Content

U.S. Fluoropolymer Coating Market Size, Share | CAGR of 5.50%.

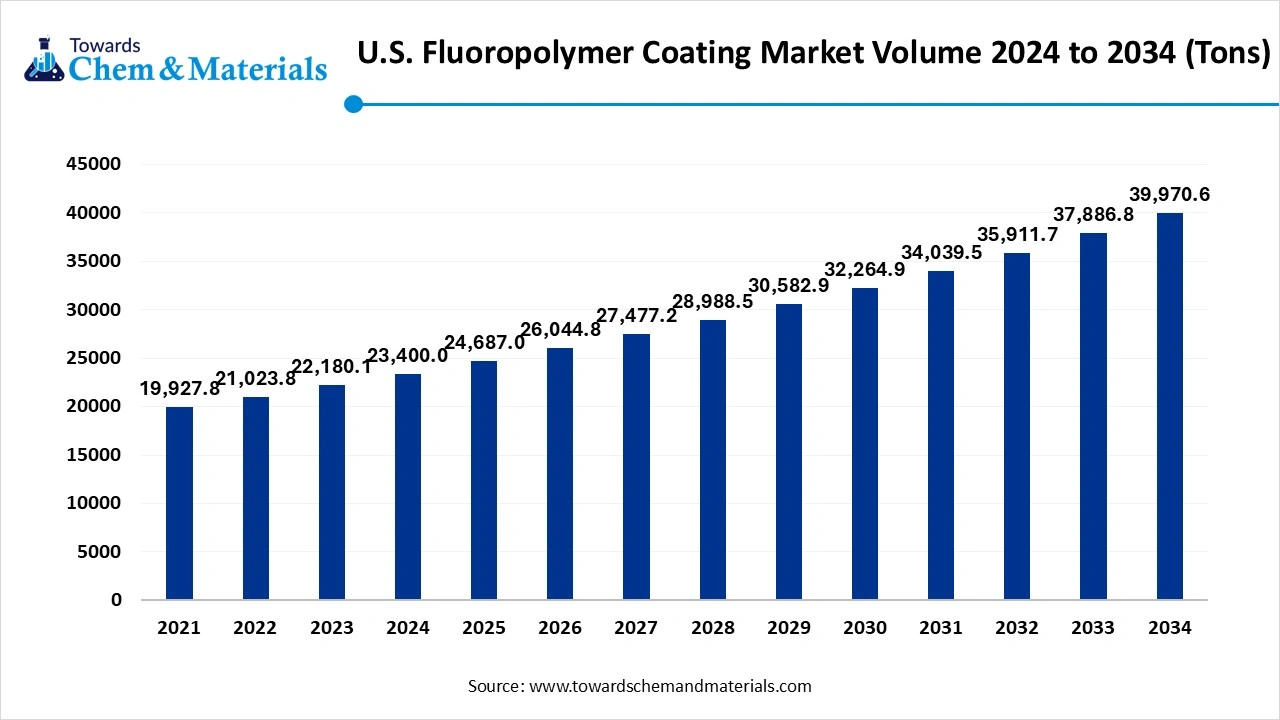

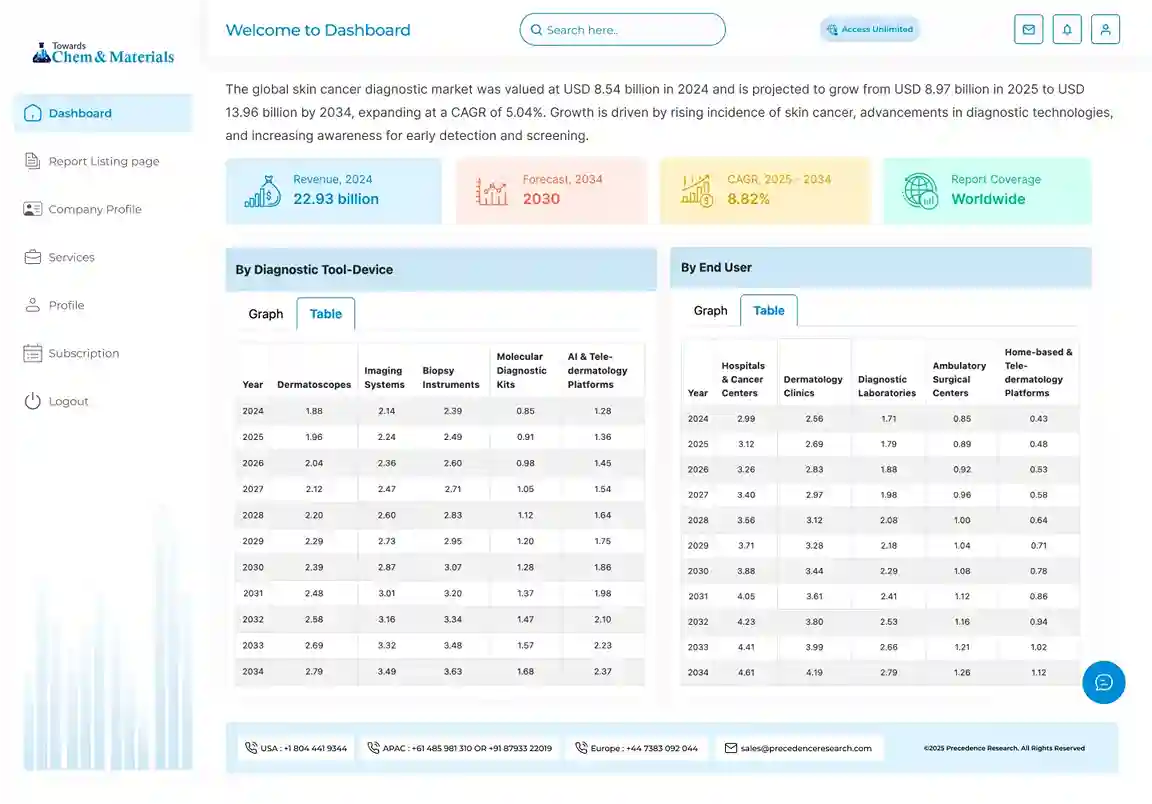

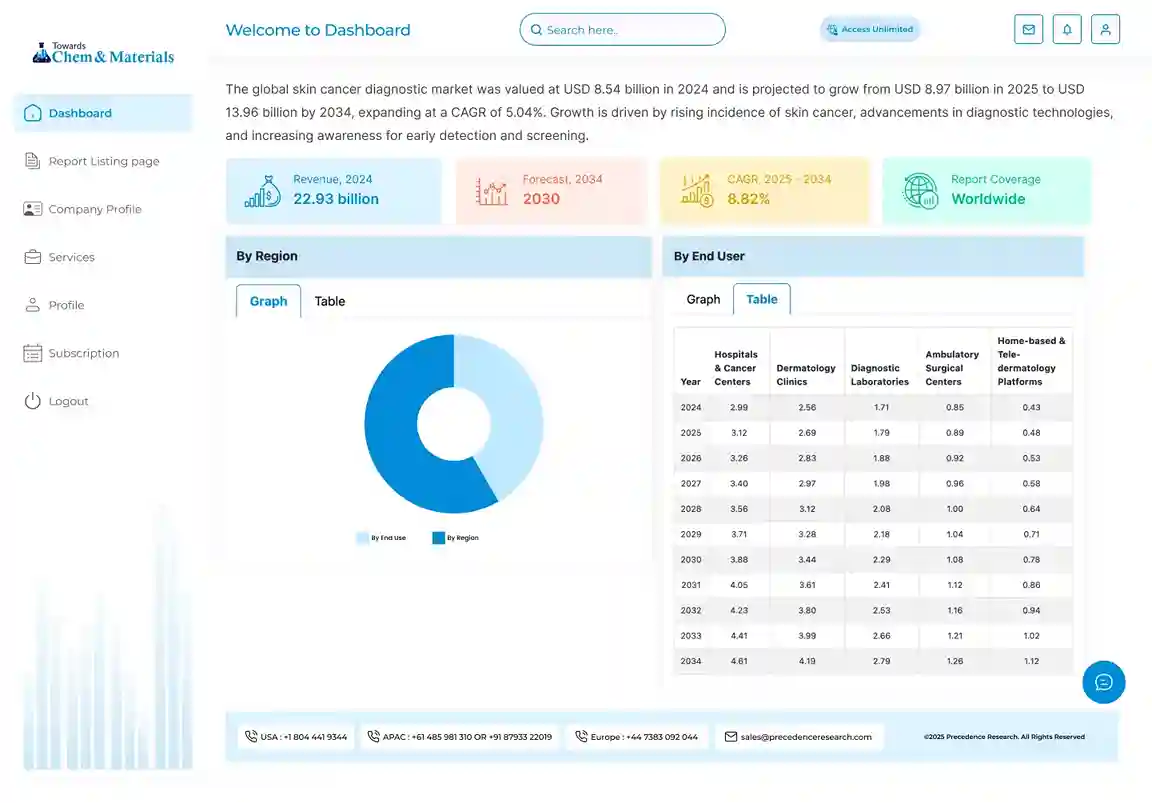

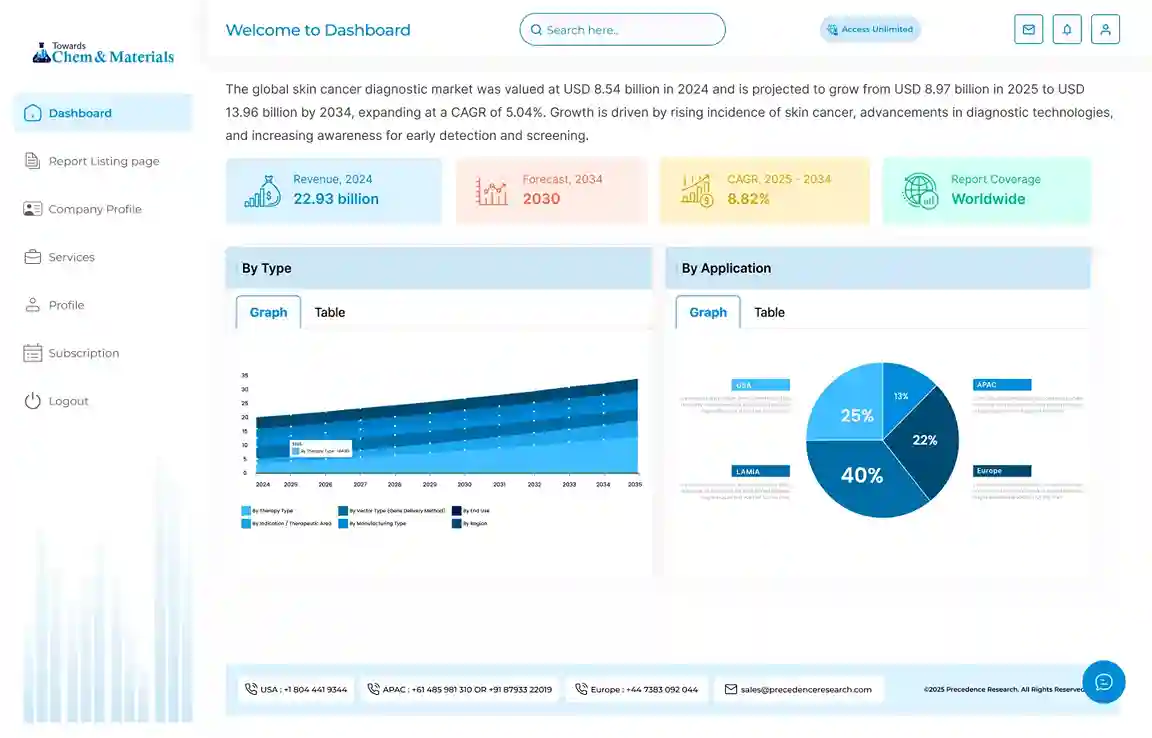

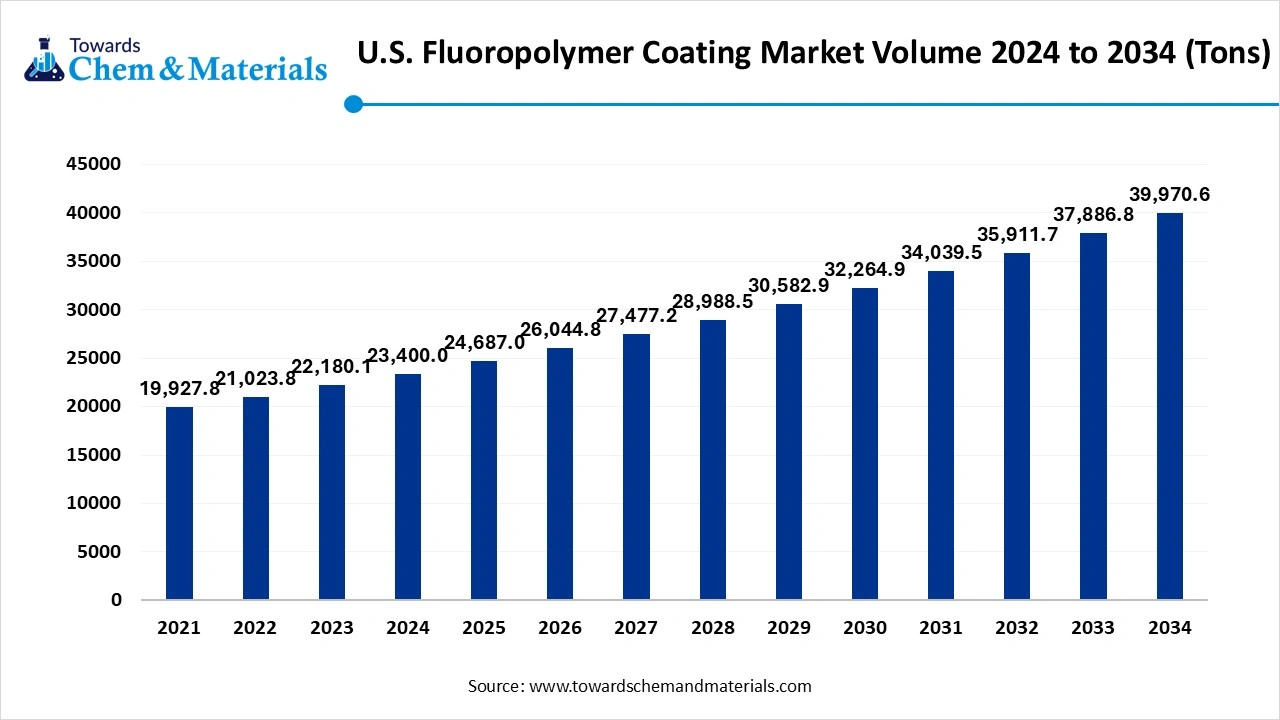

The U.S. fluoropolymer coating market volume was reached at 23,400.0 tons in 2024 and is expected to be worth around 39,970.6 tons by 2034, growing at a compound annual growth rate (CAGR) of 5.50% over the forecast period 2025 to 2034. The growing demand across sectors like aerospace, automotive, construction, and electronics drives the market growth.

Key Takeaways

- By resin type, the PTFE segment held a 46% share in the market in 2024 due to the growing production of automotive components.

- By resin type, the PVDF segment is expected to grow at the fastest CAGR in the market during the forecast period due to the increasing production of electronic components.

- By coating type, the powder coatings segment held a 58% share in the U.S. fluoropolymer coating market in 2024 due to the lower volatile organic compound emissions.

- By coating type, the liquid coatings segment is expected to grow at the fastest CAGR in the market during the forecast period due to the increasing production of medical devices.

- By application, the industrial equipment segment held a 36% share in the market in 2024 due to the growing industrial expansion.

- By application, the electronics segment is expected to grow at the fastest CAGR in the market during the forecast period due to the increasing demand for consumer electronics.

- By substrate, the metal segment held a 61% share in the market in 2024 due to the growing use of metal substrates in various industries.

- By substrate, the plastics segment is expected to grow at the fastest CAGR in the market during the forecast period due to the increasing manufacturing of aircraft parts.

The Role of the U.S. Fluoropolymer Coating in Manufacturing and Industries

U.S. fluoropolymer coating is a protective coating made up of fluoropolymer resins. They offer excellent resistance to mechanical stress, temperatures, and harsh chemicals. The high-performance coating is formulated with fluoropolymers like PVDF, ETFE, PTFE, and FEP. These coatings possess low friction, non-stick properties, high thermal stability, and UV resistance. It can be applied to various materials like composites, metals, and glass.

The architectural applications, like curtain-wall systems, storefronts, metal roofing, and windows, increase demand for fluoropolymer coating. The increasing demand for industrial equipment fuels the adoption of fluoropolymer coating for harsh chemical resistance. The increasing demand for durable, corrosion-resistant, and low-maintenance coatings in various industries helps market growth. The growing demand across various sectors like cookware, electronics, construction, industrial processing, automotive, and aerospace contributes to the growth of the U.S. fluoropolymer market.

- The United States exported 444 shipments of fluoropolymer resins.(Source: www.volza.com )

- The United States exported $143M of polytetrafluoroethylene.(Source: oec.world)

Growing Construction Activities Drive U.S. Fluoropolymer Coating Market

The rapid urbanization and growing development of new construction increase demand for fluoropolymer coating for various applications. The increasing investment in infrastructure development fuels demand for fluoropolymer coating. The growing demand for residential and commercial spaces in the region requires fluoropolymer coating. The increasing demand for various construction materials like glass, metal, and concrete requires fluoropolymer coating for aesthetic appeal.

The growing focus on extending the construction lifespan increases the adoption of fluoropolymer coating to provide good chemical, UV radiation, and extreme temperature resistance. Thy offers aesthetic appeal to construction and is available in various finishes and colors. The United States in stringent regulations for construction increases the adoption of fluoropolymer coating. The growing demand for roofing membranes, building facades, and interior finishes increases the adoption of fluoropolymer coating. The growing construction activities are a key driver for the growth of the U.S. fluoropolymer coating market.

Market Trends

- Growing Renewable Energy: The growing investment in renewable energy sources like wind, solar, and other sources increases demand for fluoropolymer coatings for manufacturing infrastructure and equipment.

- Increasing Production of Medical devices: The growing production of various medical devices like drug delivery systems, catheters, and implants increases demand for biocompatible fluoropolymers coatings.

- Growing Adoption of Electronic Devices: The increasing adoption of various electronic devices like computers, smartphones, wearable devices, laptops, and many more increases demand for fluoropolymer coating for the development of high-performance electronic devices.

Report Scope

| Report Attribute | Details |

| Market Volume in 2025 | 24,687.0 Tons |

| Expected Volume by 2034 | 39,970.6 Tons |

| Growth Rate from 2025 to 2034 | CAGR 5.50% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Resin Type, By Coating Type, By Application, By Substrate |

| Key Companies Profiled | PPG Industries,The Chemours Company, DAIKIN America, Inc., Whitford Corporation (a PPG brand), AkzoNobel N.V., Sherwin-Williams Company, Valspar Corporation, Arkema Inc. (Kynar PVDF) Solvay USA, Dupont, Xylan Coatings, Nippon Paint Holdings Co., Ltd., Hempel USA, Tiger Drylac U.S.A., Axalta Coating Systems |

Market Opportunity

The Growing Automotive Industry Surges Demand for Fluoropolymer Coating

The growing automotive industry in the United States increases demand for fluoropolymer coating. The increasing focus of the automotive industry on lowering the weight of vehicles fuels the adoption of fluoropolymer coating for manufacturing lightweight vehicle materials. The well-developed automotive industry increases demand for corrosion resistance and durable fluoropolymer coating. The increasing demand for braking systems, fuel systems, and engine components in the automotive industry fuels demand for fluoropolymer coating.

The growing demand for hybrid and electric vehicles fuels the adoption of fluoropolymer coating to offer excellent resistance against chemical damage, corrosion, and rust. The increasing production of exterior and interior parts of vehicles fuels demand for fluoropolymer coating. The United States' focus on the development of electric vehicles increases demand for fluoropolymer coating for manufacturing EV components. The growing automotive industry creates an opportunity for the U.S. fluoropolymer coating market.

Market Challenge

High Production Cost Shuts Down U.S. Fluoropolymer Coating Market Growth

Despite several benefits of the fluoropolymer coating in the United States, the high production cost restricts the market growth. Factors like stringent environmental regulations, high raw materials cost, and complex manufacturing processes are responsible for high production costs. The cost of raw materials like hydrofluoric acid, resins, solvents, pigments, additives, and fluorspar is expensive.

The high cost of raw materials directly impacts the market. The need for specialized equipment, intricate production methods, and the requirement for advanced technologies increases the production cost. The requirement of multiple layers, like top coat, metallic base, and adhesion, increases the production cost. The stricter environmental regulations increase demand for emission control and waste management, which increases the cost. The high production cost hampers the growth of the U.S. fluoropolymer coating market.

Segmental Insights

Product Type Insights

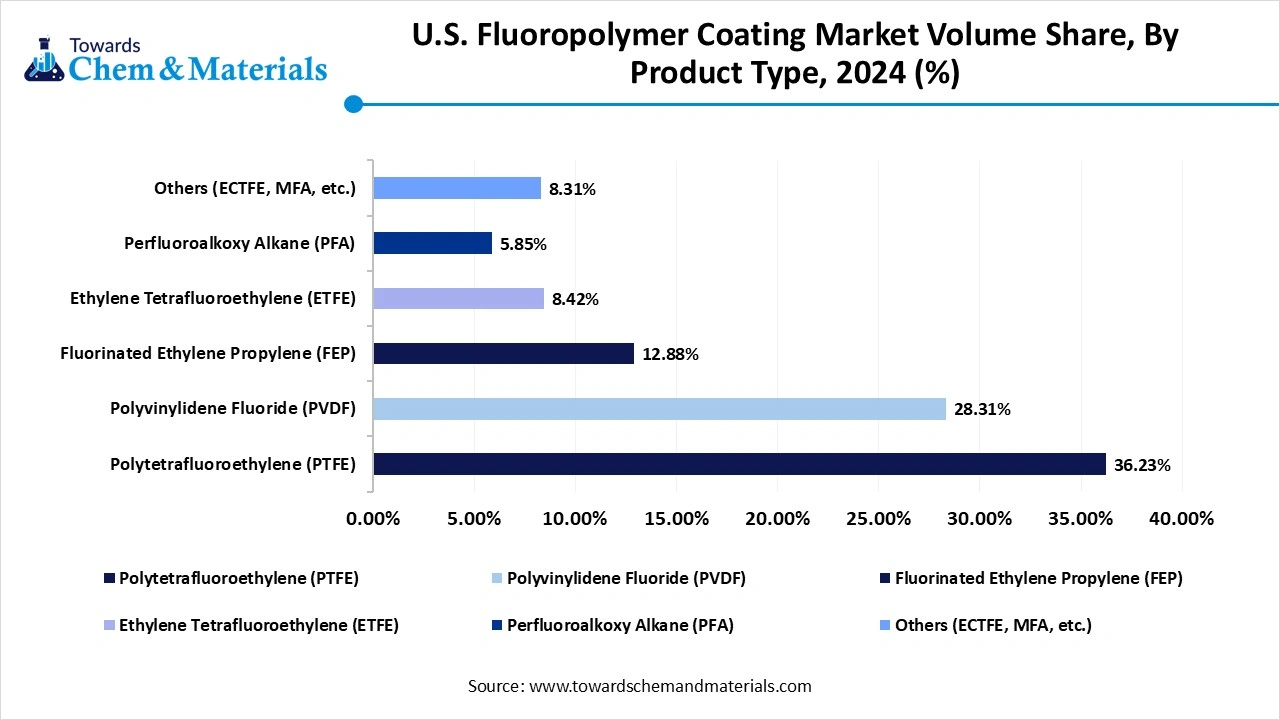

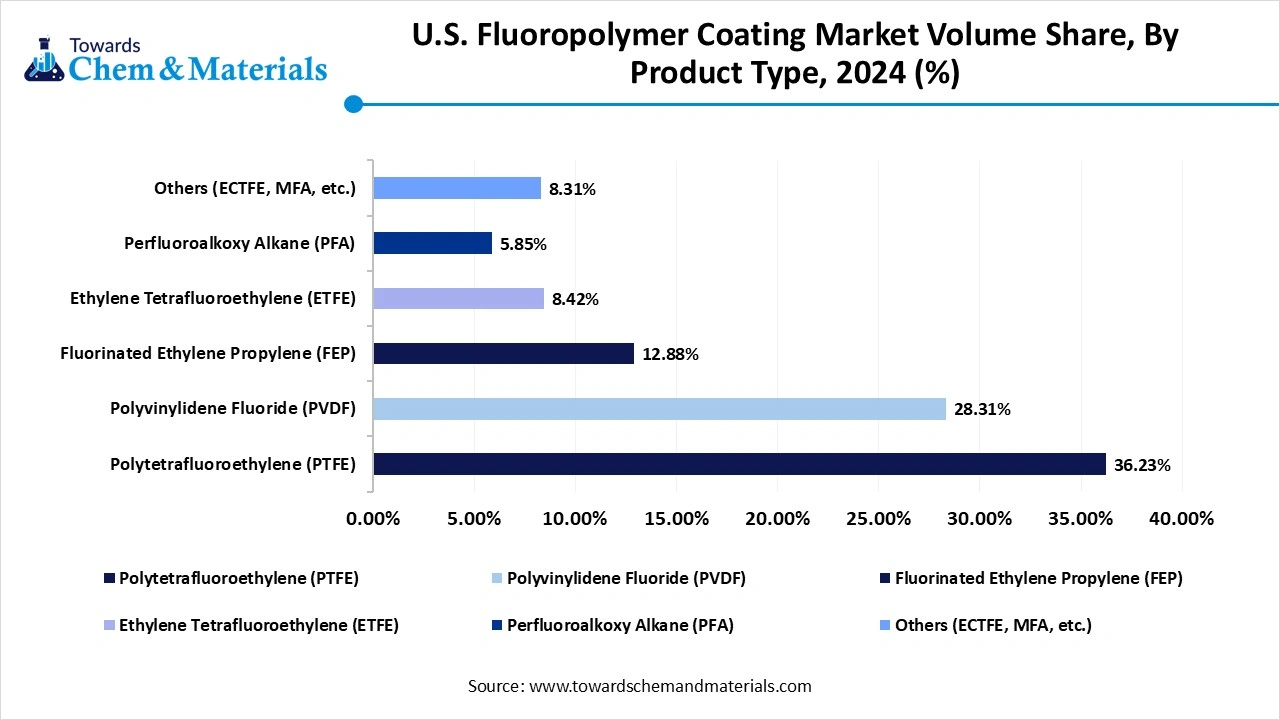

Why PTFE Segment Dominates the U.S. Fluoropolymer Coating Market?

The polytetrafluoroethylene (PTFE) segment dominated the U.S. fluoropolymer coating market in 2024. The growing automotive industry's focus on improving fuel efficiency and reducing the weight of vehicles increases demand for PTFE. The increasing production of components like bearings, gaskets, and seals fuels demand for PTFE. The rising sales of vehicles help the market growth. The growing demand for electric vehicles and the growth in 5G technology increase demand for PTFE for applications like insulation. PTFE is highly resistant to chemicals like solvents, acids, & bases, and has an extremely low coefficient of friction. It offers good electrical insulation and withstands high temperatures. The growing demand across end-user industries like electronics, consumer goods, and building & construction drives the market growth.

The polyvinylidene fluoride (PVDF) segment is the fastest growing in the market during the forecast period. The growing construction applications, like window frames, metal roofing, and cladding, increase demand for PVDF for aesthetic appeal and long-lasting protection. The increasing production of electronic components like circuit boards, cables, and wires fuels demand for PVDF. The increasing demand for lithium-ion batteries in electric vehicles and renewable energy requires PVDF, helping the market growth. PVDF provides excellent mechanical strength and withstands UV radiation. The growing demand across sectors like renewable, medical, and aerospace supports the overall growth of the market.

U.S. Fluoropolymer Coating Market Volume Share, By Product, 2024-2034 (%)

| By Product Type | Volume Share, 2024 (%) | Market Volume Tons - 2024 | Volume Share, 2034 (%) | Market Volume Tons - 2034 | CAGR (2025 - 2034) |

| Polytetrafluoroethylene (PTFE) | 36.23% | 8,478.1 | 33.34% | 13,326.2 | 5.15% |

| Polyvinylidene Fluoride (PVDF) | 28.31% | 6,624.5 | 27.41% | 10,955.9 | 5.75% |

| Fluorinated Ethylene Propylene (FEP) | 12.88% | 3,013.9 | 14.43% | 5,767.8 | 7.48% |

| Ethylene Tetrafluoroethylene (ETFE) | 8.42% | 1,970.3 | 10.21% | 4,081.0 | 8.43% |

| Perfluoroalkoxy Alkane (PFA) | 5.85% | 1,368.7 | 6.04% | 2,414.2 | 6.51% |

| Others (ECTFE, MFA, etc.) | 8.31% | 1,944.5 | 8.57% | 3,425.5 | 6.49% |

| Total | 100% | 23,400.0 | 100% | 39,970.6 | 5.50% |

Coating Type Insights

How Powder Coatings Segment Held the Largest Share of the U.S. Fluoropolymer Coating Market?

The powder coatings segment held the largest revenue share in the U.S. fluoropolymer coating market in 2024. The growing demand across the automotive industry increases demand for powder coatings for protective & aesthetic purposes. The increasing demand for appliances like washing machines, refrigerators, and many more fuels demand for powder coatings for an attractive and durable finish. Powder coatings provide a high-quality finish and offer excellent resistance to chemicals, mechanical abrasion, corrosion, and weathering. It is easily applied to various substrates like wood, metal, and plastics, and has lower VOC emissions. The growing focus on sustainability and growth in infrastructure development fuels demand for powder coatings, driving the overall growth of the market.

The liquid coatings segment is experiencing the fastest growth in the market during the forecast period. The growing demand for vehicles and the development of infrastructure projects increase the demand for liquid coatings. The growing oil & gas industry increases the adoption of liquid coatings for equipment production and pipelines. The increasing production of medical devices like endoscopes, catheters, and guidewires increases demand for liquid coatings. The increasing investment in various industrial sectors and the expansion of manufacturing activities fuel demand for liquid coatings, supporting the overall market growth.

Application Insights

Why did the Industrial Equipment Segment Dominate the U.S. Fluoropolymer Coating Market?

The industrial equipment segment dominated the U.S. fluoropolymer coating market in 2024. The growing expansion of industries and the growth chemical processing industry increases demand for fluoropolymer coating for equipment like tanks, reactors, valves, and pipes. The increasing demand for food processing equipment, like conveyors, packaging equipment, hoppers, cooking equipment, and bakeware, requires fluoropolymer coating for properties like non-stick and easy-to-clean. The growing demand for various equipment in industries like oil & gas, pharmaceuticals, and semiconductors fuels the adoption of fluoropolymer coating, driving the overall growth of the market.

The electronics segment is the fastest growing in the market during the forecast period. The growing production of electronic devices and the rising demand for high-performance electronic devices like smartphones, wearables, computers, and laptops increases the demand for fluoropolymer coating. The increasing demand for electronic components like connectors, circuit boards, cables, and many more fuels the demand for fluoropolymer coating. The growing advancements in electronics and focus on the development of long-lasting electronic components increase demand for fluoropolymer coating. The focus on miniaturization of electronic devices and the increasing demand for automotive & medical electronics support the overall growth of the market.

Substrate Insights

Which Substrate Held the Largest Share in the U.S. Fluoropolymer Coating Market?

The metal segment held the largest revenue share in the U.S. fluoropolymer coating market in 2024. The increasing demand for various metal substrates like galvanized steel, aluminium, and steel increases the demand for fluoropolymer coating. The growing use of metal components in various industries increases demand for fluoropolymer coatings like PFA, PTFE, and FEP. The growing production of metals like stainless steel and aluminium leads to a higher demand for fluoropolymer coating to avoid corrosion. The increasing use of metal substrates in LEDs, PCBs, power electronics, and high-frequency circuits fuels demand for fluoropolymer coating. The growing use of metal substrates in industries like aerospace, manufacturing, automotive, and construction drives the market growth.

The plastics segment is experiencing the fastest growth in the market during the forecast period. The growing manufacturing of printed circuit boards, flexible displays, and other electronic devices increases the adoption of plastic substrates. The increasing production of vehicle components like under-the-hood components, fuel systems, and wire insulation increases demand for plastic substrates, which require fluoropolymer coating. The manufacturing of aircraft parts, like engine components and fuel systems, requires a plastic substrate. The growing demand across industries like construction and medical supports the market growth.

Recent Developments

- In May 2025, PPG launched new powder coatings, PPG Enviroluxe with recycled plastic content. The coating is made without PFAS and consists of 18% rPET. It offers aesthetic appeal to products and minimizes carbon footprint. The coating is applicable for end-use products like shelving & racking systems, metal office furniture, and outdoor fencing. (Source: www.indianchemicalnews.com )

- In July 2024, PPG launched energy-curable coatings, PPG DuraNEXT for coiled metal. The coating portfolio includes ultraviolet curable bankers, clearcoats, electron beam curable backers, basecoats, and primers. The coating offers high-speed energy curing and energy efficiency. (Source: www.indianchemicalnews.com )

- In May 2025, Huntsman launched intumescent polyurethane coating, POLYRESYST EV5005, for automotive applications. The coating offers fire protection to EVs' composite and metal substrates. The coating improves battery cells' fire protection and protects structural integrity.(Source: www.indianchemicalnews.com)

Top Companies List

- PPG Industries

- The Chemours Company

- DAIKIN America, Inc.

- Whitford Corporation (a PPG brand)

- AkzoNobel N.V.

- Sherwin-Williams Company

- Valspar Corporation

- Arkema Inc. (Kynar PVDF)

- Solvay USA

- Dupont

- Xylan Coatings

- Nippon Paint Holdings Co., Ltd.

- Hempel USA

- Tiger Drylac U.S.A.

- Axalta Coating Systems

Segments Covered

By Product Type

- Polytetrafluoroethylene (PTFE)

- Polyvinylidene Fluoride (PVDF)

- Fluorinated Ethylene Propylene (FEP)

- Ethylene Tetrafluoroethylene (ETFE)

- Perfluoroalkoxy Alkane (PFA)

- Others (ECTFE, MFA, etc.)

By Coating Type

- Powder Coatings

- Liquid Coatings

By Application

- Industrial Equipment & Processing

- Cookware & Bakeware

- Automotive & Transportation

- Aerospace & Defense

- Electronics

- Architectural/Construction

- Oil & Gas/Chemical Processing

- Others (Textiles, Medical Devices, etc.)

By Substrate

- Metal

- Glass

- Plastics

- Ceramics

- Others