Content

Peracetic Acid Market Size and Growth 2025 to 2034

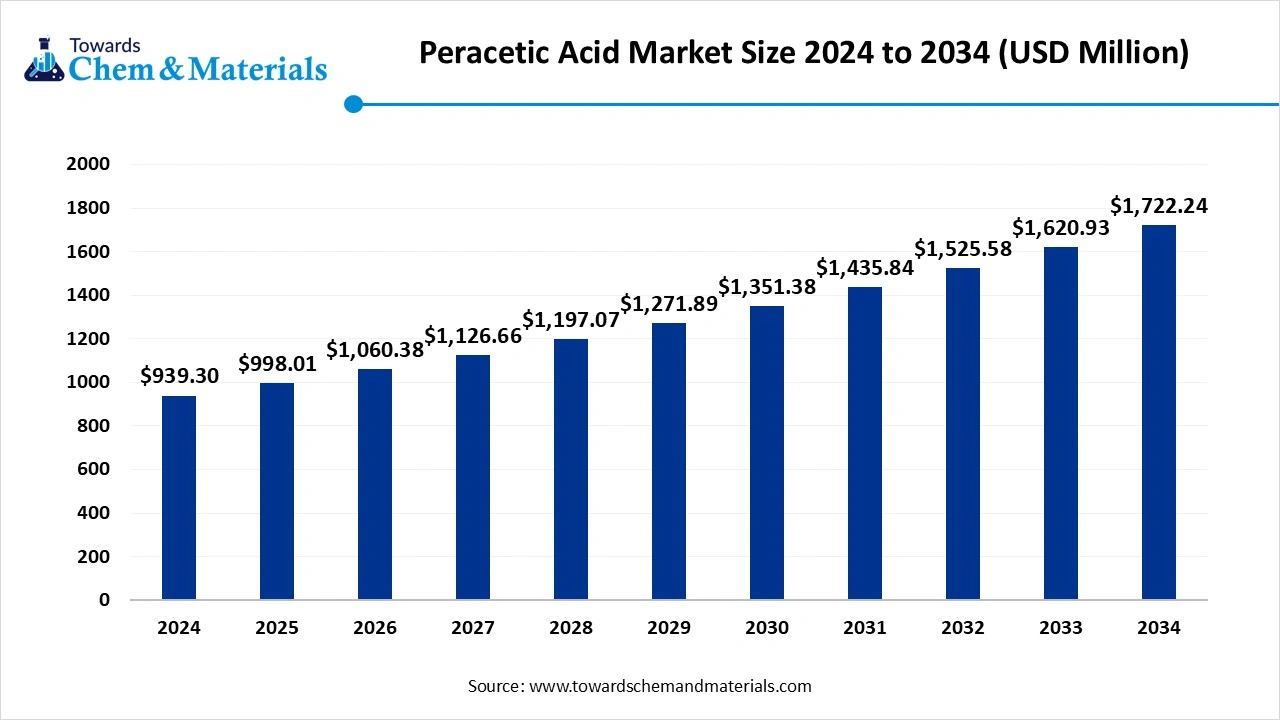

The global peracetic acid market size was valued at USD 939.30 million in 2024 and is estimated to reach around USD 1722.24 million by 2034, exhibiting a compound annual growth rate (CAGR) of 6.25% during the forecast period 2025 to 2034. The growing healthcare sector, increasing water pollution concerns, and stringent food safety regulations drive the market growth.

Key Takeaways

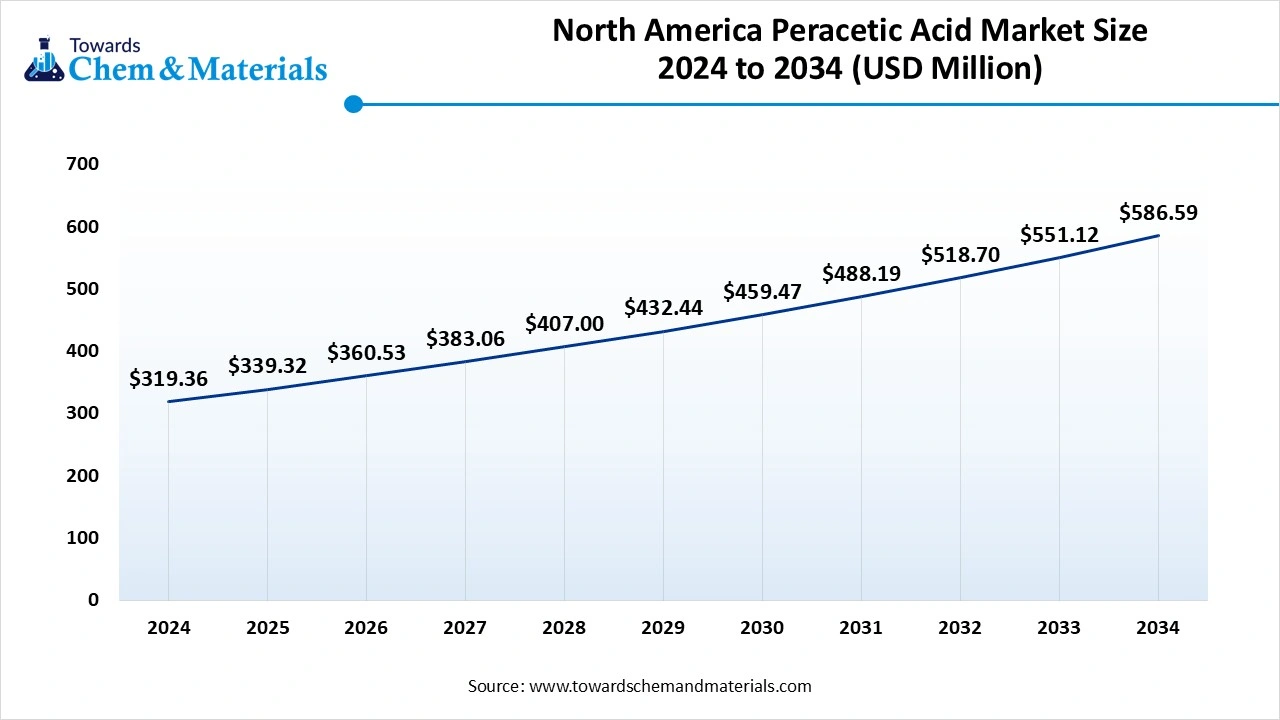

- The North America peracetic acid market size was estimated at USD 319.36 million in 2024 and is expected to reach USD 586.59 million by 2034, growing at a CAGR of 6.27% from 2025 to 2034.

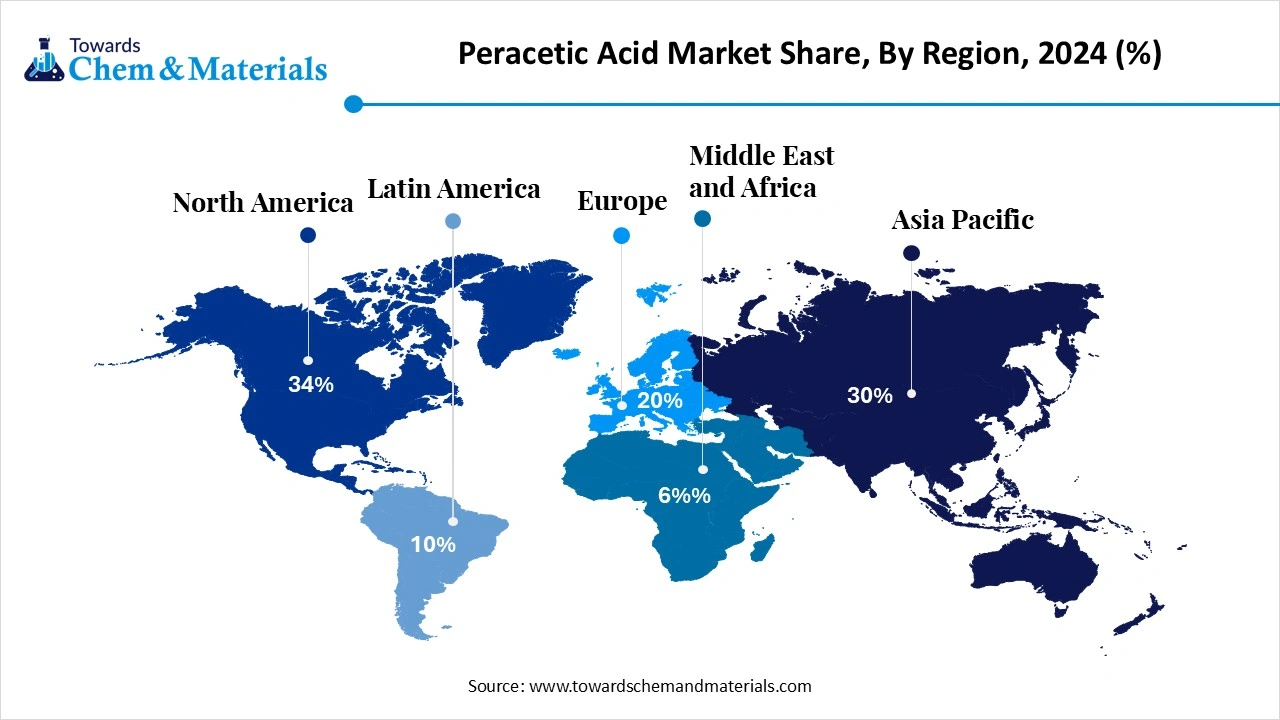

- By region, Asia Pacific is growing at the fastest CAGR in the market during the forecast period due to the increasing demand for food & beverages.

- By grade, the 5-15% PAA solution segment held a 45% share in the market in 2024 due to the growing demand for killing various microorganisms.

- By grade, the >15% PAA solution segment is expected to grow at the fastest CAGR in the market during the forecast period due to the increasing demand for general disinfection.

- By application, the disinfectant segment held a 30% share in the market in 2024 due to the growing demand for controlling bacterial contamination.

- By application, the sterilant segment is expected to grow at the fastest CAGR in the market during the forecast period due to the increasing demand for sterilizing medical devices.

- By end-use industry, the food & beverage segment held a 38% share in the market in 2024 due to the growing demand for processed foods.

- By end-use industry, the healthcare & pharmaceuticals segment is expected to grow at the fastest CAGR in the market during the forecast period due to the increasing focus on maintaining hygiene in healthcare infrastructure.

- By form, the liquid segment held a 92% share in the market in 2024 due to its easy application and cost effectiveness.

- By form, the powder segment is expected to grow at the fastest CAGR in the market during the forecast period due to the growing demand in agricultural applications.

- By concentration, the 5-15% segment held a 47% share in the market in 2024 due to the growing demand across the food processing industry.

- By concentration, the 15-25% segment is expected to grow at the fastest CAGR in the market during the forecast period due to the increasing sterilization applications.

- By distribution channel, the direct sales segment held a 60% share in the peracetic acid market in 2024, due to the growing demand for customized PAA solutions.

- By distribution channel, the online/e-commerce segment is expected to grow at the fastest CAGR in the market during the forecast period due to the growing focus on online ordering.

- By packaging type, the HDPE drums segment held a 50% share in the market in 2024, due to the focus on maintaining packaging integrity.

- By packaging type, the IBC totes segment is expected to grow at the fastest CAGR in the market during the forecast period due to the increasing demand for effective transportation.

Peracetic Acid: Power Behind Eco-Friendly Sanitizers and Disinfectants

Peracetic acid is a colorless, organic compound with a chemical formula CH3COOH. It is a powerful oxidizing agent that breaks down into biodegradable by-products. The concentration of peracetic acid ranges from 5% to 40%. It is a powerful disinfectant against various microorganisms like viruses, bacteria, and fungi. Peracetic acid breaks down into substances like water, acetic acid, and oxygen. It has a vinegar-like, pungent odor and is commonly available in liquid form. The various concentrations of peracetic acid are used in different sectors for applications like bleaching, disinfection, sterilization, chemical synthesis, sanitization, and hygiene.

The increasing demand for disinfectants in various sectors is fueling demand for peracetic acid. The growing focus on sterilization, infection control, and hygiene fuels demand for peracetic acid. Factors like the growing healthcare sector, stricter food safety regulations, increasing demand for water treatment, and growing demand across the pulp & paper industry contribute to the peracetic acid market growth.

- India exported 419,827 shipments of peracetic acid.(Source: www.volza.com)

Who is the Leading Supplier of Peracetic Acid in the World?

| Company Name | Constituent Percentage | Shipments |

| Exide Industries Ltd. | 23% | 19,127 |

| Merck Life Science KGaA | 12% | 10,195 |

| TOKYO CHEMICAL INDUSTRIES CO, LTD | 9% | 7,770 |

Growing Demand for Wastewater Treatment Drives Market Growth

The rapid urbanization and growing industrialization increase demand for peracetic acid for wastewater treatment. The increasing demand for safe and clean water increases the adoption of peracetic acid for wastewater treatment. The growing wastewater discharge due to industrialization increases the demand for robust wastewater treatment. The stricter regulations about water quality increase the adoption of sustainable wastewater treatment, like peracetic acid.

The increasing demand for municipal drinking water treatment fuels demand for peracetic acid. The rising demand for removing harmful pollutants and microorganisms increases the adoption of peracetic acid for efficient water treatment. The growing population and rising demand for clean water increase the adoption of peracetic acid. The growing demand for wastewater treatment is a key driver for the growth of the market.

Market Trends

- Growing Demand for Various Foods: The increasing demand for various foods like seafood, meat, and poultry increases demand for peracetic acid for disinfecting. The increasing demand for processing food fuels the demand for peracetic acid for effective sanitization.

- Rising Expansion of the Agriculture Sector: The growing expansion of the agriculture sector increases demand for peracetic acid for applications like water management, crop protection, and post-harvest treatment. It is widely used as a disinfectant in storage facilities, irrigation systems, and equipment. The growing shift towards sustainable agriculture increases demand for peracetic acid.

- The Growing Demand for Disinfectants: The increasing demand for infection control and growing awareness about hygiene increases demand for peracetic acid. The rising prevalence of infectious diseases fuels demand for peracetic acid disinfectant.

Report Scope

| Report Attribute | Details |

| Market Size in 2025 | USD 998.01 Million |

| Expected Size by 2034 | USD 1722.24 Million |

| Growth Rate from 2025 to 2034 | CAGR 6.25% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | North America |

| Segment Covered | By Grade, By Application, By End-Use Industry, By Form, By Concentration, By Distribution Channel, By Packaging Type, By Region |

| Key Companies Profiled | Solvay S.A., Evonik Industries AG, Ecolab Inc., Kemira Oyj, PeroxyChem LLC (acquired by Evonik), Airedale Chemical, Enviro Tech Chemical Services, Inc., Seeler Industries, Christeyns, Acuro Organics Limited, FMC Corporation, National Peroxide Limited, Balaji Chem Solutions, Biosan LLC, Lenntech B.V., Kersia Group, Quaron S.A., Mitsubishi Gas Chemical Company, Shandong Huatai Interox Chemical Co., Ltd., Zhejiang Jihua Group Co., Ltd. |

Market Opportunity

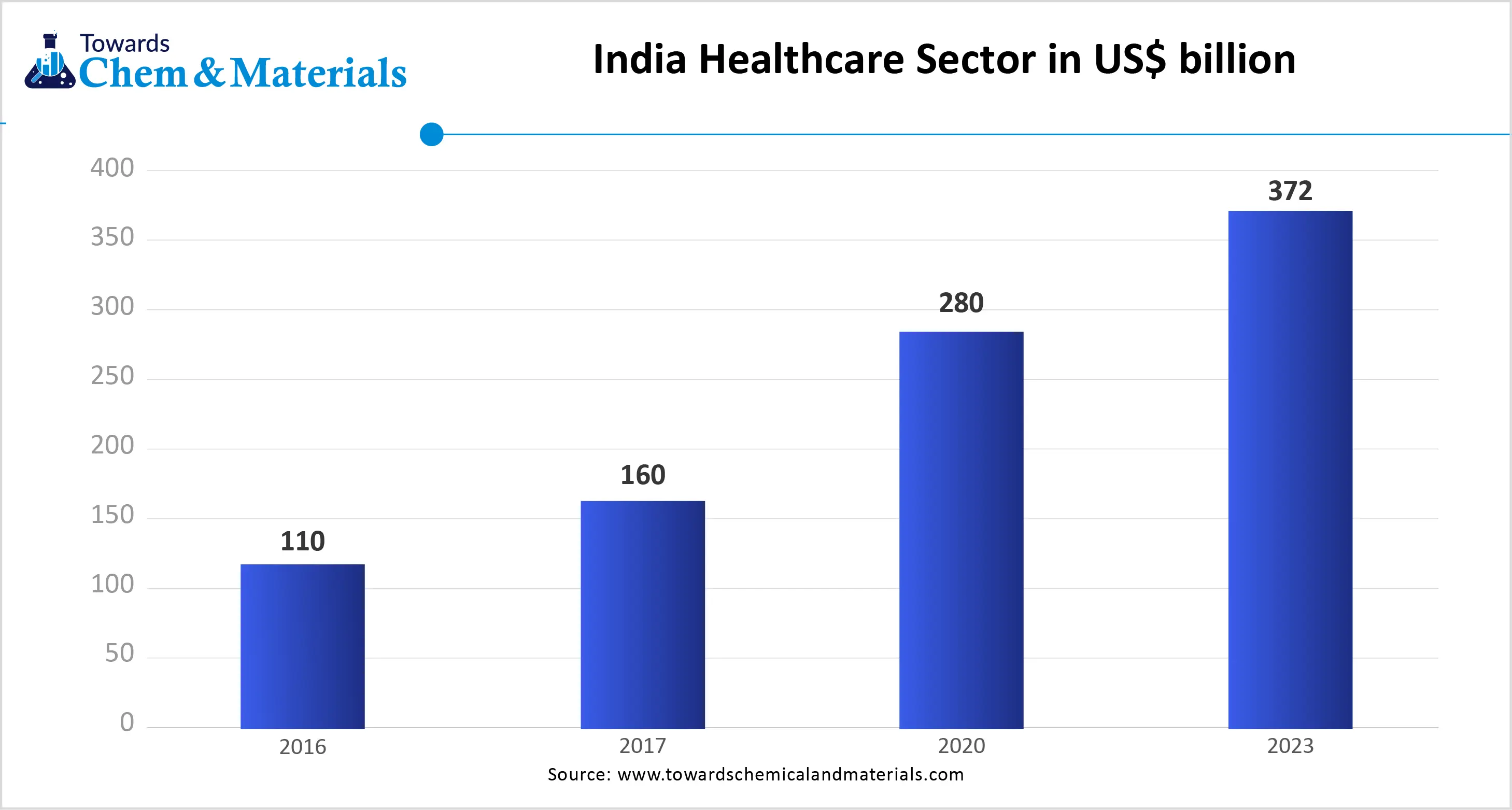

Growing Expansion of the Healthcare Sector Surge Demand for Peracetic Acid

The growing expansion of the healthcare sector in various regions increases demand for peracetic acid for various applications. The increasing expansion of clinics & new hospitals and stricter hygiene regulations in healthcare infrastructures fuel demand for peracetic acid. The increasing healthcare-related infections and focus on patient safety increase demand for peracetic acid for sanitization purposes. The need for sterilizing medical devices & instruments like dental equipment, endoscopes, and surgical tools fuels the adoption of peracetic acid to remove pathogens.

The increasing demand for surface disinfection in intensive care units, operating rooms, and patient rooms increases demand for peracetic acid to avoid infections. The focus on avoiding drug production contamination fuels demand for peracetic acid. The prevention of microorganisms like viruses, spores, bacteria, and fungi in healthcare facilities increases the adoption of peracetic acid. The growing expansion of the healthcare sector creates an opportunity for the peracetic acid market.

Market Challenge

High Production Cost Limits Expansion of Peracetic Acid Market

Despite several benefits of the peracetic acid in various industrial sectors, higher cost of production hampers the growth of the market. Factors like the requirement for specialized storage, the high cost of raw materials, and the complex manufacturing process are responsible for high production costs. The fluctuations in the cost of raw materials like acetic anhydride directly affect the market. The complex manufacturing process, like multi-step reactions, increases the production cost. The development bio-based synthesis process leads to higher cost. The need for specialized storage and handling to avoid degradation increases the cost. The safety concerns and stricter regulations increase the overall cost. The high production cost hampers the growth of the peracetic acid market.

Regional Insights

How North America Dominated the Peracetic Acid Market?

The North America peracetic acid market size was estimated at USD 319.36 million in 2024 and is anticipated to reach USD 586.59 million by 2034, growing at a CAGR of 6.27% from 2025 to 2034. North America has accounted highest revenue share of around 34% in 2024.

North America dominated the peracetic acid market in 2024. The growing demand for eco-friendly disinfection solutions increases the demand for peracetic acid. The well-established healthcare infrastructure fuels demand for peracetic acid to be used in sterilization applications, helping the market growth. The stricter hygiene and food safety standards increase demand for peracetic acid for disinfecting and sanitizing applications. The focus on modernizing water treatment fuels demand for peracetic acid. The increasing demand for food & beverages is fueling demand for peracetic acid for various purposes. The growing demand across sectors like water treatment, food safety, and healthcare sterilization drives the overall growth of the market.

The United States Peracetic Acid Market Trends

The United States is a major contributor to the market. The well-developed and advanced industrial infrastructure increases demand for peracetic acid. The increasing demand for eco-friendly disinfectants helps the market growth. The growing sectors like healthcare, food & beverage, and water treatment increase demand for peracetic acid. The stringent food safety regulations from the EPA and FDA increase demand for peracetic acid. The presence of key players like Evonik Industries, PeroxyChem, Solvay, and Kemira supports the overall growth of the market.

- The United States exported 344,852shipments of peracetic acid.(Source: www.volza.com)

Why is Asia Pacific the Fastest Growing in the Peracetic Acid Market?

Asia Pacific experiences the fastest growth in the market during the forecast period. The growing expansion of the food & beverage industry increases demand for peracetic acid for packaging and food processing purposes. The high demand for safe and clean water fuels demand for peracetic acid, helping the market growth. The growing number of healthcare facilities and hospitals increases demand for peracetic acid for disinfectant application. The stricter environmental and food safety regulations increase the adoption of peracetic acid. The availability of effective sanitization solutions and increasing awareness about hygiene drive the overall growth of the market.

What are the Trends of the Peracetic Acid Market in China?

China is a key contributor to the peracetic acid market. The well-established manufacturing across sectors like wastewater treatment, food & beverage, and pulp & paper increases demand for peracetic acid for various applications. The strong government support for green chemicals and environmental protection helps the market growth. The rapid urbanization and growing industrialization increase demand for peracetic acid. The growing expansion of industries like healthcare and food & beverage supports the overall growth of the market.

- COYFHEX LOGISTCS H K LTD is the leading supplier of peracetic acid in China.(Source: www.volza.com)

- China exported 572,100 shipments of peracetic acid.(Source: www.volza.com)

Segmental Insights

Grade Insights

Why did the 5-15% PAA Solution Segment Dominate the Peracetic Acid Market?

The 5-15% PAA solution segment dominated the peracetic acid market in 2024. The growing demand for killing viruses, spores, bacteria, and fungi increases the demand for 5-15% PAA solution. The stringent safety regulations increase adoption of 5-15% PAA solution to use in consumer products, helping the market growth. The 5-15% PAA solution is safe for use on surfaces and equipment. It helps to kill various microorganisms like fungi, bacteria, and viruses. The growing demand for disinfection of equipment in various sectors like agriculture, food processing, and healthcare drives the market growth.

The >15% PAA solution segment is the fastest growing in the market during the forecast period. The growing demand for general sanitation and disinfection increases the adoption of >15% PAA solution. The increasing need for tackling a wide range of microorganisms and pathogens fuels demand for >15% PAA solution. The increasing demand for sanitation in the food processing industry increases demand for >15% PAA solution. The increasing demand for the sterilization of medical instruments supports the overall growth of the market.

Application Insights

How Disinfectant Segment Held the Largest Share in the Peracetic Acid Market?

The disinfectant segment held the largest share in the peracetic acid market in 2024. The increasing demand for sanitation and hygiene in various industries increases the demand for disinfectants. The focus on broad-spectrum antimicrobial activity helps the market growth. The need for sanitizing food packaging, processing equipment, and surfaces fuels demand for disinfectants. The growing agriculture sector increases demand for disinfectants for controlling bacterial contamination, driving the overall growth of the market.

The sterilant segment experiences the fastest growth in the market during the forecast period. The increasing demand for sterilizing water treatment systems, medical instruments, and food processing equipment helps the market growth. The growing demand for the sterilization of processed foods fuels demand for peracetic acid sterilant. The rising use of sterile medical equipment increases demand for the peracetic acid sterilization method. The growing sterilization of medical equipment, like surgical instruments and endoscopes, supports the overall growth of the market.

End-Use Industry Insights

Which End-User Industry Dominated the Peracetic Acid Market in 2024?

The food & beverage segment dominated the peracetic acid market in 2024. The stricter food safety regulations and increasing focus on preventing foodborne diseases fuel demand for peracetic acid to kill pathogens. The increasing demand for sanitizing food packaging materials, cleaning equipment, and treating food products increases the adoption of peracetic acid, helping the market growth. The focus on reducing food waste and extending the shelf life of food products fuels demand for peracetic acid. The increasing expansion of the food & beverage industry fuels demand for peracetic acid. The rising demand for packaged & processed foods and consumer awareness about food safety drive the overall growth of the market.

The healthcare & pharmaceuticals segment is the fastest growing in the market during the forecast period. The increasing demand for sterilizing medical devices and instruments fuels demand for peracetic acid. The focus on maintaining hygiene in patient care and operating rooms increases the adoption of peracetic acid, helping the market growth. The stricter regulations in the healthcare & pharmaceutical industry fuel the adoption of peracetic acid for disinfection applications. The growing demand for peracetic acid in drug manufacturing facilities supports the overall growth of the market.

Form Insights

Why Liquid Form Held the Largest Share of the Peracetic Acid Market?

The liquid segment held the largest share in the peracetic acid market in 2024. The growing integration of liquid form in sprayers and water systems for disinfection & sanitization helps in the market growth. Liquid form is a cost-effective and preferred option in various applications. They are easy to apply, handle, and transport. They are highly effective against fungi, bacteria, and viruses. The growing demand across sectors like water treatment, healthcare, and food processing drives the overall growth of the market.

The powder segment experiences the fastest growth in the market during the forecast period. The increasing on-demand solution preparation fuels the adoption of powder form. The focus on convenience and ease of use in various industries increases demand for powder form, helping the overall market growth. The powder form is more concentrated and has a longer shelf life. It reduces waste and has more stability in certain conditions. The increasing demand in agriculture operations and healthcare facilities supports the overall market growth.

Concentration Insights

How 5-15% Concentration Dominated the Peracetic Acid Market?

The 5-15% segment dominated the peracetic acid market in 2024. The growing demand for killing viruses, spores, bacteria, and fungi in diverse settings increases the demand for a 5-15% concentration. It is cost-effective and offers good performance. The growing demand across industries like healthcare and food processing helps the market growth. It is safer for handling and does not require any safety equipment. The growing demand across applications like preventing microbial growth, disinfecting surfaces, and sanitizing equipment drives the overall market growth.

The 15-25% segment is the fastest growing in the market during the forecast period. The increasing demand for a higher level of sterilization and disinfection in various industries increases demand for 15-25% concentration. It is effective against a broad spectrum of microorganisms and is used in industrial settings. It has a high concentration of active ingredients and is cost-effective. The growing demand from wastewater treatment plants supports the overall growth of the market.

Distribution Channel Insights

How Direct Sales Segment Held the Largest Share in the Peracetic Acid Market?

The direct sales segment held the largest share in the peracetic acid market in 2024. The growing demand for customized and tailored PAA formulations increases demand for direct sales. The increasing focus on technical expertise and personalised service helps the market growth. The need for specialized knowledge and support increases demand for direct sales. The focus on promotional activities, control over pricing, and distribution channels fuels the adoption of direct sales. The growing demand for building trust and long-term relationships drives the market growth.

The online/e-commerce segment experiences the fastest growth in the market during the forecast period. The high availability of various peracetic acid products on online platforms helps the market growth. The focus on lower prices and competitive pricing increases the adoption of online/e-commerce platforms. The increasing online ordering and delivery, and the focus on lowering time, increase the adoption of online/e-commerce platforms. The availability of safety data sheets, detailed product information, and technical specifications supports the overall growth of the market.

Packaging Type Insights

Which Packaging Type Segment Dominated the Peracetic Acid Market?

The HDPE drums segment dominated the peracetic acid market in 2024. The focus on sustainability and growing environmental concerns increases demand for HDPE drums. The strong focus on effective transportation and production of peracetic acid increases demand for HDPE drums, helping the market growth. HDPE drums avoid contamination and maintain the integrity of the packaging. They are lightweight, shatterproof, leak-proof, and protect against UV radiation. They are an affordable and sustainable approach for packaging. The growing demand for HDPE drums across industries like healthcare, food processing, and water treatment drives the market growth.

The IBC totes segment is the fastest growing in the market during the forecast period. The strong focus on reliable storage and transportation of peracetic acid increases demand for IBC totes. They hold a higher volume of peracetic acid and help in saving time. They consist of safety features like overpressure prevention and venting devices to reduce the risk of spills. The increasing demand across large-scale industrial applications helps the market growth.

Recent Developments

- In May 2023, Evonik launched VIGOROX Trident peracetic acid for aquaculture to control water quality. The new product is approved by the U.S. EPA, and it can be applied when fish are present. The product breaks down into acetic acid, water, and oxygen.(Source: central-south-america.evonik.com)

Top Companies List

- Solvay S.A.

- Evonik Industries AG

- Ecolab Inc.

- Kemira Oyj

- PeroxyChem LLC (acquired by Evonik)

- Airedale Chemical

- Enviro Tech Chemical Services, Inc.

- Seeler Industries

- Christeyns

- Acuro Organics Limited

- FMC Corporation

- National Peroxide Limited

- Balaji Chem Solutions

- Biosan LLC

- Lenntech B.V.

- Kersia Group

- Quaron S.A.

- Mitsubishi Gas Chemical Company

- Shandong Huatai Interox Chemical Co., Ltd.

- Zhejiang Jihua Group Co., Ltd.

Segments Covered

By Grade

- <5% PAA Solution

- 5–15% PAA Solution (Standard)

- >15% PAA Solution (High Purity Grade)

- Food Grade

- Pharmaceutical Grade

- Industrial Grade

By Application

- Disinfectant

- Sterilant

- Sanitizer

- Oxidizer

- Bleaching Agent

- Reagent in Chemical Synthesis

By End-Use Industry

- Food & Beverage

- Meat & Poultry Processing

- Dairy Processing

- Beverages

- Fruits & Vegetables

- Healthcare & Pharmaceutical

- Medical Equipment Sterilization

- Surface Disinfection

- Water Treatment

- Municipal Wastewater

- Industrial Effluent

- Drinking Water Treatment

- Pulp & Paper

- Pulp Bleaching

- Agriculture

- Post-harvest Treatment

- Irrigation Water Disinfection

- Others (Cosmetics, etc.)

By Form

- Liquid

- Powder/Granular (Stabilized)

- Tablets

By Concentration

- <5%

- 5–15%

- 15–25%

- >25%

By Distribution Channel

- Direct Sales (OEMs, Industries)

- Distributors / Dealers

- Online / E-commerce Channels

By Packaging Type

- IBC Totes

- HDPE Drums

- Cans & Bottles

- Bulk Tankers

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- South Africa

- UAE

- Saudi Arabia

- Kuwait