Content

What is U.S. Biopolypropylene Market Size and Volume?

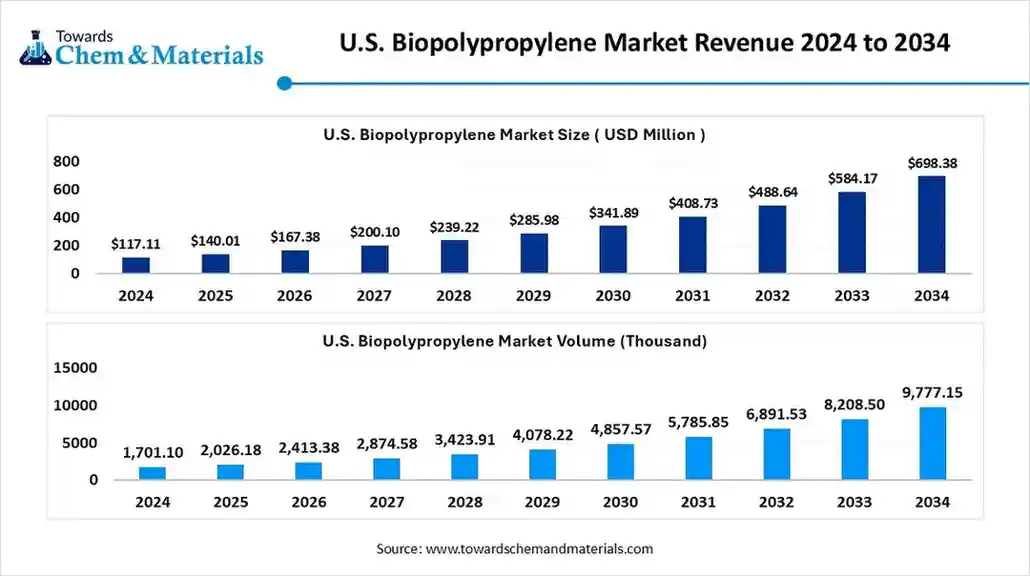

The U.S. Biopolypropylene market is expected to reach a volume of approximately 2,026.18 thousand in 2025, with a forecasted increase to 9,777.15 thousand by 2034, growing at a CAGR of 19.11% from 2025 to 2034.

The U.S. biopolypropylene market size was valued at USD 117.11 million in 2024 and is expected to hit around USD 698.38 million by 2034, growing at a compound annual growth rate (CAGR) of 19.55% over the forecast period from 2025 to 2034. The growth of the market is driven by growing demand for sustainable and eco-friendly solutions and the use of materials that align with sustainability, driving the growth of the market.

Key Takeaways

- By product type, the mass-balance bio-PP segment dominated the market with an approximate share of 55% in 2024.

- By product type, the mass-balance bio-PP segment expects significant growth in the market during the forecast period.

- By resin grade, the homopolymer segment dominated the market with an approximate share of 45% in 2024.

- By resin grade, the random copolymer segment is expected to experience significant growth in the market during the forecast period.

- By application, the films segment dominated the market with an approximate share of 30% in 2024.

- By application, the automotive components segment expects significant growth in the market during the forecast period.

- By end-use industry, the packaging segment dominated the market with approximate share of 40% in 2024.

By end-use industry, the automotive & transportation segment expects significant growth in market during the forecast period. - By physical form, the pellets/granules segment dominated the U.S. biopolypropylene market with a share of approximately 85% in 2024.

- By physical form, the masterbatch/concentrates segment expects significant growth in the market during the forecast period.

- By feedstock route, the mass-balance certification segment dominated the market with a share of approximately 60% in 2024.

- By feedstock route, the bio-ethanol to bio-propylene segment expects significant growth in the U.S. biopolypropylene market during the forecast period.

Market Overview

What Is The Significance Of the U.S. Biopolypropylene Market?

The U.S. bio-polypropylene (Bio-PP) market plays a significant role in the growth of the market. The rapid growth in the bio-plastics industry due to growing environmental concerns in the country drives the demand and adoption of eco-friendly and sustainable solutions, and the use of sustainable products is driving the growth of the market. The sustainability and environmental benefits, like reduced carbon footprint and renewable feedstocks, help reduce greenhouse gas emissions, which is a major concern.

U.S. Biopolypropylene Market Outlook:

- Industry Growth Overview: Between 2025 and 2034, the US biopolypropylene market is projected to grow steadily, supported by the demand for sustainable and eco-friendly plastics in various sectors, especially the packaging and automotive sectors, due to growing demand for lightweight materials, and its application makes it a preferred choice.

- Sustainability Trends: the growing shift towards sustainability amid rising environmental concerns and initiatives to reduce greenhouse gas emissions drives the demand for bio-based products, which are eco-friendly and sustainable to use. The government initiatives and policies for the promotion and use of renewable resources also support the growth.

- Global Expansion: the market has seen significant growth, driven by the presence of key players in the country, and partnerships and heavy investments from the companies support the expansion. A prominent player in the market, Braskem is a key company involved in its production.

Report Scope

| Report Attributes | Details |

| Market Size in 2026 | USD 200.10 Million |

| Expected Size by 2034 | USD 698.38 Million |

| Growth Rate from 2025 to 2034 | CAGR 19.55% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Product Type, By Resin Grade, By Application, By End-Use Industry, By Physical Form, By Feedstock Route |

| Key Companies Profiled | ExxonMobil Chemical , INEOS Olefins & Polymers , Chevron Phillips Chemical , Formosa Plastics Corporation , Reliance Industries , Mitsui Chemicals , Versalis (Eni) , Mitsubishi Chemical Group , LG Chem , Sinopec , PetroChina , Toray Industries , Westlake Chemical , Celanese Corporation , Dow |

Key Technological Shifts In The U.S. Biopolypropylene Market:

The key technological shift in the U.S. biopolypropylene market includes the advancements in biotechnology feedstock production, which helps in lowering the cost of the material and helps in improving the versatility of the product. The integration of AI and digital tools also helps in optimizing the production process and managing and controlling the quality, which aligns with the development of recycling and circular economy models, helping in optimization and sustainability profile.

Trade Analysis Of U.S. Biopolypropylene Market: Import & Export Statistics

- The primary destinations for U.S. polypropylene exports were Mexico and Canada, with substantial volumes and values.

- In 2023, the U.S. exported over $1,848,819.21K worth of polypropylene globally.(Source: wits.worldbank.org)

- The primary export markets were Mexico and Canada.

- Major companies involved in the bio-based polypropylene sector include Braskem, LyondellBasell, Neste, and SABIC. Collaborations between these firms are common for developing and supplying renewable feedstocks.

- In 2024, Citroniq raised funding for a new plant in Nebraska. Braskem and Shell Chemicals also partnered to bring certified bio-based polypropylene to the U.S. market.(Source: www.shell.com)

- The U.S. Department of Energy is providing $27 million in funding for plastics recycling and the development of new recyclable or biodegradable plastics, which supports the bioplastics sector.(Source: www.energy.gov)

U.S. Biopolypropylene Market Value Chain Analysis

- Chemical Synthesis and Processing : The biopolypropylene does not naturally occur in microorganisms; its bio-production requires engineered metabolic pathways or catalytic conversion of other biomass-derived chemicals.

- Key players : Emco Industrial Plastics, Inc., CS Hyde Company, Trident Plastics Inc: Industrial Plastic Supply, Inc

- Quality Testing and Certification : The biopolypropylene requires ISCC PLUS, OK biobased (TÜV Austria), ASTM D6866, and USDA BioPreferred Program certification.

- Key players: ASTM International, BIS, FDA, BRCGS, and UL Solutions

- Distribution to Industrial Users : The biopolypropylene is distributed to the packaging, automotive, electronics, consumer goods, medical and healthcare, textiles, and construction industries.

- Key players: Braskem, LyondellBasell Industries, SABIC, Neste, and Borealis AG.

U.S. Biopolypropylene Regulatory Landscape: Global Regulations

| Country / Region | Regulatory Body | Key Regulations | Focus Areas | Notable Notes |

| United States | U.S. EPA (Environmental Protection Agency), FDA (Food and Drug Administration), USDA (United States Department of Agriculture), ASTM International | -EPA Clean Air Act (regulates emissions & processing of bio-based plastics) - FDA 21 CFR (food-contact safety for bio-PP applications in packaging/containers) - USDA BioPreferred Program (certification for bio-based content & labeling) - ASTM D6866 (standard test method for determining bio-based carbon content) - ASTM D638/D790 (mechanical property testing for plastics |

Environmental compliance - Food-contact safety - Bio-based certification & labeling - Material performance standards |

Bio-PP qualifies for BioPreferred labeling, boosting marketability. FDA approval is crucial for food packaging applications. ASTM ensures performance parity with fossil-based PP. |

Segmental Insights

Product Type Insights

Which Product Type Segment Dominated The U.S. Biopolypropylene Market In 2024?

The mass-balance bio-PP segment dominated the market with an approximate share of 55% in 2024. Mass balance bio-PP integrates renewable feedstock with fossil-based streams while maintaining identical performance. It enables a gradual transition to sustainable plastics without altering existing infrastructure. This approach is gaining traction in the U.S. as companies meet regulatory sustainability targets while retaining compatibility with established polypropylene applications.

The mass-balance bio-PP segment expects significant growth in the U.S. biopolypropylene market during the forecast period. Certified mass-balance bio-PP ensures traceability and accountability across the supply chain. Certification schemes validate renewable content, supporting eco-labeling and compliance with environmental standards. In the U.S., demand is rising from the packaging and automotive sectors, where end-users prioritize transparency, carbon reduction, and sustainable material sourcing.

Resin Grade Insights

How Did the Homopolymer Segment Dominated The U.S. Biopolypropylene Market In 2024?

The homopolymer segment dominated the market with an approximate share of 45% in 2024. Homopolymer bio-PP offers excellent stiffness, strength, and chemical resistance, making it suitable for rigid packaging and automotive applications. Its ability to match fossil-based PP properties while lowering carbon footprint positions it as a preferred option in high-volume manufacturing. U.S. adoption is increasing in both consumer and industrial sectors.

The random copolymer segment is expected to experience significant growth in the market during the forecast period. Random copolymer bio-PP delivers superior clarity, flexibility, and impact resistance. It is widely used in packaging films, medical devices, and food containers. The growing focus on lightweight, transparent, and eco-friendly materials is fueling its adoption across U.S. industries seeking performance and sustainability benefits.

Application Insights

Which Application Segment Dominated The U.S. Biopolypropylene Market In 2024?

The films segment dominated the market with an approximate share of 30% in 2024. Bio-PP films are increasingly adopted in food packaging, labels, and agriculture due to their lightweight, recyclable, and low-carbon characteristics. Their compatibility with existing processing technologies makes them an easy substitute for conventional PP films, driving their expansion in the U.S. sustainable packaging sector.

The automotive components segment expects significant growth in the market during the forecast period. Automotive manufacturers are embracing bio-PP in interior trims, dashboards, and under-the-hood parts to reduce environmental impact while meeting performance standards. Bio-PP’s lightweight properties enhance fuel efficiency and sustainability, aligning with U.S. automotive industry goals of reducing emissions and complying with stringent regulations.

End-Use Industry Insights

How Did the Packaging Segment Dominated The U.S. Biopolypropylene Market In 2024?

The packaging segment dominated the market with a share of approximately 40% in 2024. The packaging industry dominates U.S. bio-PP consumption, driven by demand for sustainable food and consumer goods packaging. Brand owners increasingly prefer bio-PP for its renewable sourcing, recyclability, and durability. The trend toward circular economy practices strengthens its adoption across retail and e-commerce packaging solutions.

The automotive & transportation segment expects significant growth in the market during the forecast period. Bio-PP is making inroads into the U.S. automotive and transportation industry as OEMs prioritize carbon-neutral materials. Its durability, versatility, and compatibility with lightweighting initiatives make it an attractive replacement for conventional PP. Partnerships between material producers and automakers are accelerating commercialization in this segment.

Physical Form Insights

Which Physical Form Segment Dominated The U.S. Biopolypropylene Market In 2024?

The pellets/granules segment dominated the U.S. biopolypropylene market with a share of approximately 85% in 2024. Pellets and granules represent the most common physical form of bio-PP used in extrusion, injection molding, and thermoforming. Their versatility supports wide industrial adoption in packaging, automotive, and consumer goods. In the U.S., resin suppliers are scaling pellet production to meet growing downstream demand.

The masterbatch/concentrates segment expects significant growth in the market during the forecast period. Masterbatch and concentrates allow customized formulations, including colors, additives, and performance enhancers, in bio-PP applications. They are gaining popularity in the packaging and automotive industries where tailored solutions are required. The U.S. market is witnessing growth in specialty masterbatches to meet both sustainability and functionality requirements.

Feedstock Route Insights

How Did the Mass Balance Certification Segment Dominated The U.S. Biopolypropylene Market In 2024?

The mass-balance certification segment dominated the U.S. biopolypropylene market with a share of approximately 60% in 2024. Mass balance certification ensures renewable content accountability in bio-PP production, fostering consumer confidence and regulatory compliance. It enables brand owners in the U.S. to market their products as sustainable without disrupting processing technologies. Growing demand from FMCG and automotive companies is driving certification adoption.

The bio-ethanol to bio-propylene segment expects significant growth in the market during the forecast period. Bio-ethanol-based routes convert renewable biomass into propylene, offering a fully renewable pathway to bio-PP. This method is gaining attention in the U.S. as companies explore low-carbon feedstocks for large-scale production. It supports decarbonization strategies and strengthens domestic bio-economy initiatives.

Recent Developments

- In August 2025, ABB and Citroniq Chemicals are partnering to construct a facility in Nebraska aimed at producing the world's first commercial-scale, 100% bio-based polypropylene from corn-based ethanol.(Source: themachinemaker.com)

- In November 2024, Citroniq Chemicals selected a site near Falls City, Nebraska, for its initial U.S. plant to produce bio-based polypropylene from corn. The facility, expected to begin operations in 2029, is planned to have an annual capacity of 400,000 metric tons and utilize a carbon-negative process.(Source: www.plasticsnews.com)

- In December 2024, Acme Mills Company introduced Natura, a new line of bio-based PLA fabrics made from renewable resources like corn starch and sugarcane, intended to replace petroleum-based textiles such as PET, PP, and Nylon.(Source: www.prnewswire.com)

Top players in the Analytical Chemistry Market & Their Offerings:

- LyondellBasell: The company is actively focusing on expanding its Circular and Low Carbon Solutions (CLCS) business, aiming for significant growth by 2030. It continues to advance its strategy of developing sustainable polymers, including bio-polypropylene, through a multi-pronged approach that combines product innovation, strategic investments, and partnerships.

- Braskem: the company is a leading global player in the bio-polypropylene (bio-PP) market, particularly in the Americas, and is actively pursuing a strategy focused on circularity and sustainability.

- SABIC: the company is a major global chemical company actively involved in the bio-polypropylene (bio-PP) market through its TRUCIRCLE™ portfolio of certified renewable materials.

- Borealis: They are a global leader in polyolefins and base chemicals, and are actively engaged in the bio-polypropylene (bio-PP) market, primarily by producing certified renewable polypropylene via a mass balance approach.

- TotalEnergies: The company is involved in the bio-polypropylene (bio-PP) market primarily through a portfolio of recycled and renewable polymers, rather than producing bio-PP from dedicated biomass feedstocks.

Other Top Players Are

- ExxonMobil Chemical

- INEOS Olefins & Polymers

- Chevron Phillips Chemical

- Formosa Plastics Corporation

- Reliance Industries

- Mitsui Chemicals

- Versalis (Eni)

- Mitsubishi Chemical Group

- LG Chem

- Sinopec

- PetroChina

- Toray Industries

- Westlake Chemical

- Celanese Corporation

- Dow

Segments Covered

By Product Type

- 100% Bio-PP (renewable feedstock only)

- Mass-balance Bio-PP (certified attribution, mixed feedstocks)

- Bio-blend PP (bio-PP mixed with fossil PP or recyclate)

By Resin Grade

- Homopolymer

- Random Copolymer

- Impact Copolymer

- High-Melt-Flow Grades

By Application

- Films (BOPP, cast, barrier)

- Rigid Packaging (containers, caps, closures, trays)

- Fibers & Nonwovens

- Automotive Components (interior & exterior)

- Electrical & Electronic Parts

- Pipes, Fittings & Building Profiles

- Consumer Goods & Appliances

- Medical & Healthcare Products

- Agricultural Films & Twine

By End-Use Industry

- Packaging (flexible + rigid combined)

- Automotive & Transportation

- Consumer Durables & Appliances

- Building & Construction

- Electrical & Electronics

- Healthcare & Medical

- Textiles & Nonwovens

- Agriculture

By Physical Form

- Pellets / Granules

- Powder

- Masterbatch / Concentrates

By Feedstock Route

- Bio-ethanol to Bio-propylene Route

- Vegetable Oil / Glycerol Derived Route

- Biomass-to-Olefins (BTO) Route

- Mass-balance Certification Route