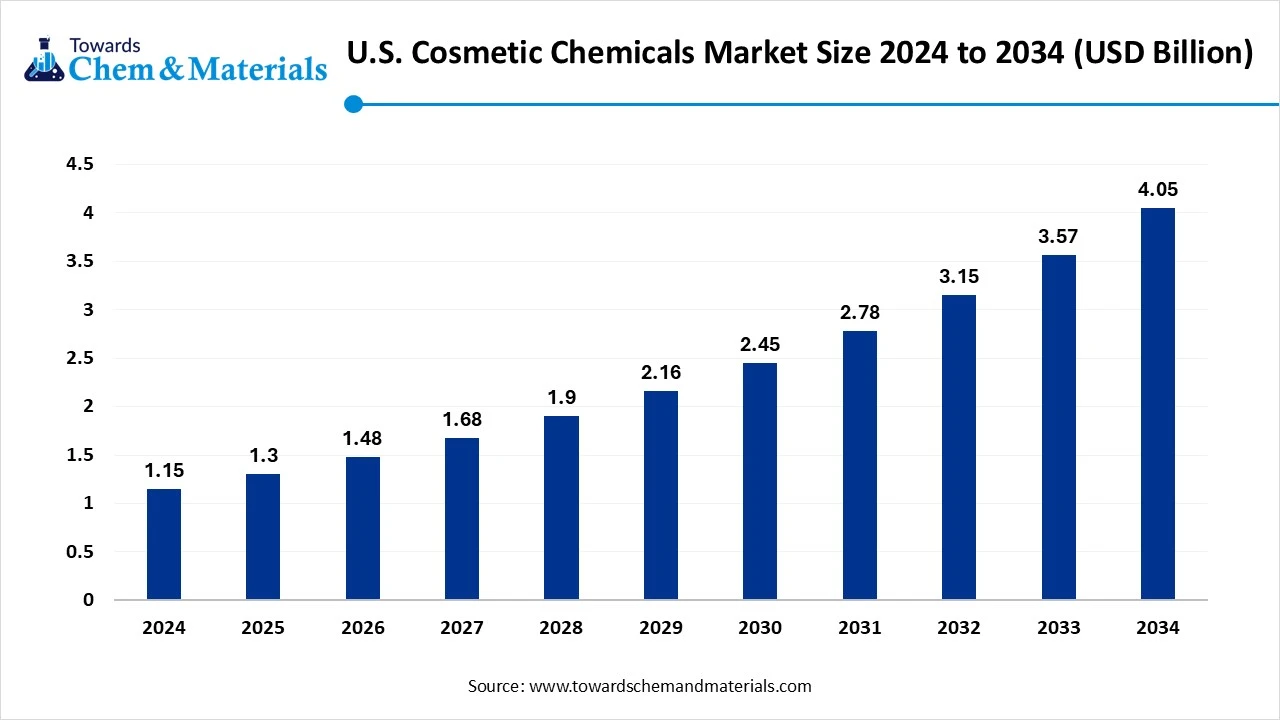

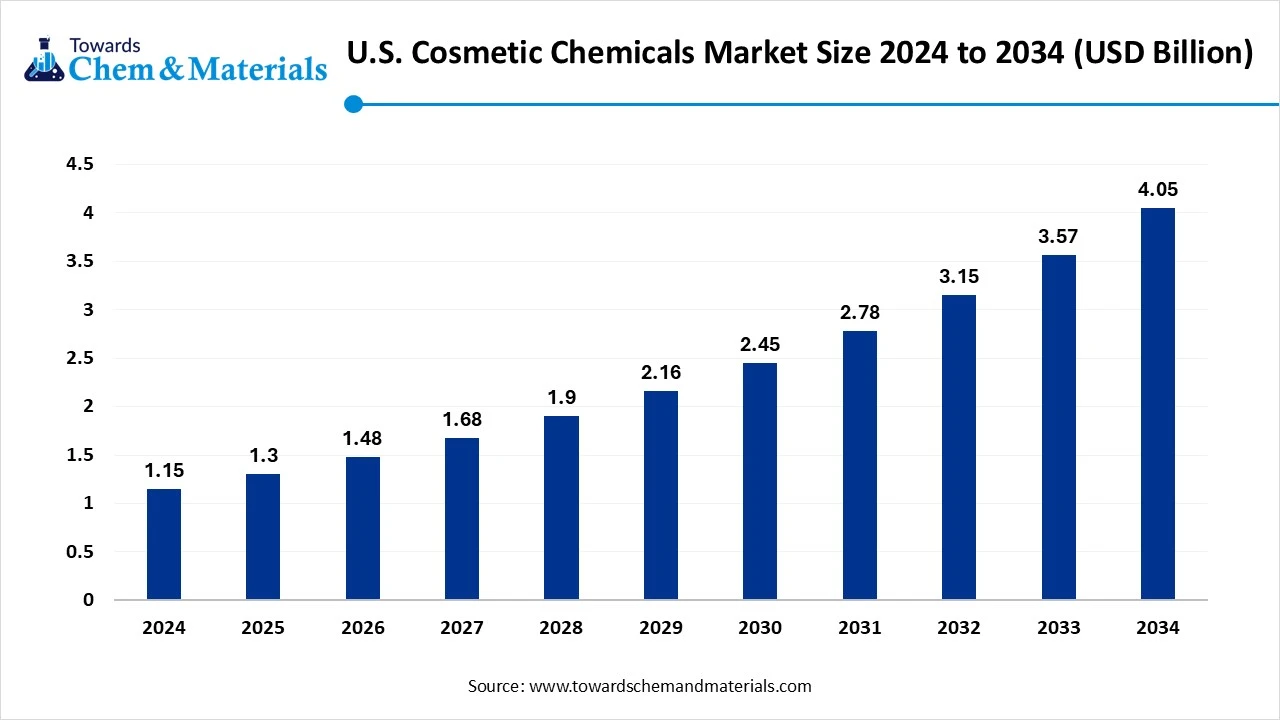

The U.S. cosmetic chemicals market size was reached at USD 1.15 billion in 2024 and is expected to be worth around USD 4.05 billion by 2034, growing at a compound annual growth rate (CAGR) of 13.43% over the forecast period 2025 to 2034. The increased need for multifunctional cosmetics has allowed stakeholders to capitalize on growth opportunities.

Key Takeaways

- By product type, the emollients and moisturizers segment led the U.S. cosmetic chemicals market with approximately 30% market share in 2024, due to hydration is considered the base of cosmetology and skin care.

- By product type, the active ingredients segment is expected to grow at the fastest rate in the market during the forecast period, akin to an increased need for result-driven cosmetics.

- By source type, the synthetic chemicals segment emerged as the top-performing segment in the market with approximately 55% industry share in 2024, due to factors such as stability, affordability, and easier production in bulk sizes.

- By source type, the natural/biobased chemicals segment is expected to lead the market in the coming years, because United States consumers increasingly prioritize sustainability and clean beauty.

- By application type, the skincare segment led the market with approximately 40% market share in 2024, because it is the most widely used and trusted cosmetic category in the United States.

- By application type, the men’s grooming & premium skincare segment is expected to capture the biggest portion of the market in the coming years, as cultural perceptions shift and men become more open to advanced grooming routines.

- By distribution type, the direct supply to the major cosmetics brands segment led the market with approximately 50% industry share in 2024, because large multinational brands prefer strong, long-term partnerships with reliable suppliers.

- By distribution type, the online raw materials platforms segment is expected to grow at the fastest rate in the market during the forecast period, as digitalization transforms B2B supply chains.

- By end-user type, the multinational cosmetics brands segment led the market with approximately 60% industry share in 2024 because it controls the largest share of the U.S. beauty market and requires massive volumes of chemicals for its global product lines.

- By end-user, the indie cosmetics brands and cosmeceuticals segment is expected to capture the biggest portion of the market in the coming years, because consumers are shifting toward niche, personalized, and science-backed beauty products.

Market Overview

Is the Demand for Natural Beauty Driving Innovation in Cosmetic Ingredients?

- The U.S. cosmetic chemicals market covers the production and supply of specialty ingredients, raw materials, and functional additives used in the formulation of skincare, haircare, makeup, fragrance, and personal care products.

- These chemicals include surfactants, emollients, polymers, colorants, preservatives, UV filters, and active ingredients.

- Growth in the U.S. market is driven by rising consumer demand for natural and sustainable formulations, expansion of premium and anti-aging skincare, strict FDA and EPA regulations on cosmetic safety, and rapid innovation in bio-based and multifunctional ingredients.

Social Media and Skin Care: A Powerful Duo Fueling Cosmetics Trends

The shift towards multifunctional beauty products is positively impacting revenue potential and industry scalability in the United States nowadays. Moreover, the individuals are actively seeking a product where they can not only get a better look but also the skin care.

Furthermore, the fast-paced lifestyle and social media marketing have been flagged as a key area of market interest in recent years in the region. Also, the innovation in chemical formulations owing to technological innovations is likely to elevate earnings potential for producers in the coming years.

- In February 2024, L'Oréal USA started making its second edition of beauty funds. The motive behind the collection of the funds is to provide financial support to the new market entrants and small businesses, as per the report published by the company. (Source : www.loreal.com)

Market Trends

- The demand for clean beauty products like natural and biobased products has accelerated the sector evolution in the United States in the past few years. Consumers are choosing products which is free from hazardous chemicals like parabens and sulfates.

- The growth of personalized cosmetics is increasingly enhancing the industry’s readiness and future industry capabilities in the current period. People are demanding chemicals according to their skin type, lifestyle needs, and tones.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 1.30 Billion |

| Expected Size by 2034 | USD 4.05 Billion |

| Growth Rate from 2025 to 2034 | CAGR 13.43% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Product Type, By Source, By Application, By Distribution Channel, By End User |

| Key Companies Profiled | DuPont, Dow, Procter & Gamble, International Flavors & Fragrances (IFF), Eastman |

Market Opportunity

Clean Beauty Meets High Growth: A New Era for U.S Cosmetics Brands

The development of bio-based and sustainable cosmetics is likely to result in brand positioning and product offerings during the projected period. Moreover, the government's push for sustainable manufacturing procurement is expected to contribute to the future industry potential in the coming years. Also, the manufacturers of plant-based emollients, biodegradable preservatives, and algae-derived actives are expected to gain traction with investment firms and analysts during the forecasted years.

Market Challenge

Tougher U.S Standards to Challenge Manufacturers' Agility

The stricter regulatory environment of the United States is likely to result in longer lead times and affect market responsiveness in the upcoming years. Also, cosmetic chemical manufacturers must meet regulatory standards of governmental firms like the FDA and other safety standards, which are expected to lead to project delays and an increase in the cost of the product.

Segment Insights

Product Type Insights

How did the Emollients & Moisturizers Segment Dominate the U.S. Cosmetic Chemicals Market in 2024?

The emollients and moisturizers segment held the largest share of the market in 2024, due to hydration is considered the base of cosmetology and skin care. Moreover, the increased demand for cosmetics that can provide a glowing and healthy skin care combo, the emollients and moisturizers gaining major industry attention in recent years. Furthermore, the characteristics like multifunctional and easy application, the segment has gained a sophisticated consumer base in the past period.

The active ingredients segment is expected to grow at a notable rate during the predicted timeframe, akin to an increased need for result-driven cosmetics. Moreover, activities like hyaluronic acid, retinol, and vitamins have driven segment potential in recent years, as several manufacturers are actively selling their products with a clean label while maintaining these actives in the current period.

Source Type Insights

Why does the Synthetic Chemicals Segment Dominate the U.S. Cosmetic Chemicals Market by Source Type?

The synthetic chemicals segment held the largest share of the U.S. cosmetic chemicals market in 2024, due to factors such as stability, affordability, and easier production in bulk sizes. Also, several cosmetic brands are seen relying on synthetic chemicals for a greater shelf life and consistent quality standards. Moreover, by delivering reliable performance at a scale, the synthetic chemical has maintained its dominance.

The natural/biobased chemicals segment is expected to grow at a notable rate during the forecast period, because United States consumers increasingly prioritize sustainability and clean beauty. Shoppers are actively choosing products with plant-based, vegan, and eco-friendly labels. Brands are responding by reformulating with natural emollients, oils, and actives that align with green claims. Advancements in biotechnology are also making bio-based alternatives more affordable and effective, closing the performance gap with synthetics.

Application Type Insights

How did the Skincare Segment Dominate the U.S. Cosmetic Chemicals Market in 2024?

The skincare segment dominated the market with the largest share in 2024 because it is the most widely used and trusted cosmetic category in the United States. Unlike makeup, skincare products are part of daily routines across all age groups and genders. Rising concerns about aging, acne, and environmental damage have further boosted skincare demand. Cosmetic chemicals such as emollients, stabilizers, and actives form the backbone of this segment, making it the largest consumer of chemical ingredients.

The men’s grooming & premium skincare segment is expected to grow at a significant rate during the forecast period, as cultural perceptions shift and men become more open to advanced grooming routines. Social media and celebrity influence are normalizing men's skincare, driving higher adoption. Premium skincare is also rising because consumers increasingly prefer products that promise fast, noticeable results and align with luxury lifestyles.

Distribution Type Insights

Why Are Major Cosmetic Brands Prioritizing Direct Supplier Relationships?

The direct supply to the major cosmetics brands segment dominated the market with the largest share in 2024 because large multinational brands prefer strong, long-term partnerships with reliable suppliers. This ensures consistent quality, bulk supply, and cost efficiency. Direct supplier relationships also allow better coordination in product development and faster innovation. For chemical manufacturers, securing contracts with global giants provides stable revenue and credibility.

The online raw materials platforms segment is expected to grow at a significant rate during the forecast period, as digitalization transforms B2B supply chains. Indie cosmetic brands and smaller manufacturers increasingly prefer flexible, on-demand sourcing instead of long contracts with large suppliers. Online platforms provide transparency in pricing, faster access to diverse ingredients, and smaller batch ordering, which supports new product launches. With e-commerce booming in every sector, cosmetic chemicals are also shifting online.

End User Type Insights

Why Multifunctional Brands Dominate the U.S. Cosmetic Chemicals Market?

The multinational cosmetics brands segment held the largest share of the market in 2024 because they control the largest share of the U.S. beauty market and require massive volumes of chemicals for their global product lines. These companies also drive innovation by collaborating directly with chemical manufacturers to create exclusive formulations. Their financial strength, wide distribution networks, and global consumer reach allow them to set trends and influence ingredient demand.

The indie cosmetics brands and cosmeceuticals segment is expected to grow at a notable rate during the predicted timeframe because consumers are shifting toward niche, personalized, and science-backed beauty products. Indie brands focus on authenticity, natural ingredients, and transparency, which align perfectly with the clean beauty movement. Cosmeceuticals, combining cosmetics with pharmaceutical-grade actives, appeal to health-conscious buyers seeking visible skin benefits.

U.S. Cosmetic Chemicals Market Value Chain Analysis

- Distribution to Industrial Users : The distribution of cosmetic chemicals is casually managed by chemical manufacturers, as per the information, where the direct sales of arms and specialized chemical distributors play a major role.

- Chemical Synthesis and Processing : The chemical synthesis and processing the cosmetic chemicals are usually done under the FDA safety standards in the United States, including non-technology and process intensification.

- Regulatory Compliance and Safety Monitoring : Regulatory compliance and safety monitoring of cosmetic chemicals are processed under the specific law of the FDA called the MoCRA and the FD&C Act.

Recent Developments

- In February 2025, CJ Olive Young established their own subsidiary in the United States. This subsidiary is likely to support a retail e-commerce platform where delivery can be achieved through CJ Logistics America, as per the company's claim.(Source: www.globalcosmeticsnews.com)

U.S. Cosmetic Chemicals Market Top Companies

Segment Covered

By Product Type

- Surfactants

- Emollients & Moisturizers

- Colorants & Pigments

- Preservatives & Antimicrobials

- Polymers & Rheology Modifiers

- UV Filters & Sunscreen Agents

- Active Ingredients

- Fragrance & Aroma Chemicals

By Source

- Synthetic Chemicals

- Natural/Bio-based Chemicals

- Hybrid/Specialty Blends

By Application

- Skincare (moisturizers, serums, sunscreens)

- Haircare (shampoos, conditioners, styling)

- Makeup & Color Cosmetics

- Fragrances & Perfumes

- Oral Care

- Men’s Grooming & Personal Care

By Distribution Channel

- Direct Supply to Cosmetic Manufacturers

- Distributors & Chemical Suppliers

- Online Raw Material Platforms

By End User

- Multinational Cosmetic Brands (L’Oréal, Estée Lauder, P&G, Unilever, Coty)

- Independent & Indie Cosmetic Brands

- Contract Manufacturers (OEM/ODM)

- Dermatology & Cosmeceutical Firms