Content

What is the Nanocatalysts Market Size?

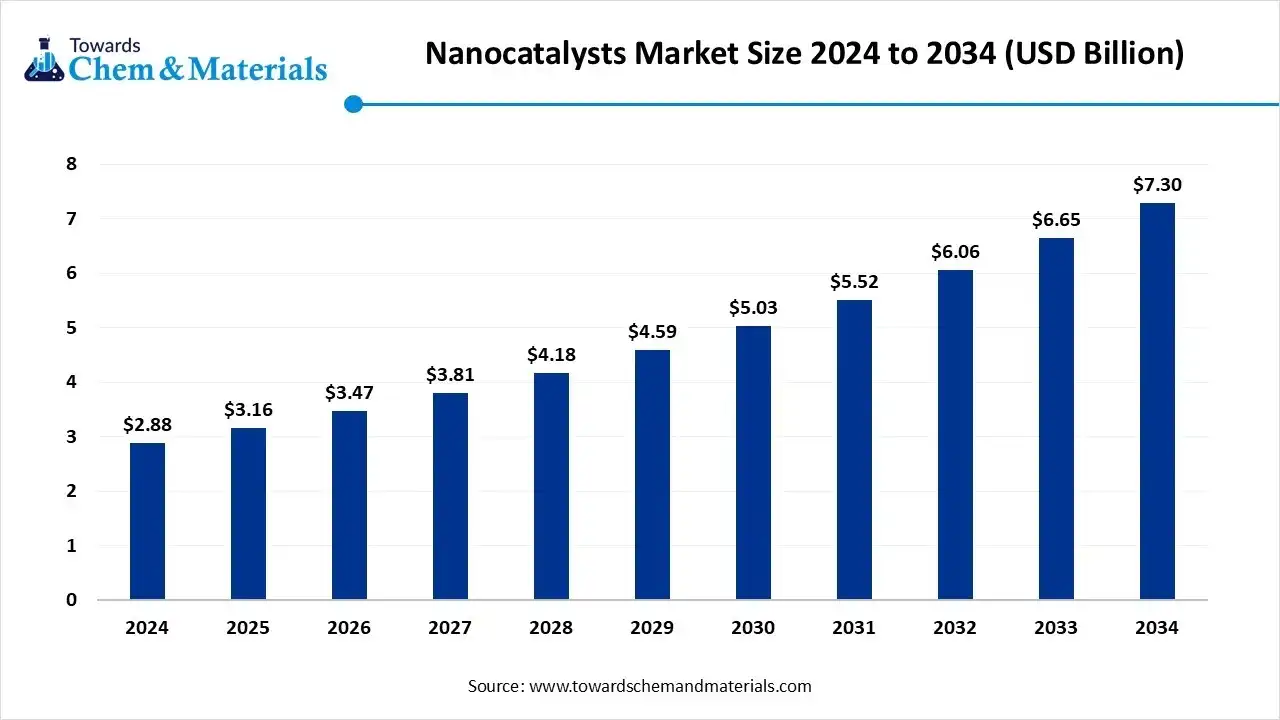

The global nanocatalysts market size was estimated at USD 3.16 billion in 2025 and is predicted to increase from USD 3.47 billion in 2026 to approximately USD 7.30 billion by 2034, expanding at a CAGR of 9.75% from 2025 to 2034. The growing demand for energy-efficient and sustainable processes is the key factor driving market growth. Also, innovations in nanotechnology, coupled with the stringent environmental regulations, can fuel market growth further.

Key Takeaways

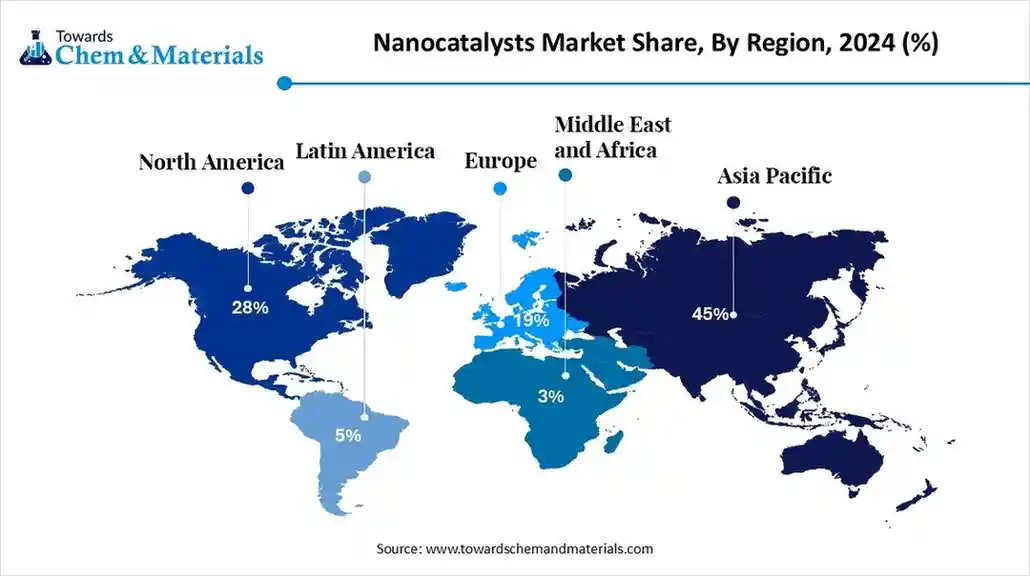

- By region, Asia-Pacific dominated the market with an approximate share of 45% in 2024.

- By region, North America is expected to grow at the fastest CAGR of nearly 18% over the forecast period.

- By region, Europe is expected to grow at a notable CAGR over the forecast period.

- By catalyst type, the noble metal nanocatalysts segment dominated the market with approximately 40% share in 2024.

- By catalyst type, the hybrid/composite nanocatalysts segment is expected to grow at the fastest CAGR of nearly 25% over the forecast period.

- By application, the petrochemicals & refining segment held approximately 35% of the market share in 2024.

- By application, the energy & fuel cells/hydrogen segment is expected to grow at the fastest CAGR of nearly 22% over the forecast period.

- By form, the nanoparticles/nanoclusters segment dominated the market by holding an approximate share of 50% in 2024.

- By form, the core-shell / supported nanocatalysts segment is expected to grow at the fastest CAGR of nearly 23% during the projected period.

What are Nanocatalysts?

The rapid innovations in nanotechnology and material science are the major factors propelling market growth. The global nanocatalysts market comprises catalysts with nanoscale active sites or supports, engineered at the molecular/nanostructure level to enhance catalytic performance (higher surface area, better selectivity, faster kinetics).

Applications span petrochemicals, refining, chemical synthesis, fine chemicals, environmental catalysis (e.g., emission control, wastewater treatment), fuel cells, and renewable hydrogen / CO₂ conversion. Key materials include noble metal nanoparticles (Pt, Pd, Au), metal oxides, metal-organic frameworks, carbon nanomaterials (graphene, carbon nanotubes), and hybrid nanostructures. Drivers include sustainability mandates, energy transition, demand for efficient pollution control catalysts, and the push for lower catalyst loads and higher performance.

Global Nanocatalysts Market Outlook:

- Industry Growth Overview: Between 2025-2034, the market is anticipated to witness substantial growth due to growing demand for nanocatalysts in applications such as pollution control and fuel desulfurization. Also, a nanocatalyst enables more effective chemical reactions and reduces waste generation.

- Sustainability Trends: Sustainability trends in the market are fuelled by the demand for more eco-friendly and efficient industrial processes, emphasising lower waste generation, reduced energy consumption, and the development of green chemistry. These trends are further boosted by government regulations and consumer choices.

- Global Expansion: Major players such as BASF SE, Evonik Industries AG, and Dow, Inc. are extending their global reach through investments in R&D, strategic partnerships, and capacity expansion, especially emphasizing high-growth regions such as Asia-Pacific.

Key Technological Shifts in the Global Nanocatalysts Market:

Key technological shifts in the market include the use of Artificial Intelligence and machine learning for catalyst design and an increasing emphasis on sustainable and green synthesis methods. Cutting-edge techniques, such as high-resolution electron microscopy, offer atomic-level and real-time insights into reaction mechanisms.

Major companies such as BASF SE, which is a leading player in cutting-edge materials, use its R&D capabilities to provide a wide portfolio of nanocatalysts for emissions control, petroleum refining, and chemical synthesis. They have also launched a new line of bio-based nanocellulose composites.

Report Scope

| Report Attributes | Details |

| Market Size in 2026 | USD 3.47 Billion |

| Expected Size by 2034 | USD 7.30 Billion |

| Growth Rate from 2025 to 2034 | CAGR 9.75% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Catalyst Type / Material, By Application / End Use, By Form / Structure, By Region |

| Key Companies Profiled | Albemarle Corporation, Sinopec Catalyst Co., Ltd., Evonik Industries, Haldor Topsoe, Umicore, Shell Global Solutions, Catalysis Materials, Inc., UOP (Honeywell), Johnson Electric, Nanoshel LLC, QuantumSphere, Inc., Nanoco Technologies |

Trade Analysis of Global Nanocatalysts Market: Import & Export Statistics

- U.S. chemicals exports are projected to rise 2.1% in 2024, rebounding from a decline in 2023. Imports are also expected to increase by 1.2%. Over the forecast period, exports are projected to average 4-5% annual growth, while imports are anticipated to average a 7% annual pace, contingent on potential trade policy changes. (Source: www.americanchemistry.com )

- During 2024, China's exports reached $713.1 billion, a 3.3% increase, while imports remained stable at $1.2361 trillion, creating a trade deficit of $523 billion. The export volume of chemical products grew by 16.3%, despite a 11.2% drop in their export prices, while import volumes rose by 1.7% with a 1.7% decrease in prices.(Source: www.echemi.com)

Value Chain Analysis of the Global Nanocatalysts Market:

- Feedstock Procurement : It is the initial stage of the value chain, which involves the whole process of sourcing and acquiring the required raw materials necessary for the manufacture and application of nanocatalysts.

- Chemical Synthesis and Processing : It is the major stage where nanocatalysts are applied in different laboratory and industrial chemical production processes. This is one of the crucial end-user sectors for nanocatalysts.

- Packaging and Labelling : It refers to a stage that discusses the regulatory requirements and specific methods for the safe containment, transport, and detection of nanocatalyst products.

- Regulatory Compliance and Safety Monitoring : This stage includes the intricate set of laws and policies that control the development, production, handling, use, and disposal of nanocatalysts.

Global Nanocatalysts Market 's Regulatory Landscape: Global Regulations

| Country/Region | Key Regulations |

| United States (US) | Nanomaterials are regulated under existing legislation, primarily the Toxic Substances Control Act (TSCA), administered by the Environmental Protection Agency (EPA). |

| Canada | Regulations fall under the Canadian Environmental Protection Act, 1999 (CEPA). New nanomaterials are subject to the New Substances Notification Regulations. |

| China | The National Nanotechnology Standardization Technical Committee (NSTC) and the Standardization Administration of China (SAC) are involved in creating guidelines, many of which remain voluntary. |

Segmental Insights

Catalyst Type Insight

Which Catalyst Type Segment Dominated the Global Nanocatalysts Market in 2024?

The noble metal nanocatalysts segment dominated the market with approximately 40% share in 2024. The dominance of the segment can be attributed to its superior performance properties and growing demand from major end-user sectors. Additionally, noble metal nanocatalysts like platinum, palladium, and gold have a high surface-area-to-volume ratio, which leads to improved reaction rates and the capability to produce desired product output.

The hybrid/composite nanocatalysts segment is expected to grow at the fastest CAGR of nearly 25% over the forecast period. The growth of the segment can be credited to the growing product demand for sustainable industrial solutions, along with its improved performance characteristics. Hybrid designs, like magnetic nanocatalysts, enable easy separation from reaction mixtures using simple magnetic techniques.

Application Insight

How Much Share Did The Petrochemicals & Refining Segment Held In 2024?

The petrochemicals & refining segment held approximately 35% of the market share in 2024. The dominance of the segment can be linked to the rising demand for higher catalytic performance and ongoing investments in refinery upgrades. Moreover, the growing global petrochemical industry directly influences the demand for more effective and efficient catalysts in its production processes.

The energy & fuel cells/hydrogen segment is expected to grow at the fastest CAGR of nearly 22% over the forecast period. The growth of the segment can be driven by stringent environmental regulations coupled with the growing need for clean energy solutions. Furthermore, advancements in nanotechnology and materials science enable the design of nanocatalysts with superior properties as compared to conventional catalysts.

Form Insight

Which Form Type Segment Dominated the Global Nanocatalysts Market in 2024?

The nanoparticles/nanoclusters segment dominated the market by holding an approximate share of 50% in 2024. The dominance of the segment is owing to technological innovations in synthesis methods and the growing need for sustainable industrial processes. Also, nanoparticles and nanoclusters have much larger surface areas as compared to bulk particles, which offer more active sites for chemical reactions.

The core-shell / supported nanocatalysts segment is expected to grow at the fastest CAGR of nearly 23% during the projected period. The growth of the segment is due to its improved stability under harsh conditions, along with superior catalytic performance. In addition, the core-shell architecture enables accurate control over the electronic properties and surface properties, which allow for greater selectivity towards desired products.

Regional Insights

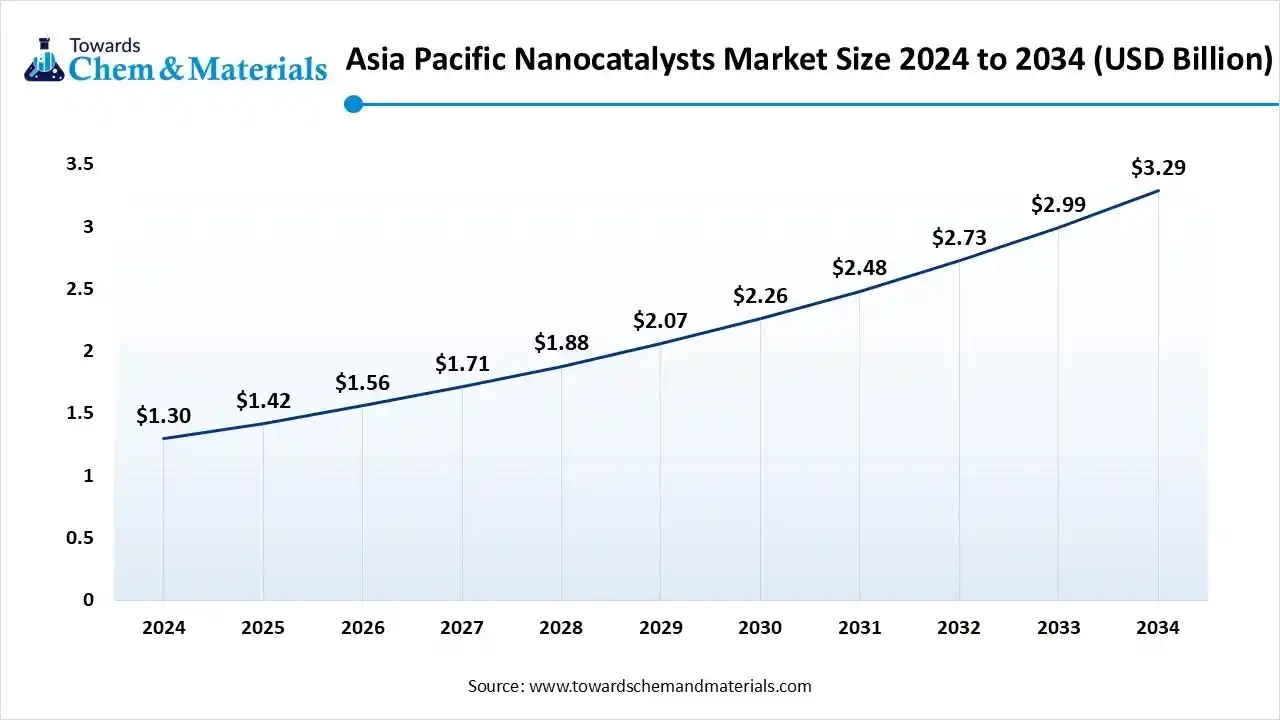

The Asia Pacific nanocatalysts market size is valued at USD 1.42 billion in 2025 and is expected to reach USD 3.29 billion by 2034, growing at a CAGR of 9.73% from 2025 to 2034. Asia Pacific dominated the market with an approximate share of 45% in 2024.

The dominance of the region can be attributed to the ongoing government investment in clean technology and rapid industrialization in the emerging economies. Also, there is an increasing demand for more effective chemical processes that minimize energy consumption and waste, provided by nanocatalysts.

China Global Nanocatalysts Market Trends

In the Asia Pacific, China led the market owing to the significant government investment in R&D, along with the massive industrial production of nanocatalysts. The country has also made major investments in nanotechnology research, which leads the world in the development of nanotechnology.

North America is expected to grow at the fastest CAGR of nearly 18% over the forecast period. The growth of the region can be credited to the ongoing push towards sustainable energy solutions and strong product demand from major sectors such as petroleum refining and pharmaceuticals. The surge in sales of electric vehicles (EVs) will also contribute to regional expansion soon.

U.S. Nanocatalysts Market Trends

In North America, the U.S. dominated the market due to innovations in nanotechnology R&D and strict environmental regulations. The country has substantial refining capacity, which depends on nanocatalysts to optimize processes such as hydrotreating and catalytic cracking, improving overall fuel yield and quality.

U.S. Europe Nanocatalysts Market Trends

Europe is expected to grow at a notable CAGR over the forecast period. The growth of the region can be driven by a growing focus on building a circular economy, coupled with the stringent policies such as the European Green Deal and REACH regulations. Moreover, ongoing innovations in materials science and nanotechnology allow for the creation of more efficient and precise catalysts.

Germany Global Nanocatalysts Market Trends

In Europe, Germany held the largest market share owing to the substantial investment in green hydrogen technology and a strong R&D ecosystem. In addition, the country has a robust research and development ecosystem, with close collaboration between research institutes, universities, and other industries, which boosts the innovation and application of nanotechnology in Germany.

Recent Developments

- In August 2025, Tehran announced that it would host the Iran Nanotechnology Exhibition, which aims to commercialize nanotechnology products. The exhibition will show the advancements and state-of-the-art technologies in different fields like medicine, civil engineering, transportation, agriculture, and more.(Source: www.tehrantimes.com)

- In May 2025, Honeywell announced it would acquire Johnson Matthey's Catalyst Technologies major part for €2.15 billion in an all-cash transaction. This integration will expand Honeywell's catalyst offering, enabling the company to offer broader solutions for creating lower-emission fuels.(Source : chemanager-online.com )

Top Vendors in the Global Nanocatalysts Market & Their Offerings:

- Johnson Matthey: Johnson Matthey is a leading global player in the nanocatalysts market, recognized for its expertise in platinum group metals (PGMs) and related catalysis.

- BASF SE: BASF SE is a leading global player in the nanocatalysts market, recognized for its extensive expertise in advanced materials and sustainable solutions. The company holds a dominant position within the competitive landscape alongside other major players.

- Clariant: Clariant is a leading global provider in the broader catalysts market and a significant player in the specific domain of nanocatalysts, primarily through its diverse portfolio of heterogeneous catalysts for industrial applications.

Other Players

- Albemarle Corporation

- Sinopec Catalyst Co., Ltd.

- Evonik Industries

- Haldor Topsoe

- Umicore

- Shell Global Solutions

- Catalysis Materials, Inc.

- UOP (Honeywell)

- Johnson Electric

- Nanoshel LLC

- QuantumSphere, Inc.

- Nanoco Technologies

Segment Covered

By Catalyst Type / Material

- Noble Metal Nanocatalysts (Pt, Pd, Au, Ru, Rh)

- Metal Oxide Nanocatalysts (TiO₂, CeO₂, Fe₂O₃, ZnO)

- Carbon-based Nanocatalysts (CNT, graphene, carbon quantum dots)

- Hybrid / Composite Nanocatalysts (metal + support, core-shell, heterostructures)

By Application / End Use

- Petrochemicals & Refining

- Fine Chemicals & Pharmaceuticals

- Environmental Catalysis (emissions control, water treatment)

- Energy & Fuel Cells / Hydrogen

- CO₂ Conversion / Green Chemistry

By Form / Structure

- Nanoparticles / Nanoclusters

- Nanorods / Nanowires / Nanotubes

- Nanosheets / 2D Catalysts

- Core-Shell / Supported / Encapsulated Nanocatalysts

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait