Content

Tile Adhesives Market Size, Share & Industry Analysis

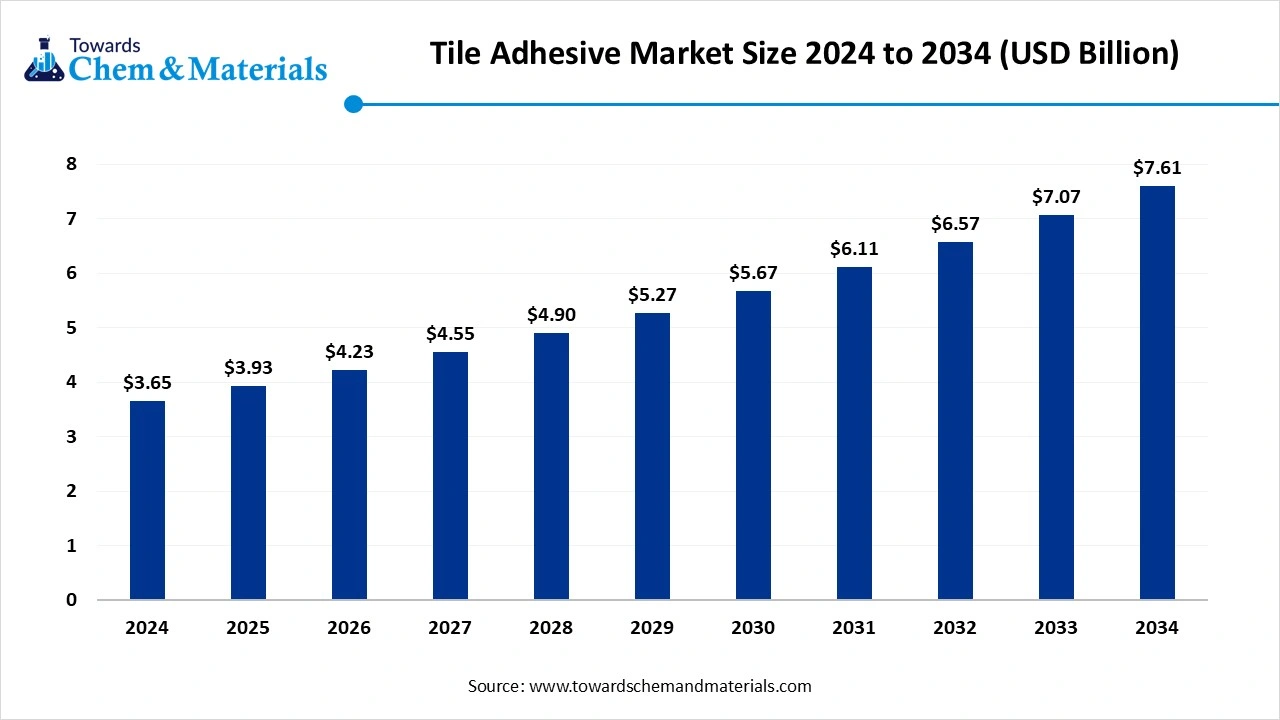

The global tile adhesives market size was valued at USD 3.65 billion in 2024, grew to USD 3.93 billion in 2025, and is expected to hit around USD 7.61 billion by 2034, growing at a compound annual growth rate (CAGR) of 7.63% over the forecast period from 2025 to 2034. The regional expansion of residential projects and the need for stronger and flexible tile bonding are fueling the expansion of opportunities within the sector.

