Content

Polyester Hot Melt Adhesives (PHMAs) Market Size and Growth 2025 to 2034

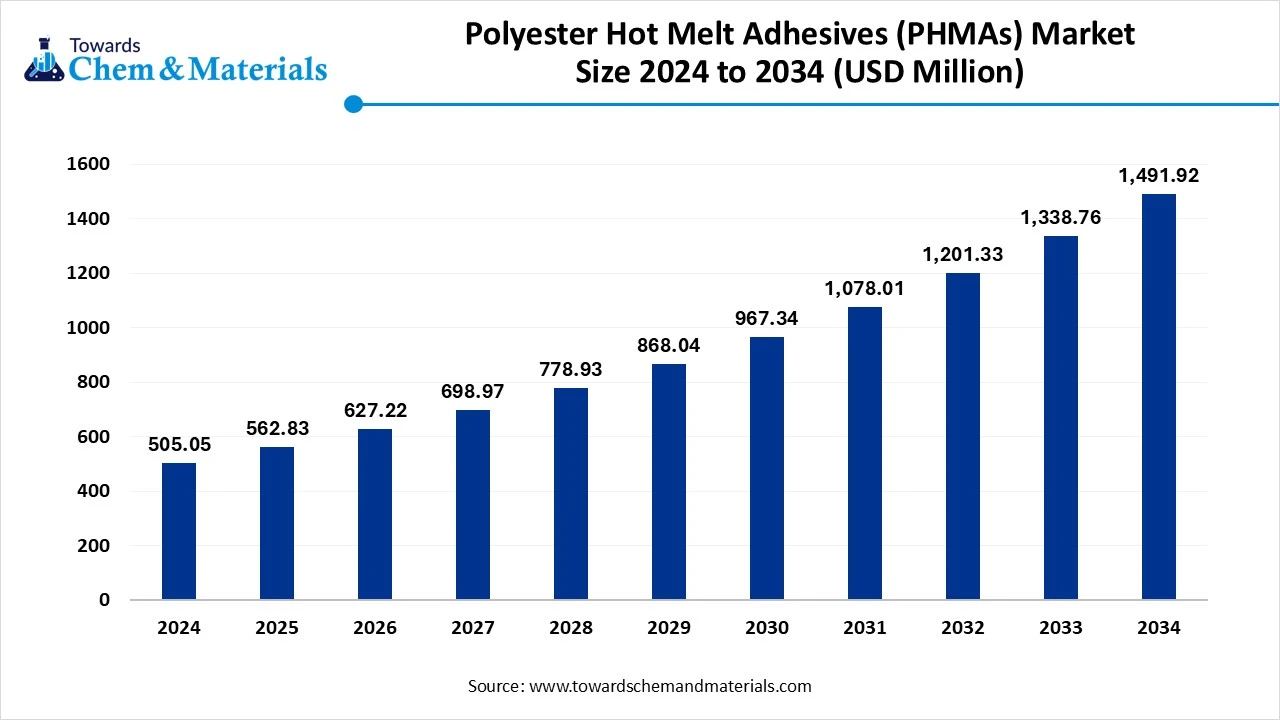

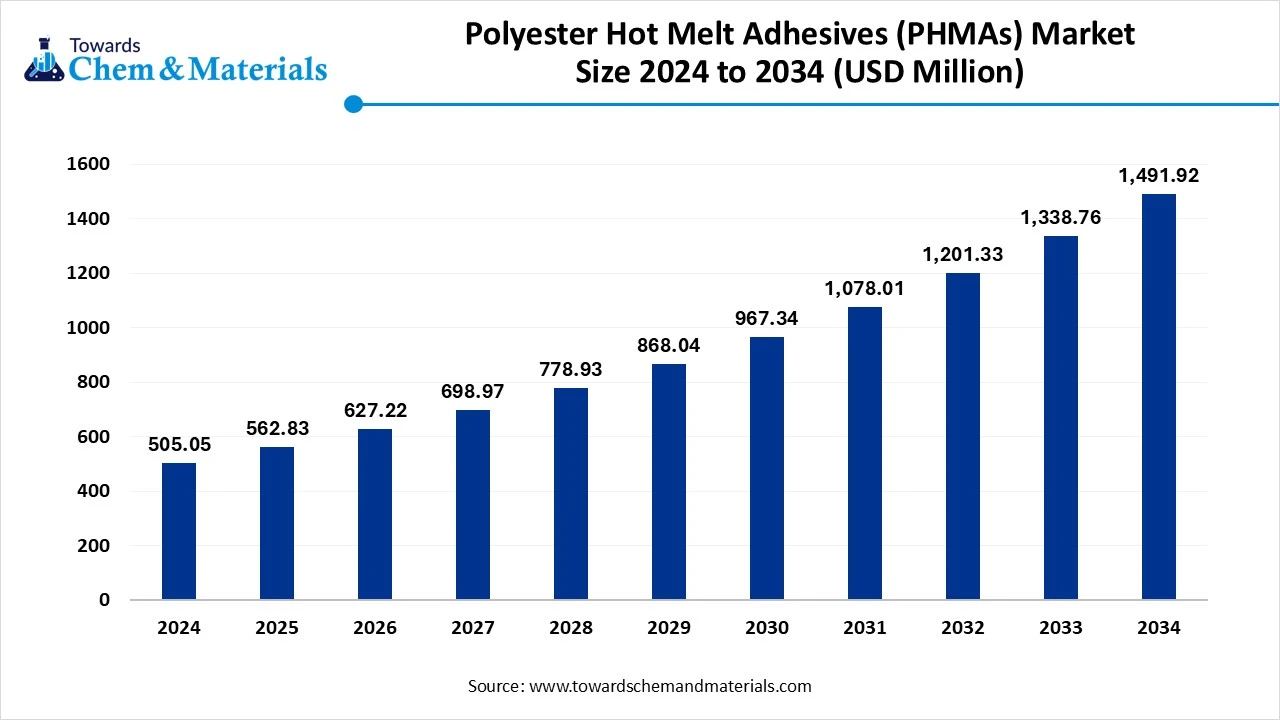

The global polyester hot melt adhesives (PHMAs) market size was reached at USD 505.05 million in 2024 and is expected to be worth around USD 1,491.92 million by 2034, growing at a compound annual growth rate (CAGR) of 11.44% over the forecast period 2025 to 2034. The global shift towards sustainability has driven investor confidence in recent years.

Key Takeaways

- Asia Pacific dominated the polyester hot melt adhesives (PHMAs) market in 2024 with 38% of the industry share, akin to its being known for its largest

- North America is expected to grow at a notable rate in the future, owing to having advanced technology access and ongoing sustainability standards.

- By resin type, the copolyester hotmelts segment led the polyester hot melt adhesives (PHMAs) market in 2024 with 38% market share, due to the characteristics such as flexibility, better adhesion across multiple surfaces, and toughness.

- By resin type, the reactive polyester hotmelts segment is expected to grow at the fastest rate in the market during the forecast period, akin to their better resistance to heat, chemicals, and moisture.

- By technology, the thermoplastic hotmelts emerged as the top-performing segment in the polyester hot melt adhesives (PHMAs) market in 2024 with 65% industry share, due to their cost-effectiveness and wide availability.

- By technology, the reactive polyester hotmelts projects segment is expected to lead the market in the coming years, because industries are shifting toward higher-performance adhesives that can withstand extreme conditions

- By physical form, the pellets/granule segment led the polyester hot melt adhesives (PHMAs) market in 2024 with 55% market share because they are the most convenient and widely used format for polyester hotmelts.

- By physical form, the cartridges segment is expected to capture the biggest portion of the market in the coming years, because they are ideal for precision applications in specialized industries such as automotive, electronics, and medical devices.

- By performance requirement, the high shear and peel strength segment led the polyester hot melt adhesives (PHMAs) market in 2024 with 32% market share, because industries like packaging, footwear, and automotive require durable bonds that can withstand mechanical stress.

- By performance requirement, the low VOC/food contact grades segment is expected to grow at the fastest rate in the market during the forecast period, because of rising health, safety, and environmental regulations.

- By application method, the slot dies extrusion/ laminating segment led the polyester hot melt adhesives (PHMAs) market in 2024 with 42% market share because it is ideal for producing uniform adhesive layers in packaging, laminates, and textiles.

- By application method, the spray/melt-blown segment is expected to capture the biggest portion of the market in the coming years, because they are perfect for non-woven and hygiene products like diapers, masks, and medical disposables.

- By end-use industry, the packaging segment led the polyester hot melt adhesives (PHMAs) market in 2024 with 30% market share, because it is the largest consumer of adhesives for cartons, labels, laminates, and flexible packaging.

- By end-user type, the non-oven and hygiene segment is expected to grow at the fastest rate in the market during the forecast period, because of growing demand for diapers, sanitary products, medical disposables, and face masks.

Market Overview

Bonding the Future: PHMAs Reshape Major Sectors

The global polyester hot melt adhesives (PHMAs) market has experienced significant growth in recent years. The sectors such as the packaging, textiles, and automotive have emerged as key points in the industry nowadays. Also, by offering the flexibility, heat resistance, and faster bonding, the polyester hot melt adhesives are being closely watched by market stakeholders in the current industry environment, as per the recent survey.

Polyester hot melt adhesives (PHMAs) are thermoplastic adhesive formulations based on polyester resins that melt on heating and solidify on cooling to form strong bonds; they can be non-reactive or reactive (moisture/heat curing) depending on functionalization.

Clean Chemistry: The Industry’s Move Toward VOC-Free Adhesives

The sudden shift towards sustainability and solvent-free adhesives has actively optimized performance and unlocked new industry potential in recent years. Several manufacturers, such as automotive, textiles, and packaging, are increasingly seen under heavy pressure to reduce VOC emissions nowadays, where the bio-based solvent-free adhesive is expected to become a central element in the future industry. Also, the use of hot melt adhesives in micro applications like wearable electronics and medical patches is supporting the market growth in the current period.

The rising demand for e-commerce packaging adhesives is observed to be reshaping market dynamics and increasing opportunity windows in the current period.

The enlarged expansion of hygiene and non-woven products is also supporting capital growth and economic activity in the sector. As several adhesives are being used in masks, diapers, and medical disposables.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 562.83 Million |

| Expected Size by 2034 | USD 1,491.92 Million |

| Growth Rate from 2025 to 2034 | CAGR 11.44% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Resin /Chemistry, By Technology Type, By Physical Form, By Performance Requirement, By Application Method, By End-Use Industry, By Region |

| Key Companies Profiled | Henkel, H.B. Fuller , Bostik (Arkema) , Jowat , 3M , Soudal , Huitian Adhesive Group , Sika , Eastman Chemical Company , Dow Chemical Company , Evonik Industries , Avery Dennison, Franklin International , Huntsman Corporation , Wacker Chemie AG , Solvay SA , Kuraray Co., Ltd. , Kao Corporation , Pidilite Industries Ltd. , Tesa SE |

Adhesive Innovation Targets Cold Chain and Medical Markets for Future Growth

Designing new grades of adhesives for the cold chain logistics packaging is anticipated to enable access to an untapped market for manufacturers in the upcoming period. Additionally, by offering adhesives that remain strong in freezing temperatures, manufacturers are likely to receive widespread interest from the frozen food and pharma sectors for their large shipments during the forecast period.

In the same vein, the medical and hygiene industry is expected to provide a greater consumer base to the adhesive manufacturers due to ongoing medical device innovation and hygiene product launches.

Resin Cost Instability Threatens Demand and Alerts Consumer Expectations

The continuous fluctuation of raw material prices is expected to result in reduced demand and changing consumer expectations in the upcoming period. Moreover, the raw material, such as resin additives, which are mainly derived from petrochemicals, where the price fluctuation is common due to factors like geopolitical tension and trade wars. This is projected to impact the overall product cost in the coming days.

Asia Pacific Polyester Hot Melt Adhesives (PHMAs) Market Trends

Asia Pacific dominated the polyester hot melt adhesives (PHMAs) market in 2024, akin to its being known for its largest manufacturing hub and heavy manufacturing industry. Moreover, the countries in the region, such as India, China, and Japan, are seen under the heavy demand for polyester hot melt adhesives for their major sectors like electronics, textiles, and consumer goods. Also, factors like easy availability of raw materials and low-cost labor have contributed to favorable market economies for the adhesive industry in the region.

Is China’s Push for Green Adhesives Reshaping Global Industry Trends?

China maintained its dominance in the polyester hot melt adhesives (PHMAs), owing to the country being known for its massive manufacturing infrastructure. Also, China is actively pushing green adhesives, which are expected to attract interest from policymakers and other global manufacturers in the coming days. Also, having the enlarged domestic consumption has played a crucial role in enhancing the industry's potential in recent years.

North America Polyester Hot Melt Adhesives (PHMAs) Market Trends

North America is expected to capture a major share of the polyester hot melt adhesives (PHMAs), owing to having advanced technology access and ongoing sustainability standards. The manufacturers in the United States are actively investing in R&D for better product innovation, which is expected to drive strategic transformation and sectoral scalability in the upcoming period, as per the latest industry survey. Also, the sudden growth in reactive polyester hotmelts, the region becomes a major area of interest for thought leaders.

Segment Insights

By Resin Type

How did the Co-Polyester Hotmelts Segment Dominate the Polyester Hot Melt Adhesives (PHMAs) Market in 2024?

The co-polyester hotmelts segment held the largest share of the market in 2024, due to the characteristics such as flexibility, better adhesion across multiple surfaces, and toughness. Moreover, the higher demand from sectors like packaging, automotive, footwear, and textiles is contributing to the segment's potential in recent years. Also, the cost-effectiveness of the copolyester has sparked considerable attention from industry analysts.

The reactive polyester hotmelts segment is expected to grow at a notable rate during the predicted timeframe, akin to their better resistance to heat, chemicals, and moisture. Furthermore, these applications of the reactive polyester hotmelts are making them suitable for the heavy industries like automotive, electronics assembly, and others. Moreover, by meeting the ongoing sustainability standards, the reactive polyester hotmelts are projected to promote sustainable development across manufacturing infrastructure during the forecast period.

By Technology

Why does the Thermoplastic Polyester Hotmelts Segment Dominate the Polyester Hot Melt Adhesives (PHMAs) Market by Technology?

The thermoplastic polyester hotmelts segment held the largest share of the polyester hot melt adhesives (PHMAs) market in 2024, due to their cost-effectiveness and wide availability. Moreover, the greater push for sustainability has provided significant attention to the segment as thermoplastic polyester hotmelts have recyclability. Furthermore, the massive production manufacturers are actively using the thermoplastic polyester hotmelts technology, akin to their bond effectiveness.

On the other hand, the reactive polyester hotmelts projects segment is expected to grow at a notable rate because industries are shifting toward higher-performance adhesives that can withstand extreme conditions. Unlike thermoplastics, reactive types form stronger bonds that improve durability, heat resistance, and chemical stability. Automotive, electronics, and healthcare sectors prefer these adhesives for long-lasting and secure bonding. The growing focus on sustainability and VOC reduction also supports their adoption.

By Physical Form

How did the Pellets/Granule Segment Dominate the Polyester Hot Melt Adhesives (PHMAs) Market in 2024?

The pellets/granule segment dominated the market with the largest share in 2024 due to they are the most convenient and widely used format for polyester hotmelts. Granules are easy to transport, store, and feed into hotmelt applicators. They provide consistent melting and processing, making them ideal for high-volume packaging and textile industries. Their long shelf life and suitability for automated systems have also boosted demand.

The cartridges segment is expected to grow at a significant rate owing to they are ideal for precision applications in specialized industries such as automotive, electronics, and medical devices. Cartridges provide controlled dispensing, reduce waste, and allow easier handling in smaller production runs or technical uses. With rising demand for customization and precision bonding, especially in high-value industries, cartridges will gain more importance.

By Performance Requirement

How High Shear and Peel Strength Segment Gained Industry Attention?

The high shear and peel strength segment held the largest share of the market in 2024 due to industries like packaging, footwear, and automotive require durable bonds that can withstand mechanical stress. Polyester hotmelts with high strength ensure that products remain intact during transport, use, and environmental exposure. This performance requirement is crucial for cartons, laminates, textiles, and industrial parts. Manufacturers prefer these adhesives for their reliability and ability to handle heavy loads or frequent handling.

The low VOC/food contract grades segment is expected to grow at a notable rate during the predicted timeframe because of rising health, safety, and environmental regulations. Governments and consumers are increasingly demanding adhesives that are safe for packaging food, beverages, and hygiene products. These grades reduce emissions, ensure consumer safety, and comply with sustainability standards.

By Application Method

How Does Slot Die Laminating Ensure Precision and Efficiency in Production?

The slot die extrusion/ laminating segment dominated the market with the largest share in 2024 akin to it is ideal for producing uniform adhesive layers in packaging, laminates, and textiles. This method ensures precision, consistency, and high production efficiency, which are critical in large-scale industries. Packaging and converting industries rely heavily on slot die laminating for strong, clean, and cost-effective adhesive application.

The spray/melt-blown segment is expected to grow at a significant rate due to they are perfect for non-woven and hygiene products like diapers, masks, and medical disposables. These methods provide excellent coverage, softness, and breathability, making them ideal for skin-contact applications. Spray technology also allows precise and flexible adhesive placement, which reduces material use and improves product comfort.

By End Use Industry

How is E-commerce Fueling Demand for Advanced Adhesive Solution?

The packaging segment held the largest share of the market in 2024 because it is the largest consumer of adhesives for cartons, labels, laminates, and flexible packaging. The boom in e-commerce, food delivery, and retail industries has increased the need for strong, fast-bonding, and recyclable adhesives. Polyester hotmelts are favored for their clean application, strong hold, and compliance with safety regulations. Their versatility across paperboard, films, and foils makes them a popular choice.

The non-wovens and hygiene segment is expected to grow at a notable rate during the predicted timeframe as growing demand for diapers, sanitary products, medical disposables, and face masks. Polyester hotmelt adhesives are soft, skin-friendly, and non-toxic, making them perfect for these applications. Manufacturers are also focusing on low-odor, breathable, and food-safe grades, which further suits hygiene products.

Polyester Hot Melt Adhesives (PHMAs) Market Value Chain Analysis

- Distribution to Industrial Users : The polyester hot melts are generally distributed by industry players who have channel networks.

- Key Players: 3M, H.B Fuller, and Bostik

- Chemical Synthesis and Processing: The chemical synthesis and processing of the polyester hot melt adhesives includes the major processes like melting, formulation, application, and cooling.

- Regulatory Compliance and Safety Monitoring : The regulatory compliance and safety monitoring of the polyester hotmelts majorly focuses on greater chemical safety and handling. Also, associations like REACH are involved.

Recent Developments

- In 2025, Henkel introduced their latest production of the hot melt adhesive. The newly launched adhesive is specifically created for PET bottle labeling, as per the report published by the company recently.(Source: packagingeurope.com)

- In 2025, Packsize and Henkel created a strategic collaboration. The companies mutually launched bio-based adhesive product line called the Eco-Pax as per the company's claim.(Source : www.packaging-gateway.com)

Top Companies list

- Henkel

- H.B. Fuller

- Bostik (Arkema)

- Jowat

- 3M

- Soudal

- Huitian Adhesive Group

- Sika

- Eastman Chemical Company

- Dow Chemical Company

- Evonik Industries

- Avery Dennison

- Franklin International

- Huntsman Corporation

- Wacker Chemie AG

- Solvay SA

- Kuraray Co., Ltd.

- Kao Corporation

- Pidilite Industries Ltd.

- Tesa SE

Segment Covered

By Resin / Chemistry

- Saturated polyester hot melts

- Unsaturated polyester hot melts

- Co-polyester hot melts

- Polyester-urethane modified hot melts

- Reactive polyester hot melts

By Technology Type

- Thermoplastic polyester hot melts (non-reactive)

- Reactive polyester hot melts

By Physical Form

- Pellets/granules

- Pastilles

- Blocks / solid bricks

- Cartridges

By Performance Requirement

- High shear and peel strength

- Flexible and elongating

- High initial tack

- Heat-resistant grades

- Low VOC / food-contact compliant grades

By Application Method

- Slot-die extrusion/laminating

- Spray / melt-blown application

- Manual/automated cartridge systems

By End-Use Industry

- Packaging

- Woodworking and furniture

- Textile and apparel lamination

- Nonwovens and hygiene

- Footwear manufacturing

- Automotive

- Electronics

- Medical disposables and device assembly

- Bookbinding and commercial printing

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa