Content

Oil & Gas Infrastructure Market Size and Growth 2025 to 2034

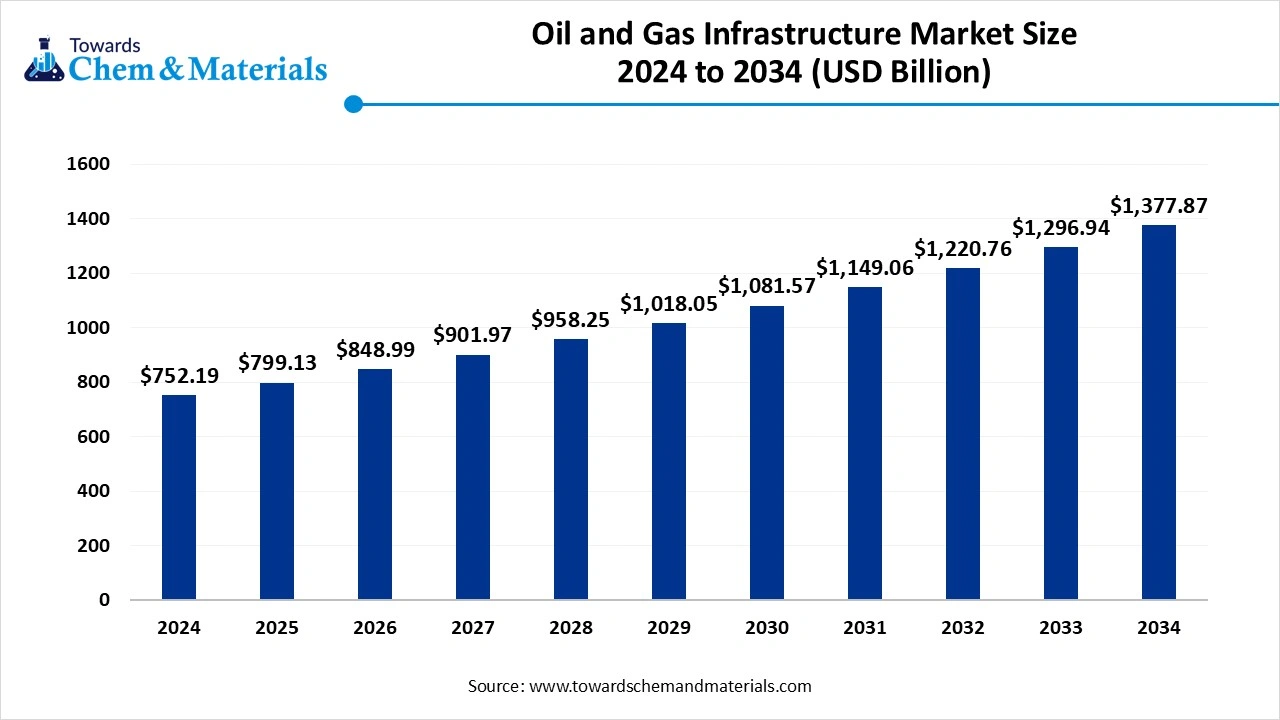

The global oil & gas infrastructure market size was reached at USD 752.19 billion in 2024 and is expected to be worth around USD 1,377.87 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.24% over the forecast period 2025 to 2034. The sudden updation of the traditional infrastructure to technologically advanced infrastructure has accelerated industry potential in recent years.

Key Takeaways

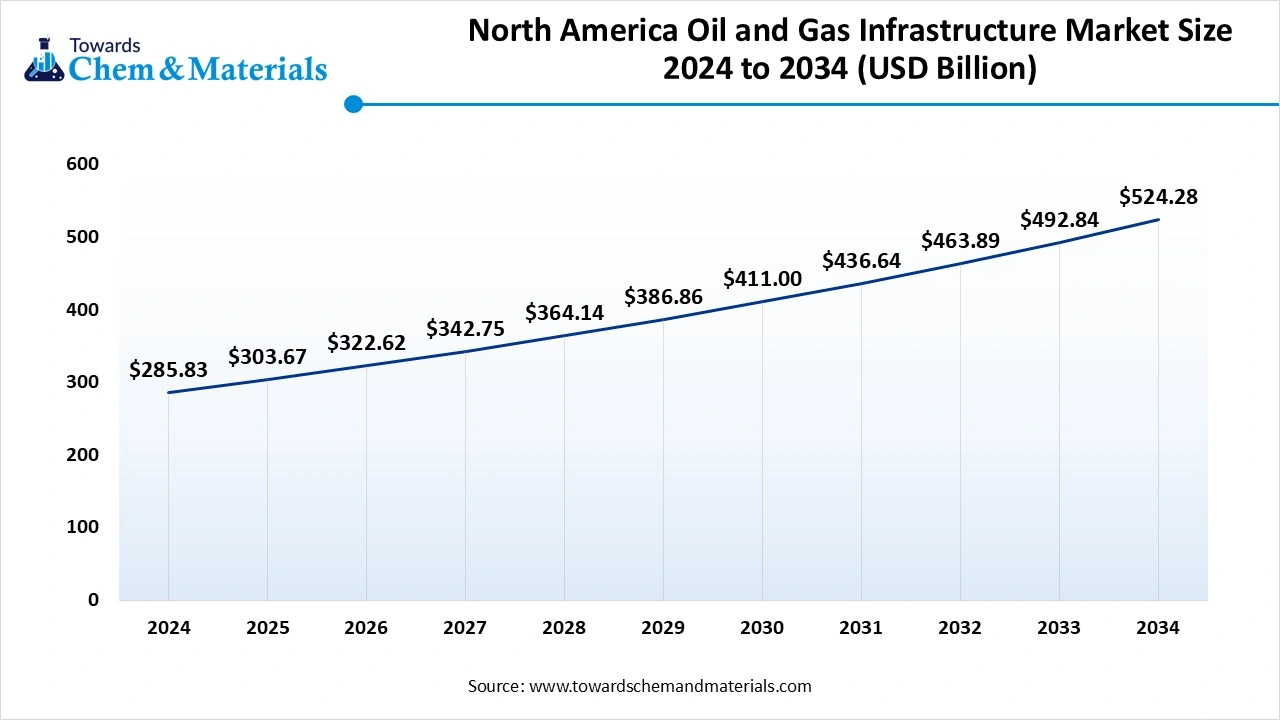

- The North America oil and gas infrastructure market size was estimated at USD 285.83 billion in 2024 and is projected to reach USD 524.28 billion by 2030, growing at a CAGR of 8.5% from 2025 to 2034.

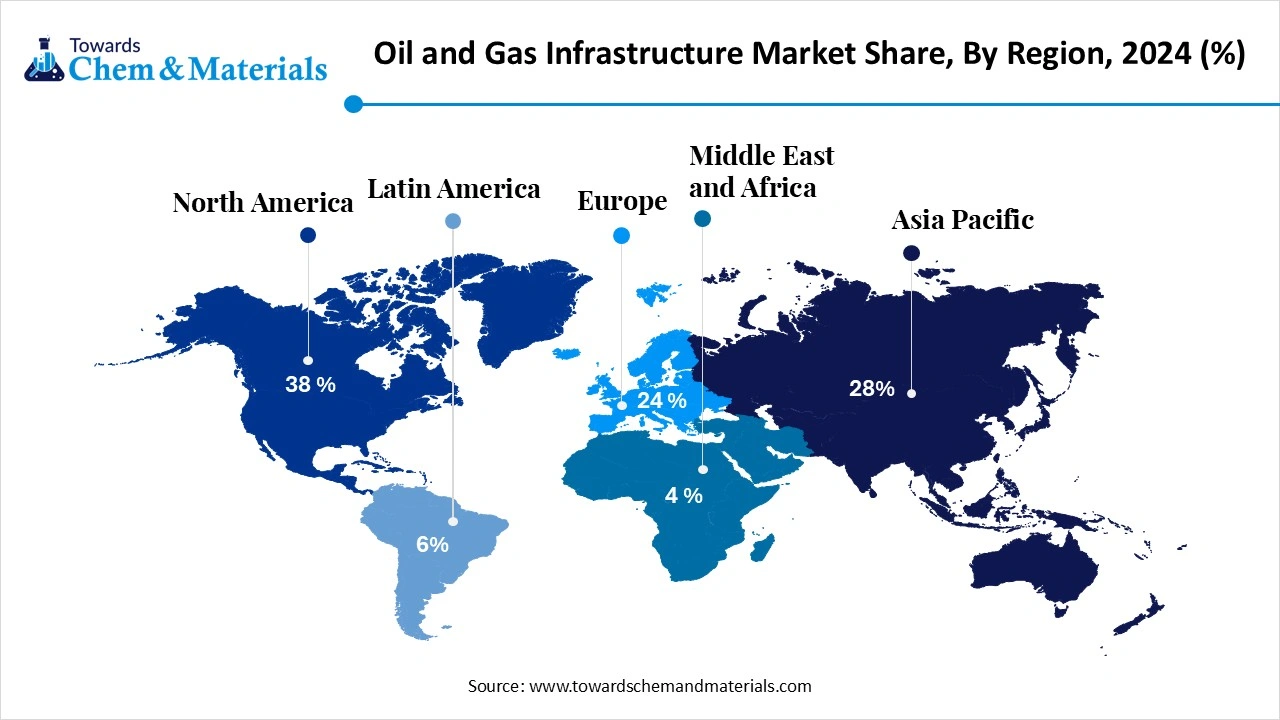

- North America dominated the oil and gas infrastructure market and accounted for the largest revenue share of over 38% in 2024.

- The Oil and Gas Infrastructure market in Asia Pacific is projected to grow at the fastest CAGR of 5.78% over the forecast period. owing to the sudden increase in demand for energy for heavy applications in recent years.

- By sector type, the upstream segment is expected to grow at the fastest rate in the market during the forecast period, akin to increased discoveries of new basins and untapped reserves in the past few years.

- By infrastructure type, the pipeline segment emerged as the top-performing segment in the market in 2024 with 38% industry share, due to the increasing need for a cost-effective and efficient way to transport heavy volumes of oil and gas globally.

- By infrastructure type, the LNG terminals are expected to lead the market in the coming years, due to a sudden global shift towards cleaner energy solutions in recent years.

- By fuel type, the crude oil segment led the market in 2024 with 45% market share, due to its being commonly considered as the ideal fuel option.

- By fuel type, the natural gas and LNG segment is expected to capture the biggest portion of the market in the coming years, because it is strong, durable, and cost-effective.

- By material type, the carbon steel segment led the market in 2024 with 52% industry share, because it is strong, durable, and cost-effective.

- By material type, the composite and thermoplastic segment is expected to grow at the fastest rate in the market during the forecast period, due to its lightweight, corrosion resistance, and long service life.

- By ownership type, the NOC’s segment led the market in 2024 with 48% industry share, because it controls most of the world's oil and gas reserves

- By ownership type, the EPC firms segment is expected to capture the biggest portion of the market in the coming years, due to the growing trend of outsourcing.

- By end-use application type, the power generation segment led the oil & gas infrastructure market in 2024 with 33% industry share, because many countries use natural gas and fuel oil to produce electricity.

- By end-use application type, the transportation segment is expected to grow at the fastest rate in the market during the forecast period, due to the rising use of LNG in shipping and fuel for aviation.

Market Overview

Exploring the Backbone of Energy: Inside the Oil & Gas Infrastructure Market

The oil & gas infrastructure market encompasses the physical facilities and systems required for the exploration, production, transportation, processing, storage, and distribution of oil and natural gas. This includes upstream infrastructure (like drilling rigs and production platforms), midstream infrastructure (such as pipelines, storage terminals, and LNG facilities), and downstream facilities (refineries, petrochemical plants, and retail distribution networks). With rising global energy demand, technological advancements, and the transition toward cleaner fuels, this market plays a critical role in ensuring supply chain resilience, energy security, and economic development.

Which Factor Is Driving the Oil & Gas Infrastructure Market?

The increased need for energy worldwide due to the sudden expansion of the heavy manufacturing infrastructure has spearheaded the industry's growth in recent years. Moreover, several developed countries have been actively seeking massive energy sources akin to their established, huge, and advanced infrastructure in recent years. Furthermore, these energy demands are actively creating the need for the oil and gas infrastructure for transportation of these oil and gas, where the pipelines, refineries, and storage tanks are expected to play a major role in the upcoming years.

Market Trends

- The sudden establishment of the LNG terminals has driven industry growth in recent years.

- Several countries are actively seen under developing LNG terminals in their region due to increased demand for cleaner fuels.

- The increased preference for modular construction in the oil and gas industries has contributed to the market potential in the past few years. Also, instead of constructing from scratch, the manufacturers are constructing in sections.

Report Scope

| Report Attribute | Details |

| Market Size in 2025 | 799.13 USD Billion |

| Expected Size by 2034 | 1,377.87 USD Billion |

| Growth Rate from 2025 to 2034 | 6.24% CAGR |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | North America |

| Segment Covered | By Sector, By Infrastructure Type, By Material Type (For Pipeline & Facility Construction),By Fuel Type, By Ownership/Operator,By End-Use Application, By Region |

| Key Companies Profiled | Kinder Morgan Inc., Enbridge Inc. , TransCanada Corporation (TC Energy), Saudi Aramco , Gazprom , Shell Plc , ExxonMobil Corporation , Chevron Corporation , TotalEnergies SE , BP Plc , Cheniere Energy Inc. , Fluor Corporation , Bechtel Corporation , Technip Energies , Petrofac Ltd. |

Market Opportunity

Developed Nations Seek Smart Solutions Amid Energy Infrastructure Revamps

The growing need for oil and gas infrastructure modification in developed countries is expected to create lucrative opportunities for manufacturers during the forecast period. Several regions are seeking modern infrastructure as the need for energy has increased in recent years. As the manufacturers have a greater opportunity to offer technologically advanced infrastructure, such as pipelines, refineries, and LNG systems, in the upcoming years

Market Challenge

High Installation Expenses Pose a Barrier to Industry Expansion

The high cost of the installation of modern oil and gas infrastructure is expected to hinder industry growth in the coming years. Moreover, these refineries need heavy upfront investment, which can create cost barriers for the new entrants and mid-sized businesses that have investment limits during the projected period.

Segmental Insights

Sector Insights

How did the Midstream Segment Dominate the Oil & Gas Infrastructure Market in 2024?

The midstream segment held the largest share of the market in 2024, due to a sudden increase in the need for processing of oil and gas, transportation, and storage globally. Furthermore, the many countries’ energy demand has increased in recent years, and countries are actively investing in the mid streams than just drilling, which is likely to create huge opportunities for the segment in the upcoming years.

The upstream segment is expected to grow at a notable rate during the predicted timeframe, akin to increased discoveries of new basins and untapped reserves in the past few years. Several countries are seen under the heavy investment in deep-sea and offshore exploration, which is anticipated to expand the segment growth in the upcoming years. Moreover, technological advancement can play a major role in these developments in the upcoming years.

Infrastructure Type Insights

Why does the Pipeline Segment Dominate the Oil & Gas Infrastructure Market by Infrastructure Type?

The pipeline segment held the largest share of the oil & gas infrastructure market in 2024, due to the increasing need for a cost-effective and efficient way to transport heavy volumes of oil and gas globally. Moreover, several countries are actively developing the pipeline infrastructure in their region for the usage of the domestic distribution of oil and gas, as well as the international export.

The LNG terminals segment is expected to grow at a notable rate due to a sudden global shift towards cleaner energy solutions in recent years. Furthermore, several global economies are actively trying to reduce their reliance on coal and oil use in recent years, where natural gas has emerged as the ideal option for them to power generation and heating. These initiatives are likely to drive the growth of the segment in the upcoming years, as per the recent observation.

Fuel Type Insights

Why Did the Crude Oil Segment Dominate the Oil & Gas Infrastructure Market in 2024?

The crude oil segment dominated the market with the largest share in 2024, due to its being commonly considered as the ideal fuel option. Also, the sectors such as transportation, manufacturing, and power are actively contributing to the segment growth as they are the main consumers of crude oil in recent years. Moreover, having properties such as being easy to store, refine, and transport, crude oil has gained immense industry attention in recent years.

The natural gas and LNG segments are expected to grow at a notable rate in the coming years due to increased demand for the cleaner fuel option globally. Moreover, several countries are actively replacing their traditional fuels with LNG, akin to increased sustainability initiatives and reduction of carbon emissions globally, as per the recent industry observation. These factors can drive the segment growth in the upcoming years

Material Type Insights

How did the Carbon Steel Segment Dominate the Oil & Gas Infrastructure Market in 2024?

The carbon steel segment held the largest share of the oil & gas infrastructure market in 2024, because it is strong, durable, and cost-effective. It's widely used in pipelines, tanks, and structural components. Carbon steel can handle high pressure and temperature, making it ideal for oil and gas transport and storage. It's also easy to weld and fabricate, which speeds up construction. Although it can corrode over time, protective coatings help extend its lifespan. Because of its balance between strength, availability, and affordability, carbon steel has remained the preferred material across most oil and gas projects.

The composite & thermoplastic manufacturing segment is expected to grow at a notable rate due to its lightweight, corrosion resistance, and long service life. Unlike carbon steel, they don't rust, making them ideal for offshore and harsh environments. These materials are also easier to install and maintain, saving time and money in the long run. As the industry pushes for lower maintenance and higher efficiency, especially in new LNG and gas infrastructure, composite pipes and thermoplastics are being adopted. Their use will expand in regions focused on clean energy, offshore gas, and advanced storage systems.

Ownership Type Insights

How did NOC’s Segment Dominate the Oil & Gas Infrastructure Market in 2024?

NOC’s segment dominated the market with the largest share in 2024 because it controls most of the world's oil and gas reserves, especially in regions like the Middle East, Africa, and parts of Asia. These government-backed firms invest heavily in infrastructure to support national energy goals and export strategies.

The EPC firms segment is expected to grow at a significant rate due to the growing trend of outsourcing. Many oil and gas companies now prefer to hire specialized EPC firms to handle large infrastructure projects from start to finish. This helps reduce costs, speed up timelines, and improve project quality. EPC firms bring technical expertise, modern equipment, and global experience, making them more efficient than in-house teams

End Use Application Type Insights

How did Power Generation Segment Dominate the Oil & Gas Infrastructure Market in 2024?

The power generation segment held the largest share of the oil & gas infrastructure market in 2024, because many countries use natural gas and fuel oil to produce electricity. This is especially true in regions where coal is being phased out. Gas-fired power plants are efficient, cleaner than coal, and can be built quickly. Infrastructure like gas pipelines, LNG terminals, and storage tanks is built to support these power plants.

The transportation segment is expected to grow at a notable rate due to the rising use of LNG in shipping and fuel for aviation. LNG is gaining popularity as a clean alternative to traditional marine fuels, especially with stricter emission rules for ships. Airports and airlines are also exploring LNG for aircraft fueling.

Regional Insights

North America Market Size and Forecast 2025 to 2034

- The North America Oil and Gas Infrastructure market size is estimated at USD 303.67 billion in 2025 and is anticipated to USD 524.28 billion by 2034, growing at a CAGR of 6.25% from 2025 to 2034.

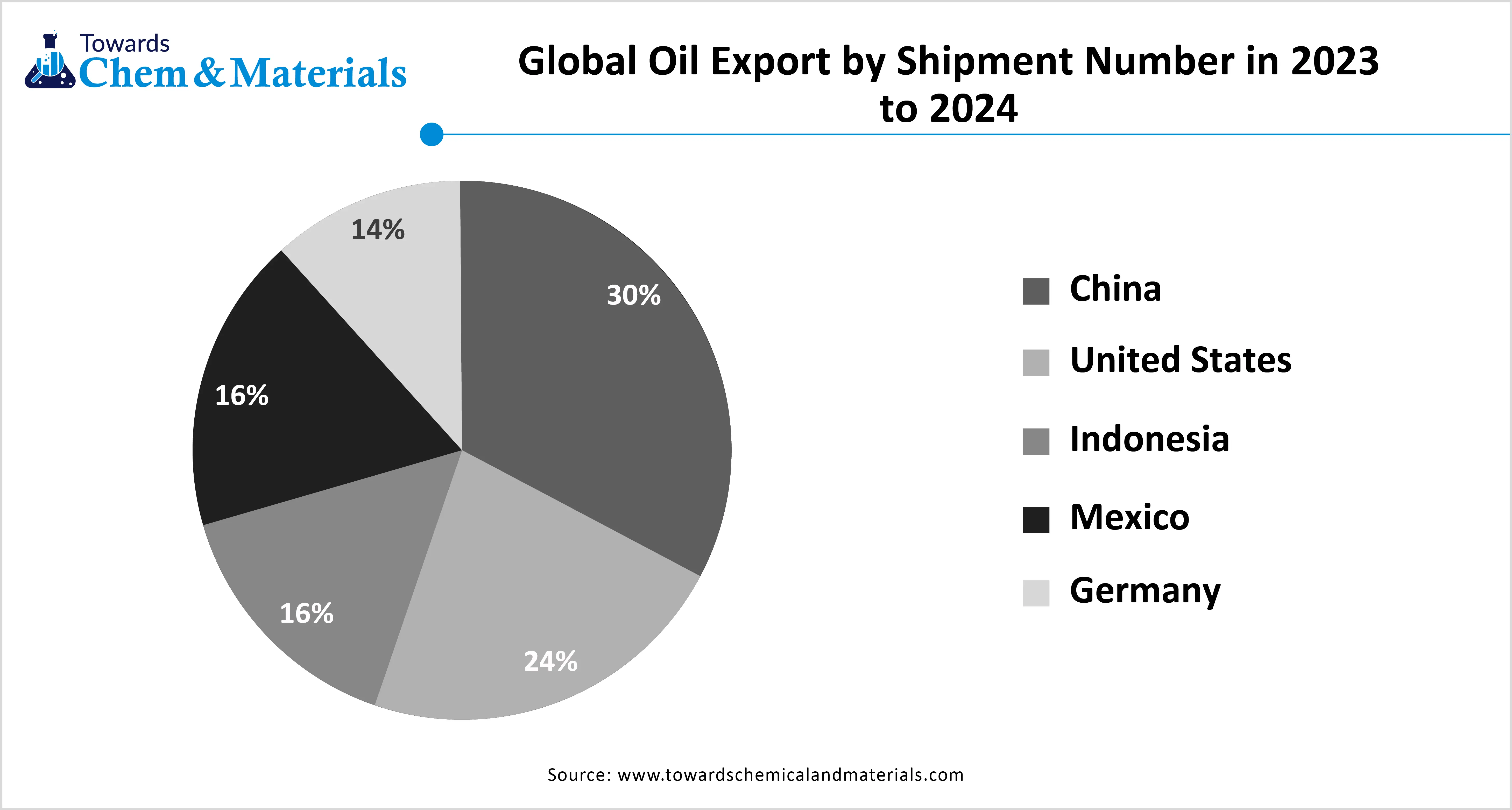

North America dominated the market in 2024, akin to the region having one of the world's richest oil and gas reserves in the current period. As the regional countries like United States and Canada are considered as the world's top producers of oil & gas in recent years, where exports have become the key earning for these countries in the past few years. Moreover, the region has seen heavy investment in the development of the pipeline, storage, and refineries nowadays, as per the recent regional survey.

Asia Pacific

Asia Pacific expected to capture a major share of the market, owing to the sudden increased demand for energy for heavy applications in recent years. Moreover, the regional counties such as China, India, and Southeast Asian countries are seen under the heavy expansion of their manufacturing facilities, where oil and gas play a crucial role as the primary fuel in the upcoming years.

Can China’s LNG Expansion Reshape Regional Power Dynamics?

China is expected to rise as a dominant country in the region in the coming years, owing to heavy development in the LNG and gas sector in recent years. The country’ observed under the heavy development of the cross-border pipelines and the huge LNG terminals as per the recent report. Furthermore, China has been heavily investing in cleaner fuels in recent years.

Recent Developments

- In June 2024, CENAGAS started its consultation services for the expansion of the gas infrastructure. Moreover, in the middle of the consultation, the company can provide a current and future analysis of the demand for gas, as per the report published by the company recently.(Source : mexicobusiness.news)

- In September 2024, Huawei unveiled its latest AI application for oil and gas upstream. The motive behind the application is to reduce operational costs while boosting efficiency and safety, as per the report published by the company recently.(Source: e.huawei.com)

Top Companies list

- Kinder Morgan Inc.

- Enbridge Inc.

- TransCanada Corporation (TC Energy)

- Saudi Aramco

- Gazprom

- Shell Plc

- ExxonMobil Corporation

- Chevron Corporation

- TotalEnergies SE

- BP Plc

- Cheniere Energy Inc.

- Fluor Corporation

- Bechtel Corporation

- Technip Energies

- Petrofac Ltd.

Segment Covered

By Sector

- Upstream (Exploration & Production)

- Midstream (Transportation & Storage)

- Downstream (Refining & Distribution)

By Infrastructure Type

- Pipelines (Oil, Gas, Multiphase)

- Offshore & Onshore Platforms

- Liquefaction & Regasification Terminals (LNG)

- Storage Tanks & Caverns

- Compressor & Pumping Stations

- Refineries

- Petrochemical Plants

- Gas Processing Units (Dehydration, Sweetening)

- Distribution Networks (Retail Outlets, Gas Stations)

By Material Type (For Pipeline & Facility Construction)

- Steel (Carbon Steel, Stainless Steel)

- Concrete

- Polyethylene & Other Thermoplastics

- Composite Materials

By Fuel Type

- Crude Oil

- Natural Gas

- Liquefied Natural Gas (LNG)

- Refined Products (Gasoline, Diesel, Jet Fuel)

- Liquefied Petroleum Gas (LPG)

By Ownership/Operator

- National Oil Companies (NOCs)

- International Oil Companies (IOCs)

- Pipeline Transportation Companies

- Independent Terminal Operators

- Engineering, Procurement & Construction (EPC) Firms

By End-Use Application

- Power Generation

- Industrial Use (Chemicals, Fertilizers, Cement)

- Residential & Commercial Use

- Transportation (Aviation, Marine, Road Fuel)

By Region

- North America

- U.S.

- Mexico

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Asia Pacific

- China

- India

- Japan

- South Korea

- Central & South America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- UAE