Key Takeaways

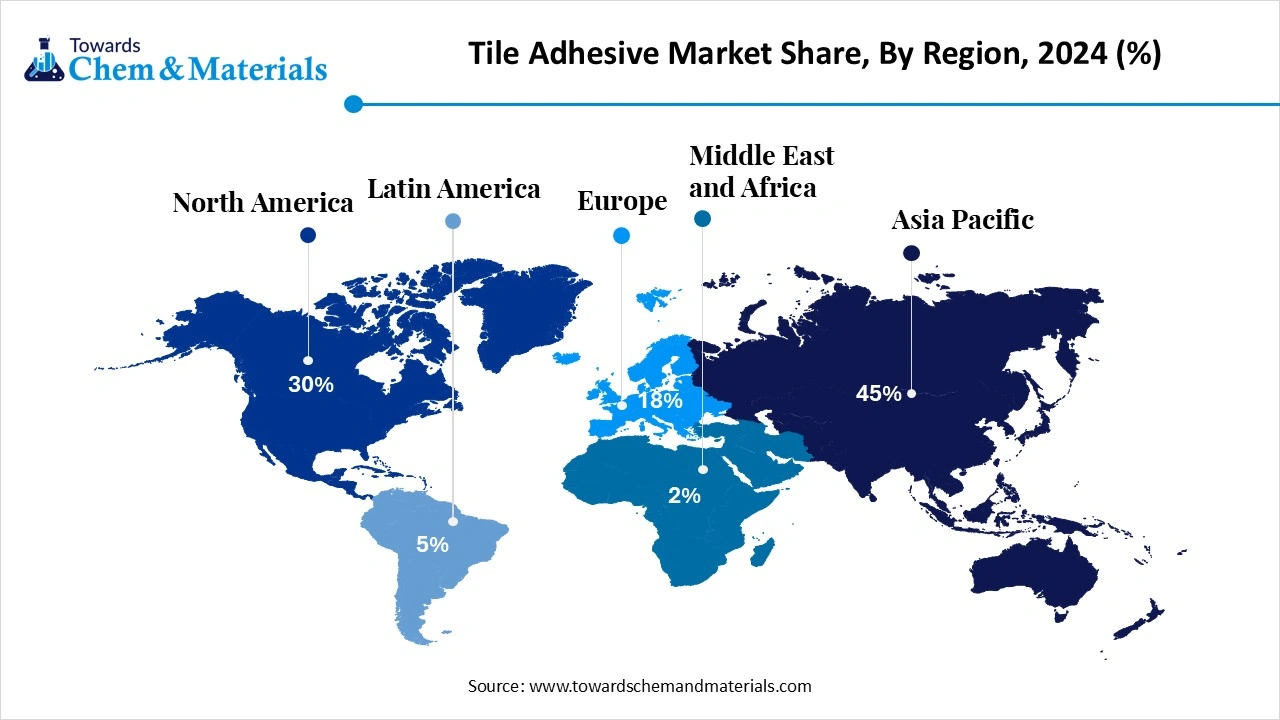

- By region, Asia Pacific dominated the tile adhesives market with approximately 45% industry share in 2024, owing to enlarged construction activity and rapid urbanization.

- By region, North America is expected to grow at a notable rate in the future, akin to the country’s greater shift towards advanced construction materials and infrastructure development projects.

- By chemistry type, the cementitious adhesives segment led the market with approximately 45% industry share in 2024, due to factors like cost-effectiveness, ease of use, and availability.

- By chemistry type, the reactive resin adhesives segment is expected to grow at the fastest rate in the market during the forecast period, owing to the increased need for adhesives in commercial and high-performance applications.

- By type, the standard tile adhesives segment emerged as the top-performing segment in the market with approximately 40% industry share in 2024, because it serves the largest volume of residential and small commercial projects.

- By type, the flexible tile adhesives segment is expected to lead the market in the coming years, due to modern building designs and advanced tile types like porcelain and glass.

- By tile type, the ceramic tiles segment led the market with approximately 50% share in 2024, as they remain the most widely used type in residential and commercial spaces.

- By tile type, the porcelain segment is expected to capture the biggest portion of the market in the coming years, because of its superior durability, water resistance, and premium aesthetic appeal.

- By end use, the residential construction segment emerged as the top-performing segment in the market with approximately 50% industry share in 2024, due to rapid urbanization and the growing demand for housing projects.

- By end use, the commercial construction segment is expected to lead the market in the coming years, as large-scale projects like malls, offices, airports, and hospitals increasingly adopt premium tiles and advanced adhesives.

- By distribution channel, the direct sales segment led the tile adhesives market with 55% share in 2024, because bulk procurement by contractors, developers, and distributors ensures efficiency and cost savings

- By distribution channel, the online channels segment is expected to capture the biggest portion of the market in the coming years, as digital transformation changes procurement habits in construction.

Why Are Tile Adhesives Replacing Traditional Mortar?

The tile adhesives market refers to specialized bonding materials used to install tiles such as ceramic, porcelain, mosaic, glass, and natural stone across various applications. These adhesives provide improved adhesion, flexibility, water resistance, and durability compared to traditional cement-sand mortar. Tile adhesives are available in multiple chemistries, including cementitious, dispersion-based, and reactive resins such as epoxy and polyurethane, each suited for specific conditions like wet areas, outdoor settings, or heavy-load flooring.

They are widely used in residential housing, commercial buildings, industrial facilities, and infrastructure projects. Rising urbanization, home renovation activities, and demand for energy-efficient and modern construction practices are driving the market. Asia Pacific dominates, supported by large-scale real estate growth and rapid infrastructure development.

- For Instance, the report published by Volza, the United States has imported 505 shipments of tile adhesives in 2024.(Source: www.volza.com)

Urban Housing Boom Fuels Tile Adhesives Market Surge

The global push for urban housing and renovation projects has played a major role in unlocking the industry’s growth potential in recent years. Also, several homeowners from around the globe are actively seen under the heavy replacement of the traditional tiles with ceramic and porcelain tiles, akin to their durability and modern aesthetics. Furthermore, having unique characteristics like greater moisture resistance, improved bonding, and better tile life, the tile adhesives have garnered substantial recognition across the sector in the past few years.

- For Instance, China has planned for housing projects in 2025 with 39801.01 tens of thousands of square meters of land area.(Source: tradingeconomics.com)

Market Trends

- The modern construction sites have observed using lightweight and flexible adhesives, which is leading the market potential in the current era. By withstanding temperature and vibrations, the flexible adhesive is likely to gain major industry attention in the coming years.

- The increasing need for low-VOC adhesives is heavily fueling the expansion of opportunities within the sector as several regional governments are seen in pushing sustainability standards across their region.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 3.93 Billion |

| Expected Size by 2034 | USD 7.61 Billion |

| Growth Rate from 2025 to 2034 | CAGR 7.63% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Chemistry, By Type, By Tile Type, By End User, By Distribution Channel, By Region |

| Key Companies Profiled | Taylor Adhesives, Dow, HENRY, Arkema, Schomburg, ISOLERA GMBH, AZO GmbH & Co. KG, Cemi-Cola Port, SL., Indarex Commerce S.L., BUTECH BUILDING TECHNOLOGY SAU |

Market Opportunity

Premix Adhesives Unlock Access to Untapped Global Market

The development of the premixed and smart adhesive is projected to enable access to untapped or underserved markets in the coming years. Moreover, several contractors and construction firms are increasingly seeking the ready-to-use adhesive for the reduction of mixing errors, whereas the pre-mix adhesive manufacturers are likely to gain traction with investment firms and analysts during the forecast period. Also, these investments of the manufacturer in premixed adhesives can provide them with a sophisticated consumer base in the developing regions in the coming years.

Market Challenge

Raw Material Volatility Threatens Adhesives Manufacturing Stability

The price sensitivity concerns of tile adhesives are likely to stall strategic initiatives and market penetration during the forecast period. Also, the price fluctuation between raw materials such as the resins, polymers, and specialty adhesives which petroleum can play a major role in production and can also create growth barriers to manufacturing in the coming years.

Regional Insights

Asia Pacific Tile Adhesives Market Size, Industry Report 2034

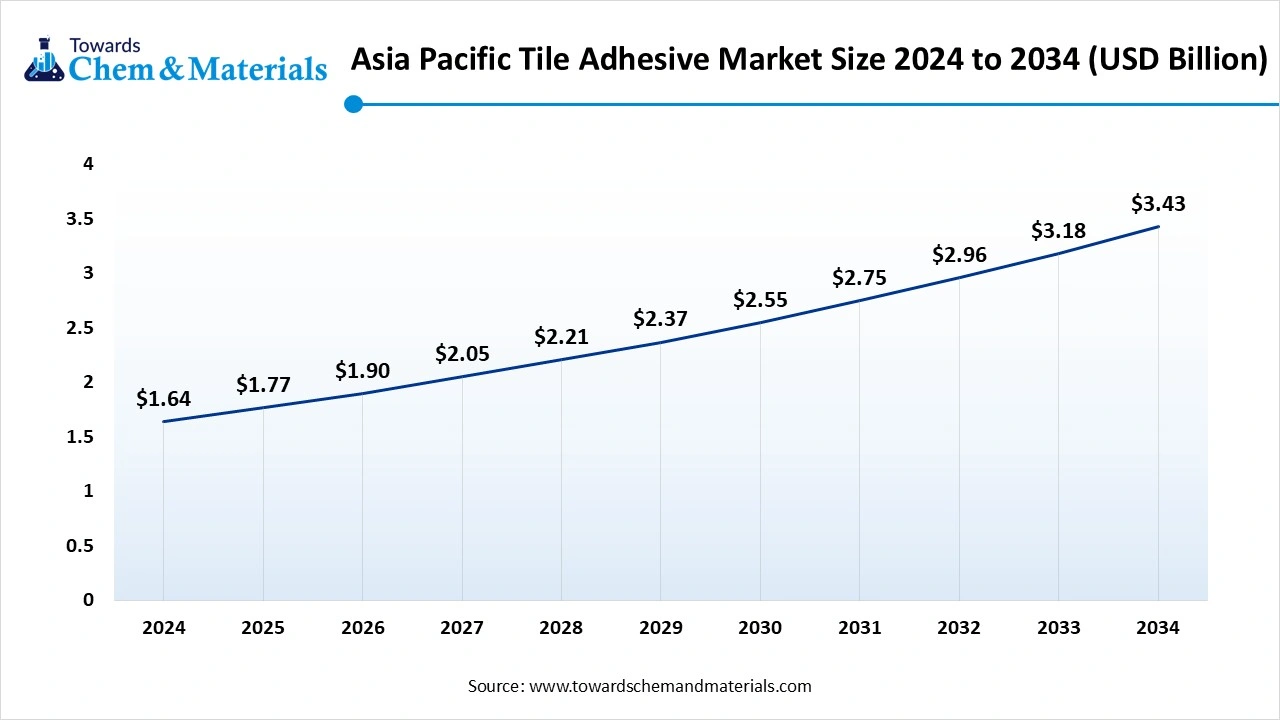

The Asia Pacific tile adhesive market size was estimated at USD 1.64 billion in 2024 and is anticipated to reach USD 3.43 billion by 2034, growing at a CAGR of 7.66% from 2025 to 2034. Asia Pacific dominated the tile adhesives market in 2024

owing to enlarged construction activity and rapid urbanization. Moreover, the regional countries like India, Vietnam, and Indonesia have seen the heavy household growth, while China is seen under working on the enlarged development projects, which are leading the sales of the tile adhesive in recent years. Furthermore, the benefits like low labor cost, availability of the raw material, and actively attracting major global manufacturers of tile adhesives in recent years.

- In 2025, in India, the manufacturers of tile adhesives are promoting a unique way through campaigns such as Pidlite’s held the campaign called “Naak Kat Gayi”, and the motive behind this campaign was to highlight embarrassment due to poorly bonded and broken tiles in households.(Source: www.afaqs.com)

Is China’s Investment in Adhesive Technology a Game Changer for the Industry?

China maintained its dominance in the market, owing to the country being known for one of the largest producers and consumers of adhesives in the current period. Moreover, China has observed under an enlarged production of ceramic tiles and greater exports in recent years. Also, the manufacturers in China are actively investing in advanced adhesives technologies, which is likely to create greater business opportunities in the region during the forecast period.

North America Tile Adhesives Market Trends

North America is expected to capture a major share of the market during the forecast period, akin to the country’s greater shift towards advanced construction materials and infrastructure development projects. Moreover, individuals have been demanding premium porcelain tiles and flexible adhesives in recent years. also, the regional countries like the United States and Canada are actively pushing sustainable construction practices, which are expected to create lucrative opportunities for tile adhesive industries during the forecast period.

Segmental Insights

Chemistry Type Insights

How did the Cementitious Adhesives Segment Dominate the Tile Adhesives Market in 2024?

The cementitious adhesives segment held the largest share of the market in 2024, due to factors like cost-effectiveness, ease of use, and availability. Moreover, the adhesives are seen in using residential projects where the limited budget is a priority. Also, the versatility, as it can be used for ceramic and basic tile installations which is driving the growth of the segment.

The reactive resin adhesives segment is expected to grow at a notable rate during the predicted timeframe, owing to the increased need for adhesives in commercial and high-performance applications. Moreover, by offering durability, superior bonding strength, and greater chemical resistance, the reactive resin adhesives are expected to gain major industry share in the upcoming years. Also, the increasing popularity of porcelain tiles in developing regions can create a better sales environment for the segment in the coming years.

Type Insights

Why does the Standard Tile Adhesives Segment Dominate the Tile Adhesives Market by Type?

The standard tile adhesives segment held the largest share of the market in 2024, because it serves the largest volume of residential and small commercial projects. These adhesives are straightforward to apply, cost-friendly, and meet the basic bonding needs for ceramic tiles. Standard adhesives are widely available and suitable for walls, floors, and other basic installations where advanced flexibility is not required.

The flexible tile adhesives segment is expected to grow at a notable rate due to modern building designs and advanced tile types like porcelain and glass. Flexible adhesives absorb structural stress, resist thermal expansion, and prevent cracks, making them ideal for high-rise buildings and seismic areas. With underfloor heating systems and energy-efficient building designs becoming more popular, flexible adhesives are increasingly essential.

Tile Type Insights

How did the Ceramic Tiles Segment Dominate the Tile Adhesives Market in 2024?

The ceramic tiles segment dominated the market with the largest share in 2024, as they remain the most widely used type in residential and commercial spaces. Ceramic tiles are affordable, versatile, and available in countless designs, making them a popular choice for kitchens, bathrooms, and outdoor areas. They require adhesives that balance cost with performance, which matches perfectly with cementitious adhesives.

The porcelain tiles segment is expected to grow at a significant rate because of their superior durability, water resistance, and premium aesthetic appeal. Porcelain tiles are denser and less porous than ceramic, making them ideal for commercial projects, luxury housing, and high-traffic areas like airports and malls. As consumers and builders increasingly opt for high-performance tiles, porcelain's demand is growing rapidly.

End User Insights

Why Did The Residential Construction Segment Dominated The Tile Adhesives Market?

The residential construction segment dominated the market with the largest share in 2024 due to rapid urbanization and the growing demand for housing projects. Bathrooms, kitchens, and living spaces in homes are driving massive consumption of ceramic tiles, which rely on standard cementitious adhesives. In emerging economies, housing affordability programs and rising middle-class demand further accelerate tile installations.

The commercial construction segment is expected to grow at a significant rate as large-scale projects like malls, offices, airports, and hospitals increasingly adopt premium tiles and advanced adhesives. These projects demand adhesives with higher strength, flexibility, and chemical resistance, particularly for heavy foot traffic and load-bearing surfaces.

Distribution Channel Insights

Why Did The Direct Sales Segment Dominated The Tile Adhesives Market?

The direct sales segment dominated the market with the largest share in 2024 because bulk procurement by contractors, developers, and distributors ensures efficiency and cost savings. Large construction firms often source adhesives directly from manufacturers to ensure consistent quality, timely delivery, and customized formulations.

The online channels segment is expected to grow at a significant rate during the forecast period, as digital transformation changes procurement habits in construction. Contractors, small businesses, and even DIY homeowners are increasingly sourcing adhesives through e-commerce and specialized B2B platforms.

Tile Adhesives Market Value Chain Analysis

- Distribution to Industrial Users: The tile adhesive has been seen to be distributed by specialized distributors which linked to the construction industry.

- Key Players: Kremlin Solutions and Fevicol

- Chemical Synthesis and Processing: The chemical synthesis and production of the tile adhesive include the contribution of Portland cement, polymer additives, and quartz sand.

- Regulatory Compliance and Safety Monitoring: The safety monitoring and regulatory compliance of tiles follow their regional standards, where Europe and America have different standards according to their specific agencies.

Recent Developments

- In November 2024, Nuvoco unveiled its latest tile adhesive. The newly launched tile adhesive, called the Zero M Tile Adhesive T5 and has suitability for both stone and tiles as per the company’s claim.(Source: www.worldcement.com)

Tile Adhesives Market Top Companies

- Taylor Adhesives

- Dow

- HENRY

- Arkema

- Schomburg

- ISOLERA GMBH

- AZO GmbH & Co. KG

- Cemi-Cola Port, SL.

- Indarex Commerce S.L.

- BUTECH BUILDING TECHNOLOGY SAU

Segment Covered

By Chemistry

- Cementitious Adhesives

- One-Component Cementitious Adhesives

- Two-Component Cementitious Adhesives

- Dispersion-Based Adhesives

- Reactive Resin Adhesives

- Epoxy Adhesives

- Polyurethane Adhesives

- Others

By Type

- Standard Tile Adhesives

- Flexible Tile Adhesives

- Waterproof / High-Performance Tile Adhesives

- Heat & Chemical Resistant Adhesives

- Others

By Tile Type

- Ceramic Tiles

- Porcelain Tiles

- Natural Stone Tiles

- Glass Tiles

- Mosaic Tiles

- Others

By End User

- Residential Construction

- Commercial Construction

- Industrial Facilities

- Infrastructure Projects

By Distribution Channel

- Direct Sales (Project-Based)

- Retail / Hardware Stores

- Online Channels

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

List of Figures

- Figure 1. Global Tile Adhesives Market Size (USD 3.65 Billion with CAGR) of 7.63% ), 2024–2034

- Figure 2. Regional Market Share, 2024: Asia Pacific 45%, Europe 22%, North America 18%, Latin America 8%, Middle East & Africa 7%

- Figure 3. Regional Market Share Forecast, 2034: Asia Pacific 45%, Europe 21%, North America 20%, Latin America 7%, Middle East & Africa 7%

- Figure 4. Chemistry Type Market Share, 2024: Cementitious Adhesives 45% (One-Component 30%, Two-Component 15%), Dispersion-Based 25%, Reactive Resin 20% (Epoxy 12%, Polyurethane 8%), Others 10%

- Figure 5. Type Market Share, 2024: Standard 40%, Flexible 30%, Waterproof/High-Performance 20%, Heat & Chemical Resistant 5%, Others 5%

- Figure 6. Tile Type Market Share, 2024: Ceramic 50%, Porcelain 25%, Natural Stone 10%, Glass 8%, Mosaic 5%, Others 2%

- Figure 7. End User Market Share, 2024: Residential Construction 50%, Commercial Construction 30%, Industrial Facilities 10%, Infrastructure Projects 10%

- Figure 8. Distribution Channel Market Share, 2024: Direct Sales 55%, Retail/Hardware Stores 30%, Online Channels 15%

- Figure 9. Asia Pacific Market Size, 2024 (USD 1.64 Bn) vs 2034 (USD 3.43 Bn), CAGR 7.66%

- Figure 10. North America Market Growth Trend, 2025–2034

- Figure 11. Competitive Landscape, Top Companies Market Share, 2024

List of Tables

- Table 1. Global Tile Adhesives Market Size, 2024–2034 (USD 3.65 Billion & CAGR 7.63%)

- Table 2. Regional Market Share, 2024 vs 2034: Asia Pacific 45%→45%, Europe 22%→21%, North America 18%→20%, Latin America 8%→7%, Middle East & Africa 7%→7%

- Table 3. Chemistry Type Market Share, 2024: Cementitious Adhesives 45% (One-Component 30%, Two-Component 15%), Dispersion-Based 25%, Reactive Resin 20% (Epoxy 12%, Polyurethane 8%), Others 10%

- Table 4. Type Market Share, 2024: Standard 40%, Flexible 30%, Waterproof/High-Performance 20%, Heat & Chemical Resistant 5%, Others 5%

- Table 5. Tile Type Market Share, 2024: Ceramic 50%, Porcelain 25%, Natural Stone 10%, Glass 8%, Mosaic 5%, Others 2%

- Table 6. End User Market Share, 2024: Residential Construction 50%, Commercial Construction 30%, Industrial Facilities 10%, Infrastructure Projects 10%

- Table 7. Distribution Channel Market Share, 2024: Direct Sales 55%, Retail/Hardware Stores 30%, Online Channels 15%

- Table 8. Key Players, 2024: Taylor Adhesives, Dow, HENRY, Arkema, Schomburg, ISOLERA GMBH, AZO GmbH & Co. KG, Cemi-Cola Port SL, Indarex Commerce S.L., BUTECH BUILDING TECHNOLOGY SAU

- Table 9. Recent Developments, 2024–2025: Notable product launches, campaigns, and regional expansions