Content

Construction Chemicals Market Size, Share, Growth, Trends 2025 To 2034

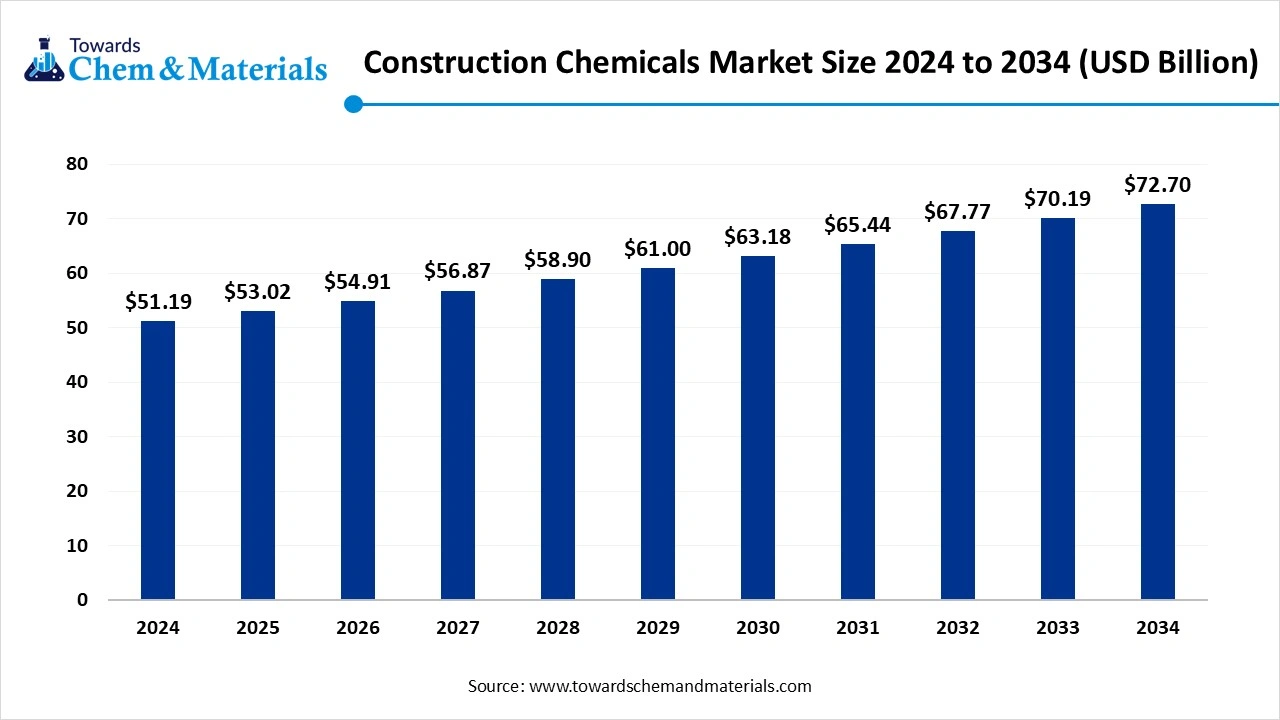

The global construction chemicals market size is calculated at USD 51.19 billion in 2024, grew to USD 53.02 billion in 2025 and is predicted to hit around USD 72.7 billion by 2034, expanding at healthy CAGR of 3.57% between 2025 and 2034. The increase in demand for construction chemicals across the globe is the key factor driving market growth. Also, ongoing industrialization in emerging economies coupled with innovations in construction technologies can fuel market growth further.

Key Takeaways

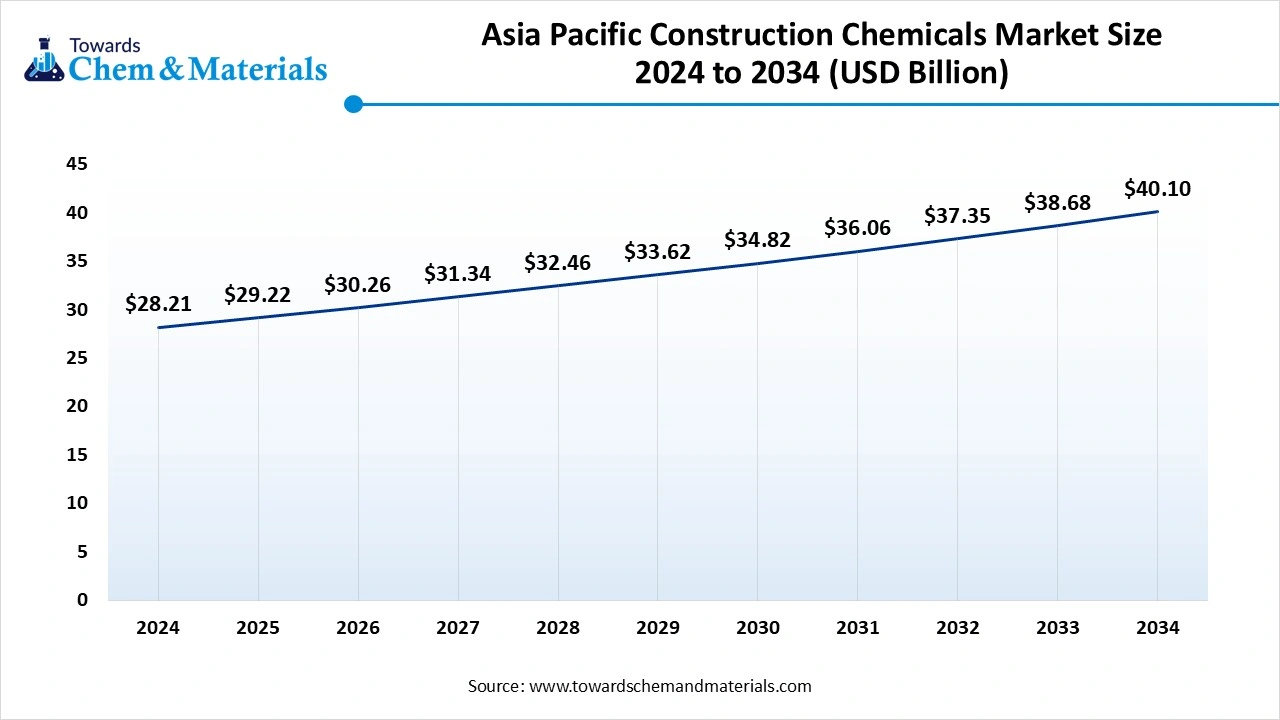

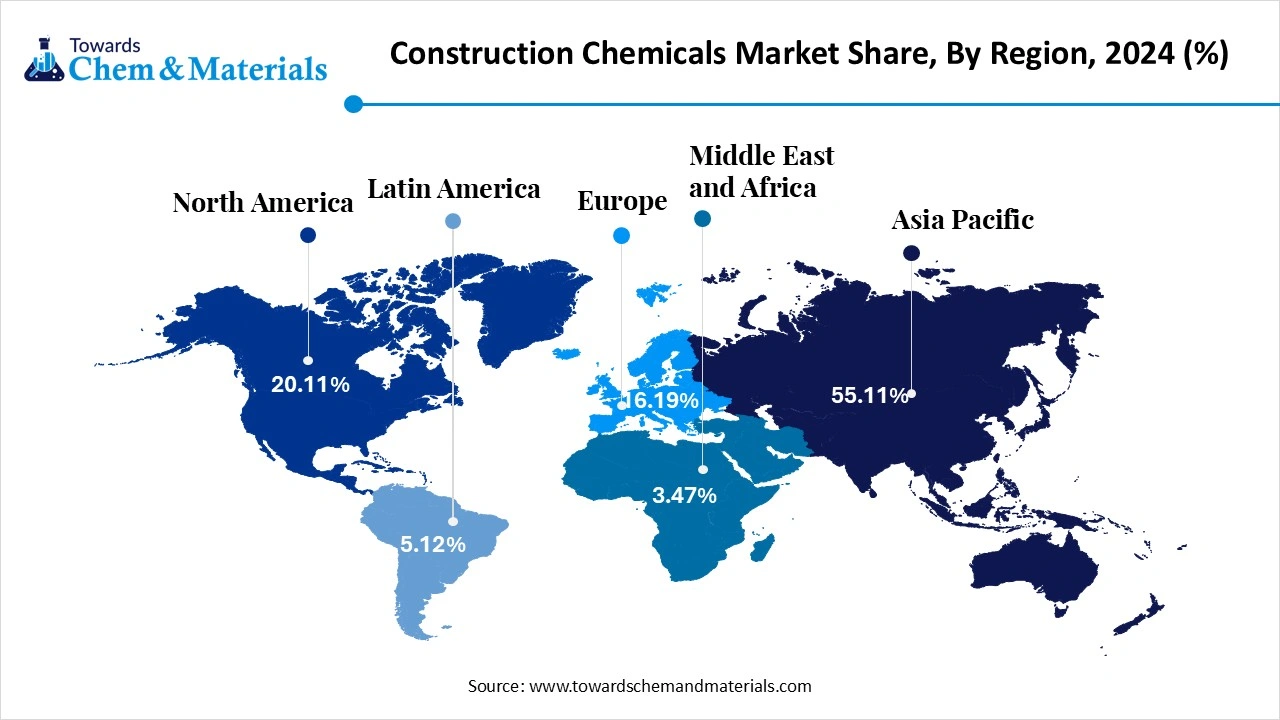

- The Asia Pacific dominated the global construction chemicals market with the largest share of 55.11% in 2024. The dominance of the region can be attributed to the increasing disposable incomes, urbanization, and surge in construction activities in the developing countries.

- The North America is expected to grow at a significant CAGR over the forecast period. The growth of the region can be credited to the increasing demand for sustainable and innovative building solutions and the presence of a well-established construction sector.

- By product, the admixture segment held the largest market revenue share of 48.69% in 2024.The dominance of the segment can be attributed to the surge in urbanization, growing construction activities, and increasing demand for high-performance concrete.

- By product, the coatings segment is projected to grow at the fastest CAGR of 5.35% over the forecast period. The growth of the segment can be credited to the growing emphasis on sustainable building practices which is fueling the demand for construction chemicals, including coatings.

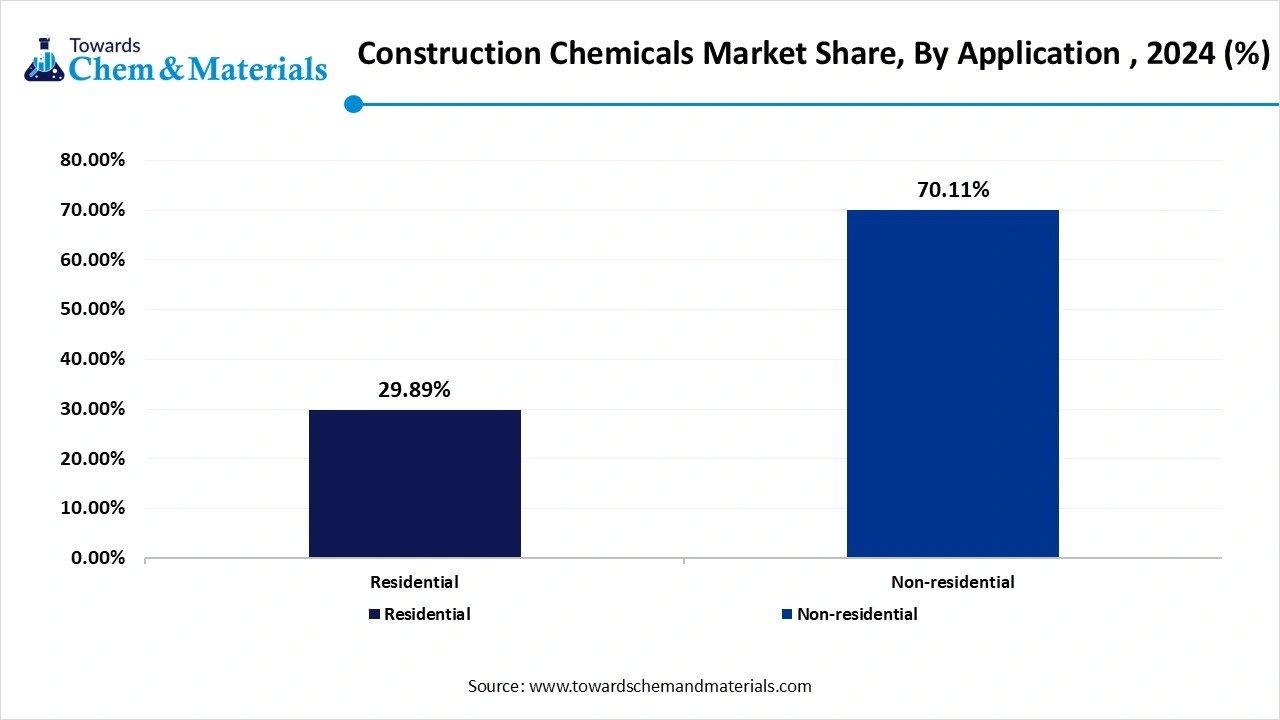

- By application, the non-residential segment held the largest market revenue share of 70.11% in 2024.The dominance of the segment can be linked to the surge in investment in infrastructure projects like industrial facilities and commercial buildings

- By application, the residential segment is projected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by rapid industrialization, the development of large-scale infrastructure projects, and increasing demand for specialized solutions.

Surge in Need for Infrastructure Development Expanding Market Growth

Construction chemicals are products incorporated into construction materials to improve their durability, performance, and sustainability. These chemicals such as waterproofing agents, admixtures, and sealants, enhance strength, workability, and resistance to environmental factors, contributing to the quality and longevity of buildings and infrastructure. They are generally designed for specific applications and provide unique characteristics that cannot be obtained with standard construction materials. A global surge in construction projects such as renovations and new buildings is generating a significant demand for construction chemicals to enhance the performance of structures.

What are the Key Trends Influencing the Construction Chemicals Market?

- The growing awareness regarding the environmental hazards facilitated by traditional buildings and shifts in government policies across the globe are the major trends for the adoption of construction chemicals, particularly for building activities. Some prominent players in the construction sector are emphasizing the protection of underground structures with green materials, driving market growth soon.

- The ongoing trend for modular construction and prefabrication is extensively fuelling the growth of the market. Prefabrication techniques relying on higher-quality construction chemicals in blending pre-manufactured components together provide cost-effective and high-quality solutions to the construction projects.

- The market is also experiencing an increasing shift towards integrated building solutions, where these chemicals are integrated with other building systems to improve overall building performance. This comprehensive approach is propelling the collaboration between engineers, builders, and architects, which leads to more sustainable and efficient construction practices.

How the Government is Supporting the Construction Chemicals Market?

The Indian government is increasingly promoting the market through various initiatives aimed at fuelling infrastructure development, supporting sustainable practices, and promoting local manufacturing. Initiatives such as Pradhan Mantri Awas Yojana (PMAY) are escalating the demand for construction chemicals in the residential sector. The national building code and the use of eco-friendly materials with innovative chemicals in construction support the adoption of sustainable practices.

The U.S. government is supporting the market through significant investments in infrastructure development, especially in areas such as bridges, roads, and public transportation. The U.S. government has also introduced specific initiatives such as the Federal Highway Administration's (FHWA) Bridge Investment Program, which preserves billions of dollars for bridge replacement and repair.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 53.02 Billion |

| Expected Size by 2034 | USD 72.7 Billion |

| Growth Rate from 2025 to 2034 | CAGR 3.57% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Product, By Application, By region |

| Key Companies Profiled | JSW, MAPEI S.p.A., Sika AG, Ashland, 3M, Arkema, Evonik Industries, Henkel AG & Co. KGaA, Dow, Thermax Limited., Saint-Gobain |

Market Opportunity

Increase in Demand for Construction Chemicals in Emerging Markets

The rising demand for construction chemicals is an outcome of the expansion of building markets in countries such as China and India along with urbanization tendencies. Furthermore, the area is becoming a prominent player in the market and is impacting the overall dynamics of the global industry. The demand is in line with the need for reliable bonding materials used in construction-related applications.

- In December 2024, Mapisa 369 introduced at the at Punjab PITEX . The event marked a substantial milestone for the company as it expanded its venture in Punjab, showing its commitment to quality and innovation in the construction chemicals industry.(Source: hindustanmetro.com)

Market Challenge

Slow Adoption of New Technologies

The sudden slowing in the adoption of newer technologies is the major factor restraining the market growth. This is due to factors such as cost considerations, lack of skilled labour, and the conservative nature of construction methods. Moreover, economic downturns can cause a decrease in construction activity, which affects the demand for construction chemicals. Constant violations in economic growth rates make the market uncertain.

Regional Insight

Asia Pacific dominated the construction chemicals market in 2024. The Asia Pacific hair construction chemicals market is expected to increase from USD 29.22 billion in 2025 to USD 40.10 billion by 2034, growing at a CAGR of 3.58% throughout the forecast period from 2025 to 2034. The dominance of the region can be attributed to the increasing disposable incomes, urbanization, and surge in construction activities in developing countries such as China and India. In addition, countries such as Japan, China, and India are witnessing substantial infrastructure development, which leads to an increase in demand for construction chemicals in the region.

- In February 2025, Vura Bau-Chemie company located in Gujrat, announced its plan to launch up to three new production facilities in southern and eastern India, which aims to boost its presence in the expanding construction chemicals market.(Source: themachinemaker.com)

Construction Chemicals Market in China

In Asia Pacific, China led the market owing to the rapid infrastructure development along with the surge in demand for infrastructure development. Also, the increase in growth in infrastructure projects including bridges, roads, and commercial buildings, is the major market driver. The growth of the residential sector in the region is fuelled by low mortgage rates and urbanization trends.

North America is expected to grow at a significant CAGR over the forecast period. The growth of the region can be credited to the increasing demand for sustainable and innovative building solutions and the presence of a well-established construction sector. Furthermore, the region's ongoing emphasis on environmental sustainability and efficiency is boosting the demand for sustainable construction materials, leading to market expansion in the region soon.

Construction Chemicals Market in U.S.

In North America, the U.S. dominated the market by holding the largest market share due to the ongoing adoption of innovative technologies such as green building solutions in the region. Additionally, the unpredictable climate in the U.S. followed by frequent rain and humidity, raises the requirement for weather-resistant construction and waterproofing solutions. The U.S. market is expanding rapidly because of government initiatives aimed at improving infrastructure resilience.

Who are the Top Exporting Nations for Organic Chemicals in 2023-24?

| Top Chemical Exporters | Organic Chemicals Export Data in Billions (USD) |

| China | USD 85.8 |

| United States | USD 43.3 |

| Ireland | USD 39.7 |

| Germany | USD 33.4 |

| Switzerland | USD 28.9 |

(Source:exportimportdata.in)

Segmental Insight

Product Insights

Which Product Type Segment Dominated The Construction Chemicals Market in 2024?

The admixture segment led the market in 2024. The dominance of the segment can be attributed to the surge in urbanization, growing construction activities, and increasing demand for high-performance concrete. Moreover, governments across the globe are investing heavily in infrastructure projects such as railways, bridges, and roads, which necessitates a large amount of concrete and, consequently, admixtures. Admixtures offer certain functionalities like reducing the use of water in the preparation of concrete and building repair.

- In January 2025, Master Builders Solutions, a leader in advanced concrete solutions and admixtures for construction sectors announced its expansion into the Indian market. Using its cutting-edge solutions and high expertise it aims to address the increasing demand for high-performance and sustainable construction materials.(Source: constructionworld.in)

The coatings segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the growing emphasis on sustainable building practices which is fuelling the demand for construction chemicals, including coatings. The segment covers protective sealants and coatings applied to different surfaces in construction to improve appearance, durability, and resistance to environmental factors. Regulatory pressures for eco-friendly building practices also drive the adoption of innovative coating solutions.

Application Insights

Why Non-Residential Segment Dominated the Construction Chemicals Market in 2024?

The non-residential segment held the largest market share in 2024. The dominance of the segment can be linked to the surge in investment in infrastructure projects like industrial facilities and commercial buildings. Furthermore, the application of chemicals in the construction of commercial buildings such as malls, offices, and hotels is propelling segment growth soon. This segment necessitates high-performance products such as innovative adhesives and fire-resistant coatings.

The residential segment is expected to grow at the fastest CAGR over the projected period. The growth of the segment can be driven by rapid industrialization, the development of large-scale infrastructure projects, and increasing demand for specialized solutions. Utilization of construction chemicals in building homes like admixtures for concrete foundations and waterproofing alternatives for basements, is impacting the positive segment growth further. These products are necessary for ensuring the safety and durability of residential buildings.

Recent Developments

- In June 2025, Cemex will launch its new prime range of cutting-edge admixtures to the EMEA market, marking a substantial stage in the detailed evolution of its admixtures portfolio. The products will be available across Cemex's global and regional markets.(Source: worldcement)

- In July 2024, Saint-Gobain Construction Chemicals launched an EnviroMix C-Clay, the latest range of admixtures created to promote the use of clay-based cement in the production of concrete. This addition will strengthen the company's profile of low-carbon concrete admixtures.(Source: worldbiomarketinsights.com)

Top Companies List

- JSW

- MAPEI S.p.A.

- Sika AG

- Ashland

- 3M

- Arkema

- Evonik Industries

- Henkel AG & Co. KGaA

- Dow

- Thermax Limited.

- Saint-Gobain

Segments Covered

By Product

- Admixture

- Adhesives

- Sealants

- Coatings

By Application

- Residential

- Non-residential

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait