Content

Recycled PET Flakes Market Size and Forecast 2025 to 2034

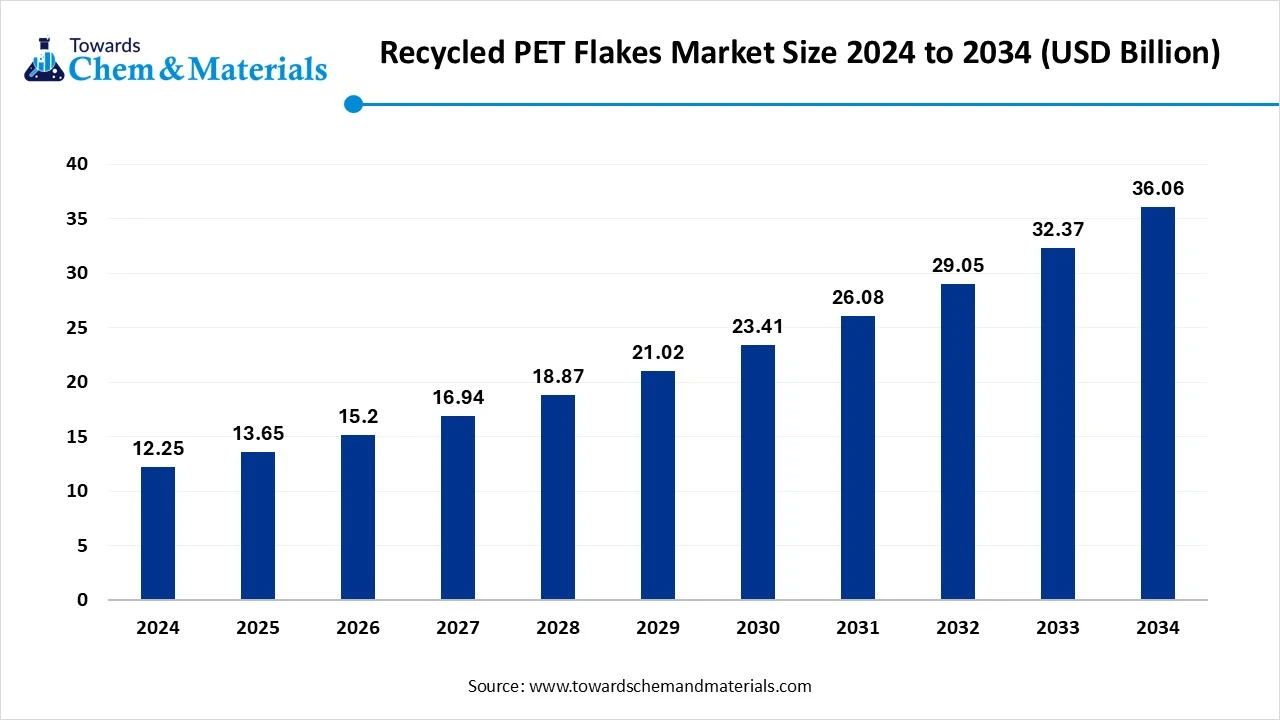

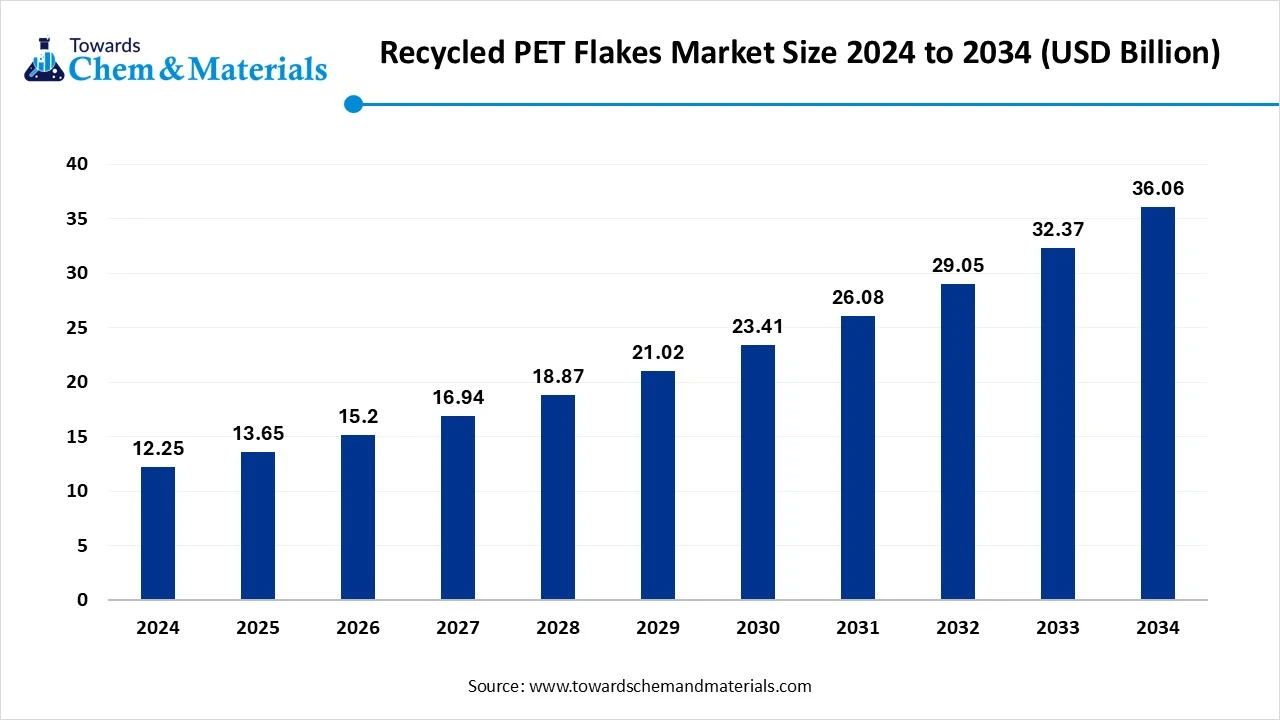

The global recycled PET flakes market size was reached at USD 12.25 billion in 2024 and is expected to be worth around USD 36.06 billion by 2034, growing at a compound annual growth rate (CAGR) of 11.40% over the forecast period 2025 to 2034. The increasing need for sustainable materials, particularly in packaging, is the key factor driving market growth. Also, ongoing innovations in recycling technology, coupled with the new government regulations and initiatives, can fuel market growth further.

Key Takeaways

- By region, Asia Pacific dominated the market with a 45% share in 2024. The dominance of the region can be attributed to the surge in environmental consciousness and government policies supporting circular economy principles.

- By region, Europe is expected to grow at the fastest CAGR over the forecast period. The growth of the region can be attributed to the innovations in recycling technology, along with the strict EU regulations.

- By source, the post-consumer PET waste segment dominated the market with approximately 70% share in 2024. The dominance of the segment can be attributed to the supportive government policies for the circular economy.

- By source, the post-industrial PET waste segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the rapid innovations in digital traceability.

- By grade, the non-food grade rPET flakes segment held approximately 60% market share in 2024. The dominance of the segment can be linked to the growing adoption of these flakes in sectors like packaging for films and non-food items.

- By grade, the food-grade rPET flakes segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by the increasing availability of standard food-grade rPET resin.

- By color, the clear flakes segment led the market by holding approximately 50% share in 2024. The dominance of the segment is owed to the growing demand for color flakes in non-food applications.

- By color, the mixed/colored flakes segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment is due to the growing demand for environmentally responsible options.

- By application, the fibers & textiles segment dominated the market with approximately 40% share in 2024. The dominance of the segment can be attributed to the growing brand sustainability initiatives and environmental awareness across the globe.

- By application, the bottles & containers segment is expected to grow at the fastest CAGR during the projected period. The growth of the segment can be credited to the growing consumer awareness of sustainability.

- By end-use industry, the packaging segment held approximately 45% market share in 2024. The dominance of the segment can be linked to the advancements in decontamination and sorting technologies.

- By end-use industry, the textiles & apparel segment is expected to grow at the fastest CAGR during the study period. The growth of the segment can be driven by rising demand for sustainable apparel.

- By distribution model, the direct supply from the recycling companies segment led the market by holding a 55% share in 2024. The dominance of the segment is owed to the rapid enhancements in collection infrastructure.

- By distribution model, the blended supply through the converters segment is expected to grow at the fastest CAGR during the projected period. The growth of the segment is due to its growing expansion in end-use applications.

Technological Advancements are Expanding Market Growth

The recycled pet (rPET) flakes market covers the production and utilization of polyethylene terephthalate (PET) flakes obtained from post-consumer and post-industrial PET waste such as bottles, films, and packaging materials. rPET flakes serve as a key raw material for manufacturing fibers, sheets, strapping, containers, bottles, food-grade packaging, and non-food applications.

Market growth is driven by rising plastic recycling mandates, sustainability initiatives by FMCG and beverage brands, cost competitiveness versus virgin PET, and growing consumer demand for eco-friendly packaging solutions.

What Are the Key Trends Influencing the Recycled PET Flakes Market?

- The ongoing innovations in recycling technologies, like optical sorting technologies and other advancements, have substantially improved the effectiveness and efficiency of PET flakes recycling processes. These advancements have optimized sorting, cleaning, and processing methods further.

- The government regulations and initiatives aimed at supporting the circular economy and recycling principles are fuelling the demand for recycled PET flakes. Major countries across the globe have implemented policies to facilitate the recycling of PET bottles and containers by utilising recycled materials in manufacturing.

- The increasing need for sustainable materials, boosted by a surge in environmental concerns across the globe, is another trend shaping positive market growth. Also, these innovations are optimising the manufacturing of high-quality flakes convenient for an extensive range of applications, leading to market growth soon.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 13.65 Billion |

| Expected Size by 2034 | USD 36.06 Billion |

| Growth Rate from 2025 to 2034 | CAGR 11.40% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Source, By Grade, By Color, By Application, By End-Use Industry, By Distribution Model, By Region |

| Key Companies Profiled | Clear Path Recycling LLC, Verdeco Recycling, Indorama Ventures Public Ltd., PolyQuest, Evergreen Plastics, Inc., Biffa, GSM Plastic Industries, RCS Entsorgung GmbH, TOMRA System ASA, Polyvim LLC, Veolia Umweltservice GmbH, AMAANI POLYFLAKES, Pashupati Polytex Pvt. Ltd., AlEn USA, RAHSAM Co., LANGGENG JAYA GROUP |

Market Opportunity

Growth in Developing Economies

Developing countries provide a wide range of opportunities to the rPET industry with rapid urbanization, pro-government policies, and increasing consumer awareness. Furthermore, the global South countries, such as Latin America, Asia-Pacific, and many African countries, are witnessing extensive demand for sustainable packaging solutions, offering potential growth opportunities for the market soon.

- In July 2025, Plastics recycler Vanden Global unveiled an advanced catalogue for recycled PET resins and flakes. The company further says this new catalogue provides a detailed and technically validated selection of industrial and food-grade rPET.(Source: www.recyclingtoday.com)

Market Challenge

Less Availability of Food-Grade Material

Food and beverage market players necessitate a large volume of food-grade and certified rPET, But the supply of this high-grade material is limited, which is the major factor hindering market growth. Moreover, the limited standardization in the market regarding formats and quality can make it challenging to offer greater transparency across the supply chain, because data is reporting variations.

Regional Insight

Asia Pacific Recycled PET Flakes Market Trends

Asia Pacific dominated the market with a 45% share in 2024. The dominance of the region can be attributed to the surge in environmental consciousness and government policies supporting circular economy principles. In addition, the rapid rise in product demand from textile and packaging industries for sustainable materials, particularly in developing economies such as China and India, is leading to positive regional growth soon.

Europe Recycled PET Flakes Market Trends

Europe is expected to grow at the fastest CAGR over the forecast period. The growth of the region can be attributed to the innovations in recycling technology, along with the strict EU regulations promoting a circular economy. Furthermore, companies in the region are increasingly focusing on minimizing their environmental footprint, which is boosting the adoption of recycled materials soon.

Segmental Insight

Source Insight

Which Source Type Segment Dominated the Recycled PET Flakes Market in 2024?

The post-consumer PET waste segment dominated the market in 2024. The dominance of the segment can be attributed to the supportive government policies for the circular economy and recycled content initiatives. Additionally, major beverage market players are emphasising expanding their use of recycled content in packaging, which creates a strong demand for high-quality rPET flakes.

The post-industrial PET waste segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the rapid innovations in digital traceability and stringent regulations compelling the use of recycled content in packaging products. Also, fluctuations in the price of virgin PET can impact the overall market competitiveness of rPET.

Grade Insight

Why Non-Food-Grade rPET Flakes Segment Dominated the Recycled PET Flakes Market in 2024?

The non-food-grade rPET flakes segment held a largest market share in 2024. The dominance of the segment can be linked to the growing adoption of these flakes in sectors like packaging for films, non-food items, and other industrial products that need sustainable and durable materials.

- Furthermore, a major portion of non-food-grade rPET is utilized to create recycled polyester fibers, which can be added to a wide array of textiles.

The food-grade rPET flakes segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by the increasing availability of standard food-grade rPET resin, optimised by enhanced processing. Furthermore, regulatory bodies are increasingly approving food-grade rPET for direct food contact, offering a convenient path for market players.

Color Insight

How Much Share Did the Clear Flakes Segment Held in 2024?

The clear flakes segment led the market in 2024. The dominance of the segment is owing to the growing demand for color flakes in non-food applications such as automotive and textile parts, which also offer cost benefits for market players, eliminating dye processes. Moreover, enhancements in recycling and color sorting technologies have improved the usability and quality of colored flakes.

The mixed/colored flakes segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment is due to the growing demand for environmentally responsible options, along with the cost-effectiveness of colored flakes as compared to virgin materials. Also, researchers are exploring the use of various colored corn varieties to improve the functional properties of these flakes.

Application Insight

Which Application Type Segment Dominated Recycled PET Flakes Market in 2024?

The fibers & textiles segment dominated the market in 2024. The dominance of the segment can be attributed to the growing brand sustainability initiatives and environmental awareness across the globe, fuelled by the need for sustainable carpets, clothing, and industrial fabrics. Brands in the fashion industry are rapidly using recycled polyester fibers to fulfil sustainability goals, driving segment growth further.

The bottles & containers segment is expected to grow at the fastest CAGR during the projected period. The growth of the segment can be credited to the growing consumer awareness of sustainability, coupled with the substantial investments in new recycling plants, especially for bottle-to-bottle facilities, which in turn increases the production capacity.

End-Use Industry Insight

Why Did the Packaging segment Held the largest Recycled PET Flakes Market Share in 2024?

The packaging segment held the largest market share in 2024. The dominance of the segment can be linked to the advancements in decontamination and sorting technologies, which are enhancing the purity, quality, and consistency of rPET flakes, making them convenient for a wider range of high-value applications. Food-grade rPET flakes are utilized to produce thermoformed packaging like trays for fresh food.

The textiles & apparel segment is expected to grow at the fastest CAGR during the study period. The growth of the segment can be driven by rising demand for sustainable apparel and major brand sustainability commitments to use eco-friendly and recycled materials. Furthermore, using rPET flakes for textile production helps market players to improve their overall brand reputation.

Distribution Model Insight

Which Distribution Model Segment Dominated the Recycled PET Flakes Market in 2024?

The direct supply from the recycling companies segment led the market in 2024. The dominance of the segment is owed to the rapid enhancements in collection infrastructure, along with the strategic collaborations among major market players. Moreover, consumers are more concerned about climate change and plastic pollution, which leads them to adopt products created with recycled materials.

The blended supply through the converters segment is expected to grow at the fastest CAGR during the projected period. The growth of the segment is due to their growing expansion in end-use applications such as automotive and textile components, and other industries. Furthermore, PET flakes are very versatile, enabling mixing with virgin PET to get desired properties for various applications.

Recycled PET Flakes Market Value Chain Analysis

- Feedstock Procurement : It is a crucial stage of the supply chain, which involves the collecting and sorting of post-industrial and post-consumer polyethylene terephthalate (PET) plastic.

- Chemical Synthesis and Processing : This stage involves chemical synthesis and processing to transform the PET flakes into a new chemical compound. This process enables the creation of new products with improved properties.

- Packaging and Labelling : This stage ensures that flakes are kept clean and segregated by color, quality, and application grade, so that the buyers have more precise information about the material they are purchasing.

- Regulatory Compliance and Safety Monitoring : This step ensures that recycled materials meet stringent quality, health, and environmental standards. These practices are crucial for food-grade rPET flakes, which necessitate cutting-edge decontamination and traceability.

Recent Developments

- In November 2024, Indorama Ventures, with other major partners, launched the world's first bio-PET bottle created from cooking oil, which can minimize carbon emissions significantly. These bottles are created from ISCC+-certified bio-paraxylene.(Source: worldbiomarketinsights.com)

Recycled PET Flakes Market Top Companies

- Clear Path Recycling LLC

- Verdeco Recycling

- Indorama Ventures Public Ltd.

- PolyQuest

- Evergreen Plastics, Inc.

- Biffa

- GSM Plastic Industries

- RCS Entsorgung GmbH

- TOMRA System ASA

- Polyvim LLC

- Veolia Umweltservice GmbH

- AMAANI POLYFLAKES

- Pashupati Polytex Pvt. Ltd.

- AlEn USA

- RAHSAM Co.

- LANGGENG JAYA GROUP

Segments Covered

By Source

- Post-Consumer PET Waste (bottles, packaging)

- Post-Industrial PET Waste (scraps, rejects)

By Grade

- Food-Grade rPET Flakes (FDA/EFSA approved)

- Non-Food Grade rPET Flakes

By Color

- Clear/Transparent Flakes

- Green Flakes

- Blue Flakes

- Mixed/Colored Flakes

By Application

- Fibers & Textiles (carpets, apparel, automotive upholstery)

- Bottles & Containers (beverage, water, food packaging)

- Sheets & Films (thermoforming, packaging)

- Strapping & Industrial Applications

- Other Uses (3D printing, consumer goods)

By End-Use Industry

- Packaging (food & beverages, personal care, household goods)

- Textiles & Apparel

- Automotive & Transportation

- Consumer Goods

- Industrial Applications

By Distribution Model

- Direct Supply from Recycling Companies

- Resin & Polymer Distributors

- Blended Supply through Converters

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait