Content

What is the Current Steel Wire Rope Market Size and Volume?

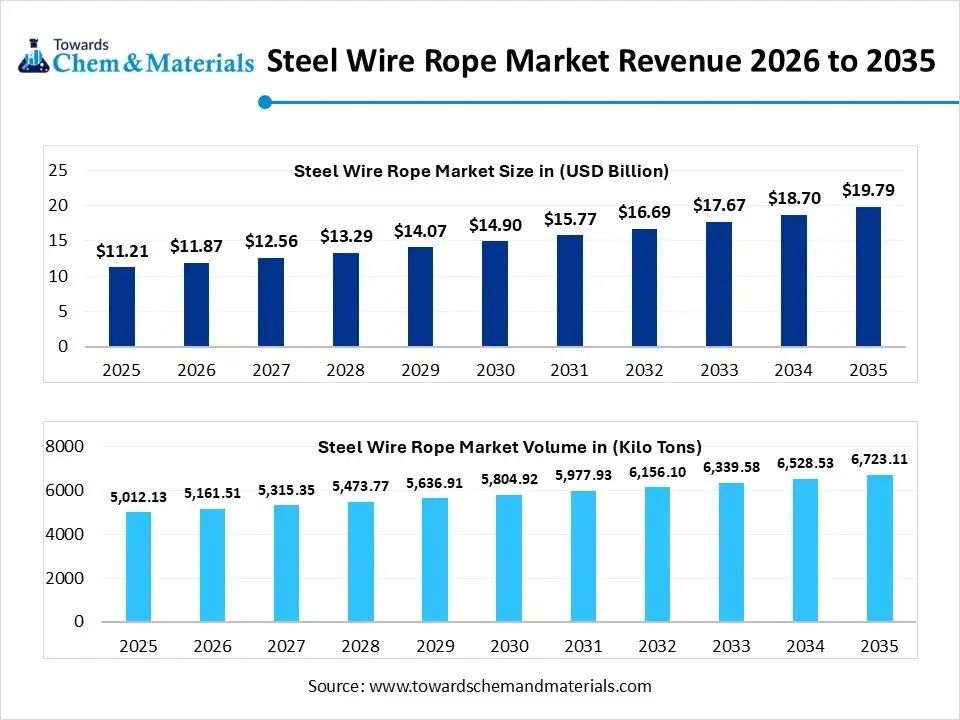

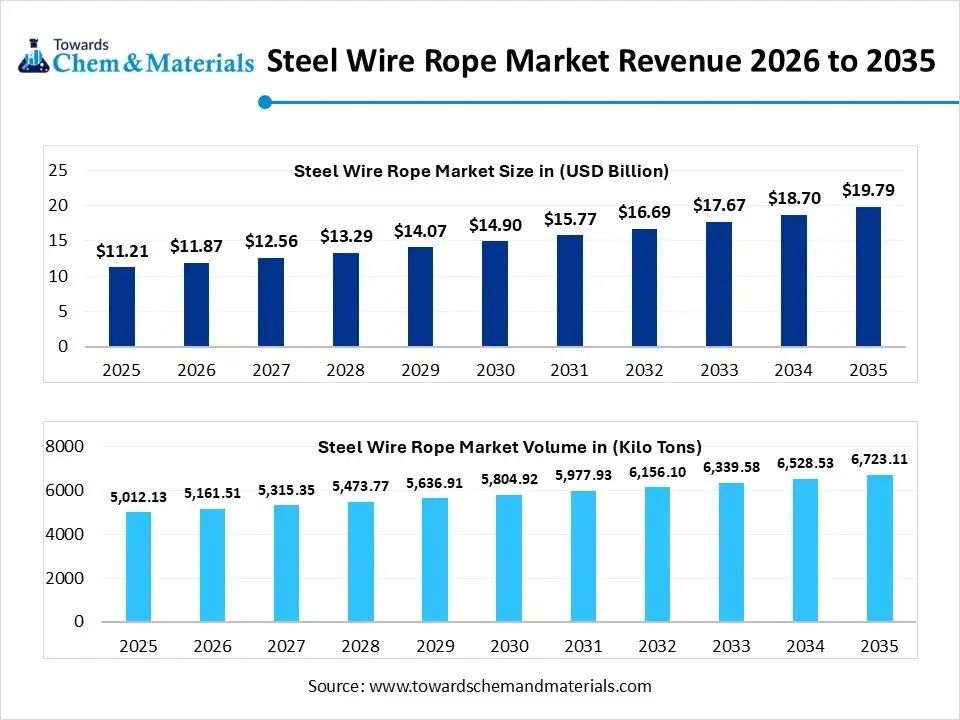

The global steel wire rope market size was estimated at USD 11.21 billion in 2025 and is expected to increase from USD 11.87 billion in 2026 to USD 19.79 billion by 2035, growing at a CAGR of 5.85% from 2026 to 2035. In terms of volume, the market is projected to grow from 5012.13 kilo tons in 2025 to 6723.11 kilo tons by 2035. growing at a CAGR of 6723.11% from 2026 to 2035. Asia Pacific dominated the steel wire rope market with the largest volume share of 45.13% in 2025.The rapid shift towards higher-performance products is the key factor driving market growth. Also, ongoing integration of smart technologies coupled with the extensive investment in highways and the construction industry can fuel market growth further.

Market Highlights

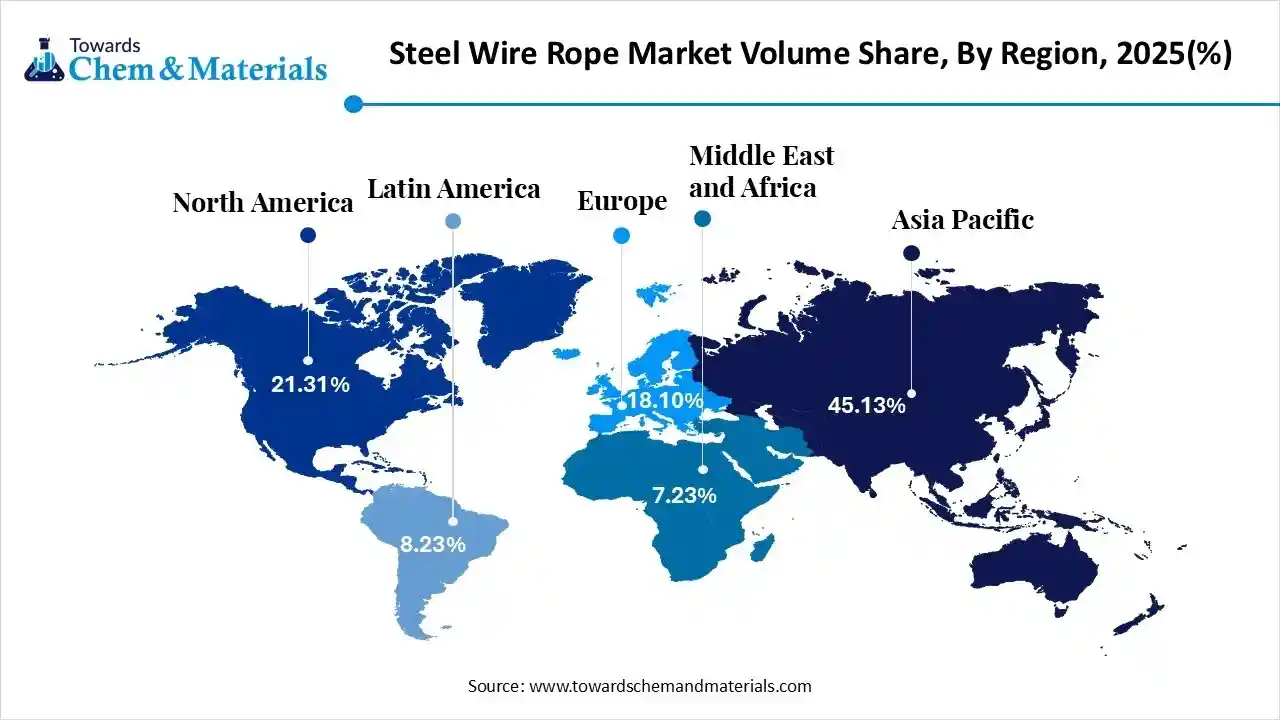

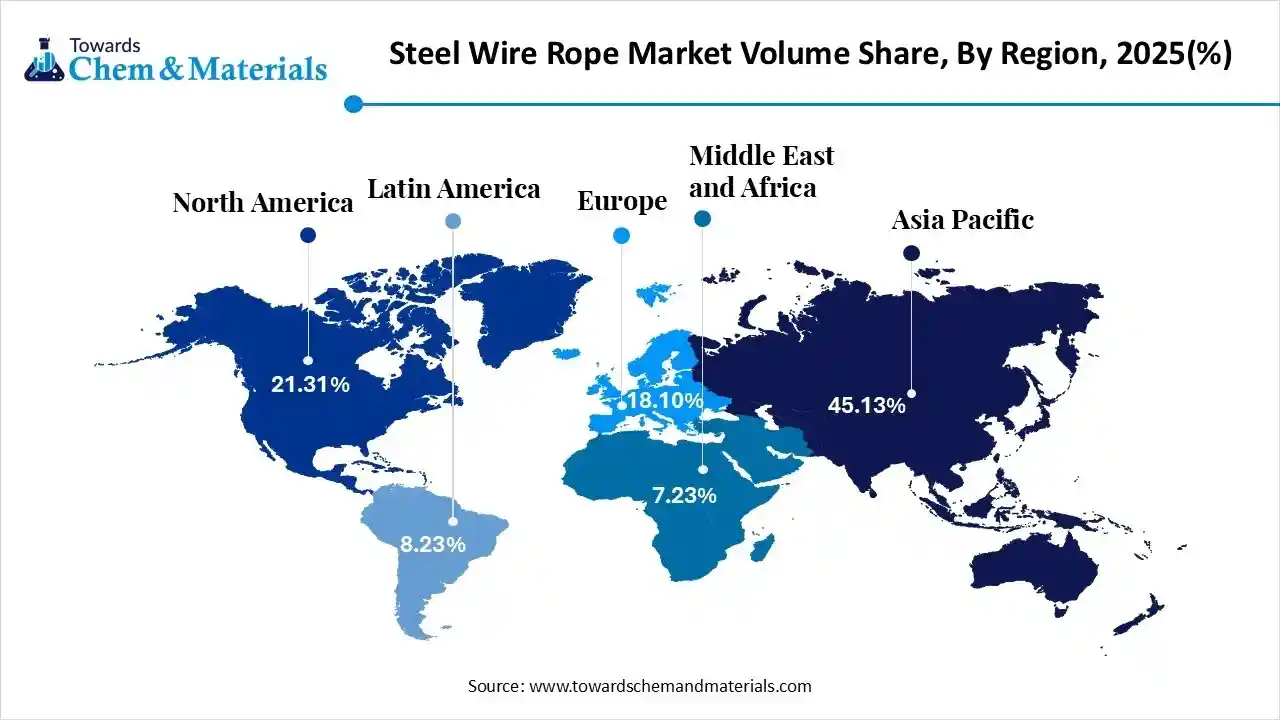

- The Asia Pacific dominated the global steel wire rope market with the largest volume share of 45.13% in 2025.

- The steel wire rope market in North America is expected to grow at a substantial CAGR of 2.03% from 2026 to 2035.

- The Europe steel wire rope market segment accounted for the major volume share of 18.10% in 2025.

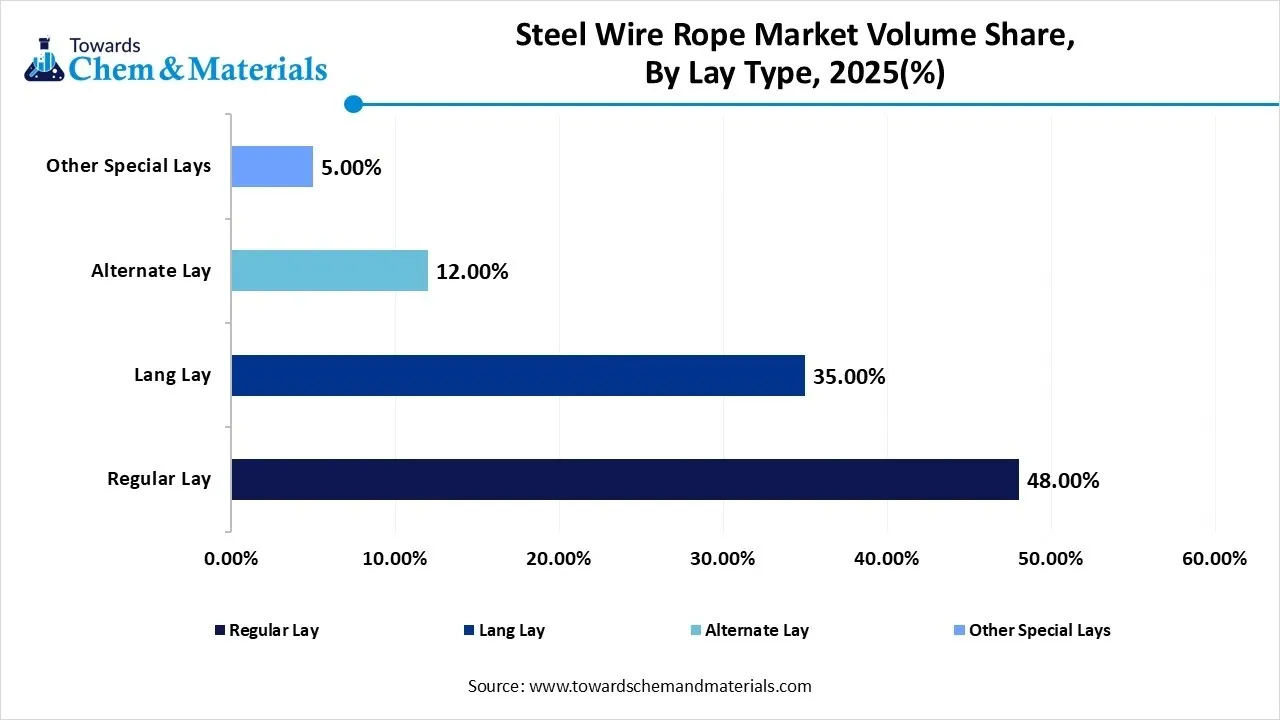

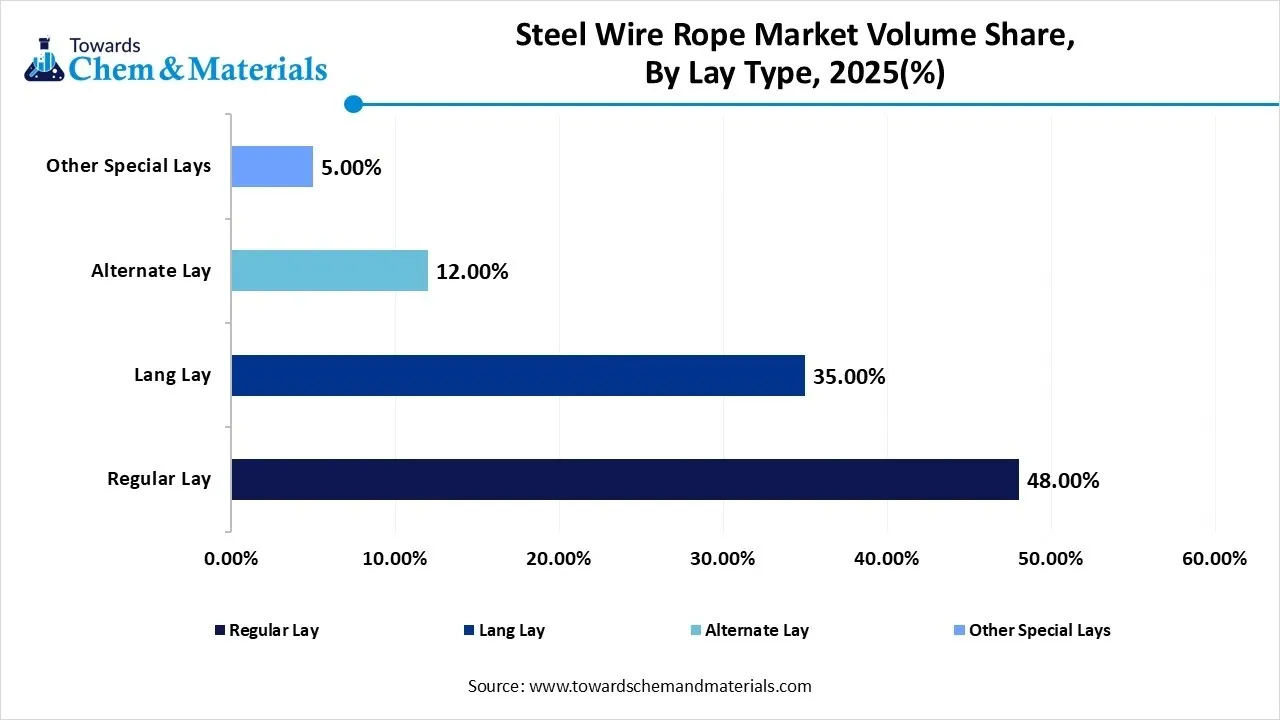

- By lay type, the regular lay segment dominated the market and accounted for the largest volume share of 48% in 2025.

- By lay type, the lang lay segment is expected to grow at the fastest CAGR of 4.64% from 2026 to 2035 in terms of volume.

- By material type, the carbon steel segment led the market with the largest revenue volume share of 64% in 2025.

- By core type, the fiber core (FC) segment dominated the market and accounted for the largest volume share of 45% in 2025.

- By application, the industrial & crane segment led the market with the largest revenue volume share of 32% in 2025.

What is Steel Wire Rope?

Steel wire rope is a sophisticated mechanical cable comprised of multiple steel wires twisted into strands, which are helically laid around a central core. Engineered for high tensile strength and flexibility, it is an essential component for heavy-duty lifting, towing, mooring, and structural support in demanding industrial environments.

Steel Wire Rope Market Trends

- The rapid growth of infrastructure projects across the globe is the latest trend in the market. Governments and major players are heavily investing in transportation, construction and energy sectors, which necessitates strong materials such as steel wire ropes.

- The growth of the renewable energy sector is expected to have a positive market growth soon. Many major countries are increasingly striving to meet energy needs through heavy investments in solar, wind, and hydroelectric projects, which generally necessitate steel wire ropes for different applications.

- Technological innovations in the production process are another major trend in the market, shaping positive market expansion. Advancements like improved coating techniques, enhanced metallurgy, and cutting-edge manufacturing methods are contributing to the development of durable steel wire ropes.

Report Scope

| Report Attribute | Details |

| Market Size and Volume in 2026 | USD 11.87 Billion / 5161.51 Kilo Tons |

| Revenue Forecast in 2035 | USD 19.79 Billion / 6723.11 Kilo Tons |

| Growth Rate | CAGR 5.85% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Units Considered | Value (Billion / Million), Volume (Kilo Tons) |

| Dominant Region | Asia Pacific |

| Segment Covered | By Lay Type, By Material Type, By Core Type, By Application, By Region |

| Key companies profiled | Bridon-Bekaert (BBRG), WireCo WorldGroup, Kiswire Ltd., Tokyo Rope Mfg. Co., Ltd., Teufelberger-Redaelli, Usha Martin Limited, Pfeifer Group, DSR Wire Corp., Guizhou Steel Rope Group, Jiangsu Langshan Wire Rope, ArcelorMittal (Steel Wire Division), SGL Carbon (Hybrid Solutions), Shree Steel Wire Ropes Ltd., Bharat Wire Ropes Ltd., Young Heung Iron & Steel Co. |

How Cutting-Edge Technologies Are Revolutionizing the Steel Wire Rope Market?

Advanced technologies are revolutionizing the market by improving product performance, enhancing overall safety, and facilitating production efficiency through automation and data-driven insights. Furthermore, advancements in material science and metallurgy are leading to the development of lightweight, high-strength, and corrosion-resistant wire ropes.

Trade Analysis of Steel Wire Rope Market: Import & Export Statistics

- In May 2025, the United States imported 511 shipments of Steel Wire Ropes. This volume represented a 24.0% year-over-year growth compared to May 2024.

Exports

- In 2024, China exported $448M of Steel Wire, being the 610th most exported product in China.

- In 2024, the main destinations of China's Steel Wire exports were: Russia ($56.5M), Brazil ($55.4M), Poland ($36.7M), the United States ($20.7M), and Malaysia ($17.4M).

Imports

- In 2024, China imported $118M of Steel Wire, being the 604th most imported product in China.

- In 2024, the main origins of China's Steel Wire imports were: Japan ($35.5M), South Korea ($25.8M), Malaysia ($16.2M), Chinese Taipei ($14.8M), and Germany ($10.7M).

Steel Wire Rope Market Value Chain Analysis

- Feedstock Procurement: It refers to the essential process of acquiring high-grade steel wire rods from steel mills to serve as the crucial raw materials for production.

- Major Players: Tokyo Rope International, Kiswire Ltd.

- Chemical Synthesis and Processing : It refers to the chemical treatments and cutting-edge processing techniques used to improve wire strength, durability and environmental resistance, which involves the synthesis of high-performance coatings.

- Major Players: Teufelberger, WireCo WorldGroup

- Packaging and Labelling: It is the crucial stage that ensures product safety, integrity, and compliance with regulations and offers crucial information for end-users.

- Major Players: Usha Martin Limited, Pfeifer Group.

- Regulatory Compliance and Safety Monitoring : It involves adhering to stringent national and international standards to ensure product reliability, safety, and legal compliance in necessary applications such as mining, construction, and marine.

- Major Players: Gustav Wolf, Bharat Wire Ropes Ltd.

Steel Wire Rope Market 's Regulatory Landscape: Global Regulations

| Country/Region | Key Regulations |

| United States | ANSI (American National Standards Institute) and ASTM (American Society for Testing and Materials): These bodies develop voluntary consensus standards that are frequently adopted by industry and sometimes referenced in regulations. |

| Europe | CE Marking: Products must meet essential health and safety requirements to be sold in the European Economic Area. This often involves compliance with specific directives and standards. |

| China | As the world's largest steel producer, China has a comprehensive system of national standards (GB standards). The country has the largest number of patent filings related to wire rope technology, indicating a mature regulatory and innovation environment. |

Segmental Insights

Lay Type Insight

How Much Share Did the Regular Lay Segment Held in 2025?

The regular lay segment volume was valued at 2405.82 kilo tons in 2025 and is projected to reach 2977.67 kilo tons by 2035, expanding at a CAGR of 2.40% during the forecast period from 2025 to 2035. The regular lay segment dominated the market with 48% share in 2025. The dominance of the segment can be attributed to its kink resistance, superior stability, and ease of handling, which makes it ideal for mining, cranes, and construction. In addition, these ropes are preferred for their operational reliability, including resistance to rotation and excellent lateral stability, which is crucial for hoisting operations.

The lang lay segment volume was valued at 1754.25 kilo tons in 2025 and is projected to reach 2637.48 kilo tons by 2035, expanding at a CAGR of 4.64% during the forecast period from 2025 to 2035. The lang lay segment held 35% market share in 2025 and is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to its superior flexibility, fatigue resistance, and reduced torque, which make it ideal for various applications. Moreover, these ropes have a greater exposed surface area, which distributes pressure more evenly.

Steel Wire Rope Market Volume and Share, By Lay Type, 2025-2035

| By Lay Type | Market Volume Share (%), 2025 | Market Volume (Kilo Tons)2025 | Market Volume (Kilo Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| Regular Lay | 48.00% | 2405.82 | 2977.67 | 2.40% | 44.29% |

| Lang Lay | 35.00% | 1754.25 | 2637.48 | 4.64% | 39.23% |

| Alternate Lay | 12.00% | 601.46 | 755.01 | 2.56% | 11.23% |

| Other Special Lays | 5.00% | 250.61 | 352.96 | 3.88% | 5.25% |

Material Type Insights

Which Material Type Segment Dominated Steel Wire Rope Market in 2025?

The carbon steel segment held 64% market share in 2025. The dominance of the segment can be credited to the surge in product demand from the automotive and construction sectors, coupled with rapid industrialisation in emerging regions. Extensive government investments in smart cities, roads, and public works in developing countries boost demand for suspension applications and heavy lifting.

The stainless-steel segment held 10% market share in 2025 and is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by rapid technological innovations in rope manufacturing and stringent durability standards. Furthermore, applications in offshore, marine, and coastal environments require stainless steels better corrosion resistance for different purposes.

Core Type Insights

Which Core Type Segment Dominated Steel Wire Rope Market in 2025?

The fiber core (FC) segment dominated the market with 45% share in 2025. The dominance of the segment is owing to a surge in marine activity and the booming construction sector. Additionally, advancements in materials and a push towards sustainable solutions, along with the changing performance standards, fuel demand for specialized ropes such as enhanced FC options.

The independent wire rope core (IWRC) segment held 38% market share in 2025 and is expected to grow at the fastest CAGR during the projected period. The growth of the segment is due to its superior crush resistance, durability, and strength, crucial for heavy-duty applications in mining, marine, and oil& gas. Enhanced production process and protective coatings improve IWRC rope performance.

Application Insights

How Much Share Did the Industrial & Crane Segment Held in 2025?

The industrial & crane segment held a 32% market share in 2025. The dominance of the segment can be attributed to the surge in investments in ports, highways, and other construction projects requiring heavy lifting. Additionally, rapid advancements in the production process and materials improve the overall durability, performance, and safety of steel wire ropes.

The oil & gas segment held 12% market share in 2025 and is expected to grow at the fastest CAGR during the projected period. The dominance of the segment can be credited to the growing investments in drilling rigs, coupled with the growing need for high-strength ropes in extraction operations. Government initiatives in oil & gas infrastructure, such as new facilities and rigs, create a strong demand for wire ropes.

Regional Insights

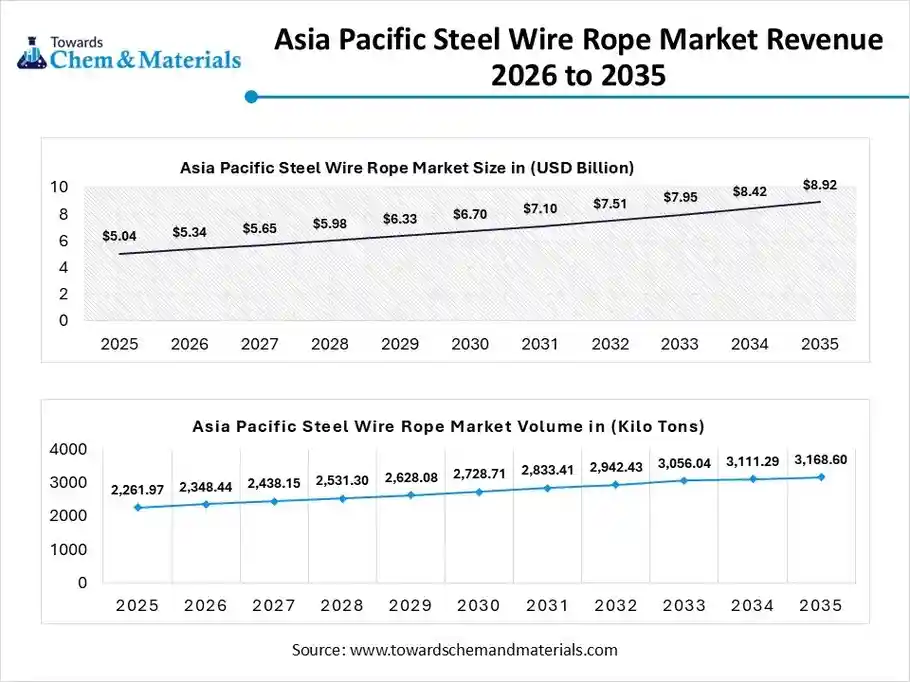

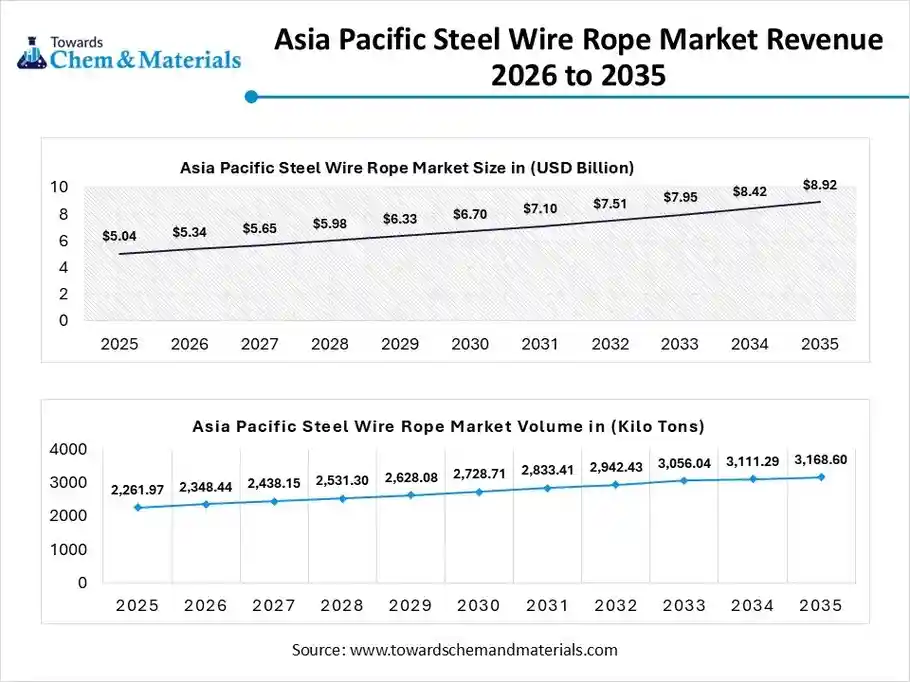

The Asia Pacific steel wire rope market size was valued at USD 5.04 billion in 2025 and is expected to be worth around USD 8.92 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 5.87% over the forecast period from 2026 to 2035.

The Asia Pacific steel wire rope market volume was estimated at 2261.97 kilo tons in 2025 and is projected to reach 3168.60 kilo tons by 2035, growing at a CAGR of 3.82% from 2026 to 2035.Asia Pacific dominated the market with the largest share 45.13% in 2025. The dominance of the region can be attributed to the ongoing transition towards corrosion-resistant and higher-performance coated ropes, along with the rising preference for specialized products. In addition, the industry in the region is witnessing an increasing focus on sustainability with major companies heavily investing in eco-friendly manufacturing methods.

China Steel Wire Rope Market Trends

In the Asia Pacific, China dominated the market owing to its extensive investments in urban development, highways, and the Belt and Road Initiative (BRI). Also, expanding sectors such as renewable energy and electric vehicles (EVs) are creating lucrative opportunities and demand for high-strength and specialised ropes.

North America Steel Wire Rope Market Trends

The North America steel wire rope market volume was estimated at 1068.08 kilo tons in 2025 and is projected to reach 1280.08 kilo tons by 2035, growing at a CAGR of 2.03% from 2026 to 2035. North America is expected to grow at a fastest CAGR over the forecast period. The growth of the region can be credited to the massive private and public investment in infrastructure projects and the growing use of advanced alloys to enhance fatigue life, durability, and corrosion resistance. The country has strict safety and regulatory standards that impact the overall manufacturing processes.

U.S. Steel Wire Rope Market Trends

The growth of the market in the country can be boosted by a rapid surge in construction activities, especially for manufacturing plants, which directly propels demand for related wire ropes and cranes. The increasing demand for electric vehicles (EVs) positively impacts market growth as EV production necessitates a greater volume of steel wires in components such as battery assemblies.

Steel Wire Rope Market Volume and Share, By Region, 2025-2035

| By Region | Market Volume Share (%), 2025 | Market Volume (Kilo Tons)2025 | Market Volume (Kilo Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| North America | 21.31% | 1068.08 | 1280.08 | 2.03% | 19.04% |

| Europe | 18.10% | 907.20 | 1220.24 | 3.35% | 18.15% |

| Asia Pacific | 45.13% | 2261.97 | 3168.60 | 3.82% | 47.13% |

| South America | 8.23% | 412.50 | 507.59 | 2.33% | 7.55% |

| Middle East & Africa | 7.23% | 362.38 | 546.59 | 4.67% | 8.13% |

Europe Steel Wire Rope Market Trends

The Europe steel wire rope market volume was estimated at 907.20 kilo tons in 2025 and is projected to reach 1220.24 kilo tons by 2035, growing at a CAGR of 3.35% from 2026 to 2035. Europe held a significant market share in 2025. The growth of the region can be driven by increasing demand for wire ropes to secure and compress waste materials for transport. The growing emphasis on renewable energy, especially offshore wind farms, is creating substantial demand for corrosion-resistant and specialized steel wire ropes for lifting and anchoring applications.

Germany Steel Wire Rope Market Trends

In Europe, Germany dominated the market due to strong product demand from major sectors such as construction, automotive, and renewable energy, fuelled by localized production and high German quality standards. The country's robust automotive industry is a major consumer, with advancements emphasizing cutting-edge alloy steel ropes, driving market growth further.

Recent Developments

- In December 2025, Bansal Wire Industries introduced a new product, LRPC (Low relaxation prestressed concrete steel strand) Wire at the Dadri plant. This launch will transform the company's product portfolio by significantly boosting its sales.(Source: www.wirecable.in)

Steel Wire Rope Market Companies

- Bridon-Bekaert (BBRG): It is a global leader in the steel wire rope market, formed by the 2016 merger of Bridon and Bekaert, combining centuries of expertise to serve demanding sectors like oil & gas, mining, cranes, and offshore.

- WireCo WorldGroup: WireCo WorldGroup is a global leader in manufacturing steel wire rope, synthetic ropes, and engineered products, serving critical applications in energy, mining, construction, and marine, known for high-performance solutions.

- Kiswire Ltd.

- Tokyo Rope Mfg. Co., Ltd.

- Teufelberger-Redaelli

- Usha Martin Limited

- Pfeifer Group

- DSR Wire Corp.

- Guizhou Steel Rope Group

- Jiangsu Langshan Wire Rope

- ArcelorMittal (Steel Wire Division)

- SGL Carbon (Hybrid Solutions)

- Shree Steel Wire Ropes Ltd.

- Bharat Wire Ropes Ltd.

- Young Heung Iron & Steel Co.

Segments Covered in the Report

By Lay Type

- Regular Lay

- Lang Lay

- Alternate Lay

- Other Special Lays

By Material Type

- Carbon Steel (High/Low)

- Galvanized Steel

- Stainless Steel

- Alloy Steel

By Core Type

- Fiber Core (FC)

- Independent Wire Rope Core (IWRC)

- Wire Strand Core (WSC)

By Application

- Industrial & Crane

- Construction

- Mining

- Oil & Gas

- Marine & Fishing

- Others (Elevators/Cable Cars)

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa