Content

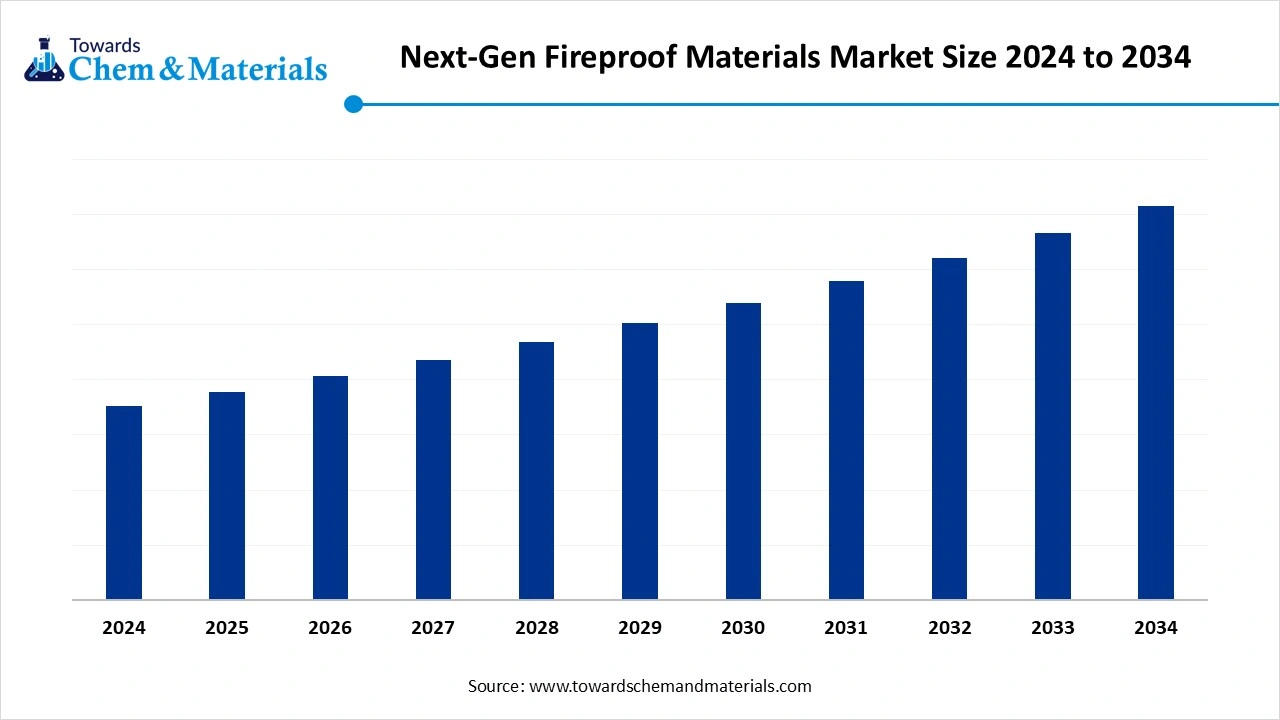

Next-Gen Fireproof Materials Market Size and Growth 2025 to 2034

Next-gen fireproof materials market is witnessing strong momentum due to stricter fire safety regulations and the global shift toward eco-friendly solutions. The construction & building materials segment remains a major contributor, driven by critical fire safety requirements in residential and commercial sectors. The automotive & transport segment is also seeing rapid growth. The ongoing construction boom and sustainability standards have fueled the industry's potential in recent years.

Key Takeaways

- By region, Asia Pacific dominated the next-gen fireproof materials market in 2024, owing to the increased advanced construction activities in the current period.

- By region, North America is expected to grow at a notable rate in the future, owing to high investment in infrastructure advancements and smarter safety regulations.

- By material type, the intumescent materials segment emerged as the top-performing segment in 2024 due to its being considered the ideal material in the construction and industrial applications in the current period

- By material type, the nanocomposite materials segment is likely to experience notable growth during the expected period, akin to having superior fire resistance, while providing lightweight and eco-friendly properties.

- By application, the construction & building materials segment dominated the market in 2024, owing to fire safety is a critical requirement in residential, commercial, and industrial structures.

- By application, the automotive & transport segment is expected to grow significantly over the forecast period, owing to the rising demand for fire-resistant materials in electric vehicles, aviation, and public transportation.

Market Overview

Protecting Lives with Smarter, Stronger Materials

Next-gen fireproof materials market refers to a class of advanced materials specifically engineered to resist ignition, withstand high temperatures, and inhibit the spread of fire far beyond traditional fire-retardant materials. These materials incorporate innovations such as nanocomposites, intumescent coatings, advanced ceramics, and non-halogenated compounds to meet stringent safety standards in high-performance applications across construction, automotive, aerospace, defence, and electronics. The modern industry's investment in advanced materials is actively contributing to the industry's growth in the current period.

Which Factor Is Driving the Growth of the Next–Gen Fireproof Materials Market?

The increased implementation of stricter fire safety regulations is spearheading the industry growth in the current period. Several private firms and governmental bodies have been supporting the initiative for the development of fireproof construction material mandatory in recent years. The implementation of these types of laws by the government has continuously provided a sophisticated consumer base to the market in recent years. Moreover, several countries are seen under the updation of their fire codes, which is leading to market potential in recent years, as per the global analysis.

Market Trends

- The sudden global shift towards eco-friendly fireproof materials is spearheading the market potential in the current period. The manufacturers are increasingly putting a heavy investment in R&D activities for innovative, sustainable materials.

- The increased adoption of electric vehicles and electronics is driving industry’s growth in recent years. Moreover, battery-powered electronics and vehicle manufacturers have been actively seeking out under the heavy demand for efficient fire-retardant materials in the past few years.

Market Opportunity

Sustainable Solutions Drive the Next Wave of Innovation

The creation of non-toxic and sustainable fireproof materials is expected to create lucrative opportunities for next-gen fireproof materials market in the coming years. Moreover, the manufacturers are seen as making a heavy investment in R&D activities for the development of eco-friendly alternative fireproof material by eliminating the traditional fire retardants, which often contain harmful chemicals. Furthermore, several regions are heavily implementing the green building standards, which are anticipated to contribute to the industry's growth in the upcoming years. Also, manufacturers can gain substantial industry attention by completing certification programs like LEED and BREEAM, which can help to build consumer trust in the coming years for the manufacturers.

Market Challenge

Compliance Complexities Delay Product Launches

The higher production costs of the next-gen fireproof materials are expected to hamper the industry growth during the forecast period, as the raw materials for these eco-friendly compositions are relatively at high price rates compared to traditional fireproof materials, which can create a growth barrier for small and medium-sized businesses in the coming years. Also, the several certification compatibilities can create product delays, as per the recent industry observation.

Regional Insights

Asia Pacific dominated the market in 2024, akin to the increased advanced construction activities in the current period. As the regional countries such as China, India, and Southeast Asia are seen under the increased awareness of fire safety, which is majorly leading the market growth in the region recently. Moreover, the regional government is observed under the implementation of stricter fire safety rules and regulations, which provide wide attention towards the next generation of fireproof materials in the region nowadays.

What Role Does China’s Construction Boom Play in Fireproof Materials?

China maintained its dominance in the next-gen fireproof market, owing to the presence of the heavy automotive, construction, and electronics industries in the country. The government of China is seen as aggressively pushing for the safety and sustainable building initiatives in recent years, which has continuously provided a sophisticated consumer base to the manufacturer in the past few years. Furthermore, having access to advanced technology, the country's major companies are putting investment in R&D activities for the production of innovative materials, as per the recent survey.

North America is expected to capture a significant share of the market during the forecast period, owing to high investment in infrastructure advancements and the smarter safety regulations. The region has the major sectors where fireproof materials are considered the most crucial materials, such as the construction, aerospace, defense, and electric vehicle sectors. As these sectors expand, the demand for fireproof materials will increase rapidly, as per future expectations. Also, the region has smart homes policies that are under continuous update of safety rules, expected to drive the industry demand in the coming years.

Can Green Building Codes Propel United States Fireproofing Demand?

The United States is expected to rise as a dominant country in the North American region in the coming years, owing to the presence of safety regulatory bodies such as the NFPA, FEMA, and OSHA. Moreover, the adoption of green building initiatives and energy-efficient buildings is expected to support industry growth in the coming years, as per the current market condition survey.

Material Type Insights

How the Intumescent Materials Segment Dominated the Next-Gen Fireproof Materials Market in 2024?

The intumescent materials segment held the largest share of the market in 2024, due to its being considered the ideal material in the construction and industrial applications in the current period. As having excellent protection abilities from fire and high temperatures, the intumescent materials gained major industry share in recent years. Also, these materials are commonly seen in common steel structures, coatings, and walls to slow down fire spread, which has led to their potential over the past few years.

The nanocomposite materials segment is seen to grow at a notable rate during the predicted timeframe, owing to having superior fire resistance, while providing lightweight and eco-friendly properties. The increased awareness of sustainability has provided immense attention in recent years. Moreover, the increasing government push for eco-friendly initiatives will drive industry growth significantly, as per industry expectations.

Application Insights

Why Construction & Building Materials Segment Dominated the Next-Gen Fireproof Materials Market by Form Type?

The construction & building materials segment held the largest share of the next-gen fireproof materials market in 2024, akin to fire safety is a critical requirement in residential, commercial, and industrial structures. Building codes worldwide now demand the use of fire-resistant materials in walls, roofs, and structural components. With rapid urbanization and growing high-rise construction, especially in developing regions, fireproof materials like coatings, boards, and panels are in high demand. Developers prioritize safety and durability, making next-gen fireproof materials a core part of modern construction. The combination of regulatory pressure and public awareness has made construction the leading application for fireproof materials globally.

The automotive & transportation segment is expected to grow at a notable rate because of the rising demand for fire-resistant materials in electric vehicles, aviation, and public transportation. As electric vehicles (EVs) become more common, the need for fireproof battery casings, wiring, and insulation is growing. Similarly, aircraft and trains require light yet fire-retardant materials to ensure passenger safety. Stricter fire safety regulations and the shift toward sustainable, high-performance components are driving innovation in this sector. As manufacturers prioritize lightweight, efficient, and safe materials, next-gen fireproof technologies will see significant adoption in transport industries.

Recent Developments

- In November 2024, Clarient introduced its latest flame retardant called the melamine-free flame retardant. This is mainly designed for intumescent coating as per the report published by the company. Moreover, this newly launched retardant can meet the stringent modern industry standards while giving superior fire resistance, as per the company's claim. (Source: www.coatingsworld.com)

- In March 2025, Hempel launched the next-gen epoxy recently. The newly launched epoxy is named the Hempafire Extreme 550. This epoxy has better fire resistance and is mainly designed for cellulosic fires, as per the report published by the company. (Source: www.pcimag.com)

Top Companies list

- 3M Company

- BASF SE

- Morgan Advanced Materials

- DuPont de Nemours, Inc.

- Saint-Gobain S.A.

- Owens Corning

- Hilti Group

- Akzo Nobel N.V.

- Sika AG

- Rockwool International A/S

- PPG Industries, Inc.

- Hempel A/S

- RPM International Inc.

- Etex Group

- Kingspan Group

- Promat International N.V.

- Unifrax (now Alkegen)

- The Sherwin-Williams Company

- Isolatek International

- ThermoDyne

Segment Covered

By Material

- Intumescent Materials

- Ammonium polyphosphate-based

- Melamine-based

- Pentaerythritol-based

- Ceramic-based Fireproof Materials

- Silicon carbide (SiC)

- Alumina (Al₂O₃)

- Zirconia (ZrO₂)

- Fiberglass and Mineral Wool

- E-glass

- S-glass

- Stone wool

- Slag wool

- Carbon-based Fireproof Materials

- Carbon foams

- Graphene-infused composites

- Coatings and Paints

- Intumescent coatings

- Ablative coatings

- Thermal barrier coatings (TBCs)

- Non-halogenated Polymers

- Polyetheretherketone (PEEK)

- Polyimides

- Polyphenylene sulfide (PPS)

- Others

- Aerogels

- Bio-based fireproof materials

- Nanocomposite materials

By Application

- Construction & Building Materials

- Panels & Claddings

- Insulation (internal/external)

- Sealants & Fillers

- Aerospace & Defense

- Cabin interiors

- Engine components

- Thermal shields

- Automotive & Transportation

- Battery enclosures (EVs)

- Interior components

- Thermal protection systems

- Electronics & Electrical

- Circuit boards

- Cables and insulation

- Enclosures & casings

- Industrial Equipment

- Ovens/furnace linings

- Pipelines & valves

- High-temperature gaskets

- Oil & Gas

- Offshore structures

- Flare stacks

- Fire barriers

- Textiles & Apparel

- Protective clothing

- Curtains & upholstery

- Military-grade apparel

- Others

By Region

- North America

- U.S.

- Mexico

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Asia Pacific

- China

- India

- Japan

- South Korea

- Central & South America

-

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- UAE