Content

Recycled Thermoplastics Market Size and Growth 2025 to 2034

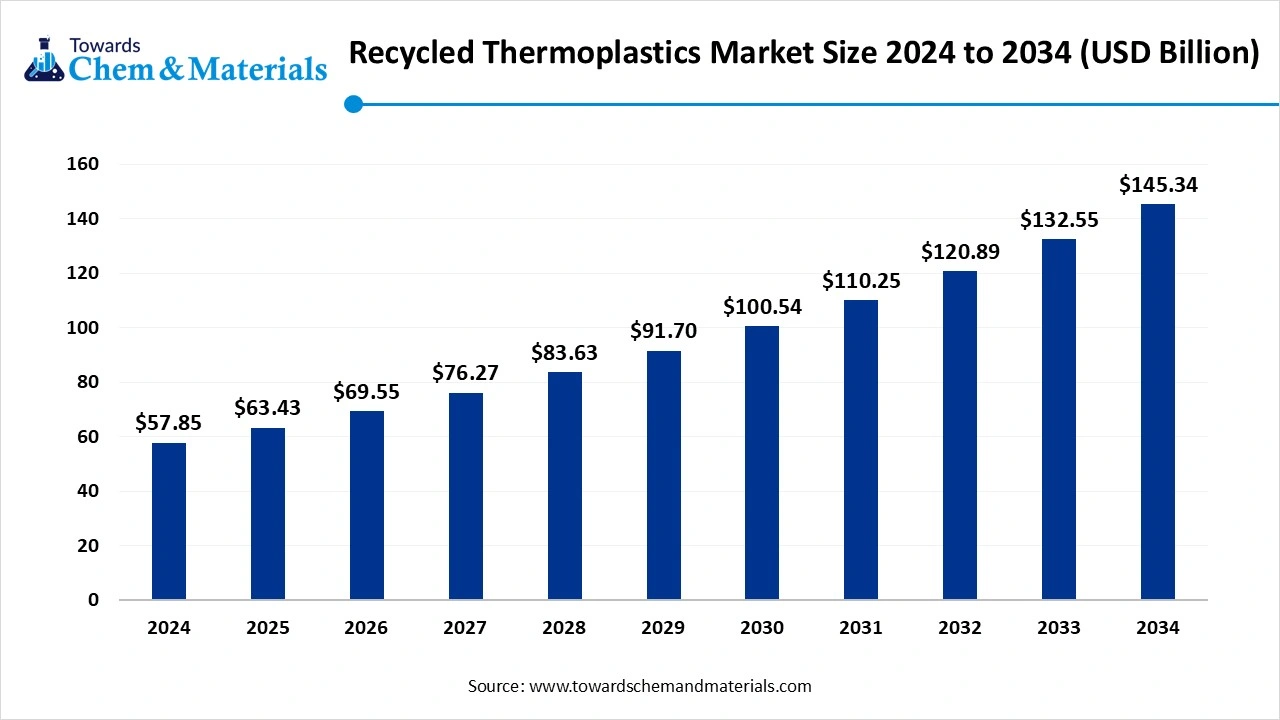

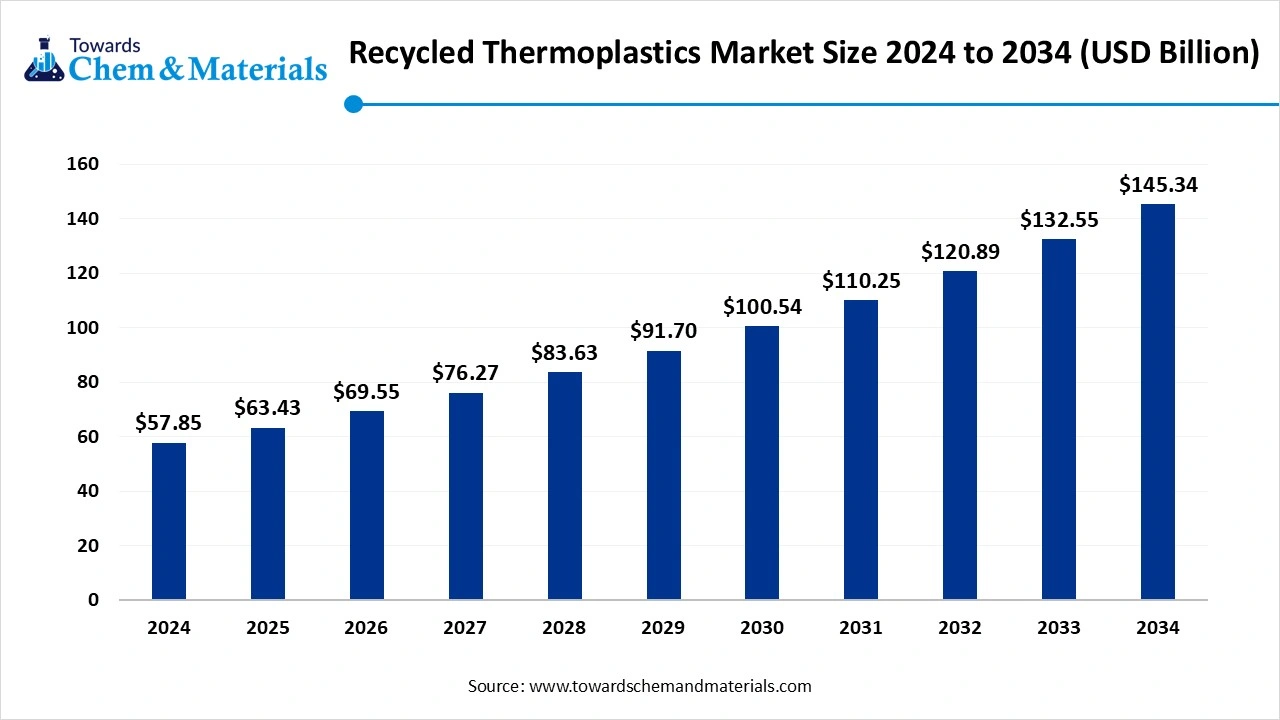

The global recycled thermoplastics market size was estimated at USD 57.85 billion in 2024 and is expected to hit around USD 145.34 billion by 2034, growing at a compound annual growth rate (CAGR) of 9.65% over the forecast period from 2025 to 2034. The surge in environmental concerns is the key factor driving market growth. Also, innovations in recycling technologies coupled with the stringent environmental regulations and mandates can fuel market growth further.

Key Takeaways

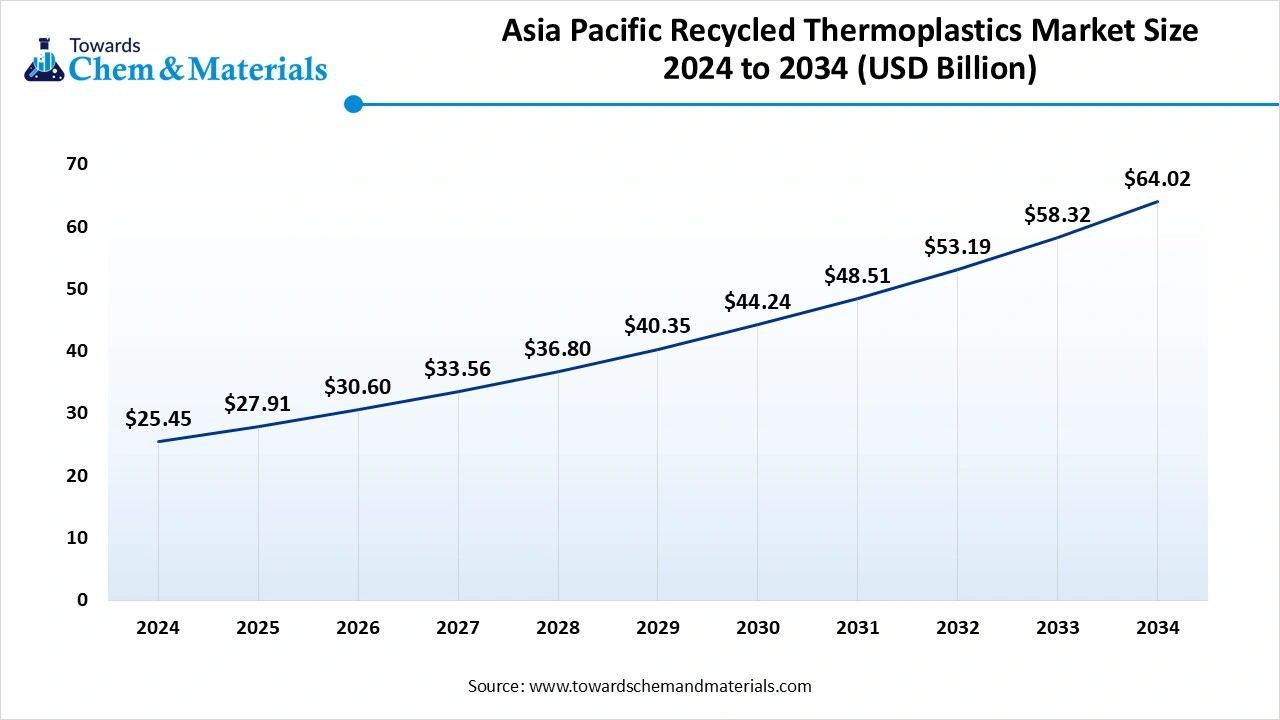

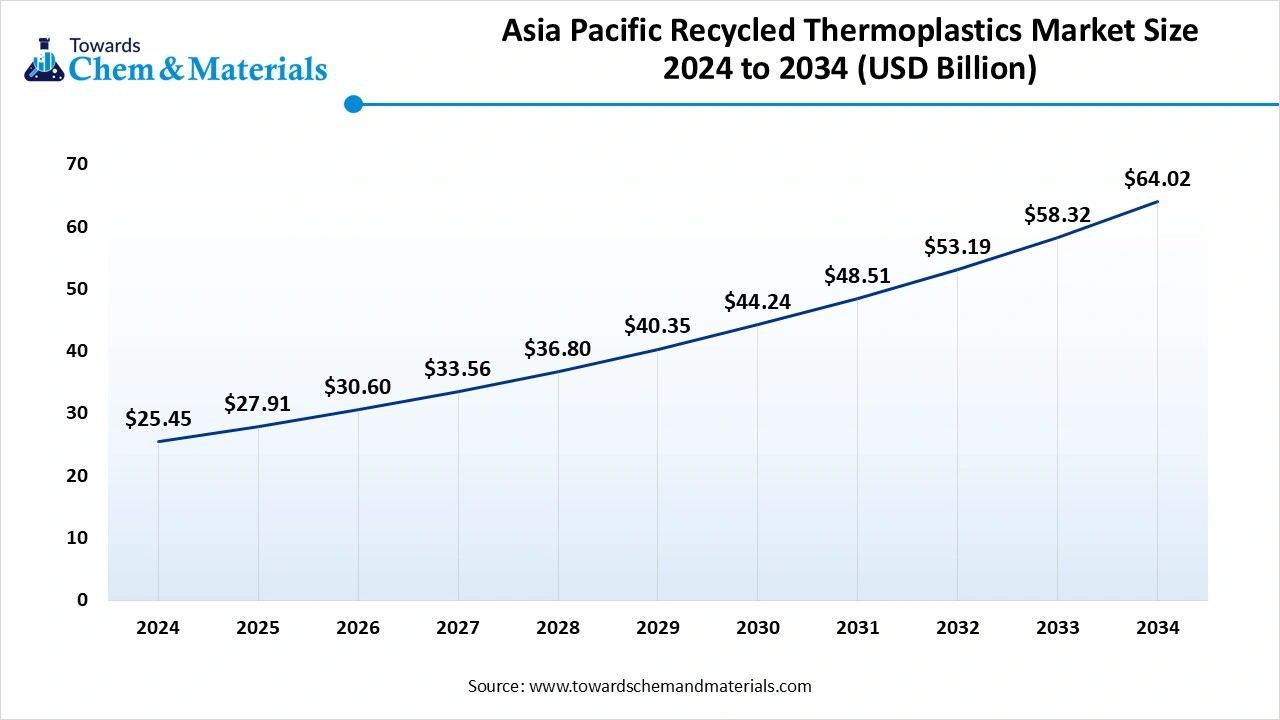

- The Asia Pacific recycled thermoplastics market size was estimated at USD 25.45 billion in 2024 and is expected to reach USD 64.02 billion by 2034, growing at a CAGR of 9.66% from 2025 to 2034.

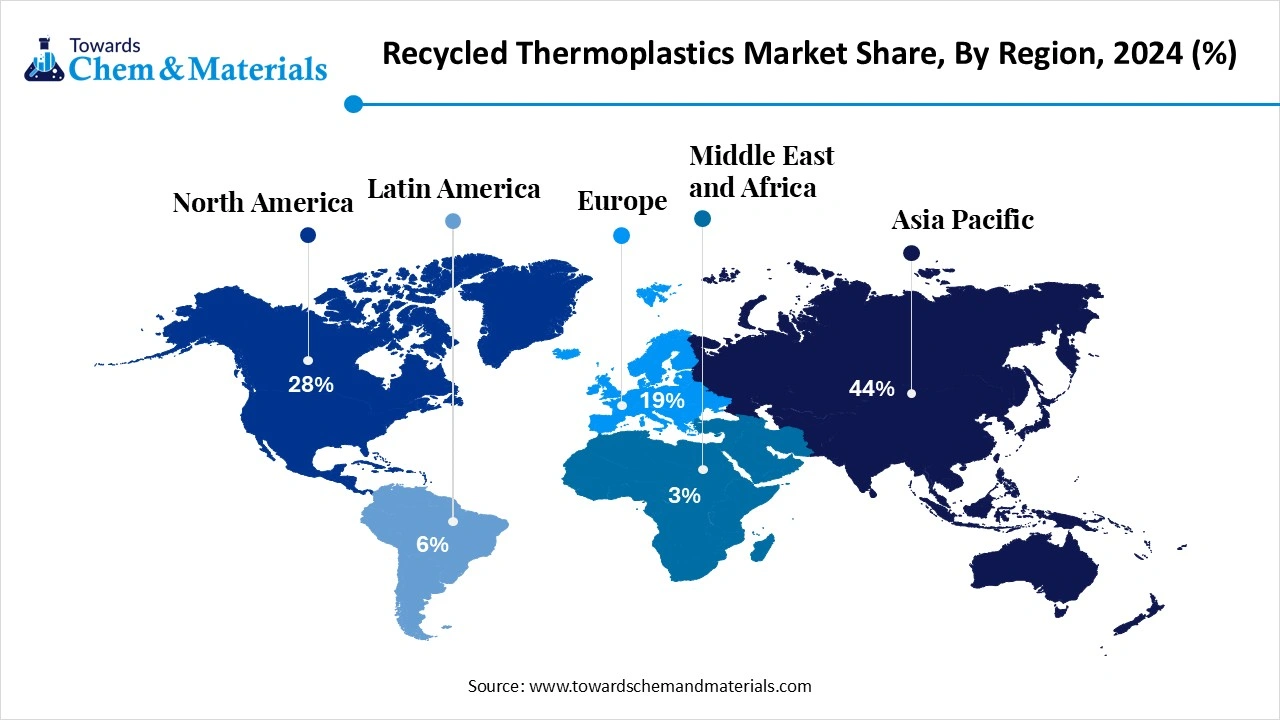

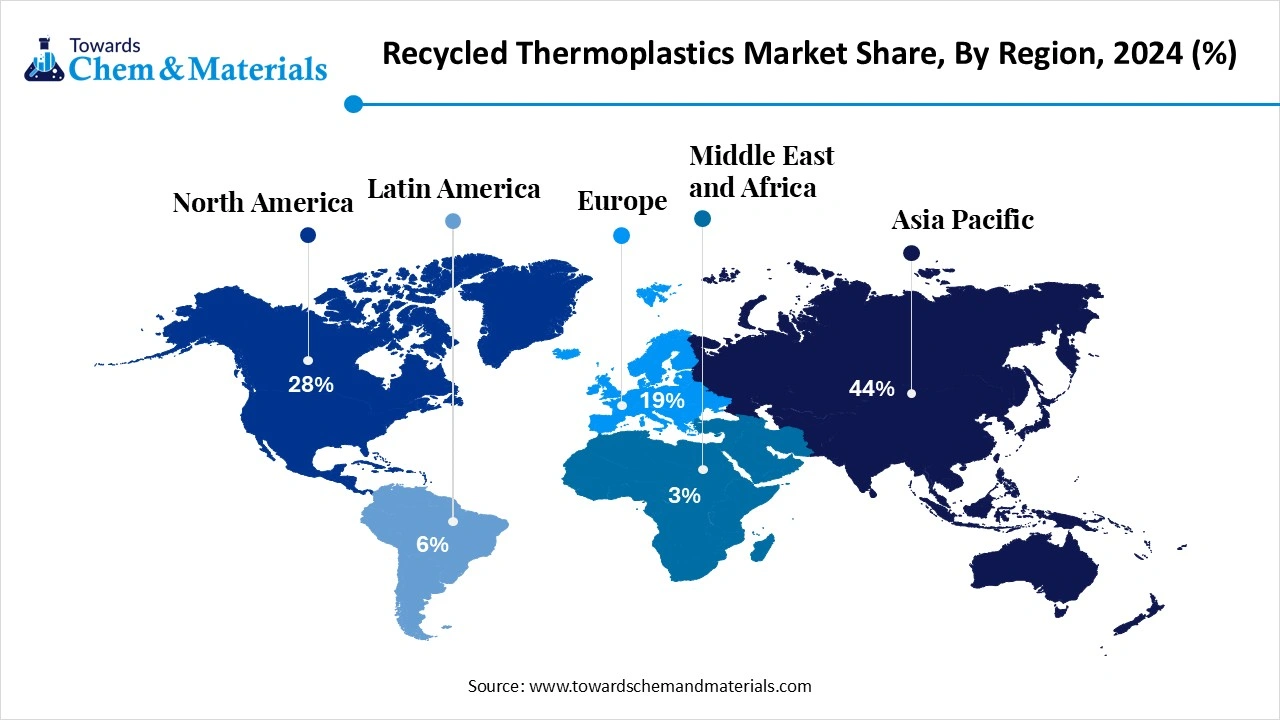

- By region, the Middle East & Africa is expected to grow at the fastest CAGR over the forecast period. The growth of the region can be credited to the increasing awareness regarding sustainable initiatives.

- By material type, the Polyethylene (PE) segment held a 28% market share in 2024. The dominance of the segment can be attributed to the growing utilisation of recycled plastics in flexible packaging alternatives.

- By material type, the Polyethylene Terephthalate (PET) segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to its extensive use in packaging and beverage containers.

- By source type, the post-consumer recycled (PCR) segment led the market with 45% market share in 2024. The dominance of the segment can be linked to the increasing emphasis on circular economy and sustainability practices across the globe.

- By source type, the ocean waste segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by the growing need for sustainable materials and rising environmental awareness.

- By processing technology, the mechanical recycling segment dominated the market by holding 68% market share in 2024. The dominance of the segment is owed to the ongoing government regulations, rising environmental awareness.

- By processing technology, the chemical recycling segment is expects the fastest growth in the market over the forecast period. The growth of the segment is due to the rapid technological advancements, environmental concerns, and economic advantages.

- By end user industry, the packaging segment held a 38% market share in 2024. The dominance of the segment can be credited to the increasing shift towards sustainable packaging solutions.

- By end user industry, the automotive segment is expected to grow at a CAGR during the projected period. The growth of the segment can be linked to the growing emphasis on environmental issues by corporations and consumers.

- By form, the pellets segment led the market with 52% market share in 2024. The dominance of the segment can be driven by the growing shift towards a circular economy.

- By form, the flakes segment is expected to grow at the fastest CAGR over the study period. The growth of the segment can be attributed to the favourable government initiatives supporting recycling.

Increasing Environmental Awareness is Expanding Market Growth

Recycled thermoplastics refer to polymeric materials that can be re-melted and reprocessed into new products after being recovered from post-industrial or post-consumer plastic waste streams. These materials retain their original characteristics and are extensively reused across industries such as automotive, packaging, construction, electrical & electronics, and textiles to reduce environmental impact and meet sustainability targets. Recycled thermoplastics are increasingly finding growing use in automotive, packaging, construction, and consumer goods.

What Are the Key Trends Influencing the Recycled Thermoplastics Market?

- The increasing shift towards sustainability is the key trend in the market. Governments across the globe are implementing stringent environmental regulations, allowing manufacturers to adopt sustainable practices. This trend is also influenced by consumers' demand for more eco-friendly products.

- The ongoing advancements in recycling technologies, like chemical recycling, are enhancing the usability and quality of recycled materials, which will impact positive market growth shortly. Also, emerging players in the market, including Revital Polymers and Ricova International, are gaining traction due to their emphasis on advanced practices and sustainability.

- Recycled thermoplastics are finding applications in many industries such as construction, automotive, packaging, and consumer goods, which is the major factor driving market expansion. The cost-effectiveness and versatility of recycled plastics make them a preferred option for market players in an extensive range of industries.

Market Opportunity

Circular Economy Initiatives

The rapid shift towards a circular economy, where materials are recycled and reused, has gained momentum in recent years. Companies are emphasising creating products with limited shelf life, which raises demand for recycled materials. Furthermore, companies are adopting CSR strategies, which include sustainable sourcing of materials, utilising recycled thermoplastics, can improve a company's image and meet CSR commitments, creating lasting opportunities in the market soon.

- In June 2025, A joint program to recycle end-of-life parts was launched by three major players, Daher, Tarmac, and Toray. In this project, thermoplastic parts are going to be repurposed for several other structural aeronautical applications.

(Source: aviationweek.com)

Market Challenges

Limited Availability of Recycled Feedstock

The availability of high-grade recycled thermoplastic feedstock is limited, especially in regions where recycling infrastructure is still at a developing stage, hindering market expansion soon. Moreover, the easy availability and low cost of virgin plastics make them more attractive to market players, which leads to hurdles in market penetration for recycled products, impacting market growth negatively.

Regional Insights

The Asia Pacific recycled thermoplastics market size was estimated at USD 25.45 billion in 2024 and is anticipated to reach USD 64.02 billion by 2034, growing at a CAGR of 9.66% from 2025 to 2034. the Asia Pacific has accounted highest revenue share of around 44% in 2024.

Asia Pacific dominated the recycled thermoplastics market with a 44% market share in 2024. The dominance of the region can be attributed to the ongoing urbanization and industrialization in developing countries such as China and India. In addition, governments in this region are increasingly implementing efficient recycling and waste management policies to address increasing environmental concerns, boosting the adoption of recycled materials in various sectors.

Recycled Thermoplastics Market in China

In Asia Pacific, China led the market owing to the ongoing technological advancements, stringent regulations, and growing environmental awareness among the people in the country. Also, China's government is increasingly implementing new initiatives and polices to minimize plastic waste and support a circular economy. These regulations are allowing major players in China to adopt recycled thermoplastics.

The Middle East & Africa are expected to grow at the fastest CAGR over the forecast period. The growth of the region can be credited to the increasing awareness regarding sustainable initiatives, along with the well-established recycling infrastructure in the developed countries in the region. Furthermore, local industries are using recycled thermoplastics as a cost-efficient option to virgin materials, particularly as raw material prices fluctuate, impacting positive market expansion soon.

Recycled Thermoplastics Market in Saudi Arabia

In the Middle East & Africa, Saudi Arabia dominated the market by holding the largest market share, due to increasing preference for eco-friendly and sustainable packaging materials in the country. Also, innovations like cutting-edge sorting techniques and chemical recycling are enhancing the efficiency and quality of recycled thermoplastics in Saudi Arabia.

What is the Plastic Item Exports by Country in 2024?

| Country | Exports in Billions |

| Mainland China | $33 billion |

| Germany | $11.1 billion |

| United States | $9.1 billion |

| Italy | $3.7 billion |

| France | $3.6 billion |

Segmental Insight

Material Type Insight

Which Material Type Segment Dominated the Recycled Thermoplastics Market in 2024?

The Polyethylene (PE) segment held a 28% market share in 2024. The dominance of the segment can be attributed to the growing utilisation of recycled plastics in flexible packaging alternatives. Polyethylene is extensively used in products such as films, plastic bags, and shrink wraps, and is also crucial in retail, food, and e-commerce sectors.

- Additionally, companies are striving to minimize their environmental footprint; there is rising pressure to use recycled versions of polyethylene.

The Polyethylene Terephthalate (PET) segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to its extensive use in packaging and beverage containers, as it is preferred for its strength, clarity, and safety, which makes it important in the food and beverage industries. Cutting-edge recycling technologies are enhancing the quality of recycled PET material.

Source Type Insight

Why the Post-Consumer Recycled (PCR) Segment Dominated the Recycled Thermoplastics Market in 2024?

The post-consumer recycled (PCR) segment dominated the market with 45% market share in 2024. The dominance of the segment can be linked to the increasing emphasis on circular economy and sustainability practices across the globe. Also, this segment includes everyday products like packaging materials, containers, and consumer goods, which are gathered through recycling programs and later processed into raw materials.

The ocean waste segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by the growing need for sustainable materials, rising environmental awareness, along strict regulations. Moreover, a rising concern about the impact of plastic pollution on marine life and oceans is propelling the demand for eco-friendly alternatives such as recycled ocean plastics.

Processing Technology Insight

How Much Share Did the Mechanical Recycling Segment Held in 2024?

The mechanical recycling segment dominated the market by holding 68% market share in 2024. The dominance of the segment is owed to the ongoing government regulations, rising environmental awareness, and innovations in recycling technologies. Furthermore, rapid technological innovations are improving the quality and efficiency of recycled materials, which makes them more competitive with virgin plastics.

The chemical recycling segment expects the fastest CAGR in the market over the forecast period.

The growth of the segment is due to the rapid technological advancements, environmental concerns, and economic advantages. In addition, chemical recycling can process an extensive range of plastics, such as contaminated plastics, mixed plastics, and multilayer materials, which are often challenging for conventional mechanical recycling.

End-Use Industry Insight

Which End-Use Industry Segment Dominated the Recycled Thermoplastics Market in 2024?

The packaging segment held a 38% market share in 2024. The dominance of the segment can be credited to the increasing shift towards sustainable packaging solutions. Consumers globally are increasingly becoming environmentally conscious, which leads market players to prioritize sustainable packaging materials. This shift is further promoted by government regulations requiring reductions in plastic use and waste of recycled content in packaging.

The automotive segment is expected to grow at a CAGR during the projected period. The growth of the segment can be linked to the growing emphasis on environmental issues by corporations and consumers, creating lucrative opportunities for sustainable materials in automotive products. Additionally, Recycled thermoplastics are often used to manufacture products such as bumpers, dashboards, and interior components, driving segment expansion shortly.

Form Insight

Why the Pellets Segment Dominated the Recycled Thermoplastics Market in 2024?

The pellets segment led the market with 52% market share in 2024. The dominance of the segment can be driven by the growing shift towards a circular economy, coupled with the reduced production costs as recycled plastics are a more cost-effective alternative to virgin plastics. The pellets derived from recycled plastic waste can be utilized in different industries such as automotive, packaging, and construction, providing sustainable alternatives to virgin plastics.

The flakes segment is expected to grow at the fastest CAGR over the study period. The growth of the segment can be attributed to the favourable government initiatives supporting recycling and the rise in environmental concerns. Moreover, flakes are generally produced from post-consumer PET products such as bottles and packs via the process of collection, sorting, washing, and shredding. Flakes are available in different grades and colors.

Recent Developments

- In March 2025, Elix Polymers and Repsol collaborated to launch ABS grades with 100%chemically recycled content. The joint industry partnership is to increase the circularity of styrenic polymers, which makes styrenics well suited to close the loop, enabling full recyclability.(Source : www.sustainableplastics.com)

- In February 2025, Mallinda Inc. announced the launch of Vitrimax versatile hot melt (VHM) resin. Created to transform the recyclability of high-performance composites. The advancements aim to enhance sustainable production and enable highly efficient composites' economic reuse.(Source: interplasinsights.com)

Top Companies List

- Veolia

- B&B Plastic

- MBA Polymers

- Republic Services

- Sue

- Plastipak Holding

- KW Plastic

- Avangard Innovative

- Indorama Ventures Public Company Ltd

- Far Eastern New Century Corporation (FENC

- Alpek Polyester

- Jayplas

- Custom Polymers Inc

- Envision Plastics

- UltrePET

- Remondis SE & Co. K

- PETC

- Replas

- Clean Tech Incorporated

- Green Line Polymers

Segments Covered

By Material Type

- Polyethylene (PE)

- High-Density Polyethylene (HDPE)

- Low-Density Polyethylene (LDPE)

- Polypropylene (PP)

- Polyethylene Terephthalate (PET)

- Polystyrene (PS)

- Polyvinyl Chloride (PVC)

- Polylactic Acid (PLA)

- Acrylonitrile Butadiene Styrene (ABS)

- Polycarbonate (PC)

- Nylon (PA)

- Others (Polyoxymethylene (POM), etc.)

By Source Type

- Post-Consumer Recycled (PCR) Plastics

- Post-Industrial Recycled (PIR) Plastics

- Ocean Waste

- Electronic Waste (E-Waste)

- Agricultural Waste

- Industrial Packaging Waste

By Processing Technology

- Mechanical Recycling

- Chemical Recycling

- Pyrolysis

- Depolymerization

- Energy Recovery / Waste-to-Energy

- Advanced Sorting & Separation Technologies

By End-Use Industry

- Packaging

- Rigid Packaging

- Containers

- Bottles

- Flexible Packaging

- Films

- Pouches

- Rigid Packaging

- Automotive

- Interior Components

- Exterior Parts

- Under-the-hood Applications

- Building & Construction

- Pipes & Fittings

- Insulation

- Roofing Sheets

- Electrical & Electronics

- Casings & Components

- Wire & Cable Insulation

- Textiles

- Fibers and Fabrics

- Carpet Backing

- Consumer Goods

- Toys

- Furniture

- Footwear

- Agriculture

- Mulch Films

- Drip Pipes

- Industrial

- Pallets

- Crates

- Bins

By Form

- Pellets

- Flakes

- Granules

- Powder

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait