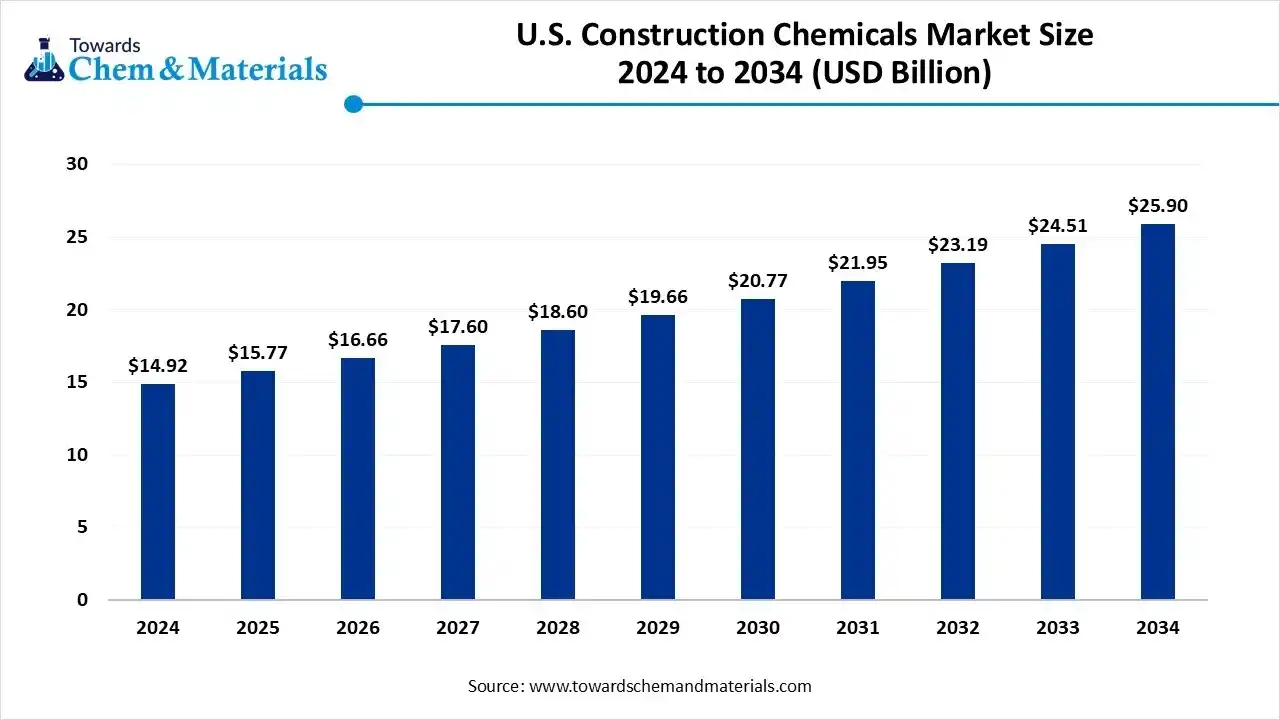

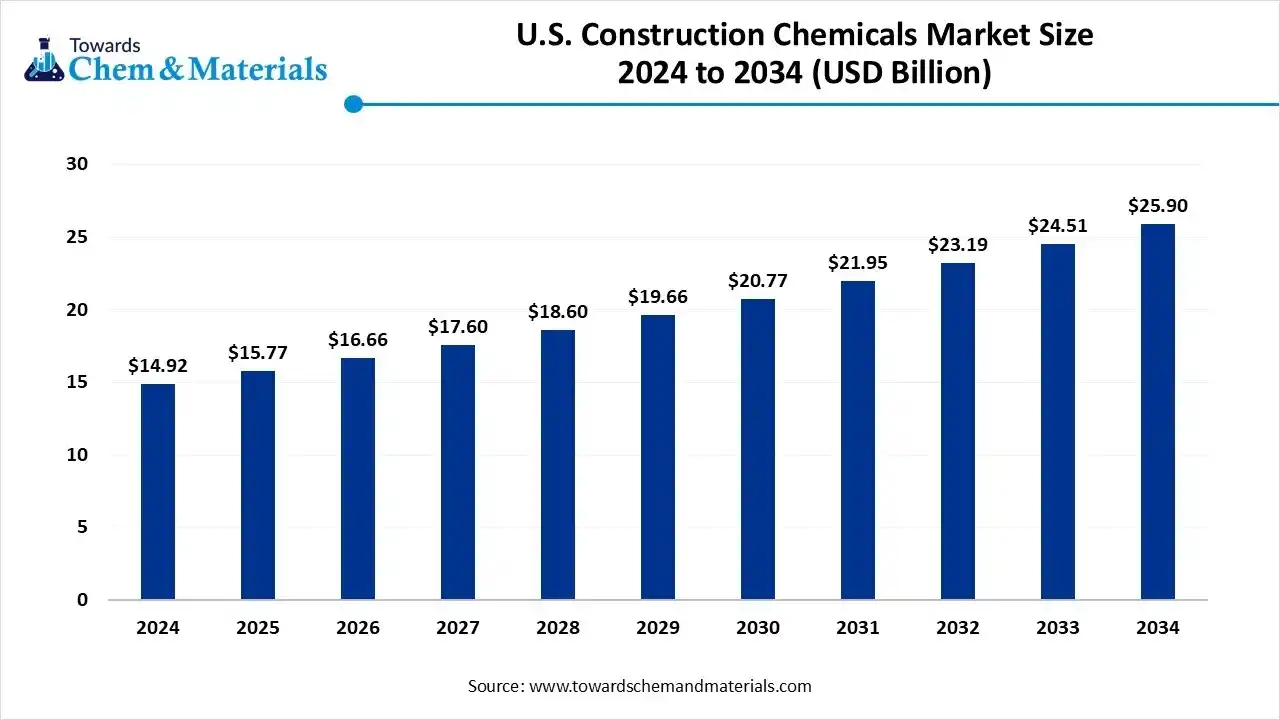

What is the U.S. construction chemicals market size?

The U.S. construction chemicals market size accounted for USD 14.92 billion in 2024 and is predicted to increase from USD 15.77 billion in 2025 to approximately USD 25.90 billion by 2034, expanding at a CAGR of 5.67% from 2025 to 2034. The growing investment in infrastructure development and the rise in new residential construction drive the market growth.

Key Takeaways

- By product, the concrete admixtures segment held a 45% share in the U.S. construction chemicals market in 2024.

- By product, the sealants & adhesives segment is expected to grow at an 8.0% CAGR in the market during the forecast period.

- By application, the residential construction segment held a 40% share in the market in 2024.

- By application, the commercial construction segment is expected to grow at an 8.0% CAGR in the market during the forecast period.

- By technology, the chemical admixtures segment held a 50% share in the market in 2024.

- By technology, the coatings & sealants segment is expected to grow at an 8.0% CAGR in the market during the forecast period.

- By end user, the construction companies segment held a 50% share in the market in 2024.

- By end user, the real estate developers segment is expected to grow at an 8.0% CAGR in the market during the forecast period.

What are Construction Chemicals?

The U.S construction chemicals market growth is driven by growing modernization of infrastructure projects, increased residential construction activities, high investment in development of healthcare & industrial facilities, rise in green buildings, and development of commercial buildings.

Construction chemicals are specialized compounds developed for enhancing the sustainability and performance of construction materials like plaster, mortar & concrete. These chemicals improve strength, enhance durability, provide surface protection, protect against water, and restore construction integrity. Construction chemicals include admixtures, sealants, flooring chemicals, waterproofing compounds, and many more.

U.S. Construction Chemicals Market Outlook:

- Industry Growth Overview: Between 2025 and 2034, the industry is expanding in high-margin niches such as infrastructure development and construction activities. Growth is driven by increasing residential and non-residential construction activities, particularly in states like Texas, New York, and Arizona.

- Sustainability Trends: Sustainability is transforming the U.S. construction chemicals industry, with rising development of recyclable admixtures, bio-based products, green sealants, and green concrete. For instance, the CEMEX company launched its bio-sourced admixtures range made up of locally sourced, natural, & renewable materials.

- Major Investors: Private equity and global companies are actively entering the space, drawn by the development of sustainable chemical products. For instance, companies like RPM International, Saint-Gobain, Sika AG, Dow, and H.B. Fuller Company are heavily investing in the development of construction chemicals.

Report Scope

| Report Attributes |

Details |

| Market Size in 2026 |

USD 16.66 Billion |

| Expected Size by 2034 |

USD 25.90 Billion |

| Growth Rate from 2025 to 2034 |

CAGR 5.67% |

| Base Year of Estimation |

2024 |

| Forecast Period |

2025 - 2034 |

| Segment Covered |

By Product, By Application, By Technology, By End User |

| Key Companies Profiled |

RPM International Inc., Pidilite Industries Ltd., CICO Technologies, GCP Applied Technologies, W. R. Grace & Co., Chryso Group, Kemira Oyj, Huntsman Corporation, Dow Chemical Company, Tremco CPG Inc. |

Key Technological Shifts in the U.S. Construction Chemicals Market:

The U.S. construction chemicals market is undergoing key technological shifts driven by the demand for optimizing supply chains and enhancing safety on a construction project. One of the most significant transformations is the integration of AI, which enables faster innovation and creates new formulations. AI easily generates new concrete formulations and develops sustainable solutions. AI optimizes concrete mixes and automates quality control.

- For instance, Sika AG partnered with Giatec to use AI for optimizing concrete mixtures to enhance the efficiency and sustainability of construction chemicals.

Trade Analysis of U.S. Construction Chemicals Market: Import & Export Statistics

- The United States exported 22,818 shipments of the sealant.(Source: www.volza.com)

- The United States exported 337,539 shipments of adhesives.(Source: www.volza.com)

- The United States exported $172M of prepared additives for cements, mortars, or concretes in 2023.(Source: oec.world )

- The United States imported $87.7M of prepared additives for cements, mortars, or concretes in 2023.(Source: oec.world )

- The United States exported 28 shipments of waterproofing admixtures.(Source: www.volza.com)

U.S. Construction Chemicals Market Value Chain Analysis

- Feedstock Procurement: The feedstock procurement is the sourcing of raw materials like renewable materials, petrochemicals, water, biomass, and minerals.

- Chemical Synthesis and Processing : The chemical synthesis & processing involve steps like hydration, polymerization, formulation, blending, and manufacturing specialized products.

- Quality Testing and Certifications : The quality testing involves analysis of properties like chemical, safety, material suitability, performance, compliance, & durability, and certifications like ASTM International, ACI, & USBBC.

What are the Types of Construction Chemicals?

| Types |

Description |

Examples |

| Concrete Admixtures |

The substances added to concrete to modify its qualities like durability, workability, & strength are known as concrete admixtures. |

- Plasticizers

- Air-Entraining Agents

- Retarders

- Superplasticizers

- Accelerators

|

| Waterproofing Chemicals |

The product is used to protect surfaces from the penetration of water, called waterproofing chemicals. |

- Cementitious Waterproofing

- Liquid-Applied Membranes

- Crystalline Waterproofing

|

| Protective Coatings |

Protective coating is a type of layer applied to a construction surface to prevent it from corrosion, damage, & wear. |

- Polyurethane Coatings

- Epoxy Coatings

- Powder Coatings

- Fire-Resistant Coatings

- Paint

- Ceramic Coatings

|

| Sealants & Adhesives |

The material used to fill gaps & joints is sealants, whereas the material used to bond surfaces together is called adhesives. |

- Epoxy Adhesives

- Silicone Sealants

- Cyanoacrylate Adhesives

- Acrylic Sealants

|

Segmental Insights

Product Insights

Why the Concrete Admixtures Segment Dominates the U.S. Construction Chemicals Market?

The concrete admixtures segment dominated the market with a 45% share in 2024. The growing development of large-scale infrastructure projects and a strong focus on green construction methods increase demand for concrete admixtures. The rapid urbanization and high volume of commercial & residential construction require concrete admixtures. The cost-efficiency and controlled setting time of concrete admixtures drive the overall market growth.

The sealants & adhesives segment is growing at a fastest CAGR in the market during the forecast period. The growing development of commercial projects and high spending on home renovation increases the adoption of sealants & adhesives. The rise in the development of infrastructure projects like tunnels, roads, & bridges requires sealants & adhesives. The growing residential construction activities and focus on the development of sustainable buildings require sealants & adhesives, supporting the overall market growth.

Application Insights

Which Application Segment Held the Largest Share in the U.S. Construction Chemicals Market?

The residential construction segment held the largest revenue share of 40% in the market in 2024. The rapid urbanization and growing development of long-lasting residential structures increase demand for construction chemicals. The adoption of green building practices and a focus on improving the aesthetic appeal of homes require construction chemicals. The strong government support for affordable housing and the development of energy-efficient buildings requires construction chemicals, driving the overall market growth.

The commercial construction segment growing at a fastest CAGR in the market during the forecast period. The rapid urbanization and growing development of office spaces require construction chemicals. The development of commercial building projects like retail centers, hotels, and restaurants requires construction chemicals. The growing expansion of commercial buildings supports the overall growth of the market.

Technology Insights

How Chemical Admixtures Segment Dominated the U.S. Construction Chemicals Market?

The chemical admixtures segment dominated the market with a 50% share in 2024. The growing development of public transit systems, roads, & bridges increases demand for chemical admixtures. The strong focus on sustainable construction and minimizing resource consumption increases demand for chemical admixtures. The development of high-rise buildings and complex infrastructures requires chemical admixtures, driving the overall market growth.

The coatings & sealants segment is growing at a fastest CAGR in the market during the forecast period. The rapid urbanization and development of infrastructure projects like smart cities, highways, & airports require coatings & sealants. The strong focus on the development of green buildings and affordable housing increases the adoption of coatings & sealants. The increasing renovation of aging infrastructure and expansion of commercial projects require coatings & sealants, supporting the overall market growth.

End User Insights

How did Construction Companies Hold the Largest Share in the U.S. Construction Chemicals Market?

The construction companies segment held the largest revenue share of 50% in the market in 2024. The rapid urbanization and growing development of infrastructure projects increase demand for construction chemicals. The development of new construction and the increasing need for high-performance materials require construction chemicals. The rise in the development of commercial buildings and residential construction projects drives the overall growth of the market.

The real estate developer segment is growing at a fastest CAGR in the market during the forecast period. The growing housing projects and high spending on renovation projects require construction chemicals. The emphasis on the development of energy-efficient buildings and the growing demand for high-performance construction materials require construction chemicals, supporting the overall market growth.

State-Level Insights

Texas U.S. Construction Chemicals Market Trends

Texas is a major contributor to the market. The growing population and development of residential projects increase the adoption of construction chemicals. The growing development of commercial real estate and data centers requires construction chemicals. The presence of abundant petrochemicals and strong cement production drives the overall growth of the market.

California U.S. Construction Chemicals Market Trends

California is growing in the U.S. construction chemicals market. The growing construction activities and high investment in infrastructure upgrading increase demand for construction chemicals. The massive spending on the development of large-scale projects and stricter green building standards requires construction chemicals. The growing expansion of office spaces and the development of residential construction support the overall growth of the market.

Florida U.S. Construction Chemicals Market Trends

Florida is significantly growing in the market. The surge in new home construction and the development of large-scale infrastructure projects like public transit, roads, & bridges requires construction chemicals. The green building mandates and government investment in mega-infrastructure projects require construction chemicals, supporting the overall market growth.

Recent Developments

- In November 2023, Sika expanded its concrete admixtures production capacity in the United States. The facility supports sustainable construction and development of large-scale infrastructure projects.(Source: www.indianchemicalnews.com)

- In December 2024, Chryso launched EnviroAdd cement additives to optimize blended cement performance in North America. The additive lowers CO2 emissions and enhances cement performance. (Source: www.chrysoinc.com)

- In October 2025, Chryso launched the Adfil®Strux 3000 series for sustainable concrete reinforcement. The product range includes Adfil®Strux 3032 & Adfil®Strux 3040 for construction applications like precast, tunnel linings, slab-on-ground, & elevated decks.(Source: www.chrysoinc.com)

Top U.S. Construction Chemicals Market Companies

BASF SE

Corporate Information

- Full Name: BASF SE (Badische Anilin- & Soda-Fabrik)

- Headquarters: Ludwigshafen, Germany

- CEO: Dr. Markus Kamieth

- Employees: Approximately 110,000 globally

- Revenue (2024): €87.3 billion

- Market Capitalization: Approximately $45.28 billion (as of October 24, 2025)

History and Background

Founded in 1865, BASF began as a producer of synthetic dyes and has since evolved into the world's largest chemical company. Over the decades, BASF expanded its portfolio through innovations in various sectors, including agriculture, automotive, construction, and electronics.

Key Developments and Strategic Initiatives

Mergers & Acquisitions

- Automotive Coatings Business Sale: In October 2025, BASF agreed to sell a majority stake in its automotive coatings business to U.S. private equity firm Carlyle Group for approximately €5.8 billion ($6.71 billion). BASF will retain a 40% stake in the new standalone company, while Carlyle and Qatar Investment Authority will manage and grow the business independently.

- Agricultural Division IPO: BASF plans to prepare its agricultural division for a 2027 initial public offering (IPO) as part of its strategy to streamline operations and focus on core areas.

Partnerships & Collaborations

- Battery Materials Collaboration: BASF is exploring collaborations in battery materials to enhance its position in the growing electric vehicle market.

- Legal Dispute with Duracell: BASF filed a lawsuit against Duracell, a battery manufacturer owned by Berkshire Hathaway, accusing the company of stealing trade secrets related to BASF’s lithium-ion battery technology.

Product Launches / Innovations

- Personal Care Ingredients: In April 2025, BASF launched natural-based innovations for personal care at in-cosmetics Global 2025, including Verdessence® Maize, Lamesoft® OP Plus, and Dehyton® PK45 GA/RA. These products enable more sustainable personal care solutions without compromising on performance.

- Catalyst Development Center: In December 2024, BASF inaugurated a new Catalyst Development and Solids Processing Center in Ludwigshafen, Germany. This facility serves as a hub for pilot-scale synthesis of chemical catalysts, enabling BASF to offer its global customers faster access to innovative technologies.

Key Technology Focus Areas

- Sustainability: BASF focuses on technologies that contribute to sustainability, including biodegradable materials, processes for sustainable value chains, and innovative processes for the plastics circular economy.

- Digital Transformation: The company is accelerating the use of digital tools in research and development to bring better technologies to market more swiftly.

R&D Organisation & Investment

- Global R&D Workforce: Approximately 10,000 employees work in R&D worldwide, with around 10% based in Greater China, including the Innovation Campus Shanghai.

- R&D Investment: In 2024, BASF invested €2.1 billion in research and development, maintaining a high level of funding despite economic challenges. A similar R&D budget is planned for 2025.

- Patent Activity: BASF filed 1,159 new patents in 2024, with about 45% focused on sustainability-related technologies.

SWOT Analysis

Strengths:

- Global leader in the chemical industry with a diverse product portfolio.

- Strong focus on sustainability and innovation.

- Extensive R&D capabilities and a large patent portfolio.

Weaknesses:

- Exposure to global economic fluctuations and commodity price volatility.

- Legal disputes and regulatory challenges in various markets.

Opportunities:

- Expansion into emerging markets, particularly in Asia.

- Growth in sustainable and renewable energy sectors.

- Potential collaborations in battery materials and electric vehicle markets.

Threats:

- Intense competition from other global chemical companies.

- Geopolitical tensions and trade disputes affecting global operations.

Recent News & Strategic Updates

- Coatings Business Sale: BASF is nearing the completion of a €7 billion deal to sell a majority stake in its automotive coatings division to Carlyle Group. BASF will retain a 40% stake in the new standalone company. This move is part of BASF's strategy to streamline operations and focus on core areas. 2. Agricultural Solutions IPO Preparation

- BASF plans to prepare its Agricultural Solutions division for a partial IPO in 2027. The division generated €9.8 billion in sales in 2024, and BASF is making progress on executing the legal entity separation and implementing an industry-specific ERP system.

Top Companies List

- Sika AG: The Swiss-based specialty chemical company offers products such as concrete admixtures, waterproofing, sealing, concrete protection, additives, flooring systems, and many more.

- Arkema Group: The major supplier of strong bonding, insulation, wall & floor coverings, sealing, and durable coating for construction purposes.

- Mapei S.p.A.: The leading producer of waterproofers, concrete admixtures, protective wall coatings, special mortars, and decorative wall coatings.

- Fosroc International Ltd.: The manufacturer of construction chemicals like concrete repair, admixtures, coatings, waterproofing, grouts, and sealants.

Other Companies List

Segments Covered

By Product

- Concrete Admixtures

- Water-Reducing Admixtures

- Superplasticizers

- Retarders & Accelerators

- Waterproofing Chemicals

- Liquid Membranes

- Crystalline Waterproofing

- Sealants & Adhesives

- Epoxy-Based

- Polyurethane-Based

- Protective Coatings

- Anti-Corrosive Coatings

- Fire-Resistant Coatings

By Application

- Residential Construction

- Commercial Construction

- Infrastructure & Industrial

- Renovation & Repair

By Technology

- Chemical Admixtures

- Coatings & Sealants

- Waterproofing Systems

By End User

- Construction Companies

- Contractors

- Real Estate Developers

- DIY/Homeowners