Content

Mechanical & Chemical Recycling of Polyethylene Market Size and Share 2034

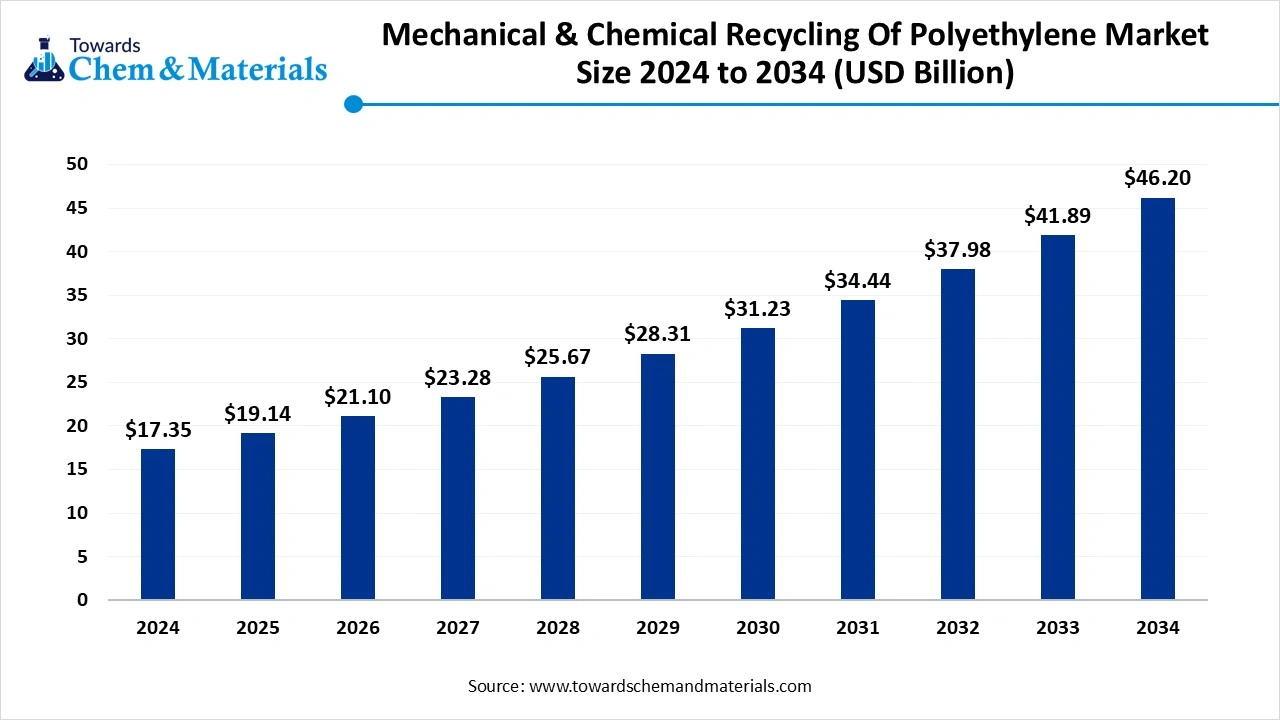

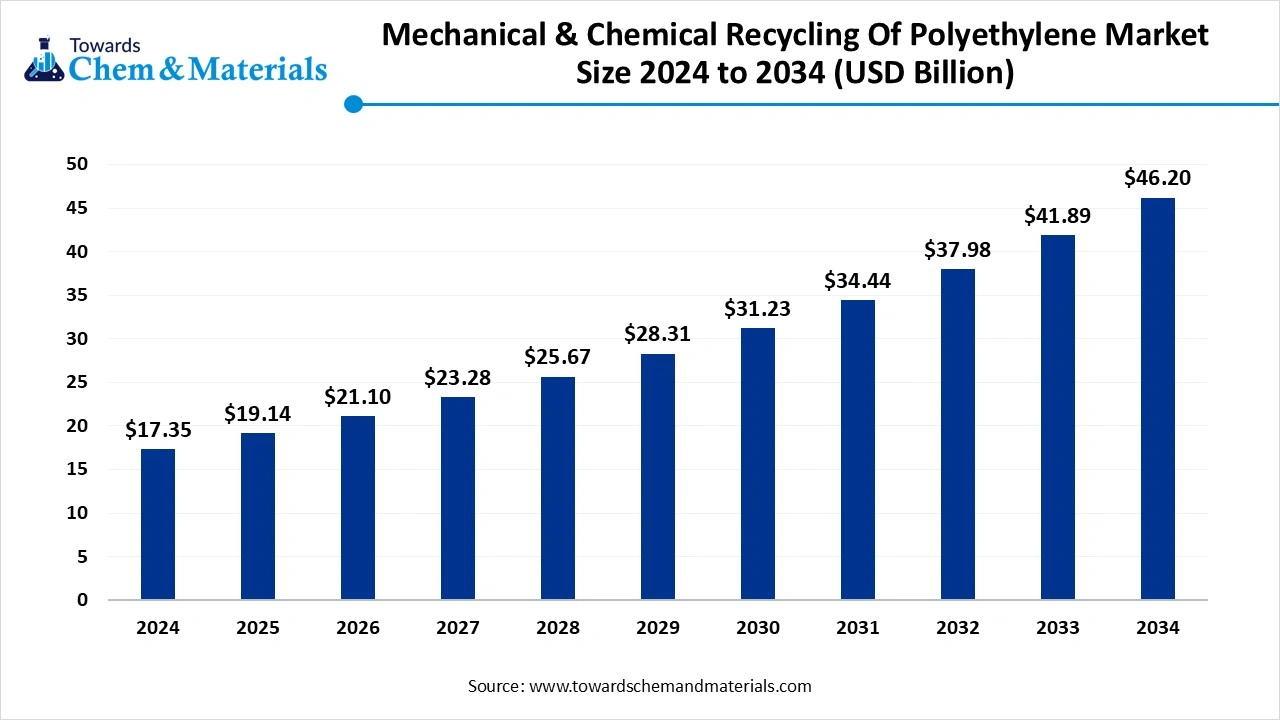

The global mechanical & chemical recycling of polyethylene market was valued at approximately USD 17.35 billion in 2024 and is projected to grow at a CAGR of 10.29% from 2025 to 2034, reaching a value of USD 46.20 billion by 2034. Sustainability initiatives by global governments and increased need for recycled

Key Takeaways

- The mechanical & chemical recycling of polyethylene market in Europe accounted for the largest revenue share of 35.15% in 2024. , akin to the stringent regulatory frameworks, strong institutional support, and high consumer awareness in the region.

- The mechanical & chemical recycling of polyethylene market in Asia Pacific is projected to grow at the fastest CAGR of 10.75% from 2025 to 2034., akin to rising plastic consumption, growing urban populations, and strengthening environmental policies.

- By recycling type, the Mechanical recycling dominated the industry in terms of revenue, accounting for a market share of 65.17% in 2024., akin to its established infrastructure, lower operational costs, and simpler processing methods.

- By recycling type, the chemical recycling segment is expected to grow at the fastest CAGR of 11.3% over the forecast period.the predicted timeframe due to its addressing key limitations of mechanical methods, specifically with contaminated, multi-layered, or degraded polyethylene waste.

- By application, the Packaging was the largest & fastest-growing application segment in the market. In terms of revenue, it accounted for a market share of 35.67% in 2024, akin to its massive consumption of polyethylene in both flexible and rigid formats in the current period.

- By application, the automotive segment is expected to experience notable mechanical & chemical recycling of polyethylene market growth in the future, owing to its sudden shift toward lightweighting and sustainability.

Regulatory Push and Technological Advancement Fuel Growth in industry

The industry is seen as undergoing a significant transformation, supported by sustainability-driven policies and rising plastic waste volumes in the current period. Moreover, mechanical recycling continues to dominate, akin to its cost-effectiveness, while chemical recycling is gaining momentum for its ability to process contaminated or mixed plastic streams. The mechanical & chemical recycling of polyethylene market is witnessing heavy investments in advanced sorting, depolymerization, and purification technologies to enhance recycling efficiency.

Furthermore, industries such as packaging, automotive, and consumer goods are increasingly adopting recycled polyethylene to meet economic goals. This increasing demand is encouraging manufacturers to increase operations volumes and form strategic partnerships to secure consistent feedstock and improve material quality for the future period.

The increasing regulatory initiatives from several governments to reduce plastic waste and boost recycled content in end-use products are expected in the current period. Also, governments across regions are enforcing stricter mandates for sustainability compliance, encouraging companies to integrate recycled polyethylene into their manufacturing streams. This resulted in higher demand for both mechanically and chemically recycled materials that meet performance standards. Increased public awareness and brand commitments toward greener packaging solutions are contributing to mechanical & chemical recycling of polyethylene market growth in recent years.

Market Trends

- The sudden shift toward monomaterial packaging designs, particularly in the flexible packaging segment, is spearheading industry growth in the current period. Moreover, brands and converters are increasingly adopting single-polymer solutions to simplify recycling processes and reduce contamination in waste streams. This change supports both mechanical and chemical recycling pathways by improving quality and processing efficiency. The trend is particularly strong in FMCG and e-commerce packaging, where demand for recyclable materials is high.

- Advanced sorting systems using AI, near-infrared (NIR) spectroscopy, and robotics are driving the mechanical & chemical recycling of polyethylene market growth while reshaping how polyethylene waste is identified and separated in the current period. Technologies enable higher purity rates and better segregation of high- and low-density polyethylene streams, which directly improves recycling efficiency. This trend is enabling recyclers to reduce contamination and increase output quality, aligning with brand demand for high-grade recycled content. As adoption grows, operational costs are gradually declining, making high-tech sorting a viable investment in the future, as per observation.

- Decentralized recycling, where small- to medium-scale facilities process polyethylene waste locally, is gaining traction in the current period. Also, this model reduces transportation emissions, creates localized supply chains, and strengthens feedstock access in some of the regions. Moreover, these setups often focus on mechanical recycling and serve localized industries such as agriculture or regional packaging.

- Chemical recycling technologies such as pyrolysis and solvolysis have gained heavy attention in recent years. These methods enable the breakdown of complex and contaminated plastics into virgin-equivalent polymers or fuels. With growing support from petrochemical firms and packaging giants, pilot facilities are now transitioning into commercial operations.

Market Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 19.14 Billion |

| Expected size by 2034 | USD 46.20 Billion |

| Growth Rate from 2025 to 2034 | CAGR 10.29% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 -2034 |

| Dominant Region | Europe |

| Segment Covered | By Recycling Type, By Application, By Region |

| Key Companies Profiled | KW Plastics, Veolia, Biffa, Plastipak, MBA Polymers, Loop Industries, Brightmark, Plastic Energy, Eastman Chemical, Agilyx, Dow Inc. |

Market Opportunity

Strategic Integration and Material Advancements Reshape the Recycled Polyethylene Industry

Integration of recycled polyethylene into high-performance applications such as automotive components, industrial containers, and durable consumer goods is expected to create significant opportunities for mechanical & chemical recycling of polyethylene market in the coming years. Advances in purification and blending technologies have improved the consistency and mechanical strength of recycled material, making it suitable for demanding environments.

Vertical integration presents a strategic opportunity for manufacturers to control quality, cost, and supply continuity in recycled polyethylene in the future as per industry observation. By investing in or acquiring sorting, washing, and pelletizing operations, companies can ensure a steady supply of raw material while optimizing downstream processing, which can create significant growth opportunities for the market.

Market Challenge

Quality Gaps in Input Materials Undermine Recycled Polyethylene Output Standards

The inconsistency of feedstock quality and availability is expected to hamper the mechanical & chemical recycling of polyethylene market potential in the coming years. For mechanical recyclers, inconsistent input quality can result in inferior end-products, affecting customer satisfaction. For chemical recyclers, unpredictable volumes of suitable waste challenge the economics of scaling. This lack of feedstock is forcing recyclers to invest more in sorting and preprocessing, raising costs and reducing margins.

Regional Insights

Europe dominated the mechanical & chemical recycling of polyethylene market in 2024, akin by the stringent regulatory frameworks, strong institutional support, and high consumer awareness in the region. The European Union’s waste directives and aggressive plastic recycling targets have accelerated investment in both mechanical and chemical recycling infrastructure in the current period. Countries across the region are seen integrating closed-loop systems, pushing industries to shift toward post-consumer recycled (PCR) materials. Moreover, corporate commitments to sustainable packaging are influencing polyethylene recovery and reuse is contributing to industry growth. These region-wide initiatives have collectively established Europe as dominant in recycling technologies, innovation, compliance, and environmental responsibility across the manufacturing and waste management sectors in the region.

Germany Leads Recycling Innovation Through Strong Infrastructure and Public Engagement, Advanced waste segregation systems and high recycling rates are driving Germany’s growth. The country’s dual bin system and deposit refund schemes promote efficient material recovery at the consumer level. Moreover, Germany’s engineering strength is seen in supporting rapid upward of chemical recycling technologies, creating a balanced ecosystem of mechanical and advanced recycling. From the regional countries, Germany is creating industry partnerships and R&D, leading innovation across its recycling industry, as per the observation. This combination of robust infrastructure, public participation, and industrial capability places Germany at the forefront of industry in the current period.

Asia Pacific expects the fastest growth in the mechanical & chemical recycling of polyethylene market during the forecast period, akin by rising plastic consumption, growing urban populations, and strengthening environmental policies. Governments are investing in recycling ecosystems as part of long-term sustainability goals, while industries increasingly adopt recycled inputs to meet needs. Moreover, infrastructure development across Southeast Asia, combined with rapid industrialization, is enabling economies to increase mechanical and chemical recycling. In addition, the region is gaining advantage from cost-effective labor and expanding technology adoption.

China Expands Recycling Capabilities with Strategic Investments in Chemical Technologies, China is expected to rise as a dominant country in the Asia Pacific in the coming years, owing to its aggressive push toward improving economic practices following the national policy. Also, the country has significantly expanded its domestic recycling infrastructure with plastic waste imports and internal material in the current period. From the other countries, China is investing heavily in chemical recycling startups and smart waste sorting systems, backed by state funding and policy initiatives. Local manufacturers are also adopting green standards under national plans, integrating recycled polyethylene into consumer and industrial goods.

Segmental Insights

Recycling Type Insights

The mechanical recycling segment held the largest share of the mechanical & chemical recycling of polyethylene market in 2024, akin to its established infrastructure, lower operational costs, and simpler processing methods. Moreover, industries prefer this method for post-consumer packaging waste as it retains polymer properties while reducing environmental impact. The process is energy-efficient and cost-effective, supporting economic initiatives without significant technological investments, which is driving the segment growth in the current period. Also, it remains the preferred choice for rigid and flexible polyethylene applications where purity and performance are less stringent, particularly in packaging and agricultural films.

The chemical recycling segment is seen to grow at a notable rate during the predicted timeframe due to its addressing key limitations of mechanical methods, specifically with contaminated, multi-layered, or degraded polyethylene waste. It breaks plastics down into monomers or fuels, enabling the production of virgin-quality materials. As regulatory initiatives push for higher recycling rates, chemical recycling offers an ideal solution for hard-to-recycle plastics in the future. Investments in depolymerization and pyrolysis technologies are growing, driven by demand for sustainability in high-performance applications like food-grade packaging, which is expected to contribute to segment growth in the future.

Application Insights

The packaging segment dominated the mechanical & chemical recycling of polyethylene market with the largest share in 2024, akin to its massive consumption of polyethylene in both flexible and rigid formats in the current period. Moreover, consumer goods, food, and e-commerce sectors drive this demand, generating large volumes of recyclable waste. Mechanical recycling technologies allow the processing of packaging waste, making collection and processing economically viable. Regulatory initiatives and brand commitments toward sustainable packaging further incentivize recycling in this segment. As a result, packaging remains a prominent driver for recycled polyethylene use, offering consistent end-use demand.

The automotive segment is expected to experience notable mechanical & chemical recycling of polyethylene market growth in the future, owing to its sudden shift toward lightweighting and sustainability. As electric vehicle adoption rises, automakers are increasingly using high-performance recycled plastics for interior and other components. Chemical recycling also enables the production of high-purity resins with mechanical strength and thermal stability suitable for automotive standards. Moreover, rising governmental regulatory pressures on vehicle recyclability and carbon footprint reduction can accelerate material innovation in the future.

Recent Developments

- In March 2025, Agilyx and Carlos Monreal created a partnership for the development of the Chemical recycling feedstock called Plastyx. Moreover, the main focus of Plastyx is to secure plastic waste of 200,000 tons by the end of 2025, as per the report published by the company. (Source- chemanalyst)

- In January 2025, PolyCycl introduced its latest patented technology for plastic recycling in India. According to the report published by the company, this technology is secured by multiple international patents. (Source: thehindu )

- In June 2024, Interzero and Coveris created a strategic collaboration. The motive behind this partnership is to recycle plastic to achieve sustainable goals in the coming years. (Source : euwid )

Top Companies List

- KW Plastics

- Veolia

- Biffa

- Plastipak

- MBA Polymers

- Loop Industries

- Brightmark

- Plastic Energy

- Eastman Chemical

- Agilyx

- Dow Inc.

Segment Covered in the Report

By Recycling Type

- Mechanical Recycling

- Chemical Recycling

By Application

- Packaging

- Automotive

- Building & Construction

- Electrical & Electronics

- Textile

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- Japan

- China

- India

- Australia

- South Korea

- Thailand

- Latin America

- Brazil

- Argentina

- The Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

- Kuwait