Content

Recycled Plastics In Green Building Materials Market Size and Share 2034

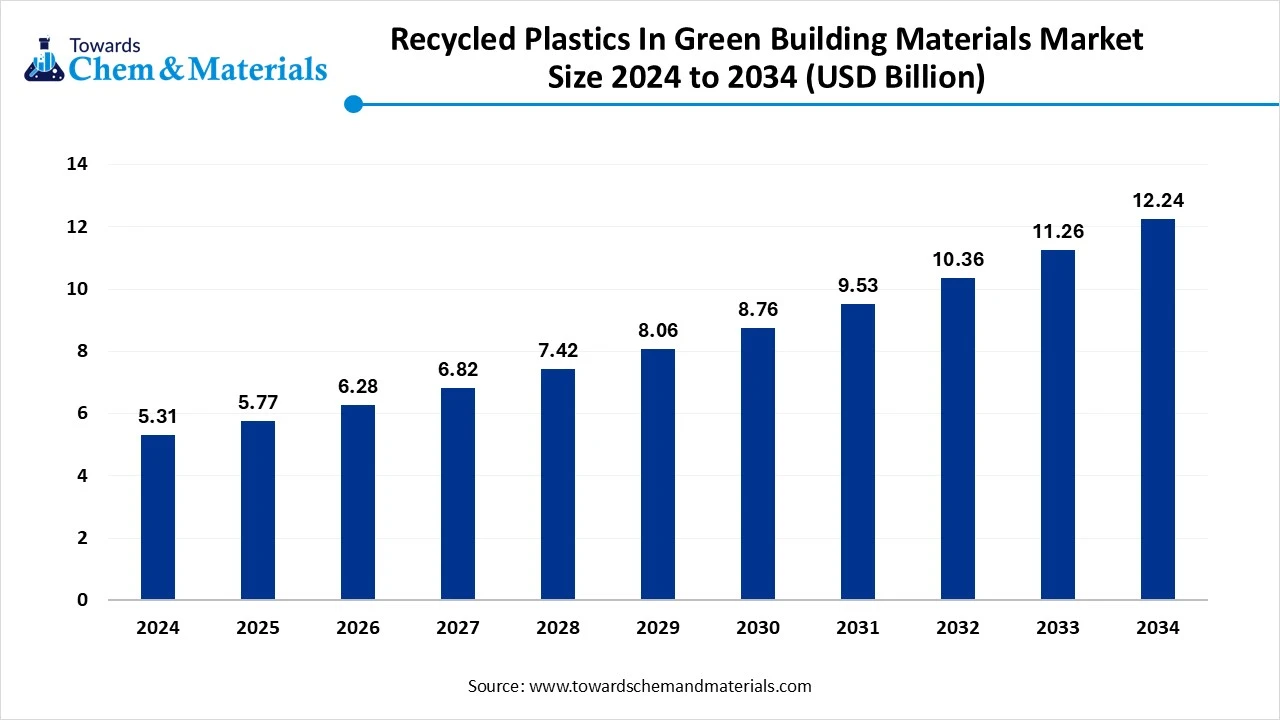

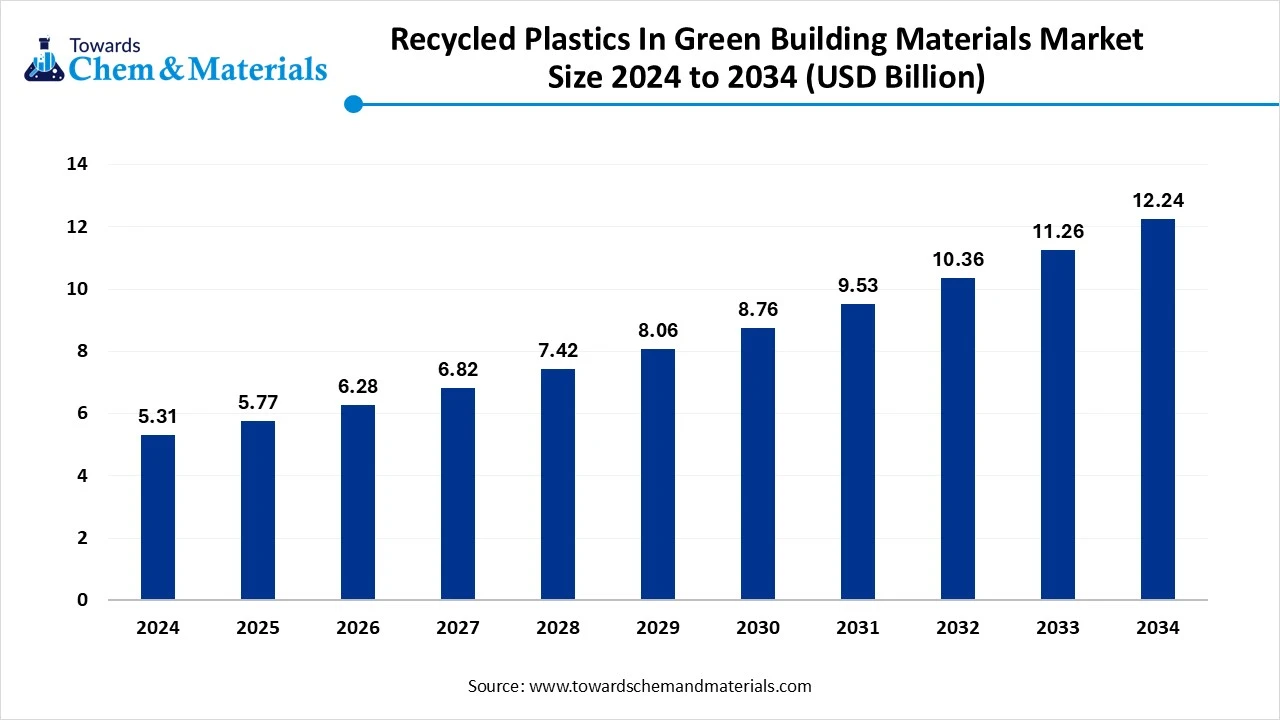

The global recycled plastics in green building materials market size was reached at USD 5.31 billion in 2024 and is expected to be worth around USD 12.24 billion by 2034, growing at a compound annual growth rate (CAGR) of 8.71% over the forecast period 2025 to 2034. The growing demand for sustainable construction practices is the key factor driving market growth. Also, innovations in recycling technologies coupled with the increasing demand for green buildings can fuel market growth further.

Key Takeaways

- By region, Asia Pacific dominated the market with a 40% market share in 2024. The dominance of the segment can be attributed to the surge in sustainability mandates.

- By region, Europe is expected to grow at the fastest CAGR over the forecast period. The growth of the region can be credited to the surge in corporate sustainability initiatives, along with increasing environmental awareness.

- By product type, the plastic lumber & decking segment dominated the market with a 28% share in 2024. The dominance of the segment can be attributed to the growing demand for sustainable construction alternatives.

- By product type, the composite building components segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the growing demand for sustainable construction practices.

- By polymer feedstock, the recycled HDPE segment led the market by holding 30% market share in 2024. The dominance of the segment can be linked to the unique properties of recycled HDPE.

- By polymer feedstock, the recycled PET segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by increasing consumer demand for transparency in material sourcing.

- By application, the residential construction segment held a 33% market share in 2024. The dominance of the segment is owed to the growing trend towards remodeling projects and home renovation.

- By application, the commercial & institutional segment is expected to grow at the fastest CAGR over the projected period. The growth of the segment is due to the cost-effectiveness of recycled plastics.

- By certification, the certified recycled content segment held a 42% market share in 2024. The dominance of the segment can be attributed to the rising environmental awareness.

- By certification, the LCA-verified segment is expected to grow at the fastest CAGR over the study period. The growth of the segment can be credited to the shifting sustainability standards and building codes.

- By end user, the homeowners & residential contractors segment held a 38% market share in 2024. The dominance of the segment can be linked to the rising consumer awareness regarding sustainability.

- By end user, the architects & specifiers segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by innovations in material science and changing building codes.

- By distribution channel, the building materials distributors & wholesalers segment dominated the market with 48% market share in 2024. The dominance of the segment is owed to the rapid research and development activities in the industry.

By distribution channel, the B2B direct contracts segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment is due to the unique benefits of recycled plastic in building materials.

Advancements in Recycling Technologies are Expanding Market Growth

The recycled plastics in green building materials market covers the production, processing, and utilization of post-consumer and post-industrial recycled polymers to manufacture sustainable building products worldwide. Key materials include recycled HDPE, PET, PVC, PP, mixed PCR blends, and bio-based/recycled hybrid resins, which are converted into plastic lumber, cladding, roofing, insulation facings, pavers, geosynthetics, and interior panels.

Globally, demand is driven by circular economy policies, extended producer responsibility (EPR) regulations, plastic waste bans, and rising adoption of green building certification systems such as LEED, BREEAM, Green Star, and WELL. Recycled-plastic-based building products are valued for durability, weather/moisture resistance, low maintenance, and their ability to reduce embodied carbon while promoting closed-loop resource use.

What Are the Key Trends Influencing the Recycled Plastics In Green Building Materials Market?

- The growing product demand in the packaging sector is the latest trend in the market. The recycled polymers have the capability to replace their conventional plastics, which acts as an obstacle between various environmental factors and food. Hence, recycled plastic is considered a preferred material in the packaging industry.

- The supportive government regulations and policies aiming at promoting plastic waste recycling are another trend shaping a positive market trajectory further. Recycled plastic building materials provide durable and cost-effective solutions to traditional materials, contributing to their rapidly growing popularity.

- Innovations in recycling technologies and the development of cutting-edge composite materials utilizing recycled plastics are increasingly expanding the range of applications by enhancing their overall performance. Also, recycled plastics are extensively used in interior finishing, insulation, and composite materials for construction purposes.

Report Scope

| Report Attribute | Details |

| Market Size in 2025 | USD 5.77 billion |

| Expected Size by 2034 | USD 12.24 billion |

| Growth Rate from 2025 to 2034 | CAGR 8.71% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Product Type, By Polymer Feedstock, By Application, By Certification, By End-User, By Distribution Channel, By region |

| Key Companies Profiled | Trex Company, Inc., Fiberon, AZEK Company Inc., Envirodeck, Composite Decking SA, Ecodek Outdoor Living, Terafest |

Market Opportunity

The Integration of Circular Economy Initiatives

The ongoing integration of circular economy principles into the production process and product design is a major factor creating lucrative opportunities in the market. Major market players are increasingly aligning with ESG goals, where products are manufactured for recyclability from inception. Furthermore, the rapid development of innovative recycling technologies like AI-based sorting systems and chemical recycling is anticipated to drive market growth soon.

- In October 2024, CRH Ventures, a major building materials solution company, introduced a new accelerator, the Sustainable Building Materials Program, to boost innovations in building materials. The program aims to detect advanced materials and applications to lessen environmental impact.(Source: www.businesswire.com)

Market Challenges

Lack of Standardisation

A lack of understanding and standardisation regarding the behavior and performance of recycled plastic building materials can affect their adoption by the construction sector. Moreover, establishing clear guidelines and standards for the utilization of recycled plastics in construction is important. The high cost associated with collecting, sorting, and processing plastic waste can hinder market growth further.

Regional Insight

Asia Pacific Recycled Plastics in Green Building Materials Market Trends

Asia Pacific dominated the market with a 40% market share in 2024. The dominance of the segment can be attributed to the surge in sustainability mandates and ongoing urbanization, especially in emerging economies such as China and India. In addition, the increased public awareness of sustainable building practices, along with subsidies for green construction, is leading to regional growth in the near future.

China Recycled Plastics In Green Building Materials Market

In the Asia Pacific, China led the market due to the rising environmental awareness, ongoing government initiatives, and innovations in recycling technology. Also, enhancements in additive technologies and polymer reclamation have increased the adoption of recycled plastics in the country.

Europe is expected to grow at the fastest CAGR over the forecast period. The growth of the region can be credited to the surge in corporate sustainability initiatives, along with increasing environmental awareness. Furthermore, European governments are increasingly implementing initiatives and regulations to promote recycling and minimize plastic waste, further fuelling the demand for recycled plastics in construction.

Segmental Insight

Product Type Insight

Which Product Type Segment Dominated the Recycled Plastics In Green Building Materials Market in 2024?

The plastic lumber & decking segment dominated the market with a 28% share in 2024. The dominance of the segment can be attributed to the growing demand for sustainable construction alternatives and the high durability and low maintenance of recycled plastic products as compared to conventional materials. The ability to recycle an extensive range of plastics into high-grade lumber contributes to segment expansion further.

The composite building components segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the growing demand for sustainable construction practices, coupled with the rising sustainability awareness. Recycled plastics are utilized in a range of composite building components such as decking, cladding, insulation, roofing, and fencing.

Polymer Feedstock Insight

Why Recycled HDPE Segment Dominated the Recycled Plastics In Green Building Materials Market in 2024?

The recycled HDPE segment dominated the market by holding 30% market share in 2024. The dominance of the segment can be linked to the unique properties of recycled HDPE and the rising need for sustainable construction practices. Also, innovations in recycling technologies are enhancing the efficiency and quality of recycled HDPE, making it more competitive with virgin materials.

The recycled PET segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by increasing consumer demand for transparency in material sourcing, which has raised rPET's appeal in the market. Rapid innovations in recycling technologies, particularly for PET bottles, are making it more convenient to produce high-quality rPET for building materials.

Application Insight

How Much Share Did the Residential Construction Segment Held in 2024?

The residential construction segment held a 33% market share in 2024. The dominance of the segment is owing to the growing trend towards remodelling projects and home renovation, along with the growing awareness regarding green building practices. Moreover, recycled plastics have applications in different residential construction areas such as decking, fencing, siding, and insulation.

The commercial & institutional segment is expected to grow at the fastest CAGR over the projected period. The growth of the segment is due to the cost-effectiveness of recycled plastics as compared to other virgin materials and government regulations supporting sustainability. Recycled plastics are used in an extensive range of building applications such as wall panels, decking, and insulation.

Certification Insight

Which Certification Segment Dominated the Recycled Plastics In Green Building Materials Market in 2024?

The certified recycled content segment held a 42% market share in 2024. The dominance of the segment can be attributed to the rising environmental awareness and other government initiatives supporting sustainable construction. In addition, the ongoing shift towards circular economy initiatives, where waste is reduced and resources are reused, is increasingly gaining traction during the forecast period.

The LCA-verified segment is expected to grow at the fastest CAGR over the study period. The growth of the segment can be credited to the shifting sustainability standards and building codes, and ongoing government subsidies and incentives promoting the market. Advancements in additive technologies and polymer modification are optimising the development of highly efficient recycled plastic composites.

End-User Insight

Which End User Segment Dominated the Recycled Plastics In Green Building Materials Market in 2024?

The homeowners & residential contractors segment held a 38% market share in 2024. The dominance of the segment can be linked to the rising consumer awareness regarding sustainability and increasing demand for green building practices. Furthermore, ongoing innovations in recycling technologies and the rapid development of cutting-edge applications for recycled plastics in the construction sector are driving the segment's growth soon.

The architects & specifiers segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by innovations in material science and changing building codes. Moreover, Architects are rapidly adopting recycled plastic products in their construction designs to fulfill client demand for sustainable buildings.

Distribution Channel Insight

How Much Share Did the Building Materials Distributors & Wholesalers Segment Held in 2024?

The building materials distributors & wholesalers segment dominated the market with 48% market share in 2024. The dominance of the segment is owed to the rapid research and development activities in the industry, along with the surge in green building initiatives. Additionally, many regions are offering tax breaks, incentives, and green building certifications that boost the use of recycled plastics in the construction sector.

The B2B direct contracts segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment is due to the unique benefits of recycled plastic in building materials. Governments across the globe are implementing policies and offering incentives to promote green building, which will impact positive market expansion shortly.

Recent Developments

- In April 2025, T2Earth introduced an OnWood Plywood, a sustainable fire-retardant treated wood. Created without toxic chemicals, it delivers a sustainable and fire retard design, providing developers and builders with healthier, higher-performing products.(Source: www.woodworkingnetwork.com)

Recycled Plastics In Green Building Materials Market Top Companies

- Trex Company, Inc.

- Fiberon

- AZEK Company Inc.

- Envirodeck

- Composite Decking SA

- Ecodek Outdoor Living

- Terafest

Segments Covered

By Product Type

- Plastic Lumber & Decking

- Exterior Cladding & Siding Panels

- Roofing Components (underlayments, tiles with recycled content)

- Insulation Facings & Vapor Barriers

- Pavers, Tiles & Hardscape Elements

- Interior Panels, Acoustic & Ceiling Tiles

- Window & Door Profiles (recycled PVC/UPVC blends)

- Geosynthetics & Landscape Products (weed barriers, drainage mats)

- Composite Building Components (structural insulated panels, façade modules)

By Polymer Feedstock

- Recycled HDPE (High-Density Polyethylene)

- Recycled PET (Polyethylene Terephthalate)

- Recycled PVC (Polyvinyl Chloride)

- Recycled PP (Polypropylene)

- Mixed/Reprocessed Plastics (regrind, PCR blends)

- Bio-plastic blends / recycled content blends

By Application

- Residential Construction (decking, siding, flooring)

- Commercial & Institutional Buildings (facades, ceiling systems)

- Infrastructure & Public Works (noise barriers, bridge components, pavers)

- Landscaping & Hardscape (pavers, edging)

- Industrial Buildings & Warehouses (cladding, vapor barriers)

- Renovation & Retrofit Projects (replacement decking, cladding)

By Certification

- Certified Recycled Content (e.g., PCR percentage certified)

- Low-VOC / Indoor Air Quality Rated

- LCA-verified Products

- Non-certified / Standard recycled content

By End-User

- Residential Homeowners & Contractors

- Commercial Developers & General Contractors

- Architects, Specifiers & AEC Firms

- Public Sector / Municipal Procurement

- Landscape Architects & Municipal Agencies

- Building Product Distributors & Retailers

By Distribution Channel

- B2B Direct Contracts (spec & bulk orders)

- Building Materials Distributors & Wholesalers

- Home Improvement Retailers (big-box & specialty)

- Online Marketplaces & OEM partnerships

- Recycling-to-manufacturing vertical supply agreements

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait