Content

Poly (Butylene Adipate-Co-Terephthalate) Market Size and Growth 2025 to 2034

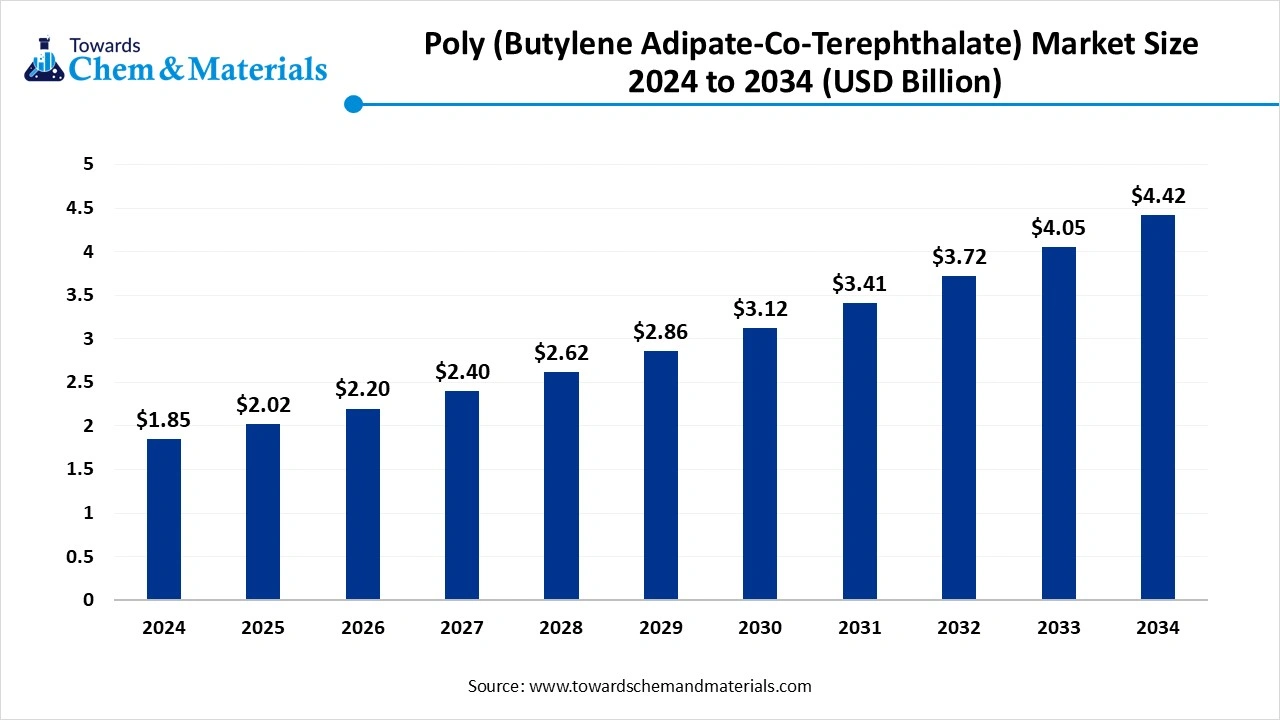

The global poly (butylene adipate-co-terephthalate) market size accounted for USD 1.85 billion in 2024 and is predicted to increase from USD 2.02 billion in 2025 to approximately USD 4.42 billion by 2034, expanding at a CAGR of 9.11% from 2025 to 2034. The growing demand for biodegradable materials and versatile applications like packaging, agriculture, and consumer goods drives the market growth.

Key Takeaways

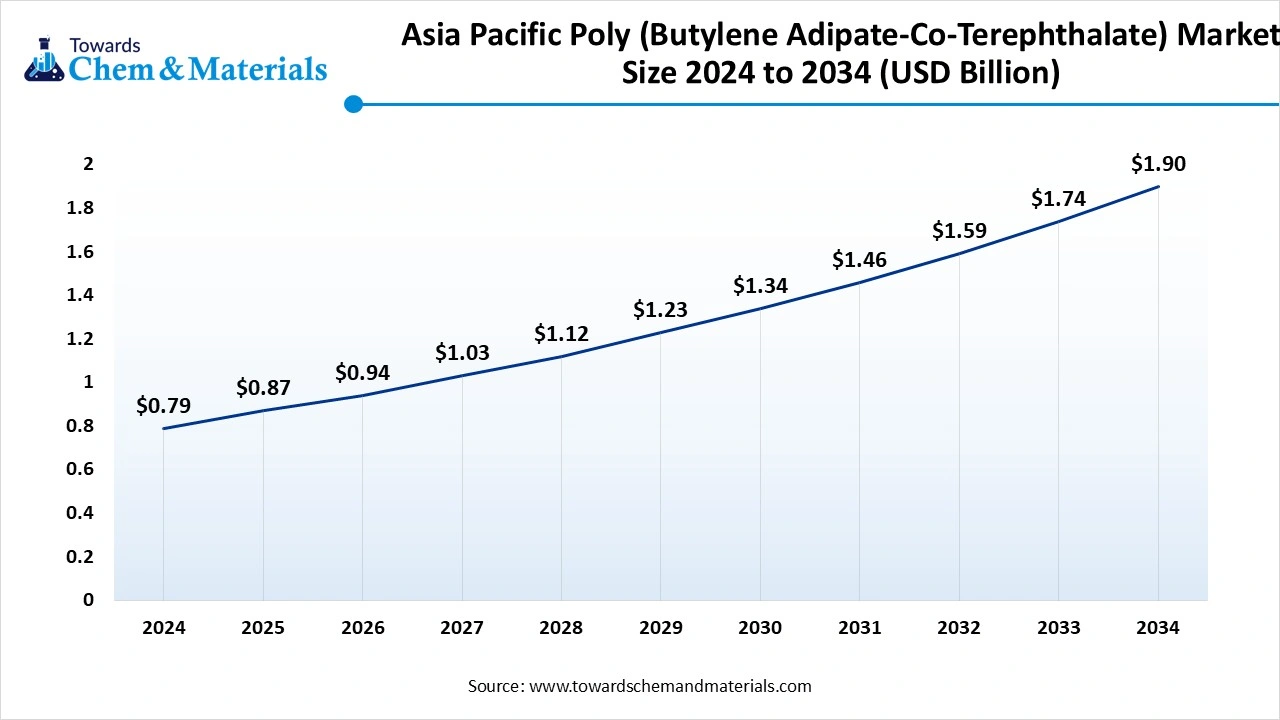

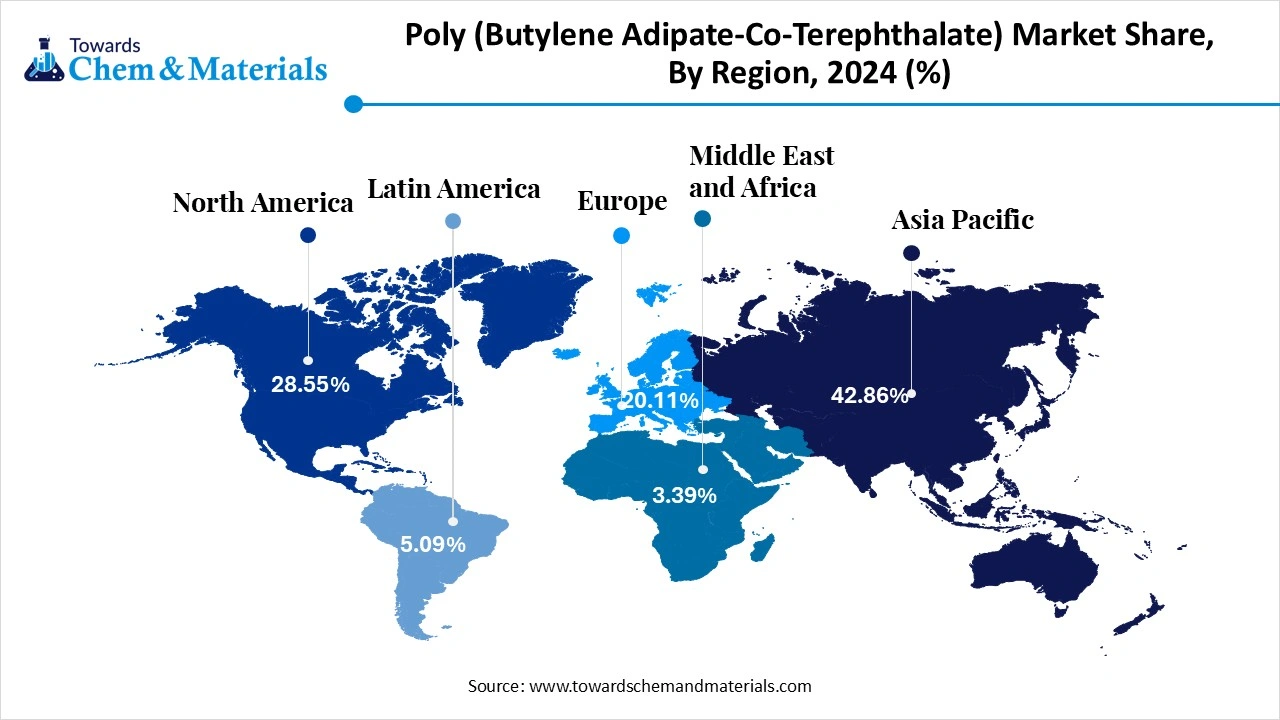

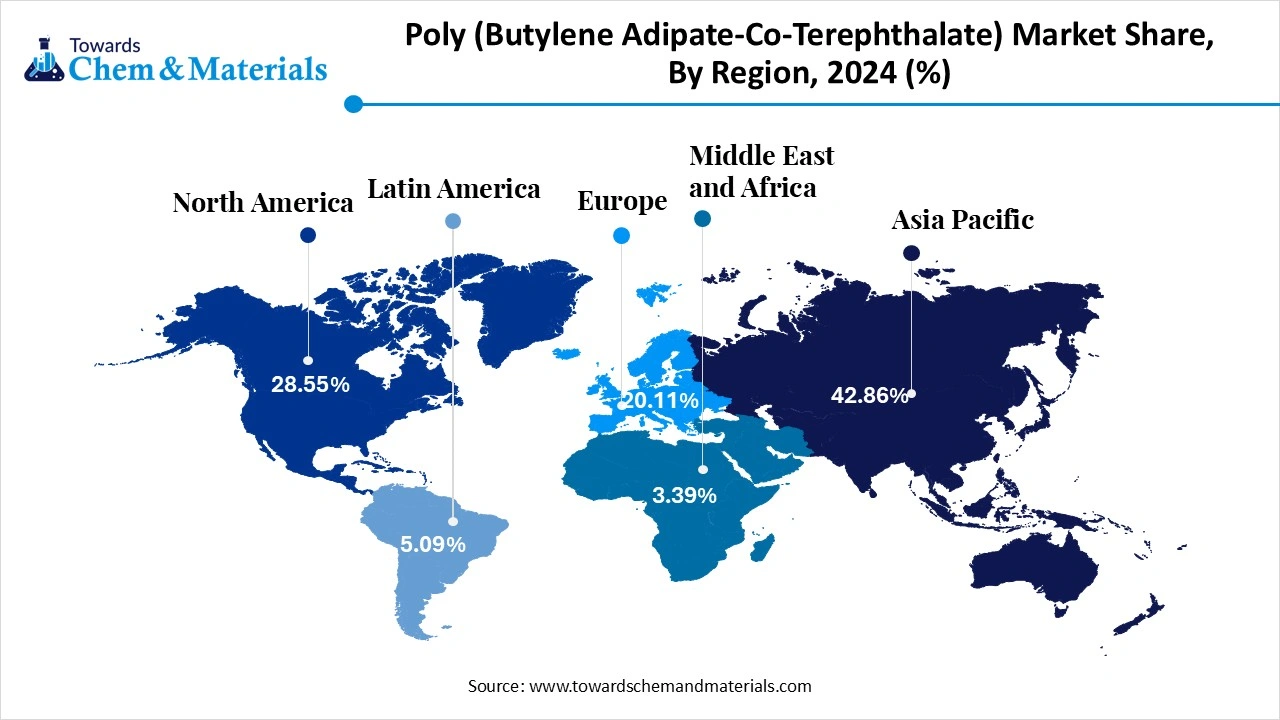

- The poly (butylene adipate-co-terephthalate) market in Asia Pacific accounted for the largest revenue share of 42.86% in 2024. due to the growing demand for packaged goods.

- The North America is growing at the fastest CAGR in the market during the forecast period due to the rapid growth in the e-commerce sector.

- By grade, the extrusion grade segment dominated the market share of 46.14% in 2024 due to growing demand for agriculture mulch films and sheets.

- By grade, the thermoforming grade segment is expected to grow at a significant CAGR in the market during the forecast period due to the increasing demand from the food & beverage industry.

- By application, the composite bags segment led the market in 2024 due to the rising demand for food packaging.

- By application, the mulch films segment is expected to grow at a significant CAGR in the market during the forecast period due to the growing demand from the agricultural sector.

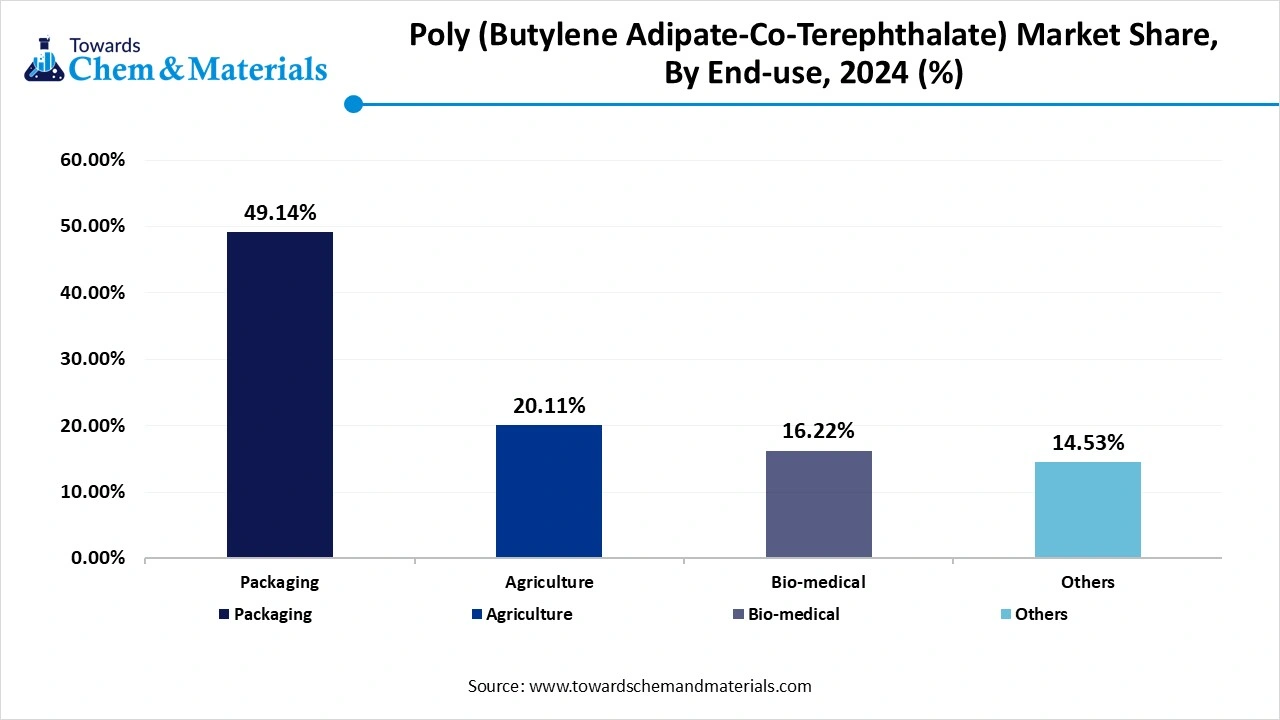

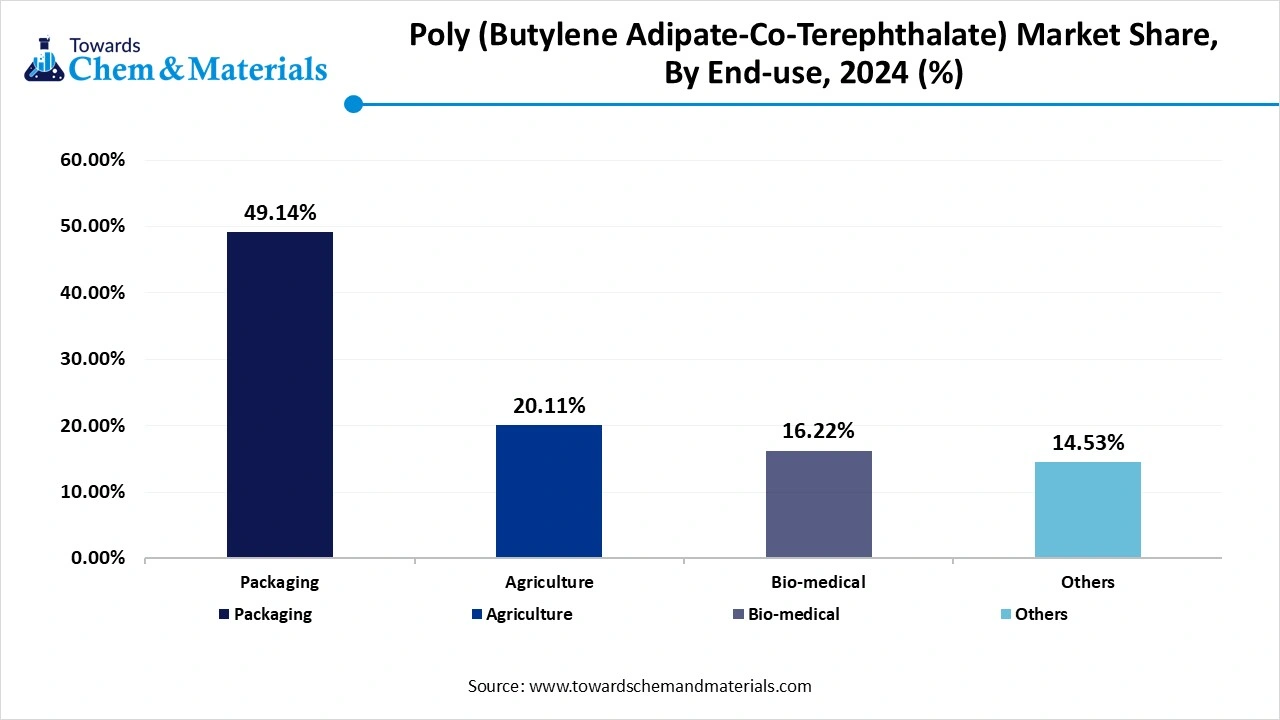

- By end use, the packaging segment dominated the market share of 49.14% in 2024 due to the rising expansion of packaged food and beverages.

- By end use, the agriculture segment is expected to grow at a significant CAGR in the market during the forecast period due to the growing focus on sustainable agricultural practices.

PBAT: Solution for Modern Packaging and a Cleaner Earth

Poly (butylene adipate-co-terephthalate) or PBAT is a compostable and biodegradable random copolymer. It is a copolyester of terephthalic acid, adipic acid, and 1,4-butanediol. It consists of an excellent film-forming ability. PBAT has high flexibility and good barrier properties against moisture. It consists of low stiffness, elastic modulus, and is chemically inert. It is fully biodegradable and has high stability & mechanical properties. PBAT reduces plastic waste and is easily composted in industrial composting facilities. It is used in hygiene products like sanitary pads and diapers. PBAT is widely used in mulch films and packaging. The growing environmental concerns increase demand for PBAT to reduce landfill waste and environmental pollution. The growing demand for biodegradable plastic increases the adoption of PBAT. The growing demand from the agricultural, coatings, packaging, adhesives, and consumer products contributes to the growth of the poly (butylene adipate-co-terephthalate) market.

- Sweden exported $381 million of natural polymers in 2023.(Source: oec.world)

- Germany exported $124 million of natural polymers in 2023.(Source: oec.world)

The Growing Demand from Biomedical Applications Propels Market Growth

The growing biomedical applications increase demand for PBAT to lower the risk of long-term implant complications. PBAT provides flexibility to implants and medical devices. The growing demand for wound closures increases the adoption of PBAT for proper sutures. The increasing focus on drug delivery systems is fueling the adoption of PBAT to create nanoparticles and microspheres for the system. PBAT offers a framework for tissue regeneration and cell growth. The growing preference to remove the need for suture removal increases the adoption of PBAT. It is widely used in surgical meshes in hernia repair. The growing focus of the biomedical industry to reduce the environmental impact of traditional plastic increases demand for PBAT. The growing demand from biomedical applications is a key driver for the growth of the poly (butylene adipate-co-terephthalate) market.

Market Trends

- The Growing Environmental Concerns & Stringent Regulations:- The growing environmental concerns due to the use of traditional plastic increase demand for PBAT, which decomposes naturally in the environment. The stringent environmental regulations regarding the use of plastic increase the adoption of PBAT for waste bags and packaging. The growing consumer awareness about plastic pollution increases demand for PBAT.

- The Growing Demand from Consumer Goods Industry:- The growing demand for various consumer goods products increases the adoption of PBAT. The growing demand for diapers, disposable tableware, personal care items, and cosmetic containers increases demand for PBAT due to its biodegradability.

- Growing Applications in the Agriculture Sector:- The growing expansion of the agriculture sector increases demand for PBAT for various applications. It is widely used in biodegradable plant pots, mulch films, and seed coatings. PBAT offers various benefits in the agriculture sector, like improving soil health, enhancing crop growth, and reducing plastic waste.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 2.02 Billion |

| Expected Size by 2034 | USD 4.42 Billiion |

| Growth Rate from 2025 to 2034 | CAGR 9.11% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Grade, By Application , By End Use, By Region |

| Key Companies Profiled | Novamont S.p.A, Kingfa Sci.&Tech. Co., Ltd., Zhejiang Biodegradable Advanced Material Co., Ltd, BASF, Willeap, Hangzhou Peijin Chemical Co., Ltd., Anhui Jumei Biological Technology Co., Ltd, Jinhui Zhaolong Advanced Technology Co., Ltd, Chang Chun Group, GO YEN CHEMICAL INDUSTRIAL CO, LTD, Mitsui Plastics, Inc. |

Market Opportunity

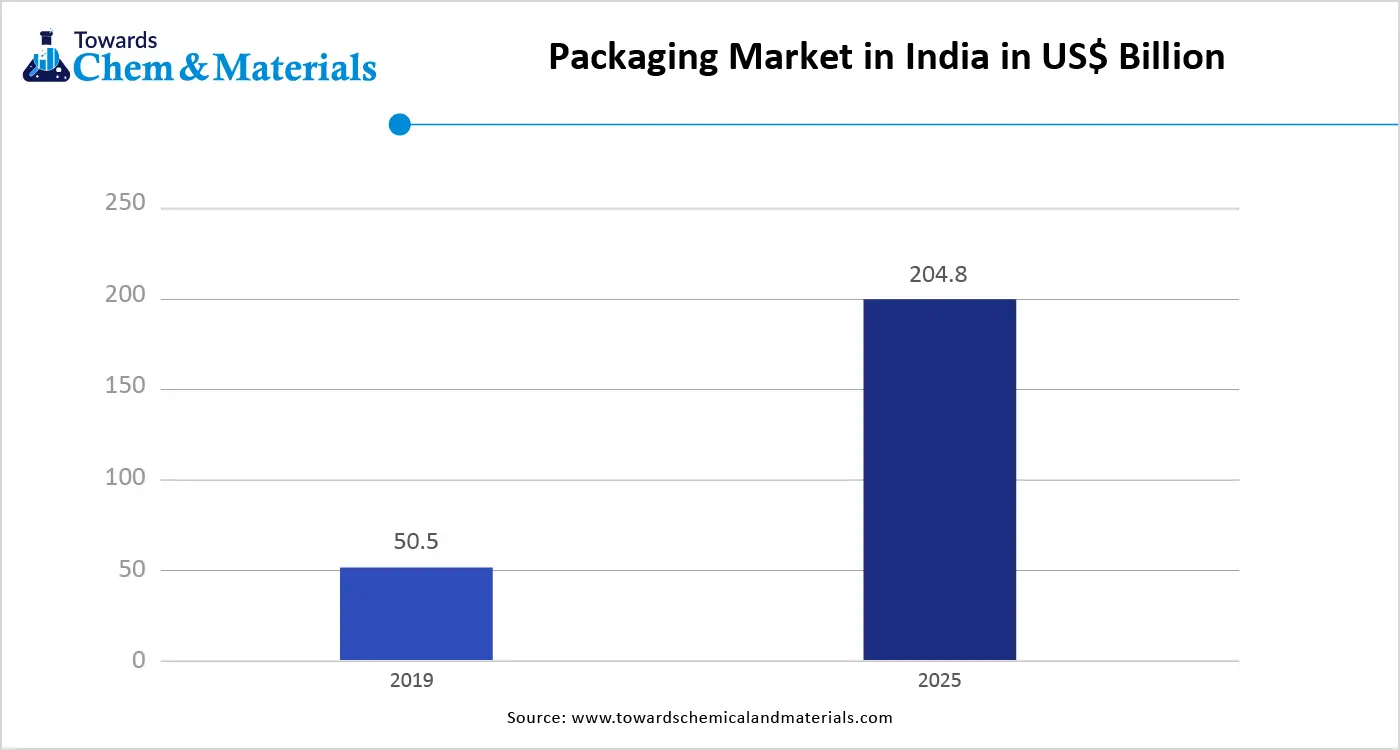

The Growing Packaging Industry Surges Demand For PBAT

The growing expansion of the packaging industry increases demand for poly (butylene adipate-co-terephthalate). The rise in online shopping and the rapid growth in the e-commerce sector increase the adoption of PBAT packaging. The growing packaging options, like flexible films, food packaging, and shopping bags, increase demand for PBAT. The growing focus on sustainable packaging and increasing plastic pollution is fueling demand for PBAT. The growing demand for cereal box liners, fruits, snacks, and vegetables packaging increases the adoption of PBAT.

The increasing demand for disposable bags, grocery bags, and waste collection bags leads to higher demand for PBAT. The growing preference for direct-to-consumer shipping increases demand for PBAT for aesthetically pleasing, protective, and tamper-evident packaging. The increasing consumer and business demand for sustainable packaging is fueling the adoption of PBAT. The rising expansion of the food & beverage industry in various regions leads to higher demand for PBAT packaging. The growing demand for packaging in various industries like food, cosmetics & personal care, healthcare, and agriculture increases demand for PBAT. The growing packaging industry contributes to the poly (butylene adipate-co-terephthalate) market.

Market Challenge

High Production Cost Limits Expansion of PBAT

Despite several benefits of the poly (butylene adipate-co-terephthalate), the high production cost restricts the market growth. Factors like small-scale production, complex manufacturing processes, and the cost of raw materials increase the overall cost of production. The complex manufacturing process, like a multi-step polymerization process, affects the production cost.

The high cost of raw materials like terephthalic acid, butanediol, and adipic acid increases the production cost. The small-scale production of PBAT leads to higher costs. The growing investment in research and development of the PBAT production method increases the production cost. Supply chain disruptions of raw materials lead to higher costs. High production cost hampers the growth of the poly (butylene adipate-co-terephthalate) market.

Regional Insights

How Asia Pacific Dominated the Poly (Butylene Adipate-Co-Terephthalate) Market?

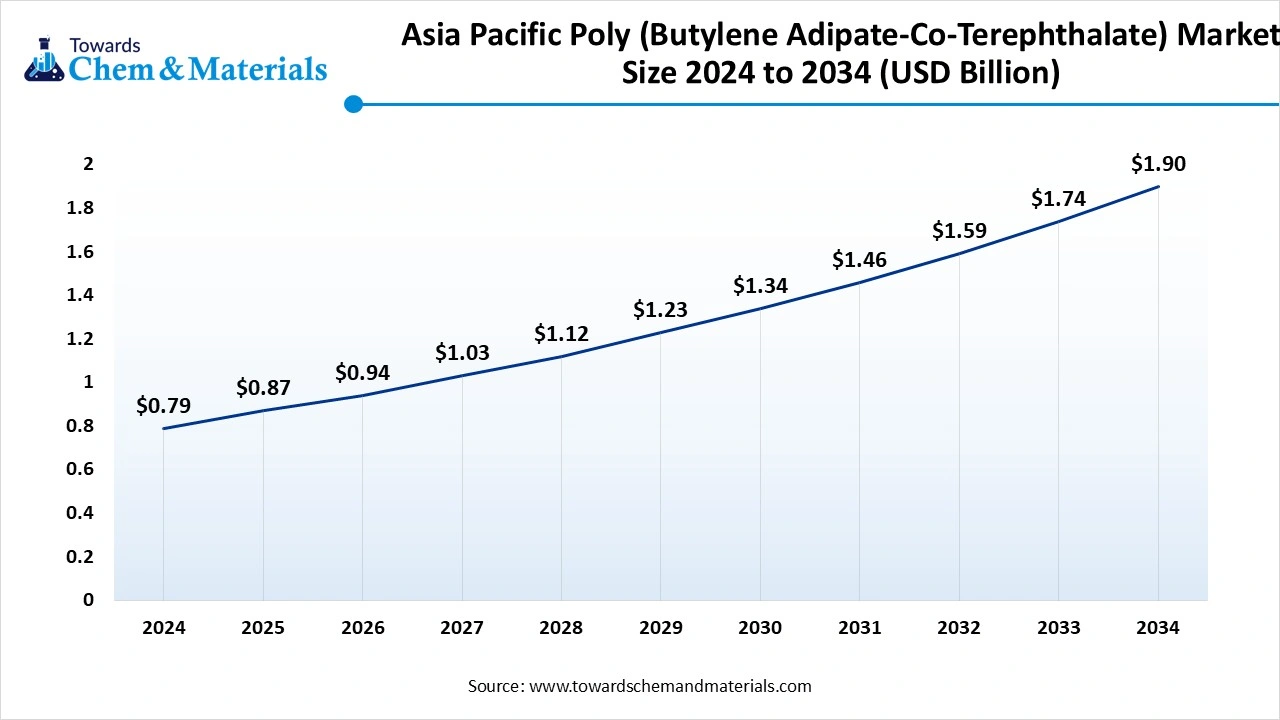

The Asia Pacific Poly (Butylene Adipate-Co-Terephthalate) market is expected to increase from USD 0.87 billion in 2025 to USD 1.90 billion by 2034, growing at a CAGR of 9.17% throughout the forecast period from 2025 to 2034. Asia Pacific dominated the market in 2024. The growing awareness about the environmental impact of conventional plastics and the advantages of biodegradable alternatives increases demand for PBAT. The growing urbanization and rising demand for food & beverages & packaged goods help in the market growth. The growing expansion of the agricultural sector increases demand for PBAT. The strong government's support for the use of biodegradable plastic fuel adoption of PBAT. The presence of a robust packaging industry increases demand for PBAT. The increasing demand from various countries like India, South Korea, China, & Japan, and growing domestic production and export drive the overall growth of the market.

China’s Poly (Butylene Adipate-Co-Terephthalate) Market Trends

China is a major contributor to the poly (butylene adipate-co-terephthalate) market. The government's support for the expansion and production of PBAT and the implementation of policies like the National Plastic Reduction Action Plan to lower plastic waste help the growth of the market. The growing demand for packaging in the food & beverage industry increases demand for PBAT. The availability of cost-effective production of PBAT helps the market growth. The growing demand from various end-use sectors like consumer goods, packaging, and agriculture supports the overall growth of the market.

- China exported 652 shipments of mulching films.(Source: www.volza.com)

- China exported $1.45 billion of natural polymers in 2023.(Source: oec.world)

What are the Growth Factors for the Poly (Butylene Adipate-Co-Terephthalate) Market in India?

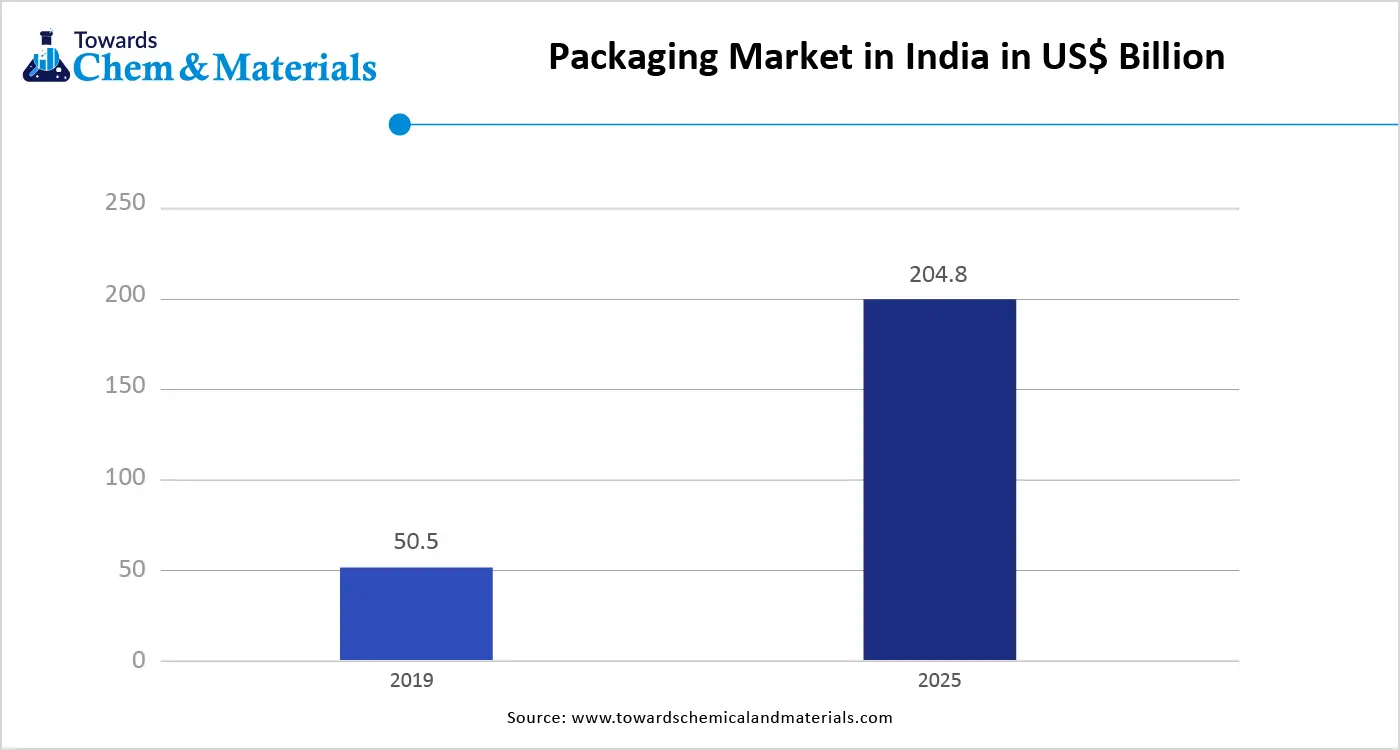

India is growing in the poly (butylene adipate-co-terephthalate) market. The rapid urbanization and growing demand for packaging materials increase the demand for PBAT. The stringent regulations for reducing plastic pollution increase demand for PBAT. The growing demand for sustainable packaging solutions helps in the market growth. The Indian government's support for environmental sustainability increases demand for PBAT. The growing expansion of the agricultural sector drives the overall growth of the market.

- India exported 523 shipments of mulching films. (Source: www.volza.com)

- From October 2023 to September 2024, India exported 236 shipments of mulching films.(Source: www.volza.com)

- India exported $20.1 million of natural polymers in 2023.(Source: oec.world )

Why is North America the Fastest-Growing in the Poly (Butylene Adipate-Co-Terephthalate) Market?

North America experiences the fastest growth in the market during the forecast period. The growing businesses and consumer awareness about the environmental impact of traditional plastic increase demand for PBAT. The well-established packaging industry helps in the growth of the market. The stringent regulations on single-use plastics increase the production of PBAT. The growing retail & e-commerce sector increases demand for PBAT. The growing demand for sustainable packaging solutions increases the adoption of PBAT. The increasing industry's focus on adopting circular economy principles increases demand for PBAT. The rise in online shopping and the presence of advanced manufacturing capabilities drive the overall growth of the market.

United States Poly (Butylene Adipate-Co-Terephthalate) Market Trends

The United States is a key contributor to the market. The businesses and consumers' strong emphasis on environmental responsibility increases demand for PBAT. The stringent environmental regulations in packaging & other applications help in the market growth. The rapid growth in food delivery services and e-commerce increases demand for PBAT for packaging. The well-established infrastructure for processing & manufacturing PBAT helps the market growth. The strong presence of the agricultural and packaging industry supports the overall growth of the market.

- The United States exported $338 million of natural polymers in 2023.(Source: oec.world )

- The United States exported $369 million of natural polymers in 2024. (Source: oec.world)

- The United States exported $31.5 million of natural polymers in April 2025. (Source: oec.world)

Segmental Insights

Grade Insights

Why did the Extrusion Grade Segment Dominate the Poly (Butylene Adipate-Co-Terephthalate) Market?

The extrusion grade segment led the market in 2024. The growing production of films and sheets increases demand for extrusion-grade PBAT. The growing demand for compostable and biodegradable plastic helps in the market growth. Extrusion grade PBAT offers a good balance of biodegradability, flexibility, and durability. The growing production of agricultural mulch films increases demand for extrusion-grade PBAT. The growing demand for packaging in various sectors, like agricultural, food, and pharmaceuticals, drives the overall growth of the market.

The thermoforming grade is significantly growing in the market during the forecast period. The growing expansion of the food & beverage industry increases demand for thermoforming grade PBAT for compostable & biodegradable packaging. Thermoforming grade PBAT is easily molded into various shapes like trays, containers, and other formats. The growing demand for clamshells, food containers, and other rigid packaging items increases demand for thermoforming grade PBAT, contributing to the overall growth of the market.

Application Insights

How Composite Bags Segment Dominated the Poly (Butylene Adipate-Co-Terephthalate) Market?

The composite bags segment dominated the market in 2024. The growing demand for durable and flexible bags with good tensile strength increases the demand for composite bags. The growing environmental concerns due to the increased plastic waste are fueling demand for composite bags for various applications. The strong government support for biodegradable polymers and the growing preference for eco-friendly products help the market growth. The rising demand across various applications like general packaging, food packaging, and agriculture mulch films drives the overall growth of the market.

The mulch films segment is the fastest growing in the market during the forecast period. The growing expansion of the agricultural sector increases demand for mulch films for temperature regulation, moisture retention, and weed suppression. The growing adoption of sustainable agricultural practices and biodegradable plastics helps in the market growth. The growing production of high-value cops like flowers, berries, and grapes increases demand for mulch films. These films offer benefits like enhancing crop growth, water conservation, and improving soil moisture retention. Mulch films reduce landfill waste and enhance biodegradability. The growing export of frozen and fresh vegetables supports the overall growth of the market.

End Use Insights

Which End Use Segment Held the Largest Share of Poly (Butylene Adipate-Co-Terephthalate) Market?

The packaging segment held the largest revenue share of the poly (butylene adipate-co-terephthalate) market in 2024. The growing demand for various packaging formats increases the adoption of PBAT. The increasing focus on sustainable packaging helps in the market growth. The growing expansion of the packaged food & beverage sector increases demand for PBAT packaging. The stringent regulations and growing environmental concerns increase demand for sustainable packaging like PBAT. The rapid growth in e-commerce and the rise in online shopping increase demand for PBAT packaging.

- Additionally, growing demand from various applications like healthcare packaging, food packaging, and non-food packaging drives the overall market growth.

The agriculture segment is significantly growing in the market during the forecast period. The growing focus on minimizing plastic waste in agricultural fields increases demand for PBAT.

The growing adoption of sustainable agricultural practices increases demand for PBAT for promoting healthier soil. The growing demand for sheets & films in agriculture helps in the market growth. The growing modernization in farming techniques to enhance crop yields increases demand for PBAT. The growing consumption of various crops supports the market growth.

Recent Developments

- In May 2025, Tripura’s Kamalpur launched biodegradable PBAT bags to curb plastic waste. The bag can decompose within 180 days, and the prices of bags are Rs. 160 per kg at retail and Rs 145 per kg for a wholesale buyer. The aim is to foster sustainable habits at the grassroots level, lower plastic pollution, and promote responsible waste management.(Source: indiatodayne.in )

- In February 2025, Bioengineering Firm Phitons launched sustainable alternatives to plastic. The solution is developed using PBAT and minerals like talcum and calcium carbonate. The range of products includes laundry bags, wrapping sheets, water bottles, sanitary pouches, carry bags, and agricultural mulch sheets. (Source: etvbharat.com )

- In May 2024, SKC to build a polybutylene adipate terephthalate (PBAT) plant in Vietnam. The plant aims to produce 70000 PBAT in 2025 third quarter and has a floor area of 22389 square meters. The plant will use renewable energy for the production of PBAT.(Source: kedglobal.com )

- In August 2024, an Indian entrepreneur developed a biodegradable, corn-based carrier bag for small businesses. The bags are developed using polybutylene adipate-co-terephthalate. Bio Reform develops almost 500000 bags per year and minimizes pollution & plastic waste. (Source: worldbiomarketinsights.com )

Top Companies List

- Novamont S.p.A

- Kingfa Sci.&Tech. Co., Ltd.

- Zhejiang Biodegradable Advanced Material Co., Ltd

- BASF

- Willeap

- Hangzhou Peijin Chemical Co., Ltd.

- Anhui Jumei Biological Technology Co., Ltd

- Jinhui Zhaolong Advanced Technology Co., Ltd

- Chang Chun Group

- GO YEN CHEMICAL INDUSTRIAL CO, LTD

- Mitsui Plastics, Inc.

Segments Covered

By Grade

- Extrusion Grade

- Thermoforming Grade

- Others

By Application

- Composite Bags

- Mulch Films

- Bin Bags

- Cling Films

- Stabilizers

By End Use

- Packaging

- Agriculture

- Bio-Medical

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- South Africa

- UAE

- Saudi Arabia

- Kuwait