Content

Europe Oil & Gas Infrastructure Market Size and Growth 2025 to 2034

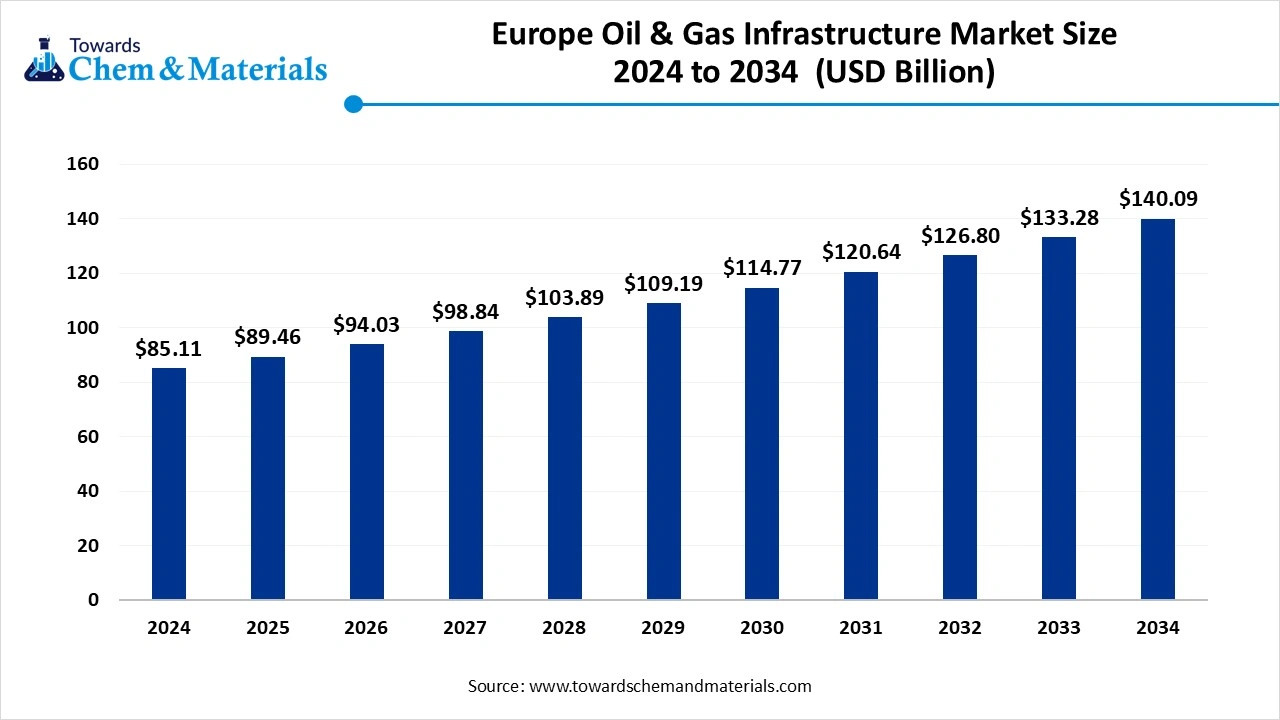

The Europe oil & gas infrastructure market size was reached at USD 85.11 billion in 2024 and is expected to be worth around USD 140.09 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.11% over the forecast period 2025 to 2034. The growth of the market is driven by the growing natural gas demand and the expansion of industries in the region.

Key Takeaways

- By sector, the midstream segment dominated the market in 2024. The midstream segment held a 43% share in the market in 2024. The growth of the market is driven by the need for secure and diversified energy transport.

- By sector, the downstream segment is expected to grow significantly in the market during the forecast period. The growth is driven by the growing need for flexible pipeline networks.

- By infrastructure, the pipelines segment dominated the market in 2024. The pipelines segment held a 36% share in the market in 2024. The increasing focus on cross-border connectivity and safety upgrades fuels the growth of the market.

- By infrastructure, the LNG terminals & hydrogen-ready networks segment is expected to grow in the forecast period. The alignment with the EU's green deal targets fuels the growth of the market.

- By fuel type, the natural gas segment dominated the market in 2024. The plastic segment held a 47% share in the market in 2024. The natural gas remains a vital fuel type, which increases the growth.

- By fuel type, the LNG & hydrogen blends segment is expected to grow in the forecast period. The growing strategies to decarbonize its energy mix propel the growth.

- By material type, the carbon steel segment dominated the market in 2024. The carbon steel segment held a 50% share in the market in 2024. The strength and durability make it a preferred choice, which increases the demand.

- By material type, the thermoplastics & composites (for hydrogen/gas) segment is expected to grow in the forecast period. The offering of superior corrosion resistance fuels the growth of the market.

- By ownership, the IOCs & TSOs segment dominated the market in 2024. The IOCs & TSOs segment held a 54% share in the market in 2024. The infrastructure development plans in the region support the growth.

- By ownership, the EPC firms (retrofitting and green infrastructure) segment is expected to grow in the forecast period. The shift towards green and sustainability goals fuels the growth of the market.

- By application, the residential/commercial heating segment dominated the market in 2024. The residential/commercial heating segment held a 38% share in the market in 2024. Growing and key drivers of the oil and gas infrastructure market.

- By application, the transportation (LNG trucking, marine bunkering) segment is expected to grow in the forecast period. Shift towards cleaner fuels drives the growth of the market.

Market Overview

Rising demand for durable materials : Europe Oil & Gas Infrastructure Market to expand

The Europe Oil & Gas Infrastructure Market covers the essential facilities and systems supporting the exploration, production, transportation, processing, storage, and distribution of oil and natural gas within European countries. This includes infrastructure from North Sea offshore platforms to extensive natural gas pipeline networks, LNG terminals, refineries, and petrochemical complexes. With the region undergoing a strategic shift toward energy diversification, reduced Russian dependency, and low-carbon fuel adoption, the oil & gas infrastructure in Europe is increasingly focusing on modernization, cross-border connectivity, and integration with renewable gas systems (like hydrogen and biogas).

What Are The Key Growth Drivers That Support The Growth Of The Europe Oil & Gas Infrastructure Market?

The growth of the market is driven by the growing demand for energy due to population growth and industrial expansion, which demand energy, including oil and gas, which drives the growth of the market. The growing transportation sector, due to increasing vehicle ownership, heavily increases the energy demand and consumption, which significantly demands infrastructure development. Other key growth drivers are infrastructure investments, technological advancements, and regulatory support, shifting focus, which are the growth drivers that support and contribute to the growth of the market.

Market Trends

- The growing demand for natural gas as a cleaner fossil fuel and the growing demand from various industries drive the growth.

- Sustainability initiatives and focus on carbon capture sue to focus as a greener initiative, fuels the growth of the market.

- Digitalization and automation are a growing trend in the market, which supports the growth of the market.

- The heavy investments from the government to increase the storage facilities and infrastructure drive the growth of the market.

Report Scope

| Report Attribute | Details |

| Market Size in 2025 | USD 89.46 Billion |

| Expected Size by 2034 | USD 140.09 Billion |

| Growth Rate from 2025 to 2034 | 5.11% CAGR |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Sector, By Infrastructure Type, By Material Type, By Fuel Type, By Ownership/Operator, By End-Use Application, By Region |

| Key Companies Profiled | Equinor ASA (Norway) , TotalEnergies (France), Shell Plc (UK/Netherlands) , BP Plc (UK) , ENI S.p.A (Italy) , OMV Group (Austria), Repsol (Spain) , Gaz-System (Poland) , Fluxys (Belgium) , GRTgaz & Terega (France) , Gasunie (Netherlands) , Vopak, Oiltanking, Technip Energies, Saipem |

Market Opportunity

What Are The Key Growth Opportunities That Support The Growth Of The European Oil & Gas Infrastructure Market?

The key growth opportunity that supports the growth of the market is the technological advancements. The integration of AI and IoT through digitalization and smart monitoring to optimize and enhance predictive maintenance fuels the growth of the market. The IoT devices and real-time data analytics integration in infrastructure help in improving monitoring and in controlling the system, and help in enhanced decision making, supporting the growth of the market. Advances in carbon capture and storage systems help in reducing the carbon footprint of oil and gas operations, contributing to the overall enhanced performance. These key factors contribute to creating opportunities for the growth of the market.

Market Challenge

What Are The Key Challenges Of The Europe Oil & Gas Infrastructure Market Which Hinders Its Growth?

The key challenges that hinder the growth of the market are the regulatory pressure, environmental standards, energy transition, renewable energy investments, geopolitical risks, supply chain disruption, environmental and safety concerns, and skill gap. These are some of the key challenges that limit the growth and hinder the expansion of the market.

Regional Insights

The Technological Advancements In The UK Drive The Growth Of The Market

The growth of the market in the UK is driven by the growing need for and demand for energy due to increasing energy consumption, which drives the growth of the market. The infrastructure development with heavy investment and development of processing plants supports the economic growth by meeting the energy needs, rising the demand, and promoting growth. Energy security and offshore and deepwater exploration require specialized infrastructure, which propels the growth of the market in the country. The key players include Shell PLC, BP PLC, TotalEnergies SE, Chevron Corporation, and Cadent Gas Ltd. play a significant role in the growth and expansion of the market in the country.

Germany Has Seen A Significant Growth In The Europe Oil & Gas Infrastructure Market

The growth of the market in Germany is driven by the pipeline infrastructure, LNG infrastructure development, and security and services fuel the growth of the market. Bohlen & Doyen and EEW Group are the key players who play a crucial role in the growth of the market. The government supports research and development for streamlining approval processes for infrastructural projects in the country. The specific areas of focus in the German market include pipeline construction and maintenance, storage facilities, and oil and gas security, which fuels the growth of the market in the country.

- The European Union shipped out 29,384 Petroleum shipments from September 2023 to August 2024 (TTM). These exports were handled by 1,234 European exporters to 1,467 buyers.(Source: www.volza.com)

- Globally, the United States, European Union, and Lithuania are the top three exporters of Petroleum. The United States is the global leader in Petroleum exports with 106,807 shipments, followed closely by the European Union with 77,304 shipments, and Lithuania in 3rd place with 47,052 shipments.(Source: www.volza.com)

Segmental Insights

Sector Insights

How Did Midstream Segment Dominated The Europe Oil & Gas Infrastructure Market In 2024?

The midstream segment dominated the Europe oil & gas infrastructure market in 2024. The midstream sector in Europe’s oil and gas infrastructure market is undergoing transformation, driven by the need for secure, diversified energy transport. Investments in LNG terminals, cross-border pipelines, and storage facilities are increasing to reduce dependency on single-source supplies. Countries are focusing on reverse flow capabilities and interconnectivity to strengthen energy resilience, which increases the demand. Ongoing geopolitical shifts and energy transition goals are accelerating infrastructure upgrades across the midstream segment.

The downstream segment expects significant growth in the market during the forecast period. The downstream sector in Europe’s oil and gas infrastructure market is evolving to meet cleaner fuel standards and changing consumption patterns. Refineries are investing in modernization, desulfurization units, and biofuel integration to comply with stringent EU regulations. Retail fuel networks are also expanding with digital payment systems and alternative fuels. The shift toward low-emission transport and petrochemical feedstocks is reshaping downstream infrastructure, driving investments in flexibility and environmental performance.

Infrastructure Insights

Which Infrastructure Segment Dominated The Europe Oil & Gas Infrastructure Market In 2024?

The pipeline segment dominated the market in 2024. Pipeline infrastructure remains a backbone of Europe’s oil and gas supply, ensuring efficient and large-scale transport of crude oil, refined products, and natural gas across the continent. Ongoing investments focus on enhancing cross-border connectivity, reverse flow capabilities, and safety upgrades. The diversification of supply sources, especially post-Russia import reductions, has intensified the need for resilient and flexible pipeline networks, supporting both energy security and the transition toward integrated regional gas markets.

The LNG terminals & hydrogen-ready networks segment expects significant growth in the Europe oil & gas infrastructure market during the forecast period.

LNG terminals and hydrogen-ready networks are rapidly expanding across Europe to diversify energy imports and support decarbonization goals. New LNG regasification facilities and floating storage units are being deployed to reduce reliance on pipeline gas. Simultaneously, infrastructure is being adapted or newly built to handle low-carbon hydrogen, aligning with EU Green Deal targets. These dual-purpose investments are critical for future energy flexibility, security, and the continent’s clean energy transition.

Fuel Type Insights

How did the Natural Gas Segment Dominate the Europe Oil & Gas Infrastructure Market in 2024?

The natural gas segment dominated the market in 2024. Natural gas remains a vital fuel type in Europe’s energy infrastructure, serving as a transitional energy source amid decarbonization efforts. Investments are focused on expanding LNG terminals, underground storage, and cross-border pipelines to ensure supply security and flexibility. The shift from Russian gas imports has accelerated diversification through new supplier agreements. Natural gas infrastructure is also being designed to accommodate future hydrogen blending, supporting long-term sustainability and energy resilience goals.

The LNG & hydrogen blends segment expects significant growth in the Europe oil & gas infrastructure market during the forecast period. LNG and hydrogen blends are gaining momentum in Europe as part of the region’s strategy to decarbonize its energy mix. Existing LNG infrastructure is being upgraded to accommodate hydrogen blending, enabling cleaner combustion and lower emissions. These blends offer a transitional solution for hard-to-abate sectors like transport and industry. Ongoing pilot projects, policy incentives, and cross-border collaboration are driving infrastructure readiness for the scalable adoption of LNG-hydrogen fuel mixtures.

Material Type

Which Material Segment Dominated The Europe Oil & Gas Infrastructure Market In 2024?

The carbon steel segment dominated the market in 2024. Carbon steel remains the predominant material in Europe’s oil and gas infrastructure due to its strength, durability, and cost-effectiveness. It is widely used in pipelines, storage tanks, and structural components of refineries and LNG facilities. Its ability to withstand high pressure and temperature makes it suitable for both onshore and offshore applications. Ongoing maintenance, anti-corrosion coatings, and regulatory compliance are key to ensuring the long-term performance of carbon steel infrastructure assets.

The thermoplastics & composites (for hydrogen/gas) segment expects significant growth in the Europe oil & gas infrastructure market during the forecast period. Thermoplastics and composite materials are gaining traction in Europe’s oil and gas infrastructure, especially for hydrogen and gas distribution networks. These materials offer superior corrosion resistance, lightweight properties, and high flexibility, making them ideal for modern pipeline systems. Their compatibility with hydrogen reduces leakage risks and enhances safety. As hydrogen adoption accelerates, these advanced materials are being integrated into new infrastructure designs, supporting Europe's transition to a low-carbon energy future.

Ownership Insights

How Did IOCS & TSOS Segment Dominated The Europe Oil & Gas Infrastructure Market In 2024?

The IOCs & TSOs segment dominated the market in 2024. International Oil Companies (IOCs) and Transmission System Operators (TSOs) play a key role in Europe’s oil and gas infrastructure development. IOCs invest in upstream and midstream assets, including LNG terminals and cross-border pipelines, to ensure energy supply and profitability. TSOs manage and expand high-capacity gas transmission networks, integrating renewable gases like hydrogen. Their collaboration is essential for balancing commercial interests with energy security and Europe’s decarbonization objectives.

The EPC firms (retrofitting and green infrastructure) segment expects significant growth in the Europe oil & gas infrastructure market during the forecast period. Engineering, Procurement, and Construction (EPC) firms are instrumental in retrofitting legacy oil and gas infrastructure and delivering green energy projects across Europe. They lead the modernization of refineries, pipeline repurposing for hydrogen, and the construction of carbon capture-ready facilities. With the push toward decarbonization, EPC firms are aligning with EU climate goals by integrating digital technologies, modular construction, and sustainable materials to build resilient, future-ready energy infrastructure.

Application Insights

Which Application Segment Dominated The Europe Oil & Gas Infrastructure Market In 2024?

The residential/commercial heating segment dominated the market in 2024. Residential and commercial heating remains a key application driving oil and gas infrastructure demand in Europe. Natural gas networks supply heating to millions of homes and businesses, especially in colder regions. As energy efficiency regulations tighten, infrastructure is being upgraded to support low-carbon alternatives, including hydrogen blending and district heating systems. Retrofitting gas grids and deploying smart metering technologies are critical to ensuring a clean, efficient, and resilient heating supply across the region.

The transportation (LNG trucking, marine bunkering) segment expects significant growth in the Europe oil & gas infrastructure market during the forecast period. Transportation applications like LNG trucking and marine bunkering are expanding rapidly in Europe, driven by stricter emission norms and the shift toward cleaner fuels. LNG infrastructure supports low-emission heavy-duty road transport and compliance in maritime shipping under IMO regulations. Investments in LNG fueling stations, mobile storage units, and bunkering terminals are growing. These developments are critical for decarbonizing the freight and maritime sectors while ensuring flexible, cross-border fuel distribution.

Recent Developments

- In April 2025, Climate, Infrastructure and Environment Executive Agency (CINEA) launched an initiative for the cross-border EU energy infrastructure projects from the EU budget worth of €600 million.(Source : energy.ec.europa.eu)

Europe Oil & Gas Infrastructure Market Top Companies

- Equinor ASA (Norway)

- TotalEnergies (France)

- Shell Plc (UK/Netherlands)

- BP Plc (UK)

- ENI S.p.A (Italy)

- OMV Group (Austria)

- Repsol (Spain)

- Gaz-System (Poland)

- Fluxys (Belgium)

- GRTgaz & Terega (France)

- Gasunie (Netherlands)

- Vopak, Oiltanking

- Technip Energies, Saipem

Segments Covered

By Sector

- Upstream (e.g., North Sea platforms)

- Midstream (cross-border pipelines, LNG)

- Downstream (refineries, distribution)

By Infrastructure Type

- Pipelines (Oil, Gas, Hydrogen-ready)

- Offshore Platforms (UK, Norway)

- LNG Terminals (Spain, France, Netherlands, Germany)

- Storage Facilities (Salt caverns, tanks)

- Compressor & Pumping Stations

- Refineries (Germany, Italy, Netherlands)

- Petrochemical Plants (Benelux, Poland)

- Gas Processing Units

- Retail Distribution Networks

By Material Type

- Steel (Carbon & Stainless)

- Concrete (Storage/Foundations)

- Polyethylene & Thermoplastics (Gas distribution)

- Composite Materials (Emerging in hydrogen infrastructure)

By Fuel Type

- Crude Oil

- Natural Gas

- Liquefied Natural Gas (LNG)

- Refined Products

- LPG

- Hydrogen (Blending stage)

By Ownership/Operator

- National Operators (e.g., Equinor, ENI)

- Transmission System Operators (TSOs) – GRTgaz, Fluxys, Gasunie, etc.

- International Oil Companies (Shell, BP, TotalEnergies)

- Independent Storage/Terminal Operators (Vopak, Oiltanking)

- EPC Firms (Saipem, Technip Energies)

By End-Use Application

- Power Generation (Gas-fired plants)

- Industrial Use (Chemicals, Steel, Fertilizers)

- Residential & Commercial Heating

- Transportation (Road fuel, Marine LNG, Jet Fuel)

By Region

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway