Content

U.S. Aerospace Foam Market- Size, Share & Industry Analysis

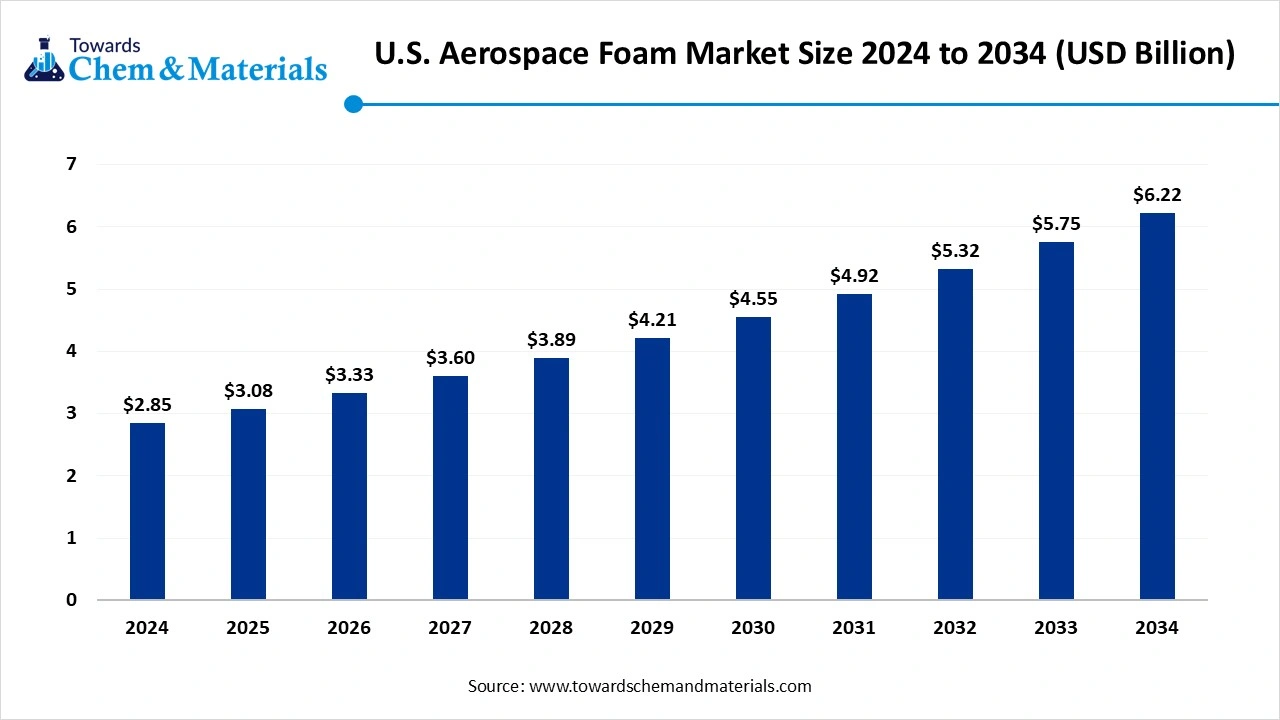

The U.S. aerospace foam market size was valued at USD 2.85 billion in 2024, grew to USD 3.08 billion in 2025, and is expected to hit around USD 6.22 billion by 2034, growing at a compound annual growth rate (CAGR) of 3.45% over the forecast period from 2025 to 2034. A shift towards fuel-efficient aerospace practices has been a key enabler of industry development.

Key Takeaways

- By foam type, the polyurethane foam segment led the U.S. aerospace foam market with approximately 35% industry share in 2024, due to factors like versatility, affordability, and lightweight nature.

- By foam type, the polyimide & melamine segment is expected to grow at the fastest rate in the market during the forecast period, owing to its specific and special characteristics like low emissions, superior fire resistance, and performance under high temperature.

- By end use, the commercial aviation segment emerged as the top-performing segment in the market with approximately 55% industry share in 2024, wing to the industry being considered crucial for the United States, akin to a higher fleet size and passenger traffic requiring the large-scale need for cushioning, insulation, and other products.

- By end use, the space craft and satellite segment is expected to lead the market in the coming years, because the United States is entering a new space race with NASA, SpaceX, and private companies leading exploration and satellite deployment.

- By functionality, the cushioning and comfort segment led the market with approximately 38% share in 2024, because commercial airlines prioritize passenger experience, ergonomic seating, and noise reduction.

- By functionality, the fire resistance and vibration control foams segment is expected to capture the biggest portion of the market in the coming years, because of stricter FAA safety regulations, rising electrification in aircraft, and the growth of space exploration.

Market Overview

Engineering the Sky: Aerospace Foam as a Game Changer in Aviation

The U.S. aerospace foam market has experienced sophisticated growth in recent years. Also, the industry refers to the production and application of lightweight, durable, and high-performance foam materials used in aircraft interiors, exteriors, and structural components.

Aerospace foams are engineered for thermal insulation, soundproofing, cushioning, vibration dampening, and lightweight structural reinforcement. They are widely utilized in commercial aviation, military aircraft, and spacecraft. Market growth is driven by fleet modernization, rising air travel demand, defence spending, and the push for fuel-efficient lightweight materials.

- In February 2025, the report published by the Federal Aviation Administration United States started research on fluorine-free foam for safety purposes. (Source: www.faa.gov)

Lightweight Aerospace Forms are Changing the Industry

The increased need for fuel efficiency and reduction of emissions in the United States has immensely impacted market scalability and potential in recent years. Having lightweight properties, the aerospace foams have sparked considerable attention from financial firms and analysts in the current period. The aerospace manufacturers are under heavy pressure from the reduction of the fuel cost while following zero emission initiatives, where the foams have been spotlighted in industry investment reports in the past few years in the United States, as per the latest survey.

- In February 2025, the company called ZOTEFOAM, which has a manufacturing base in the United States and introduced their innovative foam for aviation called ZOTEK® F.(Source : www.zotefoams.com)

Market Trends

- The development of the smart foam, which is integrated with sensors, has gained traction with investment firms in recent years as the aerospace manufacturers are seeking safety and real-time insights.

- The shift towards the recycled aerospace foams is likely to boost the overall capacity of the industry in the coming years. Furthermore, the rising sustainability initiatives are likely to contribute to market potential.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 3.08 Billion |

| Expected Size by 2034 | USD 6.22 Billion |

| Growth Rate from 2025 to 2034 | CAGR 3.45% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Foam Type, By End-Use Platform, By Functionality |

| Key Companies Profiled | BASF SE (U.S. operations) , Evonik Industries AG , SABIC , Rogers Corporation , Boyd Corporation , Armacell International S.A. , Zotefoams plc , Recticel NV/SA , The Dow Chemical Company, UFP Technologies, Inc. , Aerofoam Industries, Inc. , General Plastics Manufacturing Company , FXI Holdings, Inc., Huntsman Corporation , Foam Supplies, Inc. |

Market Opportunity

Foam Customization Brings Competitive Edge to Aerospace Makers

The customization of foam according to need from the electric aircraft and space vehicles could result in high-yield outcomes for industrial players in the coming years. Also, the manufacturer can gain substantial industry attention by establishing a collaboration with prominent aerospace players in the United States, which gives them long-term profit margins with the specified consumer base. Furthermore, the development of the more lightweight foam using technology integration is likely to set competitive advantages in the production space in the upcoming years.

Market Challenge

Certification Barriers Impact Aerospace Foam Competitiveness

The higher regulatory and certification challenges for the aerospace foams in the United States are anticipated to impede the industry’s competitive positioning in the coming years. Moreover, the aerospace foams can pass multiple safety steps where the smoke, toxicity, and vibration standards will be strictly observed. Also, the regulation is likely to create product delays and expenses, which is likely to create growth barriers for the new market entrants and mid-sized businesses in the coming years.

Segmental Insights

Foam Type Insights

How did the Polyurethane Foam Segment Dominate the U.S. Aerospace Foam Market in 2024?

The polyurethane foam segment held the largest share of the market in 2024, due to factors like versatility, affordability, and lightweight nature. Furthermore, the manufacturers are increasingly seen using these foams for aircraft insulation, seating, and interior panels, where the polyurethane foam is considered ideal. Also, the ongoing demand for cost efficiency is likely to maintain polyurethane foam dominance in the industry, as per the recent survey in the United States.

The polyimide & melamine segment is expected to grow at a notable rate during the predicted timeframe, owing to their specific and special characteristics like low emissions, superior fire resistance, and performance under high temperature. Also, the nation’s ongoing programs like space exploration, reusable aircraft, and next-generation aircraft development are likely to create greater opportunities in the industry during the forecast period, as per the future industry expectations.

End Use Insights

Why does the Commercial Aviation Segment Dominate the U.S. Aerospace Foam Market in 2024?

The commercial aviation segment held the largest share of the U.S. aerospace foam market in 2024, owing to the industry being considered crucial for the United States, akin to a higher fleet size and passenger traffic requiring the large-scale need for cushioning, insulation, and other products. Furthermore, the airlines in the United States are seen under the heavy update of the interiors, which is leading the sales of the aerospace foams in recent years.

The space craft and satellite segment is expected to grow at a notable rate during the forecast period, because the United States is entering a new space race with NASA, SpaceX, and private companies leading exploration and satellite deployment. These projects require advanced foams with extreme durability, insulation, and vibration control to function in outer space. With increasing launches of small satellites, reusable spacecraft, and lunar/Mars missions, high-performance foams like polyimide and melamine will be critical.

Functionality Insights

How Did The Cushioning And Comfort Segment Dominate The U.S. Aerospace Foam Market In 2024?

The cushioning and comfort segment dominated the market in 2024 because commercial airlines prioritize passenger experience, ergonomic seating, and noise reduction. Polyurethane foams became the standard material for seats, cabin walls, and insulation due to their balance of cost-effectiveness and comfort. Passengers expect quieter cabins and softer seating, and foams play a key role in delivering these.

The fire-resistant & vibration control foams segment is expected to grow at a significant rate during the forecast period, because of stricter FAA safety regulations, rising electrification in aircraft, and the growth of space exploration. As aircraft systems become more complex and battery-powered aviation grows, the need for materials with flame-retardant and vibration-damping properties will increase. Vibration control is especially critical for spacecraft, satellites, and electric aircraft to protect sensitive instruments.

U.S. Aerospace Foam Market Value Chain Analysis

- Distribution to Industrial Users: The aerospace foams in the United States are distributed by direct sales and through specialized distributors, according to the recent survey.

- Key Players: General Plastics Manufacturing Company, UFP Technologies, and Rogers Corporation.

- Chemical Synthesis and Processing: The chemical synthesis of the aerospace foams includes polymerization with specialized propellants and coatings integration.

- Regulatory Compliance and Safety Monitoring: The United States has a specialized regulatory body for the safety and regulatory compliance of the foam called the Federal Aviation Administration (FAA).

Recent Developments

- In September 2024, L&L unveiled its latest product line of foaming materials. The newly launched foam material, called InsituCore™, is specifically designed for composite manufacturing.(Source: www.llproducts.com)

U.S. Aerospace Foam Market Top Companies

- BASF SE (U.S. operations)

- Evonik Industries AG

- SABIC

- Rogers Corporation

- Boyd Corporation

- Armacell International S.A.

- Zotefoams plc

- Recticel NV/SA

- The Dow Chemical Company

- UFP Technologies, Inc.

- Aerofoam Industries, Inc.

- General Plastics Manufacturing Company

- FXI Holdings, Inc.

- Huntsman Corporation

- Foam Supplies, Inc.

Segment Covered

By Foam Type

- Polyurethane Foam

- Polyethylene Foam

- Polyimide Foam

- Melamine Foam

- Polypropylene Foam

- Specialty Foams (PVC, EVA, Others)

By End-Use Platform

- Commercial Aviation (Passenger Aircraft, Cargo Aircraft)

- Military Aviation (Combat Aircraft, Transport Aircraft)

- Business Jets & General Aviation

- Spacecraft & Satellites

By Functionality

- Cushioning & Comfort

- Thermal Insulation

- Acoustic Insulation

- Vibration & Impact Resistance

- Fire Resistance