December 2025

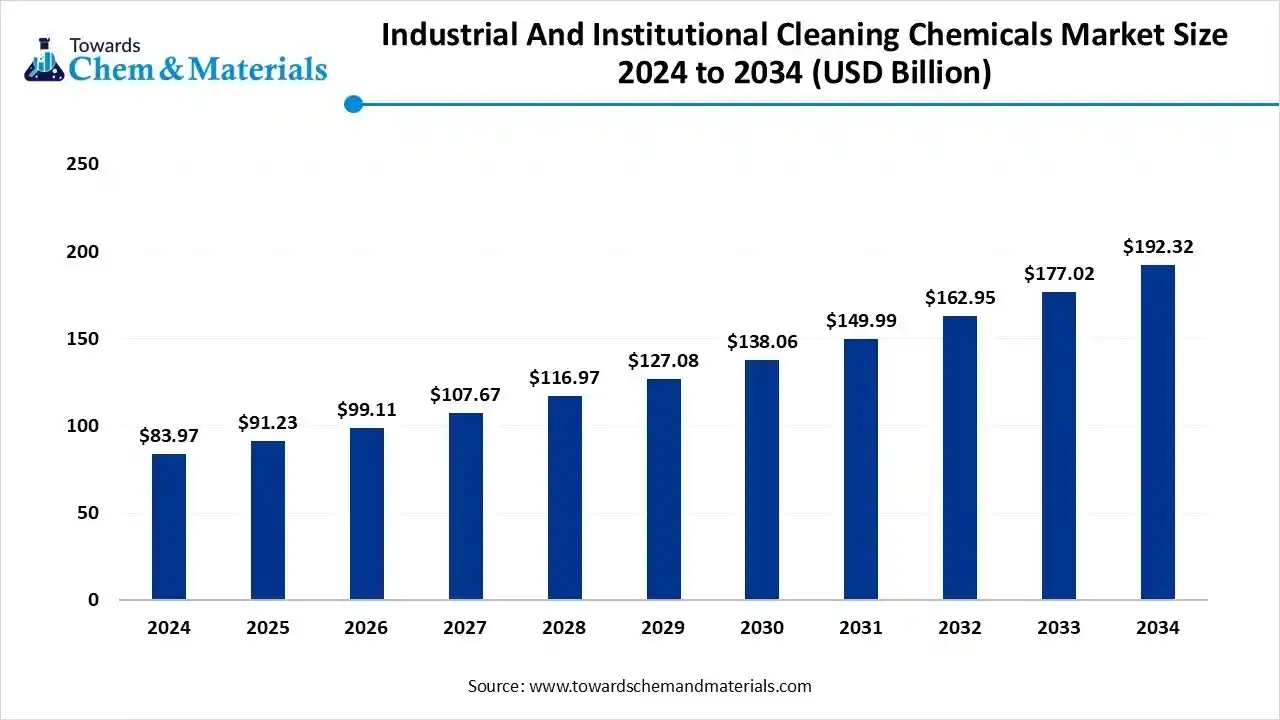

The global industrial and institutional cleaning chemicals market size was reached at USD 83.97 billion in 2024 and is expected to be worth around USD 192.32 billion by 2034, growing at a compound annual growth rate (CAGR) of 8.64% over the forecast period 2025 to 2034. The Asia Pacific industrial and institutional cleaning chemicals market dominated with the largest revenue share of 36.40% in 2024. The increasing prevalence of hygiene in every field is underpinning the present momentum in market growth.

Industrial and Institutional (I&I) Cleaning Chemicals are formulations designed to maintain hygiene, sanitation, and safety in commercial, industrial, and institutional environments such as healthcare facilities, food service, hospitality, manufacturing plants, and offices.

These chemicals include detergents, disinfectants, sanitizers, and specialty cleaners that remove dirt, grease, and microorganisms from surfaces and equipment. Driven by health regulations, sustainability initiatives, and hygiene awareness, the market serves diverse sectors including food processing, healthcare, janitorial services, and institutional maintenance.

| Report Attributes | Details |

| Market Size in 2026 | USD 10.58 Billion |

| Expected Size by 2034 | USD 20.71 Billion |

| Growth Rate from 2025 to 2034 | CAGR 8.75% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Product / Type, By Filler Type, By Form / Product Form, By End-User Industry, By Region |

| Key Companies Profiled | The Clorox Company , Henkel AG & Co. KGaA , 3M Company , Reckitt Benckiser Group plc , Kimberly-Clark Corporation , Zep Inc. , Spartan Chemical Company, Inc. , Betco Corporation , Croda International Plc , Solvay S.A. , Kao Corporation |

The technology upgrade has heavily impacted the industry dynamics in recent years. Moreover, the manufacturers are heavily investing in the development of the smart dispensers, which have an accurate release of product. Furthermore, the shift towards the enzyme-based cleaners is likely to enhance brand positioning and product offerings in the upcoming period.

| Country / Region | Regulatory Body | Key Regulations | Focus Areas | Notable Notes |

| United States | Environmental Protection Agency (EPA) | Federal Insecticide, Fungicide, and Rodenticide Act (FIFRA) | Chemical registration and approval | The agency oversees the registration and approval of products making pesticidal or disinfecting claims |

| European Union | European Chemicals Agency (ECHA) | REACH Regulation (EC No 1907/2006) | Ingredient safety, biodegradability | The agency manages the registration, evaluation, authorization, and restriction of chemicals (REACH) within the EU |

| China | State Administration for Market Regulation (SAMR) and Standardized Administration | GB Standards | Product safety and testing | This agency publishes and enforces national standards (GB standards) for cleaning products. |

| India | Department of Chemicals and Petrochemicals (DCPC) | BIS Act, 2016 | Setting and enforcing quality parameters | A division of the Ministry of Chemicals and Fertilizers that oversees the chemical industry. |

How did the Disinfectants & Sanitizers Segment Dominate the Industrial and Institutional Cleaning Chemicals Market in 2024?

The disinfectants & sanitizers segment dominated the market with 32.4% of industry share in 2024 due to a sudden surge in the healthcare and business sectors. Cleanliness has become the top priority around every global sector where disinfectants and sanitizers have gained major industry attention due to their affordability and household use. Moreover, factors like quick action, ease of use, and stronger protection are further supporting the segment growth in the current period.

The laundry care products segment is expected to grow at a notable rate owing to increased focus on fabric hygiene nowadays. Moreover, the need for clean linens and uniforms in major sectors like hotels, hospitals, and food services has driven the segment's potential in recent years. Also, the automation and eco-friendly detergents have gained more popularity in the laundry sector in the past few years.

Why does the Surfactant Segment Dominate the Industrial and Institutional Cleaning Chemicals Market?

The surfactant segment dominated the market with 34.4% industry share in 2024 because surfactants are the main active ingredient that helps remove dirt, oil, and grease. They are found in almost every cleaning product from floor cleaners to hand soaps. Surfactants mix water with oil and break down stains easily, making them highly versatile and effective. They are affordable, easy to produce, and perform well in both acidic and alkaline formulas.

The solvents segment is expected to grow at a notable rate because industries are demanding stronger cleaners for heavy-duty applications. Solvents dissolve stubborn grease, oil, ink, and paint residues that surfactants alone cannot handle. As factories, printing, and machinery sectors grow, the use of precision cleaning chemicals will rise. New green and bio-based solvents are also entering the market, offering strong cleaning with less harm to people and the environment.

How did the Healthcare Segment Dominate the Industrial and Institutional Cleaning Chemicals Market in 2024?

The healthcare segment dominated the market with 32.4% of industry share in 2024 because hospitals, clinics, and laboratories require the highest level of hygiene. Cleaning chemicals are essential for disinfecting surfaces, tools, and patient areas to prevent infections. The sector uses a wide range of products- sanitizers, disinfectants, laundry cleaners, and floor care agents. Continuous hospital expansions and strict cleanliness rules ensure strong product use.

The food service & hospitality segment is expected to grow at a notable rate because customers now expect visible cleanliness in restaurants, hotels, and cafes. Hygiene is directly linked to brand reputation and food safety. As travel and tourism grow, hotels and restaurants need reliable cleaning solutions for kitchens, dining areas, linens, and guest rooms. New eco-friendly and fragrance-rich products are being designed for these businesses.

Why does the Distributors Segment Dominate the Industrial and Institutional Cleaning Chemicals Market?

The distributors/wholesalers segment dominated the market with a 62.5% industry share in 2024 because cleaning chemicals are usually bought in bulk. Large institutions like hospitals, hotels, and schools prefer trusted suppliers that deliver in large volumes with consistent quality. Distributors manage storage, transport, and bulk pricing efficiently, which small buyers can't handle on their own. They also offer credit, after-sales service, and product training.

The online / e-commerce segment is expected to grow at a notable rate because buying habits are changing quickly. Facility managers and small businesses now prefer ordering cleaning chemicals directly from brand websites or online marketplaces. It saves time, offers better price comparisons, and ensures fast doorstep delivery. Many manufacturers are also launching their own digital platforms with bulk order options and subscription models

The Asia Pacific industrial and institutional cleaning chemicals market size is valued at USD 33.21 billion in 2025 and is expected to reach USD 70.10 billion by 2034, growing at a CAGR of 8.65% from 2025 to 2034. Asia Pacific dominated the market with an approximate share of 8.65% in 2024. Asia Pacific dominated the market with 36.4% of the industry share, owing to the presence of enlarged manufacturing factories and premises like hotels, hospitals, and schools.

Also, the regional countries like China, India, and Vietnam have seen under heavy urbanization, where the cleaning chemicals have gained industry attention in recent years. Moreover, the improvisation of the healthcare industry in the region has heavily supported the industry in the past few years.

How is China Dominating the Cleaning Chemical Industry?

China maintained its dominance in the industrial and institutional cleaning chemicals market due to having a large healthcare and business office network. Moreover, the country is seen under the heavy establishment of large-scale industrialization, where cleaning chemicals have played a major role in recent years. Furthermore, China’s food processing industry has heavily supported the industry's growth in recent years.

Europe Industrial and Institutional Cleaning Chemicals Market Analysis

Europe is expected to capture a major share of the market due to a regional shift towards stricter hygiene regulations and green innovations. Moreover, the regional manufacturers are increasingly producing the production of low-toxicity and safer cleaning chemicals, which is gaining more attention from the globe in recent years.

Is the Future of Sustainable Cleaning Being Engineered in Germany?

Germany is expected to emerge as a prominent country for the industrial and institutional cleaning chemicals market in the coming years, owing to the country's known for their strong chemical manufacturing base and advanced technology. Moreover, the country is heavily promoting energy-efficient cleaning programs, which are expected to create lucrative opportunities for manufacturers in the coming years.

North America Industrial and Institutional Cleaning Chemicals Market Trends

North America is a notably growing region because hygiene and safety are top priorities in industries, schools, and healthcare. The region is adopting advanced cleaning technologies like smart dispensers and automated systems. Rising demand for sustainable and fragrance-free products is also driving innovation. More awareness about workplace cleanliness, especially in food and healthcare facilities, supports market growth.

Is the United States Leading the Way in Cleaner, Smarter, and Safer Industry Growth?

The United States is expected to gain a major industry share because of its large healthcare, hospitality, and food industries. Hospitals and restaurants follow strict hygiene rules, ensuring steady demand for cleaning and disinfection products. U.S. consumers also prefer eco-friendly and high-performance brands, encouraging companies to develop safer and smarter chemicals.

Industrial And Institutional Cleaning Chemicals Market Share, By Region, 2024 (%)

| Regional | Revenue Share |

| North America | 30.11% |

| Europe | 21.33% |

| Asia Pacific | 36.40% |

| Latin America | 7.45% |

| Middle East and Africa | 4.71% |

By Product Type

By Ingredient Type

By End-Use Industry

By Distribution Channel

By Region

December 2025

December 2025

November 2025

November 2025