Content

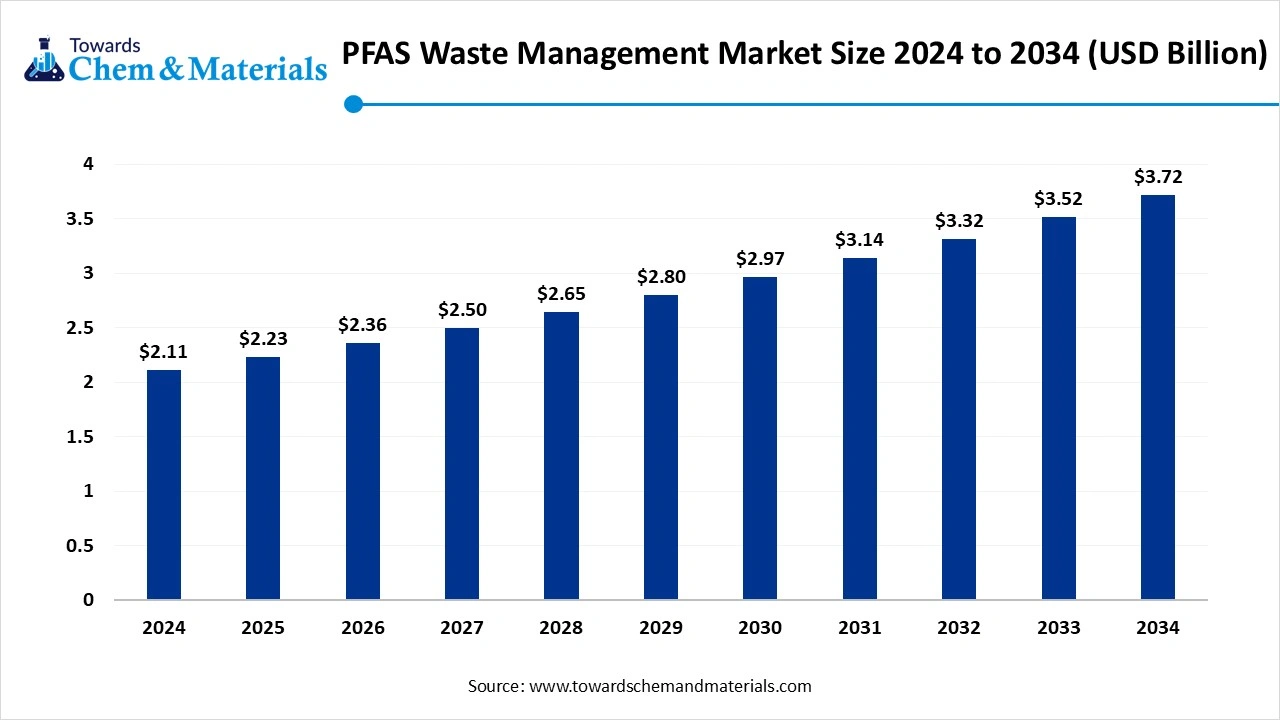

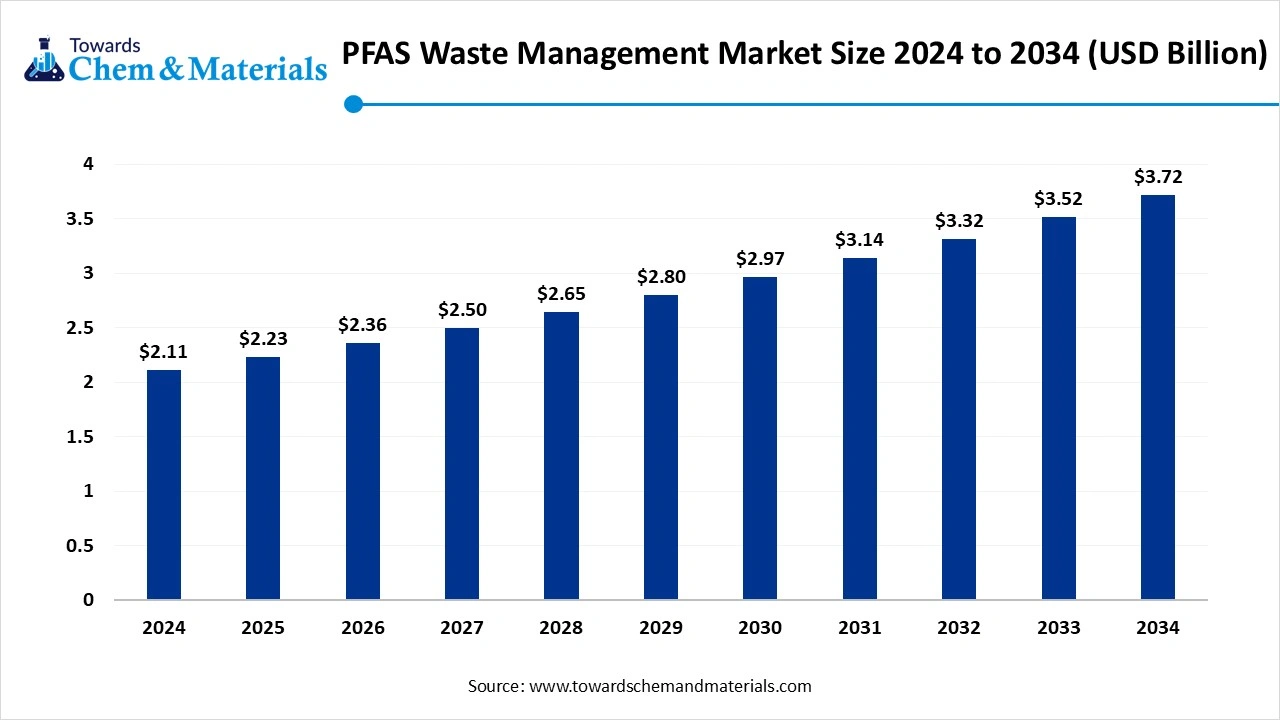

PFAS Waste Management Market Size and Forecast 2025 to 2034

The pfas waste management market size is calculated at USD 2.11 billion in 2024, grew to USD 2.23 billion in 2025, and is projected to reach around USD 3.72 billion by 2034. The market is expanding at a CAGR of 5.84% between 2025 and 2034. Surge in public awareness of health is the key factor driving market growth. Also, rising regulatory pressure, coupled with the innovations in detection and remediation technologies, can fuel market growth further.

Key Takeaways

- By region, North America dominated the market with the largest share in 2024.

- By region, Asia Pacific is expected to grow at the fastest CAGR over the forecast period.

- By waste type, the PFAS contaminated water segment dominated the market with the largest share in 2024.

- By waste type, the PFAS contaminated sludge segment is expected to grow at the fastest CAGR over the forecast period.

- By treatment method, the physical treatment segment held the largest market share in 2024.

- By treatment method, the chemical treatment segment is expected to grow at the fastest CAGR over the forecast period.

- By end user, the industrial waste management segment dominated the market by holding the largest market share in 2024.

- By end user, the municipal waste management segment is expected to grow at the fastest CAGR during the projected period.

What is PFAS Waste Management?

The growing inclination towards effective PFAS waste management is a major factor propelling market expansion. It is the techniques used to control and dispose of waste containing per- and polyfluoroalkyl substances (PFAS), a group of synthetic chemicals found in various industrial and consumer products. Innovative separation and destruction techniques are currently being developed to cut the strong carbon-fluorine bonds in PFAS to smoothly manage the end hazardous materials.

PFAS Waste Management Market Outlook:

- Industry Growth Overview: Between 2025 and 2034, the market is anticipated to witness substantial growth in the manufacturing of PFAS-containing products and the development of innovative treatment technologies. Ongoing investment in the development of cost-effective and advanced technologies for controlling and destroying PFAS is a crucial growth driver.

- Sustainability Trends: The market sustainability trends are fuelled by technological innovations in treatment and disposal methods like nanofiltration and bioremediation techniques, along with the rise in public health awareness. The growing demand for environmentally responsible substitutes is leading to an increased need for specialized services and efforts.

- Global Expansion: Major market players such as WSP, Waste Management Inc., and Clean Harbors are expanding their operations mainly by acquiring specialized technology suppliers and building strong regional presence in response to public demand for safer and more effective PFAS treatment and solutions.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 2.23 Billion |

| Expected Size by 2034 | USD 3.72 Billion |

| Growth Rate from 2025 to 2034 | CAGR 5.84% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Northa America |

| Segment Covered | By Waste Type, By Treatment Method, By End-User, By Region |

| Key Companies Profiled | Dow Chemical Company, Arcadis NV, Tetra Tech Inc., Jacobs Engineering Group, SUEZ Water Technologies & Solutions, Clean Harbors, Golder Associates, PeroxyChem, Geosyntec Consultants, Solvay, Ecolab, Horizon Environmental Services, KORE Environmental, Mylan Inc., Chemours |

Key Technological Shifts in the PFAS Waste Management Market:

Key technological shifts in the market are moving from conventional containment techniques to cutting-edge destruction and removal techniques, fuelled by the consistent nature of these chemicals and growing regulatory pressure. The latest destruction technologies, such as supercritical water oxidation (SCWO) and electrochemical oxidation, aim to break down PFAS compounds into non-toxic elements.

Companies such as AECOM, WSP, and Evoqua are increasingly deploying advanced technologies such as ion exchange systems, GAC, and reverse osmosis for PFAS remediation. Also, collaborative efforts between government agencies and academia are boosting the innovation and deployment of these technologies.

Market Opportunity

Increasing Emphasis on Source Reduction and Alternatives

The growing focus on source reduction with alternatives is the major factor creating lucrative opportunities in the market. The ongoing development and use of PFAS-free solutions are a key trend because it is pushing companies to phase out production. Furthermore, partnerships between private and public sectors, like research institutions and government organizations, are boosting the development of new solutions.

Market Challenge

Lack Of Skilled Workforce

There is a significant shortage of skilled professionals needed for operating and maintaining innovative PFAS testing and remediation, particularly in developing regions. Moreover, insufficient waste management and laboratory infrastructure in emerging economies further challenge the implementation of effective solutions, hindering market expansion further.

Value Chain Analysis of PFAS Waste Management Market:

- Feedstock Procurement : It is the process of acquiring and maintaining waste materials that contain PFAS. These PFAS-contaminated materials can further serve as a feedstock for their treatment and technologies.

- Chemical Synthesis and Processing : This process refers to the segment of the market that emphasizes developing innovative chemical-based methods to destroy PFAS or create safer compounds.

- Packaging and Labelling : It is the crucial stage within the market, due to the persistent, stable, and toxic nature of PFAS; hence, their packaging and labelling are subject to stringent regulations.

- Regulatory Compliance and Safety Monitoring : This stage involves adhering to a rapidly fluctuating web of regulations and implementing technologies and methods to ensure the safe treatment of disposable PFAS.

PFAS Waste Management’s Regulatory Landscape: Global Regulations

| Country / Region | Key Regulations |

| European Union (EU) | In 2023, several REACH member states submitted a comprehensive proposal to ban the manufacture, use, and placing on the market of most PFAS. |

| United States | In April 2024, the EPA finalized a rule designating PFOA and PFOS as hazardous substances under the Comprehensive Environmental Response, Compensation, and Liability Act (CERCLA). |

| India and China | While increasingly focusing on PFAS pollution, these countries have lagged Western jurisdictions in comprehensive regulations. |

Segmental Insights

Waste Type Insights

Which Waste Type Segment Dominated the PFAS Waste Management Market in 2024?

The PFAS contaminated water segment dominated the market with the largest share in 2024. The dominance of the segment can be attributed to the stringent regulatory standards for PFAS in wastewater and drinking water, along with the growing awareness regarding PFAS risks. In addition, PFAS are found in various consumer products and industrial applications, leading to extensive contamination of water sources, which requires proper management.

The PFAS contaminated sludge segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the extensive presence of PFAS in industrial and municipal sludge, coupled with the rapid development of cutting-edge treatment technologies. Additionally, the technique of applying biosolids to agricultural fields introduces PFAS directly into soil and water systems, underscoring the need for careful management.

Treatment Method Insights

How Much Share Did the Physical Treatment Segment Held in 2024?

The physical treatment segment held the largest market share in 2024. The dominance of the segment can be linked to the growing demand from industries and municipalities for cost-effective and sustainable solutions to address PFAS contamination. Furthermore, the rise in demand for safe and clean drinking water globally directly boosts the growth of the segment.

The chemical treatment segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by growing health concerns and public awareness about PFAS's persistence and technological innovations in developing efficient chemical treatment solutions. Also, there is a rising demand for cost-effective and innovative technologies that provide more eco-responsible and sustainable methods for managing PFAS-contaminated waste.

End-User Insights

Which End User Segment Dominated the PFAS Waste Management Market in 2024?

The industrial waste management segment dominated the market by holding the largest market share in 2024. The dominance of the segment is owed to the increasing public concerns over the harmful effects and environmental impact of PFAS, along with the rising demand for cost-effective and sustainable waste management solutions. Moreover, the extensive presence of PFAS in industrial by-product soils and landfill leachate is also a major segment driver.

The municipal waste management segment is expected to grow at the fastest CAGR during the projected period. The growth of the segment is due to the increasing scrutiny from governments, especially in the developed region, which leads to the implementation of stringent policies that necessitate municipalities to address PFAS pollution. Rising focus on environmental sustainability is supporting organisations and municipalities to prioritize the cleanup of PFAS-contaminated sites.

Regional Insights

North America dominated the market with the largest share in 2024. The dominance of the region can be attributed to the growing public environmental awareness, along with the ongoing investment in innovative treatment technologies. In addition, major waste management companies in the region are well-positioned to offer specialized services and solutions to control PFAS-contaminated waste.

Asia Pacific is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the rapid industrialization and the increasing detection of PFAS contamination in soil and water. Furthermore, the surge in investment in new infrastructure, particularly for water safety and treatment, is creating demand for cutting-edge PFAS treatment systems, driving regional expansion soon.

Country-level Investments & Funding Trends for the PFAS Waste Management Market:

- United States: The U.S. holds the major market share in North America and is a key player in PFAS testing, fuelled by stringent regulations and strong waste management infrastructure.

- Canada: The government is taking a standard regulatory approach to classify nearly all PFAS as "toxic" under the Canadian Environmental Protection Act.

- Japan: In 2025, Japan launched a nationwide monitoring program to identify contaminated sites near military and industrial zones.

Recent Development

- In June 2025, Clariant will introduce a cutting-edge PFAS-free polymer processing for more eco-friendly polyolefin extrusion. The new range involves AddWorks PPA 101 FG, which mainly emphasizes the Americas, EMEA, and SEAP markets.(Source: www.clariant.com)

Top Vendors in PFAS Waste Management Market & Their Offerings:

- 3M Company: It is a major historical manufacturer with significant environmental liabilities.

- AECOM: The company offers comprehensive services such as risk investigations, environmental assessments, and remediation planning.

- Thermo Fisher Scientific: The company is a major player in the market, offering software, analytical instrumentation, and workflows for detecting environmental samples like water and soil.

Other Players

- Dow Chemical Company

- Arcadis NV

- Tetra Tech Inc.

- Jacobs Engineering Group

- SUEZ Water Technologies & Solutions

- Clean Harbors

- Golder Associates

- PeroxyChem

- Geosyntec Consultants

- Solvay

- Ecolab

- Horizon Environmental Services

- KORE Environmental

- Mylan Inc.

- Chemours

Segment Covered

By Waste Type

- PFAS Contaminated Water

- PFAS Contaminated Soil

- PFAS Contaminated Sludge

By Treatment Method

- Physical Treatment

- Adsorption

- Filtration

- Chemical Treatment

- Oxidation

- Reduction

- Thermal Treatment

- High Temperature Incineration

- Plasma Arc Treatment

By End-User

- Industrial Waste Management

- Manufacturing Plants

- Chemical Plants

- Oil & Gas Industry

- Municipal Waste Management

- Wastewater Treatment Plants

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait